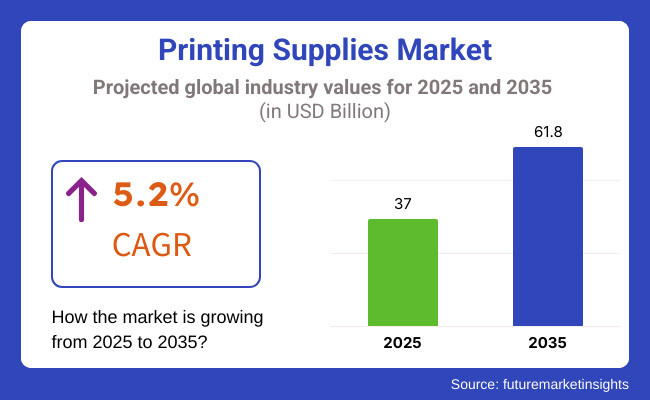

The printing supplies market is anticipated to be valued at USD 37.0 billion in 2025. It is expected to grow at a CAGR of 5.2% during the forecast period and reach a value of USD 61.8 billion in 2035.

Printing supplies include ink and toner, paper, cartridges, and other supplies which are consumable in nature and are used in the printing process widely for commercial, manufacturing, and personal applications. Essentials for publishing, packaging, advertising, office documentation, and textile printing, such supplies serve industries like education, retail, manufacturing, and media, with the increasing demand for eco-friendly and high-efficiency printing solutions.

The printing supplies market includes consumables like ink, toner, paper, and cartridges used in commercial, industrial, and personal printing applications. Increasing demand for packaging, advances in digital printing, needs for office documentation, and eco-friendly printing solutions are the prominent factors driving global market growth, while expanding e-commerce and the advertising industry also support market growth.

Explore FMI!

Book a free demo

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Gradual decline due to digitalization but stable demand in specific industries. | Market restructuring with sustainable materials, 3D printing advancements, and AI-driven production methods. |

| Transition from traditional printing to digital and inkjet technologies. | Advanced AI-driven printing processes, smart printers, and integration of automation in supply management. |

| Early adoption of recycled paper and eco-friendly inks but limited enforcement. | Widespread use of biodegradable printing supplies, carbon-neutral manufacturing, and waste reduction programs. |

| There is demand for cost-effective supplies, but businesses still rely on traditional printing. | Shift towards on-demand and personalized printing solutions with reduced reliance on physical print. |

| Emerging applications but primarily used in niche sectors like prototyping. | Mainstream adoption in industries such as healthcare, automotive, and construction, reducing demand for traditional supplies. |

| Strengthened environmental policies encouraging the use of sustainable materials. | Stricter regulations on waste disposal, carbon emissions, and sustainability compliance in printing. |

| Global supply chain disruptions impacting ink, toner, and paper availability. | AI-driven predictive supply chains reducing disruptions and optimizing material usage. |

| Improved energy efficiency and automation in commercial printers. | Self-maintaining printers, equipped with total automation and artificial intelligence, can automatically detect and resolve errors. |

| The rise of remote work has caused a decline in office printing. | Minimal reliance on paper-based printing as digital transformation dominates workplace documentation. |

| The rise of online print sales coincides with existing challenges in logistics and costs. | Personalized, AI-optimized, just-in-time production with reduced inventory waste. |

Eco-Friendly and Refillable Printing Solutions

Sustainable printing supplies, which have a minimal environmental dissipation, are being demanded by consumers. In response to this, companies are creating refillable ink cartridges, biodegradable toners and soy-based inks that reduce plastic waste and chemical pollution. With stringent e-waste regulations and increasing eco-awareness, a populace that prefers products that offer cost-effective and eco-friendly alternative solutions. Subscription refill services are becoming more common, offering the 2-for-1 advantage of ensuring an ink supply and minimizing waste.

Smart and IoT-Enabled Printing Technologies

Conventional printing supplies now prefer smart ones that synergize with the Internet of Things and cloud systems. Ink cartridges fitted with sensors measure ink levels, predict use patterns, and connect to the internet to reorder supplies when running low.

Remote troubleshooting is also available, and AI-driven maintenance alerts keep business and home-user operations running smoothly and efficiently with minimal downtime. Amid the tightening pace of digital transformation, there is growing consumer demand for printing solutions that offer automation, connectivity, and improved user experience for personal and professional requirements.

Commercial printing supplies hold about 80% of the market share, and demand for marketing and branding materials is rising. Marketing companies and business owners depend on brochures, catalogs, and business cards to develop their brand presence. Even though business organizations try to persist in communicating with their clients and capturing their interest, the necessity for attractive quality prints keeps growing.

With more e-commerce and retail expansion, packaging plays an important role in product protection and brand recognition. These printing materials are expected to retain a clean and neat appearance with the ability to be durable for printing labels, tags, and customized packaging. Given growing environmental issues, it is anticipated that the market will increasingly move toward the use of biodegradable inks and recyclable packing material, thus enhancing the demand for the commercial segment even further.

The laser printing segment remains highly preferred due to its sharp, high-resolution prints and fast output speed. Laser printers are the common choice for bulk documents, marketing material, and report printing in company offices. The work produced is clean as well as free from smudges, making these printers acceptable in business environments where clarity is essential for contracts, presentations, and promotional materials.

As per FMI estimation, the toner cartridges for laser printers last longer than ink-based cartridges, in general, meaning you'll spend less in the long run. This made them widely adopted in commercial printers and corporate offices based on low maintenance costs, page yield, and durability. With new tech, energy-efficient & cordless laser printers are up-and-coming, boosting workflow effectiveness and sustainability.

| Countries | CAGR |

|---|---|

| USA | 5.3% |

| China | 5.0% |

Expansion of Digital Printing Drives Growth in the USA Market

The USA is forecasted to grow at a 5.3% CAGR during the period of 2025 to 2035. Market growth is further propelled by the rising need for digital printing solutions due to the increasing growth in e-commerce, packaging, and on-demand printing services.

Growing usage of inks, toners, and specialist paper among businesses, which are towards high quality and cost-effective printing technologies are further expected to drive growth of the global printing consumables market. Therefore, the shift towards personalized and short-run print solutions is also helping the demand for advanced printing supplies which is extending the overall market growth.

Sustainability considerations are changing the face of the industry. It increasingly embraces eco-friendly inks and recycled paper materials. The government and big corporations in the United States market encourage green printing practices, making manufacturers invest in biodegradable and energy-efficient supplies. Also, the growing popularity of digital and 3D printing for commercial and industrial purposes will play a major role in shaping long-term growth prospects for the market in the USA

Technological Advancements and Eco-Friendly Solutions Propel China’s Printing market

China is expanding at about a 5.0% compounded annual growth rate from 2025 to 2035 as a result of prompt technological innovations and growing investments in the commercial printing sector. The rapid development of textiles has directly stimulated the demand for high-performance inks, toners, and special printing materials. As the advertising and publishing industries continue to expand, they further fuel growth in the market in China.

As a result of these developments, Chinese manufacturers are being pressured by environmental regulations to come up with sustainable printing solutions, such as soy-based inks and recyclable materials.

Emerging trends associated with digitalization and smarter printing technologies are giving the new face to this trade and giving scope for companies to enhance productivity through waste reduction. With modernization taking place in industries, the demand for innovative and cost-effective supplies will be booming in the years to come in the country.

Rising Demand for Digital Printing Fuels Growth in the UK Market

The UK economy has witnessed stable growth, owing to the growing penetration of digital printing technologies in a wide range of end-user industries. With the growth of e-commerce, customized packaging, and advertising industries, the need for quality inks, toners, and specialty papers is at an all-time high. Print Statements: Businesses are now concentrating on cost- effective and flexible printing solutions; hence, there are opportunities for innovative printing supplies that improve efficiency and sustainability.

This trend is leading companies to explore recyclable and biodegradable inks and recycled paper goods in order to create products that have lower environmental impact; these companies are finding their way into the industry and their investments are shifting the focus of the market.

In fact, the government is mandating manufacturers to come up with sustainable solutions, thus reducing carbon footprints. Also, the rise of 3D and on-demand printing are expected to fuel long-run growth, and in particular, the steady demand of advanced printing supplies across the UK.

Technological Advancements and Sustainability Efforts Boost India

India is expanding rapidly, fueled by the growing packaging, publishing, and textile industries. Demand for high-performance inks, toners, and specialty papers is driven by the fast-growing use of technologies at digital and offset printing. The further market growth is encouraged by small and medium enterprises and the rise of customized and short-run printing.

Sustainability is increasingly becoming the new focus, with manufacturers investing in eco-friendly printing solutions such as vegetable-based inks and recycled materials. Government policies promoting green production and digitalization of print operations shall also be trend setters in the sector. As firms continue to reinforce processes with upgradations and fresh modernizations, business for high-quality yet reasonably priced printing material is expected to be strong in India.

Growing Focus on Innovation and Eco-Friendly Printing Drives Germany’s Market

Germany is experiencing growth owing to the increasing demand for sustainable as well as high-quality printing solutions. The leadership role of advanced printing technologies in commercial and industrial segments is fueling demand for premium printing materials, specialty inks, and toners. The expansion of the packaging and advertising sectors is also playing a key role in market development.

Environmental consciousness is a major factor influencing the industry, with companies shifting toward energy-efficient and biodegradable. Government regulations encouraging sustainability have led to increased investment in eco-friendly printing technologies. As digitalization and automation continue to advance, the demand for innovative and cost-effective printing solutions is expected to sustain the market's growth in Germany.

Although the industry is significantly consolidated with lead manufacturers owning their distribution, pricing, and even innovation, there is some level of fragmentation within the third-party ink and specialty paper segments. By cutting-edge production technology, a wide distribution network, and proprietary formulations, top manufacturers rule the industry.

They guard ink, toner, and specialty paper, not only for the commercial segment but also for the industrial and consumer markets. Exclusive contracts with printer manufacturers ensure their own access to coalescing and compatibility within the supply chains.

Such firms also spend millions on research and development activities to improve the quality, longevity, and eco-friendliness of the print outputs. Innovations, such as environmental cartridges, high yielding toners, and rapid drying inks, substantiate their market strength. Patented technologies and compliance with regulation keep them in a lead position in the market while making it difficult for many smaller suppliers to garner prominence.

The more well-known names create the structure of prices and standards in the industry through these economies of scale and exclusive arrangements in distribution. They can provide bulk purchases and subscription-based replacement models, thereby committing consumers to a longer continuous relationship with the company. Finally, a strong recognition of brand, combined with aggressive campaign-building for consumers, limits chances for new brands to compete efficiently in promising domains of high demand in printing.

Thus, while the competitive environment remains very concentrated, such dominant firms are perpetually stretching their product portfolios and geographic coverage. They connect mobile smart printing technology with automated supply monitoring and packaging in an environment-friendly manner, thereby enriching customer experience over time.

Since controls over distribution channels and advancement in technology are already placed, it would find narrow passage for new entrants to raise challenges against the already established power.

The global printing supplies market is experiencing rapid transformations owing to technology, acquisitions, and changing customer tastes. Recent acquisition USD of Lexmark by Xerox for 1.5 billion marks an important step in the consolidation trend of printing supplies, giving leverage to Xerox in the A4 arena concerned. This move should bolster its presence, especially in the Asia-Pacific, where competition remains tough.

Within its printing segment, HP is fighting declining revenues in its printing segment with price and currency pressures taking a toll on its printing business. But spending on AI PCs has boosted investor confidence in HP, thereby demonstrating a new direction towards innovation. Inkjet technology and green-friendly printing solutions are being targeted primarily by companies like HP, Canon, and Epson to secure the nod of environmentally aware customers and retain market-leader positions.

E-commerce is also changing the distribution of this supplies, and online sales are gaining popularity. This change demands that companies strengthen their presence in multiple digital channels and fine-tune their supply chains for efficiency. Yet, rising costs of raw materials such as ink and paper pose serious challenges to profitability. To counter these challenges, manufacturers are resorting to localized production and partnerships with suppliers to maintain stability.

While sustainability still holds tremendous clout as a market driver, it has led several manufacturers to develop eco-friendly inks along with recyclable printing materials. Green-oriented printing practices are gaining traction with consumer demand, forcing several brands to go green. Add to this the sub-factors of AI-driven printing management systems and cloud document handling in product innovation, and you see the assurance of sustained market growth mixed with steady evolution of challenges.

Recent Developments

In December 2024, the USD 1.5 billion purchase of Lexmark International, a Chinese-owned manufacturer of printers and printing software, will provide Xerox an opportunity to strengthen its grip on the Asian markets and compete in an industry transformed by the digital age.

The market is expected to reach USD 37.0 billion in 2025 and grow to USD 61.8 billion by 2035 at a CAGR of 5.2%.

Printing supplies product sales are projected to grow due to increasing demand for digital printing, eco-friendly solutions, and advancements in AI-driven and automated printing technologies.

Key manufacturers include HP Inc., Canon Inc., Epson Corporation, Brother Industries, Xerox Corporation, Ricoh Company, Konica Minolta, Lexmark International, Seiko Epson, and Toshiba Tec Corporation.

North America, particularly the USA, and Asia-Pacific, including China and India, are expected to generate lucrative opportunities for market players due to technological advancements and rising demand for sustainable printing solutions.

The market is segmented by application into commercial, household, industrial, and government.

Based on the technology, the market is segmented into laser, inkjet, thermal, and dot matrix.

The market is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

Domestic Booster Pumps Market Growth - Trends, Demand & Innovations 2025 to 2035

Condition Monitoring Service Market Growth - Trends, Demand & Innovations 2025 to 2035

Industrial Robotic Motors Market Analysis - Size & Industry Trends 2025 to 2035

Ice Cream Processing Equipment Market Growth - Trends, Demand & Innovations 2025 to 2035

Large Synchronous Motor Market Analysis - Size & Industry Trends 2025 to 2035

Machine Mount Market Analysis - Size & Industry Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.