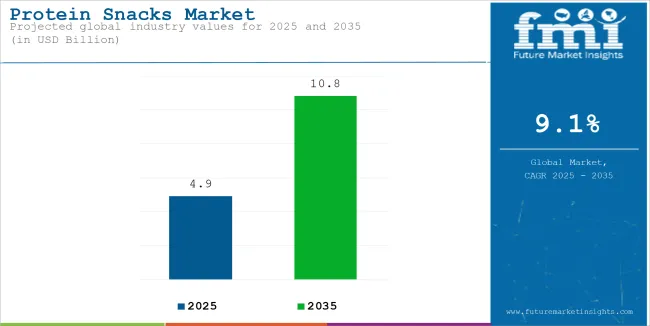

The global Protein Snacks Market is estimated to account for USD 4.92 billion in 2025. It is anticipated to grow at a CAGR of 9.1% during the assessment period and reach a value of USD 10.83 billion by 2035.

| Attributes | Description |

|---|---|

| Estimated Global Protein Snacks Market Size (2025E) | USD 4.92 billion |

| Projected Global Protein Snacks Market Value (2035F) | USD 10.83 billion |

| Value-based CAGR (2025 to 2035) | 9.1% |

Protein snacks are delicious and nutritious options that are packed with protein, an essential nutrient for our bodies. They play a vital role in muscle repair, growth, and overall health. These snacks are great for anyone looking to maintain energy levels, and balance taste with health.

These snacks are helpful to support an active lifestyle. Protein snacks come in various forms, like bars, nuts, seeds, yogurt, and jerky. They are convenient and perfect for instant eating, making them ideal for busy schedules, post-workout recovery, or a quick pick-me-up during the day.

Easy Availability of Nutritious Food Options

One of the main reasons for the growing popularity of protein snacks is the increasing demand for convenient, nutrient-dense food options. As our lives become busier, many people look for snacks that not only satisfy hunger but also provide essential nutrients to keep them energized throughout the day.

Protein snacks are perfect for this need, offering a quick and portable source of energy. They are especially popular among fitness enthusiasts and busy professionals who want to maintain a balanced diet but don’t have time to prepare elaborate meals. By combining convenience with nutrition, protein snacks have become a go-to choice for people on the move.

Growing Awareness of Chronic Disease

There is a rising awareness of chronic diseases like diabetes, obesity, and heart conditions. More individuals are focusing on healthier eating habits to manage these conditions or reduce their risk. Protein snacks, which are often low in sugar and high in essential nutrients, appeal to health-conscious consumers. High-protein diets can help regulate blood sugar levels, promote feelings of fullness, and assist with weight management.

As healthcare professionals emphasize the importance of balanced nutrition, more people are choosing protein-rich snacks over traditional, carb-heavy options. This shift not only supports a healthier lifestyle but also boosts the demand for protein snacks among those looking to improve their overall well-being.

Cost Issues Deter Customers

A significant challenge for the protein snacks market is their higher cost compared to regular snack options. Many protein snacks use premium ingredients like whey or plant-based proteins, which can be more expensive to produce. Additionally, adding functional ingredients like probiotics or superfoods raises production costs even further. This price difference makes protein snacks less accessible for budget-conscious consumers, especially in regions where price sensitivity is high.

While some health-focused individuals may prioritize nutrition, the overall market growth for protein snacks could be limited by their premium pricing, making it necessary for manufacturers to find ways to lower costs without sacrificing quality.

Consumers are increasingly seeking protein snacks that offer more than just high protein content. Snacks enriched with additional benefits, such as probiotics for gut health and omega-3 fatty acids for heart health, are becoming popular. This trend shows a growing interest in functional foods that support specific health goals, like boosting immunity and enhancing athletic performance.

People of all ages are looking for portable and easy-to-eat snacks that fit into their busy lives. Protein snacks are often pre-packaged and convenient, making them perfect for commuting or long work hours. The rise of single-serving formats and resealable packaging caters to this need. Options like protein bars, ready-to-drink shakes, and bite-sized snacks are favored for their ease of consumption, allowing individuals to fuel their day without taking up too much time or effort.

