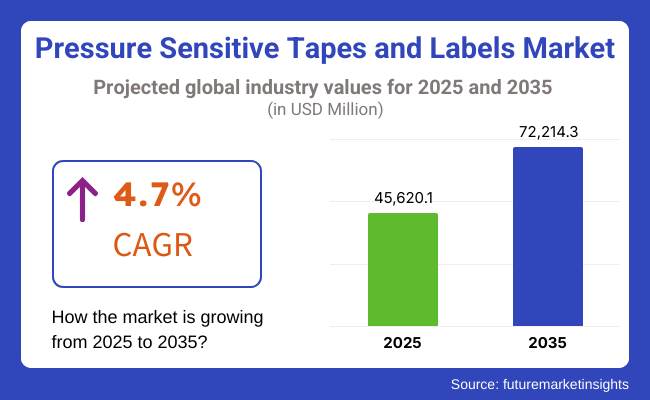

The market size of pressure-sensitive tapes and labels is estimated to reach USD 45,620.1 million in 2025 and is likely to reach a value of USD 72,214.3 million by 2035. Sales are expected to increase at a CAGR of 4.7% during the forecast period of 2025 to 2035. Revenue from pressure-sensitive tapes and labels in 2024 was USD 42,755.8 million.

Pressure-sensitive tapes and labels are increasingly used in industries such as automotive, electronics, packaging, and healthcare. The demand is driven by their versatility, ease of application, and ability to be used across multiple substrates. Tapes and labels are crucial for product labelling, securing packaging, and facilitating quick, effective branding, making them essential for businesses in various sectors.

The rise of e-commerce and the growing focus on sustainable packaging are expected to propel the growth of the pressure-sensitive tapes and labels market. Additionally, increasing consumer demand for innovative and easy-to-use packaging solutions is boosting the growth of this market.

In terms of type, acrylic-based pressure-sensitive tapes and labels are expected to dominate, capturing over 40% of the market share by 2035. Acrylic-based solutions are widely used due to their excellent adhesion properties, durability, and resistance to UV light, moisture, and other environmental factors.

They are used in applications ranging from labelling products in retail to heavy-duty industrial tasks. The rising demand for eco-friendly products is also pushing the growth of acrylic-based solutions as they are more sustainable than many other types.

The market of pressure-sensitive tapes and labels is expected to expand significantly, offering incremental opportunities amounting to USD 26,594.2 million by 2035 and will increase by 1.9 times its existing value during the forecast period.

Explore FMI!

Book a free demo

The table below presents the expected CAGR for the global pressure-sensitive tapes and labels market over several semi-annual periods spanning from 2025 to 2035.

| Particular | Value CAGR |

|---|---|

| H1 | 5.2% (2024 to 2034) |

| H2 | 4.8% (2024 to 2034) |

| H1 | 5.5% (2025 to 2035) |

| H2 | 4.5% (2025 to 2035) |

In the first half (H1) of the decade from 2024 to 2034, the market is predicted to grow at a CAGR of 5.2%, followed by a slightly lower growth rate of 4.8% in the second half (H2) of the same period. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is expected to decrease slightly to 5.5% in the first half and rise to 4.5% in the second half. In H1, the market is expected to witness a slight decline of 70 BPS, while in H2, an increase of 70 BPS is projected.

Rising Consumer Preference for Sustainable and Customizable Packaging Solutions is Driving Market Growth

With the great demand for sustainable and customised packaging pressure, sensitive tapes and labels are gaining popularity. These are made from recyclable materials and allow companies to achieve sustainability targets while being easily brandable and product identifiable. In addition to this, the flexibility of customisation in designs, size and materials is another driver leading to more consumer demand for customised solutions both in consumer and industrial sectors.

E-commerce Growth is Boosting the Demand for Packaging Solutions

The growth of e-commerce has surged the demand for packaging solutions, such as pressure-sensitive tapes and labels. The use of these types of products is critical for labelling and securing packages for transport and delivery to ensure that products reach consumers safely and securely. With changing shopping habits and a growing number of online purchases, the demand for these solutions has risen significantly, as these tapes and labels are being used for product packaging, shipping labels, branding, etc.

Focus on Reducing Packaging Waste Promotes Market Growth

The shift towards sustainable pressure-sensitive tapes and labels is expected to increase with companies and governments tightening regulations on packaging waste. The ability of pressure-sensitive tapes and labels is attracting businesses to minimise their environmental impact. Innovations in adhesive technologies that enhance recyclability serve the market to strive in response to global sustainability initiatives.

Challenges Related to Raw Material Costs and Supply Chain Disruptions

Fluctuation in the price of raw materials, particularly paper and plastic films, is one of the key factors hampering the growth of the pressure-sensitive tapes and labels market. Production timelines and cost efficiency have also been affected by supply chain disruptions, especially considering global events. Manufacturers face a significant challenge in high production costs, compounded by rising prices for raw materials. Also, the growing demand for green alternatives has necessitated R&D investments to maintain sustainability without compromising performance.

| Key Investment Area | Why It’s Critical for Future Growth |

|---|---|

| Sustainable Materials | To align with increasing demand for eco-friendly alternatives to traditional adhesives and reduce plastic waste. |

| Smart & Interactive Labels | To cater to the growing need for enhanced functionality, such as QR codes, RFID, and other interactive technologies. |

| Automation in Production | To improve manufacturing efficiency, reduce costs, and meet global demand in a cost-competitive market. |

| Customization & Design Innovation | To address the growing trend for unique branding, product differentiation, and high-quality design aesthetics. |

| Regulatory Compliance & Adaptation | To comply with environmental and safety regulations across multiple regions, especially regarding VOC emissions and recyclability. |

| Market Aspect | 2025 to 2035 (Future Projections) |

|---|---|

| Market Growth | Accelerated expansion (~4.7% CAGR) with regulatory shifts and demand for eco-friendly labels. |

| Sustainability Push | Full-scale shift to sustainable pressure-sensitive adhesives, zero-waste labelling solutions. |

| Raw Materials | Exploration of bio-based, sustainable raw materials (e.g., algae-based films, biodegradable adhesives). |

| Technology & Automation | AI, robotics, and advanced coating technologies allow for mass customisation and higher efficiency. |

| Product Innovation | Integration of smart labels with RFID, NFC, and temperature-sensing capabilities. |

| Cost & Pricing | Automation reduces production costs, making sustainable and functional tapes more affordable. |

| Industry Adoption | Expanding to automotive, pharmaceuticals, and high-end consumer goods packaging. |

| Customisation | Hyper-customized solutions with digital printing, embossing, and personalised designs. |

| Regulatory Influence | Stricter global regulations demand full recyclability, reduced emissions, and eco-friendly adhesives. |

| E-commerce Influence | Full integration of interactive and sustainable labelling standards for e-commerce packaging. |

| Circular Economy | Widespread adoption of reusable adhesive tapes and labels in circular packaging models. |

| Factor | Manufacturer Priorities (2019 to 2024) & (2025 to 2035) |

|---|---|

| Sustainability |

|

| Cost & Pricing |

|

| Performance (Durability, Moisture Resistance, Strength) |

|

| Aesthetics & Branding |

|

| Product Availability & Convenience |

|

| Food Safety & Hygiene |

|

| Reusability & Circular Economy |

|

Tier 1 Companies

Tier 1 Market leaders have a high market share in the global pressure-sensitive tapes and labels market. They are characterised by their massive production capacities, broad product portfolio, and large technical expertise. They have a very strong presence across the regions, backed by a good consumer base.

These companies offer an array of products, such as adhesive tapes, labels, and bespoke solutions, leveraging cutting-edge technologies around custom adhesives, printed solutions, and sustainable materials wherever possible. Some of the major Tier 1 companies are 3M, Avery Dennison, Uline, Scotch, Henkel, Tesa SE, Intertape Polymer Group, and Nitto Denko Corporation.

Tier 2 Companies

The Tier 2 companies are regional or niche players. These companies have excellent regional footprints, are super influential in local markets and offer competitive products with a strong tech stack. These are not as famous as Tier 1 players but are known for their niche capabilities in pressure-sensitive tapes and labels.

They have a proven track record of good regulatory compliance and proven solutions to these applications. Shurtape Technologies, LLC, Grafix, Inc., Cantech Industries, Kraton Polymers, Mactac, Bostik, ExxonMobil, and Tachii Industrial Co are some of the tier 2 companies.

Tier 3 Companies

Tier 3 companies are the smaller players, often focused on a geographic region and targeted in niche categories. These companies tend to cater to defined customer needs, often serving custom or low-volume orders. However, they lack cutting-edge technology or a wide geographical coverage, and they offer value in niche applications due to their flexibility and customizability.

Tier 3 companies usually serve smaller markets or have specialised offerings for pressure-sensitive tapes and labels. Many of these companies are unorganised or in less formal environments, with little opportunity for extensive market penetration. Versions of these products have been attempting to solve referential questions, contextual and conversational, where appropriate.

The countries, including China, Japan and India, have witnessed steady growth from 2019 to 2024. The adoption of pressure-sensitive labels increased, especially in the food and beverage sector. The rise in e-commerce also fuelled demand for labelling solutions.

In the following decade, rapid growth with China led the way. India, Vietnam, and Indonesia will witness a significant adoption due to the rise of e-commerce, industrial growth and regulatory shifts towards eco-friendly packaging. High growth in demand for sustainable tapes and labels.

Due to rising acceptance across automotive, pharmaceutical, and packaging industries, strong demand. Regulatory pressures were pushing for sustainable solutions during the past period. Countries such as Germany and France experienced the highest growth in eco-certified label and tape sales.

With the EU pushing for sustainability, the region is anticipated to move in the recyclable and green direction for pressure-sensitive products by 2035. The rising energy demand, coupled with the generation of consumer and industrial sectors, is expected to grow the market.

Latin America observed Low adoption of pressure-sensitive tapes and labels, i.e. 940-973 (but some progress in SA). Regulatory barriers, high costs and a lack of local production facilities hampered growth in the past.

With their burgeoning industrial and retail sectors, the UAE and Saudi Arabia are projected to witness growth in the Middle East in the upcoming years. These regions will witness the push from global brands for sustainable products.

Over the past years, the demand for pressure tapes and labels has witnessed robust growth, particularly due to their usage in automotive, consumer goods and healthcare domains. The boom of online retailing led to a much higher demand for packaging solutions.

Sustainable and smart labelling solutions, particularly in healthcare, e-commerce, and consumer electronics, are driving continued growth. RFID labels and recyclable tapes will see increases in North America in the next 10 years.

In the past years, regions including India and Southeast Asia have seen significant expansion in the sector. Low-cost structures were chiefly adopted in packaging, while some advances were also made in automotive.

India will drive overall growth, supported by a strong regulatory backdrop for sustainable packaging solutions in the upcoming years. Also, the availability of cost-effective tapes and labels will lead to increased demand coupled with innovation in the eco-friendly and biodegradable material used.

The following outlines key countries and their projected growth in the pressure-sensitive tapes and labels market from 2025 to 2035:

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 4.2% |

| India | 5.9% |

| Germany | 3.1% |

| China | 5.7% |

| Brazil | 4.2% |

| United Kingdom | 3.9% |

| Canada | 4.5% |

In the United States, the demand for pressure-sensitive labels is increasing, especially in sectors like retail, pharmaceuticals, and consumer electronics. With the growth of e-commerce, labels need to do more than just identify products-they must also provide additional functionalities such as anti-counterfeiting, RFID integration, and tracking.

Pressure-sensitive labels, a common sight, are increasingly used for inventory management, logistics and security, especially when they have RFID or NFC functionality. Moreover, the increasing trend of eco-conscious consumers to make their products sustainable, recyclable, and biodegradable label options is driving the growth of the market.

Germany is regarded for its strict environmental legislation. It is expected to rise in the pressure-sensitive tapes and labels market, especially for food and beverage, pharmaceuticals, and automotive application industries. The companies are now applying their energy to alternative packaging materials as the government strives to reduce waste and increase sustainability.

There is an increasing demand for recyclable or biodegradable pressure-sensitive labels, particularly in the food industry, due to the need for traceability and compliance with eco-regulations. Such trends are likely to drive the market as consumers in Germany want sustainable packaging.

The section contains information about the leading segments in the pressure-sensitive tapes and labels market. In terms of application, packaging is estimated to account for a share of 44.2% by 2035. By adhesive type, acrylic-based adhesives are projected to dominate with a share of 41.3% by the end of 2035.

Pressure-sensitive Tapes & Labels Market: By Sub-segment

The packaging segment is the largest and most dominant sub-segment of the pressure-sensitive tapes & labels market. These products play a crucial role in packaging solutions for multiple sectors, including food and beverage, consumer goods, pharmaceuticals, and logistics.

The e-commerce and online shopping trends have increased the demand for labels and tapes used in the packaging of products, which is contributing towards solid growth of the market. Pressure-sensitive tapes and labels are flexible and economical and provide outstanding durability in storage and transportation.

Seal and brand the products, which makes them essential for businesses that want to guarantee the safe and effective delivery of their goods. Moreover, this segment's growth is also propelled by the pressure for sustainable packaging and the rising consumer demand for eco-friendly products.

| Product Type | Market Share (2025) |

|---|---|

| Packaging | 44.2% |

Acrylic adhesives are gaining traction in the pressure-sensitive tapes and labels industry owing to their excellent adhesive strength, UV stability, and high-temperature resistance. This type of adhesive is commonly used in packaging, automotive, and industrial applications.

Acrylic adhesives support the global need for eco-friendly materials due to their low VOC emission levels and recyclability in certain applications. Additionally, their adoption as various industries work towards reducing their environmental footprint. Rising disposable income and changing lifestyles are facilitating the production of sustainable packaging solutions with significant demand for acrylic-based adhesives having the properties of being environmentally and functionally compatible, which is leading to cost-effective solutions that are durable, long-lasting, and performance-driven.

| Source | Market Share (2025) |

|---|---|

| Acrylic Adhesive | 41.3% |

Key players in the industry are continuously innovating and launching new products and developing strategic alliances. They are emphasising their position in the market by expanding geographic reach and acquisitions and announcing mergers and partnerships. The primary suppliers are also looking for new markets in up-and-coming regions where the need for pressure-sensitive solutions is developing effectively.

| Manufacturer | 2025 to 2035 (Future Priorities) |

|---|---|

| 3M | Increasing investments in eco-friendly materials and solutions. Expanding portfolio in consumer and healthcare sectors. |

| Avery Dennison | Greater emphasis on sustainable packaging materials. Focusing on smart labels and RFID technology integration. |

| Scotch® (by 3M) | Increasing focus on product recyclability and sustainability across global markets. |

| UPM-Kymmene | Transitioning to fully sustainable, compostable, and recyclable products. Expanding eco-labelling solutions. |

| Henkel | Continued development of sustainable adhesive solutions and improved recyclability in packaging. |

| LINTEC Corporation | Focus on high-performance adhesives for packaging and expanding in digital and RFID labelling markets. |

| Berry Global Group | Investing in innovative technologies to reduce the environmental impact of tape and labels, with a focus on circular economy practices. |

| Intertape Polymer Group | Developing advanced tape solutions with sustainable adhesive and backing technologies. |

| Mactac | Expansion into digital and eco-friendly label solutions, with increased focus on reducing plastic usage. |

| Sappi Lanier | Focus on enhancing sustainability efforts with bio-based and recyclable label stock products. |

Key Developments in the Pressure Sensitive Tapes and Labels Market

| Company Strategy | Development |

|---|---|

| Product Launch | Scotch® (by 3M) launched a new line of pressure-sensitive tapes using a bio-based adhesive that offers superior bonding strength while being environmentally friendly. This innovation aligns with the growing demand for sustainable packaging solutions. |

| Partnership | Henkel partnered with a major packaging company to introduce a new line of eco-friendly pressure-sensitive labels for packaging. This collaboration aims to reduce the carbon footprint of packaging and make recycling more efficient. |

| Acquisition | Berry Global completed the acquisition of RPC Group, expanding its portfolio of packaging solutions, including pressure-sensitive tapes and labels, to further strengthen its position in the global market. |

| Acquisition | Avery Dennison acquired Mactac, allowing it to enhance its capabilities in the high-performance adhesive and labelling market. This acquisition will boost its sustainability goals and expand its product offerings in various industries. |

| Certification | 3M received the FSC® certification for its paper-based tapes and labels, highlighting its commitment to sustainable practices in the industry. |

| Acquisition | Intertape Polymer Group acquired Polyair, expanding its presence in the protective packaging and pressure-sensitive adhesive tape markets positioning it for growth in e-commerce and logistics packaging. |

| Product Launch | UPM-Kymmene introduced a new range of pressure-sensitive labels made from renewable resources, further strengthening its position in the market for sustainable labelling solutions. |

| Partnership | Scotch® (by 3M) partnered with Tetra Pak to provide eco-friendly adhesive labelling solutions for the food and beverage packaging industry. |

| Manufacturer | Vendor Insights |

|---|---|

| 3M Company | 3M has maintained a strong market position due to its innovations in adhesive technologies and extensive product offerings across various industries. |

| Avery Dennison Corporation | Avery Dennison has experienced steady growth, driven by its leadership in sustainable labelling solutions and continuous product innovation. |

| Henkel AG & Co. KGaA | Henkel's growth is attributed to its diverse portfolio of pressure-sensitive adhesives and strategic expansions in emerging markets. |

| UPM-Kymmene Corporation | UPM has focused on eco-friendly labelling solutions and has experienced market growth due to its sustainability-focused initiatives. |

| Sappi Limited | Sappi has grown by expanding its pressure-sensitive paper products and focusing on the packaging segment. |

| Intertape Polymer Group | Intertape has strengthened its position by providing a wide range of pressure-sensitive tapes used across various industrial and consumer applications. |

| Scotch (A division of 3M) | Scotch continues to lead in both consumer and industrial segments with a strong focus on the durability and versatility of its tape products. |

| Tesa SE | Tesa’s growth is attributed to its innovations in high-performance adhesive solutions and focus on the automotive and industrial sectors. |

| Shurtape Technologies, LLC | Shurtape has maintained strong market growth by focusing on both professional and consumer products, including packaging and masking tapes. |

| Beiersdorf AG | Beiersdorf has expanded its market share with sustainable adhesive solutions, focusing on packaging and medical applications. |

| Lintec Corporation | Lintec has increased its market presence through the development of high-quality labels and tapes for industrial and retail applications. |

| Mactac (a division of Lintec) | Mactac’s market presence has grown due to its cutting-edge technology in pressure-sensitive adhesives, particularly in labels for consumer goods. |

| Innovia Films | Innovia has capitalised on the growing demand for sustainable and recyclable labels, focusing on biodegradable films. |

| Cenveo | Cenveo’s strategic acquisitions have bolstered its presence in the label printing and packaging segments, supporting steady market growth. |

| Essentra | Essentra has expanded its market share by diversifying into speciality tapes and labels, with a focus on niche markets such as healthcare and electronics. |

| American Biltrite Inc. | American Biltrite has seen growth through strategic partnerships in the industrial and automotive sectors, focusing on high-performance tapes. |

| Siegwerk Druckfarben AG & Co. | Siegwerk has innovated in packaging and labels with its sustainable, high-quality ink and adhesive solutions for flexible packaging. |

| Ritrama | Ritrama has gained market share by specialising in digital and custom printed labels, focusing on flexible and durable applications. |

| Multicolor Corporation | Multicolor has expanded its market presence with a focus on colour technology and premium-label products for consumer goods. |

| Kimberly-Clark Corporation | Kimberly-Clark’s market position remains strong due to its diverse adhesive technologies, particularly in medical and hygiene products. |

Here is a growth in demand for pressure-sensitive tapes and labels across various applications, which is expected to drive market growth over time. Stakeholders should focus on:

Sustainability: As sustainability becomes a key priority for consumers and businesses, improvements in eco-friendly adhesives and recyclable materials are vital.

Technological Innovations: Investing in smart labels, RFID technologies, and digital printing will open doors to emerging opportunities in succeeding markets like retail, healthcare, and automotive applications.

Geographic Expansion: Companies need to explore opportunities for growth in emerging markets where the demand for packaged goods and logistics services is increasing at a rapid pace.

Customisation: Providing tailored solutions for niche industries like food & beverage, pharmaceuticals, and electronics will boost product differentiation and market presence.

Collaborations: This will include partnerships among manufacturers, suppliers and retailers to drive innovation and deploy new standards, especially for biodegradable tapes and labels.

By focusing on these strategies, stakeholders can inspire managers to explore the strategies to attain a sustainable advantage in the sensitive tapes and labels sector.

The pressure-sensitive tapes and labels industry is projected to witness a CAGR of 4.7% from 2025 to 2035.

The global market for pressure-sensitive tapes and labels stood at USD 45,620.1 million in 2025.

The market is anticipated to reach USD 72,214.3 million by 2035.

South Asia & Pacific is expected to record a CAGR of 6.2% during the assessment period.

Key players include 3M, Avery Dennison, Henkel, Tesa, and UPM-Kymmene Corporation.

Nitrogen Flushing Machine Market Analysis by Automatic and Semi-Automatic Through 2035

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Perfume Filling Machine Market Analysis by Automatic Perfume Filling Machines and Manual Perfume Filling Machines Through 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.