The global prophylactic dental handpiece industry is valued at USD 256.2 million in 2025. It is expected to grow at a CAGR of 5.7% and reach USD 446.0 million by 2035. The prophy dental handpiece market will transform the dental care sector driven by advancements in technology and increasing global demand for professional oral care solutions.

With awareness of dental health on the rise and processes becoming increasingly sophisticated, the demand for high-performance handpieces continues to grow.In 2024, the prophy dental handpiece industry grew steadily due to increased demand for electrically driven handpieces, which continued to lead the way with their higher efficiency and longer lifespan compared to air-driven counterparts.

Manufacturers emphasized ergonomic designs, sound reduction, and better speed control, solving some of the main pain points for dental professionals.North America and Europe currently dominate this industry. The Asia-Pacific region is showing the fastest growing due to increased healthcare spending and rising incomes.

As the dental industry develops, innovations are making tools quieter, more precise, and easier to use, increasing their demand. Continuous technological advancements present significant opportunities for manufacturers and all those involved in the dental care sector.

Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 256.2 Million |

| Industry Size (2035F) | USD 446.0 Million |

| CAGR (2025 to 2035) | 5.7% |

Explore FMI!

Book a free demo

The prophy dental handpiece segment is growing steadily as the demand for effective, ergonomic, and technologically advanced dental instruments increases. Electric-powered handpieces are driving the transition with dental professionals wanting durability, precision, and decreased noise levels, while AI-powered integration and intelligent connectivity are soon to become the game-changers.

Industry titans and visionary manufacturers will benefit, while traditional air-driven handpieces will become less relevant as the segment moves toward automation, sustainability, and enhanced patient comfort.

Invest in Next-Generation Electric & Smart HandpiecesR&D

should be focused on AI-driven diagnostics, wireless connectivity, and battery-saving motors to improve accuracy and ease of use. Diversification of product lines with ergonomic, noise-reducing, and environmentally friendly models will guarantee long-term segment dominance.

Align with Changing Dental Industry Trends & Regulations

Companies must stay ahead by adapting to shifting consumer demand with changing consumer needs, such as the need for handheld, cordless products and conformity to international sterilization and environmental standards. Aligning with dental schools and clinics can improve brand positioning and accelerate adoption.

Grow Industry Share Through Strategic Partnerships & M&A

Strengthening distribution channels in high-growth sectors such as Asia-Pacific and Latin America will open up new streams of revenue. M&A or joint ventures with technology-focused dental startups can offer a competitive advantage in innovation and integration with smart devices.

| Risk | Probability & Impact |

|---|---|

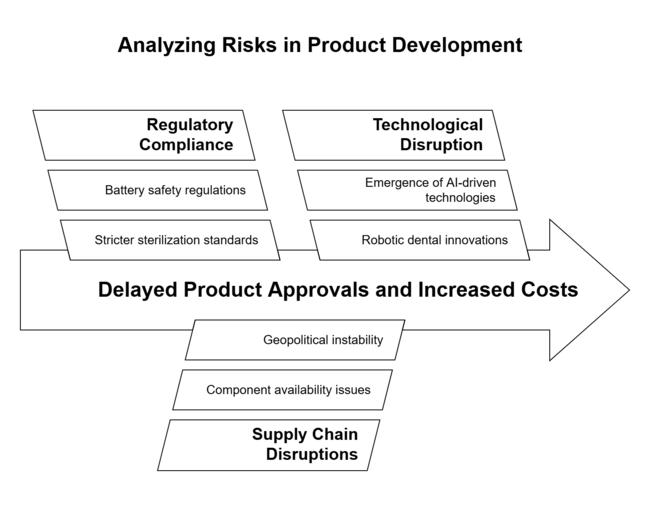

| Regulatory Compliance & Safety Standards - Stricter global regulations on sterilization, battery safety, and emissions could delay product approvals. | Probability: Medium Impact: High |

| Supply Chain Disruptions & Raw Material Costs - Fluctuations in component availability (e.g., motors, lithium batteries) and geopolitical instability could increase production costs. | Probability: High Impact: Medium |

| Technological Disruption & industry Competition - Emerging AI-driven and robotic dental technologies may outpace traditional handpieces, pressuring legacy manufacturers. | Probability: Medium Impact: High |

| Priority | Immediate Action |

|---|---|

| Smart & AI-Integrated Handpieces | Run feasibility study on AI-driven diagnostics and wireless-enabled handpieces to enhance sector competitiveness. |

| Supply Chain Resilience | Initiate OEM feedback loop to assess demand for alternative raw materials and mitigate supply chain disruptions. |

| Global Segment Expansion | Launch aftermarket channel partner incentive pilot in high-growth regions like Asia-Pacific & Latin America to boost adoption. |

To dominate the evolving prophy dental handpiece landscape, the company must promptly increase investments in AI-driven, intelligent, and ergonomic handpieces. It should also pay special attention to increasing presence in high-growth geographies such as Asia-Pacific and Latin America.

Supply chain robustness can be achieved by seeking alternative sources of materials and forming alliances with original equipment manufacturers (OEMs) to help mitigate cost fluctuations. In addition, the company must think about acquiring or merging with dental startups that specialize in technology to remain ahead with new technologies.

This strategy focuses on creating the next generation of products, complying with regulations, and expanding into international sectors, which will establish long-term leadership in this rapidly evolving industry.

Regional Variance:

High Variance:

ROI Perception Differences:

Consensus:

Regional Variance:

Shared Challenges:

Regional Differences:

Manufacturers:

Distributors:

End-Users (Dentists & Hygienists):

| Region | Regulatory Impact & Key Considerations |

|---|---|

| United States | FDA Class I & II Regulations: 68% of manufacturers cited compliance with FDA sterilization and safety mandates as a challenge. State-level mandates (e.g., California’s Prop 65) require strict material disclosures. |

| Western Europe | EU MDR (Medical Device Regulation) 2023 to 2027: 81% of stakeholders see it as a driver for premium, compliant handpieces. CE certification demands detailed clinical safety testing. Sustainability laws (e.g., carbon footprint limits) affect material sourcing. |

| Japan | Pharmaceutical and Medical Device Act (PMDA): 32% of stakeholders felt regulatory impact was minimal, citing less aggressive enforcement compared to Western sectors . Approval times remain a bottleneck for foreign brands. |

| South Korea | MFDS (Ministry of Food and Drug Safety) Regulations: Strict sterilization standards and import restrictions affect global brands. However, lower enforcement on local players allows price-sensitive models to thrive. |

| China | NMPA (National Medical Products Administration) Approval: Rising enforcement on dental device safety & quality, impacting imported handpieces. Domestic brands benefit from policy incentives, creating a competitive pricing challenge for foreign manufacturers. |

| Latin America | ANVISA (Brazil) & COFEPRIS (Mexico) Regulations: Increasing demand for ISO 13485 compliance is raising entry barriers for small and mid-sized firms. However, industry growth is driven by affordable, mid-range handpieces. |

The global CAGR forecast for the USA prophy dental handpiece sector is 6.2% from 2025 to 2035. Global average owing to factors like rapid adoption of handpieces based on artificial intelligence, stringent sterilization standards and increasing economic dental services.

The USA is still considered a key segment where advanced, ergonomic, and automation-integrated handpieces are likely to develop. Emerging technologies, including real-time pressure monitoring sensors and AI-powered torque control, have started to take root.

Regulatory oversight from the FDA and state-level compliance will continue to drive demand for high-quality, sterilizable materials like titanium and stainless steel. Dental Service Organizations (DSOs) are rapidly expanding, as are private dental chains, further accelerating the bulk purchasing of electric-driven handpieces.

The UK sector is anticipated to grow at a sturdy CAGR of 5.4% from 2025 to 2035 owing to preventive dentistry, an increase in private dental clinics, and sustainable healthcare. While a public body, the National Health Service (NHS) in Britain provides basic dental care, and patients are increasingly choosing to go private, driving demand for premium electric handpieces featuring ergonomic designs.

The UK has stringent adherence to the EU medical device regulation (MDR) and post-Brexit regulatory amendments are a vital component driving the segment that demands advanced safety and sterilization standards.

The rise of battery-powered and cordless models is further evidence of the UK dental clinic's demand for mobility and efficiency. Sustainability is a significant segment driver since over 60% of UK dental practitioners would choose low-carbon-footprint dental tools.

The prophy dental handpiece sector of France is estimated to grow at a CAGR of 5.0% over the forecast period (2025 to 2035), fueled by the preventive dentistry culture, digital health infiltration, and government-funded reimbursement schemes.

Electric and hybrid-powered handpieces are certainly in demand, with 73% of dentists in France choosing low-vibration and noise-reducing models to enhance patient comfort. France’s green commitment translates into a growing interest in biodegradable and energy-efficient handpieces with EU regulations guiding sustainable practices.

France’s complex reimbursement policies can slow the adoption of high-cost models. However, the dental tourism industry, particularly near Switzerland and Belgium, is driving demand for high-speed and ergonomic handpieces.

The market for prophy dental handpieces in Germany is predicted to grow at a CAGR of 5.8% from 2025 to 2035 owing to the presence of a sophisticated dental health care system in the country in which a stringent regulatory framework and growing acceptance for digitalized handpieces.

Germany has one of Europe's highest densities of private dental clinics, where dental practitioners predominantly use electric-driven instrumentation. Germany is a hotspot for high-quality, premium-priced handpieces due to strict MDR regulations and a focus on precision engineering. Automated and AI-driven models allowing torque and pressure adjustments are increasingly entering clinics.

The demand for smart learning-friendly handpieces is also being propelled by automotive dental schools and training centres. The situation is challenging due to competition from Eastern European manufacturers that sell affordable models. As a result, German manufacturers are concentrating on innovation, research, and the adoption of sustainable materials to maintain industry advantage.

The demand for Prophy Dental Handpieces in Italy is expected to grow at a CAGR of 5.2% in 2025. Italy, with its large number of private dental clinics, represents a key market for ergonomic and high-speed handpieces. Dentists in Italy choose a light and quiet motor handpiece method in which more of the dentists prefer hybrid aluminium-titanium motor handpieces.

The country’s booming dental tourism industry especially in Milan, Rome, and Florence. The rise of dental tourism in Italy has driven demand for high-end sterilizable handpieces that can withstand high patient turnover. Manufacturers are also looking at leasing and financing models to gain a foothold in smaller clinics. Clinics are investing more in low-energy and recyclable material handpieces.

The South Korea prophy dental handpiece sector is predicted to grow with a CAGR of 5.9% across the forecast years, citing high-tech dental architecture integrations, strong domestic manufacturing, and growing demand for aesthetic dentistry as benefactors.

Premium dental clinics in Seoul and Busan are increasingly adopting handpieces driven by AI and integrated with sensors. Korea’s stringent MFDS regulations guarantee strict safety and sterilization protocols and ensure a preference for premium and ISO-certified dental instruments.

Cost-sensitive clinics, however, are still most often settling for semi-automated or more affordable manual handpieces, thus ensuring that both entry and high-end level models retain relevance in the sector. Korea’s dental innovation industry is also on the rise owing to corporations investing in low-speed handpieces that can be ultra-light weight and designed for compact storage.

The Japan prophy dental handpiece sector is expected to grow at a CAGR of 4.8% owing to its responsiveness toward compact, low-maintenance, and precision-oriented handpieces. An aging population in the country is boosting demand for minimally invasive dental tools, with low-vibration, ergonomic handpieces being preferred.

Japan’s conservative dental sector and sluggish regulatory approvals stymie rapid adoption of innovations. In contrast, local manufacturers concentrating on inexpensive, sterilization-prepared models are primed for stable, steady growth.

In fact, the China prophy dental handpiece segment is expected to grow at a CAGR of 6.5% during the forecast period of 2025 to 2035. Some of the major factors that will have the impact during the forecast period are the rapid urbanization, increasing disposable income, increasing focus on oral health and strong governmental support for the expansion of healthcare sector.

China’s rapidly expanding private dental sector has increased demand for high-quality handpieces. While local manufacturers dominate the lower-cost segment, premium AI-based handpieces are primarily sourced from foreign brands.

Battery-powered and hybrid electric-pneumatic models are emerging as more clinics call for low-maintenance, high-precision solutions. Moreover, the growing incidence of dental procedures and the fear of painful oral treatments is likely to stimulate demand for high-speed and ergonomic handpieces, especially in the segments of cosmetic and pediatric dentistry is another key player.

The Australia & New Zealand (ANZ) prophy dental handpiece landscape is projected to reach more than 55,000 units in terms of volume during the period 2025 to 2035 at a healthy 5.3% CAGR. Preventive care is emphasized by the Australian Dental Association (ADA), which runs a country with one of the highest per capita expenditures on dental care in the world.

The common trend in urban clinics and corporate dental chains is the use of ergonomic or electric handpieces, as the need for these handpieces is increasing. Sustainability focused products with designs for recyclable material and low-energy motors have gained traction due to the region’s focus on sustainable medical devices.

The New Zealand segment is smaller yet appears to be ever-growing, as smart dental technologies gain significant industry share. However, sluggish import costs and supply chain disruptions pose a risk to the industry players.

India’s prophy dental handpiece sector is estimated to witness highest growth, registering a CAGR of 6.8% during the forecast period (2025 to 2035). With more than 300,000 practicing dentists and a growing middle-class population that is willing to spend on oral healthcare, the demand for low-cost, high-performance handpieces is driving forward.

Increasing number of multi-specialty dental clinics and corporate dental chains are set to drive the demand for electric and hybrid handpieces. India’s price-sensitive segment prefers relatively inexpensive but reliable handpieces, as Chinese and domestic brands challenge European and USA manufacturers.

High-end AI-powered and ergonomic versions are creating a segment among top-tier dental clinics and cosmetic dentistry in urban centers. Furthermore, strengthening working relations and partnership between the Dental Council of India (DCI) and Bureau of Indian Standard (BIS) to ensure dental device harmonisation will provide opportunities to the foreign manufacturers to expand their footprint.

The prophy dental handpiece industry will grow, at a CAGR of 5.7% during the forecast period of 2025 to 2035.This increase is attributed to increasing adoption of dental care, prevalence of periodontal diseases, and advances in technologies enabling improved accuracy and effectiveness of the dental procedures.

By product, the contra-angle dental handpieces segment dominates the industry share due to their flexibility and ergonomically designed construction. Among these, the more commonly adopted are the rotary contra-angle handpieces that provide for better manoeuvrability and control that work towards making the process of dental polishing and prophylaxis more effective. The industry for straight prophy dental handpieces is consistently increasing due to improvements in posterior teeth accessibility.

The prophy dental handpiece industry will grow, at a CAGR of 5.6% during the forecast period of 2025 to 2035. The industry is examined on the basis of power supply, prophy dental handpieces are the segment leaders and possess the largest industry share.

Their popularity is increasing because of consistent torque, lower vibration, and increased patient comfort, which makes them a choice for contemporary dental practices. They are especially popular in busy dental clinics and group practices where efficiency is the key factor.

Battery-operated handpieces hold a smaller market share and are mainly used by professionals who require mobility, such as those in mobile dentistry or emergency dental clinics. Frequent recharging and may not offer the same amount of torque as electric-powered ones, their use continues to be somewhat limited.

The prophy dental handpiece industry will grow, at a CAGR of 5.8% during the forecast period of 2025 to 2035. Prophy dental handpieces remain the norm for the industry owing to their economic viability and endurance. Dental hospitals and clinics find these handpieces convenient because they provide long-term value.

Moreover, the initial cost of reusable handpieces is higher, but the cost per procedure is low overall, and hence they are a favorite among high-volume dental clinics. There is a strong movement towards single-use handpieces, however, due to a rising concern for infection control as well as potential cross-contamination.

Due to the increasing emphasis on patient safety and stringent regulatory requirements for sterilization, dental professional particularly more popular in hospitals, group practices, and ambulatory surgical centers wherever hygiene compliance is highest.

The prophy dental handpiece industry will grow, at a CAGR of 5.7% during the forecast period of 2025 to 2035. Dental clinics are the biggest part of the demand for dental services. This increase is mainly because there are more private dental offices opening up, and people prefer getting special care for their dental needs.

There is also a growing interest in cosmetic dentistry procedures like teeth whitening, veneers, and smile corrections. Moreover, clinics are using high-quality dental tools to provide better services and ensure patient comfort.

In certain regions, dental insurance now covers more treatments, which motivates more individuals to visit dental clinics for regular inspection and treatments.Group dental practices are also becoming increasingly popular and growing quickly.

Key players in the prophy dental handpiece sector are leveraging pricing, innovations in product development, strategic partnerships, and geographic presence to gain a competitive edge. Dominant firms are leveraging economies of scale to offer aggressive prices while remaining profitable. Luxury brands focus on high-performance handpieces featuring revolutionary ergonomic design, noise control technology, and enhanced durability to stand out in the sector.

Businesses also invest a lot of money into R&D, and electric-powered and oscillating handpieces are expected to grow as a key technology as they prove to be efficient and improve patient comfort. Smart technology is permeating most manufacturers, with smarter products taking precedence, such as IoT-connected equipment and devices where manufacturers can monitor performance and track maintenance.

The rising emphasis on infection control, developments in electric-driven technology, and the growing volume of dental procedures are key drivers of demand. The growth in cosmetic dentistry and increased oral hygiene awareness also led to increased adoption.

Electrically driven handpieces are the most popular because they deliver a steady torque, have less vibration, and offer longer life. Nevertheless, battery-powered versions are increasingly becoming popular among mobile dentistry practitioners and emergency care specialists.

Advances like oscillating contra-angle designs, ergonomic and light weight models, and IoT monitoring systems are enhancing efficiency, accuracy, and patient-practitioner comfort. The technologies assist in mitigating practitioner fatigue and increasing procedural accuracy.

Some of the key issues are sterilization needs, longevity, cost-effectiveness, and maintenance ease. Although reusable models offer long-term cost savings, single-use models are becoming increasingly popular because of stringent hygiene rules and lower cross-contamination risks.

North America and Western Europe are leading in adoption, with advanced health care infrastructure and regulatory standards. Conversely, Asia-Pacific is a region that is growing rapidly with escalating dental consciousness, growing clinics, and increased disposable income.

It is segmented into Straight Prophy dental Handpieces, Contra-angle Dental Handpieces(Oscillating Contra-angle handpieces, Rotary Contra-Angle Handpieces), and Right-Angle Prophy Dental Handpieces

It is segmented intoElectric Driven and Battery Operation

It is segmented intoReusage and Single-Use

It is segmented intoHospital, Dental Clinics, Group Dental Practice, and Ambulatory Surgical Centers

It is segmented into North America, Latin America, Europe, South Asia, East Asia, Oceania, and Middle East and Africa (MEA)

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Atrophic Vaginitis Treatment Market Analysis And Forecast by Diagnosis, Treatment, Therapy Type, Distribution Channel, and Region through 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Automated Sample Storage Systems Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.