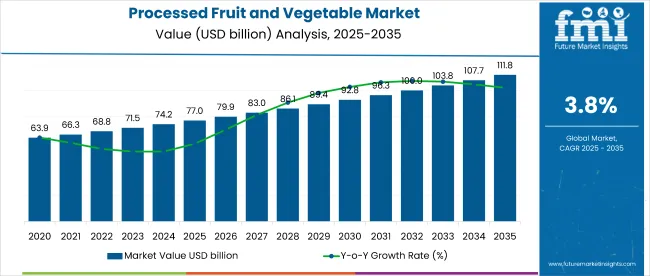

The global processed fruit and vegetable market is projected to grow from USD 77 billion in 2025 to USD 111.6 billion by 2035, registering a CAGR of 3.8%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 77 billion |

| Industry Value (2035F) | USD 111.6 billion |

| CAGR (2025 to 2035) | 3.8% |

The market expansion is being driven by increasing urbanization, busy lifestyles, and the rising demand for convenient, ready-to-eat food options. Recommendations by health organizations to consume adequate fruits and vegetables daily are encouraging consumers to include processed variants in their diets. Additionally, the growth of eCommerce platforms and improvements in cold chain logistics are enabling better distribution and availability of processed fruits and vegetables across regions, contributing to broader market adoption.

The market holds significant shares across its parent markets. It commands 100% within the processed food preservation segment as its core category. In the food processing market, it holds around 12%, highlighting its role in value addition. Within the packaged food market, its share is 4%, driven by growing demand for convenient foods. It contributes about 2% to the overall food retail market and nearly 8-10% of the fruits and vegetables market, focusing on processed offerings. However, in the vast global food and beverage market, its share is close to 2-3%, and below 0.2% in the global agriculture and food industry.

Government regulations impacting the market focus on food safety, quality standards, and labeling requirements. The Food Safety and Standards Act, 2006, and the Food Safety and Standards (Packaging and Labelling) Regulations, 2011 in India set strict guidelines to ensure processed fruits and vegetables meet hygiene, nutritional, and transparency standards.

Additionally, Codex Alimentarius international standards guide processing, additive usage, and packaging practices to protect consumer health and facilitate fair trade. These regulations drive the adoption of advanced processing, preservation, and packaging technologies, ensuring compliance and enhancing consumer confidence in processed fruit and vegetable products.

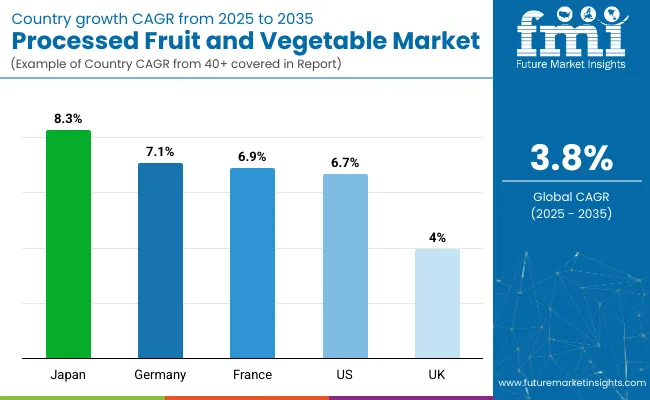

Japan is projected to be the fastest-growing market, expected to expand at a CAGR of 8.3% from 2025 to 2035. Offline will lead the distribution channel segment with a 70% share, while the food and beverage will dominate the end use segment with a 60% share. The USA and Germany markets are also expected to grow steadily at CAGRs of 6.7% and 7.1%, respectively.

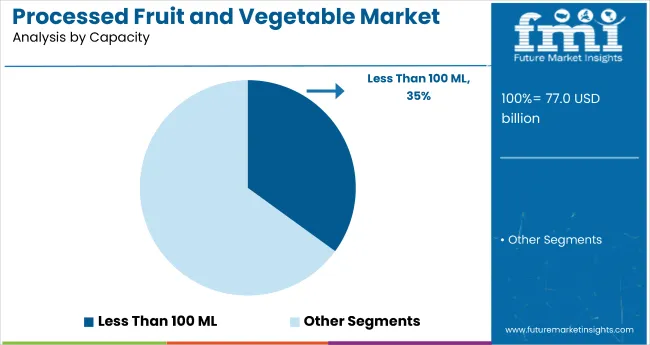

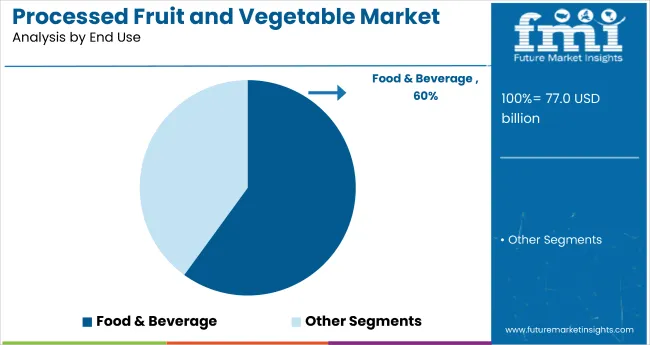

The market is segmented by capacity, end use, distribution channel, and region. By capacity, the market is divided into less than 100 ML, 101 ML to 250 ML, 251 ML to 500 ML, and more than 500 ML. In terms of end use, the market is classified into food & beverage, cosmetics & personal care, pharmaceutical, and consumer durables. Based on distribution channel, the market is bifurcated into online and offline. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and Middle East & Africa.

Less than 100 ML is projected to lead the capacity segment, capturing 35% of the market share by 2025. These units are widely used for single-use and personal consumption.

Food and beverage is expected to dominate the market in 2025, capturing a 60% share, driven by rising demand for processed fruits and vegetables in beverages, bakery products, ready meals, and packaged snacks globally.

Offline is projected to lead the distribution segment in 2025, capturing a 70% market share, due to strong consumer preference for supermarkets, hypermarkets, and local stores when purchasing processed fruit and vegetable products.

The global processed fruit and vegetable market is experiencing steady growth, driven by increasing urbanization, busy lifestyles, and the rising demand for convenient, ready-to-eat food options. Processed fruits and vegetables play a crucial role in ensuring year-round availability of seasonal produce while catering to health-conscious consumer needs.

Recent Trends in the Processed Fruit and Vegetable Market

Challenges in the Processed Fruit and Vegetable Market

Japan momentum is driven by advanced food processing technologies, strong consumer demand for convenient packaged products, and regulatory alignment with nutrition and food safety targets. Germany and France maintain consistent demand driven by EU food safety mandates and funding for healthy eating initiatives under the Green Deal. In contrast, developed economies such as the United States at 6.7% CAGR, United Kingdom at 4% CAGR, and Japan at 8.3% CAGR are expected to expand at a steady 1.05 to 2.18 times the global growth rate.

Japan leads the market with strong demand for premium packaged products and minimal additive use. Germany follows, driven by its focus on organic and sustainably sourced items under strict EU regulations. France shows growth due to national nutrition policies and a strong preference for clean-label products. The United States market expands with high consumption of packaged, canned, and frozen products in households and food services. The United Kingdom has the slowest growth among these countries, supported by demand for chilled ready meals and healthy snacking despite post-Brexit supply chain challenges.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The Japan processed fruit and vegetable revenue is growing at a CAGR of 8.3% from 2025 to 2035. Growth is driven by high demand for premium packaged fruits and convenient vegetable products suited to urban diets. As a technology-driven OECD economy, Japan prioritizes advanced processing systems ensuring nutrition retention, minimal additive use, and long shelf life.

The sales of processed fruits and vegetables in Germany are expected to expand at 7.1% CAGR during the forecast period, nearly double the global average. EU healthy eating campaigns, strict food safety standards, and a strong bakery, dairy, and beverage industry drive demand.

The French processed fruit and vegetable revenue is projected to grow at a 6.9% CAGR during the forecast period, closely aligned with Germany. Growth is driven by national nutrition policies, consumer preference for organic and clean-label products, and robust food manufacturing sectors including dairy, bakery, and gourmet industries.

The USA processed fruit and vegetable market is projected to grow at 6.7% CAGR from 2025 to 2035, translating to 1.76 times the global rate. Unlike emerging markets focused on fresh produce, United States demand is driven by high consumption of packaged, canned, and frozen fruits and vegetables in household and food service sectors.

The UK processed fruit and vegetable revenue is projected to grow at a CAGR of 4% from 2025 to 2035, slightly above the global pace. Growth is supported by consumer demand for chilled ready meals, healthy snacking options, and clean-label products. Post-Brexit trade adjustments have impacted sourcing and supply chains.

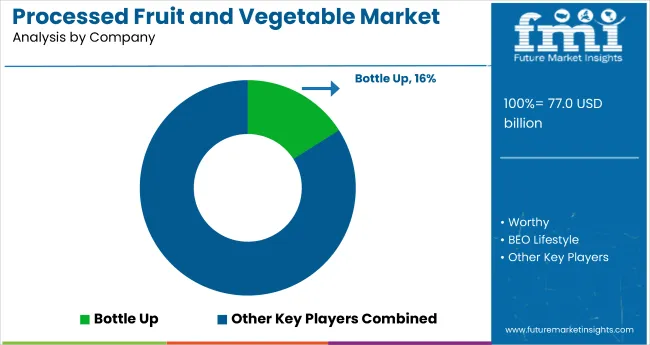

The market is moderately fragmented, with leading players like Bottle Up, Worthy, BE O Lifestyle, LYSPACKAGING, and Berry Global Inc. dominating the industry. These companies provide innovative, sustainable packaging and processing solutions catering to food and beverage manufacturers globally. Bottle Up focuses on eco-friendly, reusable packaging, while Worthy specializes in plant-based, ready-to-eat fruit and vegetable products.

BE O Lifestyle delivers biodegradable packaging solutions for processed food brands. LYSPACKAGING offers 100% compostable bottles and containers, and Berry Global Inc. is known for its wide range of packaging and processing products. Other key players like SHENZHEN UNIQUE PACK CO., LTD., Reyoung Corp., The Natural Bottle, Suzhou Fomalhaut Eco-Pack Material Tech Co., Ltd., and Eurobottle contribute by providing specialized, high-quality packaging and processing materials to enhance product safety, shelf life, and sustainability.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 77 billion |

| Projected Market Size (2035) | USD 111.6 billion |

| CAGR (2025 to 2035) | 3.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value/volume in metric tons |

| Capacity Analyzed | Less than 100 ML, 101 ML to 250 ML, 251 ML to 500 ML, More than 500 ML |

| End Use Analyzed | Food and Beverage, Cosmetics and Personal Care, Pharmaceutical, and Consumer Durables |

| Distribution Channel Analyzed | Online and Offline |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia |

| Key Players Influencing the Market | Bottle Up, Worthy, BE O Lifestyle, LYSPACKAGING, Berry Global Inc., SHENZHEN UNIQUE PACK CO., LTD., Reyoung Corp., The Natural Bottle, Suzhou Fomalhaut Eco-Pack Material Tech Co., Ltd., Eurobottle |

| Additional Attributes | Dollar sales by product type, share by end use, regional demand growth, policy influence, packaging trends, competitive benchmarking |

The market is valued at USD 77 billion in 2025.

The market is forecasted to reach USD 111.6 billion by 2035, reflecting a CAGR of 3.8%.

Offline will lead the distribution channel segment, accounting for 70% of the global market share in 2025.

Food and beverage will dominate the end use segment with a 60% share in 2025.

Japan is projected to grow at the fastest rate, with a CAGR of 8.3% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Processed Beef Market Size and Share Forecast Outlook 2025 to 2035

Competitive Breakdown of Processed Beef Market Share

Market Share Insights for Processed Cashew Providers

Processed Meat Market Analysis by Type, Packaging, Meat Type, and Region through 2035

Analysis and Growth Projections for Processed Cheese Market

Processed Cashew Market Trends – Snack Innovation & Industry Growth 2025 to 2035

Processed Meat Packaging Market Growth & Trends 2024 to 2034

Processed Eucheuma Seaweed Market

Analysis and Growth Projections for Processed Superfruit Market

Reprocessed Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

UK Processed Beef Market Analysis

Brief Outlook of Growth Drivers Impacting Consumption of UK Processed Cashew.

Analysis of the USA Processed Beef Market by Product Type, Processing Method, Distribution Channel, Packaging Type and Region through 2035

USA Processed Cashew Market Analysis – Growth & Industry Trends 2025-2035

Europe Processed Cashew Market by Conventional and Organic Varieties Through 2035

Analysis of the Europe Processed Beef Market by Product Type, Processing Method, Distribution Channel, Packaging Type and Region through 2035

Chilled Processed Food Market Analysis by Ready Meal, Processed Meat, Processed Fish or Seafood Through 2035

Fermented Processed Food Market Size and Share Forecast Outlook 2025 to 2035

Brief Outlook of Growth Drivers Impacting Consumption of Asia Pacific Processed Cashew.

Asia Pacific Processed Beef Market Outlook - Size, Share & Industry Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA