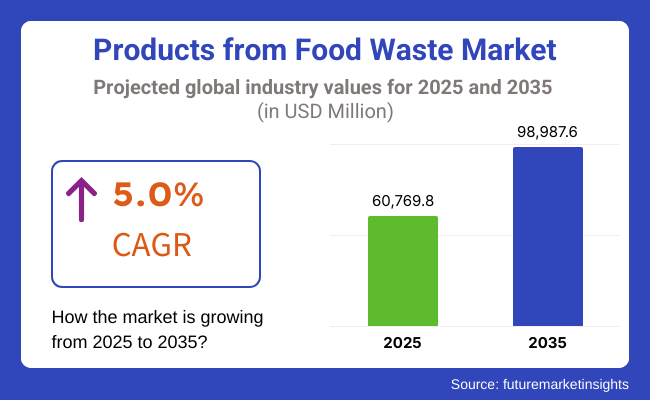

The global Products from Food Waste market is estimated to be worth USD 60,769.8 million in 2025 and is projected to reach a value of USD 98,987.6 million by 2035, expanding at a CAGR of 5.0% over the assessment period of 2025 to 2035.

The circular economy is an economic model that prioritizes sustainability by minimizing waste and maximizing resource use. In this framework, products made from food waste play a crucial role by transforming discarded materials into valuable resources.

This approach not only reduces the environmental impact of food production but also fosters innovation in product development. By closing the loop in the food supply chain, businesses can create a more sustainable system that benefits both the economy and the environment.

As consumers become more environmentally conscious, there is a rising demand for ethically sourced and produced goods. Products derived from food waste resonate with this demographic, as they are perceived as sustainable and socially responsible.

This shift in consumer behavior encourages companies to adopt eco-friendly practices and develop products that align with ethical values. By catering to this demand, businesses can enhance their brand reputation and attract a loyal customer base committed to sustainability.

Explore FMI!

Book a free demo

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for global products from food waste market. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision about the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 3.3% (2024 to 2034) |

| H2 | 3.9% (2024 to 2034) |

| H1 | 4.4% (2025 to 2035) |

| H2 | 5.0% (2025 to 2035) |

The above table presents the expected CAGR for the global products from food waste demand space over semi-annual period spanning from 2025 to 2035. In the first half (H1) of the year 2024, the business is predicted to surge at a CAGR of 3.3%, followed by a slightly higher growth rate of 3.9% in the second half (H2) of the same year.

Moving into year 2025, the CAGR is projected to increase slightly to 4.4% in the first half and remain relatively moderate at 5.0% in the second half. In the first half (H1 2025) the market witnessed a decrease of 16 BPS while in the second half (H2 2025), the market witnessed an increase of 34 BPS.

Upcycling Innovations

Upcycling innovations are revolutionizing the way companies approach food waste by transforming surplus or discarded food into high-value products. This trend is gaining momentum across various industries, including cosmetics, beverages, and dietary supplements. For example, mango peels and apple cores are being repurposed into natural extracts, powders, and flavorings, appealing to health-conscious consumers who prioritize sustainability.

Brands are increasingly recognizing the potential of these upcycled ingredients to enhance their product offerings while reducing waste. This not only helps in minimizing environmental impact but also positions companies as leaders in sustainability. As consumer demand for eco-friendly and nutritious products continues to rise, upcycling innovations are expected to play a pivotal role in shaping the future of the food waste market.

Collaborative Initiatives

Collaborative initiatives are becoming essential in the fight against food waste, as partnerships between food manufacturers, retailers, and NGOs are increasingly common. These collaborations aim to address food waste challenges collectively, leading to innovative solutions and new product lines that utilize food waste effectively. By pooling resources, expertise, and networks, stakeholders can create a more efficient supply chain that maximizes the value of food by-products.

For instance, joint ventures may focus on developing new upcycled products or implementing waste reduction strategies. Such collaborations not only enhance the availability of products derived from food waste but also foster a sense of community and shared responsibility among industry players, ultimately driving growth in the market.

Sustainable Packaging Solutions

The demand for sustainable packaging solutions is on the rise as consumers become more environmentally conscious. Companies are increasingly exploring biodegradable packaging options made from food waste, such as agricultural by-products like berry waste. These innovations not only help reduce plastic waste but also align with the growing consumer preference for eco-friendly products.

By utilizing food waste in packaging materials, brands can enhance their sustainability credentials and appeal to a market that values environmental responsibility. This trend is fostering competition among companies to develop creative and effective packaging solutions that minimize their ecological footprint. As a result, sustainable packaging is becoming a key differentiator in the market, enhancing brand loyalty and attracting environmentally aware consumers.

Global Products from Food Waste sales increased at a CAGR of 4.0% from 2020 to 2024. For the next ten years (2025 to 2035), projections are that expenditure on products from food waste will rise at 5.0% CAGR

Manufacturers are increasingly recognizing the economic advantages of utilizing food waste as a resource. By converting surplus or discarded food into valuable products, companies can significantly reduce waste disposal costs while simultaneously creating new revenue streams.

This resource-efficient approach not only enhances profitability but also contributes to sustainability by minimizing environmental impact. By aligning with the principles of a circular economy, businesses can optimize resource use, reduce waste, and foster innovation, ultimately benefiting both their bottom line and the planet.

Governments and organizations around the world are actively implementing regulations and initiatives aimed at reducing food waste, creating a supportive environment for manufacturers. This regulatory framework encourages businesses to invest in products derived from food waste by providing incentives, grants, and guidelines for sustainable practices.

As a result, manufacturers are more motivated to develop innovative solutions that address food waste challenges. This regulatory support not only drives market growth but also fosters collaboration among stakeholders to promote sustainability and responsible resource management.

Tier 1 Companies: This tier comprises industry leaders with substantial market revenue exceeding USD 20 million, capturing a significant market share of approximately 40% to 50% globally. These companies are recognized for their high production capacity, extensive product portfolios, and robust distribution networks.

They possess advanced technologies and a strong commitment to sustainability, allowing them to innovate continuously and meet the growing consumer demand for eco-friendly products. Prominent players in Tier 1 include established names such as Kerry Group, Tate & Lyle, Cargill, and ADM, which leverage their extensive expertise in food processing and waste management to lead the market.

Tier 2 Companies: This tier includes mid-sized players with revenues ranging from USD 5 million to USD 20 million. These companies have a strong regional presence and significantly influence local markets. They are characterized by their ability to adapt to specific consumer preferences and regulatory requirements within their operational regions.

While they may not have the extensive global reach of Tier 1 companies, they possess good technological capabilities and ensure compliance with industry standards. Notable companies in Tier 2 include Ingredion, Corbion, and Novozymes, which focus on innovative solutions derived from food waste, catering to niche markets and local demands.

Tier 3 Companies: The majority of companies in this tier operate on a small scale, with revenues below USD 5 million. These businesses primarily serve local markets and fulfill niche demands, often focusing on specific products derived from food waste, such as snacks or ingredients.

Tier 3 companies are typically characterized by limited geographical reach and a lack of formal structure compared to their larger counterparts. This segment is often seen as unorganized, with many small players contributing to the overall market without extensive resources or capabilities.

| Countries | Market Value (2035) |

|---|---|

| United States | USD 27,923.7 million |

| Germany | USD 4,731.0 million |

| China | USD 1,156.2 million |

| India | USD 789.3 million |

| Japan | USD 345.8 million |

Corporate sustainability goals are increasingly driving USA companies to adopt strategies that focus on reducing food waste and utilizing by-products in their operations. This commitment to sustainability enhances their corporate social responsibility (CSR) profiles and appeals to environmentally conscious consumers.

Concurrently, the USA stands as a hub for food technology innovation, where startups and established firms are pioneering new methods to upcycle food waste into valuable products. Advances in processing techniques enable the extraction of high-quality ingredients from food waste, making it economically viable for manufacturers to create diverse offerings, from nutritious snacks to cosmetics.

Germany's robust emphasis on research and development, especially in the food technology sector, plays a crucial role in advancing the upcycling of food waste. Universities and research institutions actively collaborate with businesses to explore innovative methods for transforming food waste into valuable products.

This partnership fosters a culture of innovation, leading to the creation of new processes and technologies that enhance the quality and marketability of food waste-derived products. As a result, the focus on R&D not only drives product development but also strengthens the overall sustainability of the food industry, positioning Germany as a leader in food waste management solutions.

In Japan, the growing interest in local and seasonal foods is significantly influencing the demand for products derived from food waste. Consumers are increasingly supporting local producers, who often have surplus ingredients that can be upcycled into new products, aligning with the ethos of sustainability.

This trend is further bolstered by government initiatives, such as the "Food Waste Reduction Promotion Law," which encourages businesses to adopt sustainable practices and innovate in the creation of food waste products. As companies respond to regulatory expectations and consumer preferences, they are developing creative solutions that not only reduce waste but also enhance the appeal of local and seasonal offerings.

| Segment | Value Share (2025) |

|---|---|

| Animal Feed (End User) | 18% |

The rising demand for products from food waste in the animal feed industry is significantly driven by their nutritional value and the growing need for sustainable feed sources. Many food waste products, such as fruit and vegetable scraps, are rich in essential vitamins, minerals, and fiber, making them beneficial for animal health. As the livestock industry increasingly focuses on enhancing the nutritional quality of feed, food waste emerges as an attractive option.

Simultaneously, the global demand for animal protein continues to escalate, prompting the industry to seek efficient and sustainable feed alternatives. By incorporating food waste into animal diets, producers can reduce reliance on conventional feed ingredients while addressing both nutritional needs and sustainability goals, ultimately supporting responsible livestock production.

The competition in the Global Products from Food Waste Market is intensifying as companies innovate to differentiate their offerings. Key players are investing in research and development to create high-quality, value-added products from food waste, such as snacks, ingredients, and packaging solutions. Collaborations with local producers and sustainability-focused initiatives are becoming common to enhance brand reputation. Additionally, companies are leveraging digital marketing and e-commerce platforms to reach environmentally conscious consumers, ensuring they remain competitive in this growing market.

For instance

The global Products from Food Waste industry is estimated at a value of USD 60,769.8 million in 2025.

Sales of Products from Food Waste increased at 4.0% CAGR between 2020 and 2024.

Aeropowder, Bio-bean Ltd., Circular Systems S.P.C., Fruitcycle, GroCycle, Jrink Juicery are some of the leading players in this industry.

The South Asia domain is projected to hold a revenue share of 24% over the forecast period.

North America holds 32% share of the global demand space for Products from Food Waste.

This segment is further categorized into Mangoes, Apples, Grapes, Citrus Fruits, Carrots, Beetroot, Berries and Others.

This segment is further categorized into Food Processing, Beverage Processing, Cosmetics & Personal Care, Dietary Supplements & Nutraceuticals, Animal Feed and Others.

Industry analysis has been carried out in key countries of North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus and the Middle East & Africa.

Take Out Coffee Market Growth - Consumer Trends & Market Expansion 2025 to 2035

Vegan Protein Market Analysis - Size, Share & Forecast 2025 to 2035

Taste Modulators Market Trends - Growth & Industry Forecast 2025 to 2035

Western Europe Whole-wheat Flour Market Analysis by Product Type, Nature, Application, Packaging, Sales Channel, and Country through 2035

Western Europe Fusion Beverage Market Analysis by Product Type, Distribution Channel, and Country through 2035

Western Europe Pectin Market Analysis by Product Type, Application, and Country Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.