Ongoing demand for purified protein in highly demanding biopharmaceutical sectors, research-oriented institutions, as well as increased industrial applications directly contributes to expansion in the demand for protein purification resins, and market players are looking more towards innovation by chromatography resin, sustainability aspects, and aspects of automation within purification efficiency combined with stringent requirement compliance.

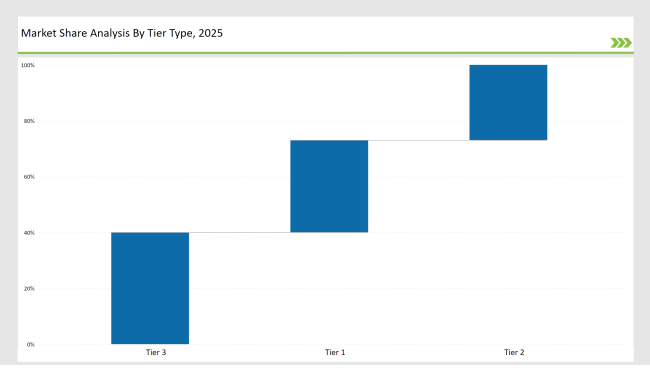

Tier 1: Cytiva, Merck KGaA, and Thermo Fisher Scientific account for 33% of the market, thanks to innovative resin technologies, extensive distribution networks, and regulatory-compliant solutions.

Tier 2: Bio-Rad, Purolite, and Tosoh Bioscience make up 27% of the market, with a focus on low-cost, high-capacity resins for niche applications.

Tier 3: Regional and specialty manufacturers account for 40% of the market, offering tailored solutions for small-scale research and niche industrial applications.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Cytiva, Merck KGaA, Thermo Fisher Scientific) | 15% |

| Rest of Top 5 (Bio-Rad, Purolite) | 11% |

| Next 5 of Top 10 (Tosoh Bioscience, Repligen, Avantor, Agilent, Sartorius) | 7% |

The growing demand for high-purity protein purification solutions in biopharmaceutical, academic, and industrial biotechnology applications is fueling innovation in chromatography resin efficiency, scale, and global standards.

The growing need for advanced chromatography resins has driven manufacturers to develop high-performance, scalable solutions for biopharma, research, and industrial applications, resulting in increased purification efficiency and regulatory compliance.

The firms are developing chromatography technologies such as sustainable resin and AI purification automation to meet the expanding global need for high-purity protein purification solutions. They emphasize efficiency, scale, and regulatory compliance.

Year-on-Year Leaders

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Cytiva, Merck KGaA, Thermo Fisher Scientific |

| Tier 2 | Bio-Rad, Purolite, Tosoh Bioscience |

| Tier 3 | Repligen, Avantor, Agilent, Sartorius |

| Manufacturer | Latest Developments |

|---|---|

| Cytiva | Launched high-performance chromatography resins (March 2024). |

| Merck KGaA | Developed sustainable bio-based resin solutions (August 2023). |

| Thermo Fisher Scientific | Introduced AI-driven purification process automation (May 2024). |

| Bio-Rad | Expanded ion exchange chromatography portfolio (November 2023). |

| Purolite | Developed advanced ligand-based purification resins (February 2024). |

The protein purification resin market is evolving with companies investing in sustainable production, AI-driven automation, and high-performance resins. Vendors focus on enhancing efficiency, cost-effectiveness, and regulatory compliance to meet growing industry demands.

The protein purification resin industry is focused on automation, sustainability, and precision purification technology. There is an investment in the development of digital monitoring, sustainable resin manufacturing, and AI-based process optimization to ensure higher productivity and regulatory compliance.

Rising demand for high-purity proteins in biopharma and life sciences.

Cytiva, Merck KGaA, Thermo Fisher Scientific, Bio-Rad, and Purolite.

AI-driven automation, bio-based resins, and enhanced ligand technologies.

Asia-Pacific, North America, and Europe.

Companies are developing recyclable and bio-based purification resin solutions.

Explore Function-driven Packaging Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.