| Attributes | Details |

|---|---|

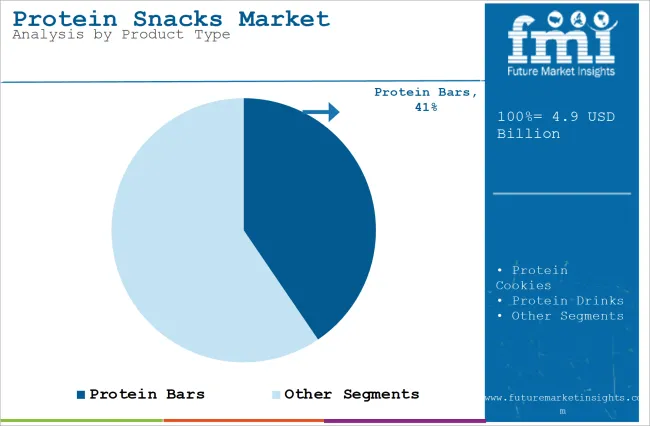

| Top Product Type | Protein Bars |

| Market Share in 2025 | 40.5 % |

Protein bars hold a significant share of the market, occupying 40.5%. This popularity is due to their convenience and portability. They are easy to carry, making them a perfect snack for busy people on the go. Protein bars often come in various flavors, appealing to different tastes. Additionally, they provide a quick source of protein, which is essential for muscle recovery and energy. Their ready-to-eat format means consumers can enjoy them without any preparation, further boosting their appeal.

| Attributes | Details |

|---|---|

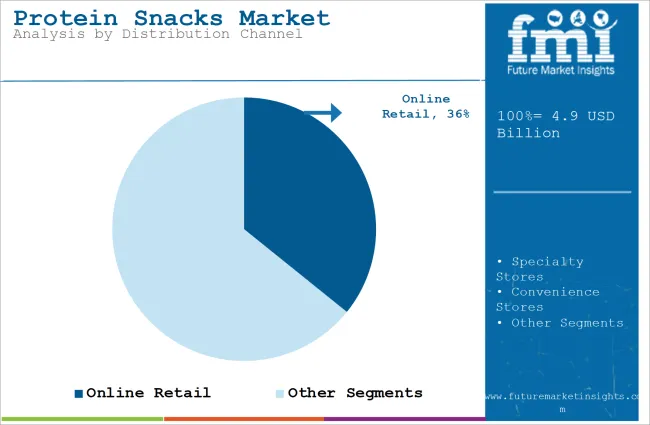

| Top Distribution Channel | Online Retail |

| Market Share in 2025 | 35.8 % |

Online retail accounts for 35.8% of the protein snacks market share. This growth is driven by the convenience of shopping from home and the wide variety of products available online. Consumers can easily compare brands, read reviews, and find specific protein snacks that meet their needs. Online shopping also allows for bulk purchases and subscription options, making it easier for health-conscious individuals to stock up on their favorite snacks. The accessibility and ease of online retail make it a preferred choice for many consumers looking to buy protein snacks.

Plant-based protein snacks are becoming more popular than meat-based options due to increased awareness of health, environmental, and ethical issues. Many people prefer plant-based snacks because they contain less saturated fat and cholesterol, and more fiber, making them healthier choices. The growth of veganism and flexitarian diets also supports this trend, as consumers are more concerned about the environmental impact of meat production.

Additionally, plant-based snacks are suitable for those with dietary restrictions, like avoiding dairy, gluten, or animal products, making them accessible to a wider audience. While some still choose meat-based snacks, especially on high-protein or low-carb diets, the demand for sustainable and plant-based options is driving their rising popularity.

In Asia Pacific, India is expected to grow at a CAGR of 13.6% during the forecast period.

In India, more people are becoming aware of how diet affects health, leading them to choose healthier snacks that offer balanced nutrition. Protein snacks, whether plant-based or meat-based, are seen as better alternatives to traditional high-carb and sugary snacks, which can worsen chronic health issues. This focus on healthier eating habits is driving the increased consumption of protein snacks as people look for smarter ways to snack while taking care of their health.

In North America, the USA is expected to grow at a CAGR of 9.2% during the forecast period.

In the USA, convenience is a key reason for the growth of the protein snacks market. With busy lifestyles, many consumers want protein-packed snacks that are easy to eat on the go without much preparation. These snacks provide a quick energy boost or help with post-workout recovery. The demand is also growing for plant-based protein options, appealing to vegan and flexitarian consumers. As awareness of protein's health benefits increases, the market for protein snacks in the USA keeps expanding.

In Europe, the UK is expected to grow at a CAGR of 9.2% during the forecast period.

In the UK, there is a noticeable shift towards healthier snacks. Consumers are replacing traditional snacks high in sugar or unhealthy fats with protein-rich alternatives. The rise of the flexitarian diet, which involves eating fewer animal products, has also boosted the popularity of plant-based protein snacks. With protein snacks readily available in supermarkets, health food stores, and online, it's easier for people to include them in their diets. As more recognize the importance of protein for a healthy lifestyle, the demand for these snacks continues to grow.

The protein snacks market is highly competitive, with both well-known brands and new companies fighting for market share. Major players like Clif Bar & Company, KIND Snacks (owned by Mars), and Quest Nutrition focus on product innovation to stay ahead. They are creating new snacks that meet various dietary needs, such as keto, gluten-free, and plant-based options, appealing to a wider audience. These companies also prioritize clean labels and natural ingredients to meet consumer demands for healthy products.

Emerging brands like RXBAR (owned by Kellogg’s) and Vital Proteins target specific consumer groups and niche markets. Many companies are forming partnerships and acquiring smaller startups to expand their reach and adapt to changing consumer trends. Effective marketing campaigns that emphasize nutritional benefits and fit with lifestyle trends, like fitness and convenience, are key to the growth strategies of both established brands and newcomers in the protein snacks market.

Key players

| Company Name | Expertise |

|---|---|

| Clif Bar & Company | Energy bars for active lifestyles |

| KIND Snacks | Nut-based snacks with clean ingredients |

| Quest Nutrition | High-protein snacks for fitness |

| RXBAR (Kellogg’s) | Simple, protein-rich bars |

| Vital Proteins | Collagen and protein supplements |

Pricing analysis

The pricing dynamics of the protein snacks market are influenced by various factors, including raw material costs, packaging, distribution channels, and product segmentation. With a wide range of offerings from budget-friendly to premium, pricing plays a critical role in determining consumer choice and market competitiveness.

| Brand/Company | Price Range (USD per Unit) |

|---|---|

| Quest Nutrition | 1.50 - 2.50 per bar |

| RXBAR | 2.00 - 3.00 per bar |

| Clif Bar | 1.50 - 2.50 per bar |

| Perfect Snacks | 3.00 - 4.50 per bar |

| KIND | 1.80 - 2.50 per bar |

| OHi Superfood Bars | 2.50 - 3.50 per bar |

| IQ BAR | 2.50 - 3.00 per bar |

Understanding these pricing dynamics is essential for businesses to optimize their market positioning and identify potential growth opportunities across diverse markets.

Key segments include plant-based protein snacks and meat-based protein snacks.

The key segments include protein bars, protein cookies, protein drinks, protein flakes, jerky, granola, and yogurt.

The key segments include online retail, specialty stores, convenience stores.

Key segments include North America, Latin America, Western Europe, South Asia and Pacific, East Asia, Middle East & Africa.

The market was valued at USD 4.92 billion in 2025.

The market is predicted to reach a size of USD 10.83 billion by 2035.

Some of the key companies manufacturing Protein Snacks Market include Vitaco Health Australia, Powerful Men LLC, Quest Nutrition LLC, General Mills (Natures Valley).

Asia Pacific is a prominent hub for Protein Snacks manufacturers.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2032

Table 2: Global Market Volume (Units) Forecast by Region, 2017 to 2032

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 4: Global Market Volume (Units) Forecast by Product Type, 2017 to 2032

Table 5: Global Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2032

Table 6: Global Market Volume (Units) Forecast by Distribution Channel, 2017 to 2032

Table 7: North America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 8: North America Market Volume (Units) Forecast by Country, 2017 to 2032

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 10: North America Market Volume (Units) Forecast by Product Type, 2017 to 2032

Table 11: North America Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2032

Table 12: North America Market Volume (Units) Forecast by Distribution Channel, 2017 to 2032

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 14: Latin America Market Volume (Units) Forecast by Country, 2017 to 2032

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 16: Latin America Market Volume (Units) Forecast by Product Type, 2017 to 2032

Table 17: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2032

Table 18: Latin America Market Volume (Units) Forecast by Distribution Channel, 2017 to 2032

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 20: Europe Market Volume (Units) Forecast by Country, 2017 to 2032

Table 21: Europe Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 22: Europe Market Volume (Units) Forecast by Product Type, 2017 to 2032

Table 23: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2032

Table 24: Europe Market Volume (Units) Forecast by Distribution Channel, 2017 to 2032

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 26: Asia Pacific Market Volume (Units) Forecast by Country, 2017 to 2032

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 28: Asia Pacific Market Volume (Units) Forecast by Product Type, 2017 to 2032

Table 29: Asia Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2032

Table 30: Asia Pacific Market Volume (Units) Forecast by Distribution Channel, 2017 to 2032

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 32: Middle East and Africa Market Volume (Units) Forecast by Country, 2017 to 2032

Table 33: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 34: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2017 to 2032

Table 35: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2032

Table 36: Middle East and Africa Market Volume (Units) Forecast by Distribution Channel, 2017 to 2032

Figure 1: Global Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 2: Global Market Value (US$ Million) by Distribution Channel, 2022 to 2032

Figure 3: Global Market Value (US$ Million) by Region, 2022 to 2032

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2017 to 2032

Figure 5: Global Market Volume (Units) Analysis by Region, 2017 to 2032

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 9: Global Market Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 12: Global Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2032

Figure 13: Global Market Volume (Units) Analysis by Distribution Channel, 2017 to 2032

Figure 14: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2022 to 2032

Figure 15: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2032

Figure 16: Global Market Attractiveness by Product Type, 2022 to 2032

Figure 17: Global Market Attractiveness by Distribution Channel, 2022 to 2032

Figure 18: Global Market Attractiveness by Region, 2022 to 2032

Figure 19: North America Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 20: North America Market Value (US$ Million) by Distribution Channel, 2022 to 2032

Figure 21: North America Market Value (US$ Million) by Country, 2022 to 2032

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 23: North America Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 27: North America Market Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 30: North America Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2032

Figure 31: North America Market Volume (Units) Analysis by Distribution Channel, 2017 to 2032

Figure 32: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2022 to 2032

Figure 33: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2032

Figure 34: North America Market Attractiveness by Product Type, 2022 to 2032

Figure 35: North America Market Attractiveness by Distribution Channel, 2022 to 2032

Figure 36: North America Market Attractiveness by Country, 2022 to 2032

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 38: Latin America Market Value (US$ Million) by Distribution Channel, 2022 to 2032

Figure 39: Latin America Market Value (US$ Million) by Country, 2022 to 2032

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 45: Latin America Market Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 48: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2032

Figure 49: Latin America Market Volume (Units) Analysis by Distribution Channel, 2017 to 2032

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2022 to 2032

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2032

Figure 52: Latin America Market Attractiveness by Product Type, 2022 to 2032

Figure 53: Latin America Market Attractiveness by Distribution Channel, 2022 to 2032

Figure 54: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 55: Europe Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 56: Europe Market Value (US$ Million) by Distribution Channel, 2022 to 2032

Figure 57: Europe Market Value (US$ Million) by Country, 2022 to 2032

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 59: Europe Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 62: Europe Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 63: Europe Market Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 64: Europe Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 66: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2032

Figure 67: Europe Market Volume (Units) Analysis by Distribution Channel, 2017 to 2032

Figure 68: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2022 to 2032

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2032

Figure 70: Europe Market Attractiveness by Product Type, 2022 to 2032

Figure 71: Europe Market Attractiveness by Distribution Channel, 2022 to 2032

Figure 72: Europe Market Attractiveness by Country, 2022 to 2032

Figure 73: Asia Pacific Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 74: Asia Pacific Market Value (US$ Million) by Distribution Channel, 2022 to 2032

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2022 to 2032

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 77: Asia Pacific Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 81: Asia Pacific Market Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2032

Figure 85: Asia Pacific Market Volume (Units) Analysis by Distribution Channel, 2017 to 2032

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2022 to 2032

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2032

Figure 88: Asia Pacific Market Attractiveness by Product Type, 2022 to 2032

Figure 89: Asia Pacific Market Attractiveness by Distribution Channel, 2022 to 2032

Figure 90: Asia Pacific Market Attractiveness by Country, 2022 to 2032

Figure 91: Middle East and Africa Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 92: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2022 to 2032

Figure 93: Middle East and Africa Market Value (US$ Million) by Country, 2022 to 2032

Figure 94: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 95: Middle East and Africa Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 96: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 97: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 98: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 99: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 100: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 101: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 102: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2032

Figure 103: Middle East and Africa Market Volume (Units) Analysis by Distribution Channel, 2017 to 2032

Figure 104: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2022 to 2032

Figure 105: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2032

Figure 106: Middle East and Africa Market Attractiveness by Product Type, 2022 to 2032

Figure 107: Middle East and Africa Market Attractiveness by Distribution Channel, 2022 to 2032

Figure 108: Middle East and Africa Market Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Protein-Coating Line Market Forecast Outlook 2025 to 2035

Protein Labelling Market Size and Share Forecast Outlook 2025 to 2035

Protein Puddings Market Size and Share Forecast Outlook 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

Protein Expression Market Size and Share Forecast Outlook 2025 to 2035

Protein Purification Resin Market Size and Share Forecast Outlook 2025 to 2035

Protein Hydrolysate For Animal Feed Application Market Size and Share Forecast Outlook 2025 to 2035

Protein Crisps Market Outlook - Growth, Demand & Forecast 2025 to 2035

Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Protein Supplement Market - Size, Share, and Forecast 2025 to 2035

Protein Powder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Protein Purification and Isolation Market Insights – Size, Share & Forecast 2025 to 2035

Protein Ingredients Market Analysis - Size, Share, and Forecast 2025 to 2035

Protein A Resins Market Trends, Demand & Forecast 2025 to 2035

Proteinase K Market Growth - Trends & Forecast 2025 to 2035

Proteinuria Treatment Market Insights – Demand & Forecast 2025 to 2035

Protein Packaging Market Trends and Forecast 2025 to 2035

Analysis and Growth Projections for Protein Hydrolysate Ingredient Market

Protein Shot Market Analysis by Packaging, Distribution Channel, Product Claims and Regions Through 2035

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA