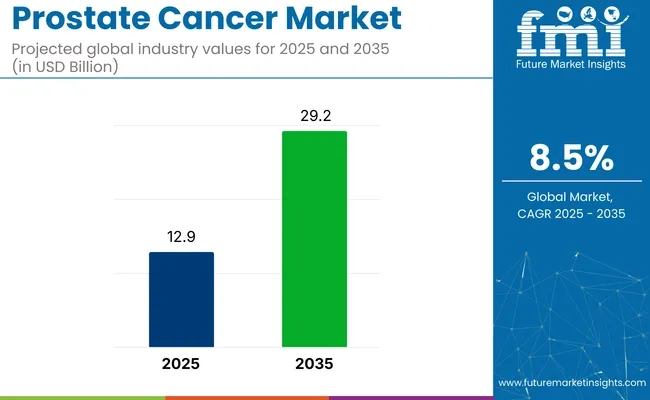

The global prostate cancer market is projected to be valued at USD 12.9 billion in 2025 and is expected to reach USD 29.2 billion by 2035, registering a CAGR of 8.5% during the forecast period, driven by advancements in diagnostics and therapeutics.

The increasing prevalence of prostate cancer, particularly among aging populations, has heightened the demand for effective treatment options. Innovations in targeted therapies, such as androgen receptor inhibitors and radio ligand therapies, have significantly improved patient outcomes. Additionally, the integration of artificial intelligence in diagnostic procedures has enhanced early detection rates.

Government initiatives and funding for cancer research further bolster market expansion. The shift towards personalized medicine, emphasizing treatments tailored to individual genetic profiles, is also a key growth driver. Overall, the prostate cancer market is poised for significant expansion, underpinned by technological advancements and increasing healthcare investments.

Prominent players in the prostate cancer market include Bayer AG, Novartis AG, Johnson & Johnson, Pfizer Inc., and AstraZeneca. These companies are actively engaged in developing innovative therapies and expanding their product portfolios.

In 2025, USA FDA Approves NUBEQA® (darolutamide) to Treat Patients with Metastatic Castration-Sensitive Prostate Cancer. “This approval, which is supported by strong clinical data, reaffirms NUBEQA as an important therapy for men with prostate cancer and underscores our commitment to delivering meaningful outcomes for patients and their families,” said Christine Roth, Executive Vice President, Global Product Strategy and Commercialization, Bayer.

With a significant pipeline indicated for the treatment of Prostrate Cancer. In 2024, Pfizer Inc. announced positive topline results for TALZENNA ® & XTANDI ®in patients with metastatic castration-resistant prostate cancer (mCRPC). As per Roger Dansey, M.D., Chief Development Officer, Oncology, Pfizer. “Pfizer is dedicated to advancing scientific breakthroughs in genitourinary cancers, and these exciting TALAPRO-2 results further highlight our long-standing commitment to improving survival for men with prostate cancer.”

| Attributes | Key Insights |

|---|---|

| Industry Size (2025E) | USD 12.9 billion |

| Industry Value (2035F) | USD 29.2 billion |

| CAGR (2025 to 2035) | 8.5% |

North America remains a dominant force in the prostate cancer market, attributed to its advanced healthcare infrastructure and significant investment in research and development. The region's emphasis on early detection and personalized medicine has led to the adoption of cutting-edge diagnostic tools and targeted therapies. Furthermore, favourable reimbursement policies and government initiatives support patient access to advanced therapies. The USA FDA’s expedited approval processes have also facilitated the introduction of innovative treatments, reinforcing North America's leadership in this sector.

Europe's prostate cancer market is characterized by a strong focus on public health initiatives and equitable access to care. Countries like Germany, France, and the United Kingdom have implemented comprehensive screening programs, leading to early diagnosis and improved treatment outcomes.

The European Medicines Agency's centralized regulatory framework streamlines the approval of new therapies, fostering a competitive and innovative market environment. Additionally, Europe's commitment to research is evident through substantial funding for oncology studies and participation in international clinical trials. The region's emphasis on multidisciplinary care approaches ensures that patients receive holistic treatment, integrating medical, psychological, and social support services. These factors collectively contribute to Europe's robust and patient-centred prostate cancer care landscape.

The below table presents the expected CAGR for the global market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 9.5%, followed by a slightly lower growth rate of 9.1% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1(2024 to 2034) | 9.5% |

| H2(2024 to 2034) | 9.1% |

| H1(2025 to 2035) | 8.5% |

| H2(2025 to 2035) | 8.2% |

From there, growth continues for the next period, and H1 2025 to H2 2035 sees the CAGR remain at a lesser 8.5% in the first half and a moderately slower 8.2% in the second half. S&M growth H1 = 100 BPS vs H2 = −90 BPS.

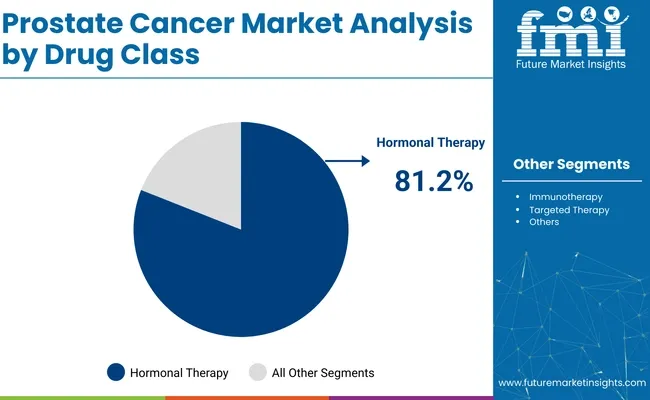

The hormonal therapy segment has been identified as the leading drug class, accounting for 81.2% of market revenue in 2025. This dominance has been attributed to the effectiveness of LHRH agonists, antagonists, and anti-androgens in controlling disease progression. Preference for hormonal drugs has been reinforced by their inclusion in first-line treatment protocols.

The increasing use of combination regimens and favourable clinical trial outcomes have supported wider adoption. Long-term disease control has been made possible by these therapies, especially in metastatic and advanced-stage prostate cancer. Moreover, consistent regulatory approvals and strategic product launches have strengthened this segment’s market position. Treatment standardization and patient tolerability have further driven the segment’s stronghold in clinical oncology practice.

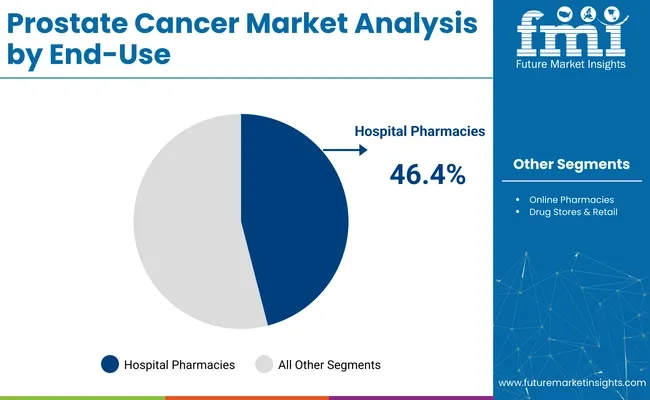

Hospital pharmacies have been observed to hold the largest distribution share, contributing to 46.4% of prostate cancer therapy revenues in 2025. This prominence has been supported by the centralized dispensing of complex and high-cost oncologic drugs. Enhanced infrastructure for handling specialized therapies has allowed safe administration under medical supervision.

In-patient coordination and pharmacy-oncology collaboration have been strengthened, improving adherence to treatment protocols. Regulatory policies have favoured controlled drug distribution through accredited hospital systems. High patient volumes and integration with diagnostic and treatment services have further boosted the reliance on hospital pharmacies. Advanced care facilities and streamlined supply logistics have continued to position this segment as a vital component in oncology treatment delivery.

Expansion of Immunotherapy Options is a Transformative Driver for Prostate Cancer

Immunotherapy development has been the more revolutionary force in the field of prostate cancer treatments. These methods work by using the body's immune system as a medium in the recognition and killing of tumors. Long-term responses in traditional therapies often offer less than optimal toleration of these newer methods, which is much favorable to the clinician and the patient.

The application of immune checkpoint inhibitors, including pembrolizumab, are the most prominent advancements in this area. They inhibit proteins like PD-1/PD-L1 hijacked by cancer cells to evade immune recognition.

Checkpoint inhibitors have been only marginally successful to date in prostate cancer because of its "cold tumor" nature, but ongoing studies are examining its application with other therapies, including androgen receptor inhibitors and radiotherapy, to enhance response rates.

A further exciting example involves therapeutic cancer vaccines, as was first demonstrated by the FDA approval of sipuleucel-T for treating metastatic castration-resistant prostate cancer. Provenge acts via the induction of an immune response against the antigen-prostate-specific antigen, extending the life of patients where their treatment options are seriously limited.

Emergent therapies within this space currently include bispecific T-cell engagers-AMG 160-and PSMA-targeted CAR-T-cell therapies. Novel approaches have gained momentum in the clinic and even more fully rounded the immunotherapy landscape.

Rapid research and breakthroughs in the clinical arena spur investment, innovation, and steer the market in its new dawn for targeted, effective treatment.

Radiopharmaceutical Therapies Transforming Prostate Cancer Treatment Options

Radiopharmaceutical treatments use radioactive isotopes linked to molecules that selectively target cancer cells, and provide specificity and therapeutic activity. In mCRPC, which is usually chemo- or hormone-resistant in origin, they offer a highly targeted treatment and low systemic side effects.

One of these is Lutetium-177-PSMA (Pluvicto), a FDA-approved radioligand therapy for mCRPC. The therapy targets PSMA, highly expressed on prostate cancer cells, and carries the radiation directly to the tumor bed, sparing all other tissues. Significant improvements in overall survival and progression-free survival were demonstrated through the VISION study, so this has really picked up quite fast in practice.

Further boosting this niche segment are ongoing clinical trials into next-generation radiopharmaceuticals, including Actinium-225-PSMA and novel alpha-emitting agents, which demonstrate promise for higher efficacy. The growth of the market is being further boosted by favorable regulatory environments, such as expedited approvals and strong endorsements from healthcare agencies.

As healthcare systems around the world look to precision oncology, radiopharmaceuticals are gaining ground- addressing critical, unmet needs in prostate cancer and significantly broadening therapeutic choices in this emergent market.

Advancements in Biomarker Discovery Present a Significant Market Opportunity for The Prostate Cancer Landscape.

Biomarkers are measured indicators of disease presence or development. They significantly contribute to detection at an early stage, differentiated treatment, and monitoring of changes in response to therapy. Progress in prostate cancer research is enhancing the discovery of new biomarkers, which continue to change its diagnosis, therapy, and monitoring, thus proving to be more innovative and yielding opportunities for a growth market in the future.

Biomarkers discovered in recent times, which include Prostate-Specific Antigen (PSA), PCA3, ERG gene fusion, and BRCA mutations, already facilitate earlier detection and prognosis. Future research studies are aiming to detect more specific biomarkers that may predict treatment success, monitor disease progression, and even identify patients with an increased likelihood of developing aggressive forms of the disease. This has led to the growing demand for diagnostic tools and genetic testing platforms.

Other related developments in liquid biopsy technology to detect tumor-derived genetic material from blood samples, in the field of non-invasive prostate cancer detection and the monitoring of therapeutic efficacy, further grow this market opportunity with advances in next-generation sequencing and molecular profiling technologies.

Biomarker-driven drug development is another emerging direction for pharmaceutical companies. Drugs developed around specific genetic mutations or molecular markers have a possibility of more efficient action with less side effect; this fact can be the prime reason to invest in the search for biomarkers. Along these lines, rapid growth in the prostate cancer market can be foreseen in future by the pace of personalized medicine and enhanced diagnosis techniques.

Lack of Screenings and Delayed Diagnostics Pose a Significant Barrier for Market Expansion

The primary restraint in the market is the lack of full-scale screenings and delayed diagnostics. Prostate cancer is often asymptomatic at its early stages and tends to be diagnosed more severely when symptoms are noticeable. It would thus reduce the effectiveness of any available treatments but would require greater use of healthcare facilities and subsequently higher healthcare costs.

This lack of standardized screening practices contributes significantly to late diagnoses. Since the most frequently used screening test is PSA, and it works unevenly-while sometimes reporting a false positive or negative-PSA screening has led several regulatory agencies to come up with different recommendations.

According to research published by the National Cancer Institute in 2023, only 37.1% of men aged 55-69 years had a PSA test in 2021, indicating a significant gap in prostate cancer screening practices. The study highlights that since the introduction of widespread PSA testing in the USA in 1992, prostate cancer-specific mortality has decreased by over 50%; however, if all PSA screenings were suspended, an estimated 25,000 to 30,000 men would die annually from prostate cancer that could have otherwise been treated effectively within ten years

These delays result in missed opportunities for early-stage intervention, leading to more aggressive treatment regimens and poorer patient outcomes, ultimately restraining the market growth for prostate cancer diagnostics and therapies.

Tier 1 firms are leaders with a substantial market share of 26.1% of international market. They spend heavily on research and development to develop new treatments, particularly in point of care diagnostics and test accuracy.

Tier 1 firms also spend on strategic partnerships and acquisitions to expand their product offerings and access pioneering technologies. Additionally, they are overemphasizing-big clinical trials to validate the efficacy and safety of their drugs. High-profile tier 1 players include Astellas Pharma Inc., AstraZeneca plc, Bayer AG, Bristol-Myers Squibb Company and Pfizer Inc.

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market and holds around 33.5% market share. They typically pursue partnerships with academic institutions and research organizations to leverage emerging technologies and expedite product development.

These companies often emphasize agility and adaptability, allowing them to quickly bring new treatments to market, sometimes targeting specific types of cancer or rare conditions. Second, they emphasize budget-friendly production procedures in order to provide competitive rates. Key operators at tier 2 are Ipsen Pharma, Ferring Pharmaceuticals Inc. and GlaxoSmithKline Plc

Lastly, Tier 3 firms, including Exelixis, Inc. and Clovis Oncology, Inc. They deal with specialized products and serve niche segments, diversifying the industry.

Overall, while Tier 1 companies are the primary drivers of the market, Tier 2 and 3 companies also make significant contributions, ensuring the prostate cancer sales remains dynamic and competitive.

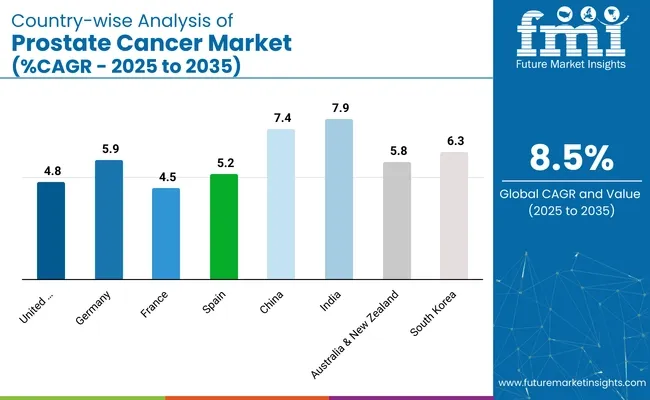

The section below covers the industry analysis for the market for prostate cancer for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and MEA, is provided. The United States is anticipated to remain at the forefront in North America, with higher market share through 2035. In Asia Pacific, India is projected to witness a CAGR of 7.9% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 4.8% |

| Germany | 5.9% |

| France | 4.5% |

| Spain | 5.2% |

| China | 7.4% |

| India | 7.9% |

| Australia & New Zealand | 5.8% |

| South Korea | 6.3% |

United States market for prostate cancer is expected to show a CAGR of 4.8% from 2025 through 2035. It has the largest market share in the North American market at present, and such is likely to be the trend throughout the forecast period.

The United States remains among the leading countries on the globe when it comes to prostate cancer research and clinical trials that are very instrumental in driving the prostate cancer therapy market.

Major pharmaceutical companies, such as well-known research institutions and hospitals like the National Cancer Institute, spearhead significant studies. The United States has hearty funding for medical research, thereby constantly making progress on immunotherapy, precision medicine, and targeted treatments for prostate cancer.

These innovations have brought about new therapies that have proved to be more effective for patients. The USA has clinical trials not only to test new formulations of drugs but also to find out combination therapies that can lead to faster implementation of the latest treatments.

The research efforts focus on personalized care and aim to enhance patient outcomes, improve treatment efficacy, and offer tailored options for prostate cancer patients. This continuous innovation through research and clinical trials contributes positively to the growing market, where the United States remains a haven for prostate cancer therapy development.

United Kingdom market for prostate cancer is going to show a CAGR of 5.2% from 2025 to 2035. It currently has the largest share in the Western Europe market, and the same trend is expected to follow over the forecast period.

The National Health Service within the United Kingdom is a highly significant force that drives the market through providing access to universal healthcare. With the NHS, prostate cancer screening, diagnosis, and treatment are available to residents. Thus, no patient is left behind.

The wide-ranging services provided by the NHS include Prostate-Specific Antigen (PSA) testing, among other early diagnostic procedures. These early detection processes ensure timely detection of prostate cancer, thereby enabling better prognosis and more effective treatment options. In general, improved patient outcomes depend on early detection, which facilitates more targeted and less invasive treatments.

In addition, the NHS provides prostate cancer patients with the latest therapies and care plans, from advanced diagnostics to personalized treatment regimens. This system of universal healthcare and early detection creates a significant market demand for prostate cancer services, making the NHS a key driver of market growth in the United Kingdom.

India's prostate cancer market is expected to grow at a CAGR of 7.9% from 2025 to 2035. It currently has the largest share in the South Asia & Pacific market, and the trend is likely to continue throughout the forecast period.

Prostate cancer is on the rise in India. The reasons behind this are because of an aging population, increased lifestyles, and improvements in the detection of disease. As the number of old people has gone up, naturally there is an increased chance of prostate cancer as the disease affects more older men. Unhealthy eating habits, no exercise, and increased urbanization that have raised the cancer cases are the other reasons.

Thus, enhanced awareness and superior diagnostic facilities, coupled with advances in medical technologies, translate into more regular detection of prostate cancer in the early stages. This increasing diagnosis is providing an added boost to prostate-specific antigen PSA testing and follow-up treatments such as radiotherapy, hormone therapy, and chemotherapy.

Thus, the rising number of cases of prostate cancer in India would require increasing diagnostics services, treatment interventions, and healthcare infrastructure facilities. Hence, it is an important market opportunity for prostate cancer care.

Key strategies include product differentiation via innovative formulation methods, as well as strategic partnerships with healthcare providers for distribution. Another strategic thrust for these companies is the proactive identification of potential partners who can strengthen their product line in consideration and enhance their global reach.

Recent Developments in the Prostate Cancer Industry

In terms of drug class, the industry is divided into- hormonal prostate cancer therapy (luteinizing hormone-releasing hormone (LHRH) antagonists, luteinizing hormone-releasing hormone (LHRH) agonists, anti-androgen), prostate cancer chemotherapy (taxotere and jevtana), prostate cancer immunotherapy (provenge), prostate cancer targeted therapy (xofigo) and other prostate cancer.

In terms of distribution channel, the industry is segregated into- hospital pharmacies, drug stores & retail pharmacies and online pharmacies.

Key countries of North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia and Middle East and Africa (MEA) have been covered in the report.

The global prostate cancer market is projected to witness CAGR of 8.5% between 2025 and 2035.

India is set to record the highest CAGR of 7.9% in the assessment period.

The key players operating in the global prostate cancer market include Astellas Pharma Inc., AstraZeneca plc, Bayer AG, Bristol-Myers Squibb Company, Pfizer Inc., Ipsen Pharma, Ferring Pharmaceuticals Inc., GlaxoSmithKline Plc, Exelixis, Inc. and Clovis Oncology, Inc.

Figure 1: Global Market Value (USD Million) by Drug Class, 2025 to 2035

Figure 2: Global Market Value (USD Million) by Distribution Channel, 2025 to 2035

Figure 3: Global Market Value (USD Million) by Region, 2025 to 2035

Figure 4: Global Market Value (USD Million) Analysis by Region, 2020 to 2035

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2025 to 2035

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2025 to 2035

Figure 7: Global Market Value (USD Million) Analysis by Drug Class, 2020 to 2035

Figure 8: Global Market Value Share (%) and BPS Analysis by Drug Class, 2025 to 2035

Figure 9: Global Market Y-o-Y Growth (%) Projections by Drug Class, 2025 to 2035

Figure 10: Global Market Value (USD Million) Analysis by Distribution Channel, 2020 to 2035

Figure 11: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2025 to 2035

Figure 12: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2025 to 2035

Figure 13: Global Market Attractiveness by Drug Class, 2025 to 2035

Figure 14: Global Market Attractiveness by Distribution Channel, 2025 to 2035

Figure 15: Global Market Attractiveness by Region, 2025 to 2035

Figure 16: North America Market Value (USD Million) by Drug Class, 2025 to 2035

Figure 17: North America Market Value (USD Million) by Distribution Channel, 2025 to 2035

Figure 18: North America Market Value (USD Million) by Country, 2025 to 2035

Figure 19: North America Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 22: North America Market Value (USD Million) Analysis by Drug Class, 2020 to 2035

Figure 23: North America Market Value Share (%) and BPS Analysis by Drug Class, 2025 to 2035

Figure 24: North America Market Y-o-Y Growth (%) Projections by Drug Class, 2025 to 2035

Figure 25: North America Market Value (USD Million) Analysis by Distribution Channel, 2020 to 2035

Figure 26: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2025 to 2035

Figure 27: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2025 to 2035

Figure 28: North America Market Attractiveness by Drug Class, 2025 to 2035

Figure 29: North America Market Attractiveness by Distribution Channel, 2025 to 2035

Figure 30: North America Market Attractiveness by Country, 2025 to 2035

Figure 31: Latin America Market Value (USD Million) by Drug Class, 2025 to 2035

Figure 32: Latin America Market Value (USD Million) by Distribution Channel, 2025 to 2035

Figure 33: Latin America Market Value (USD Million) by Country, 2025 to 2035

Figure 34: Latin America Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 37: Latin America Market Value (USD Million) Analysis by Drug Class, 2020 to 2035

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Drug Class, 2025 to 2035

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Drug Class, 2025 to 2035

Figure 40: Latin America Market Value (USD Million) Analysis by Distribution Channel, 2020 to 2035

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2025 to 2035

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2025 to 2035

Figure 43: Latin America Market Attractiveness by Drug Class, 2025 to 2035

Figure 44: Latin America Market Attractiveness by Distribution Channel, 2025 to 2035

Figure 45: Latin America Market Attractiveness by Country, 2025 to 2035

Figure 46: Europe Market Value (USD Million) by Drug Class, 2025 to 2035

Figure 47: Europe Market Value (USD Million) by Distribution Channel, 2025 to 2035

Figure 48: Europe Market Value (USD Million) by Country, 2025 to 2035

Figure 49: Europe Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 50: Europe Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 51: Europe Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 52: Europe Market Value (USD Million) Analysis by Drug Class, 2020 to 2035

Figure 53: Europe Market Value Share (%) and BPS Analysis by Drug Class, 2025 to 2035

Figure 54: Europe Market Y-o-Y Growth (%) Projections by Drug Class, 2025 to 2035

Figure 55: Europe Market Value (USD Million) Analysis by Distribution Channel, 2020 to 2035

Figure 56: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2025 to 2035

Figure 57: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2025 to 2035

Figure 58: Europe Market Attractiveness by Drug Class, 2025 to 2035

Figure 59: Europe Market Attractiveness by Distribution Channel, 2025 to 2035

Figure 60: Europe Market Attractiveness by Country, 2025 to 2035

Figure 61: South Asia & Pacific Market Value (USD Million) by Drug Class, 2025 to 2035

Figure 62: South Asia & Pacific Market Value (USD Million) by Distribution Channel, 2025 to 2035

Figure 63: South Asia & Pacific Market Value (USD Million) by Country, 2025 to 2035

Figure 64: South Asia & Pacific Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 65: South Asia & Pacific Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 66: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 67: South Asia & Pacific Market Value (USD Million) Analysis by Drug Class, 2020 to 2035

Figure 68: South Asia & Pacific Market Value Share (%) and BPS Analysis by Drug Class, 2025 to 2035

Figure 69: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Drug Class, 2025 to 2035

Figure 70: South Asia & Pacific Market Value (USD Million) Analysis by Distribution Channel, 2020 to 2035

Figure 71: South Asia & Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2025 to 2035

Figure 72: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2025 to 2035

Figure 73: South Asia & Pacific Market Attractiveness by Drug Class, 2025 to 2035

Figure 74: South Asia & Pacific Market Attractiveness by Distribution Channel, 2025 to 2035

Figure 75: South Asia & Pacific Market Attractiveness by Country, 2025 to 2035

Figure 76: East Asia Market Value (USD Million) by Drug Class, 2025 to 2035

Figure 77: East Asia Market Value (USD Million) by Distribution Channel, 2025 to 2035

Figure 78: East Asia Market Value (USD Million) by Country, 2025 to 2035

Figure 79: East Asia Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 80: East Asia Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 81: East Asia Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 82: East Asia Market Value (USD Million) Analysis by Drug Class, 2020 to 2035

Figure 83: East Asia Market Value Share (%) and BPS Analysis by Drug Class, 2025 to 2035

Figure 84: East Asia Market Y-o-Y Growth (%) Projections by Drug Class, 2025 to 2035

Figure 85: East Asia Market Value (USD Million) Analysis by Distribution Channel, 2020 to 2035

Figure 86: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2025 to 2035

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2025 to 2035

Figure 88: East Asia Market Attractiveness by Drug Class, 2025 to 2035

Figure 89: East Asia Market Attractiveness by Distribution Channel, 2025 to 2035

Figure 90: East Asia Market Attractiveness by Country, 2025 to 2035

Figure 91: MEA Market Value (USD Million) by Drug Class, 2025 to 2035

Figure 92: MEA Market Value (USD Million) by Distribution Channel, 2025 to 2035

Figure 93: MEA Market Value (USD Million) by Country, 2025 to 2035

Figure 94: MEA Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 95: MEA Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 96: MEA Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 97: MEA Market Value (USD Million) Analysis by Drug Class, 2020 to 2035

Figure 98: MEA Market Value Share (%) and BPS Analysis by Drug Class, 2025 to 2035

Figure 99: MEA Market Y-o-Y Growth (%) Projections by Drug Class, 2025 to 2035

Figure 100: MEA Market Value (USD Million) Analysis by Distribution Channel, 2020 to 2035

Figure 101: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2025 to 2035

Figure 102: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2025 to 2035

Figure 103: MEA Market Attractiveness by Drug Class, 2025 to 2035

Figure 104: MEA Market Attractiveness by Distribution Channel, 2025 to 2035

Figure 105: MEA Market Attractiveness by Country, 2025 to 2035

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Breast & Prostate Cancer Diagnostics Market in Europe – Trends & Forecast 2025 to 2035

Hormone Sensitive Prostate Cancer Market – Trends & Forecast 2025 to 2035

Castration-Resistant Prostate Cancer (CRPC) Treatment Market Insights - Demand, Size & Industry Trends 2025 to 2035

Hormone Sensitive Advanced Prostate Cancer Treatment Market Size and Share Forecast Outlook 2025 to 2035

Prostate-Specific Antigen Testing Market Analysis - Size, Share & Forecast 2025 to 2035

Prostate Health Market Trends - Growth, Demand & Forecast 2025 to 2035

BPH Prostate Treatment Market Report – Trends & Forecast 2024-2034

Cancer Registry Software Market Size and Share Forecast Outlook 2025 to 2035

Cancer Biological Therapy Market Size and Share Forecast Outlook 2025 to 2035

Cancer Diagnostics Market Analysis - Size, Share and Forecast 2025 to 2035

Cancer Biopsy Market - Growth & Technological Innovations 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Cancer Gene Therapy Market Overview – Trends & Future Outlook 2024-2034

Cancer-focused Genetic Testing Service Market Analysis – Growth & Industry Insights 2024-2034

Cancer Tissue Diagnostic Market Trends – Growth & Industry Forecast 2024-2034

Cancer Supportive Care Products Market Trends – Growth & Forecast 2020-2030

Cancer Antigens Market

Pet Cancer Therapeutics Market Insights - Growth & Forecast 2024 to 2034

Skin Cancer Detection Devices Market Size and Share Forecast Outlook 2025 to 2035

Lung Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA