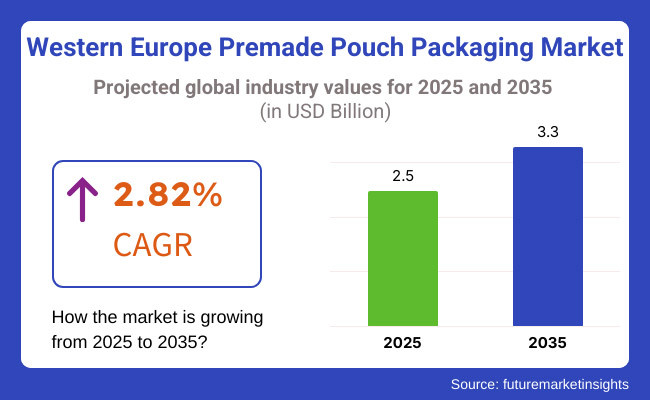

The Western Europe premade pouch packaging market is estimated to account for USD 2.5 billion in 2025. It is anticipated to grow at a CAGR of 2.82% during the assessment period and reach a value of USD 3.3 billion by 2035.

Industry Outlook

As per FMI analysis, the Western European premade pouch packaging market is likely to witness stable growth from 2025 through 2035 due to a rise in demand for flexible and sustainable packaging options.

Growing consumer demands for convenience, longer shelf life of products, and environmentally friendly options will heavily impact the growth of the market. Innovation in packaging technology, such as the use of recyclable and biodegradable materials, will also be important.

Moreover, the beverage, food, and pharmaceutical industries are anticipated to be key drivers of market expansion with the increased use of flexible packaging solutions. Nevertheless, there could be threats from regulatory policies, raw material prices, and competitive forces due to other formats of packaging.

In spite of this, the sector is set to experience persistent innovation, initiatives based on sustainability, and growth in investments related to automation and digital printing, leading to long-term growth.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Demand for lightweight and flexible packaging, rise in e-commerce, and pandemic-related food safety concerns. | Rising consumer preference for sustainable materials, technological advancements in packaging, and growing demand from food & beverage and pharmaceutical sectors. |

| Shift towards convenience packaging due to increased home consumption during COVID-19. | Increasing demand for eco-friendly, recyclable, and biodegradable packaging solutions. |

| Adoption of digital printing and smart packaging technologies began to rise. | Further advancements in digital printing, automation, and active packaging for extended shelf life. |

| Growing awareness of plastic waste and initial steps towards sustainable alternatives. | Stringent regulations pushing manufacturers towards compostable, paper-based, and recyclable pouches. |

| Initial regulations on plastic usage and sustainability policies. | Stricter EU packaging laws focusing on circular economy and waste reduction. |

| Supply chain disruptions due to the pandemic, fluctuating raw material prices. | Challenges include regulatory compliance, rising material costs, and competition from alternative packaging solutions. |

| Industry adapted to post-pandemic trends, focusing on flexible and resealable packaging. | Stronger focus on innovation, automation, and sustainability, ensuring steady long-term growth. |

Sustainability and Eco-Friendly Packaging

Western European consumers are actively choosing sustainable packaging options, prompting brands to make the move to recyclable, compostable, and biodegradable packaging materials for ready-made pouches. Growing concerns over plastic pollution and stringent EU regulation of single-use plastics are accelerating the shift towards green alternatives.

Companies are counteracting by trial runs of paper-based pouches, bio-based films, and recyclable laminates to meet the increasing needs for eco-friendly packaging. Convenience and On-the-Go Lifestyles Urban consumers are increasingly looking for convenient, portable, and resealable packaging formats to

support their on-the-go lifestyle.

Premade pouches are also emerging as the format of choice for ready-to-eat foods, snacks, and drinks because of their lightweight, easy-to-carry format. Companies are also outfitting packaging features with spouts, zippers, and easy-tear notches to facilitate consumer convenience and ease of use.

Premiumization and Aesthetic Appeal

Western European consumers are placing greater emphasis on high-quality packaging designs that signal quality and value. Brands are leveraging sophisticated printing technologies such as high-resolution digital printing and matte/glossy finishes to create appealing premade pouches. Single shapes, metallic appearance, and transparent windows are gaining popularity, allowing brands to optimize shelf appeal and connect with discerning consumers.

Rise of Health-Conscious Consumers

Wellness-conscious consumers are choosing packaging that aligns with their dietary and health requirements. Clean-label, organic, and preservative-free product demand is compelling brands to choose pouches that provide product freshness without the inclusion of artificial ingredients. Clear or simple packaging with ingredient transparency is becoming more popular, as consumers seek authenticity and trust in the brands they purchase.

| Metric | Value |

|---|---|

| Closure Type | Tear Notch |

| Expected Share in 2025 | 44.90% |

Based on closure type, the market is divided into tear notch, spout, zipper, and flip lid & others. The market for tear notch premade pouch packaging in Western Europe is generally on the rise with its convenience, functionality, and ease of use. Customers opt for packaging that is easy to open without having to use scissors or other aids, so tear notches become a must-have feature across several product categories.

Food and drink brands are specifically leading this trend, since resealable and single-serve pouches with tear notches increase product freshness and offer a convenient opening experience. The pharmaceutical and personal care markets are also embracing this packaging form to provide controlled and hygienic access to products.

Additionally, tear notches are being added to flexible packaging options by manufacturers to meet changing consumer demands for convenience and portability. The functionality is particularly in demand in on-the-go foods, including snacks, dried fruit, and powdered supplements, because it provides rapid access without sacrificing packaging integrity.

| Metric | Value |

|---|---|

| Material Type | Plastic |

| Expected Share in 2025 | 47.35% |

Based on material type, the market is divided into plastic, aluminium laminates, paper, and others. Plastic premade pouch packaging is the most used material in Western Europe, with the highest market share of 47.35%, far surpassing aluminum laminates and paper-based substitutes.

Plastic leads because it is versatile, affordable, durable, and has excellent barrier properties against oxygen and water, hence suitable for food, beverage, and personal care products. Its light weight keeps transportation costs low, and its flexibility enables innovative design that improves consumer acceptance.

While aluminum laminates provide strong barrier protection, they are more expensive and less flexible, keeping them from becoming widespread. In contrast, paper-based pouches are becoming increasingly popular among environmentally friendly consumers but tend to need added coatings to attain required protective properties, making recycling more difficult.

Although plastic is the favorite, rising regulatory pressures and sustainability issues are compelling brands to seek greener alternatives, dictating the future of premade pouch packaging in the region.

| Metric | Value |

|---|---|

| End-Use Industry | Food |

| Expected Share in 2025 | 76.70% |

Based on end-use industry, the market is divided into food, pharmaceuticals, cosmetics & personal care, and others. The market for food premade pouch packaging in Western Europe is generally fueled by consumer desire for convenience, sustainability, and long shelf life.

Active lifestyles have amplified the demand for on-the-go and resealable packaging, which makes premade pouches well-suited for snacks, ready-to-eat meals, frozen foods, and dry foods. The pouches provide excellent barrier protection against moisture, oxygen, and contaminants, which preserves food freshness and minimizes waste. The food packaging industry is also aided by light and flexible packaging, which reduces transportation costs and minimizes the carbon footprint.

The sustainability trends and the pressures exerted by regulations are also compelling brands to use recyclable, compostable, and bio-based pouch materials, meeting the European Union's circular economy vision. Innovative printing technologies further add dimension to branding and consumer interaction with the possibility of eye-catching, customizable packaging designs.

The Western European premade pouch packaging market indicates a moderate to high concentration, with several giant players dominating the market. Big players in the packaging industry and multinational companies control the market by using cutting-edge technology, well-established distribution channels, and scale advantages to remain competitive.

Firms aggressively invest in automation, sustainability, and innovation to address changing consumer needs. The market witnesses rising consolidation as big players take over small packaging firms to increase their portfolios. Strategic alliances, mergers, and acquisitions are the drivers of strengthening market positions and broadening product offerings in various food, beverage, and personal care categories.

Sustainability laws affect market concentration since firms with green packaging solutions have a competitive edge. Organizations that create recyclable, biodegradable, or compostable products gain more customers, which strengthens their market share. Small companies find it challenging to cope with stringent environmental regulations, which results in possible exits or takeovers by larger firms.

Despite dominance by major players, regional and niche producers identify opportunities in specialized markets, including organic food, premium pet food, and functional beverages. Their capacity to offer customized, high-quality packaging enables them to create loyal consumer bases, thereby ensuring some degree of market diversity in Western Europe.

Western Europe's premade pouch packaging market is extremely competitive, with large multinational corporations, regional competitors, and specialty manufacturers competing based on innovation. The top players dominate with the latest technology, automation, and material developments, whereas smaller firms compete on providing bespoke, high-quality, and environmentally friendly packaging solutions to suit changing consumer demands.

Environmental issues and sustainability laws dictate the competitive environment, and businesses have to invest in compostable, biodegradable, and recyclable packaging material. The established R&D resources of large firms are an advantage, but small-scale manufacturers are turning toward niches like functional beverages, organic food, and premium pet food to distinguish themselves in the marketplace.

The industry sees ongoing mergers, acquisitions, and strategic alliances, enabling leading players to increase their product offerings and geographic presence. Firms actively buy specialized companies to consolidate their positions in high-demanding industries such as food, beverages, pharmaceuticals, and personal care, resulting in higher consolidation in the industry.

Technological innovations in digital printing, resealable packaging, and intelligent packaging solutions further fuel competition. Brands that incorporate QR codes, freshness indicators, and interactive packaging elements boost consumer interaction, expanding their market share. The emphasis on automation and low-cost production also fuels competition, enabling companies to streamline operations and enhance profit margins.

The growth of e-commerce and direct-to-consumer brands drives market trends, as packagers create tamper-proof, lightweight, and long-lasting pouches to address the demand surge. Companies offering customization, short-run printing, and eco-friendly packaging gain a competitive advantage, becoming go-to suppliers for online merchants and subscription-based companies.

With respect to closure type, the market is classified into tear notch, spout, zipper, and flip lid & others.

In terms of material type, the market is segmented into plastic, aluminium laminates, paper, and others.

In terms of end-use industry, the market is divided into food, pharmaceuticals, cosmetics & personal care, and others.

In terms of country, the market is segmented into the UK, Germany, Italy, France, Spain, and the Rest of Western Europe.

The market is anticipated to reach USD 2.5 billion in 2025.

The market is predicted to reach a size of USD 3.3 billion by 2035.

Prominent players include Swiss Pack, ePac Flexible Packaging, Omag-Pack, FFP Packaging Solutions, Pouches.co.uk, WeighPack Systems, Tyler Packaging, Bemis Company, Bossar Packaging, and General Packer.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2019 to 2034

Table 2: Industry Analysis and Outlook Volume (Tonnes) Forecast by Country, 2019 to 2034

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Closure Type, 2019 to 2034

Table 4: Industry Analysis and Outlook Volume (Tonnes) Forecast by Closure Type, 2019 to 2034

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 6: Industry Analysis and Outlook Volume (Tonnes) Forecast by Material Type, 2019 to 2034

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by End-use Industry, 2019 to 2034

Table 8: Industry Analysis and Outlook Volume (Tonnes) Forecast by End-use Industry, 2019 to 2034

Table 9: UK Market Value (US$ Million) Forecast By Region, 2019 to 2034

Table 10: UK Market Volume (Tonnes) Forecast By Region, 2019 to 2034

Table 11: UK Market Value (US$ Million) Forecast by Closure Type, 2019 to 2034

Table 12: UK Market Volume (Tonnes) Forecast by Closure Type, 2019 to 2034

Table 13: UK Market Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 14: UK Market Volume (Tonnes) Forecast by Material Type, 2019 to 2034

Table 15: UK Market Value (US$ Million) Forecast by End-use Industry, 2019 to 2034

Table 16: UK Market Volume (Tonnes) Forecast by End-use Industry, 2019 to 2034

Table 17: Germany Market Value (US$ Million) Forecast By Region, 2019 to 2034

Table 18: Germany Market Volume (Tonnes) Forecast By Region, 2019 to 2034

Table 19: Germany Market Value (US$ Million) Forecast by Closure Type, 2019 to 2034

Table 20: Germany Market Volume (Tonnes) Forecast by Closure Type, 2019 to 2034

Table 21: Germany Market Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 22: Germany Market Volume (Tonnes) Forecast by Material Type, 2019 to 2034

Table 23: Germany Market Value (US$ Million) Forecast by End-use Industry, 2019 to 2034

Table 24: Germany Market Volume (Tonnes) Forecast by End-use Industry, 2019 to 2034

Table 25: Italy Market Value (US$ Million) Forecast By Region, 2019 to 2034

Table 26: Italy Market Volume (Tonnes) Forecast By Region, 2019 to 2034

Table 27: Italy Market Value (US$ Million) Forecast by Closure Type, 2019 to 2034

Table 28: Italy Market Volume (Tonnes) Forecast by Closure Type, 2019 to 2034

Table 29: Italy Market Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 30: Italy Market Volume (Tonnes) Forecast by Material Type, 2019 to 2034

Table 31: Italy Market Value (US$ Million) Forecast by End-use Industry, 2019 to 2034

Table 32: Italy Market Volume (Tonnes) Forecast by End-use Industry, 2019 to 2034

Table 33: France Market Value (US$ Million) Forecast By Region, 2019 to 2034

Table 34: France Market Volume (Tonnes) Forecast By Region, 2019 to 2034

Table 35: France Market Value (US$ Million) Forecast by Closure Type, 2019 to 2034

Table 36: France Market Volume (Tonnes) Forecast by Closure Type, 2019 to 2034

Table 37: France Market Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 38: France Market Volume (Tonnes) Forecast by Material Type, 2019 to 2034

Table 39: France Market Value (US$ Million) Forecast by End-use Industry, 2019 to 2034

Table 40: France Market Volume (Tonnes) Forecast by End-use Industry, 2019 to 2034

Table 41: Spain Market Value (US$ Million) Forecast By Region, 2019 to 2034

Table 42: Spain Market Volume (Tonnes) Forecast By Region, 2019 to 2034

Table 43: Spain Market Value (US$ Million) Forecast by Closure Type, 2019 to 2034

Table 44: Spain Market Volume (Tonnes) Forecast by Closure Type, 2019 to 2034

Table 45: Spain Market Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 46: Spain Market Volume (Tonnes) Forecast by Material Type, 2019 to 2034

Table 47: Spain Market Value (US$ Million) Forecast by End-use Industry, 2019 to 2034

Table 48: Spain Market Volume (Tonnes) Forecast by End-use Industry, 2019 to 2034

Table 49: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Closure Type, 2019 to 2034

Table 50: Rest of Industry Analysis and Outlook Volume (Tonnes) Forecast by Closure Type, 2019 to 2034

Table 51: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 52: Rest of Industry Analysis and Outlook Volume (Tonnes) Forecast by Material Type, 2019 to 2034

Table 53: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by End-use Industry, 2019 to 2034

Table 54: Rest of Industry Analysis and Outlook Volume (Tonnes) Forecast by End-use Industry, 2019 to 2034

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Closure Type, 2024 to 2034

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Material Type, 2024 to 2034

Figure 3: Industry Analysis and Outlook Value (US$ Million) by End-use Industry, 2024 to 2034

Figure 4: Industry Analysis and Outlook Value (US$ Million) by Country, 2024 to 2034

Figure 5: Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 6: Industry Analysis and Outlook Volume (Tonnes) Analysis by Country, 2019 to 2034

Figure 7: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 8: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 9: Industry Analysis and Outlook Value (US$ Million) Analysis by Closure Type, 2019 to 2034

Figure 10: Industry Analysis and Outlook Volume (Tonnes) Analysis by Closure Type, 2019 to 2034

Figure 11: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Closure Type, 2024 to 2034

Figure 12: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Closure Type, 2024 to 2034

Figure 13: Industry Analysis and Outlook Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 14: Industry Analysis and Outlook Volume (Tonnes) Analysis by Material Type, 2019 to 2034

Figure 15: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 16: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 17: Industry Analysis and Outlook Value (US$ Million) Analysis by End-use Industry, 2019 to 2034

Figure 18: Industry Analysis and Outlook Volume (Tonnes) Analysis by End-use Industry, 2019 to 2034

Figure 19: Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-use Industry, 2024 to 2034

Figure 20: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-use Industry, 2024 to 2034

Figure 21: Industry Analysis and Outlook Attractiveness by Closure Type, 2024 to 2034

Figure 22: Industry Analysis and Outlook Attractiveness by Material Type, 2024 to 2034

Figure 23: Industry Analysis and Outlook Attractiveness by End-use Industry, 2024 to 2034

Figure 24: Industry Analysis and Outlook Attractiveness by Region, 2024 to 2034

Figure 25: UK Market Value (US$ Million) by Closure Type, 2024 to 2034

Figure 26: UK Market Value (US$ Million) by Material Type, 2024 to 2034

Figure 27: UK Market Value (US$ Million) by End-use Industry, 2024 to 2034

Figure 28: UK Market Value (US$ Million) By Region, 2024 to 2034

Figure 29: UK Market Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 30: UK Market Volume (Tonnes) Analysis By Region, 2019 to 2034

Figure 31: UK Market Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 32: UK Market Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 33: UK Market Value (US$ Million) Analysis by Closure Type, 2019 to 2034

Figure 34: UK Market Volume (Tonnes) Analysis by Closure Type, 2019 to 2034

Figure 35: UK Market Value Share (%) and BPS Analysis by Closure Type, 2024 to 2034

Figure 36: UK Market Y-o-Y Growth (%) Projections by Closure Type, 2024 to 2034

Figure 37: UK Market Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 38: UK Market Volume (Tonnes) Analysis by Material Type, 2019 to 2034

Figure 39: UK Market Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 40: UK Market Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 41: UK Market Value (US$ Million) Analysis by End-use Industry, 2019 to 2034

Figure 42: UK Market Volume (Tonnes) Analysis by End-use Industry, 2019 to 2034

Figure 43: UK Market Value Share (%) and BPS Analysis by End-use Industry, 2024 to 2034

Figure 44: UK Market Y-o-Y Growth (%) Projections by End-use Industry, 2024 to 2034

Figure 45: UK Market Attractiveness by Closure Type, 2024 to 2034

Figure 46: UK Market Attractiveness by Material Type, 2024 to 2034

Figure 47: UK Market Attractiveness by End-use Industry, 2024 to 2034

Figure 48: UK Market Attractiveness By Region, 2024 to 2034

Figure 49: Germany Market Value (US$ Million) by Closure Type, 2024 to 2034

Figure 50: Germany Market Value (US$ Million) by Material Type, 2024 to 2034

Figure 51: Germany Market Value (US$ Million) by End-use Industry, 2024 to 2034

Figure 52: Germany Market Value (US$ Million) By Region, 2024 to 2034

Figure 53: Germany Market Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 54: Germany Market Volume (Tonnes) Analysis By Region, 2019 to 2034

Figure 55: Germany Market Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 56: Germany Market Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 57: Germany Market Value (US$ Million) Analysis by Closure Type, 2019 to 2034

Figure 58: Germany Market Volume (Tonnes) Analysis by Closure Type, 2019 to 2034

Figure 59: Germany Market Value Share (%) and BPS Analysis by Closure Type, 2024 to 2034

Figure 60: Germany Market Y-o-Y Growth (%) Projections by Closure Type, 2024 to 2034

Figure 61: Germany Market Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 62: Germany Market Volume (Tonnes) Analysis by Material Type, 2019 to 2034

Figure 63: Germany Market Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 64: Germany Market Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 65: Germany Market Value (US$ Million) Analysis by End-use Industry, 2019 to 2034

Figure 66: Germany Market Volume (Tonnes) Analysis by End-use Industry, 2019 to 2034

Figure 67: Germany Market Value Share (%) and BPS Analysis by End-use Industry, 2024 to 2034

Figure 68: Germany Market Y-o-Y Growth (%) Projections by End-use Industry, 2024 to 2034

Figure 69: Germany Market Attractiveness by Closure Type, 2024 to 2034

Figure 70: Germany Market Attractiveness by Material Type, 2024 to 2034

Figure 71: Germany Market Attractiveness by End-use Industry, 2024 to 2034

Figure 72: Germany Market Attractiveness By Region, 2024 to 2034

Figure 73: Italy Market Value (US$ Million) by Closure Type, 2024 to 2034

Figure 74: Italy Market Value (US$ Million) by Material Type, 2024 to 2034

Figure 75: Italy Market Value (US$ Million) by End-use Industry, 2024 to 2034

Figure 76: Italy Market Value (US$ Million) By Region, 2024 to 2034

Figure 77: Italy Market Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 78: Italy Market Volume (Tonnes) Analysis By Region, 2019 to 2034

Figure 79: Italy Market Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 80: Italy Market Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 81: Italy Market Value (US$ Million) Analysis by Closure Type, 2019 to 2034

Figure 82: Italy Market Volume (Tonnes) Analysis by Closure Type, 2019 to 2034

Figure 83: Italy Market Value Share (%) and BPS Analysis by Closure Type, 2024 to 2034

Figure 84: Italy Market Y-o-Y Growth (%) Projections by Closure Type, 2024 to 2034

Figure 85: Italy Market Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 86: Italy Market Volume (Tonnes) Analysis by Material Type, 2019 to 2034

Figure 87: Italy Market Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 88: Italy Market Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 89: Italy Market Value (US$ Million) Analysis by End-use Industry, 2019 to 2034

Figure 90: Italy Market Volume (Tonnes) Analysis by End-use Industry, 2019 to 2034

Figure 91: Italy Market Value Share (%) and BPS Analysis by End-use Industry, 2024 to 2034

Figure 92: Italy Market Y-o-Y Growth (%) Projections by End-use Industry, 2024 to 2034

Figure 93: Italy Market Attractiveness by Closure Type, 2024 to 2034

Figure 94: Italy Market Attractiveness by Material Type, 2024 to 2034

Figure 95: Italy Market Attractiveness by End-use Industry, 2024 to 2034

Figure 96: Italy Market Attractiveness By Region, 2024 to 2034

Figure 97: France Market Value (US$ Million) by Closure Type, 2024 to 2034

Figure 98: France Market Value (US$ Million) by Material Type, 2024 to 2034

Figure 99: France Market Value (US$ Million) by End-use Industry, 2024 to 2034

Figure 100: France Market Value (US$ Million) By Region, 2024 to 2034

Figure 101: France Market Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 102: France Market Volume (Tonnes) Analysis By Region, 2019 to 2034

Figure 103: France Market Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 104: France Market Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 105: France Market Value (US$ Million) Analysis by Closure Type, 2019 to 2034

Figure 106: France Market Volume (Tonnes) Analysis by Closure Type, 2019 to 2034

Figure 107: France Market Value Share (%) and BPS Analysis by Closure Type, 2024 to 2034

Figure 108: France Market Y-o-Y Growth (%) Projections by Closure Type, 2024 to 2034

Figure 109: France Market Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 110: France Market Volume (Tonnes) Analysis by Material Type, 2019 to 2034

Figure 111: France Market Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 112: France Market Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 113: France Market Value (US$ Million) Analysis by End-use Industry, 2019 to 2034

Figure 114: France Market Volume (Tonnes) Analysis by End-use Industry, 2019 to 2034

Figure 115: France Market Value Share (%) and BPS Analysis by End-use Industry, 2024 to 2034

Figure 116: France Market Y-o-Y Growth (%) Projections by End-use Industry, 2024 to 2034

Figure 117: France Market Attractiveness by Closure Type, 2024 to 2034

Figure 118: France Market Attractiveness by Material Type, 2024 to 2034

Figure 119: France Market Attractiveness by End-use Industry, 2024 to 2034

Figure 120: France Market Attractiveness By Region, 2024 to 2034

Figure 121: Spain Market Value (US$ Million) by Closure Type, 2024 to 2034

Figure 122: Spain Market Value (US$ Million) by Material Type, 2024 to 2034

Figure 123: Spain Market Value (US$ Million) by End-use Industry, 2024 to 2034

Figure 124: Spain Market Value (US$ Million) By Region, 2024 to 2034

Figure 125: Spain Market Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 126: Spain Market Volume (Tonnes) Analysis By Region, 2019 to 2034

Figure 127: Spain Market Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 128: Spain Market Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 129: Spain Market Value (US$ Million) Analysis by Closure Type, 2019 to 2034

Figure 130: Spain Market Volume (Tonnes) Analysis by Closure Type, 2019 to 2034

Figure 131: Spain Market Value Share (%) and BPS Analysis by Closure Type, 2024 to 2034

Figure 132: Spain Market Y-o-Y Growth (%) Projections by Closure Type, 2024 to 2034

Figure 133: Spain Market Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 134: Spain Market Volume (Tonnes) Analysis by Material Type, 2019 to 2034

Figure 135: Spain Market Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 136: Spain Market Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 137: Spain Market Value (US$ Million) Analysis by End-use Industry, 2019 to 2034

Figure 138: Spain Market Volume (Tonnes) Analysis by End-use Industry, 2019 to 2034

Figure 139: Spain Market Value Share (%) and BPS Analysis by End-use Industry, 2024 to 2034

Figure 140: Spain Market Y-o-Y Growth (%) Projections by End-use Industry, 2024 to 2034

Figure 141: Spain Market Attractiveness by Closure Type, 2024 to 2034

Figure 142: Spain Market Attractiveness by Material Type, 2024 to 2034

Figure 143: Spain Market Attractiveness by End-use Industry, 2024 to 2034

Figure 144: Spain Market Attractiveness By Region, 2024 to 2034

Figure 145: Rest of Industry Analysis and Outlook Value (US$ Million) by Closure Type, 2024 to 2034

Figure 146: Rest of Industry Analysis and Outlook Value (US$ Million) by Material Type, 2024 to 2034

Figure 147: Rest of Industry Analysis and Outlook Value (US$ Million) by End-use Industry, 2024 to 2034

Figure 148: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Closure Type, 2019 to 2034

Figure 149: Rest of Industry Analysis and Outlook Volume (Tonnes) Analysis by Closure Type, 2019 to 2034

Figure 150: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Closure Type, 2024 to 2034

Figure 151: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Closure Type, 2024 to 2034

Figure 152: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 153: Rest of Industry Analysis and Outlook Volume (Tonnes) Analysis by Material Type, 2019 to 2034

Figure 154: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 155: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 156: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by End-use Industry, 2019 to 2034

Figure 157: Rest of Industry Analysis and Outlook Volume (Tonnes) Analysis by End-use Industry, 2019 to 2034

Figure 158: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-use Industry, 2024 to 2034

Figure 159: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-use Industry, 2024 to 2034

Figure 160: Rest of Industry Analysis and Outlook Attractiveness by Closure Type, 2024 to 2034

Figure 161: Rest of Industry Analysis and Outlook Attractiveness by Material Type, 2024 to 2034

Figure 162: Rest of Industry Analysis and Outlook Attractiveness by End-use Industry, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Western Blotting Processors Market Trends and Forecast 2025 to 2035

Western Blotting Market is segmented by product, application and end user from 2025 to 2035

Western Europe Automotive Performance Tuning & Engine Remapping Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Western Europe Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Load Floor IndustryAnalysis in Western Europe Forecast & Analysis 2025 to 2035

Western Europe Probiotic Supplement Market Analysis in – Growth & Market Trends from 2025 to 2035

Western Europe Women’s Intimate Care Market Analysis – Size, Share & Trends 2025 to 2035

Western Europe Non-Dairy Creamer Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Western Europe Last-mile Delivery Software Market – Growth & Outlook through 2035

Western Europe Inkjet Printer Market – Growth & Forecast 2025 to 2035

Western Europe HVDC Transmission System Market – Growth & Forecast 2025 to 2035

Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Western Europe Intelligent Enterprise Data Capture Software Market - Growth & Forecast 2025-2035

Communications Platform as a Service (CPaaS) Market Growth - Trends & Forecast 2025 to 2035

Visitor Management System Industry Analysis in Western Europe - Market Outlook 2025 to 2035

Western Europe Base Station Antenna Market - Growth & Demand 2025 to 2035

Western Europe Banking-as-a-Service (BaaS) Platform Market - Growth & Demand 2025 to 2035

Western Europe Event Management Software Market Trends – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA