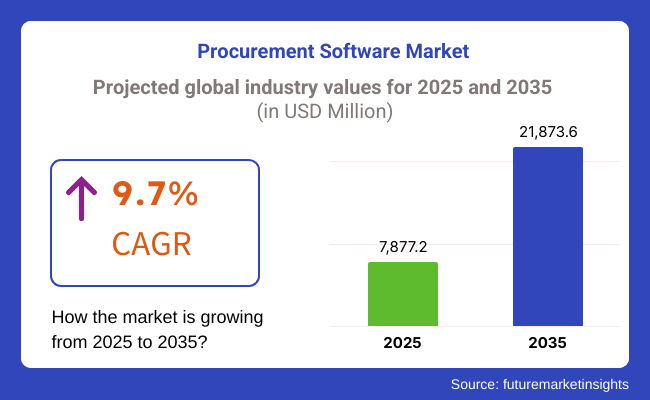

The procurement software market size is expected to reach USD 21,873.6 million by 2035 up from USD 7,877.2 million, and it is projected to register a strong CAGR of 9.7% from 2025 to 2035.

Organizations are also leveraging procurement software to manage third-party risks, ensuring compliance and operational efficiency. For global enterprises, procurement processes have multiple external vendors through which the enterprises procure goods and services, hence requiring clear visibility, enabling risk assessment and regulatory adherence.

Global Supply Chain Management: As supply chains become increasingly global and intricate, there is a rising demand for procurement solutions that can effectively manage vendor relationships and minimize disruptions.

Various industries such as BFSI, healthcare, and IT drive the need for strong procurement software, which, in turn, is expected to augment the growth. All such sectors depend on automated tools for supplier assessment, contract management, and compliance tracking. Regulatory regimes such as GDPA in Europe and CCPA in California require businesses to perform robust supplier due diligence, which led to increased demand for software that combines risk management and regulatory compliance.

As organizations embark on the journey of digital transformation at an aggressive pace, they increasingly rely (and rely more) on procurement platforms to source, negotiate contracts, and collaborate with suppliers. Cloud-based procurement solutions allow organizations to design workflows while being sure that third-party relationships do not create vulnerabilities or compliance issues. Automation and AI-driven analytics help to improve decision-making in procurement processes in a manner that limits inefficiencies and financial risks.

Organizations are increasingly vulnerable to supply chain risks due to the rise in cyber threats; thus, procurement software equipped with real-time monitoring and risk mitigation features is required. These advanced procurement platforms can now provide capabilities such as AI-powered fraud detection, predictive analytics, and continuous monitoring of supplier performance. These capabilities also allow organizations to protect themselves from potential security breaches and financial fraud as a result of third-party relationships.

North America accounts for a large share owing to stringent regulatory needs and a robust focus on cybersecurity. The presence of a leading procurement software provider is supporting innovation and adoption even more as emerging markets such as India and Australia have seen an increase in the adoption of procurement solutions as companies scale up and look to improve supply chain resilience as well as compliance management.

Explore FMI!

Book a free demo

The industry is rapidly evolving due to digital transformation, cloud computing, and AI-enabled automation. Retail & e-commerce emphasizes procurement software in terms of enhancing supply chain responsiveness and providing real-time tracking of inventory.

ERP integration, material supply source streamlining, and supplier management are at the top of the agendas for manufacturing companies. Compliance-oriented procurement for adhering to standards on pharmaceuticals and medical equipment is a top priority of the healthcare sector.

BFSI companies need safe and transparent procurement processes with anti-fraud protection and compliance with financial regulations. IT & telecommunication sectors need cloud-based procurement systems that handle global supplier networks and software license management effectively.

The major trends are AI-powered predictive analytics, blockchain-backed smart contracts, robotic process automation (RPA), and procurement with a sustainability focus. These technologies enable firms to streamline procurement costs, increase collaboration with suppliers, and optimize operational efficiency.

| Company | Contract/Development Details |

|---|---|

| Jaggaer | Partnered with a top-tier university to deploy its procurement software, aiming to modernize the institution's purchasing processes and improve supplier management. |

| GEP | Secured a contract with a major energy company to provide procurement software solutions, focusing on enhancing sourcing strategies and reducing procurement cycle times. |

| Ivalua | Engaged by a financial services firm to implement its procurement platform, aiming to increase spend visibility and enforce compliance across all purchasing activities. |

Between 2020 and 2024, the market for purchasing software grew gradually as business organizations grappled with automating and streamlining procurement. Cloud-based purchasing software was the norm, allowing firms to achieve end-to-end management of vendor relationships, purchase orders, and billings. Artificial intelligence and big data-driven contract management, vendor evaluation, and spending analysis with fewer errors and higher savings.

Enterprise resource planning (ERP) systems combined with e-procurement systems to provide enhanced visibility and decision-making capabilities. Data security, issues of integration for the systems, and issues related to supplier compliance were of concern, however. Autonomous procurement technology from 2025 to 2035 through the support of artificial intelligence (AI) will provide real-time decision-making, contract flexibility with modifications, and dynamic supplier management.

Quantum computing will address intricate procurement patterns, optimizing sourcing and supplier performance. Quantum computing will execute advanced mathematics and search for advanced patterns and correlations. Smart contracts in blockchain will offer transparent, secure, and autonomous enforcement of contracts. Edge AI will enable local decision-making for procuring to react to supply chain disruption more promptly.

AI carbon footprint monitoring and supplier sustainability ranking will facilitate procurement sustainability. Predictive analytics will enable proactive forecasting of demand and supplier risk analysis and render the procurement climate highly efficient, responsive, and secure. Market will move towards AI-native, autonomous, and sustainability-driven procurement solutions.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increased regulatory oversight rendered compliance monitoring indispensable in procurement software. | Compliance by AI automation maintains global trade standards and anti-fraud laws in line. |

| Cloud procurement software gained popularity due to scalability and affordability. | Edge computing boosts decentralized procurements with higher-order real-time analytics. |

| Artificial intelligence-powered demand forecast and supplier scorecard models optimized procurements. | Autonomous procurement systems utilize AI to enable autonomous negotiation and contract optimization. |

| Growing cyber threats resulted in the implementation of secure procurement workflows and access management. | Blockchain-enabled procurement networks reduce third-party risk and enhance transparency of transactions. |

| Smooth automation of purchase orders and invoices accelerated efficiency. | Hyper-automated end-to-end procurement processes driven by artificial intelligence and robotic process automation (RPA) automate everything. |

| Green procurement initiatives encouraged businesses to prioritize eco-friendly vendors. | AI-driven sustainability scoring and carbon offset tracking become standard in procurement decision-making. |

| Digital procurement adoption, demand for transparency, and cost-saving initiatives. | AI-powered procurement ecosystems, real-time risk mitigation, and decentralized procurement models accelerate market growth. |

The industry is at risk for several things that might hinder adoption and efficiency in operations. One of the significant risks is data security and cyber threats because procurement software is used for supplier contracts, pricing, and highly sensitive financial transactions. A hacker attack could cause data leaks, counterfeiting, and damage to the reputation of the company.

Integration challenges are yet another risk since firms often spend significant time and resources trying to marry the procurement software with the existing ERP and accounting systems. The result of poor integration can be eligibility mismatches, hacks, and falling behind the times in the case of the employees who have relied on the old ways of working.

Lack of regulatory compliance is also a risk, given that the procurement process must adhere to tax laws, trade regulations, and supplier transparency guidelines. Failure to meet the standard could lead to finding themselves on the wrong side of the law, incurring financial losses, and experiencing disruptions in their operational activities, especially in those firms that are in multi-national setups.

Another weaker section is vendor independence, where the companies depend on third parties for software upgrades, maintenance, and cloud hosting. This could bring about operational inefficiencies coupled with downtime to the organizations in a case where the vendors are either financially unstable or unwilling to provide the required services.

Competition and cost issues also cause risks, with businesses holding back on software procurement due to excessive costs at the outset or unclear ROI. Outweighing these risks through effective cybersecurity measures, adaptable integration, and compliance-led automation must be the core of the continued growth.

| Countries | CAGR (2025 to 2035) |

|---|---|

| The USA | 11.2% |

| The UK | 9.8% |

| France | 8.5% |

| Germany | 9.2% |

| Italy | 7.9% |

| South Korea | 10.1% |

| Japan | 9.0% |

| China | 12.5% |

| Australia | 8.7% |

| New Zealand | 7.5% |

The industry is likely to record a CAGR of 11.2% in the period 2025 to 2035. High investments in cloud-based procurement software and the rapid digitalization of industries are fueling growth. Large companies are implementing artificial intelligence and machine learning to enhance supply chain effectiveness, reduce costs, and enhance supplier relationship management. Government policies encouraging transparency in procurement also drive the adoption of software, particularly in the public sector and healthcare industries.

Mid-sized businesses are also embracing automation to automate procurement processes, with increasing demand for scalable solutions. Greater use of e-procurement marketplaces and integration with financial systems enhances procurement efficiency.

Strategic collaborations between software vendors and large organizations are also driving market growth. With sustainability emerging as a key area, organizations are embracing procurement solutions that take environmental and ethical considerations into account in their sourcing.

The industry is projected to grow with a CAGR of 9.8% during the forecast period. Digital transformation of procurement and cloud-based technology are on the rise and are driving growth in the market. Organizations are investing more in procurement analytics and supplier management software to enhance efficiency. Digital public procurement by the government also allows the deployment of advanced procurement platforms in the public sector.

Furthermore, the post-Brexit trade environment has also motivated businesses to adopt agile procurement practices to offset supply risks. Artificial intelligence and robotic process automation in procurement functions enable organizations to automate their operations. The growing emphasis on ESG (Environmental, Social, and Governance) compliance is also compelling businesses to adopt procurement solutions for ethical sourcing and supplier diversity.

The industry is likely to develop at a CAGR of 8.5% through 2035. Increased business use of digital procurement platforms is driving market growth. Businesses are seeking to automate negotiations with suppliers, contract handling, and procurement analytics to make procedures more streamlined. In addition, the government transition to digital public procurement is creating new growth prospects for procurement software vendors.

French companies are focusing on risk management in procurement, which is driving the implementation of AI solutions. Cloud procurement software is also gaining widespread acceptance among SMEs, particularly to take advantage of cost management and supplier management. As sustainability is a big issue in procurement processes, companies are implementing solutions that focus on green and ethical procurement.

The industry is predicted to expand at a CAGR of 9.2% over the next ten years. German organizations are investing heavily in digital procurement software in order to automate supply chain processes. The usage of IoT, blockchain, and artificial intelligence in procurement activities is improving efficiency as well as transparency. Large-scale manufacturing facilities are deploying procurement software to optimize supplier relationships and boost cost savings.

SMEs are also turning to cloud-based procurement platforms for scalable and automated procurements. The automotive and industrial sectors, in particular, are pushing the demand for procurement software to create supply chain resilience. Furthermore, Germany's highly regulatory environment is compelling companies to maintain compliance-driven procurement solutions, which they can use to ensure procurement standards and compliance with due diligence by suppliers.

The industry is expected to grow at a 7.9% CAGR between 2025 and 2035. Increasing automation of procurement operations by Italian businesses to reduce costs and improve efficiency is driving market growth. Private and public sector usage of e-procurement solutions is increasing, thereby driving market growth. Businesses are also emphasizing using AI-based procurement software to improve decision-making authority and negotiation with vendors.

Retail and manufacturing businesses are investing heavily in digital procurement platforms to facilitate automated buying operations. Government initiatives encouraging digitalization in procurement are also increasing levels of adoption. With sustainability growing in popularity, Italian businesses are leveraging procurement solutions to handle responsible procurement and compliance with the environment.

The industry is expected to record a CAGR of 10.1% from 2025 to 2035. The country's focus on digitalization and automation in procurement is driving market growth. Large businesses are leveraging AI and big data analytics to enhance supplier performance and optimize procurement strategies. The government's expenditure on smart procurement solutions for public sector businesses is also driving market growth.

Increased focus on cloud-based procurement software among small and medium-sized enterprises is driving growth in the market. The highly advanced high-tech business environment of South Korea facilitates ease in integrating procurement solutions into business infrastructure. Additionally, a growing focus on sustainability in supply chains is encouraging businesses to implement ethical procurement systems to enable them to be consistent with green compliances.

The industry is likely to witness a CAGR of 9% between 2025 and 2035. Increasing numbers of Japanese organizations are opting for digital procurement solutions to reduce costs and improve efficiency. AI and automation use during procurement are becoming increasingly popular, which assists the company in maximizing vendor interaction and reducing procurement cycle time.

The nation's strong manufacturing base is one of the prime drivers for the use of procurement software, primarily in the automotive and electronics industries. Government initiatives towards digital procurement in their procurement process also propel market growth. With Japanese businesses becoming more sustainability-oriented, procurement solutions with ESG compliance and ethical sourcing are becoming more prominent.

The industry is likely to grow at a CAGR of 12.5% over the next decade. The rapid digitalization of supply chains and increasing investments in procurement technology are fueling market expansion. Large enterprises are integrating AI-powered procurement tools to improve efficiency and cost control. The Chinese government's emphasis on digital procurement in public infrastructure projects is also driving adoption.

Small and medium enterprises are shifting to cloud-based procurement systems to enable higher scalability. A greater focus on sustainability and adherence to global trade regulations is pressurizing organizations to implement advanced procurement solutions. In addition to this, China's strong e-commerce platform is also fostering the rise in demand for electronic procurement solutions, facilitating higher collaboration with suppliers and greater efficiency.

The industry is predicted to grow at a CAGR of 8.7% during the period 2025 to 2035. Organizations are implementing digital procurement solutions in an effort to enhance operational efficiency and reduce costs. Cloud-based procurement solutions are highly sought after, particularly with medium-sized enterprises needing to automate sourcing and supplier management.

Government focus on boosting transparency in government procurement is driving market expansion. Companies are also placing greater importance on ESG compliance, and procurement software ensuring ethical procurement is becoming increasingly critical. Greater application of procurement analytics driven by artificial intelligence is assisting firms in making fact-based procurement decisions, thus contributing to market expansion.

The industry is expected to develop at a 7.5% CAGR during the coming decade. Companies are embracing electronic procurement software to improve effectiveness and simplify the management of suppliers. The government sector is relying more on e-procurement tools to increase transparency and lower costs.

Cloud-based procurement solutions are becoming popular among SMEs looking for dynamic and agile solutions. Enhancing the value of sustainability, companies are adopting procurement solutions that guarantee ethical buying and compliance with environmental regulations. Growing demands for AI and automation in all procuring processes are also helping drive the growth.

| Segment | CAGR (2025 to 2035) |

|---|---|

| Supplier Management (Software Type) | 11.6% |

Supplier management is one of the core pillars of modern procurement software, growing at a CAGR of 11.6% over the period 2025 to 2035. With businesses extending their global supply networks, enterprises narrow down on risk assessment, compliance tracking, and suppliers' performance evaluation for uninterrupted operations.

Advanced supplier management systems, such as SAP Ariba, Ivalua, and Jaggaer, offer real-time risk monitoring and analytics made possible through artificial intelligence, among other features. As geopolitics heat up and regulatory expectations rise, governments around the world are pushing for stricter supplier compliance.

While the initiative which saw GeM halting 40% of fake vendors from signing up last year thanks to its digital supplier verification scheme has undoubtedly been effective, demand for automated supplier management technologies has rapidly increased by 35% due to the USA Federal Supplier Risk Assessment program.

Contract management software is a lucrative domain that aspires to a CAGR of 10.2% between 2025 and 2035. Organizations are looking for automated contract lifecycle management (CLM) solutions for negotiating, compliance, and renewal automation, as well as reducing legal risks.

Solutions to DocuSign CLM, Coupa, and Agiloft offer AI-powered contract analysis for an up to 25% reduction in contract disputes, risk flagging, and automated renewal alerts, all increasing efficiency in contract processing. Given that 80% of procurement disputes stem from lack of visibility into contracts, organizations are hasting to embrace cloud-based CLM systems to ensure transparency and saving costs.

| Segment | Value Share (2025) |

|---|---|

| Retail (Industry) | 19.4% |

In 2025, the retail sector held the majority share in the procurement software market, representing 19.4% of the total share. Bulk stores, supermarkets, and e-commerce giants such as Amazon, Walmart, and Alibaba use AI-driven procurement solutions to source inventory, negotiate with vendors, and forecast demand.

This has driven automation of purchase orders (POs), cost savings, and efficiency, which has led to the emergence of software that can drive this, and the role of government regulation, such as China's Smart Retail Procurement Policy, which has enhanced the procurement efficiency of these large chains by 20%, the sustainable sourcing mandates by the EU (driving more carbon footprint to be tracked through procurement systems).

Further, the regulatory authority of the USA. FDA provides stringent rules on how suppliers are digitally tracked. As a result, the adoption of procurement software for food retailers has increased by 45% to meet stringent safety rules.

More recently, the automotive industry has also gone wide in 2025, representing 15.7% of the procurement software market. The need for real-time procurement solutions to handle global supply chains, multi-tier suppliers, and raw material sourcing in the automotive industry has also become a prominent area of focus among OEMs and suppliers alike.

To improve supplier collaboration, monitor compliance with regulations, and reduce disruptions to the supply chain, leading manufacturers such as Tesla, Ford, and BMW adopt cloud-based procurement platforms. The only thing pushing adoption faster than the boardroom is regulation, for example, Germany's Digital Automotive Procurement Initiative, which strongly advises AI-based supplier risk assessments that are critical for maintaining supply chain resilience.

The procurement software market is progressively moving further into an era where businesses will tend towards automating their processes, lowering costs, and reducing risks in procurement. These include AI-enabled analytics, cloud-based platforms for operational data integration, and real-time data importation.

Although cloud solutions have substantially taken over because of their scalability and flexible accessibility, on-premises installations still find their relevance inappropriately managed industries due to regulation and compliance as well as security requirements.

Prominent companies such as SAP Ariba, Coupa Software, Oracle Procurement Cloud, Jaggaer, and GEP Smart make up a market share with comprehensive AI-enabled procurement automation but simple yet direct connections to ERPs.

Amongst them are medium-sized players like Basware, Ivalua, and SynerTrade, which target sector-specific process tools and cost-efficient source solutions. New entrants and niche vendors thus disrupt the market by enabling low-code platforms to manage contracts through AI and transparency through the procurement process blockchain.

The emerging predictive analytics-adoption autonomous procurement bot with segmentation for ESG-driven supplier management will shape the market. Companies are further enriching their platforms through mobile-first procurement, smart contract automatic execution, and embedded financing instrument provisions to respond to changing business needs.

While all these factors define an organization, they also manipulate mergers, acquisitions, and collaboration-scoping strategic opportunities, extending procurement intelligence, supplier collaboration, and overall global reach. Organizations fast-track their digital transformation to gain a competitive edge over their counterparts using highly customized, AI-driven, user-friendly procurement solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| SAP Ariba | 22-26% |

| Coupa Software | 16-20% |

| Oracle Procurement Cloud | 12-16% |

| Jaggaer | 8-12% |

| GEP Smart | 6-10% |

| Other Players | 25-35% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| SAP Ariba | Market leader with end-to-end procurement solutions, deep ERP integration, and AI-driven insights. |

| Coupa Software | Strong in spend management, procurement analytics, and AI-driven cost optimization. |

| Oracle Procurement Cloud | Seamless cloud-based P2P and ERP integration, catering to large enterprises. |

| Jaggaer | Specializes in source-to-pay automation with AI-powered procurement solutions. |

| GEP Smart | Offers cloud-native, AI-driven procurement and supply chain solutions. |

Key Company Insights

SAP Ariba (22-26%)

Market frontrunner for procurement automation based on deep integration into ERPs and AI-assisted supplier management.

Coupa Software (16-20%)

Powerful AI-fueled spend management solution centered on cost reduction, compliance, and automation.

Oracle Procurement Cloud (12-16%)

Integrate the business-case procurement cloud suite, which is strongly coupled with Oracle's ERP infrastructure.

Jaggaer (8-12%)

AI-assisted procurement and supplier management geared toward supply chain optimization.

GEP Smart (6-10%)

Cloud-borne AI-enabled procurement platform, increasing supply chain management and automation.

Other Key Players (25-35% Combined)

Recent Developments

In January 2025, Verizon and Honeywell collaborated to bring in an innovative solution that streamlines the retail lifecycle, from procurement to customer operations. The solution combines IoT, AI-powered analytics, and 5G connectivity to boost procurement efficiency, inventory management, and supplier coordination.

In January 2024, Ramp increased its purchasing capabilities through the acquisition of Venue, bolstering its ability to simplify vendor management and purchasing processes. The acquisition enhances Ramp's platform with automated approval, cost control, and contract management capabilities.

The Global Procurement Software industry is projected to witness CAGR of 9.7% between 2025 and 2035.

The Global Procurement Software industry stood at USD 7,877.2 million in 2025.

The Global Procurement Software industry is anticipated to reach USD 21,873.6 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 11.7% in the assessment period.

The key players operating in the Global Procurement Software Industry SAP Ariba, Coupa Software, Oracle Procurement Cloud, Jaggaer, GEP Smart, Ivalua, Basware, Zycus, Proactis, Workday Procurement.

In terms of software type, the segment is divided into Spend Analysis, E-Sourcing, E-Procurement, Supplier Management, Contract Management and Others

In terms of deployment, the industry is segregated into cloud based and on premise.

In terms of end-use industry, the industry is segregated into Retail, Automotive, Travel & Logistics, Consumer Electronics, IT & Telecom, Healthcare, BFSI, Government and Others.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Mobility as a Service Market - Demand & Growth Forecast 2025 to 2035

Infrared Sensors Market Analysis – Growth & Trends 2025 to 2035

Laser Marking Market Insights - Growth & Forecast 2025 to 2035

Laser Hair Removal Devices Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.