The proton pump inhibitors or gastric acid suppressants market is valued at USD 3.2 billion in 2025. As per FMI's analysis, the industry will grow at a CAGR of 5.2% and reach USD 5.46 billion by 2035. In 2024, the gastric acid suppressants market grew at a consistent rate as demand for chronic treatment of GERD continued to rise, especially among the aging populations of Western Europe and North America.

FMI research revealed that Omeprazole maintained its leadership position, supported by continued over-the-counter availability and strong clinical familiarity. Significantly, esomeprazole and pantoprazole gained renewed popularity as a result of positive clinical trials highlighting reduced long-term side effects and enhanced bioavailability.

Hospitals and ambulatory surgical centers raised PPI purchasing as surgical procedures for reflux and ulcer treatment remained elevated. Consumer preference has moderately shifted toward prescription-strength products as awareness of the dangers of self-medication has increased.

FMI suggests that 2025 will witness a stronger shift toward combination therapies that include PPIs and antibiotics for H. pylori eradication, especially in Asia. Regulatory approvals and policy shifts favoring generic entries will also support industry growth, spurring price competition and increasing access.

In the coming decade, increasing digestive issues associated with sedentary lifestyles, NSAID use, and obesity will continue to will sustain robust demand for acid-suppressive therapies and support long-term industry expansion. Increased confidence in the clinical effectiveness of PPIs will continue to drive prescription volumes despite increasing debate regarding long-term safety.

Market Forecast Table

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3.2 Billion |

| Industry Value (2035F) | USD 5.46 Billion |

| CAGR (2025 to 2035) | 5.2% |

Explore FMI!

Book a free demo

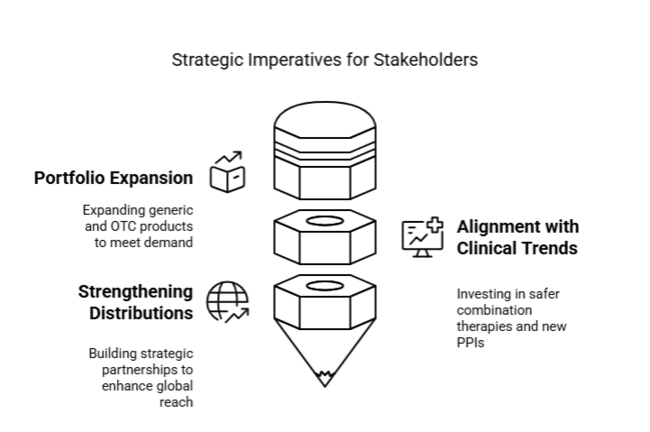

The gastric acid suppressants industry will grow steadily up to 2035 as a result of the increasing global prevalence of acid-related disorders like GERD and peptic ulcers. Increased geriatric populations and extensive usage of NSAIDs continue to fuel demand for sustained acid suppression treatment. Generic and OTC manufacturers are poised to gain the most, while brands relying on legacy products and lacking innovation risk losing market share.

Expand Generic and OTC Portfolios

Invest in expanding the portfolio of over-the-counter and generic products for gastric acid suppressants to meet increasing consumer demand and stay competitive in price-sensitive industries.

Align with Emerging Clinical Trends

Focus on investing in research and development for combination therapies and new PPIs that are safer, to meet the evolving preferences of doctors and the expectations of patients for long-term use.

Strengthen global distributions and partnerships.

Seek strategic partnerships with local wholesalers and pharmacy groups, particularly in Asia and Latin America, to accelerate industry reach and strengthen brand footprint in high-growth geographies.

| Risk | Probability - Impact |

|---|---|

| Regulatory scrutiny over long-term safety of PPIs | Medium - High |

| Rising competition from H2 blockers and antacids | High - Medium |

| Supply chain disruptions affecting API availability | Medium - Medium |

| Priority | Immediate Action |

|---|---|

| Reformulation Strategy | Conduct feasibility study on low-dose, extended-release PPI blends |

| Pharmacovigilance Enhancement | Launch real-world long-term safety and efficacy data collection on PPI usage |

| Emerging Industry Penetration | Establish local licensing deals in Southeast Asia and Latin America |

To gain a competitive edge, companies need to focus on growing the generic and OTC portfolio and accelerate investment in safer, next-generation drugs. This insight supports a move away from focusing exclusively on volume to a value-plus strategy-combining affordability with clinical innovation.

The board should approve deeper penetration in Asia and Latin America through licensing and co-marketing arrangements while implementing a global pharmacovigilance system. These actions will future-proof the pipeline, create industry resilience, and establish the company as a differentiated leader in long-term gastrointestinal care.

Regional Variations

Innovation and technology adoption

Formulation Preferences

Pricing and Accessibility Pressures

Manufacturers

Distributors

Retailers/Pharmacists

Variance vs. Consensus

Key Variances

Strategic Insight

| Countries | Policy & Regulatory Impact on Proton Pump Inhibitors Industry |

|---|---|

| United States | The FDA requires stringent post- market ing monitoring of PPIs because of long-term risks such as kidney disease and fractures. Although the FDA has not yet implemented REMS, frequent label revisions occur. |

| United Kingdom | Traceability is required from generic manufacturers in compliance with the Drug Supply Chain Security Act (DSCSA). MHRA applies pharmacovigilance revisions following Brexit -driven changes to approvals of medicines. Parallel imports are subject to closer examination. Firms need to have a UK-specific market ing Authorization (UKMA) after Brexit, even if previously authorized by EMA. |

| France | Every year, the National Agency for the Safety of Medicines (ANSM) revises prescription guidelines to enforce strict controls on PPI overuse. Eco-pharmacovigilance regulations now include impact assessments of the environmental discharge of medicines. |

| Germany | Under BfArM, PPIs fall under the purview of AMNOG law for early benefit assessment. There is a requirement to prove added clinical value in order to be eligible for positive reimbursement. EU GMP certification is obligatory, and green packaging requirements are increasing in popularity. |

| Italy | The Italian Medicines Agency (AIFA) limits reimbursement for chronic PPI unless supported by diagnostic confirmation. E-PILs (electronic patient information leaflets) will be compulsory from 2026 for all prescription drugs. |

| South Korea | The MFDS has raised bioequivalence testing requirements for all generic PPIs after the 2023 safety re - evaluation. K-GMP compliance is required for domestic and foreign suppliers. Patient information should be in bilingual form (Korean-English). |

| Japan | PMDA requires localized clinical trials or bridging studies for any new PPI formulation. Strict advertising regulations limit DTC (Direct-to-Consumer) campaigns for GI drugs. Reimbursement remains tightly regulated through centralized NHI pricing mechanisms. |

| China | NMPA categorizes PPIs as high-risk based on misuse issues and now mandates periodic reassessments of long-term data. The MAH system decentralizes responsibility to regional licensees. The eCTD submission is now mandatory. |

| Australia-NZ | TGA and Medsafe together mandate extensive risk labeling for OTC PPIs, citing rebound acid hypersecretion. Serialization and traceability compliance under the Medicines Traceability Framework will be mandatory by 2025. |

| India | Every generic PPI launch must include bioequivalence and stability studies, as mandated by CDSCO. Price controls in DPCO (Drug Price Control Order) restrict profit margins. Although there is no central pharmacovigilance certification, the proposed draft rules mandate mandatory ADR (Adverse Drug Reaction) reporting by 2026. |

Between 2025 and 2035, esomeprazole will be the most profitable drug type segment, driven by its improved pharmacokinetic profile and widespread use as a first-line treatment for acid-related disorders. This industry is expected to grow at a CAGR of 5.9% from 2025 to 2035, ahead of traditional proton pump inhibitors like lansoprazole and rabeprazole.

Esomeprazole, a version of omeprazole, is better absorbed by the body and maintains intragastric pH suppression for an extended duration. This benefits patients with gastroesophageal reflux disease (GERD), peptic ulcers, and Zollinger-Ellison syndrome leading to symptom relief and mucosal healing. Clinical studies have repeatedly demonstrated its efficacy to hold intragastric pH at over 4 for a long duration of time, which aids in mucosal healing and symptom relief.

Its dual presence in the industry as a generic and branded product, as well as its OTC availability in most areas, broadens patient access and reduces treatment cost. Insurance coverage for prolonged usage, especially in the USA and Europe, favors long-term use. Esomeprazole's strong lifecycle plan, covering pediatric and IV formulations, has broadened its application across patient segments.

Oral administration will continue to be the leading and most profitable path in the proton pump inhibitor (PPI) industry during the forecast period. This will be propelled by patient convenience, positive safety profiles, and extensive formulation availability.With formulary placement and retail pharmacy accessibility as supports, FMI believes that the oral administration segment will grow at a CAGR of 5.6% from 2025 to 2035.

Oral dosing is versatile, suitable for acute and chronic conditions, and commonly used across outpatient and inpatient settings. Tablets and capsules are widely available across branded and generic options, contributing to pricing competition and accessibility. Patients prefer oral formulations due to their non-invasive nature, which enhances adherence over long treatment durations, especially in GERD and peptic ulcer cases.

Additionally, oral administration aligns well with OTC consumer behavior, as most patients self-manage conditions like heartburn and indigestion. Healthcare providers and hospitals also opt for oral formats for discharged patients, thereby supporting repeat sales. With increased prevalence of fixed-dose combinations and enteric-coated tablets that provide improved gastric tolerance, further boosts the preference for oral administration.

The tablet segment is expected to continue as the dominant and most profitable dosage form in the PPI industry space, based on their ease of manufacture, economy, and strong consumer acceptance. With tablet generics achieving robust penetration in emerging nations and branded forms maintaining loyalty in mature industries, FMI analysis predicts a CAGR of 5.5% for this segment between 2025 and 2035.

Tablets provide dose uniformity, longer shelf stability, and greater convenience in packaging for distribution through retail and hospital channels. Tablet manufacturing cost-effectiveness renders them an attractive proposition for generic manufacturers seeking scalable, high-volume production, particularly in Latin America and Asia.

Moreover, tablets are most amenable to long-term regimens of medications, specifically in chronic acid-related illnesses such as GERD and functional dyspepsia. Methods like delayed-release and enteric-coating technology have made tablet-form PPIs more effective and easier on the stomach. Patients are more likely to comply with once-daily treatment regimens when provided with tablet forms.

Between 2025 and 2035, generics will become the most profitable segment within the proton pump inhibitors industry, driven by sheer patent expirations across large areas, efforts in healthcare cost-containment, and a transformation to high-volume, low-margin prescription models.

With strong penetration in retail pharmacy and hospital chains alike, coupled with increasing volume in telemedicine and mail order channels, FMI anticipates this segment growing at a 6.1% CAGR, ahead of branded variants.

Since the branded exclusivities for generic leader molecules such as omeprazole, esomeprazole, and pantoprazole have expired in most parts of the world, generics have gained significant industry share in both developing and mature economies. Regulatory bodies such as the FDA and EMA have accelerated generic approval pathways to facilitate quicker entry into the marketplace.

Generic PPIs translate into substantial savings for public and private payers, which adds to reimbursement favourability. Pharmacies favor generics due to their higher margins and quicker turnover and ready availability. Patient access also increased through aggressive pricing strategies in large out-of-pocket expenditure nations like India and Southeast Asia's select regions.

Between 2025 and 2035, Gastroesophageal Reflux Disease (GERD) is expected to continue as the most dominant and profitable indication for using proton pump inhibitors. The FMI study reveals this indication segment to progress gradually at a CAGR of 6.0% through the forecast period, backed by ongoing formulation innovation and robust patient efficacy.

GERD affects approximately 20% of the world's adult population and is further associated with lifestyle factors including unhealthy diet, obesity, physical inactivity, and stress. Long-term GERD can lead to serious problems like damage to the esophagus, changes in the esophagus lining, and even cancer of the esophagus if not treated, underscoring the clinical necessity of sustained acid suppression.

Clinical guidelines advocate for the use of PPIs as the first-line treatment for symptom control and mucosal healing. With increased awareness of GERD through DTC (direct-to-consumer) advertising and telemedicine consultations, early diagnosis rates are on the rise worldwide. Secondly, the chronic condition of GERD has patients dependent on PPIs for prolonged periods, which results in high prescription volumes.

Retail pharmacies will be the most profitable distribution channel for proton pump inhibitors to maintain consistency, backed by the global transition to OTC availability and the growing consumer inclination toward direct purchase access. As DTC marketing and pharmacist-driven care models mature, FMI expects this segment to grow at a CAGR of 5.8%, solidifying its leadership in volume and revenue terms in the ecosystem for proton pump inhibitors.

Retail pharmacies are a primary access channel for self-medication in minor cases of GERD and heartburn, particularly among urban and suburban populations. These outlets provide flexible hours, instant access, and visibility for promotional campaigns from both branded and generic manufacturers.

With increasing awareness and ease of consultation with the pharmacist, patients are increasingly turning to OTC PPIs without official prescriptions. Furthermore, retail chains from developed nations are incorporating e-prescriptions and individualized refill systems, which improve chronic treatment compliance. In developing economies, retail pharmacy networks are growing at a rapid pace, fuelled by urbanization and increasing middle-class incomes.

The United States industry for proton pump inhibitors is projected to grow at the CAGR rate of 4.9% from 2025 to 2035. The USA industry is highly mature; however, it remains one of the largest revenue generators worldwide due to high GERD prevalence, extended acid suppression treatments, and a significant aging population.

Despite growing concerns about long-term PPI use, the demand from chronic users remains unabated. Generic penetration is close to saturation, but next-generation products with enhanced safety features and dual-release mechanisms are picking up pace. FMI analysis found that trends based on real-world evidence will likely encourage hospital networks and outpatient clinics to adopt these products more widely.

In the United Kingdom, the industry for proton pump inhibitors is projected to grow at a CAGR of 4.7% in the assessment term. Prescription guidelines are becoming more stringent under NHS cost-containment policies, restricting indiscriminate use of PPIs. FMI, however, believes that demand will be stable in aging populations and H. pylori treatment.

With MHRA setting up post-Brexit pharmacovigilance regulations, manufacturers now have to maintain UK-specific approvals and adopt sustainable labeling practices. FMI analysis found that the growing demand for ODTs and medication reviews started by pharmacists will influence how new products are developed and how they are distributed in communities.

From 2025 to 2035, projections indicate a CAGR of 5.7% for the proton pump inhibitor industry in France. France demonstrates robust clinical use of PPIs for gastroprotection, particularly among elderly patients who are on NSAIDs or corticosteroids. The National Agency for the Safety of Medicines (ANSM) requires periodic re-evaluation of chronic therapies, but reimbursement by the government of important generics guarantees high accessibility.

The FMI analysis found that systems for monitoring drug safety and hospital purchasing networks tend to favor suppliers who provide transparent information about the full life cycle of their products. Advances in more environmentally friendly packaging and low-dose versions designed for long-term therapy are likely to capture share.

In Germany, the proton pump inhibitors' industry is approximated to grow at a rate of 5.5% CAGR during the forecast period. Pharmaceutical firms are mandated by the country's early benefit assessment law (AMNOG) to present evident clinical excellence or cost-efficacy as a prerequisite to gain positive reimbursement. Despite this fact, FMI maintains that there is a strong demand for PPIs in both outpatient and in-hospital settings due to the high prevalence of acid-related disorders.

Germany also leads Western Europe in the adoption of oral dispersible formulations, especially in pediatric and geriatric segments. Green packaging and digitalized delivery of patient information are becoming regulatory mandates at a rapid pace, leaving the field open for differentiation.

Sales in Italy is projected to grow at a CAGR of 5.3% between 2025 and 2035. National reimbursement schemes continue to prioritize the diagnostic confirmation policy, yet FMI analysis indicates that the therapeutic demand in gastroenterology and internal medicine has remained resilient.

The trend is growing as hospitals increasingly import low-priced generics, but drug makers who make value-added versions-such as rapid-release capsules or fixed-dose combinations-gain share. The e-labeling obligations set to come into force in 2026 will accelerate the digitalization process among distributors. Italy's decentralized procurement system also presents regional opportunities for nimble distributors that match local public health policy objectives.

The South Korean industry of proton pump inhibitors is expected to grow at a CAGR of 5.4% during the period from 2025 to 2035. Through its analysis, FMI’s research indicates that rising diagnoses of gastric ulcers and acid reflux due to lifestyle habits and the aging population are propelling prescription volumes.

The Ministry of Food and Drug Safety (MFDS) has strengthened bioequivalence and stability tests, increasing the entry barriers to the industry. However, local companies are innovating in a big way, with patient-friendly formulations like easy-to-swallow granules becoming popular. Government price controls continue to be a limitation, but co-pay subsidies and broader insurance coverage facilitate industry growth.

The Japanese industry for proton pump inhibitors is projected to grow at a CAGR of 4.6% during the period 2025 to 2035. High generic formulation penetration and conservative prescribing habits dominate the industry. The Pharmaceuticals and Medical Devices Agency (PMDA) requires domestic clinical bridging studies for new PPI drugs, imposing entry barriers on foreign companies.

FMI believes that even with the challenges, there are opportunities in geriatric-oriented drug delivery systems, particularly as Japan's elderly population increases. Insurer-driven cost containment has delayed new product launches, but branded companies with effective post-marketing surveillance programs continue to have a competitive advantage.

The projections indicate a CAGR of 6.1% for the proton pump inhibitors industry in China between 2025 and 2035. China is the most dynamic growth industry in the world, driven by increasing diagnosis rates, growing middle-class access to healthcare, and urban hospital growth.

FMI research discovered that e-pharmacy and e-prescription integration is driving retail penetration in Tier II and Tier III cities. The NMPA's tightening regulations, which include mandatory local clinical data and central procurement, are raising the standard of quality. With the implementation of the marketing Authorization Holder (MAH) system, international firms are forming joint ventures to establish local control and minimize risk.

From 2025 to 2035, projections indicate a CAGR of 6.3% for the proton pump inhibitors industry in India. India continues to be among the fastest-growing and most competitive PPI industries, fueled by excessive use of NSAIDs, a high incidence of H. pylori infections, and over-the-counter demand.

FMI research identified public sector procurement and Jan Aushadhi schemes as key drivers of high-volume generic sales. The Drug Price Control Order (DPCO) imposes ceiling prices on several key PPI formulations, limiting profitability but ensuring access. Bioequivalence testing, cost-effective production and rural logistics optimization position manufacturers for long-term success.

Competing fiercely, major players in the gastric acid suppressants industry are adopting a combination of generic pricing strategies, product life cycle extension, and geographic expansion. Major players such as Pfizer, Takeda, and AstraZeneca are making incremental innovation investments in terms of dual-release formulations and combination treatments to ensure brand salience.

At the same time, generic leaders in the industry are gaining momentum through competitive pricing and local collaborating in emerging economies. FMI analysis has revealed that leading companies are diversifying their revenue streams by expanding their OTC products, digital health integrations for compliance tracking, and licensing arrangements to gain positions in Asia-Pacific and Latin America.

In March 2024, Pfizer acquired Seagen, a leader in antibody-drug conjugate (ADC) technology, for USD 43 billion. This acquisition aimed to bolster Pfizer's oncology portfolio. In October 2024, the company partnered with the Ignition AI Accelerator to utilize artificial intelligence in expediting drug discovery, improving operational efficiency, and optimizing manufacturing processes.

In March 2024, AstraZeneca acquired Fusion Pharmaceuticals for USD 2 billion in cash, aiming to enhance its cancer treatment capabilities through Fusion's proprietary platform. In March 2024, the company acquired Amolyt Pharma for USD 1.05 billion, focusing on expanding its rare-disease portfolio.

Sun Pharma acquired Checkpoint Therapeutics, a USA-based immuno-oncology company, for USD 355 million to enhance its oncology portfolio in March 2025. Before that, in January 2024, the company completed a merger with Taro Pharmaceuticals, acquiring the remaining stake for USD 347.73 million to expand its presence in the dermatology segment.

Pfizer Inc.

Share: ~20-25%

A global leader in the pharma industry, Pfizer has a strong foothold in the PPI industry with products such as Protonix (pantoprazole), based on its large distribution network and brand equity.

AstraZeneca PLC

Share: ~18-22%

AstraZeneca continues to be aindustry leader with Nexium (esomeprazole) through high prescription demand and key industry partnership strategies.

Takeda Pharmaceutical Company Limited

Share: ~15-20%

Takeda is a major player with its lead PPI, Prevacid (lansoprazole), especially in the Asia-Pacific and North American regions.

Bayer AG

Share: ~10-15%

With its PPI brands, such as Nexium (licensed from AstraZeneca in certain industries), Bayer is a challenger, concentrating on over-the-counter (OTC) extensions.

Procter & Gamble (P&G) and Teva Pharmaceutical Industries Ltd.

Share: ~8-12%

P&G (via its joint venture with Teva) sells Prilosec OTC (omeprazole), enjoying a large part of the non-prescription PPI industry.

Sun Pharmaceutical Industries Ltd.

Share: ~5-10%

Sun Pharma has been strengthening its generic PPI portfolio, especially in emerging industries, with cost-saving alternatives for branded products.

Other Generic Manufacturers (Dr. Reddy's, Mylan, etc.)

Share: ~10-15% combined

Generic manufacturers continue to undermine branded PPI sales, selling cheaper products and reaping the rewards of patent expirations.

The sales is propelled by the growing incidence of GERD, growing OTC accessibility, and enhanced awareness regarding acid-related diseases.

FMI analysis determined that the industry will continue to grow steadily until 2035, aided by generics uptake, aging populations, and widening access in emerging industries.

Major firms are AstraZeneca, Bayer AG, Cadila Pharmaceuticals, Eisai Inc., GlaxoSmithKline PLC, Pfizer Inc., Takeda Pharmaceuticals, Sanofi SA, Perrigo Company PLC, Dr. Reddy's Laboratories, Redhill Pharma Limited, Cipla Limited, Sun Pharmaceutical Industries Ltd., and Mylan N.V.

Oral tablets and capsules are expected to be the leading dosage forms owing to the convenience of administration and patient preference.

FMI believes that the overall value will amount to around USD 5.46 billion by 2035.

The industry is segmented intoesomeprazole, omeprazole, dexlansoprazole, pantoprazole, rabeprazole, lansoprazole and others.

The industry is segmented into oral and injectable.

The industry is segmented into tablet, capsules, injection and others.

The industry is segmented into branded and generics.

The industry is segmented into gastroesophageal reflux disease, heartburn, peptic ulcers and others.

The industry is fragmented into hospital pharmacies, retail pharmacies, drug stores and specialty clinics.

The industry is studied across North America, Latin America, Europe, South Asia, East Asia, Oceania, Middle East & Africa.

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Analysis by Product, Testing Methods, End User, and Region - Forecast for 2025 to 2035

Procalcitonin (PCT) Assay Market Analysis by Component, Type, and Region - Forecast for 2025 to 2035

Cardiovascular Diagnostics Market Report- Trends & Innovations 2025 to 2035

Prostate-Specific Antigen Testing Market Analysis - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.