Experts say that the global prepreg market (pre-impregnated composite fibers) will continue to grow at a fast rate through 2024, driven by demand in aerospace, automotive, wind energy, and sports equipment. Aerospace manufacturers are using more light carbon fiber prepregs to meet fuel efficiency and environmental sustainability standards in 2024, reflecting this trend. Major aircraft producers like Boeing and Airbus increased manufacturing capacity, ramping up bulk consumption of next-generation composite materials.

In automotive, electric vehicle (EV) producers further leveraged high-performance thermosets and thermoplastic prepregs for lightweight cars for battery endurance. In 2023, Tesla and other major automakers partnered with prepreg composite suppliers to introduce prepreg-based structural components, increasing adoption rates by 15%.

In 2024, the rising demand for offshore wind turbine blades, driven by global clean-energy initiatives, further boosted the prepreg market. The introduction of next-generation wind turbines, featuring longer and more durable blades, significantly boosted prepreg demand.

Fast-forward to 2025 and beyond; steady growth for the industry is expected because of improvements in resin systems, automation of prepreg production, and new applications in medical and industrial industries. By 2035, the industry is expected to reach a value of USD 28.68 billion, with a compound annual growth rate (CAGR) of 11%, driven by the increasing demand for lightweight and high-tensile strength materials in major industries.

Industry Forecast Table

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 10.1 billion |

| Industry Value (2035F) | USD 28.68 billion |

| CAGR (2025 to 2035) | 11% |

The Future Market Insights study maps key players in the prepreg (pre-impregnated composite fibers) sector to provide insights into their market footprint. The results show 100% agreement within the industry about the demand for lightweight composites, with 72% of respondents citing fuel efficiency regulations and sustainability mandates as key growth drivers.

Supply chain resilience became a critical topic, with over 60% of manufacturers citing challenges with raw material sourcing and logistics. High costs of carbon fibers and epoxy resins have led end-users to explore alternative materials and localize supply chains to ensure uninterrupted production. Prepreg production automation was identified as a significant trend, with 47% of respondents investing in automated lay-up processes to enhance efficiency and minimize waste.

The poll also noted a shift in end-use applications in electric vehicles (EVs) and renewables. Nearly 55% of automaker respondents plan to incorporate prepreg-based structural components to enhance EV efficiency and reduce weight. In contrast, wind energy manufacturers reported a shift towards prepregs for longer, high-performance turbine blades that work in extreme environments.

| Country | Key Regulations & Certifications |

|---|---|

| United States | These regulations include the Federal Aviation Administration (FAA) regulations (14 CFR Part 25) for aerospace materials, ASTM composites standards, the environmental regulations of the Environmental Protection Agency (EPA) for so-called green production, and the design requirements for automobiles by the Department of Transportation (DOT). |

| United Kingdom | Manufacturers must comply with UK REACH rules and BSI Standards (BS EN 9100) for aerospace composites. The Civil Aviation Authority (CAA) must also approve the use of prepreg in aircraft. |

| France | Certifications: Aerospace: EASA Part 21 & 145, AFNOR standards-composite materials; Automotive: Low-emission vehicle regulations-automotive composites. |

| Germany | The company adheres to DIN composite material standards, TÜV structural integrity certification for automotive and wind power, and EU Green Deal conformance for green manufacturing. |

| Italy | EU REACH, RINA marine composite certification, and automotive materials regulations for lightweight vehicle production. |

| South Korea | The Korean aerospace and automotive composite standards, the KEITI eco-labeling for resource-efficient production, and the government regulations of KAA in carbon fiber application are all important factors. |

| Japan | JIS prepreg material standards and the JCAB and METI green material regulations are governed by the JIS standards and JCAB/METI regulations. |

| China | MIIT policies encourage domestic carbon fiber production, CAAC certification requirements for aerospace composites, and China's REACH regulatory compliance for chemical safety during prepreg manufacture. |

| Australia & New Zealand | CASA prepregs for aerospace, AS/NZS standards for structural composites, and Clean Energy Council wind energy guidelines. |

| India | Composite material meeting BIS guidelines, DGCA approval to be used in aerospace sectors, and FAME-II standards driving its usage in EV manufacturing. |

The USA prepreg industry is projected to grow at a CAGR of 10.5% between 2025 and 2035, driven by demand from aerospace, defense, automotive, and wind energy sectors. Boeing and Lockheed Martin are pioneering next-generation aircraft using carbon fiber prepregs, while electric vehicles such as Tesla and General Motors are increasing their use of lightweight composite materials.

The United States wind power industry is also on a growth spurt and even making big spending commitments on offshore wind farms. Also, strict FAA safety rules and government incentives for manufacturing that do not release greenhouse gases keep the use of high-performance prepregs growing in many areas.

The UK prereg industry is expected to grow at 9.8% CAGR between 2025 and 2035, driven by competitive aerospace, automotive, and renewable energy sectors. The increasing prepreg utilization in the automotive industry, particularly in Jaguar Land Rover and Aston Martin, is driving innovation in the emerging EV industry. In the UK, the government’s production target of 50 GW (gigawatts) of offshore wind energy by 2030 is fuelling demand for glass and carbon fiber prepregs for huge wind turbine blades.

The prepreg industry within France is projected to have a CAGR of 10.2% until 2035, driven by aerospace, defense, and automotive. Advancements in the application of carbon fiber prepreg to aircraft are progressing for both Airbus and Dassault Aviation, according to the French government, through their sustainable aviation policy. In addition, big investments in EV lightweight solutions are also happening, with Renault and Peugeot closing in on thermoplastic prepregs to improve automotive efficiency. However, the French wind energy industry demonstrates resilience by adopting high-performance prepreg materials in the rotor blades of wind turbines.

Germany will experience one of the fastest-growing prepreg demands in Europe, with a projected CAGR of 10.7% from 2025 to 2035. Germany’s nationally recognized automotive industry, including Volkswagen, BMW, and Mercedes-Benz, is driving demand for carbon fiber and thermoplastic primers for next-generation EVs, notes Stringer. Germany’s rapid expansion of wind energy, along with high aerospace demand from Airbus’ German factories, is driving the need for advanced composite turbine blade technologies. The quality-orientated production of composites integrated with the TÜV certification system, which gives a strong commitment to quality, will promote the development of the industry.

Automotive, marine, and aerospace applications drive the Italian prepreg industry, with a CAGR of 9.5% until 2035. High-end car makers like Ferrari and Lamborghini use carbon fiber prepregs due to their need for performance and weight savings. Marine-grade composites are also big business in the luxury yacht industry, a pillar of the Italian economy. Kuyler added Italy's wind power industry is gradually expanding, increasing demand for glass fiber prepregs. On the other hand, the high prices of raw materials and restricted local fabrication capacity are restraining the industry's development.

The South Korean prepreg industry is expected to witness a high compound annual growth rate of 10.9% throughout the next 10 years (2025 to 2035) due to increased utilization of prepreg in aerospace, automotive, and electronics applications. South Korea’s two largest EV battery and auto material makers-Hyundai and Kia-now adopt lightweight vehicle parts using thermoplastic prepregs.

In the aerospace industry, Korea Aerospace Industries (KAI, Seoul, South Korea) is also increasing its use of carbon fiber prepregs on civilian and military planes. Further pushing the requirement for high-performance composite turbine blades is the government’s push towards green energy projects such as offshore wind farms.

The prepreg industry in Japan is expected to grow at a CAGR of 10.3% during the forecast period, owing to a significant automotive, aerospace, and electronics industry. Automotive sector development is trending towards electric vehicles (EVs): Major car manufacturers, such as Toyota and Honda, are adopting carbon and thermoplastic prepregs in EV vehicles to enhance efficiency and improve mileage.

Japan’s aerospace sector-led by Mitsubishi Heavy Industries-is likewise ramping up investments in light composites. The wind energy industry is still small, and government subsidies have also been lobbied for to build offshore wind farms. Japan’s stringent JIS standards require prepreg manufacturers to produce high-quality composite materials.

China will have the fastest-growing prepreg market, with a CAGR of 11.5% from 2025 to 2035, driven by rapid advancements in aerospace, EVs, and wind energy. The government's homegrown carbon fiber output plan and rising investments in high-speed rail and aircraft production stimulate demand for prepregs. Driven by industry leaders such as BYD and NIO, the Chinese electric car industry is rapidly adopting. The scale of China's wind power sector has surpassed any other country and is quickly becoming the largest consumer of glass fiber preparations for giant turbines.

The region's prepreg market is expected to grow at a CAGR of 9.2% until 2035, driven by aerospace and wind energy applications. In Australia, the Civil Aviation Safety Authority, CASA, has elevated the use of composites to the standard of civil aviation. As such, the expanding offshore wind energy industry is leading to demand for large-scale turbine blades, with large-scale projects in line. The marine sector is another growth driver, with high-performance yachts and boats using prepreg-based composite materials. However, local manufacturing capacity is still limited.

India's prepreg industry is projected to grow at a compound annual growth rate (CAGR) of 10.8% through 2035, driven by applications in automotive, aerospace, and wind energy. This rise of EVs is fuelled by the government and its policy to use alternative fuels-the FAME-II policy-which has resulted in strong demand for lightweight thermoplastic primers in EVs.

HAL and ISRO are increasing their use of composite carbon fibers to manufacture fighter aircraft and satellite parts. The wind energy sector is also booming, with significant investment in onshore and offshore wind projects driving demand for glass fiber preparations. At the same time, the Made in India campaign encourages domestic manufacturing to reduce reliance on imports.

Carbon fiber prepreg is the leading segment, which commands a large share due to its high strength-to-weight ratio, fatigue and corrosion resistance, and durability. The aerospace and defense segment is the largest end-user, in which large aircraft manufacturers use carbon fiber prepregs in fuselages, wings, and structural parts. Within the automotive sphere, more and more manufacturers are also taking advantage of the properties of carbon fiber prepregs in EVs to help improve efficiency by ensuring that weight is kept to a minimum.

The growth in wind energy applications, especially for offshore wind turbine blades, is generating demand. Within this segment, glass fiber prepreg is experiencing rapid growth, driven by its lower costs, electrical insulating properties, and growing applications in wind energy and electronics. With an increase in the deployment of renewable power projects worldwide, the demand for glass fiber prepregs will accelerate in turbine blade manufacturing. Due to their superior impact resistance compared to other prepregs, aramid fiber prepregs are widely used in defense, ballistic products, and lightweight body armor; however, they remain a niche application compared to carbon fiber and glass fiber prepregs.

Thermoset prepregs dominate the industry due to their extensive use in aerospace, wind power, and automotive industries. Thermoset resins like epoxy, phenolic, and bismaleimide (BMI) have enhanced mechanical properties, heat resistance, and durability, which is the reason they are used in aircraft structures, car body panels, and wind turbine blades. Epoxy-based prepregs are the most widely used due to their versatility and strong adhesion. The most rapidly growing industry, though, is thermoplastic prepregs, which are fueled by improved toughness, quicker cure, and recyclable nature.

The automotive and sporting goods industries use thermoplastic prepregs. They are easier to make because they can be shaped and reformed. Thermoplastic prepregs are also gaining ground in aerospace for next-gen aircraft designs, particularly for lightweight interior parts and secondary structures. The switch to sustainable materials is also accelerating the implementation of thermoplastic composites across various sectors.

Aerospace & Defense, the major application segment, dominates prime demand and is strongly supported by the requirement for lightweight, strong materials in aircraft production. The growing demand for air travel, fleet expansion, and next-generation aircraft development has manufacturers investing in carbon fiber preparations, which offer high mechanical properties and fuel efficiency. Key growth drivers also include defense uses (ballistic protection, UAVs, and fighter aircraft). The automotive sector is experiencing the fastest growth due to the preference for electric vehicles (EVs) and stringent fuel economy standards.

To meet carbon emissions targets, automakers are adopting prepreg-based lightweight materials to improve range and safety. Wind power is also a growing business, as demand for composite turbine blades, which need to be highly performant and have long durability, is growing thanks to the increasing installation of offshore wind farms. Also, the use of prepregs is growing steadily in electronics and sports equipment because they are being used more and more in structural reinforcements, high-performance equipment, and consumer electronics.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Despite the COVID-19 pandemic and the supply chain standstill, industry development was steady. | Dynamic growth is bolstered by tech innovation, automation, and localizing production to lessen supply risk. |

| Air transport was also weak, and this led to a delay in deliveries for aircraft production. | There is a strong demand for composite materials in next-generation aeroplanes, with new investments from high-end producers. |

| Prepreg usage remained extremely low compared to metallic lightweighting alternatives, mostly for the automotive industry. | Consequently, the global usage of prepregs in EVs has increased, improving range, safety, and efficiency. |

| Due to this change in government policy and project delays, the wind industry sector experienced some sporadic demand fluctuations. | Preparations to meet offshore wind demand are increasing as turbine blade installations rise. |

| The thermoset prepregs led to maximum industry share, with the epoxy-based type being the dominant one used. | On the other hand, there has been a strong growth of thermoplastic prepregs with recyclability, shorter processing time, and better mechanical properties. |

| High production costs and dependence on short-term raw material vendors led to price pressures. | Automation, new resin systems, and smart procurement of raw materials are improving cost-efficiency and profit margins. |

| North America and Europe continued to be the dominant industries, and the Asia-Pacific region saw steady growth. | The Asia-Pacific region is experiencing rapid growth. China, India, and South Korea lead aerospace, EV, and wind power. |

The global macroeconomic conditions strongly influence the prepreg industry. The aviation, automobile, and energy industries are especially sensitive to GDP growth, industrial production, and infrastructure spending demand, which is directly related to GDP growth, industrial production, and infrastructure spending. Growth of the industry is also supported by the use of more electric vehicles, in combination with stricter fuel-efficiency standards, which is pulling demand for lightweight composites. Similarly, investments in green energy, such as wind sourced from offshore facilities, are driving great consumption of glass and carbon fiber prepregs used in turbine blades.

Government policy and sustainability objectives are also key industry drivers. The demand for lightweight, fuel-efficient materials has surged due to global net-zero carbon emission goals. Supply chain disruptions have introduced geopolitical tensions that drive the regionalization of production and increase the emphasis on local sourcing of raw materials.

The industry faces risks from volatile raw material prices, technical barriers to mass production, and regulatory compliance costs. The industry is expected to grow beyond USD 32 billion by 2035, driven by advanced automation, low-cost thermoplastic prepregs, and bio-based resins.

Global innovative forces permeate the prepreg (pre-impregnated composite fibers) industry. The industry leaders, such as Toray Industries, Hexcel Corporation, Solvay, Gurit, and Mitsubishi Chemical, are taking major steps toward R&D with the inception of advanced thermoplastic and bio-based prepregs. Collaborations with aerospace, auto, and wind energy companies are helping to clarify supply chains. To meet this growing demand, firms are also upping their manufacturing presence in emerging high-growth industries like the Asia-Pacific. Cost savings initiatives and eco-friendly material innovations also serve as vital differentiators in this vibrant and dynamic space.

Toray Industries Inc.

Industry Share: ~25-30%

Toray is a leading global advanced material supplier and is a top prepreg industry-leading supplier through its high-performance carbon fiber composites. It maintained its position through its strong R&D strength and strategic alliances.

Hexcel Corporation

Industry Share: ~20-25%

Hexcel is a leading player in the prepreg industry due to its presence in the aerospace and industrial segments. It commands a substantial industry share due to its focus on innovation and sustainability.

Solvay S.A.

Industry Share: ~15-20%

Solvay is one of the top prepreg material suppliers, particularly for aerospace and automotive. Concentration of the Featherweight and High-Strength Composites Industry has improved its industry position.

Teijin Limited

Industry Share: ~10-15%

Teijin is a leading name in the prepreg industry, especially for high-end carbon fiber and thermoplastic composites. Teijin has been reinforcing its presence in the automotive and renewable energy sectors.

Gurit Holding AG

Industry Share: ~5-10%

Gurit is a leader in preparing material for wind and marine industries. Its focus on sustainable options has also helped it carve out a space in the industry.

SGL Carbon

Industry Share: ~5-10%

SGL Carbon is a leading supplier of carbon fiber-based prepregs with strong positions in the automotive and industrial industries. Their focus on innovation and affordability further drives company growth.

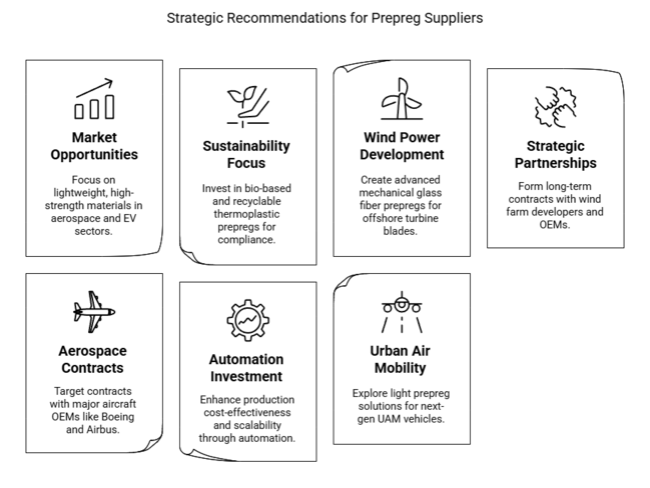

The growing demand for lightweight, high-strength materials in the aerospace and electric vehicles (EV) segments is a major growth opportunity for prepreg suppliers. This expansion of manufacturing capabilities in the Asia-Pacific industry, particularly in countries like China, India, and South Korea, would continue to yield benefits for companies looking for fast-paced industrialization and localization of composite manufacturing. Sustainability regulations are evolving, making an early investment in bio-based and recyclable thermoplastic prepregs a strategic advantage, ensuring compliance ahead of legal mandates in the USA and Europe.

However, in the case of wind power, companies must also focus on developing advanced mechanical glass fiber prepregs suitable for the large sizes of current offshore turbine blades. As governments around the world continue to raise their offshore wind energy targets, companies that can provide cost-effective, durable prepregs will therefore be well-placed competitively. Taking long-term contracts from wind farm developers and OEMs, through strategic partnerships, will be essential for ensuring supply chain stability.

For aerospace and defense vendors, successfully winning contracts with major aircraft OEMs, such as Boeing, and Airbus, and burgeoning space enterprises, will be paramount. Investing in automation will enhance cost-effectiveness and scalability in production. Vendors must also explore light prepreg solutions for next-generation urban air mobility (UAM) vehicles, a rapidly evolving sector with significant growth potential.

The industry is segmented into carbon fiber prepreg, glass fiber prepreg, and aramid fiber prepreg.

It is bifurcated into thermoset and thermoplastic.

It is fragmented among aerospace & defense, automotive, wind energy, sporting goods & electronics, and others.

The industry is studied across north American, Latin America, Europe, Asia Pacific, the Middle East, and Africa.

Prepregs are widely used in lightweight, durable, high-performance applications across key sectors, including aerospace, automotive, wind power, and sporting goods.

Automation of production techniques is improving consistency, reducing costs, and enabling high-volume production, especially of thermoplastic varieties.

However, more stringent environmental laws combined with desires for global sustainability mean that companies are already making recyclable and bio-based prepregs.

Long blades on turbines require lightweight, high-strength composites, making glass fiber prepregs essential for efficiency and longevity.

Firms are investing in local manufacturing, strategic raw material procurement, and partnerships with end-users to deliver secure supply with cost-competitiveness.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Meter) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Fiber, 2018 to 2033

Table 4: Global Market Volume (Meter) Forecast by Fiber, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Resin, 2018 to 2033

Table 6: Global Market Volume (Meter) Forecast by Resin, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (Meter) Forecast by Application, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Meter) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Fiber, 2018 to 2033

Table 12: North America Market Volume (Meter) Forecast by Fiber, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Resin, 2018 to 2033

Table 14: North America Market Volume (Meter) Forecast by Resin, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (Meter) Forecast by Application, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Meter) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Fiber, 2018 to 2033

Table 20: Latin America Market Volume (Meter) Forecast by Fiber, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Resin, 2018 to 2033

Table 22: Latin America Market Volume (Meter) Forecast by Resin, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Latin America Market Volume (Meter) Forecast by Application, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Meter) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Fiber, 2018 to 2033

Table 28: Europe Market Volume (Meter) Forecast by Fiber, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Resin, 2018 to 2033

Table 30: Europe Market Volume (Meter) Forecast by Resin, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: Europe Market Volume (Meter) Forecast by Application, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Meter) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Fiber, 2018 to 2033

Table 36: Asia Pacific Market Volume (Meter) Forecast by Fiber, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Resin, 2018 to 2033

Table 38: Asia Pacific Market Volume (Meter) Forecast by Resin, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Asia Pacific Market Volume (Meter) Forecast by Application, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Meter) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Fiber, 2018 to 2033

Table 44: MEA Market Volume (Meter) Forecast by Fiber, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Resin, 2018 to 2033

Table 46: MEA Market Volume (Meter) Forecast by Resin, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: MEA Market Volume (Meter) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Fiber, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Resin, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Meter) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Fiber, 2018 to 2033

Figure 10: Global Market Volume (Meter) Analysis by Fiber, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Fiber, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Fiber, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Resin, 2018 to 2033

Figure 14: Global Market Volume (Meter) Analysis by Resin, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Resin, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Resin, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 18: Global Market Volume (Meter) Analysis by Application, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Global Market Attractiveness by Fiber, 2023 to 2033

Figure 22: Global Market Attractiveness by Resin, 2023 to 2033

Figure 23: Global Market Attractiveness by Application, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Fiber, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Resin, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Meter) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Fiber, 2018 to 2033

Figure 34: North America Market Volume (Meter) Analysis by Fiber, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Fiber, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Fiber, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Resin, 2018 to 2033

Figure 38: North America Market Volume (Meter) Analysis by Resin, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Resin, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Resin, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 42: North America Market Volume (Meter) Analysis by Application, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 45: North America Market Attractiveness by Fiber, 2023 to 2033

Figure 46: North America Market Attractiveness by Resin, 2023 to 2033

Figure 47: North America Market Attractiveness by Application, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Fiber, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Resin, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Meter) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Fiber, 2018 to 2033

Figure 58: Latin America Market Volume (Meter) Analysis by Fiber, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Fiber, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Fiber, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Resin, 2018 to 2033

Figure 62: Latin America Market Volume (Meter) Analysis by Resin, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Resin, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Resin, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 66: Latin America Market Volume (Meter) Analysis by Application, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Fiber, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Resin, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Fiber, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Resin, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Meter) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Fiber, 2018 to 2033

Figure 82: Europe Market Volume (Meter) Analysis by Fiber, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Fiber, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Fiber, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Resin, 2018 to 2033

Figure 86: Europe Market Volume (Meter) Analysis by Resin, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Resin, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Resin, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 90: Europe Market Volume (Meter) Analysis by Application, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Europe Market Attractiveness by Fiber, 2023 to 2033

Figure 94: Europe Market Attractiveness by Resin, 2023 to 2033

Figure 95: Europe Market Attractiveness by Application, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Fiber, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Resin, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Meter) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Fiber, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Meter) Analysis by Fiber, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Fiber, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Fiber, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Resin, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Meter) Analysis by Resin, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Resin, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Resin, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Meter) Analysis by Application, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Fiber, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Resin, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Fiber, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Resin, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Meter) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Fiber, 2018 to 2033

Figure 130: MEA Market Volume (Meter) Analysis by Fiber, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Fiber, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Fiber, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Resin, 2018 to 2033

Figure 134: MEA Market Volume (Meter) Analysis by Resin, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Resin, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Resin, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 138: MEA Market Volume (Meter) Analysis by Application, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 141: MEA Market Attractiveness by Fiber, 2023 to 2033

Figure 142: MEA Market Attractiveness by Resin, 2023 to 2033

Figure 143: MEA Market Attractiveness by Application, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tow Prepreg Market Size and Share Forecast Outlook 2025 to 2035

Glass Prepreg Market Size and Share Forecast Outlook 2025 to 2035

Carbon Fibre Prepreg Market

Thermoplastic Prepreg Market Size and Share Forecast Outlook 2025 to 2035

Non-Woven Glass Fiber Prepreg Market 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA