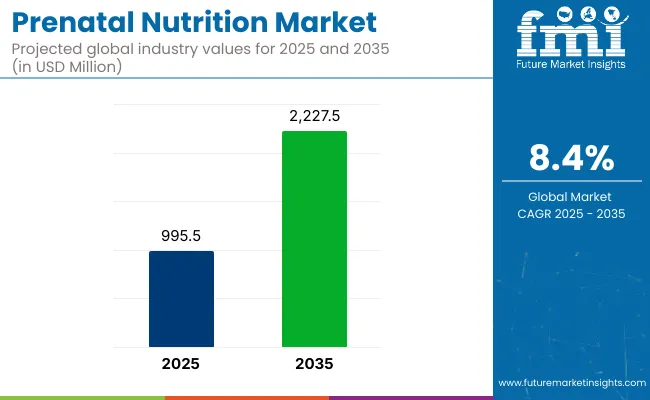

The global prenatal nutrition market is valued at USD 995.5 million in 2025 and is expected to reach USD 2,227.5 million by 2035, reflecting a CAGR of 8.4%.

| Metric | Values |

|---|---|

| Estimated Size (2025) | USD 995.5 million |

| Projected value (2035) | USD 2,227.5 million |

| CAGR (2025 to 2035) | 8.4% |

Factors driving this growth include the rising aging maternal population, growing awareness of targeted nutritional supplementation during pregnancy, and the increasing prevalence of nutritional deficiencies such as iron and folic acid. Moreover, the market expansion is likely to be supported by premiumization trends as more women invest in specialized prenatal products addressing age-related needs, gestational health, and fetal development.

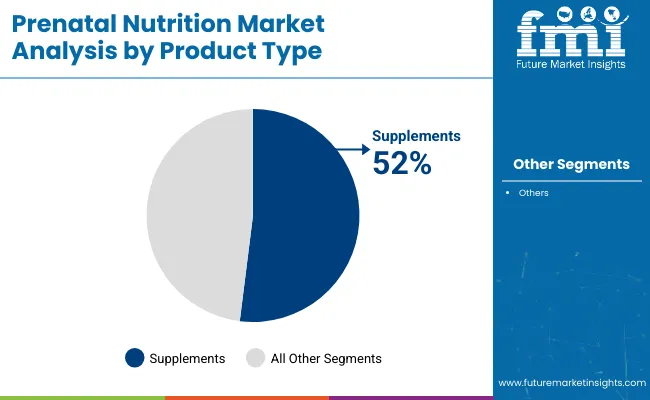

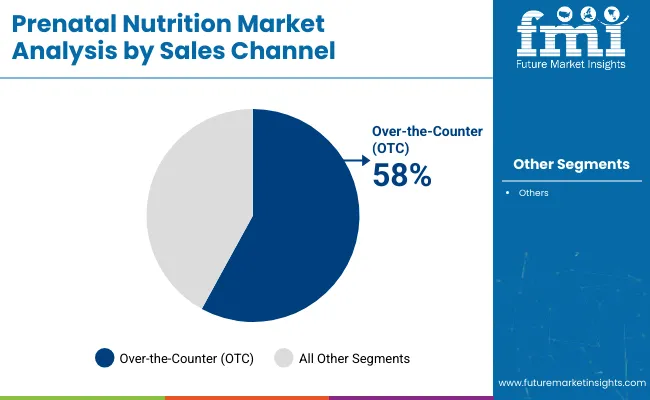

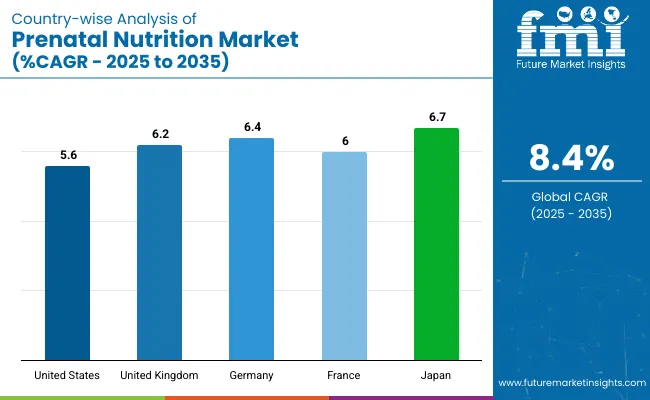

The USA is projected to remain the largest market for prenatal nutrition products, driven by robust innovations in nutritional formulations, though expanding at a moderate CAGR of 5.6%. In contrast, Japan and Germany are anticipated to register significant growth, rising at significant CAGRs of 6.7% and 6.4% respectively. Supplement sare projected to lead the product type with a prominent market share of 52%.Over-the-counter supplements account for 58% of the market share by sales channel.

The market accounts for approximately 6-8% of the overall maternal and child nutrition market, reflecting its niche yet essential role in targeted maternal health. Within the broader dietary supplements market, prenatal nutrition contributes around 1-2%, driven by its specialized consumer base of pregnant women.

It holds nearly 0.5-1% share in the functional foods and beverages market, where fortified foods are a minor category. In the health and wellness nutrition market, prenatal products represent less than 1% due to their focused demographic. However, within women’s health nutrition, prenatal nutrition commands a significant 15-18% share, reflecting its critical positioning.

The market is segmented into product type, primary ingredients, sales channels, and region. By product type, it is segmented into functional food (protein bars, protein powders, cereals, cookies, soups, nutrient-rich stews, crisps & others [snacks, meal replacements]), beverages (herbal teas, fortified milk, ready-to-drink smoothies, electrolyte drinks), and supplements (vitamins and minerals, herbal supplements, calcium supplements, iron supplements, omega-3 fatty acids, probiotics, magnesium supplements and others [multivitamins, DHA blends]).

By primary ingredients, it includes folic acid, iron, calcium, vitamin D, omega-3 fatty acids, magnesium, protein, zinc, choline, and vitamin C. By sales channel, it is segmented into prescription supplements (institutional sales - hospitals and clinics), over-the-counter supplements (drug stores and pharmacies, hypermarkets/supermarkets, convenience stores, health and wellness stores, specialty stores, departmental stores, other retail store) and online retail (company website, third-party/mass merchandiser). By region, it covers North America, Latin America, Europe, East Asia, South Asia, Oceania, and MEA.

The supplements segment is likely to remain the largest within product types, accounting for over 52% share in 2025, due to their ability to deliver targeted nutrients such as iron, folic acid, and omega-3, which are essential for maternal and fetal health.

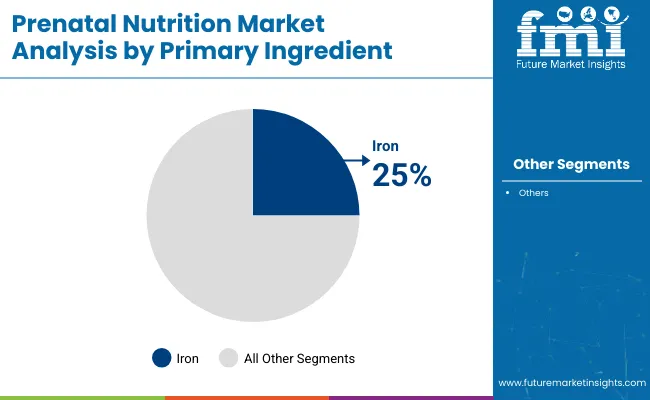

Iron is projected to be the leading primary ingredient segment with a market share of around 25% in 2025. Its dominance is attributed to its crucial role in hemoglobin production and oxygen transport, especially as blood volume increases during pregnancy.

The over-the-counter supplements segment is anticipated to dominate sales channels, holding nearly 58% market share in 2025. Its growth is driven by the widespread availability of prenatal products in pharmacies, supermarkets, and health stores, making them easily accessible to consumers without requiring a prescription.

Recent Trends in the Prenatal Nutrition Market

Challenges in the Prenatal Nutrition Market

Among the top five countries in the prenatal nutrition market, Japan is projected to record the highest CAGR at 6.7% from 2025 to 2035, driven by strong government programs and cultural emphasis on maternal health. Germany follows with a CAGR of 6.4%, supported by preventive healthcare initiatives and high organic product demand.

The United Kingdom is expected to grow at 6.2% CAGR, reflecting NHS-backed nutrition guidelines and plant-based trends. France is projected at 6.0% CAGR, driven by public health campaigns and premium product demand, while the USA records the lowest among these at 5.6% CAGR, despite its strong market size and innovation focus.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The prenatal nutrition revenue in the USA is projected to grow at a CAGR of 5.6% from 2025 to 2035. Growth is driven by high awareness about maternal health, continuous innovation in nutritional formulations, and the strong presence of major companies offering advanced supplements such as probiotics, omega-3 enriched products, and organic blends.

The prenatal nutrition market in the UK is anticipated to expand at a CAGR of around 6.2% between 2025 and 2035. Growth is supported by the NHS’s robust prenatal care programs that emphasize maternal nutrition, increasing consumer preference for fortified foods and supplements, and the rising adoption of plant-based prenatal products.

The revenue from prenatal nutrition in Germany is expected to rise at a CAGR of 6.4% from 2025 to 2035. This growth is underpinned by the country’s strong emphasis on preventive maternal healthcare, which integrates nutritional guidelines into routine prenatal check-ups.

The sales of prenatal nutrition products in France are predicted to flourish at a CAGR of approximately 6.0% from 2025 to 2035. Growth is driven by increasing awareness among expectant mothers about the importance of targeted prenatal nutrition, coupled with the influence of public health campaigns promoting folic acid and iron intake.

The prenatal nutrition market in Japan is projected to grow at a CAGR of 6.7% between 2025 and 2035. Growth is driven by high maternal health awareness, extensive government health programs promoting prenatal care, and the cultural emphasis on nutrition during pregnancy.

The market is moderately fragmented, with a mix of multinational leaders and numerous small to medium enterprises competing across product categories. Top companies such as Nestlé, Abbott Nutrition, Unilever, Church & Dwight Co. Inc., and Garden of Life are leveraging strong brand portfolios, broad distribution networks, and innovation capabilities to maintain market dominance.

Competition centers on differentiated formulations, clean-label certifications, pricing strategies, and regional expansions to capture emerging markets.

Company strategies increasingly focus on developing personalized and targeted prenatal supplements, expanding organic and non-GMO product lines, and forming partnerships with healthcare providers and digital health platforms to build trust and credibility.

Recent Prenatal Nutrition Industry News

In 2024, Nestlé launched Materna Pre and Materna Nausea, two new nutritional solutions designed for women’s fertility and to ease pregnancy-related symptoms such as nausea and vomiting.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 995.5 million |

| Projected Market Size (2035) | USD 2,227.5 million |

| CAGR (2025 to 2035) | 8.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD million/Volume in units |

| By Product Type | Functional Food (Protein Bars, Protein Powders, Cereals, Cookies, Soups, Nutrient-Rich Stews, Crisps, Others [snacks, meal replacements]), Beverages (Herbal Teas, Fortified Milk, Ready-to-Drink Smoothies, Electrolyte Drinks), Supplements (Vitamins and Minerals, Herbal Supplements, Calcium Supplements, Iron Supplements, Omega-3 Fatty Acids, Probiotics, Magnesium Supplements, Others (multivitamins, DHA blends)) |

| By Primary Ingredient | Folic Acid, Iron, Calcium, Vitamin D, Omega-3 Fatty Acids, Magnesium, Protein, Zinc, Choline, Vitamin C |

| By Sales Channel | Prescription Supplements (Institutional Sales - Hospitals and Clinics), Over the Counter Supplements (Drug Stores and Pharmacies, Hypermarkets/Supermarkets, Convenience Stores, Health and Wellness Stores, Specialty Stores, Departmental Stores, Other Retail Stores), Online Retail (Company Website, Third Party/Mass Merchandiser) |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, the Middle East and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Nestlé S.A., Country Life LLC, Abbott Nutrition, Church & Dwight Co. Inc., Garden of Life, Vitamin Angels, Ritual, New Chapter Inc., Rainbow Light, PlusPlus Lifesciences LLP, CE CHEM, Avion Pharmaceuticals LLC, Perdays Health Functional Food Pty Ltd, Exeltis USA Inc., Mead Johnson & Company LLC, AdvaCare Pharma, Unilever, Otsuka Pharmaceutical Co. Ltd, Gelita AG, Mead Johnson & Company LLC. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

As per product type, the industry has been categorized into Functional Food (Protein Bars, Protein Powders, Cereals, Cookies, Soups, Nutrient-Rich Stews, Crips, Others), Beverages (Herbal Teas, Fortified Milk, Ready-To-Drink Smoothies, Electrolyte Drinks), Supplements (Vitamins and Minerals, Herbal Supplements, Calcium Supplements, Iron Supplements, Omega-3 Fatty Acids, Probiotics, Herbal Supplements, Magnesium Supplements, Others)

This segment is further categorized into Folic Acid, Iron, Calcium, Vitamin D, Omega-3 Fatty Acids, Magnesium, Protein, Zinc, Choline, and Vitamin C.

As per sales channel, the industry has been categorized into Prescription Supplements (Rx)/ (Institutional Sales (Hospital and Clinics)), Over the Counter Supplements (OTC) (Drug Stores and Pharmacies, Hypermarkets/Supermarkets, Convenience Stores, Health and wellness Stores, Specialty Stores, Departmental Stores, Other Retail Stores), Online Retail (Company Website, 3rd party/Mass Merchandiser)

As per Region, North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East and Africa

The market size is valued at USD 995.5 million in 2025.

The market is forecasted to reach USD 2,227.5 million by 2035, reflecting a CAGR of 8.4%.

Supplements are expected to lead the market with over 52% share in 2025.

Iron is projected to hold approximately a 25% share of the market in 2025.

Japan is anticipated to be the fastest-growing market with a CAGR of 6.7% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Prenatal Vitamin Preparation Market Size and Share Forecast Outlook 2025 to 2035

Prenatal Vitamin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Prenatal Vitamin Supplement Market Analysis - Size, Share, and Forecast 2025 to 2035

Examining Market Share Trends in the Prenatal Vitamin Supplement Industry

UK Prenatal Vitamin Supplement Market Outlook – Demand, Trends & Forecast 2025-2035

USA Prenatal Vitamin Supplement Industry Analysis from 2025 to 2035

ASEAN Prenatal Vitamin Supplement Market Growth – Trends, Demand & Forecast 2025-2035

Europe Prenatal Vitamin Supplement Market Analysis – Size, Share & Forecast 2025-2035

Australia Prenatal Vitamin Supplements Market Insights – Size, Growth & Forecast 2025-2035

Latin America Prenatal Vitamin Supplement Market Outlook – Size, Share & Forecast 2025-2035

Nutritional Bars Market Size and Share Forecast Outlook 2025 to 2035

Nutritional Yeast Market Size, Growth, and Forecast for 2025 to 2035

Nutritional Labelling Market Trends and Forecast 2025 to 2035

Nutritional Ingredients in Animal Feed Market Trends - Growth & Industry Forecast 2025 to 2035

Nutritional Lipids Market

Nutrition Therapy Market

Fish Nutrition Market Size, Growth, and Forecast for 2025 to 2035

GLP-1 Nutritional Support Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Multi Nutritional Supplement Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Infant Nutrition Hydrolysate Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA