The market for probiotic ingredients is defined by a combination of strong multinational companies, regional giants, and rising players. The combined share of the market of the top five players accounts for around 55%, while market leaders Chr. Hansen Holding A/S, Koninklijke DSM N.V., and Lallemand Inc. spearhead industry development.

30% of the market is provided by regional manufacturers who target localized usage and specialty probiotic strains as per customer taste. The other 15% is held by niche brands and start-ups that offer specific dietary innovations and trends. This allocation implies a moderately consolidated market in which a few industry leaders define market dynamics while niche players fuel local innovations and supply chains.

Explore FMI!

Book a free demo

| Market Structure | Top Multinationals |

|---|---|

| Industry Share (%) | 55% |

| Key Companies | Chr. Hansen, DSM, Lallemand, DuPont, Lesaffre |

| Market Structure | Regional Leaders |

|---|---|

| Industry Share (%) | 30% |

| Key Companies | Yakult, Morinaga, Probi AB, Kerry Group, Novus |

| Market Structure | Startups & Niche Brands |

|---|---|

| Industry Share (%) | 15% |

| Key Companies | UAS Labs, Ganeden, Sabinsa, BioGaia, Protexin |

The market is moderately consolidated with leading multinationals controlling over half of the business, and regional players and start-ups adding to innovation and niche applications.

Bacterial probiotic ingredients control the market with 75% share based on their traditional application in food, beverages, and supplements. Players such as Chr. Hansen and DSM dominate bacterial probiotics with Lactobacillus and Bifidobacterium strains because of their established health benefits and capacity to maintain gut microbiota balance.

Yeast-based probiotics, with 25% market share, have been on the rise because of their stability in harsh conditions and use in functional foods and animal nutrition. Yeast probiotics, including Saccharomyces boulardii, are becoming central in antibiotic-associated diarrhea management and gut health improvement.

In developed economies such as Europe and North America, bacterial probiotics still reign supreme, while in the developing world, yeast-based strains are gaining traction due to their resistance to adverse manufacturing conditions. Rising awareness of gut health and digestive well-being is still driving demand for both bacterial and yeast-based probiotics in various applications globally.

Powdered probiotic ingredients are the largest with 40% share since they are the most desired form for dietary supplements and functional beverages. Granules constitute 25%, providing controlled release and higher bioavailability, and are hence ideal for pharmaceutical usage.

Capsules are 20%, or convenience and dose precision, with market participants such as BioGaia and Probi AB setting up probiotic capsule products. Gel form and other new delivery forms are 15%, and their application in probiotic-enriched skincare and new oral care products is increasing in Asia-Pacific and North America.

Western markets are dominated most by powder and granules, although capsules and gel probiotics are increasing popularity in Asia as efficacy and convenience become consumer needs. Probiotic delivery forms change according to the trend towards shelf-stable forms that meet differentiated consumer needs.

2024 was marked by major activity in the probiotic ingredients market, fueled by strategic deals, product development, and research advancements in gut microbiome. Firms enhanced their emphasis on precision nutrition by leveraging AI-based gut health diagnosis to create customized probiotic products.

Regulatory shifts in key markets also influenced reformulation plans and product compliance. International expansion into new, as yet untapped, markets, with Latin America and Africa being major areas, was also a significant trend, as interest in probiotics continued to build.

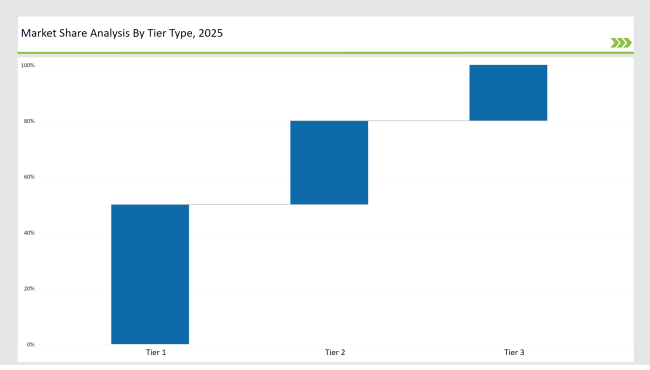

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 50% |

| Example of Key Players | Chr. Hansen, DSM, DuPont, Lallemand |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 30% |

| Example of Key Players | Yakult, Morinaga, Kerry, Probi AB |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 20% |

| Example of Key Players | Startups, emerging brands, niche players |

| Brand | Key Focus |

|---|---|

| Chr. Hansen | Strengthened strain stability for extended shelf life |

| DSM | Expanded research into gut-brain health probiotics |

| Lallemand | Opened a new fermentation plant for large-scale production |

| Yakult | Introduced advanced gut microbiome mapping services |

| Morinaga | Developed immune-boosting probiotic strains |

| Kerry Group | Enhanced probiotic integration in sports nutrition |

| BioGaia | Focused on oral health probiotics in pediatric segments |

| Ganeden | Collaborated on functional coffee probiotic formulations |

| Novus International | Expanded livestock applications for sustainable feed |

| UAS Labs | Advanced microencapsulation technology for better efficacy |

AI-driven microbiome testing will define precision nutrition, where consumers can purchase highly personalized probiotic formulations. Companies that make investments in genetics and microbiome research will hold a competitive edge in manufacturing extremely personalized probiotic supplements.

Fermented plant-based beverages like oat and almond probiotic milk will see considerable growth in the USA and Europe. Brands utilizing sustainable packaging along with distinctive flavors will make a mark in this category.

Probiotics will be introduced in ready-to-eat foods, bars, and cookies, broadening their usage in conventional food categories. Those manufacturers partnering with leading food companies to formulate fortified foods will have greater traction in North America and Europe.

Probiotics aimed at specific conditions like IBS, mental well-being, and immune system support will pick up momentum in North America and Japan. Firms putting money into clinical trials and receiving regulatory approvals for pharmaceutical probiotics will corner this market.

Regulatory innovations and growing awareness about health will drive probiotic growth in emerging markets, most notably in Brazil and South Africa. Firms working on low-cost formulations and region-specific consumer education will leverage these markets.

Personalized probiotics will enable consumers to select strains based on their unique gut microbiome. Companies integrating AI-driven gut health diagnostics are expected to drive market differentiation.

The food & beverage segment accounts for approximately 45% of total probiotic ingredients demand, with yogurt, dairy-based drinks, and non-dairy probiotic beverages being the dominant categories.

Regulatory approvals significantly impact the industry, especially in regions like the EU and the USA, where stringent guidelines affect probiotic labeling, health claims, and novel strain approvals.

Probiotics are increasingly used in cosmetics (5%), personal care, and pharmaceutical applications. Skincare brands in South Korea and Europe are leading in probiotic-infused beauty products.

The animal feed industry accounts for 20% of the total probiotic ingredients market, with livestock and pet food probiotics growing due to increased focus on gut health in animal nutrition.

Lactobacillus and Bifidobacterium remain dominant, while yeast-based probiotics like Saccharomyces boulardii are gaining traction for their stability and broader application in supplements.

Liqueurs Market Analysis by Type, Packaging, Distribution Channel, and Region - Growth, Trends, and Forecast from 2025 to 2035

Japan Dietary Supplements Market, By Ingredients, Form, Application, and Region through 2035

Dehydrated Pet Food Market Insights – Premium Nutrition & Market Trends 2025 to 2035

Date Syrup Market Growth – Natural Sweetener Trends & Industry Demand 2025 to 2035

Cat Food Market Insights – Trends & Growth Opportunities 2025 to 2035

USA Bubble Tea Market Analysis from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.