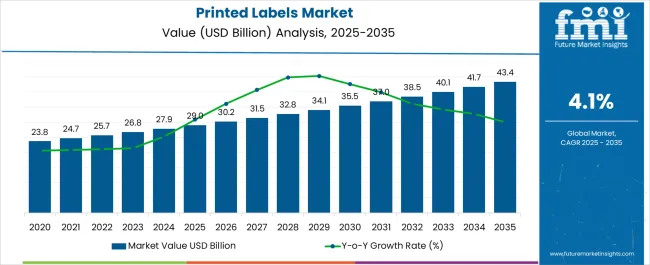

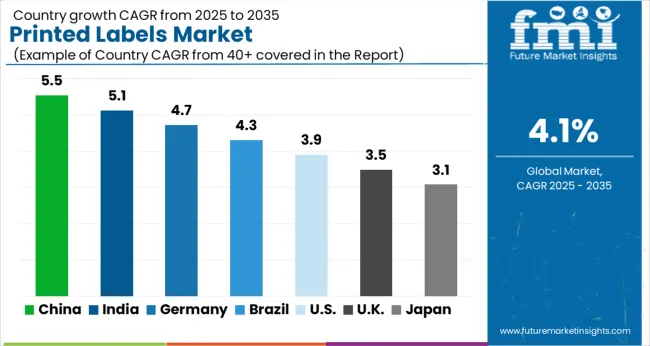

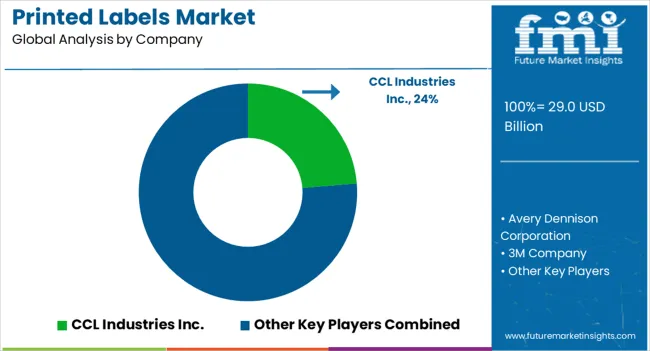

The Printed Labels Market is estimated to be valued at USD 29.0 billion in 2025 and is projected to reach USD 43.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

| Metric | Value |

|---|---|

| Printed Labels Market Estimated Value in (2025 E) | USD 29.0 billion |

| Printed Labels Market Forecast Value in (2035 F) | USD 43.4 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The printed labels market is experiencing robust growth fueled by rising demand for product differentiation, regulatory compliance, and brand visibility across multiple sectors. Increasing consumption of packaged food, beverages, and personal care products is creating consistent requirements for high quality printed labels that enhance shelf appeal and provide critical information.

Advancements in printing technologies have improved speed, cost efficiency, and design flexibility, further driving adoption. Additionally, sustainability initiatives are influencing material choices and boosting demand for recyclable substrates and eco friendly inks.

Regulatory mandates for clear labeling in pharmaceuticals and food sectors are also strengthening market adoption. The outlook remains positive as manufacturers invest in digital and hybrid technologies to support shorter print runs, customization, and just in time production, aligning with dynamic retail and e commerce requirements.

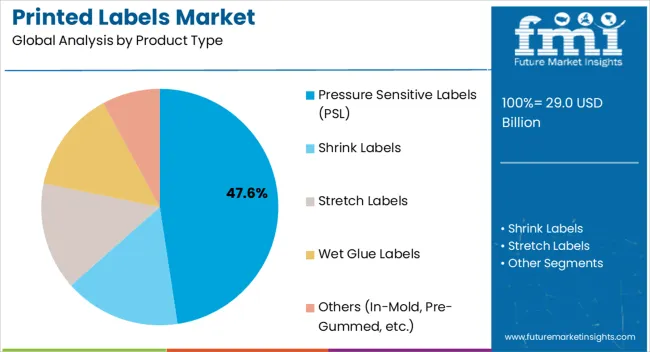

The pressure sensitive labels segment is projected to account for 47.60% of the total market by 2025 within the product type category, establishing itself as the leading segment. Growth is being driven by their versatility, ease of application, and compatibility with various container shapes and surfaces.

Their ability to provide high quality graphics and durability across diverse environments has reinforced adoption across food, beverages, healthcare, and logistics. Additionally, the demand for tamper evident and security labels has further supported the growth of this product type.

These factors combined have positioned pressure sensitive labels as the most dominant format within the printed labels landscape.

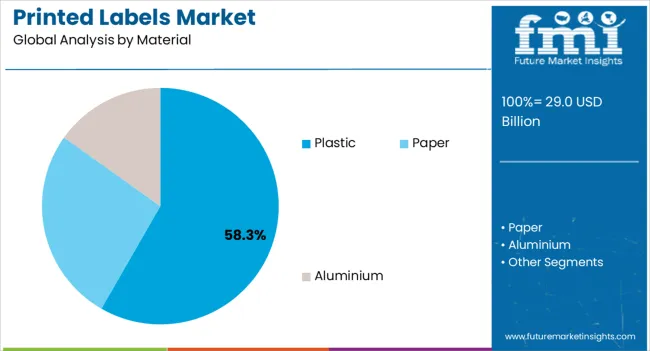

The plastic material segment is expected to hold 58.30% of total market revenue by 2025 within the material category, making it the most prominent segment. This dominance is due to its durability, resistance to moisture, and ability to maintain print quality under varying conditions.

Plastic substrates support a wide range of finishes and printing technologies, enhancing branding and visual appeal. Growing usage in beverages, personal care, and household products has reinforced adoption due to functional advantages such as flexibility and extended shelf life.

Consequently, plastic has become the preferred material in the printed labels industry.

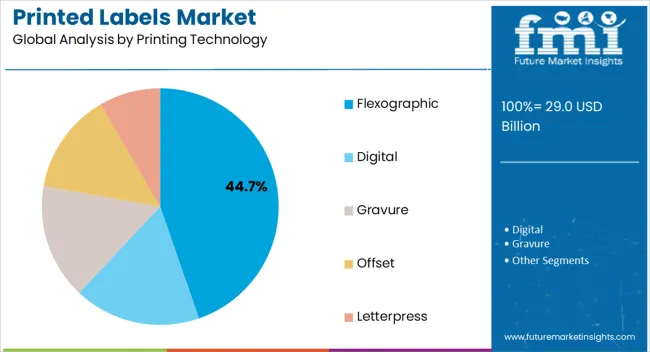

The flexographic printing technology segment is projected to contribute 44.70% of the total market by 2025 within the printing technology category, positioning it as the leading segment. Its dominance is attributed to cost efficiency, high speed production, and the ability to print on a wide range of substrates including paper, film, and metallic foils.

Flexography supports both large volume production and high quality output, making it suitable for fast moving consumer goods packaging. The adoption of water based inks and advancements in plate technology have further enhanced sustainability and print clarity.

These advantages have ensured flexographic printing remains the most widely utilized technology within the printed labels market.

From 2020 to 2025, the global printed labels market experienced a CAGR of 2.1%, reaching a market size of USD 29 billion in 2025.

The historic demand outlook for the printed labels market has witnessed significant growth and transformation over the years. The significance of visually appealing and informative labels to attract and engage consumers and this led to a growing demand for high-quality, eye-catching labels that could effectively communicate product attributes, branding elements, and regulatory information.

With the proliferation of supermarkets, department stores, and e-commerce platforms, the need for clear and visually striking labels became crucial for product identification and differentiation.

The retail boom, particularly in emerging markets, fuelled the demand for printed labels across a wide range of industries, including food and beverages, personal care, pharmaceuticals, and consumer electronics.

The future market outlook for the global printed labels industry is highly promising, with the increasing demand for sustainable labeling solutions. The shift towards sustainability presents a significant opportunity for the printed labels industry to develop and offer labels made from recycled materials, biodegradable substrates, and other environmentally friendly alternatives.

The rise of smart packaging, Internet of Things (IoT) devices, and augmented reality (AR) is expected to revolutionize the way labels are used and interacted with. Labels equipped with sensors, RFID tags enabling real-time tracking, product authentication, and interactive experiences for consumers.

These innovations will enhance supply chain visibility, improve product safety, and create engaging brand experiences, contributing to the overall growth of the printed labels industry.

| Country | India |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 2.5 billion |

| CAGR % 2025 to End of Forecast (2035) | 5.7% |

India has emerged as a strong market base for the printed labels market, exhibiting notable growth and offering unique opportunities. The country's expanding economy, burgeoning retail sector, and increasing consumer awareness have contributed to its significance in the industry.

One distinctive aspect of the Indian market is its diverse and vibrant packaging landscape. With a rich cultural heritage and a multitude of languages, Indian consumers value personalized and region-specific packaging, which drives the demand for printed labels that cater to these preferences.

Additionally, the country's large population and rising middle class have led to a surge in consumer goods, pharmaceuticals, and food and beverage industries, all of which heavily rely on printed labels for branding and product information.

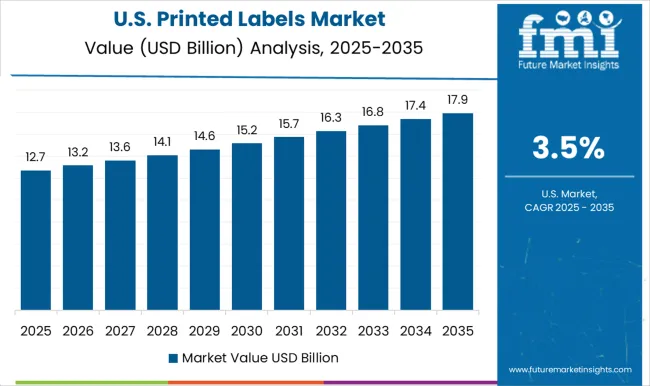

| Country | USA |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 11.2 billion |

| CAGR % 2025 to End of Forecast (2035) | 3.6% |

The United States commands a substantial market share in the global printed labels market, solidifying its position in the industry. With its thriving economy and advanced manufacturing capabilities, the country has created a highly competitive market for printed labels.

The aspects of the USA market is its emphasis on technological advancements. American companies have been quick to adopt innovative printing techniques and materials, such as digital printing, eco-friendly inks, and smart labels with RFID technology.

This focus on cutting-edge solutions has allowed USA manufacturers to offer a wide range of customized and high-quality printed labels, catering to diverse industries like food and beverage, pharmaceuticals, retail, and logistics. Furthermore, the United States' extensive network of distribution channels and well-established retail sector provides many opportunities for printed label manufacturers to reach a vast consumer base.

The market's dynamism, coupled with its commitment to innovation, positions the United States as a dominant force in the global printed labels market on a global scale.

| Country | China |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 4.8 billion |

| CAGR % 2025 to End of Forecast (2035) | 5.2% |

China has made significant strides in digital printing technologies, such as UV and laser printing, allowing for high-resolution and precise label printing. This technological prowess positions Chinese manufacturers at the forefront of innovation in the industry, attracting both domestic and international clients seeking cutting-edge printing solutions.

The country has experienced a digital revolution, with a vast number of consumers embracing online shopping and mobile commerce. This has created a tremendous demand for printed labels that provide secure and convenient packaging, delivery tracking, and brand identification for online purchases.

Chinese companies have responded to this demand by offering specialized label solutions for e-commerce, including tamper-evident labels, QR codes, and variable data printing.

With its technological prowess, booming e-commerce sector, favourable geographic location, and government support, China's expected notable growth potential in the printed labels market positions it as a key player and a driving force for the industry's future development.

The pressure sensitive labels segment is expected to dominate the printed labels industry with a CAGR of 4.9% from 2025 to 2035. Pressure-sensitive labels hold a major market share in the printed labels industry due to their unique characteristics and advantages.

Pressure-sensitive labels are highly preferred for their ease of application, making them suitable for both manual and automatic labeling processes across various industries.

Additionally, pressure-sensitive labels are known for their durability and resistance to moisture, chemicals, and abrasion, ensuring that the label remains intact and legible throughout the product's lifecycle.

The food segment is expected to dominate the printed labels industry with a CAGR of 5.1% from 2025 to 2035. Food products require labels that provide clear and accurate information about ingredients, allergens, nutritional values, expiration dates, and proper handling instructions.

Compliance with food safety regulations is of utmost importance, and printed labels help to convey vital information to consumers, promoting transparency and trust in the food supply chain. As the food service industry continues to prioritize food safety, product information, and branding, the demand for printed labels remains strong.

In the fiercely competitive printed labels market, market players employ innovative strategies to maintain a strong competitive edge. By leveraging AR technology, companies can create interactive labels that provide an immersive and engaging experience for consumers.

These labels can be scanned using a smartphone or tablet, unlocking digital content such as product information, videos, or promotional offers. By staying at the forefront of technology and leveraging unique experiences, companies can forge stronger connections with consumers and stay ahead of their competitors in the printed labels market.

Key Strategies in Printed Labels Market:

Product Innovation

Product innovation in this industry is the development of smart labels embedded with sensors and data-tracking capabilities. This innovative approach not only enhances product safety and efficiency but also opens up new possibilities for supply chain optimization, consumer engagement, and brand transparency.

Customization:

Customization is particularly valuable in industries like pharmaceuticals, where each product requires unique identification and tracking. Additionally, variable data printing techniques allows for targeted marketing campaigns by printed labels with personalized messages or offers tailored to specific customer segments.

Sustainability:

Sustainability in this market is the utilization of innovative materials derived from renewable sources. Market players are exploring options such as plant-based or bio-based label materials that reduce dependence on fossil fuels and have a lower carbon footprint.

For instance, labels made from bamboo, sugarcane, or other agricultural residues offer an eco-friendly alternative to traditional petroleum-based materials.

Additionally, companies are exploring water-based or solvent-free inks that minimize harmful volatile organic compounds and reduce environmental impact during the printing process.

Strategic Expansion:

Strategic expansion is a key aspect of staying competitive in the printed labels market, and market players employ various unique approaches to broaden their reach and capture new opportunities. Strategic expansion approach positions market players as trusted partners capable of delivering seamless and integrated labeling solutions, giving them a competitive advantage over standalone label providers in the market.

The global printed labels market is estimated to be valued at USD 29.0 billion in 2025.

The market size for the printed labels market is projected to reach USD 43.4 billion by 2035.

The printed labels market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in printed labels market are pressure sensitive labels (psl), shrink labels, stretch labels, wet glue labels and others (in-mold, pre-gummed, etc.).

In terms of material, plastic segment to command 58.3% share in the printed labels market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of 3D-Printed Stickers & Labels Manufacturers

3D-Printed Stickers & Labels Market Growth – Trends & Forecast 2024-2034

Printed Electronics Market Size and Share Forecast Outlook 2025 to 2035

Printed Chipless RFID Radio Frequency Identification Market Size and Share Forecast Outlook 2025 to 2035

Printed Sensors Market Size and Share Forecast Outlook 2025 to 2035

Printed Circuit Board (PCB) Assembly Market Size and Share Forecast Outlook 2025 to 2035

Printed Tape Market Size and Share Forecast Outlook 2025 to 2035

Printed Antenna Market Size and Share Forecast Outlook 2025 to 2035

Printed Electronics Devices Market Size and Share Forecast Outlook 2025 to 2035

Printed Aluminium Foil Packaging Market Size and Share Forecast Outlook 2025 to 2035

Printed and Flexible Sensors Market Report - Growth & Demand 2025 to 2035

Printed Circuit Boards (PCB) Market Trends - Demand & Forecast 2025 to 2035

Printed Plastic Films Market Insights - Growth & Forecast 2025 to 2035

Printed Boxes Market Analysis – Trends, Demand & Forecast 2025 to 2035

Industry Share & Competitive Positioning in Printed Aluminium Foil Packaging

Market Share Distribution Among Printed Carton Manufacturers

3D Printed Dental Brace Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Prosthetic Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Maxillofacial Implants Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Personalized Masks Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA