Several factors, including the rise of automation technologies across industries, increasing government regulation, and corporate social responsibility will drive the process liquid Analyzer market over the next 10 years. From water conditioning plants to pharmaceutical production facilities, these analysers are essential for real-time monitoring and control of the quality and composition of liquids.

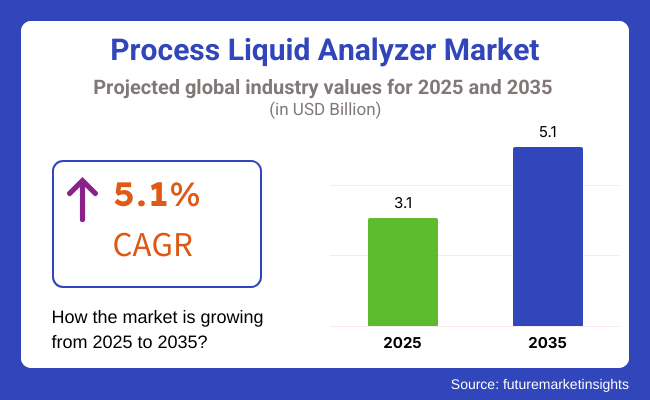

The global Process Liquid Analyzer market is expected to reach USD 3.1 Billion by 2025 and USD 5.1 Billion by 2035, registering an estimated CAGR of 5.1% during the forecast period. The expansion is a response to strong demand for reliable, accurate and rugged analysers capable of operation in harsh industrial environments. Industries are adopting new liquid analysis technologies due to an increasing focus on environmental laws, automation in processes, and energy efficiency.

Applications range across chemical production to food and beverage manufacture, oil and gas processing, and pharmaceutical manufacturing where precision in liquid parameters is a must. Application of innovative sensor technologies, digital connectivity, and data analytics have led to analysers that deliver not just accurate readings but that easily connect into industrial control systems.

Process Liquid Analyzers also enable industries to look ahead while addressing their environmental responsibilities. This twofold advantage, improving operational execution in tandem with supporting sustainability, renders the Process Liquid Analyzer market a bedrock of contemporary industrial practices.

Explore FMI!

Book a free demo

Owing to its sophisticated industrial base and a strict regulatory framework, North America holds a strong and thriving market in the Process Liquid Analyzer platform. Chemical and pharmaceutical industries in particular need to monitor the liquids they use carefully to ensure that the required quality is met as per the safety standards set by USDA, FDA, EPA, Health Canada, and Water Efficiency Labelling and Standards Labelling.

The rising instances of digital transformation initiatives across industries in North America is responsible for the increasing demand for analysers deployed through integration with industrial IoT platforms. Process Liquid Analyzers are extensively adopted in water and wastewater treatment plants for regulatory compliance and operational improvement. Ongoing investments in infrastructure modernization and renewable energy projects in the region also have opened new opportunities for manufacturers of these analysers.

Europe is a significant market for Process Liquid Analyzers due to its high emphasis on environmental sustainability and regulatory compliance. The region is characterized by sound environmental directives in Germany, France and the United Kingdom regarding water treatment, chemical processing and food and beverage.

European Union's strict regulations for wastewater discharge and emissions control have driven the need for Process Liquid Analyzers to ensure operational compliance. Moreover, the emphasis in Europe on renewable energies and circular economy is also propelling the adoption of advanced liquid analysis technologies for waste reduction and resource use efficiency.

Asia Pacific is the fastest growing market for Process Liquid Analyzers owing to rapid urbanization, industrialisation and growing middle-class population. In regions such as China, India, Japan, and South Korea, investment in water treatment infrastructure, chemical plants, and pharmaceutical production facilities improves, and all this infrastructure needs strong liquid analysis systems.

The demand for advanced Process Liquid Analyzers is being propelled by China's increasing emphasis on elevating environmental standards and curbing industrial pollution. The government of India is working to improve wastewater treatment and sanitation infrastructure, creating an environment where manufacturers of analysers that monitor water quality and process efficiencies can grow.

Challenge

Process Liquid Analysers: Old Technology with High Cost and Complexity

The Process Liquid Analyzer market high cost, integration complexity as well as having specialized maintenance need. These analysers are crucial for accurate fluid composition analysis in several industries including chemicals, pharmaceuticals, food & beverage, and water treatment. However, these advanced liquid analysers are limited due to high sensor technology costs along with impractical installation and constant calibration maintenance.

Also, due to the importance of the industrial operations, they usually need to customize the configurations that increase costs and complexity. To be cost efficient and more user-friendly, manufacturers should consider producing some of the equipment, simplifying installation as well as an automatic calibration process.

Opportunity

Demand for Real Time Monitoring and Automation

The Process Liquid Analyzer Market has immense growth potential due to the rising demand for real-time fluid analysis and automation. Industries are opting for smart monitoring systems that allow the continuous and real-time measurement of various parameters such as chemical composition, pH level, conductivity, etc. With the rise of industrial automation and digital transformation, advanced data analytics and remote diagnostics are becoming integrated with liquid analysers, and this will result in the expected efficiency and operational uptime improvement.

The solution lies in the form of cloud-connected sensors, intelligent monitoring with AI-driven anomaly detection and intuitive digital interfaces organizations who invent their approach in this domain will own their competitive edge in this fast-changing sector.

Market Overview and Dynamics: Process Liquid Analyzer Market Rapid adoption linked to the rise of industrial automation and quality control requirements drove a shift in the Process Liquid Analyzer Market from 2020 to 2024. Pharmaceuticals, as well as water treatment and similar industries began turning to inline liquid analysers to comply with more stringent safety and regulatory criteria.

Supply chain disruptions, high initial investment costs, and the complexity of maintaining these systems were some of the factors posed as barriers to widespread implementation. To tackle these issues, manufacturers introduced modular analyser systems that incorporated advanced self-diagnostic tools and more accurate sensors to ensure that their instruments would operate reliably over the long term.

The focus on tech advancement towards smart & analytics, miniaturization and multi-parameter monitoring solutions indicates a robust and polished market in 2025 to 2035. Data processing powered by AI will enhance predictive maintenance and process optimization, minimizing the need for manual involvement. Development of wireless and cloud-linked LIAs that allow remote access to real-time data will pave the way for integration with digital twin frameworks.

Also, as more sustainability initiatives come to the forefront, sectors will seek analyser solutions that are environmentally friendly, minimize waste and energy usage, and improve regulatory compliance. Future market leaders will be companies who embrace automated, low-maintenance solutions with security and connectivity features.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Increasing compliance standards for liquid analysis in critical industries |

| Technological Advancements | Growth in high-precision sensors and digital displays |

| Industry Adoption | Rising use in water treatment, pharmaceuticals, and food processing |

| Supply Chain and Sourcing | Disruptions impacting sensor availability and production costs |

| Market Competition | Established players dominate with proprietary technologies |

| Market Growth Drivers | Demand for precision monitoring in process industries |

| Sustainability and Efficiency | Early adoption of eco-friendly calibration methods |

| Integration of Smart Analytics | Limited adoption of digital monitoring in industrial applications |

| Advancements in Sensor Technology | Use of traditional sensors with periodic calibration |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global mandates requiring advanced, eco-friendly liquid monitoring systems. |

| Technological Advancements | AI-powered predictive maintenance, multi-parameter sensing, and cloud-based analytics. |

| Industry Adoption | Widespread integration in energy, petrochemicals, and autonomous manufacturing plants. |

| Supply Chain and Sourcing | Localization of manufacturing, increased supply chain resilience, and sustainable sourcing of raw materials. |

| Market Competition | Growth of start-ups offering cost-effective, plug-and-play analysers with open-source integration. |

| Market Growth Drivers | Expansion of Industry 4.0, automation, and real-time quality control systems. |

| Sustainability and Efficiency | Development of self-cleaning, low-maintenance analysers reducing industrial waste and downtime. |

| Integration of Smart Analytics | Widespread AI-powered diagnostics, real-time alerts, and digital twin integration. |

| Advancements in Sensor Technology | Introduction of next-gen autonomous sensors with real-time self-calibration and predictive fault detection. |

The United States continuously develops processing analytical instrumentation for liquid examination as necessitated by prospering needs in petroleum and gas, medicines, and water handling industries. Stringent regulations enforced by the Environmental Protection Agency and Food and Drug Administration on industrial wastewater remediation, pharmaceutical purity, and food safeness have substantially increased demands for real-time fluid analysers.

The oil and gas sector, notably in Texas and along the Gulf Coast, predominantly relies on pH, TOC, and turbidity analyzers for refinery and petrochemical applications. Simultaneously, the pharmaceutical industry has progressively incorporated high-precision fluid analyzers for persistent monitoring of drug fabrication methods.

With amplifying financial backing in intelligent fabrication and computerized procedural oversight, forecasts envision the progressive upsurge of the American fluid analytical hardware advertise to remain rather consistent. Nevertheless, certain regional markets may encounter more volatile demands depending on commodity price fluctuations and specific plant operations.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.4% |

The United Kingdom Process Liquid Analyzer market continues to blossom thanks to strict environmental regulations, escalating demands for quality control in food and beverage production, and a growing adoption of intelligent manufacturing solutions. The UK Environmental Agency vigorously enforces stringent industrial wastewater and emissions monitoring laws, driving an urgent need for liquid analyzers in chemical and water treatment industries.

The pharmaceutical and biotech sectors, major economic drivers in the UK, are investing heavily in highly accurate liquid analyzers for precision monitoring and adherence to stringent MHRA regulations. At the same time, the food and beverage industry is embracing liquid analyzers for optimized processes and fast contamination detection.

With burgeoning investments in Industry and AI-integrated process oversight, analysts expect the UK Process Liquid Analyzer market to experience steady, measurable growth in the coming years that will boost the country's economic progress.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.9% |

The European Union Process Liquid Analyzer market has steadily flourished propelled by increasingly stringent environmental and industrial regulations, rapidly expanding adoption in chemical and pharmaceutical manufacturing facilities, and a dramatic surge in demand for intelligent process oversight. Germany, France, and Italy led as frontrunners, with pressing need arising from the multifaceted nature of chemical processing, fluctuations in oil and gas extraction yields, and ensuring consistent quality and safety standards across food and beverage production.

While the EU's directives on industrial emissions and water quality enforcement strict yet nuanced standards on wastewater handling and permissible industrial discharges, considerably increasing the strategic implementation of precisely calibrated liquid analyzers in water treatment plants to effectively monitor even subtle variations. Furthermore, the booming pharmaceutical sector throughout the EU exemplifies a sizable and discerning client base reliant on high-precision liquid analyzers for rigorous compliance purposes.

With growing long-term investments in adaptable smart factories, integrated digital process monitoring systems, and determined sustainability initiatives, experts forecast the EU Process Liquid Analyzer market will maintain steady expansion in the coming years. Forward-thinking enterprises are increasingly embracing these innovative technologies to proactively identify oversight gaps and optimize performance with granular control throughout their purifying operations.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.2% |

The Japanese Process Liquid Analyzer market continues to blossom due to escalating needs in microchip fabrication, spreading use in water treatment, and solid policies on commercial emissions. Japan's state-of-the-art electronics and microchip industries are reliant on high-purity water surveillance frameworks, driving requirement for TOC and conductivity analyzers.

The pharmaceutical and biotechnology enterprises also act as key patrons, utilizing fluid analyzers for precision monitoring in medication manufacture and research center applications. Moreover, Japan's strict wastewater treatment directives are increasing the adoption of real-time fluid analyzers in commercial and municipal water treatment facilities. Concurrently, breakthroughs in sensor engineering and swelling financial commitments in industrial robotization indicate the Japanese process fluid analyzer market is anticipated to develop steadily moving forward.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.0% |

South Korean metalworking fluid industry is expanding with rapid industrialization, strong demand in automotive and electronics manufacturing, and rapidly expanding investments in precision engineering. South Korea's automotive industry, led by Hyundai and Kia, is one of the biggest consumers of high-performance forming and cutting fluids.

The electronics and semiconductor industries, dominated by Samsung and SK Hynix, are the leading growth drivers for ultra-pure metalworking fluids applied in precision machining operations. Government initiatives toward environmentally friendly manufacturing processes also continue to fuel the demand for synthetic and bio-based lubricants.

Since there is ongoing technological innovation in industrial automation and growing investment in high-technology lubricants, South Korean metalworking fluids will experience ongoing growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.1% |

The process liquid analyzer market is characterized by significant demand for both the NIR-based and NMR-based segments, with increasing investments in advanced liquid analysis solutions aimed at improving process control, regulatory compliance, and quality assurance being fuelled by industries. Such advanced analytical branches find their usage widely in real-time monitoring, high-throughput composition, and non-destructive testing in pharmaceutical, chemical, food & beverage, water treatment, and petrochemical industries.

The liquid analyzers based on NIR technology lead the demand in the process digital analyser market as the real-time spectroscopic analysis is getting wider.

Among these, near-infrared (NIR)-based process liquid analyzers have emerged as one of the most widespread analytical technologies, enabling high-speed analysis with non-invasive measurement and minimal sample preparation. NIR-based analyzers apply molecular absorption principles, unlike traditional wet chemistry methods, so they can enable real-time compositional analysis for improved process efficiency and cost-effectiveness.

Increasing quality control in pharmaceutical manufacturing, drug uniformity verification, and compliance with FDA’s Process Analytical Technology (PAT) regulatory guidelines are driving the adoption of advanced near-infrared (NIR) spectroscopy solutions, as pharmaceutical manufacturers place greater emphasis on precision-driven production monitoring that helps improve quality, drive down costs and maintain compliance. Through the reductions in batches that fall outside specifications, companies have seen measurable improvements in production efficiencies, enhanced quality control, and compliance with regulations.

Growing demand to adopt quality assurance and safety compliance in food and beverage processing using real-time supervisory control and data acquisition for moisture content, protein levels, and sugar levels with NIR-based analyzers has added fillip to market.

Recent years have seen developments within portable and inline NIR-based analyzers, along with direct measurement via fiber-optic probes and monitoring through the cloud, have also enhanced adoption of these technologies, allowing for better efficiency in remote and automated settings in processing facilities.

The emerging NIR-AI technologies, such as automated data interpretation and machine-learning-assisted spectral calibration, have added to the optimization of this market growth, leading to their significant adoption in high-precision industrial applications.

The implementation of NIR-based analyzers in petrochemical refineries, including hydrocarbon content analysis and characterization of crude oil, has substantiated the market growth, leading to better compliance with environmental regulations and fuel quality standards.

NIR-based process analyzers, while advantageous when rapid analysis, non-destructive testing, and high-precision monitoring are necessary, are hindered by spectral interference, limited depth penetration of opaque liquids, and calibration difficulties for highly varying compositions. However, emerging innovations such as AI-assisted spectral analysis, hybrid NIR-Raman spectroscopy, and cloud-based real-time monitoring are enhancing accuracy, ease of use, industrial scalability, consolidating the growth of NIR-based process liquid analyzers market.

The diverse applications of NMR spectroscopy in molecular fingerprint, structural elucidation, and quantitative analysis have set some industries, such as high-precision chemical analysis, polymer synthesis, and biopharmaceutical research, to achieve strong market adoption rates for NMR-based process liquid analyzers. The NMR-based analyzers compared to conventional chromatography methods can provide less invasive methods of analysis with a higher degree of reproducibility and chemical selectivity giving better reliability in multi-component liquid mixtures.

As chemical manufacturers emphasize process optimization and waste minimization, the increased need for NMR-based analyzers in chemical and polymer industries, delivering real-time monitoring of reactions, tracking of catalyst efficiencies, and control of polymerization, has led to the adoption of advanced NMR spectrometers. Using these studies, NMR-based process monitoring has been found to reduce raw material use by ensuring optimal reaction conditions leading to cost-efficient and sustainable processes.

The growing presence of NMR-based analyzers in the biopharmaceutical industry with fast metabolomics profiling, additional quantification of the active pharmaceutical ingredient (API) content, and protein level structural identification, has further driven the market's increasing revenue share, facilitating higher adoption rates in sophisticated manufacturing pipelines and regulatory guidelines compliance.

Moreover, the use of compact, low-maintenance benchtop and inline NMR-based analyzers for on-site testing has increased adoption rates and improved accessibility for both laboratory and industrial applications.

The development of high-field NMR spectrometers, which offer improved sensitivity and resolution for the detection of trace-level impurities, has further optimized market growth and initiated greater uptake in firearms, explosives, environmental and materials research applications.

AI-assisted NMR analysis, including machine-learning algorithms for spectral deconvolution or automated anomaly detection, new enables small unmanned lab spaces with high precision and reliability for the analysis of complex liquid mixtures, consolidating overall market growth.

NMR-based process analyzers are highly specific, enable real-time reaction monitoring and non-destructive testing, however, the high initial costs, the complexity of data interpretation, and the sensitivity limitations at low concentrations complicate the utilization of NMR in process analytics. Nevertheless, innovations encompassing AI-based spectral processing, cryogen-free magnet technology, and compact NMR system design are enhancing cost efficiency, analytical precision, and usability, promising ongoing growth in the NMR-based folio of process liquid analyzers available on the market.

The two largest market drivers are the water and oil segments, which are progressively adopting process liquid analyzers to ensure regulatory compliance, improve process efficiency, and monitor fluid composition in real-time.

The increasing adoption of stringently regulated market demand for water driven by stringent regulations and quality control standards

As a result, water has become one of the most analysed liquid mediums as process liquid analyzers are included in municipal water treatment facilities, industrial shops, and environmental programs to assess water quality, identify contaminants, and validate regulatory compliance. While traditional batch sampling only provides periodic measurements, real-time process liquid analyzers sample continuously, this provides for rapid detection of most anomalies and proactive intervention.

With a focus on delivering clean water to the public for human consumption and protecting the environment for future generations, the market benefits from an increase in process liquid analyzers for municipal water treatment in response to increasing demand for real-time pH, dissolved oxygen, and turbidity monitoring.

The leading process liquid analyzers in wastewater treatment with biochemical oxygen demand (BOD) and chemical oxygen demand (COD) in their core offerings have helped boost market demand, with market participants offering engagement for increased uptake in industrial effluent management & pollution control programs.

The adoption of smart, IoT-enabled water analyzers with features such as remote monitoring, AI-enabled anomaly detection and cloud-based reporting has accelerated this journey, as companies strive to meet environmental safety obligations.

Process liquid analyzers in water treatment - although benefiting from real-time water quality measurement, regulatory compliance, and pollution control - are subject to common challenges: sensor fouling, calibration drift, and high maintenance costs. Innovations such as novel self-cleaning sensors, AI-driven predictive maintenance and spectral analysis of water are making process liquid analyzers more sophisticated, dependable and more commercially available than ever, paving the way for ongoing growth of these instruments in water applications.

Oil specifically through petrochemical refining, lubricant production, and crude quality assessment is now one of the most-embedded industries to use process liquid analyzers to monitoring hydrocarbon properties, Impurity detection, and optimization of refining process. In contrast to manual sampling methods, real-time analyzers offer instant measurements of parameters such as viscosity, density, and contaminant levels, allowing for improved operating control and decreased service interruptions.

Process liquid analyzers are being increasingly used in crude refining, which leverages real-time sulphur content analysis, distillation curve measurement, and chemical composition tracking for improved efficiency and fuel quality compliance.

In lubricant formulation and quality control, the large-scale adoption of process liquid analyzers with automated viscosity measurement, additive concentration, and wear metal detection capabilities has further corroborated market demand with gradual penetration into automotive, industrial, and aerospace lubrication solutions.

Although process liquid analyzers can undoubtedly bring value to hydrocarbon quality assessment, refining optimization and regulatory compliance, they often struggle in oil applications due to sensor fouling, complex calibration requirements and variation in crude feedstock composition. Nonetheless, new innovations in AI-based hydrocarbon fingerprinting and multi-parameter real-time analysis and automated sample conditioning systems are enhancing the instrument's efficiency, cost-efficacy, and scalability, so the growth of process liquid analyzers in oil applications will undoubtedly persist.

The process liquid analyzer market is estimated to grow owing to the surging need for real-time liquid analysis, rising industrial automation, and regulatory compliance for water treatment, chemicals, pharmaceuticals, and food & beverage products.

AI-driven analytics, intelligent sensors, and cloud-based monitoring solutions is built around improving efficiency, accuracy, and operational safety for products and services. The market comprises of international instrumentation suppliers and analytical equipment manufacturers who have relocated their production to new frontiers of technological innovation including spectroscopy, electrochemical and chromatography based liquid analyzers.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| ABB Ltd. | 15-20% |

| Emerson Electric Co. | 12-16% |

| Thermo Fisher Scientific, Inc. | 10-14% |

| Endress+Hauser AG | 8-12% |

| Yokogawa Electric Corporation | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| ABB Ltd. | Develops AI-powered online liquid analyzers, real-time water quality monitoring systems, and spectroscopy-based chemical analysis solutions. |

| Emerson Electric Co. | Specializes in industrial pH, conductivity, and turbidity analyzers for process control and environmental compliance. |

| Thermo Fisher Scientific, Inc. | Manufactures high-precision spectroscopy, chromatography, and electrochemical analyzers for lab and process industries. |

| Endress+Hauser AG | Provides real-time process liquid monitoring, optical and electrochemical sensors, and cloud-based data management solutions. |

| Yokogawa Electric Corporation | Offers intelligent process liquid analysis systems with smart calibration, remote diagnostics, and AI-integrated monitoring. |

Key Company Insights

ABB Ltd. (15-20%)

ABB leads the process liquid analyzer market, offering cloud-integrated, AI-powered liquid analysis solutions for industrial and environmental applications.

Emerson Electric Co. (12-16%)

Emerson specializes in industrial-grade liquid analyzers, ensuring real-time process control, chemical quality monitoring, and automated sensor calibration.

Thermo Fisher Scientific, Inc. (10-14%)

Thermo Fisher provides laboratory and process liquid analyzers, integrating high-precision spectroscopy and electrochemical detection for industrial automation.

Endress and Hauser AG (8-12%)

Endress and Hauser develops automated process liquid analyzers, offering remote data integration and IoT-based smart monitoring solutions.

Yokogawa Electric Corporation (5-9%)

Yokogawa manufactures advanced liquid analysis instruments, integrating AI-driven diagnostics and automated calibration for industrial and environmental monitoring.

Other Key Players (40-50% Combined)

Several analytical instrumentation and industrial automation companies contribute to next-generation process liquid analyzers, AI-enhanced sensor technology, and real-time cloud monitoring. These include:

The overall market size for Process Liquid Analyzer Market was USD 3.1 Billion in 2025.

The Process Liquid Analyzer Market expected to reach USD 5.1 Billion in 2035.

The demand for the Process Liquid Analyzer Market will be driven by the growing need for real-time monitoring and quality control in industries such as pharmaceuticals, chemicals, and food & beverage. Increasing automation, regulatory requirements, and the demand for efficient production processes will further boost market growth.

The top 5 countries which drives the development of Process Liquid Analyzer Market are USA, UK, Europe Union, Japan and South Korea.

NIR-Based and NMR-Based Technologies Drive Market Growth to command significant share over the assessment period.

Power System Simulator Market Growth - Trends & Forecast 2025 to 2035

Aerospace Valves Market Growth - Trends & Forecast 2025 to 2035

United States Plastic-to-fuel Market Growth - Trends & Forecast 2025 to 2035

Power Generator for Military Market Growth – Trends & Forecast 2025 to 2035

Immersion Heater Market Growth - Trends & Forecast 2025 to 2035

Tire Curing Press Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.