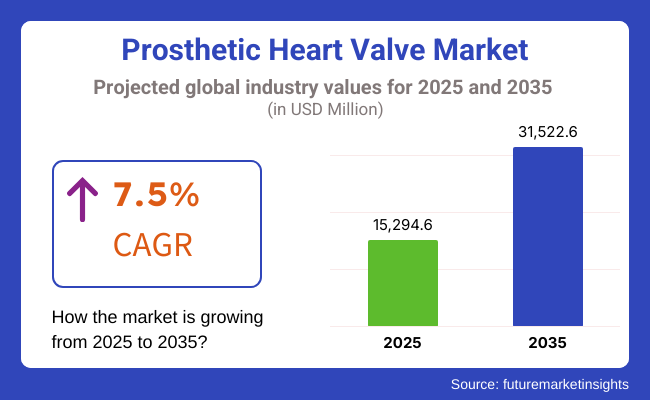

The global market for prosthetic heart valve is forecasted to attain USD 15,294.6 million by 2025, expanding at 7.5% CAGR to reach USD 31,522.6 million by 2035. In 2024, the revenue of prosthetic heart valve was around USD 14,227.52 million.

The likely increase in aortic stenosis and mitral regurgitation will ensure the need for the highest quality valve replacement interventions. There are now emerging methods with improved intervention through the new technology and innovative devices such as transcatheter heart valves and minimally invasive surgical treatments.

Among the public awareness is being increased, along with early detection of valvular diseases, which are some of the factors contributing to huge successful markets related to this area. On the other hand, high prices for procedures, possibilities of complications, and intense regulation systems can limit market growth. However, a very strong thrust at enhancing cardiac care through the introduction of new prosthetic valves will position the industry of prosthetic heart valves for the growth predicted in the next decade.

The years 2020 and 2024 have seen yet another favorable increase in the prosthetic heart valve market, with the rise owed to the increasing incidence of valvular heart diseases and shifting trends in aging populations along with advancements in minimally invasive procedures. A thrust on the adoption of transcatheter aortic valve replacement (TAVR) has opened up a realm of possibilities for patients by presenting an alternative percutaneous option for traditional surgical aortic valve replacement (SAVR) procedures.

Prosthetic heart valve market has undergone tremendous growth through the innovations and advancements in cardiovascular technology, which are now based on patient-driven innovations. Traditionally, mechanical and tissue heart valves were for life-sustaining interventions only in serious valvular illness.

Later on, transcatheter heart valve introduction revolutionized the era of prosthetic valve therapy, spreading the treatment beyond high-risk and inoperable patients while keeping procedural complications lower. It was driven by a need for fewer invasive techniques, quicker recovery, and better long-term outcomes.

With ongoing innovation, attention has shifted to improved durability, hemodynamic performance, and biocompatibility. Next-generation biomaterials, advanced imaging for accurate implantation, and totally percutaneous valve replacement methods have become the priority. These innovations enhance patient safety, increase device lifespan, and maximize clinical outcomes.

Explore FMI!

Book a free demo

Due to the existence of an established healthcare infrastructure, high rates of the advanced valve technologies, and heavy investment in research and development, it is expected that North America will represent the prosthetic heart valve market during the forecast period. The United States particularly contributes greatly to market growth owing to the high occurrence of valvular heart diseases and focus on innovative treatment solutions.

Prospective patient-oriented care and presence of principal market players would also further drive the adoption of prosthetic heart valves. Nevertheless, it is possible that a very stringent regulatory framework coupled with high development costs would challenge market expansion in this region.

Europe commands a sizeable share in the prosthetic heart valve market because of enhanced awareness for intervention and demand for operations with better patient outcomes. Germany, France, and the UK lead countries that have a strong focus on healthcare innovation and a growing number of medical device companies developing novel valve technologies. Transcatheter heart valve uptake is augmenting market growth; however, economic uncertainty and different regulatory policies between countries can impact this region’s market dynamic.

The highest growth rates in the market for prosthetic heart valves are predicted for the Asia-Pacific, where the strengthening of healthcare facilities, rise in healthcare spending, and rising consciousness regarding various novel treatment modalities are likely to propel market demand.

China, India, and Japan are among the nations where the incidence of valvular heart disease is on the rise due to increased lifestyle changes and aging populations. For the conditions to be more conducive for market growth, the region's medical device sector is continuously growing. Conversely, weak awareness in the rural pockets and regulatory challenges will curtail market penetration in certain regions in this region.

Challenges

High Costs and Regulatory Hurdles for Prosthetic Heart Valves is hindering the Overall Market Growth

Very few challenges exist in the prosthetic heart valve industry, but these are paramount to restricting its development. Probably the biggest challenge is the financial burden it puts on replacement- this cost is extremely high and limits access, thus becoming generally a great challenge in many poorer sections of health care systems.

Risk of complications, such as valve thrombosis or structural deterioration, would add on to the problems as each of these risk factors would affect the patient outcome and require subsequent intervention, in the long view. As for new valves, very strict regulatory frameworks are established to govern their approval and commercialization, which will require a huge amount of testing and compliance and, thus, delay the launch of such products.

Opportunities

Rising Incidence of Valvular Heart Diseases is Driving Demand for Innovative Prosthetic Valve Solutions within Healthcare Settings

There is a vast scope for growth in the prosthetic heart valve industry amidst all these adversities. With future emphasis more on minimally invasive procedures, the development avenues for transcatheter valves whose outcome is improved on patients and decreased recovery time are opened. Advances in technology, especially in state-of-the-art imaging techniques and new durable biomaterials, open exciting avenues for precision and longevity in the design of these valves.

The increasing incidence of valvular heart diseases worldwide entails the development of the needed innovative valve solutions to which improvements could be made in the quality of life of patients. Medical device firms might bring some paradigm shift by entering into solid collaborative alliances with health care institutions to boost innovation and broaden the pool of patients in whom prosthetic heart valves can be applied.

Technological Evolution in Image-Guidance Systems: Hybrid Imaging, Portability, and Robotics Reshaping Diagnostics:

The image-guidance systems are becoming piqued in their cusp with significant technological evolution and an increasing patient-centric imaging application. The recent most significant development is an advent of the combination imaging systems, including new modalities, such as PET-CT and PET-MRI combined together, which bring different diagnostic data and ameliorate better clinical decisions.

In addition, the portable systems are now developed to point-of-care imaging, thus broadening accessibility to advanced diagnostic techniques in any health care setting, even in a remote and underserved area. The market also sees changing trends toward a backward incorporation of modern imaging technologies: intraoperative imaging, which allows real-time visualization and evaluation of surgery locations by the surgeon.Robotics are meant to revolutionize the image-guided processes by enhancing precision and control in procedures, reflective of the growing applications and advantages these technologies offer.

Advancements made in bio prosthetic and mechanical heart valves helped greatly improve durability and outcomes for patients. Obstacles such as the extensive costs an individual incurs for the procedure, comprehensive regulations set for one to meet during recruitment, and limited access to the masses in emerging markets thwarted widespread acceptance.

The market will be next molded by innovation in bioengineered next-generation heart valves, advanced AI-assisted surgical planning, and increased indications for transcatheter valve procedures. The regulatory agencies would shape the refined paths for approval in a manner that innovativeness could constructively be embraced into the valve technology under rigorous safety provisions.

There will be a substantial increase in demand for personalized medicine to cater to personalized valve designs according to patients' needs. Sustainability will leave space for biodegradable and longer-lasting biomaterials to be used instead of repeat procedures. Supply chain diversification, as well as element localization, will also bolster market resilience and availability of critical components in the future.

Comparison Table

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Rigorous FDA and CE approval protocols, prioritizing safety and the longevity of valves. |

| Technological Advancements | Increased adoption of transcatheter aortic valve replacement (TAVR), hybrid-valve design, and enhanced bioprosthetic valve durability.. |

| Consumer Demand | Growing demand for less invasive valve replacement procedures, especially in elderly patients. |

| Market Growth Drivers | Growing incidence of valvular heart disease, aging population, and enhancement of procedural success rates. |

| Sustainability | Limited attention to sustainability; focus on enhancing longevity to minimize reoperations. |

| Supply Chain Dynamics | Dependence on specialty manufacturers for bioprosthetic and mechanical valve components. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Streamlined regulations for bioengineered valves and artificial intelligence (AI)-supported surgical planning technology. |

| Technological Advancements | Bioengineered and polymer valves, AI-predicted patient selection, and optimization of minimally invasive valve therapies. |

| Consumer Demand | Broadening indications of TAVR to younger patients and high-risk populations, with more adoption in the emerging world. |

| Market Growth Drivers | Greater investments in regenerative medicine, decision support systems with AI, and greater accessibility to advanced valve therapy. |

| Sustainability | Movement towards biodegradable materials, environmentally friendly production, and long lifespan valve technology. |

| Supply Chain Dynamics | Increased localization of production, supply chain diversification, and implementation of additive manufacturing (3D printing) for the production of valves. |

Market Outlook

Increased prevalence of valvular heart diseases and growing elderly population are being the prime factors inciting remarkable growth of the prosthetic heart valve market across the United States. In conjunction with these, advancements of transcatheter valve replacement technologies and rising preference for minimally invasive procedures shall drive the market through the forecast period. Another factor possibly limiting the growth of this market is the high cost associated with the procedures, coupled with very stringent regulatory requirements.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.9% |

Market Outlook

Due to the risky structure of the healthcare systems and high prevalence of cardiovascular diseases, the German prosthetic heart valve market is witnessing growth. That said, strong government support for healthcare programs and adoption of advanced valve replacement technologies will again drive future growth. The high cost of devices and associated procedures may act as major restraints to the widespread adoption of these technologies.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 4.1% |

Market Outlook

The prosthetic heart valve market in China is said to be undergoing high expansion due to vast patient populations suffering from valvular heart diseases, along with increases in investments in healthcare. The government is also giving emphasis on improving the healthcare reach, coupled with bringing in advanced medical technologies. However, this can make the market difficult due to the varying qualities of healthcare in urban areas compared to rural regions.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 5.5% |

Market Outlook

India's prosthetic heart valve market is set to see a major boom on account of rising prevalence of valvular heart diseases as well as growing awareness regarding healthcare. Development of more and more healthcare establishments, along with government initiatives to promote their cardiac care systems, leads to the establishment of this market. Coupled with direr conditions in rural areas, lack of access to advanced treatments may be a barrier to growth.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.9% |

Market Outlook

The adoption of advanced valve replacement procedures and government efforts to enhance healthcare access contribute to market expansion. Economic disparities and regional differences in healthcare quality may pose challenges.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 4.5% |

Transcatheter Heart Valves: Transcatheter heart valves, especially TAVR, are at the forefront of the market due to the fact that they are very minimally invasive and because of the increasing tendency for their use in high-risk elderly patients. TAVR therapy has redefined the treatment of aortic stenosis with much shorter recovery times and less surgical complication, along with better outcomes as compared to traditional open-heart valve replacement.

The other major factor that caused this market to grow even more is the expanded use of TAVR procedures, which include the low-risk patient population. The growth in next-generation transcatheter mitral valve replacement technologies TMVR appears to be picking up steam and to provide much-needed minimally invasive solutions for mitral regurgitation, a condition that stands among the highest in terms of unmet needs.

Increased frequency of FDA approvals, burgeoning investment into structural heart innovations, and ramping up of hybrid operating rooms in hospitals are also increasing the speed of global adoption of transcatheter heart valves.

Biological/Tissue Heart Valves: Biological (tissue) heart valves of Tissue Aortic and Tissue Mitral variety are gaining acceptance based on biocompatibility, greater ease management without lifelong anticoagulant therapy, and increased durability. These valves, human-valved & bovine-or-porcine-typed valves, are well suited for older patients and others with contraindications to blood thinners, thereby making tissue valves a better choice over mechanical ones.

Further development of the newer pericardial and decellularized tissue valves has further added a new dimension in evaluation, which with respect to longevity and durability is greatly enhanced. Thus, with the increased incidence of valvular heart diseases (VHD), optimal recognition toward minimally invasive artificial valve replacement, and the continued evolution of tissue engineering, the biological heart valve segment continues to expand at a rapid pace.

Hospitals: Prosthetic heart valve here refers to the market segment with the highest end-user demographics in advanced surgical capabilities. Hospitals continue to take pole position as the end-users of prosthetic heart valves. In fact, they comprise the vast network of primary hospitals for surgeries, transfusion procedures, and further care in the cardiovascular system.

This is due to the high prevalence of heart valve disorders and the increasing number of valve replacement surgeries and advancement in the hybrid operating room (OR) setups that directly impact the demand for prosthetic heart valves in hospitals. Furthermore, with AI-enabled imaging, patient-specific design using 3D printing, and robotic-assisted surgeries into cardiac procedures, surgical procedures are made very precise and more beneficial to patients.

With the government funding cardiovascular research with expanding cardiac care units and increased proliferation of medical tourism for heart valve procedures, hospitals will continue to be the dominant setting for prosthetic valve implantation.

Ambulatory Services: For minimally invasive heart valve replacement procedures including TAVR and TMVR, ambulatory surgical centers (ASCs) are rapidly growing segments. Cardiovascular interventions are increasingly being moved to outpatient settings along with the development of same-day discharge from the hospital. ASCs thus play an increasingly important role in the day of heart valve replacement.

Such centers are more economical, offer even cheaper, effective and convenient treatment alternatives against a backdrop of improved health services by reducing the daily hospital burden while improving the view of treatment from the patient perspective.

Also, the trend may be assisted with developments in compact echocardiography, catheter-based valve technologies, and AI-enabled surgical preparation tools that together can facilitate the transformation of low-risk valve replacement procedures from hospital to outpatient settings. Given the continuous trend of increased regulatory and reimbursement coverage, more such procedures will probably increase the growth of the ASC section over time.

Prosthetic heart valve market is growing robustly owing to growing cases of valvular heart disease, rise in the use of minimally invasive surgical interventions, and growth in transcatheter valve technology. Market players are emphasizing innovation, regulatory clearance, and acquisitions in order to establish strong competition. The competition within the market is intense with existing medical device manufacturers and start-up companies competing fiercely for next-generation heart valve offerings.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Edwards Lifesciences | 34.6% |

| Medtronic plc | 22.4% |

| Abbott Laboratories | 15.3% |

| Boston Scientific Corporation | 9.7% |

| Other Companies (combined) | 18.0% |

| Company Name | Key Developments/Activities |

|---|---|

| Edwards Lifesciences | 2024: Specializes in transcatheter and surgical heart valves with innovative tissue technology. |

| Medtronic plc | 2025: Develops transcatheter and mechanical heart valves with a strong focus on minimally invasive procedures. |

| Abbott Laboratories | 2024: Offers advanced structural heart solutions, including cutting-edge bioprosthetic valves. |

| Boston Scientific Corporation | 2024: Expanding its transcatheter heart valve portfolio with a focus on next-gen valve systems. |

Key Company Insights

Edwards Lifesciences (34.6%)

As the kingpin and dominant leader in prosthetic heart valves, the company has superior transcatheter and surgical valve technologies and enhances efforts to innovate and research on improving durability and hemodynamic performance continuously.

Medtronic plc (22.4%)

Medtronic involves itself heavily in most of the transcatheter aortic valve replacement via both mechanical and bioprosthetic valves. It was known to have invested big bucks into AI-based diagnostics and robotic-assisted heart surgeries.

Abbott Laboratories (15.3%)

With innovative TAVR and mitral valve replacement technologies, Abbott is widening its business in the structural heart domain relative to advanced heart valve solutions. The company has made its market position even more powerful with its substantially increasing focus on minimally invasive therapies.

Boston Scientific Corporation (9.7%)

The newcomer in the arena of prosthetic heart valves, Boston Scientific is nonetheless quickly establishing its position with an expanding portfolio of transcatheter heart valves. The company emphasizes clinical trials and global market expansion.

Other Important Players (18.0% Combined)

The other companies play a larger role in the prosthetic heart valve market by developing a specific valve as well as widening access to currently underserved regions. Notable players include

The global prosthetic heart valve industry is projected to witness CAGR of 7.5% between 2025 and 2035.

The global Prosthetic Heart Valve industry stood at USD 14,227.52 million in 2024.

The global prosthetic heart valve industry is anticipated to reach USD 31,522.6 million by 2035 end.

China is expected to show a CAGR of 5.5% in the assessment period.

The key players operating in the global Prosthetic Heart Valve industry are Edwards Lifesciences, Medtronic plc, Abbott Laboratories, Boston Scientific Corporation and Other market players.

mechanical heart valves, biological/tissue heart valves and transcatheter heart valves.

hospitals and ambulatory services

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.