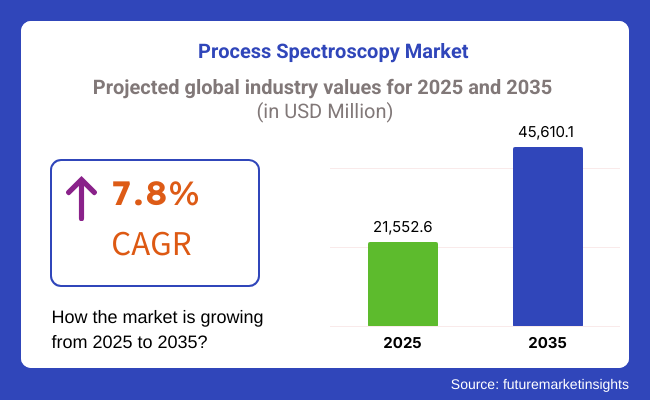

The process spectroscopy market is projected to grow significantly, from 21,552.6 million in 2025 to 45,610.1 million by 2035 an it is reflecting a strong CAGR of 7.8%.

With the increasing need for reaction monitoring in industries such as pharmaceuticals, food & agriculture, and oil & gas, the growth of the process spectroscopy market will help propel the demand for real-time, non-destructive analysis.

Spectroscopy systems for process analytics are gaining acceptance for quality control, process optimization, and regulatory compliance. Spectroscopy software and spectrometry services are meanwhile emerging trends as industries implement AI, IoT, and cloud-based analytics to improve data processing, predictive maintenance, and automation.

Spectroscopy, in its various forms, serves different industry requirements. Molecular spectroscopy (NIR, Raman, FTIR) is a powerful technique that is intensively applied for material characterization and contamination detection within the pharmaceutical and food safety analysis sectors. Mass spectrometry-based compound analysis methods are the most sensitive among chemical analyses and, therefore, play an essential role in chemical and environmental applications.

The demand for atomic spectroscopy (AAS, ICP-OES, and XRF) is realized in metal & mining, water & wastewater, and oil & gas industries; these industry segments can't afford detection of impurities and require compliance with stringent environmental, safety, and health regulations.

A few verticals are poised for adoption. Spectroscopy is the least mentioned but quite important technique used in drug formulation, quality testing, and new drugs to comply with both the FDA and the EMA guidelines. These are adopted by the Food & agriculture sectors for safety and quality evaluation and following regulations such as FSMA and HACCP.

In chemical and polymer industries, spectroscopy finds applications in analyzing and detecting composition defects, as well as monitoring contaminants in metal & mining, pulp & paper, and water & wastewater industries.

The North American market leads in terms of overall market share owing to the presence of a well-established industrial infrastructure, stringent regulatory frameworks, and a higher penetration of the key solution providers. Moreover, countries such as India and Australia are experiencing a rise in process spectroscopy adoption, driven by their expanding manufacturing sectors and increasing regulatory scrutiny.

The data is updated until October 2023 As the fusion of spectroscopy and digital transformation initiatives accelerates market expansion, the introduction of real-time monitoring, automated compliance management, and improved operational efficiency propel growth to new heights.

Explore FMI!

Book a free demo

The global process spectroscopy industry is seen to be progressing at an unprecedented rate, which is mainly attributed to the necessity of real-time monitoring, regulatory compliance, and automation across industries. In pharmaceuticals, spectroscopy becomes the key to the precision of products and the adherence to FDA and GMP through high standards, thus guaranteeing quality control.

The food and beverage industry aims for the most economical solutions with the least error for detecting contaminants and guarantees that products are consistent. In oil & gas automation, real-time spectroscopy enables efficient fuel analysis and process optimization, subsequently minimizing time-wasting.

Chemical manufacturers employ spectroscopy while they track reactions and verify recycling materials, thus highlighting the importance of automation and the integration of AI with quality control. Environmental monitoring applications prioritize the economic aspect, the simplicity of use for measuring emissions, and the adherence to emission standard regulations.

Improvements in portable and handheld spectroscopy, AI-driven analytics, and cloud-based data integration have been made and are the key contributors to the growth, which in turn leads to the control of processes and the efficiency of operations in different industries.

| Company | Contract/Development Details |

|---|---|

| ABB Group | Secured a contract to supply process spectroscopy equipment for a major pharmaceutical company's manufacturing facilities, aiming to enhance quality control and process efficiency. |

| Bruker Corporation | Partnered with a leading petrochemical firm to provide advanced spectroscopy solutions for real-time monitoring and analysis, improving product quality and reducing operational costs. |

| Danaher Corporation | Awarded a contract to implement spectroscopy systems in multiple food processing plants, focusing on ensuring safety and compliance with industry standards. |

Between 2020 and 2024, the process spectroscopy market grew steadily due to increasing demand for real-time process monitoring and quality control in industries such as pharmaceuticals, food and beverage, and chemicals. Near-infrared (NIR), Raman, and Fourier-transform infrared (FTIR) spectroscopy implementation enabled firms to analyze material content and trace impurities with high accuracy.

AI and big data improved real-time data interpretation, which enhanced the productivity of manufacturing and reduced losses. Portable and handheld spectrometers gained increased usage with on-site analysis and faster decision-making. However, equipment costs were high, calibration processes were complex, and integration of data problems posed limitations.

From 2025 to 2035, autonomous spectroscopy systems based on AI will provide real-time adaptive process control, augment production precision, and limit human intervention. Quantum-class spectrometers will improve sensitivity and detection limits to allow improved molecular analysis.

Blockchain recording of data will provide secure and transparent records of material quality and composition. Edge AI will allow local analysis with reduced latency and process response times. Energy-conserving and sustainable spectroscopy technology will lead the market as environmental regulations tighten the industry.

AI-powered self-adaptive spectrometers will adjust parameters in real-time automatically to optimize accuracy and operation efficiency. The market will incline towards AI-facilitated, real-time, and sustainable spectroscopy solutions for optimizing industrial processes.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Harsh industry regulations accelerated process spectroscopy adoption in pharma and food safety. | AI-based compliance monitoring guarantees automated quality control with minimized manual intervention. |

| Improved portable and handheld spectroscopic instruments facilitated on-site real-time analysis. | Quantum-based spectroscopy and AI-based predictive analytics transform chemical and material evaluation. |

| Pharmaceutical, food & beverage, and petrochemical industries dominate the market. | Pervasive usage in biotech, nanotechnology, and environmental monitoring applications. |

| Enhanced spectral data processing via cloud-based systems. | Blockchain integration provides tamper-proof spectral analysis records, increasing data transparency. |

| Automated spectroscopic solutions reduced human error and improved process efficiency. | Autonomous spectroscopy systems utilize AI and robotics for real-time monitoring and adjustments. |

| Growing use of spectroscopy in waste reduction and sustainable manufacturing processes. | Eco-friendly spectroscopic techniques gain traction, emphasizing non-destructive and chemical-free analysis. |

| Regulatory requirements, demand for real-time quality control, and digital transformation. | AI-driven material characterization and increased R&D investment in advanced spectroscopy propel market expansion. |

The industry players face numerous risks that can alter their growth trajectory. One of the foremost challenges is the high implementation and maintenance costs, which are a major concern for small and medium-sized enterprises (SMEs). Sophisticated spectrometric equipment demands high-performing and expensive hardware and software, which accompany huge expenditures on initial investments.

In addition, the intricacy of incorporating the new system into the existing industrial procedures could slow down the deployment and, as a result, increase the operational risks. Regulatory compliance is a further setback as it is extremely important in areas like pharmaceuticals, food & beverages, and chemicals that a tight quality control is observed.

The regular changes in the regulatory guidelines necessitate that the companies make continuous upgrades to their spectroscopy solutions. This not only makes the firms absorb the higher initial cost but also incurs the costs of operating the upgraded technologies.

Alongside, the integration of cloud-based spectroscopy solutions has caused concerns about data security, and the risks entailed by cyberattacks and data breaches have grown to an extent where they potentially compromise the sensitive information of the industries involved.

The economic downturn can lead to the shorter view on industrial sectors' capital expenditure, resulting in the delay of spectrometry investments. Furthermore, disruptions in the supply chain also affect the availability of key components, causing production delays and consequent price hikes. The market is extremely saturated with technological progress, which is very dynamic.

Businesses are in a relentless state of innovation or risk the threat of failure. If not handled judiciously, these threats can undermine the market's growth factor and entice the lag in various sectors. Market growth, therefore, necessitates confronting these risks through availing affordable solutions and making sure to uphold cybersecurity and compliance with regulations.

The section highlights the CAGRs of countries experiencing growth in the Process Spectroscopy market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 10.4% |

| China | 11.8% |

| Germany | 3.7% |

| Japan | 6.7% |

| United States | 7.4% |

In the chemical industry, it helps in precise chemical composition analysis, which is vital for maintaining product standards and regulatory compliance. Also, in the metal & mining sector, it helps in the study of mineral compositions for enhancing process efficiency. The Chinese government invested in upgrading industrial technologies.

According to the Ministry of Industry and Information Technology, initiatives have been launched to promote advanced manufacturing technologies, such as the Made in China 2025 plan. In 2023, the government allocated USD 15 billion to support the adoption of high-tech analytical equipment across various industries. China is anticipated to see substantial growth at a CAGR of 11.8% from 2025 to 2035 in the process spectroscopy market.

Polymers are used in different applications, from automotive parts to medical devices. Process spectroscopy provides the tools for polymer characterization and helps ensure the performance and consistency of polymer-based products.

As the manufacturing sector holds advanced techniques, including automation and real-time monitoring, process spectroscopy becomes integral to maintaining high production standards, according to the Department of Science and Technology-funded research projects that will focus on advanced manufacturing and materials science.

The government announced a USD 10 billion investment in a national mission on advanced manufacturing to foster innovation and technology adoption in 2023. India's process spectroscopy market is growing from 1,021.4 million in 2025 to USD 2,769.1 million by 2035 at a CAGR of 10.4% during the forecast period.

Germany prioritizes environmental sustainability and efficient resource management. Process spectroscopy is an essential tool to ensure water quality and optimize treatment processes. To enable precise monitoring and ensure compliance with stringent environmental regulations, the technology allows real-time analysis of water for chemical compositions. The Federal Ministry for the Environment, Nuclear Safety, and Nature Conservation launched the Digital Water Management 2030 initiative in 2022.

The purpose of this initiative is to integrate advanced digital technologies into water management systems. This initiative allocated a budget of USD 600 million for the next five years. The will helps to enhance water quality monitoring and to improve the efficiency of wastewater treatment plants across the country. Germany is anticipated to see substantial growth in the process spectroscopy market significantly holds dominant share of 24.0% in 2025.

| Segment | Mass spectroscopy (Technology) |

|---|---|

| CAGR (2025 to 2035) | 6.3% |

Mass spectroscopy is an analytical tool of great importance in pharmaceutical, environmental, forensic, food safety, materials engineering, and many other industries that allow for the highly sensitive detection, identification, and quantitation of chemical constituents. Glycomics are essential to drug discovery, biomarker identification, and contaminant analysis, creating novel opportunities for innovative progress in biotechnology and medicine.

Mass spectroscopy is increasingly used by governments and industries in an effort to increase better quality control, research, and real-time monitoring. Mass spectroscopy is an important field in which a patent is also increasing by 15%.

To continue progress in drug discovery, environmental monitoring, and industrial applications, the market for mass spectrometers is expected to grow as new tools become available (e.g., high-resolution hybrid mass spectrometers, artificial intelligence for data analysis, and miniaturization) at a CAGR of 6.3% from 2025 to 2035.

Molecular spectroscopy is employed widely for chemical characterization, molecular identification, and structural study of molecules in the biological sciences, renewable energy, nanotechnology, and more. Appropriate for applications in materials science, drug design, and environmental studies due to their efficiency to accurately sense chemical bonds, molecular interactions, and manifestation of changes in the composition.

A deeper focus on clean energy, pharmaceutical R&D, and nanomaterials is giving rise to opportunities for advanced molecular spectroscopy technologies. As a result, investments in infrared (IR), Raman, and nuclear magnetic resonance (NMR) spectroscopy will see growth as industries seek greater analytical accuracy and efficiency.

Technology adoption is improving with better pocket spectroscopy machines, better spectral performance analytics powered by AI, and real-time tracking solutions. Between 2025 and 2035, this is expected to generate a compound annual growth rate (CAGR) of 5.8%, which means that molecular spectroscopy remains one of the fundamental tools used in scientific research and industrial innovation.

| Segment | Pulp & Paper (Industry) |

|---|---|

| CAGR (2025 to 2035) | 5.7% |

The pulp & paper industry is expected to remain one of the most significant end users in the process spectroscopy market, capturing nearly 39.5% share of the process spectroscopy market in 2025 while growing at a CAGR of 5.7% over the projected period (2025 to 2035). This leadership can be attributed to the shift of the industry to the road of process spectroscopy to calculate incoming raw materials, control chemical compositions, and provide quality assurance during production.

Using spectroscopy, manufacturers can detect impurities or composition changes at various stages in the production process, and making real-time adjustments minimizes waste and optimizes their processes. Companies that have implemented process spectroscopy have reported a 10% increase in customer satisfaction thanks to improved product quality, reduced defects, and a 15% decrease in production waste with matching savings.

A second driver for the industry's embrace of spectroscopic technology is the increasing demand for quality, green paper products, along with regulatory pollution controls.

Real-time monitoring, process optimization, and regulatory compliance are some of the factors that have led to the growth of this market, with chemical and petrochemical industries being the most major applications and the fact that process spectroscopic techniques are widely used in these industries.

These techniques are critical to determining chemical compositions, maintaining batch uniformity, and improving safety protocols. The growth of spectroscopy in the chemical industry is because of the increasing demands of companies that focus on accuracy rather than precision, cost-effectiveness, and adherence to environmental regulations.

The process spectroscopy market is growing owing to various industries need sophisticated analytical, real-time monitoring, and quality control solutions. Companies compete with themselves in improving the speed, application versatility, and precision of spectroscopic technologies such as NIR, Raman, FTIR, and mass spectrometry.

The leading companies in the market with complete solutions on the spectroscopic application for pharmaceuticals, food & beverages, chemicals, and environmental monitoring are Thermo Fisher Scientific, Agilent Technologies, Bruker Corporation, Revvity, and Shimadzu Corporation. Mid-tier players Horiba, Metrohm, and ABB target specialized instruments for industry-specific applications. Newly emerging start-ups drive innovations in developing AIspectroscopy and portable devices.

The market trend is influenced by advances in automation, miniaturization, and integration with AI and IoT for real-time analytics and predictive assurance of quality. Investing in compliance-driven solutions and cloud platforms with innovative spectroscopy would give these companies an edge over competitors in times when compliance regulations are becoming more stringent. All these strategic factors encompass mergers, acquisitions, and partnerships to enhance R&D, global distribution, and technological advancements.

Increasingly, these companies will respond to market demands for precision manufacturing and sustainable practices with customizable, cost-effective, and intelligent spectroscopy solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Thermo Fisher Scientific Inc. | 18-22% |

| Agilent Technologies, Inc. | 14-18% |

| Bruker | 12-16% |

| Revvity (PerkinElmer Inc.) | 10-14% |

| Shimadzu Corporation | 8-12% |

| Other Players | 25-35% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| Thermo Fisher Scientific | Industry leader in FTIR, Raman as well as NIR spectroscopy, with strong AI-powered analytics and automation. |

| Agilent Technologies | Specializes in molecular and atomic spectroscopy, catering to pharmaceuticals, food safety, and environmental monitoring. |

| Bruker | Strong portfolio in high-performance NMR, mass spectrometry, and vibrational spectroscopy for advanced research applications. |

| Revvity (PerkinElmer Inc.) | Focuses on life sciences, healthcare, and chemical analysis with portable and high-speed spectroscopy solutions. |

| Shimadzu Corporation | Leading provider of analytical instruments with Raman, FTIR, and UV-Vis spectroscopy for industrial and research applications. |

Key Company Insights

Thermo Fisher Scientific (18-22%)

The worldwide leader in spectroscopy solutions, using AI-enabled spectral analysis and automation to monitor processes better.

Agilent Technologies (14-18%)

Specializes in chemical and pharmaceutical uses, with sophisticated molecular spectroscopy and quality control solutions.

Bruker (12-16%)

A pioneer in high-resolution spectroscopy, especially in academic and industrial research applications.

Revvity (PerkinElmer) (10-14%)

Geared towards life sciences and healthcare markets, with a broad portfolio of spectroscopy and imaging technologies.

Shimadzu Corporation (8-12%)

Well-established in process control and R&D applications, with a strong presence in the pharmaceutical and chemical industries.

Other Key Players (25-35% Combined)

Recent Developments

Bruker has unveiled the BEAM, a one-point FT-NIR process spectrometer that is ideal for use in the chemical, pharmaceutical, polymer, and food industries for improving real-time process monitoring, in February 2024.

The Global Process Spectroscopy industry is projected to witness CAGR of 7.8% between 2025 and 2035.

The Global Process Spectroscopy industry stood at USD 21,552.6 million in 2025.

The Global Process Spectroscopy industry is anticipated to reach USD 45,610.1 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 9.2% in the assessment period.

The key players operating in the Global Process Spectroscopy Industry Thermo Fisher Scientific Inc., Agilent Technologies, Inc., Bruker, Revvity, Yokogawa Electric Corporation, Mettler Toledo and ABB.

In terms of component, the segment is divided into process spectroscopy devices, process spectroscopy software and services.

In terms of technology, the industry is segregated into molecular spectroscopy, mass spectroscopy and atomic spectroscopy.

In terms of industry, the industry is segregated into food & agriculture, polymer, pulp & paper, chemical, metal & mining, water & wastewater, pharmaceutical, oil & gas and others.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

Mid-infrared Lasers Market Analysis - Growth & Trends 2025 to 2035

Multi-Axis Sensors Market Insights - Trends & Forecast 2025 to 2035

Photonic Integrated Circuit & Quantum Computing Market - Trends & Forecast 2025 to 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.