The market for protective packaging is expanding at a very rapid pace due primarily to the need for high-performance and eco-friendly protective solutions due to e-commerce logistics, industrial shipping, and environmental concerns. The market also tends to move towards light-weight, biodegradable, and recyclable packaging materials in order to reduce waste while maintaining products intact during transit and storage. The firms are testing air cushions, molded pulp, and fiber-based packaging to increasingly replace the traditional plastic-based protective packaging.

Smart packaging technologies, shock material, and AI-optimized design solutions are being integrated to optimize packaging solutions in terms of performance while minimizing environmental impacts. Towards that objective, the sector is now concentrating on foam-free packaging, reusability cushioning systems, and space-efficient protective designs to optimize shipping efficiency while addressing modern consumer needs.

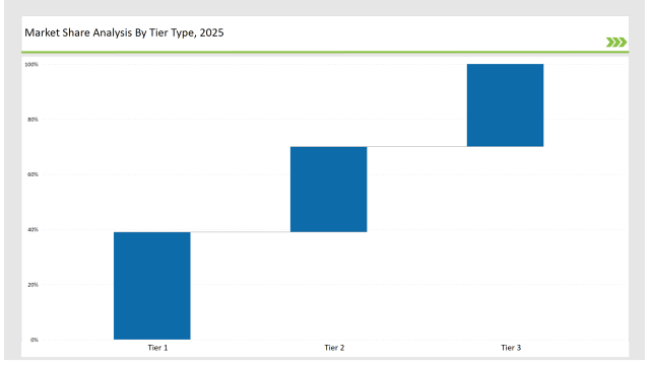

As top performers in the provision of high-performance protective solutions, with a large worldwide presence and an outlook for sustainability-oriented innovations, Tier 1 companies like Sealed Air, DS Smith, and Pregis hold 39% market share.

Tier 2 firms like Storopack, Pro-Pac Packaging, and Ranpak have secured 31% of the market through their affordable, flexible, paper-based e-commerce, retail, and industrial protective packaging solutions.

Tier 3 is regional and niche players which are molded pulp, air cushioning, and biodegradable material specialists with 30% market share. They are producing locally, focused on specialized protection formats, and environmentally friendly innovation.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Sealed Air, DS Smith, Pregis) | 19% |

| Rest of Top 5 (Storopack, Pro-Pac Packaging) | 12% |

| Next 5 of Top 10 (Ranpak, Sonoco, Veritiv, Intertape Polymer Group, Smurfit Kappa) | 8% |

The protective packaging industry serves multiple sectors where product integrity, sustainability, and efficiency are essential. Companies are developing advanced solutions to optimize packaging strength while reducing environmental impact.

Manufacturers are optimizing protective packaging with high-performance materials, sustainable alternatives, and digital tracking capabilities.

Packaging sectors are being transformed radically because of sustainability, as well as supply chain efficiency. Predictive designs with the use of AI, compostable packages, and data-driven innovations are being used by businesses to reduce waste and enhance performance. Stripping away bulk and weight but maintaining product protection has allowed firms to create light-weight, high-strength protection formats at a lower shipping cost. Manufacturers are embedding tracking for supply chain transparency with smart packaging. In addition, it presents customizable, reusable protective designs to encourage circular economy practices.

Technology suppliers should focus on automation, eco-friendly materials, and smart tracking technologies to support the evolving protective packaging market. Partnering with e-commerce and logistics brands will accelerate adoption.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Sealed Air, DS Smith, Pregis |

| Tier 2 | Storopack, Pro-Pac Packaging, Ranpak |

| Tier 3 | Sonoco, Veritiv, Intertape Polymer Group, Smurfit Kappa |

Leading manufacturers are advancing protective packaging technology with sustainable materials, AI-driven quality control, and innovative cushioning solutions.

| Manufacturer | Latest Developments |

|---|---|

| Sealed Air | Launched fully recyclable air cushioning in March 2024. |

| DS Smith | Developed molded fiber protective packaging in April 2024. |

| Pregis | Expanded biodegradable and foam-free protective formats in May 2024. |

| Storopack | Released refillable, paper-based protective packaging in June 2024. |

| Pro-Pac Packaging | Strengthened high-barrier, paper-based packaging solutions in July 2024. |

| Ranpak | Introduced compostable, shock-resistant cushioning materials in August 2024. |

| Sonoco | Pioneered smart protective packaging with tracking technology in September 2024. |

The protective packaging market is evolving as companies invest in sustainable materials, smart cushioning, and AI-driven optimizations.

The sector will increasingly incorporate AI-infused materials, recyclable cushioning, and eco-friendly alternatives. Producers will advance molded fiber and paper-based options to substitute foam and plastic. Companies will make investments in reusable protection formats for encouraging circular economy operations. Enterprises will launch intelligent protective designs with sensors integrated within for real-time monitoring. Light materials with high strength will enhance efficiency and minimize logistics expenses. Companies will also reduce production with automated, precision-made protective packaging solutions.

Leading players include Sealed Air, DS Smith, Pregis, Storopack, Pro-Pac Packaging, Ranpak, and Sonoco.

The top 3 players collectively control 19% of the global market.

The market shows medium concentration, with top players holding 39%.

Key drivers include sustainability, smart tracking, high-strength materials, and automation.

Nitrogen Flushing Machine Market Analysis by Automatic and Semi-Automatic Through 2035

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Perfume Filling Machine Market Analysis by Automatic Perfume Filling Machines and Manual Perfume Filling Machines Through 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.