The market for probiotic supplements is primarily dominated by multinational companies, regional players, and emerging/niche brands, at a moderate consolidation level. Market leaders, consisting of Nestlé Health Science, Danone, Chr. Hansen, DuPont, and Kerry Group, combine to account for 58% of the market, due to significant R&D investment, proprietary strains, and diversified product offerings in capsules, powders, and functional beverages.

Regional players include Yakult (Japan), BioGaia (Sweden), Blackmores (Australia), and NOW Foods (USA), whose bacterial strains and traditional fermentation technique dominate 26% of the market. The emerging/niche players, representing 16% of the market, are gaining popularity in offering diversified probiotic solutions, vegan-friendly formulations, and microbiome-based personalized nutrition.

The top five firms in each type of structure make up about 70-75% of its category, reflecting a moderate consolidation with scope left for innovation-fueled entry into the markets.

Though multinationals dominated the global marketplace, regional leaders and new emerging brands are gradually increasing their control over the different markets, more so in personalized nutrition, plant-based probiotics, and precision gut health-based solutions for the immune system as well as various digestive disorders.

Explore FMI!

Book a free demo

| Global Market Share 2025 | Industry Share (%) |

|---|---|

| Top Multinationals (Nestlé, Danone, Chr. Hansen, DuPont, Kerry Group) | 58% |

| Regional Leaders (Yakult, BioGaia, Blackmores, NOW Foods, Amway) | 26% |

| Startups & Niche Brands (Jarrow Formulas, Custom Probiotics, Renew Life, Bio-K Plus) | 16% |

The market is moderately consolidated with multinational brands in the leading positions, however regional and niche players are innovating specialized product developments.

Based on bacterial strains, the market of probiotic supplements is highly dominated by Lactobacillus, with 45% market share. The Lactobacillus strains, for instance, such as Lactobacillus acidophilus and Lactobacillus rhamnosus, have been extensively researched to support the benefits of gut health, immune function, and general well-being.

Bifidobacterium species is the second leading species at 30% in the market as it can inhabit the lower intestines and can be associated with general health for the digestive tract. Streptococcus makes up 15% of the market and represents another significant bacterial genus that has been linked with respiratory and oral health benefits through probiotic supplementation.

Other probiotic strains include Bacillus and Saccharomyces, occupying the remaining 10% of the market and gaining popularity for their unique properties and targeted applications.

The global probiotic supplements market is distributed through various channels, with retail pharmacies and drug stores leading the way at 35% of the market. These brick-and-mortar outlets offer consumers easy access to probiotic supplements and the opportunity to receive guidance and recommendations from healthcare professionals.

Online retail channels account for 28% of the market, offering convenience, a wider selection of products, and the ability to compare prices and reviews. Distribution channels where supermarkets and hypermarkets account for 22% of the market, benefit a more average consumer who tends to buy probiotics as an accessory to their everyday grocery shopping, usually in the context of an overall healthy lifestyle.

The probiotic supplements industry of 2024 saw significant product innovation, strategic partnerships, and expansion into emerging health categories. A key trend was the high-speed adoption of symbiotic formulations, involving the combination of probiotics with prebiotics, driven by scientific research in gut microbiota balance and immune system modulation.

Nestlé Health Science and Chr. Hansen led the market with clinically backed probiotic strains targeting gut health, stress management, and metabolic regulation, while Danone strengthened its dairy-free probiotic line under Activia to cater to lactose-intolerant consumers.

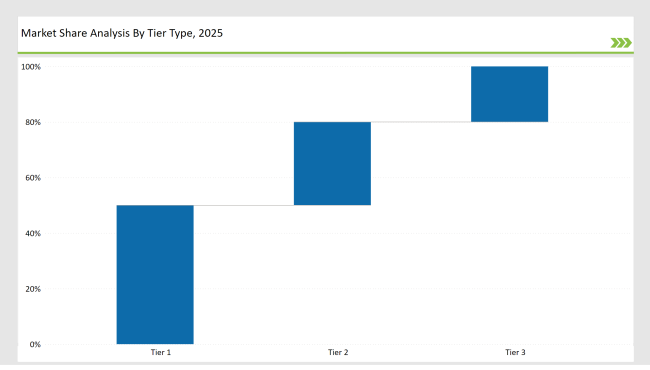

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 50% |

| Example of Key Players | Nestlé, Danone, Chr. Hansen, DuPont, Kerry Group |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 30% |

| Example of Key Players | Yakult, BioGaia, Amway, Blackmores, NOW Foods |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 20% |

| Example of Key Players | Jarrow Formulas, Custom Probiotics, Renew Life, Bio-K Plus |

| Brand | Key Focus |

|---|---|

| Nestlé Health Science | Endowed in microbiome sequencing technology to develop targeted probiotic solutions. |

| Danone | Expanded dairy-free probiotic portfolio to cater to lactose-intolerant and vegan consumers. |

| Chr. Hansen | Launched next-generation probiotic strains targeting metabolic health and stress resilience. |

| Yakult | Strengthened Asian distribution networks with new localized marketing campaigns. |

| BioGaia | Introduced athlete-focused probiotics to enhance gut health and endurance. |

| Jarrow Formulas | Developed synbiotic supplements (probiotic + prebiotic) for enhanced gut microbiome balance. |

| Renew Life | Entered European markets with allergen-free, plant-based probiotic capsules. |

| Blackmores | Acquired emerging probiotics startup to expand product innovation in Australia & New Zealand. |

| Kerry Group | Launched spore-based probiotics to improve survivability and digestive benefits. |

| NOW Foods | Expanded into children’s probiotics, focusing on chewable formulations for gut health support. |

The future of probiotics lies in personalized supplementation, with companies investing in AI-driven microbiome analysis to tailor formulations to individual gut health needs. Manufacturers will gain from the development of direct-to-consumer diagnostic kits, thereby enabling consumers to customize their intake based on gut microbiome composition.

Synbiotics (prebiotics + probiotics) and postbiotics (useful metabolites from probiotics) will surge in demand by 2030, providing a higher level of gut health than the traditional formulations. Companies making investment in combination formulations, like Chr. Hansen and Jarrow Formulas, will be positioned for competitive success.

Probiotic supplement sales through D2C models, subscription-based sales, and e-commerce platforms will contribute a significant portion of global revenue by 2035. Manufacturers should utilize social media, influencer marketing, and targeted digital advertising to reach health-conscious consumers.

The next decade will see a shift from supplement-based probiotics to food-based delivery systems. Fermented drinks, dairy-free probiotic yogurts, and probiotic-infused snacks will dominate consumer choices, offering alternative delivery mechanisms to capsules and tablets. Brands entering the functional food sector early will gain long-term market penetration.

Rising consumer awareness of gut health, immunity, and digestive wellness, along with increasing scientific validation of probiotic benefits.

Lactobacillus rhamnosus, Bifidobacterium lactis, and Saccharomyces boulardii will see strong demand for gut and immune health applications.

Increasing scrutiny by FDA, EFSA, and CFDA will require brands to back claims with clinical trials and transparent ingredient labeling.

Synbiotics, postbiotics, allergen-free probiotics, and sports-specific probiotics are expected to gain momentum.

Targeted formulations, scientific backing, sustainable packaging, and regional flavor adaptations can help brands stand out.

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.