The global process automation and instrumentation market is expected to grow at a compound annual growth rate (CAGR) of 4.4% and reach a total value of USD 722.6 billion by 2035. This growth is primarily driven by the widespread adoption of smart industrial automation, real-time data monitoring, and Industry 4.0 technologies across various sectors.

Other key sectors include oil & gas, chemicals, food & beverages, pharmaceuticals, and power generation. These have incorporated advanced automation systems, smart sensors, and AI-powered controllers in order to optimize operational efficiency, reduce time for downtime, and optimize resources.

The biggest market driver is the growing demand for real-time process control, predictive maintenance, and enhanced safety norm compliance. All these factors drive the adoption of technologies like PLCs, SCADA systems, and DCS, which help in implementing high-level controls and monitoring of industrial processes.

SCADA systems, in particular, dominate a huge share of the market with 38% of market share because of their capabilities in the acquisition of real-time data, remote monitoring, and control of the process.

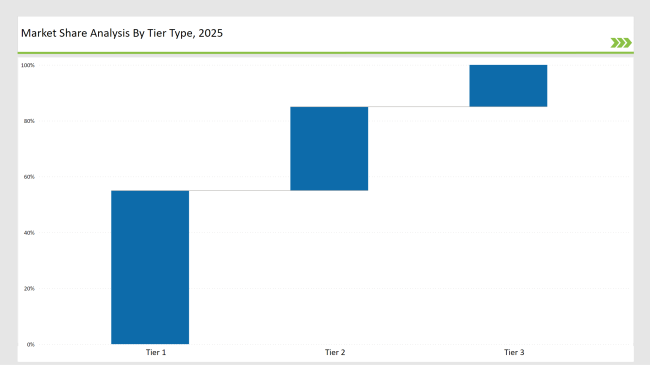

The market remains moderately consolidated with Tier 1 players like Siemens AG, ABB Ltd., Schneider Electric, Emerson Electric, and Honeywell International Inc., representing 58% of the total market share. Within instrumentation types, transmitters are very prominent; 40% of the market is shared by transmitters as those represent a core component that measures and transmits paramount process parameters.

As industries increasingly adopt automation and the digital transformation of their processes, a strong demand for process automation solutions is anticipated to go steadily forward. The underlying theme here is that advanced technologies really drive the pursuit of bigger productivity gains in operations, predictive maintenance, and robust safety standards across diverse industries

| Attribute | Details |

|---|---|

| Projected Value by 2035 | USD 722.6 billion |

| CAGR (2025 to 2035) | 4.4% |

Explore FMI!

Book a free demo

| Category | Industry Share (%) |

|---|---|

| Top 3 Players | 35% |

| Next 2 of 5 Players | 30% |

| Rest of the Top 10 | 35% |

The Top 3 players (Siemens AG, ABB Ltd., Schneider Electric) dominate due to their broad portfolio of industrial automation solutions, global presence, and expertise in smart process control.

Tier 2 Players: Emerson Electric, Honeywell International Inc., Advanced SCADA solutions, Digital twin technologies and AI powered Predictive Analytics Local Manufacturers Local automation and instrumentation in cost sensitive market.

The market is fairly consolidated, with leading firms investing in AI-powered automation, IIoT (Industrial Internet of Things), and cloud-integrated process monitoring solutions.

Several key players contributed to market advancements in 2024:

| Tier | Tier 1 |

|---|---|

| Market Share (%) | 25% |

| Examples | Siemens AG, ABB Ltd., Schneider Electric |

| Tier | Tier 2 |

|---|---|

| Market Share (%) | 30% |

| Examples | Emerson Electric, Honeywell International Inc. |

| Tier | Tier 3 |

|---|---|

| Market Share (%) | 45% |

| Examples | Regional and niche players |

Rise in AI-Enabled Smart Automation Solutions

Growth of Cybersecure SCADA and Industrial IoT (IIoT) Systems

Expansion of Sustainable and Energy-Efficient Process Instrumentation

| Company | Initiative |

|---|---|

| Siemens AG | Developed AI-powered SCADA systems with predictive analytics and real-time monitoring. |

| ABB Ltd. | Introduced advanced process controllers with machine learning-based automation. |

| Schneider Electric | Launched cloud-integrated flow meters for industrial process optimization. |

| Emerson Electric | Expanded DCS portfolio for large-scale industrial automation. |

| Honeywell International Inc. | Focused on cybersecurity-enhanced MES solutions for smart factory automation. |

The largest market share is held by key players such as, Siemens AG, ABB Ltd., Schneider Electric, collectively controlling a significant portion of the global market.

Regional companies, like Siemens AG, ABB Ltd., Schneider Electric, Emerson Electric, Honeywell International Inc., hold a notable portion of the market, catering to specific regions and applications.

Startups and emerging players, focusing on innovations in sustainability and niche applications, hold a smaller yet growing share of the market, contributing to around 10-15%.

Private labels, primarily in niche markets or through distributors, account for a smaller portion, generally under 5% of the market.

The market concentration in 2025 is expected to be high for the top 5-6 global players controlling over 30% of the market, medium for the next tier of players, and low for smaller regional or specialized players.

Rubber Conveyor Belt Market Analysis by Product Type, End Use, and Region through 2035

Korea Aircraft Ground Support Equipment Market Analysis & Forecast by Equipment, Ownership, Power, Application, and Region Through 2035

Korea Aerial Work Platform Industry Analysis by Product Type, Fuel Type, End-Use, Platform Height, Sales Channel, and Province through 2035

Safety Valve Market Growth-Trends, Analysis & Forecast by Material, End-Use and Region through 2035

Motor Soft Starters Market Trend Analysis Based on Voltage, End-Use, and Region 2025 to 2035

Miniature Ball Bearings Market Analysis by Type, End-use and Region: Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.