Overall growth prospects of process instrumentation are positive, owing to increasing automation in industry, regulatory constraints and process control efficiency across sectors are the key factors which are anticipated to boosts up the growth of global process instrumentation market demand between 2025 to 2035.

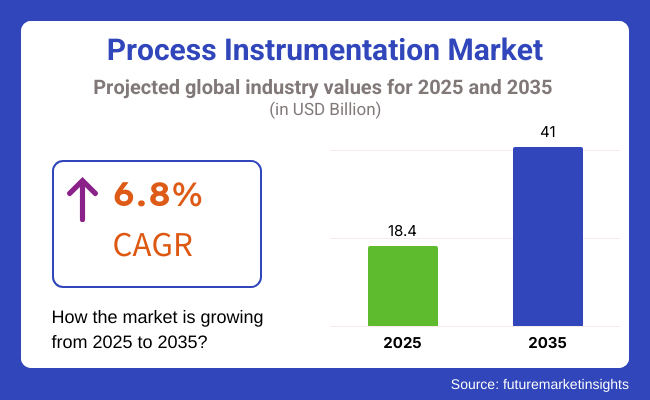

In 2025 the process instrumentation market was valued at around USD 18.4 Billion; the projected market size in 2035 is USD 41.0 Billion. This translates to a compound annual growth rate (CAGR) of 6.8% over the forecast period. As industries rapidly invest in smart instrumentation solutions, wireless communication technologies, and advanced analytics, the market is thus moving towards increased automation and digitalization.

Using process instrumentation for approximate measurements, early detection of faults, and predictive maintenance has become a keystone in helping manufacturers boost productivity and cut operational costs. Furthermore, the market is witnessing a paradigm shift as Internet of Things integration and Industry 4.0 principles become more prevalent, allowing for real-time data acquisition, remote monitoring, and increased process optimization.

The 6.8% CAGR reflects the increasing significance of process instrumentation to ensure compliance with stringent regulatory requirements, improve operational reliability, and embrace an increasingly automated environment. This also will boost the steady growth of market. The increases in manufacturing activities in developing countries and the greater requirement for precision in process industries are expected to contribute to the steady growth of the global market.

Explore FMI!

Book a free demo

North America is considered a mature market for process instrumentation, with a significant emphasis on automation and adherence to regulatory standards. Demand is fuelled by the region’s established manufacturing, oil & gas and power generation sectors. Also, United States and Canada industries are channelling investments in smart sensors, wireless devices, and advanced process analysers to get real-time insights, cut downtime, and enhance overall productivity.

It has a significant increase in adoption of cloud-based and IoT-enabled process instrumentation solutions as businesses strive for greater process transparency and control. Upgrade of existing plants and retrofit of legacy systems with latest instrumentation further drive demand in North America.

With its strong industrial foundation and tight environmental laws, Europe is yet another key market for process instrumentation. Leading nations, including Germany, the UK, and France are pioneering the implementation of cutting-edge process control technologies. The region already hosts several successful chemical, pharmaceutical and water treatment industries that greatly depend on accurate measurement and control systems to ensure compliance and operate efficiently.

Europe has also experienced the increased uptake of process instrumentation within renewable energy initiatives, including wind farms and biomass power plants to drive energy economy and reach sustainability targets. This growing adoption of digital solutions such as remote monitoring and analytics is expected to bolster the market here.

During the forecast period, the process instrumentation market in the Asia-Pacific region is expected to grow at a rapid pace owing to the rapid industrial development, growing infrastructure investment, and increasing process industries in the region. Countries including China, India, Japan, and South East Asia shows surge demand to achieve consistent product quality along with optimization of resources will be positively impacting on advanced measurement and control device market.

Moreover, increasing environmental concerns and regulatory pressures in Asia-Pacific region are driving industries to adopt modern instrumentation solutions that ensure compliance and sustainability. Regionally, the market is expected to be dominated by North America owing to the continuous adoption of smart sensors, IoT-based devices and automation technologies, which further is expected to boost the market growth in the region.

Challenge

Rising Implementation Costs and Complex Integration in Process Industries

High implementation costs, system integration complexity, and changing industrial regulations are the most growth- hampering factors for the Process Instrumentation market. Process instrumentation is a key need for industries like oil & gas, pharmaceuticals, chemicals, water treatment, etc., for real-time monitoring and automation, so, it can be adopted fully only when advanced-level sensors, analysers, and controllers become affordable for small and mid-sized enterprises too.

Moreover, the integration of new instrumentation with legacy infrastructure involves significant technical skill and calibration, resulting in longer deployment time and potential disruptions. To overcome these hurdles, manufacturers must develop cost-effective, scalable solutions that can be easily installed and calibrated in the cloud. Improving intuitive interfaces and providing pre-emptive maintenance solutions will add to the process controllability making it a cost-efficient and downtime friendly solution for the long-term operation of the company.

Opportunity

Expansion of Industrial Automation and Smart Instrumentation Technologies

Growing usage of industrial automation, smart manufacturing and digital twin technology AI-enabled sensors, IoT-based analysers and real-time process monitoring solutions are being increasingly employed by industries to boost efficiency, safety and adhere to strict regulatory standards. The trend of data-driven decision making and remote asset management is escalating the demand for process control systems integrated with the cloud.

Moreover, the Internet of Things (IoT) is reshaping industries, where enhanced wireless instrumentation and smaller volume sensors are offering new paradigms for managing operations by managing predictive maintenance and lowering elements of risk in operations. AI-driven analytics, sustainable instrumentation and autonomous process control are the technologies that will put such companies into the leading league in the industrial landscape of the future.

Between 2020 and 2024, any fledgling market, the market faced challenges including supply chain disruptions, high costs for new advanced instrumentation, and the inability to integrate new technologies with existing industrial infrastructure. Manufacturers addressed these concerns with modular instrumentation systems, automated calibration tools, and AI-driven process control improvements.

Going forward to 2025 to 2035, Sensor Fusion Technology, Ai based Automation, and Real-Time Predictive Maintenance will change the market completely. Self-learning process instruments, wireless communication protocols, and block chain-powered data security will become the cornerstone for other instruments and processes to gain operational transparency and reliability.

Industries will merge process instrumentation with digital twin models to simulate live scenarios and optimize their production efficiency. Sustainability initiatives will also lead to the development of low-energy and eco-friendly sensors. The next wave of industrial automation will be driven by innovators in intelligent monitoring, sustainable instrumentation, and cloud integration.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with industrial safety and environmental standards |

| Technological Advancements | Growth in cloud-integrated process control and automation |

| Industry Adoption | Increased use in water treatment, energy, and pharmaceuticals |

| Supply Chain and Sourcing | Dependence on specialized sensor components and electronic chips |

| Market Competition | Presence of established automation manufacturers |

| Market Growth Drivers | Rising demand for precision monitoring and regulatory compliance |

| Sustainability and Energy Efficiency | Initial adoption of energy-efficient instrumentation solutions |

| Integration of Smart Monitoring | Limited use of AI-driven real-time monitoring in process industries |

| Advancements in Instrumentation Connectivity | Gradual shift towards digitalized process monitoring |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Adoption of AI-based compliance monitoring and automated regulatory reporting. |

| Technological Advancements | Expansion of AI-powered sensors, real-time diagnostics, and digital twin integration. |

| Industry Adoption | Expansion into renewable energy, precision agriculture, and smart manufacturing. |

| Supply Chain and Sourcing | Localization of sensor production and investment in sustainable, low-energy process instruments. |

| Market Competition | Rise of tech-driven startups offering intelligent process instrumentation and software-based automation. |

| Market Growth Drivers | Increased focus on predictive analytics, real-time asset management, and cloud-integrated process automation. |

| Sustainability and Energy Efficiency | Full-scale deployment of carbon-neutral, self-powered process sensors and green manufacturing techniques. |

| Integration of Smart Monitoring | AI-based predictive analytics, wireless IoT sensors, and fully automated remote monitoring systems. |

| Advancements in Instrumentation Connectivity | Universal adoption of edge computing, block chain-secured data exchange, and self-learning process instruments. |

The ever-expanding United States process instrumentation sector is driven by numerous factors. Rising automation across manufacturing is surging the need for monitoring and control, as is increased investment into oil and natural gas extraction. Stringent environmental regulations mandated by governing organizations like the EPA compel precise measurement. Industries such as chemical production, water treatment and energy output are subject to close oversight by the EPA and OSHA to safeguard worker and public well-being.

The adoption of clever sensors, wireless instrumentation and AI-aided process guidance is reshaping industrial procedures. Moreover, burgeoning shale gas harvesting and refining are propelling requirement for exact flow meters, pressing indicators and gas analyzers of the highest calibre.

Advancements in industrial automation and process oversight mechanisms will persist, assuring steady progression for the USA process instrumentation industry on the whole.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.1% |

The United Kingdom process instrumentation market is primed for considerable development due to rising financial commitment in renewable resources, stricter industrial safety legislations, and burgeoning adoption of intelligent manufacturing answers. The UK’s pledge to net-zero emissions is stimulating requirement for precision screening instruments in carbon catching, energy administration, and water treatment crops.

Moreover, the pharmaceutical and chemical sectors, which necessitate extremely-accuracy stress, temperature, and level monitoring instruments, are also major progress drivers. Substantial investments in smart factories and electronic twin technology are fueling demand for IoT-empowered process instrumentation. The precision machines screen and control important procedures like temperature, stress, float stages and even more throughout production.

With robust regulatory assistance for industrial efficiency and sustainability, the process instrumentation sector in the UK is set for steady evolution. Various producers are establishing new sophisticated crops with digitalized screening answers to optimize efficiency and decrease waste. Forward-looking groups are also investigating methods to merge man-made intelligence and the Internet of Items into their instruments to enable self-sufficient operations.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.5% |

The European Union's evolution of industrial detection innovations have witnessed noteworthy growth powered by exacting ecological rules, swelling require for automation across industrial sectors, and amplified investments in intelligent process oversight platforms. Nations such as Germany, France, and Italy have been at the vanguard of embracing ground-breaking detection methods in manufacturing, chemicals, and energy industries.

The EU's Industrial Emissions Directive and Green New Deal projects are advancing highly sophisticated process observation remedies for pollution administration, energy optimization, and water quality management. Additionally, ballooning investments in Industry 4.0 and smart factory initiatives are driving the acceptance of AI-powered and IoT-integrated process instruments.

Simultaneously, burgeoning emphasis on sustainable industrial techniques and regulatory adherence signifies the EU process detection market is expected to develop steadily. Some aspects have remained consistent over time, while others have evolved in important ways. Strict regulations and innovative technology continue to shape this consequential industry sector.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.7% |

The precision monitoring required for complex industrial automation processes in Japan has increased demand for process instrumentation greatly. This high-level quality control and efficiency emphasized across vital industries like automotive, electronics, and pharmaceuticals relies upon advanced pressure, temperature, and flow measurement systems for maximum effectiveness.

The rapidly expanding hydrogen energy and smart city infrastructure initiatives also contribute to growing needs for process instrumentation in energy management and water treatment facilities. In addition, Japan's pioneering work in robotics and factory automation has accelerated the integration of AI-powered sensing and IoT technologies within industrial process control schemes.

Continued technological breakthroughs coupled with strong industrial necessity for highly accurate instrumentation ensures the Japanese process instrumentation market remains on a steady upward trajectory going forward.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.6% |

The rapid growth of South Korea's semiconductor, electronics, and chemical fields has vigorously propelled process instrumentation development through burgeoning demands for automated factories. South Korea's initiative to modernize manufacturing facilities with intelligent technologies and pioneering investments in AI-empowered industrial systems are amplifying needs for highly precise live sensors, digital overseers, and data-driven monitoring platforms.

The lightning-quick evolution of the semiconductor and display fabrication sectors, headed primarily by Samsung and SK Hynix, has profoundly magnified requirements for instruments with ultra-refined temperature and pressure regulation. What's more, proliferating investments into water remediation and renewable energy initiatives are further catalyzing market expansion.

With ongoing enhancements in AI-integrated process monitoring solutions and deepening industrial computerization, analysts anticipate the South Korean process instrumentation market will steadily advance. Operations will be intensely tracked and productively optimized owing to breakthroughs in smart detectors, machine learning, and automated systems regulating production workflows in real time. A diversity of exacting and real-time tools will be crucial to supporting South Korea's leadership in cutting-edge fields such as semiconductors and visual display technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.8% |

The process instrumentation market comprises a significant share of control valve & flow instrumentation segment as growing emphasis on advanced measurement and control are intended for industrial integration with emerging technologies to boost operational efficiency, unify resources effectively and meet regulatory requirements. Ideal for process engineering applications, high-performance process instruments are the heart of process monitoring, control, and automation, making them indispensable to oil & gas, chemical production, power generation, and water treatment.

This systematic approach has transformed control valves into a widely used cross-application process instrumentation solution, internationally Fed. In contrast to manual valves, automated control valves offer real-time responsiveness, enabling industries to adjust process parameters according to fluctuating operational conditions.

In the oil & gas refining industry, there is growing usage of control valves to regulate pressure and flow accurately in drilling, refining and transmission through pipelines; this has surged demand for highly efficient control valve systems in the sector, as operators place emphasis on safe, efficient operations with minimum downtimes in processes. The system response time is improved by much as 50% over manual control after installation of automated control valves, which ensures more reliable control in dynamic processing environments.

The growing adoption of control valves in chemical processing enabled by corrosion-resistant materials for better handling of aggressive chemicals and high-pressure fluids has augmented market demand, thereby facilitating a wider adoption in applications pertaining to the processing of high-purity and hazardous materials.

Adoption has been aided further by the rollout of smart control valves, with AI-enabled predictive analytics and real-time flow optimization, better process efficiency and lowered maintenance costs as a result.

Recent years have seen the introduction of self-regulating control valves with pressure-compensating actuators increasing accuracy with a more reliable flow of product through your critical industrial processes, further driving increased growth in this sector.

Market growth has been further propelled by the use of high-performance control valves in water treatment with precise flow modulation capabilities for desalination and filtration operations to ensure better sustainability and compliance with global water management standards.

Control valves have significant over edge in terms of real-time process control, automation, and energy-efficient operations; however, high capital cost, difficult integration with legacy system, and stress endured during continuous running remains bottleneck for control valves. Nevertheless, newer innovations in AI-based and enhanced predictive maintenance, lighter weight valve materials, and low-energy actuation mechanisms are both enhancing durability, economic, and performance, and maintaining the competitive landscape for control valve solutions in the market.

Industries are leading to wide-scale adoption of flow instrumentation, including water management, energy generation, and chemical processing; flow measurement technology enables accurate and timely data that optimize fluid management and resource usage. Modern flow instrumentation systems form part of an integrated approach towards the digitalization of processes, unlike traditional mechanical flow meters, allowing for real-time data collection, and contributing to the overall monitoring process.

Increasing demand for flow measurement in power generation, including high accuracy flow sensor for steam and cooling water circulation, is expected to augment the growth of advanced flow instrumentation, as power plants focus on compliance with regulatory and efficient operational processes.

This is supported by the increasing adoption of flow instrumentation in industrial automation, coupled with the growing use of ultrasonic and electromagnetic flow meters that provide non-contact and high-accuracy liquid measurement, thus enhancing the market growth owing to the prevailing high precision application areas.

In addition to this, the adoption is fuelled by the presence of AI-based flow analytics that provide real-time monitoring and automated anomaly detection, which could help with predictive maintenance and leak detection.

The recent development of small and high-sensitivity flow meters with non-invasive or clamp-on sensors that offers higher adaptability in retrofitting existing process systems has further optimized the growth of the market.

The use of multi-phase flow meters, which utilize advanced data analytics for differentiating fluid compositions, has bolstered market growth by ensuring the better management of resources involved with the extraction and refining process of oil & gas.

Despite its benefits of accurate measurement, automation, and resource optimization, flow instrumentation has difficulties in high calibration costs, sensor fouling, and integration complexity with legacy infrastructure. Nonetheless, innovations across wireless (flow monitoring), AI-assisted data analytics and next-gen lower maintenance sensors improve usability, efficiency, and long-term cost-effectiveness, thus securing expansion for flow instrumentation solutions.

As industries continue to leverage modern process instrumentation to optimize resource utilization, improve operational safety, and adhere to stringent environmental regulations, two of the most prominent market drivers are the oil & gas and chemical processing segments.

Nowhere is this more apparent than in the oil & gas sector, as operators expand their portfolios and employ new measurement and control technologies to drive drilling efficiency, improve refinery performance and pipeline safety. By virtue of current process instrumentation, in contrast with traditional monitoring methods, businesses have real-time access to critical parameters to take preemptive measures, reduce downtime, and make informed business decisions.

The increasing adoption of next-generation automation solutions in upstream oil extraction, comprising high-precision flow meters and pressure transmitters for wellhead monitoring, as well as high-throughput analyzers, modules and fitted systems are majorly driving the demand for process instrumentation as operators work diligently to optimize production and reservoir performance. Research shows that the use of digital process instrumentation can help recover up to 20% more oil, resulting in better operational economics.

Market demand has been fortified by expansion of process instrumentation in midstream pipeline operations, leading to increased focus on smart pressure and leak detection systems for real-time safety monitoring, and thus greater adoption in long-distance crude and natural gas transportation.

AI process analytics coupled with predictive maintenance for compressor stations and LNG terminals is accelerating the adoption of such solutions, ensuring greater asset reliability and less operational risk.

This has helped the growth of the market for explosion-proof instrumentation with the growth of the intrinsically safe sensors for hazardous places which would help in a better compliance with international safety standards.

The emergence of real time SCADA (Supervisory Control And Data Acquisition) driven process control systems with integrated flow, pressure and temperature monitoring has also augmented the market growth as these act as a cover for better operational decision making at remote and offshore oil production locales.

However, process instrumentation is a very well optimized, safe, and environmentally friendly option that comes with challenges such as high upfront capex, the network security risks associated with using digitalized systems in the oil & gas upstream industry, and maintenance issues in challenging, hazardous, and remote conditions. Still, IoT-based remote monitoring, AI-enabled fault detection, and cloud-embedded process control bring innovations that will make process instrumentation in oil & gas applications adaptable, cost-effective, and scalable, and is good news in the long run.

The chemical industry has seen solid market adoption and advanced process instrumentation has been applied with increased frequency in specialty chemicals, petrochemicals, and pharmaceutical manufacturing, with companies seeking to improve product quality, maintain consistency in batch production, and improve worker safety. Modern process instrumentation, as opposed to traditional manual sampling methods enables continuous real-time monitoring of critical process variables, providing higher accuracy and less waste.

The high-precision chemical processing industry has witnessed significant demand for process instrumentation, as next-generation monitoring solutions are crucial to maintaining automated level, temperature, and pressure control systems to ensure consistency in batch processing when the chemical manufacturer is keen on complying with stringent regulatory frameworks.

Trending factors boosting market growth include significant implementation of digitalized process control systems, providing analytics on real-time process efficiency optimization which has facilitated the in greater adoption in specialty chemical production.

Adoption is further enhanced by AI-powered Chemical process monitoring with automation of outlier detection (basically monitoring the real-time stability of chemical reactions) and ensuring enhancement in operational proficiency with reduced defect in products.

While it has advantages regarding product quality, process safety, and regulatory compliance, chemical industry process instrumentation presents unique challenges, such as the need for corrosion resistance and degradation of sensors in extreme conditions, as well as high calibration costs. However, new innovations in smart self-calibrating sensors, AI-assisted chemical process modeling, and remote monitoring solutions are significantly enhancing efficiency, cost-effectiveness, and long-term sustainability - paving the way for continued growth in process instrumentation for chemical processing.

Rising demand for industrial automation, real time process monitoring and regulatory compliance are some of the key drivers for growth post process instrumentation market growth is driven by the demand coming from oil & gas, chemical processing, pharmaceuticals, water treatment and power generation. To improve process efficiency, accuracy, and operational safety, companies have begun adopting AI-driven process control, smart sensors, and IoT-enabled instrumentation. The market comprises global automation providers and specialized instrumentation producers, driving technology evolution in pressure, flow, temperature, and level counters.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Siemens AG | 15-20% |

| ABB Ltd. | 12-16% |

| Emerson Electric Co. | 10-14% |

| Honeywell International Inc. | 8-12% |

| Schneider Electric SE | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Siemens AG | Develops smart process instrumentation, AI-powered flow and pressure sensors, and digitalized industrial automation solutions. |

| ABB Ltd. | Specializes in advanced temperature, level, and flow measurement devices with cloud-based data integration. |

| Emerson Electric Co. | Manufactures high-precision process control instruments, including smart valves and real-time monitoring solutions. |

| Honeywell International Inc. | Provides industrial automation systems, predictive analytics for process control, and IoT-enabled measurement devices. |

| Schneider Electric SE | Offers AI-integrated instrumentation solutions for process industries, including energy-efficient control systems. |

Key Company Insights

Siemens AG (15-20%)

An instrument solution provider for process instrumentation offers Automation solutions, AI-integrated measurement devices, and cloud-based process control in the process instrumentation market.

ABB Ltd. (12-16%)

ABB is a provider of smart sensors, real-time monitoring instrumentation, and predictive maintenance for process industries.

Emerson Electric Co. (10-14%)

Combine technology and engineering to provide high-reliability process measurement solutions that help industries with their critical applications to be efficient and in compliance.

Honeywell International Inc. (8-12%)

Honeywell creates AI-powered industrial automation systems for process control and operational safety.

Schneider Electric SE (5-9%)

They manufacture smart process control instrumentation that combines IoT-enabled automation with real-time analytics.

Other Key Players (40-50% Combined)

Some of the industrial automation and process control companies are behind next-generation instrumentation solutions, AI-driven analytics, and sustainable process monitoring. These include:

The overall market size for Process Instrumentation Market was USD 18.4 Billion in 2025.

The Process Instrumentation Market expected to reach USD 41.0 Billion in 2035.

The demand for process instrumentation will be driven by factors such as increasing automation across industries, the need for precise monitoring and control in manufacturing processes, rising adoption of smart technologies, and stringent quality and safety standards in sectors like chemicals, oil and gas, and pharmaceuticals.

The top 5 countries which drives the development of Process Instrumentation Market are USA, UK, Europe Union, Japan and South Korea.

Control Valves and Flow Instruments Drive Market Growth to command significant share over the assessment period.

Diaphragm Coupling Market Growth - Trends & Forecast 2025 to 2035

HID Ballast Market Growth - Trends & Forecast 2025 to 2035

Fluid Conveyance Systems Market Growth - Trends & Forecast 2025 to 2035

GCC Magnetic Separator Market Analysis by Over band/Cross Belt Separator and Magnetic Roller Separator through 2035

United Kingdom Magnetic Separator Market Analysis by Over band/Cross Belt Separator and Magnetic Roller Separator through 2035

Glass Door Merchandisers Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.