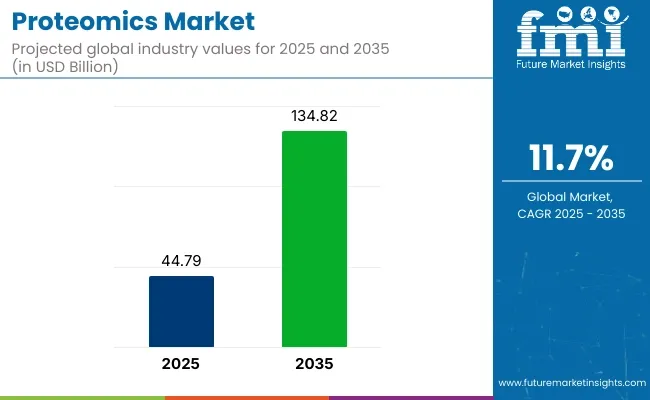

The global proteomics market is projected to be valued at USD 44.79 billion in 2025 and is expected to reach USD 134.82 billion by 2035, registering a CAGR of 11.7% during the forecast period. This expansion is driven by the escalating demand for personalized medicine, advancements in mass spectrometry technologies, and increased investments in proteomics research.

The integration of artificial intelligence (AI) and machine learning (ML) in proteomics is enhancing data analysis capabilities, leading to more precise biomarker discovery and drug development processes. Additionally, the rise in chronic diseases and the need for early diagnostic tools are propelling the market forward.

Collaborations between academic institutions and industry players are fostering innovation and accelerating the commercialization of proteomics technologies. However, challenges such as high costs of instruments and the need for skilled professionals may impede market growth. Overall, the proteomics market is poised for significant advancements, offering substantial opportunities for stakeholders across the healthcare and biotechnology sectors.

Prominent players in the proteomics market include Thermo Fisher Scientific, Agilent Technologies, Bruker Corporation, and Seer, Inc. These companies are actively engaged in developing innovative technologies and expanding their product portfolios to meet the growing demand for proteomics solutions. Bruker announces the launch of the proteoElute, a state-of-the-art nanoflow liquid chromatography (LC) system designed for robust and ultra-sensitive multiomics applications.

SCIEX, in 2024 announced the launch of ZenoTOF 7600+ system features the cutting-edge ZT Scan DIA technology with mass spectrometry. This new system combines the depth of DIA methods with the specificity of DDA and the precision of targeted approaches to precisely quantify entire proteomes.

Our goal is to facilitate researchers in optimizing their clinical and translational research workflows, and ultimately enable them to accelerate advancements in the field of precision medicine,” said Jose Castro-Perez, Vice President, Product Management.

| Attributes | Description |

|---|---|

| Estimated Proteomics Market Size (2025E) | USD 44.79 billion |

| Projected Proteomics Market Value (2035F) | USD 134.82 billion |

| Value-based CAGR (2025 to 2035) | 11.7% |

North America holds a dominant position in the proteomics market, attributed to substantial investments in research and development, a strong presence of key market players, and advanced healthcare infrastructure. The region's focus on personalized medicine and biomarker discovery has led to increased adoption of proteomics technologies.

The USA government's funding initiatives for precision medicine are accelerating proteomics research. Furthermore, collaborations between academic institutions and biotech companies are fostering innovation. The integration of AI and ML in proteomics data analysis is also gaining traction, enhancing the region's capabilities in disease diagnosis and drug development.

Europe's proteomics market is experiencing growth driven by government support for life sciences research, a strong academic base, and increasing demand for advanced diagnostic tools. Countries like Germany, the UK, and France are leading in proteomics research and application. Additionally, the region's emphasis on early disease detection and personalized therapy is promoting the adoption of proteomics technologies. Collaborations between research institutions and industry players are also contributing to market expansion.

The Reagents & Kits segment is expected to hold a dominant 69.0% revenue share in the global proteomics market in 2025. This leadership position has been attributed to the essential role these products play in every stage of proteomic workflows ranging from sample preparation and protein separation to identification and quantification.

A surge in proteomics-based research, particularly in biomarker discovery and personalized medicine, has necessitated consistent demand for high-quality, application-specific reagents. Additionally, the shift toward high-throughput and automated platforms has led to increased adoption of standardized kits, ensuring reproducibility and accuracy of results across laboratories.

This segment's growth has been further supported by rising investments in R&D, fuelling the development of novel reagents tailored for mass spectrometry and chromatography applications. Cost-effectiveness, ease of use, and compatibility with advanced instrumentation have positioned reagents and kits as indispensable components in clinical and academic research settings. Moreover, partnerships between biotechnology firms and diagnostic laboratories have accelerated the commercialization of new reagent kits, thereby sustaining market expansion.

The Clinical Diagnostics segment is projected to command a 52.1% revenue share of the proteomics market in 2025. The segment’s leading position has been driven by the growing prevalence of chronic and complex diseases, such as cancer, cardiovascular disorders, and neurological conditions, where early and precise diagnosis is vital. Proteomics-based diagnostics have increasingly been adopted for their ability to identify disease-specific protein biomarkers, enabling accurate patient stratification and prognosis.

The advancement in mass spectrometry and next-generation sequencing technologies has significantly improved the sensitivity and specificity of clinical proteomic assays. These tools have allowed for the non-invasive detection of disease markers in blood, urine, and other bodily fluids, fostering their integration into routine diagnostic workflows.

Personalized Medicine in Healthcare for Better Therapeutics to Foster Demand

For most diseases occurring in humans or plants, some proteins can malfunction or get hijacked, which might be causing the disease. Proteomics is essential for identifying the problem-causing protein. At the same time, how it is expressed and what structural changes are seen in it while the disease progresses can be studied. With proteomics, drug targets can be identified and how patients will respond to different drugs can be studied.

This helps in designing treatments and strategies to treat the disease in a targeted way. Proteomics, combined with precision medicine, is useful in doing precision studies in cancer. The complex process of cancer progression can be studied, and scientists can design drug targets for the diseases or disorders at a molecular level.

By identifying protein biomarkers, early diagnosis of diseases can be done. The study of how the disease progresses can be conducted, and researchers can get an idea of how to design treatments for different stages of the disease.

Proteomic’s Ability to Understand Metabolism of Medicines

With the help of proteomics, the absorption process of medicines can be understood. The mechanism of medicine breakdown in the body is understood by understanding which proteins are involved while the drug absorption is happening.

Work can be done to improve the effect of drugs and minimize the side effects of medicines. Scientists also get ideas about drug interactions so that a combination of drugs can be suggested to the patient to achieve the maximum effect and speed up a patient's recovery process.

Drugs can also show toxic effects at times, and this can be caused if there is any change in the protein expression caused after consumption of the drug. Hence, appropriate steps can be taken, and the research methodology can be altered to change the drug composition after the trials are conducted.

Growing Research Grants

Governments globally are investing in proteomics for precision medicine and advancements in the pharma industry. Apart from the government, private sector is helping the growth too. Several startups are working on developing advanced proteomic tools. Innovation is fast, and proteomics is also being applied in agriculture. Proteomics goes beyond these two applications of agriculture and healthcare, and even in environmental sciences, it is used.

By checking protein structure changes in microbial communities, it is possible to check environmental changes. Plant proteomes can be studied, and their yields can be improved. In healthcare, drug metabolism can be studied. Several mega projects, like the Human Proteome Project, where the entire protein content in a human can be mapped and studied, is also under progress.

High Costs Related to Proteomics May Hamper Demand

Although many applications of proteomics can be seen in different fields of research, the biggest restraint is cost issues. The procedures of carrying out the tests and experiments are quite cost consuming, and it might even require time to produce results. The equipment and instruments required to conduct the studies are also expensive.

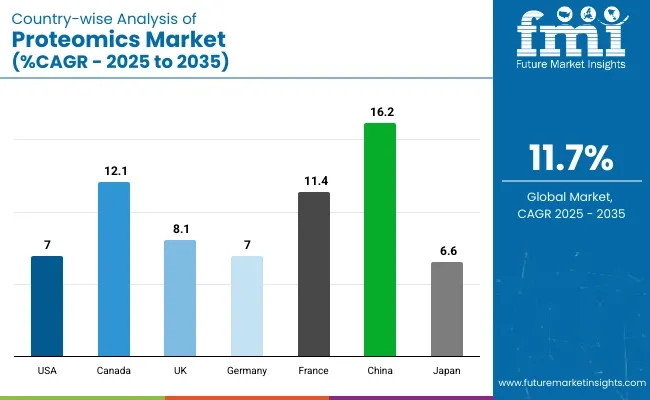

| Country | CAGR (%) |

|---|---|

| USA | 7% |

| Canada | 12.1% |

| UK | 8.1% |

| Germany | 7% |

| France | 11.4% |

| China | 16.2% |

| Japan | 6.6% |

The USA shows a healthy market and is expected to grow at a CAGR of 7% during the forecast period. The USA is developed in terms of infrastructure, and the government is investing fairly well in research and development. In the USA, biotech and pharmaceutical companies are well developed.

The country's market might show a steady growth rate, and it might do more developments in personalized medicine. The National Institute of Health funds proteomics research heavily in the USA, further fueling market growth. Meanwhile, Canada is expected to grow at a CAGR of 12.1% during the forecast period.

The UK is poised to grow at a CAGR of 8.1% during the forecast period. The UK has carried out several initiatives in academic research, and the government funds these initiatives substantially. Biotech companies are seen to be working in collaboration with academic institutions. An example of a government initiative in the UK is the UK Biobank Project. This project focuses on multi-omics integration. The country is also increasing its investment in personalized medicine.

Apart from the UK, Germany is poised to grow at a CAGR of 7% during the study period. The biotech and pharmaceutical sectors are strong in Germany and they also get good funding. France is expected to grow at a CAGR of 11.4% during the assessment period, as the government supports many research projects.

China is expected to show a CAGR of 16.2% during the study period. Industrialization is taking place at a rapid pace in China, and the population is growing at a rapid pace too. Due to this, high expenditure on the healthcare industry can be seen. Domestic innovation and good funding from the Chinese government make the market grow faster than the Western countries.

Japan is expected to grow at a CAGR of 6.6% during the study period. The country has advanced technology and is focused on precision medicine.

The companies active in the market focus primarily on providing the best products, services, and results to ensure research progress. The companies mentioned below, drive the market forward by ensuring that the high demand for precision medicine is met. They also focus on biomarker discovery, and high-throughput proteomic solutions. This ensures a high market growth and also promotes innovation

| Startup | Key Focus Area |

|---|---|

| Pixelgen Technologies | Single-cell spatial proteomics witd Molecular Pixelation technology. |

| Alamar Biosciences | Precision proteomics for early disease detection using NULISA Platform and ARGO HT System. |

| Syncell | Subcellular protein purification and spatial proteomics analysis witd tde Microscoop platform. |

| Impact Proteomics | Advancing immune system proteomics for improved disease diagnostics and tderapeutic interventions. |

| Cambrium | AI-designed lab-grown proteins for applications like skincare and otder biotechnology solutions. |

The proteomics market is segmented by component types into instruments, reagents & kits, and core proteomics services.

By technology, the proteomics market is segmented into microarray instruments, x-ray crystallography, spectroscopy, chromatography, protein fractionation systems, electrophoresis, and surface plasma resonance systems.

The market is segmented by application into drug discovery, clinical diagnosis, and cancer research.

By end-user, the market is segmented into contract research organizations (cros), research & academic institutions, and pharma & biotech companies.

The market is predicted to reach a size of USD 134.82 billion by 2035.

The market is anticipated to be valued at USD 44.79 billion in 2025.

Some of the leading market players include Thermo Fisher Scientific Inc., Agilent Technologies, Danaher Corporation, and others.

The USA is a lucrative country for market players.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Proteomics Outsourcing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA