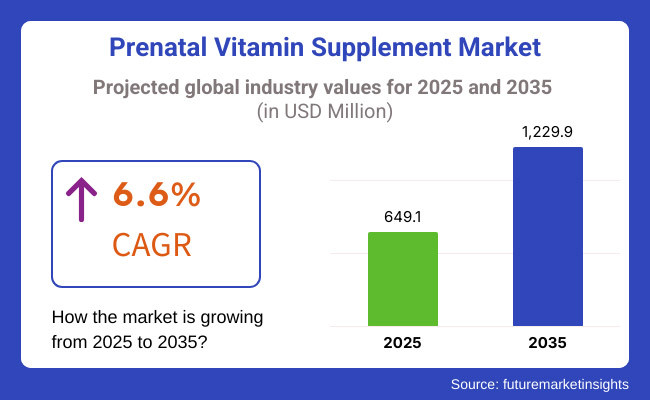

The prenatal vitamin supplement market is projected to grow from USD 649.1 million in 2025 to USD 1,229.9 million by 2035, registering a CAGR of 6.6% during the forecast period, driven by increasing maternal health awareness and the rising adoption of prenatal nutrition products.

The global prenatal vitamin supplements market is dreamy to grow from 2025 to 2035, propelled by rising maternal health consciousness, more healthcare deals, and changing consumer preferences towards available and personalized nutrition. As prenatal health still gaining priority, the market is anticipated to be the one that will see the largest innovations in formulation, delivery formats, and distribution channels, the long-term growth trajectory of which is set by them.

One of the main reasons for market expansion is the increasing consumer preference for clinically validated and bioavailable formulations. Expecting mothers now are more conscious of nutrient absorption obstacles, thus, the brands are now focusing on the use of methylated folate, algae-based DHA, chelated minerals, and liposomal vitamin C instead of other forms of these nutrients to achieve better bioavailability. For instance, Theralogix, Ritual, and Needed are the companies which are currently making the transition possible through the provision of OB-GYN-endorsed, scientifically based products.

The emergence of bioindividuality and artificial intelligence (AI) which guides supplement recommendations shall contribute to the further expansion of the market. Companies like Beli, Persona Nutrition, and Perelel Health are setting a remarkable trend in the communication of prenatal nutrition based on the genetic model and specific trimester diet; they are formulating diets that depend on one's genetic disposition, eating habits, and way of life. It is expected that this hyper-personalized strategy will transform the purchasing behavior of consumers in such a way that custom-made prenatal packs will become a common choice.

E-commerce will be the main propelling channel supported by the companies that prioritize the direct-to-consumer sales and subscription services model. Online portals such as Amazon, Tmall, and iHerb will be the key drivers for sales as the brands connect auto replenishment, supplement programming and use health tracker app which is based on AI to better customer relationship. They will also integrate pharmacies and healthcare providers who will expand their digital interface and thus fill the gap between online recommendations and the professional ones.

Though North America and Europe are presently in the forefront of the market, the Asia-Pacific, Latin America, and the Middle East regions are showing the signs of rapid adoption of the prenatal supplements as a result of the developed healthcare facilities, maternity programs, and the rising personal incomes. Trends like China+TCM and India+Ayurveda prenatal adding vitamins to the choice of market that is moving strongly towards use of TCM and Ayurveda are appearing in the countries.

Due to the stringent regulations set by the authorities on supplement safety, companies shall have to dedicate funds to independent testing, obviousness as well as ingredient tracking. The aspect of sustainability will also get in the act, with a concentration on plant-based, vegan-friendly, and ecologically responsible packaging options. Overall, the prenatal vitamin supplements industry will be a platform for great innovation and increased growth, which will change globally the manner in which maternal nutrition has been addressed.

Explore FMI!

Book a free demo

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global industry. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 6.2% (2024 to 2034) |

| H2 2024 | 6.8% (2024 to 2034) |

| H1 2025 | 6.4% (2025 to 2035) |

| H2 2025 | 7% (2025 to 2035) |

The global industry's predicted compound annual growth rate (CAGR) over a semi-annual period from 2025 to 2035 is shown in the above table. The business is anticipated to grow at a CAGR of 6.2% in the first half (H1) of 2024 and then slightly faster at 6.8% in the second half (H2) of the same year. The CAGR is anticipated to decrease somewhat to 6.4% in the first half of 2025 and continues to grow at 7% in the second half. The industry saw a decline of 30 basis points in the first half (H1 2025) and an increase of 40 basis points in the second half (H2 2025).

The Increasing Popularity of Multi-Stage Pregnancy Supplements Over Multi-Stage Pregnancy Supplements

The classic prenatal vitamin, with its one-size-fits-all component, is now being dethroned by multi-stage variations that are specifically made for preconception, every trimester, and postpartum recovery. Expecting mothers are in need of different nutrients at different pregnancy times-more folate and choline for neural tube development in the first trimester, more iron and calcium for fetus growth in the second trimester, and omega-3s and vitamin D for brain and immune system development in the third trimester.

After delivery, the need switches to the vitamins that help along lactation (B12, iodine) and those that balance mood (magnesium, DHA). For instance, the labels like Pink Stork and Needed are on-trend with them by, besides, pre-natal lines of specific stage. The OB-GYN support to this demand along with the rising consumer awareness of nutrient timing really stresses the production of trimester-based and extended postpartum formulas by supplement companies.

The Surge in Awareness of the Problems Related to Nutrient Absorption in Pregnant Women

Due to the increased consumer awareness of the bioavailability of the ingredients and the genetic factors affecting nutrient absorption, the whole prenatal supplementation scheme is left in a mess. The MTHFR gene mutation, which leads to reduced folate, is one of the factors that cause an increasing requirement for methylated folate (L-methylfolate).

The preference of chelated iron and magnesium over traditional mineral forms of better absorption and less gastrointestinal side effects are no less either. Algae-based DHA will replace fish oil since it is cleaner and comes from plants. Brands like Theralogix, Ritual, and MegaFood have adopted bioavailable nutrient forms as a response to these issues.

The movement was fueled by doctors practicing functional medicine and social media influencers who instructed women as to the genetic predispositions, challenges in their digestion, and the importance of proper nutrients in order to maintain their and their child’s health.

Popularity of Formats Low in Nausea and Easily Consumable

Conventional prenatal vitamins specifically rich in iron and generally big pills are the ones mostly that initiate nausea, vomiting, and digestive discomfort among pregnant women possessive to first trimester. A pill aversion and morning sickness are the reasons that the market is transforming into gummies, softgels, liquids, dissolvable powders, and chewables.

Gummies are getting broader recognition for their taste and the fact that they are easier to take since they are sometimes devoid of iron and thus, require separate supplementation. Brands like SmartyPants and Nature Made deliver gummy prenatals that are iron-free without any other elements.

For instance, Mary Ruth’s holds the advantage of liquid formulas that are fast absorbed and easy on the stomach. The effervescent powders for consumer to mix the vitamins into the drinks and thus enhance compliance. This trend is promoted by the comfort and convenience preferences of pregnant women making alternative delivery formats a competitive advantage for supplement brands.

The Development of Precision Prenatal Supplements through Genetic Testing

Personalized nutrition is a main trend yet has a rupture point, the prenatal supplement market, where the beginning brands with the help of DNA health assessments and blood tests create custom formulations. Companies such as Beli, Needed, and Persona Nutrition are providing personalized prenatal remedies which are based on genetic markers, lifestyle, and dietary habits.

Advanced blood tests can give information about vitamin deficiencies like iron, vitamin D3, or omega-3 that are targets for a nuanced supplementation plan, also. Artificial Intelligence (AI) is also suggesting nutrition plans across the board and the overall personalized health ideas build a new market ecosystem.

This change is spurred by consumer interest for scientifically backed solutions, particularly among millennial and Gen Z mothers-to-be. As genetic testing has become less expensive, it is likely that this personalized prenatal nutrition finds wider recognition, which, in turn, will form the basis for brands to offer very specific types of formulations that will, in the end, be hard to imitate.

Micro-Encapsulation and Delayed-Release Technologies

Manufacturers of prenatal supplements are involving microencapsulation, liposomal technology, and enteric-coated capsules for both enhancing nutrient absorption and minimizing side effects. Iron and folate are crucial but they often lead to gastrointestinal distress; the use of advanced encapsulation techniques is a solution for lowering the amount of release.

Liposome-coated DHA and fat-soluble vitamins (A, D, E, K) are the vehicles that transport and enhance nutrient bioavailability by protecting these nutrients from being destroyed in the digestive system. Like, the Theralogix and Seeking Health firms make use of the slow-release iron and time-release B vitamins to secure steady nutrient availability without vector spikes or crashes.

Plus, the generic probiotics having the enteric coating added will be the support component in prenatal supplements for gut health & immune function. By these methods, not only the supplements are better but they also win the trust of the consumers, as pregnant women are looking or supplements that will maximize their nutrient absorption and at the same time decrease their digestive discomfort which are the most common in pregnancy.

The Vertically Integrated Manufacturing of Supplements to Assure Quality

As the prenatal quality supplements face the heat of increased regulation, the best brands react by either moving in-house the whole production or collaborating with pharmaceutical-grade manufacturers exclusively to secure quality, compliance, and good channels of supply.

Most of the consumers have also become aware of the problems of heavy-metal contamination, sourcing of ingredients, and added third-party tests, and as such, companies have resorted to stringent quality control. A good example of this would be the Garden of Life and Nordic Naturals. They have managed to instill a variety of quality measures such as overseeing ingredient purity, testing, production transparency, and the like.

The credibility now comes from ISO, NSF, and third-party lab tests (ConsumerLab, Labdoor) which are the major differentiators as most pregnant women are into taking safe and clinically proven products. Domestic manufacturing is also up to run because of the risks to foreign supply chains which are unstable, therefore letting the expected mothers receive the products on time and without any difficulties.

The prenatal vitamin supplements market had a positive growth trend throughout the 2020 to 2024 period, propelled by a surge in maternal health education, physician recommendations, and the introduction of premium and bioavailable formulations. The pandemic era shifted the spotlight onto immune-boosting prenatal supplements, leading the market towards high-quality, clinically proven, and organic products.

The introduction of direct-to-consumer brands, subscription models, and clean-label formats facilitated further reshaping of the market. In the period 2025 to 2035, the demand will also continue to increase through the research achievements on precision nutrition, the inclusion of new genetic-based supplementation, and the innovation in bioavailability.

The market is anticipated to witness the introduction of more personalized, gut-health-focused prenatal alternatives, as well as expansion of the currently untapped emerging markets in distribution. Furthermore, the path towards market's future will be also determined by e-commerce leadership, regulatory changes, and the rising penetration of AI-driven personalized recommendations.

The worldwide prenatal vitamin supplements market can be subdivided into three levels, out of which each has a unique strategy that impacts the market differently and attracts different types of consumers.

Players Tier 1, are led by Bayer AG (One A Day), Abbott Laboratories (Similac), Nestlé (Garden of Life), Vitabiotics (Pregnacare), and Church & Dwight (Vitafusion), which together comprise 50-60% of the total market. These multinational companies use their strong branding, hospitals/personal associations, plus retail and pharmacy channels, to secure this level of control.

Their strategy is focused on the proposed scientific rationale, clinical validation, and advanced formulations that are at the forefront in both over-the-counter (OTC) and prescription-based prenatal supplements. Their control over the market not only comes from the active promotion of bioavailable nutrient formats but also through the implementation of subscription models and targeted formulations for specific stages during pregnancy.

Tier 2 players, for instance, including Ritual, Needed, Thorne, New Chapter, MegaFood, and Nordic Naturals, own approximately 25-35% of the market. These are mid-range brands which present themselves as high quality, clean-label, and personalized products for pregnancy nutrition, appealing to eco-friendly, organic, vegan, and allergen-free seekers.

They develop and operate on a direct-to-consumer (DTC) sales model, focusing on subscription models and the overall growth of e-commerce, as well as using digital marketing, influencer endorsements, and OB-GYN collaborations to differentiate themselves. They are propelled ahead due to the new functionality of absorbed nutrients, making gut-friendly formulations, and precision-based supplementation.

Tier 3 includes brands such as Persona Nutrition, Perelel Health, Beli, and other regional supplements, which altogether represent 10-15% of the market. These pioneer brands ensure their marks; applying hyper-personalized, functional, and holistic prenatal solutions and intricate genetics-based nutrition, TCM-infusion as well as Ayurvedic blends, among other things. Some Tier 3 companies are on specialty health stores and niche online wellness platforms, appealing to engaged, information-seeking consumers.

The following table shows the estimated growth rates of the top three countries. USA, China and Germany are set to exhibit high consumption, and CAGRs of 3.8%, 5.5% and 4.5% respectively, through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| United States | 3.2% |

| China | 5.5% |

| Germany | 4.5% |

The USA prenatal vitamin market is experiencing a tremendous growth of the subscription-based, doctor-formulated, and AI-driven personalized supplement plans. The companies such as Ritual, Needed, and Perelel Health have adopted the approach of a monthly subscription, where consumers receive customized prenatal packs according to their specific nutrient needs.

These brands, being different from standard OTC supplements, incorporate third-party lab testing, targeted ingredient dosing, and science-backed formulations to come up with personalized regimens. The convenience, transparency, and medical credibility are some of the factors that consumers associate with these subscription models which is why they are more attractive.

The e-commerce-first companies are also the leaders, as they sell through DTC platforms and establish their credibility through medical advisory boards. The situation with OB-GYNs, who more often recommend precision nutrition, and people who are ready to pay for personalized, clinically effective prenatal formulas, is slightly deviating the trend toward which the market is switching from the one-off supplement sell to the continuous tracking of maternal health.

Traditional Chinese Medicine (TCM) is being integrated into prenatal vitamins in the China market. Companies like BY-HEALTH, Tong Ren Tang, and Swisse are making combinations of herbal ingredients (Ginseng, goji berry, Astragalus, and Cordyceps) with pregnancy essential vitamins like Folate, Bifidobacterium, and Iron.

Expecting mothers in China go for natural, holistic prenatal care, which in turn drives the demand for plant-based and TCM-inspired prenatal supplements. Cross-border and e-commerce channels have contributed to the entry of premium foreign brands in the TCM market on platforms such as Tmall and JD.com, while domestic brands are using the cultural trust in TCM remedies to leverage their position.

The trend is a reflection of the growing interest in pre-pregnancy preventive health, where adaptogenic herbs, antioxidants, and traditional botanicals are used in addition to proven prenatal nutrients to promote fetal growth and mothers well-being.

Germany's prenatal vitamin market is evolving seen from the angle of fermented, bioavailable, and gut-friendly products, where brands such as Doppelherz, Orthomol, and Pure Encapsulations show the way. A considerable number of German customers tend to select the more digestible type of proeubiotics as well as the naturally fermented prenatal vitamins which work all the better in the absorption of nutrients during the use of these products.

This situation can be explained by the country’s continued emphasis on optimizing gut health and the preference for clean-label supplements. Prenatal supplements featuring liposomal iron, methylated folate, and algae-based DHA are the latest innovations, which promote outreach and lessen nausea and digestive discomfort.

Expecting mothers in Germany also tend to pick low-excipient and filler-free formulations, which further underline the demand for minimalist, high-purity supplements. The emphasis is being shifted towards maintaining a balanced microbiome in pregnancy and because of that, prenatal vitamins that include prebiotics, probiotics, and postbiotics are getting popular, thus, it marks the German market as different as compared to other worldwide regions.

| Segment | Value Share (2025) |

|---|---|

| Capsules & Tablets (Form) | 45% |

The most common formats fo prenatal supplements are still capsules and tablets that are preferred by many mostly they are their chief reasons such as : precision of the nutrient dosing, long shelf life, and excellent controlled nutrient release.

They are a much better alternative for the brands than gummies and liquids since they are not concerned about the sugar content, oxidation, or degradation and they can put the high concentrations of main vitamins and minerals such as iron, folate, and DHA in the products. For idea that a company can illustrate in different new products, brands include Garden of Life that uses the slow-delivery technology with peptide coating tablets, Bayer’s One A Day with delayed-release capsules, and Thorne that implements the same approach to enhance absorption and to minimize nausea.

However, they are more generally talking about those have been swallowed. But now manufacturers have come up with smaller, easy-to-swallow tablets, soft gel formats, and enteric-coated capsules that dissolve in the intestines but instead of the stomach. These innovations assure minimum side effects and the use of capsules and tablets as the gold standard for prenatal nutrition worldwide is underlain by the best nutrient delivery.

| Segment | Value Share (2025) |

|---|---|

| Drug Stores & Pharmacies (Sales Channel) | 30% |

Pharmacies and supermarkets prevailed in the prenatal vitamin supplement market as they were well-known, easy to navigate around and pharmacist-recommended sales channels. The main way of buying trusted prenatal vitamins for pregnant women is still the pharmacy route where they get personalized consultation from the pharmacist who makes sure that the chosen clinical and physician-approved safe formulation is selected.

The biggest pharmacy chains CVS, Walgreens, and Boots offer a wide selection of OTC & prescription prenatal vitamins, making them a one-stop-shop for pregnancy essentials. Pharmacies on their part, in addition to stocking high-quality service, also yield brands with pharmacy-only and high bioavailability of products.

In addition, insurance coverage and government prenatal programs support the dominance of the pharmacy channel. As e-commerce widens, pharmacies are now working on online prescription and home-delivery service making them the main player in the prenatal supplement distribution supply chain.

The prenatal vitamin supplement market is full of competition with the likes of the Vitabiotics, Bayer AG, Church & Dwight, Abbott Laboratories, and Nestlés Garden of Life being at the forefront. Achieving the widest market share is the main priority for all the brands that have started providing individualized solutions, just like Ritual’s traceable prenatal with delayed-release technology and Needed’s trimester-specific formulations.

Companies are also focusing on the fashion of choices where the products are gut-friendly and do not have sugar that is accessible-seen in Theralogixs methylated folate prenatal & MegaFoods whole-food-based vitamins. Subscription models as Perelel Health or Persona Nutrition are the ones to make a remarkable impact on customer retention, as well as, partnerships with OB-GYNs and pharmacists that strengthen the credibility.

Of course, we can also mention new products like SmartyPants that have released omega-3 DHA prenatal gummies and New Chapter that has created fermented prenatal multivitamin. Mothers are now wondering about new clean-label vegan and allergen-free formats from the companies which they continuously explore in order to fulfill their changing needs regarding health during the bearing period of their children.

The market is expected to reach USD 1,229.9 million by 2035, growing from USD 649.1 million in 2025.

The market is projected to expand at a CAGR of 6.6%, driven by increasing awareness of maternal health and the benefits of prenatal nutrition.

Leading companies in the market include Bayer AG, Church & Dwight Co., Inc., Nestlé, Abbott Laboratories, and Nordic Naturals, focusing on innovative formulations and expanding product availability.

Capsule/Tablets (45%), Gummies (30%), Powders, liquids, others

Online (25%), Drug Stores and Pharmacies (30%), Hospital & Clinics, Hypermarkets/Supermarkets (35%), Convenience Stores, Health and, wellness Stores, Specialty Stores, Departmental Stores

Industry analysis has been carried out in key countries of North America, Latin America, Europe, Middle East and Africa, East Asia, South Asia, and Oceania

Ginger Beer Market Insights – Craft Brews & Market Expansion 2025 to 2035

Functional Mushroom Market Trends – Health Benefits & Industry Expansion 2025 to 2035

Comprehensive industry analysis and forecast by from, end use, derivative type and region.

Food Starch Market Insights - Growth & Demand Analysis 2025 to 2035

Frozen Snacks Market Growth - Convenience & Consumer Trends 2025 to 2035

Gelatin Market Trends - Food, Pharma & Nutritional Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.