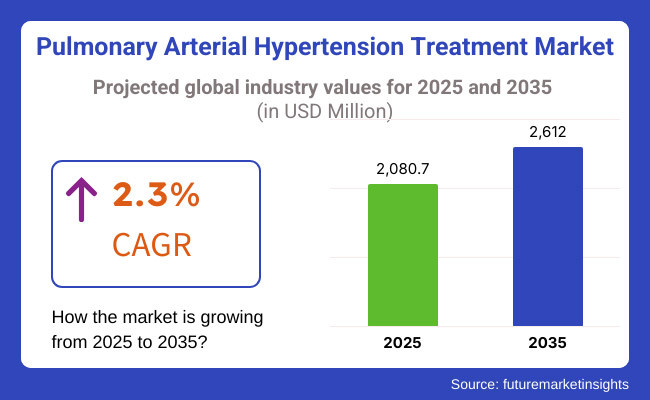

The pulmonary arterial hypertension market is expected to reach USD 2,080.7 million by 2025 and is expected to steadily grow at a CAGR of 2.3% to reach USD 2,612.0 million by 2035.

The pulmonary arterial hypertension (PAH) treatment market is growing due to an increasing incidence of PAH. Further targeted therapy advancement along with raising awareness of rare cardiovascular diseases will also foster the impetus of progress.

Growth drivers such as newer classes of PAH-specific drugs, namely, endothelin receptor antagonists (ERAs), phosphodiesterase-5 (PDE-5) inhibitors, and prostacyclin analogs, remain influential in this area. Moreover, significant focus is now also given to gene therapy and regenerative medicine. Furthermore, the advance in diagnosing capabilities and the programs for early detection are enhancing early detection of those patients, qualifying them for intervention at an early stage.

However, there are challenges. High treatment costs plus limited disease-modifying therapies are strong deterrents to the growth of the market. Barriers to approval for novel drugs include regulatory constraints. On the flipside, combination therapy is envisioned to be the way forward in seismic opportunities for the industry. Progress made in precision medicine and an emerging trend of AI-powered predictive analytics seem to create other positive outlooks for players in the industry.

The Pulmonary Arterial Hypertension treatment industry is expected to be propelled significantly in the future. This increased growth will be due to the rising incidence of disease and the evolving treatment options. Most prominent amongst the growth drivers of this market segment are the introduction of new drugs targeting pathophysiological processes of PAH, with examples of drugs being endothelin receptor antagonists, phosphodiesterase type 5 inhibitors, and prostacyclin analogs. Furthermore, awareness about the disease and improved diagnosis methods mean that diagnosis and, therefore, treatment are being given to a higher number of patients.

Combined with the emphasis placed by many companies toward combination therapy and customized treatment for PAH, steady ongoing research development is enthused by the continuing foray into the research and development arena.

Explore FMI!

Book a free demo

At present, North America occupies a primary place in the Pulmonary Arterial Hypertension (PAH) treatment markets. This is so due to improved healthcare infrastructure, raised awareness of the disease, and notable investments in research and development into cardiopulmonary therapeutics. The United States is in the lead, given the approval of the targeting therapies by the FDA.

Here clinical trials are already testing its new combinations and the new approaches to gene therapies. However, its commercial racketing prices and the dreadful accessibility problem of therapies to the patients still prevail. Conflicting issues regarding insurance reimbursement are still unresolved. Whereas, amidst all this, there is an explosion of technology.

Artificial Intelligence-based diagnostic tools and health monitoring devices worn on one's body have greatly enhanced the early diagnosis, which translates into better management of patients and good long-term treatment outcomes. These are among the challenges that are slowly but surely going to be eased by such solutions. These developments put a bright future for PAH therapy management on the horizon. These opened the gates of hope for newer treatment paradigms in the region.

Pulmonary Arterial Hypertension (PAH) forms a big place in Europe as far as international markets are concerned. This is because of the increasing incidence of pulmonary hypertension, the support that government policies provides, and increasing interest in rare diseases through orphan drug designations.

Germany, France, and the UK - key markets with growing healthcare coverage combined with strong clinical research initiatives-increased influx of patients but challenges such as tight regulatory requirements from the European Medicines Agency (EMA) and pricing pressures from government reimbursement policies make the environment challenging for pharmaceutical companies.

The increased demand for oral PAH therapies will be a very important growth driver in combination with digital health technologies, such as remote monitoring and AI-based tools, in enhancing disease management. Public-private partnerships between research institutions and pharmaceutical companies will further hasten the development of such innovative next-generation treatments for PAH. Overcoming the regulatory and monetary hurdles where necessary will help in sustaining growth in the PAH treatment market in Europe.

The Asia-Pacific region is trending up sharply in Pulmonary Arterial Hypertension treatment acquisition concerns and market potential. The rising countries such as China, Japan, and India are set to become strong contenders as they improve diagnostic capabilities and expand pharmaceutical distribution networks.

Even with positive growth, challenges such as affordability, poorly understood disease conditions, and inequity in healthcare facilities are very much experienced and hence limit access to the best care. The launching of biosimilar drugs for PAH and the expansion of local pharmaceutical production capacity have been making treatments even more affordable.

Government-led awareness campaigns have further defined early diagnosis and recognition of the disease. AI-assisted diagnostics and telemedicine are set to change the face of PAH management even in remote and underprivileged areas, allowing for broader monitoring and better treatment outcomes. The whole process is collectively making the region utilize more productive and accessible PAH care development.

Challenges

Limited access to specialized healthcare providers is hindering the market growth

The paediatric treatment market is hindered by a plethora of challenges, with limited access to specialized healthcare providers being one of the main factors. Availability of specialties directly responsible for providing diagnosis and proper care on time strongly impedes the growth of this market since it prevents lots of patients from receiving timely and appropriate care.

In a very few selected geographical zones, one would find specialists who can adequately address PAH with effective diagnostic and therapeutic options, causing delay in treatment of patients and worsening their overall outcome. Illiteracy about the disease and misdiagnosis lead to treatment delay.

From limited access to specialized healthcare, high price of therapy, and difficulty in complex management constitute issues confronting treatment. PAH necessitates lifelong treatment; thus becoming a financial headache for the patient. Inconsistent policies regarding reimbursement across regions further complicate access to affordable treatment.

Opportunities

The increasing focus on precision medicine and combination therapies presents significant growth opportunities

There is a growing tendency toward precision medicine and combination therapies that is expected to open up valuable opportunities in the treatment market for PAH. Novel avenues are now being opened in PAH therapy through the advances made in gene therapy, regenerative medicine, and stem cell research.

The development of AI-based predictive analytics for early disease discovery and optimization of treatment response also advances clinical decision-making. They both have a bright future regarding niche patient-centered drug delivery systems-for example, inhaled and subcutaneously administered prostacyclin formulations, which enhance treatment convenience and compliance. In addition, partnerships among biotech companies and universities are fast forwarding into innovation on novel PAH drug targets and expanding pipeline candidates with disease-modifying potential.

Emerging Novel Combination Therapy Approaches Propels the Market Growth

Increased investigation into combination therapies has developed as the most frequently used treatment approaches with increasing interest in PAH. Their efficacy derives from targeting the multiple pathways of the disease at once. Combinations such as Endothelin Receptor Antagonists (ERAs) and Phosphodiesterase-5 (PDE-5) inhibitors or prostacyclin analogs provide a more optimal approach to improving management of PAH in patients.

The mechanisms are quite clearly defined for a broader intervention in the underlying pathological mechanisms of the disease, with eventually better clinical outcome and symptom control, and ultimately of maybe slower progression of the disease in patients.

Personalization of Treatment Strategies are Revolutionizing the Market

Treatment strategies will, in the future, be individualized by looking at individual patient profiles, including genetic markers, so that therapies can be directed to the needs of each patient. This would help possibly reduce the risk of adverse effects while maximizing drug efficacy according to being in better-ranging tune with the patient's condition. Personalized treatments are expected to revolutionize PAH management by improving the outcome and quality of life.

Development in Novel Drug Delivery Systems improves therapeutic efficacy

In this way, newer drug delivery systems improve adherence and overall outcomes in treatment for PAH. Inhaled therapies, which include nebulized prostacyclin analogs, are an easier mode for self-managing the disease at home. Long-acting injectables provide sustained release with reduced dosing frequency to improve ease of use for the patient. Additionally, implantable devices will contribute to continuous medicine administration and greater treatment constancy. Such innovative systems were configured to lessen treatment burden and optimize therapeutic efficacy, adding to better patient compliance and improved quality of life among PAH patients.

From 2020 to 2024, the Pulmonary Arterial Hypertension (PAH) treatment market is experiencing growth due to the increase in the number of patients suffering from PAH. This has developed a higher demand for therapies. Patient outcomes have improved due to an increasing number of treatment options. The market has also seen the increased use of combination therapies. Clinical evidence supports personalized treatment as an effective strategy for treating patients with PAH.

The PAH treatment market will witness a dynamic expansion beyond the year 2025 and until 2035. Awareness of PAH at a global level, along with the advances in diagnostics technologies, will translate into opportunities for early diagnosis and demand for treatments.

Continuous innovation in therapies for PAH along the avenue of targeted treatment by way of introducing more specific drugs will enhance therapeutic outcome and quality of life for patients. Trends of personalized medicine and more effective combination therapies will make an active contribution to intensifying the market.

Healthcare providers globally are now paying increasing attention toward improving the accessibility of PAH treatments, especially in developing regions, and thereby creating greater global demand. This will in turn speedily enhance the current demand, met through the strategic collaborations between pharmaceutical companies, healthcare institutions, and research organizations aimed at accelerating the development and availability of treatments that meet the actual needs of patients.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | The approval of progressive medicines for PAH treatment will have an accelerated pace like the rapid approval of Winrevair in the recently passed year. |

| Technological Advancements | Adoption of novel classes of drugs targeting selective pathways in PAH that will improve specificity and outcomes of treatment. |

| Consumer Demand | Patients demand a quality of life improvement through therapies and increased awareness resulting in high demand for effective and accessible PAH treatments. |

| Market Growth Drivers | Increasing prevalence of PAH, supportive government legislation for orphan drug development, and huge investments in R&D. |

| Sustainability | Initial forays into developing environmentally friendly manufacturing processes and reducing the environmental footprint of pharmaceuticals. |

| Supply Chain Dynamics | Dependence on the previously constructed mere delivery chain with a fair concentration on storage and supply of PAH medicines in tertiary healthcare facilities. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Full guidelines would come into effect for combination therapy and personalized medicine approaches to standardization in treatment protocols for patient safety. |

| Technological Advancements | Implementation of digital health technology, like telemedicine and wearable devices, for remote patient monitoring for individualized treatment adjustments. |

| Consumer Demand | Patients demand therapy regimens personalized to their disease profiles and genetic markers, working with healthcare providers to tailor these therapies. |

| Market Growth Drivers | Market Expansion into emerging countries with developing healthcare infrastructures, increased focus on early diagnosis and intervention, and strategic partnerships between a pharmaceutical company and healthcare systems for facilitating access to treatments. |

| Sustainability | Full adoption of sustainable practices such as principles of green chemistry, use of biodegradable packaging materials, and energy-efficient manufacturing processes as per global environmental standards. |

| Supply Chain Dynamics | Digitization of supply chains and e-commerce channels would optimize the distribution of medicines to far-dark, remote areas, as well as ensure transparency, efficiency, and resilience throughout the distribution process. |

Market Outlook

The increasing incidence of cardiovascular diseases and growing public awareness will propel the USA PAH management market into significant growth. Technological advancements in personalizing medicines such as AI-supported diagnostics and targeted treatments are hastening the development of these effective therapies.

This truly will lead to improved early diagnosis and closer monitoring of disease states as well as more precise treatment applications to strengthen patient outcomes. There, however, are several impediments that pose a considerable threat to the universal availability of high-tech cures, which include high therapy costs, restrictive insurance reimbursements, and possibly a need for lifelong therapies.

Going further, the market will continue growing with increased R&D investment and a growing aging population that requires advanced PAH treatments. Furthermore, pharmaceutical companies could perhaps outsource particular development phases to enhance the growth of novel approaches and improve operational feasibility such that more patients may benefit from timely access to effective PAH treatment.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 2.3% |

Market Outlook

Increasing cardiovascular diseases, air pollution, and improving healthcare have transformed China's market for the treatment of pulmonary arterial hypertension (PAH). Having educated a larger population regarding health issues, more consumers are asking for treatment for PAH. The introduction of new diagnostic techniques into clinical practice-including telemedicine and AI-supported imaging-employed forthright identification and management of the condition at a preliminary stage.

Local pharmaceutical manufacturing capacity increases the access to low priced alternatives for PAH treatments. But other factors such as varying healthcare delivery in the regions, low awareness about PAH among medical professionals, and affordability still pose challenges. However, the relatively rare disease government initiatives combined with R&D investment are potential strategic drivers for growth in the PAH treatment market.

The progressive digitalization of health services is expected to go a long way to improving patient management and ensuring optimum accessibility of patients to treatment options, especially in poorly served areas.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 2.8% |

Market Outlook

The booming PAH treatment market in India is attributable primarily to the sharpened cardiovascular disease incidence, the gradual improvement in healthcare infrastructure, with an increase in awareness regarding rare diseases. Rapidly growing internal pharmaceutical industry, large applicable local manufacturers, is significant for making PAH treatments more economical.

The growing technological advancements include fast emerging digital health tools and AI-driven diagnostics revolutionizing PAH management, risk assessments, and personalized treatment. However, six challenges remain of limited awareness towards PAH in healthcare professionals and affordability issues, especially in rural areas, although improvements are being made.

India is expected to witness the future flair of expansion in healthcare access as well as government initiatives on rare disease research, besides the rising trend of telemedicine, hence elevating market growth. An increasing trend of foreigners working with domestic industries to achieve low-cost drug design and distribution could again accelerate the growth of this market.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 2.7% |

Market Outlook

From healthy healthcare facilities, a highly developed pharmaceutical industry, and powerful initiatives for clinical research, the German PAH treatment market stands tall among others in the European continent. The well-organized system of healthcare in Germany ensures that PAH patients acquire innovative therapeutic approaches.

These include specialized therapies and combination drugs, which are instrumental in improving patient outcomes. Digital health technologies, such as AI-powered diagnostics and remote monitoring devices, are enhanced with disease management. Therefore, they are employed for early intervention at a more personalized level.

Regulatory obstacles and pricing constraints due to government reimbursement policies are challenges that bar the growth of the market. Still, from its solid investment in research and development, plus the collaborative effort of pharmaceutical firms together with research institutions, the country is bound to produce next-generation PAH therapeutics. Moreover, Germany's high specialty medicine demand along with increasing personalized treatment trends are also stimulating the growth of the market for PAH therapies.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 1.4% |

Market Outlook

The incidence of rising cardiovascular diseases will also facilitate increasing the Brazilian market for PAH treatment, which has access to treatment services and enhanced government initiatives for rare diseases. Awareness of PAH among health practitioners has increased. Advances in technologies improve the diagnosis and management of the disease. Availability of cheaper generic drugs increases market opportunity.

Despite this, healthcare challenges abound in many parts of Brazil. There are geographic differences in access to specialized health care; affordability is the major issue. These conditions should help speed the future development of this market, as should the expanding Brazilian healthcare market and increased health insurance coverage.

In addition, contemporary government policies for improved access to medicines will play a key role. In the same way, setting up telemedicine and AI-based healthcare solutions in Brazil will set the stage for easier management of chronic diseases such as PAH in the future. This will improve patient outcomes and treatment adherence.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 1.7% |

The Usage of Endothelin Receptor Antagonists Is Increasing Due To Their Proven Efficacy in Reducing Pulmonary Arterial Pressure

The market for PAH treatment - pulmonary arterial hypertension - is significantly endowed with endothelin receptor antagonists (ERAs). As of now, it is indicated that they also have vasodilator and antiproliferative features on the pulmonary arteries. In this line of drugs are, bosentan, ambrisentan, and macitentan, which act as inhibitors to the blocker action of endothelin-1, a vasoconstrictor molecule that raises pulmonary arterial blood delivery and decreases exercise capacity.

Among other [several] reasons, the fast increase in cases of PAH, A really growing trend for intense combinations involving ERAs, and positive clinical efficacy in halting the ongoing progression of diseases level must be contributed to the growth of this market. North America and Europe still dominate in the uptake of ERAs due to strong regulatory approvals and wide preferences among physicians; however, Asia-Pacific shows an ever-growing trend, spurred on by better access to PAH medications.

Future trends will involve AI precision medicine aimed at the optimized dosing of ERAs, new formulations of ERAs with improved bioavailability, and combination regimens of ERAs and PDE-5 inhibitors for added therapeutic efficacy.

The Usage of Phosphodiesterase-5 Inhibitors Is Increasing Due To Growing Preference For Combination Therapy

The phosphodiesterase-5 inhibitors sildenafil (Revatio) and tadalafil action in the pulmonary vasculature is based on vasodilation. Moreover, comparatively, they are regarded as being cost-effective against the other drugs being used in PAH therapy. Hence, they are generally preferred in early PAH or combination therapy.

An increase in the inclusion of PDE-5 inhibitors in PAH treatment protocols, the growing demand for low-cost agents for PAH management, and increased awareness of the disease among health workers are some factors driving market demand. North America and Europe are the largest areas in which PDE-5 inhibitors are marketed. However, Asia-Pacific has begun to witness growing adoption as healthcare becomes more accessible and prices begin to drop.

Hospital pharmacies hold the largest share due to the need for specialist care.

Hospital pharmacies hold the largest share in the PAH treatment market, as PAH management requires specialist care, high-cost medications, and close monitoring. Many PAH drugs, particularly ERAs and SGC stimulators, are dispensed primarily through hospital networks, where specialist cardiologists and pulmonologists manage treatment protocols.

The rising hospitalization rates due to PAH complications, increasing preference for hospital-based specialty pharmacies, and growing adoption of advanced PAH therapies requiring physician supervision are fueling market growth.

North America and Europe lead in hospital pharmacy-based PAH drug distribution, while Asia-Pacific is witnessing increasing demand due to expanding tertiary healthcare facilities and government-backed PAH treatment programs. Future trends include hospital-based AI-driven medication tracking for PAH, digital prescription management systems, and expanded access to biologic PAH treatments through hospital formularies.

The Online PAH Treatment Market Is Growing Due To the Increasing Demand for Convenience

As an increasingly high preference of past PAH patients in home delivery services and medication access ease improves price transparency for online pharmacies, popularity gains. In this area, for long-term management of patients requiring regular refills for costly drugs such as ERAs and PDE-5 inhibitors, online pharmacies can prove beneficial.

Growth in e-pharmacy, increasing demand for direct-to-consumer (DTC) fulfilling of prescriptions, and rising prescriptions through telemedicine are some of the major drivers of demand. North America and Europe are leading regions for online PAH drug sales, while the Asia-Pacific is one of the fast-growing regions, fueled by increased digital healthcare infrastructure and the gradual acceptance of online medication ordering.

Future innovations drop some names: AI-driven online prescription validation, blockchain-enabled secure pharmacy transactions, and digital PAH patient engagement platforms featuring real-time medication adherence tracking.

There is competition in the PAH treatment market fueled by the increasing prevalence of PAH. Companies today are focusing on developing novel drug formulations. The market would be additionally shaped by the earlier established pharmaceutical companies that have their seat in the PAH treatment arena, biotechnology companies, and those drug developers who in time become emergent.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Actelion Ltd. | 39 - 40% |

| United Therapeutics Corporation | 24% - 28% |

| Gilead Sciences, Inc. | 10% - 12% |

| Pfizer Inc. | 4% - 8% |

| Bayer AG | 3% - 7% |

| Others | 20% - 6% |

| Company Name | Key Offerings/Activities |

|---|---|

| Actelion Ltd. | Well known for the development of Tracleer (bosentan) |

| United Therapeutics Corporation | Works on PAH therapy with Remodulin, Tyvaso, and Orenitram. |

| Gilead Sciences, Inc. | Provides Letairis (ambrisentan) as an endothelin receptor antagonist |

| Pfizer Inc. | Offers Veletri (epoprostenol) and Uptravi (selexipag), targeting PAH with prostacyclin analogs. |

| Bayer AG | Develops Adempas (riociguat), a soluble guanylate cyclase stimulator used for treating PAH. |

Key Company Insights

Actelion Ltd. (39 - 40%)

Actelion Ltd. derives a considerable portion of its revenues from Tracleer (bosentan). The company's research interests have centered on therapies for pulmonary hypertension and innovative formulations.

Actelion seems to have succeeded on the basis of its ability to identify the cause of pulmonary arterial hypertension, or PAH, and thus measures in improving the patients' quality of life and reducing complications for such patients. Actelion is in the process of diversifying its pipeline with several antipulmonary arterial hypertensive treatment options for continued market leadership.

United Therapeutics Corporation (24% - 28%)

United Therapeutics Corporation is truly the pioneer in the development of prostacyclin analogues and inhaled therapies. The work done by United Therapeutics in developing revolutionary therapies for pulmonary hypertension, such as Remodulin and Tyvaso .

United Therapeutics pursue the development of therapies that can be very effective but at the same time very accessible, so that more favorable prospects of treatment can be opened to patients. This multidimensional approach to pulmonary arterial hypertension includes pulmonary vasodilation and reversal of pulmonary arterial pressure.

Gilead Sciences, Inc. (10% - 12%)

Gilead Sciences, Inc. is a prominent company in the PAH market. It has got an endothelin receptor antagonist in the name of Letairis. The Letairis is capable of reducing pulmonary arterial pressure and increasing exercise ability in patients with pulmonary arterial hypertension.

Gilead maintains a pro forma understanding of PAH but is never limited to a host of other seemingly less threatening diseases, since it considers setting out into new therapeutics that would change the lives of patients afflicted by those that are extremely complex.

Pfizer Inc. (4% - 8%)

Pfizer Inc. current product line-up mainly consists of prostacyclin analogs and endothelin receptor antagonists whose functional effects include decreasing pulmonary vascular resistance and improving patient prognosis. It is an indicator of Pfizer's utmost devotion toward advancing PAH treatments.

Undoubtedly, Pfizer is quite serious in developing new therapy strategies and treatments for the disease. Having such a strong presence and footprint in the market makes Pfizer an important part of the shaping of that transformation in PAH care lying as well in the demand by the different kinds of PAH patients..

Bayer AG (3% - 7%)

Bayer AG focuses on targeting different pathways related to pulmonary hypertension. Scientific innovation gives Bayer other options for the improvement of the treatment pathways toward delivering better outcomes for PAH patients. Bayer's products, including Adempas (riociguat), target the complex mechanisms of PAH through mechanisms that enhance vasodilation and promote overall cardiovascular health.

Prolonged with continuous investments in research and a diversified pipeline, Bayer continues to work internationally toward the fight against PAH, bringing new therapeutic avenues to the patients across the globe.

Other Key Players (20% - 6%)

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These companies focus on expanding the reach of PAH treatments, offering competitive pricing and cutting-edge innovations to meet diverse patient and healthcare provider needs

The overall market size for Pulmonary Arterial Hypertension Treatment Market was USD 2,080.7 million in 2025.

The Pulmonary Arterial Hypertension Treatment Market is expected to reach USD 2,612.0 million in 2035.

The demand for the Pulmonary Arterial Hypertension (PAH) treatment market will be driven by factors such as the increasing prevalence of cardiovascular diseases, advancements in early diagnosis, innovative therapies, and growing awareness. Additionally, the aging population, government support for rare diseases, improved drug delivery systems, and rising demand for specialty drugs will further boost market growth during the forecast period.

The top key players that drives the development of Pulmonary Arterial Hypertension Treatment Market are Actelion Ltd., United Therapeutics Corporation, Gilead Sciences, Inc., Pfizer Inc. , and Bayer AG.

Endothelin receptor antagonists (ERA) by drug class in Pulmonary Arterial Hypertension Treatment Market is expected to command significant share over the assessment period.

Tablets, Vasodilators, Endothelin receptor antagonists (ERA), PDE-5, and SGC stimulator.

Hospital pharmacies, retail pharmacies, and online pharmacies.

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Analysis by Product, Testing Methods, End User, and Region - Forecast for 2025 to 2035

Procalcitonin (PCT) Assay Market Analysis by Component, Type, and Region - Forecast for 2025 to 2035

Cardiovascular Diagnostics Market Report- Trends & Innovations 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.