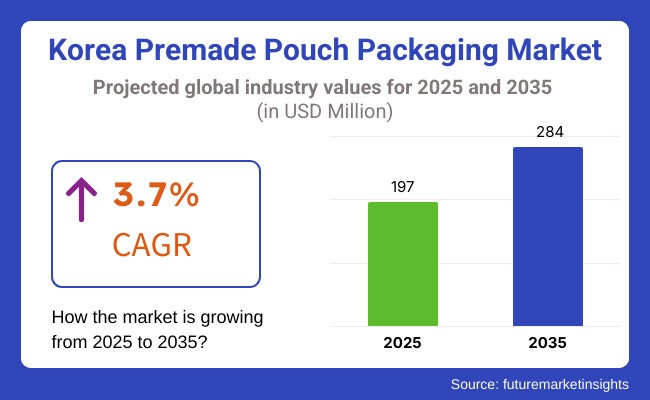

The Korea premade pouch packaging market is estimated to account for USD 197 million in 2025. It is anticipated to grow at a CAGR of 3.7% during the assessment period and reach a value of USD 284 million by 2035.

Industry Outlook

From 2025 to 2035, the Korea premade pouch packaging business is projected to witness stable growth with respect to changing lifestyles of consumers, environmental strategies, and technological developments. Light, flexible packaging will further grow, especially in the food, beverage, pharmaceutical, and personal care industries.

Sustainability will be the driving force behind the industry with higher usage of recyclable, biodegradable, and compostable packaging as a result of stringent environmental laws and consumer pressure.

Regulatory compliance will be key, with companies investing in sustainable materials and practices to keep up with government policies. The competitive environment will have both domestic and foreign players competing to innovate and remain ahead, with a focus on green solutions and increased consumer convenience. The long-term growth of the industry will be influenced by sustainability trends, technology integration, and the capacity to address changing consumer needs.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Consumers showed a growing interest in lightweight and portable packaging, especially for food, beverages, and personal care products. | Consumers will prioritize eco-friendly, recyclable, and reusable packaging, along with enhanced convenience features like resealable closures and smart packaging. |

| Shift towards flexible plastic packaging, with early adoption of recyclable and biodegradable materials. Brands focused on reducing packaging waste. | Widespread adoption of sustainable materials, including compostable bioplastics and paper-based pouches, driven by government regulations and eco-conscious consumer behavior. |

| Regulations were gradually introduced to encourage sustainable packaging, but implementation was still in the early stages. | Stricter environmental regulations will enforce sustainability practices, pushing companies to adopt greener alternatives and comply with recycling mandates. |

| Initial developments in digital printing and automation, improving branding and production efficiency. | Advanced automation, AI-driven manufacturing, and digital printing will dominate, enabling faster production, customization, and lower waste. Smart packaging (QR codes, NFC tags) will enhance consumer interaction and traceability. |

| The market saw increasing competition among domestic and international packaging companies, with a focus on affordability and branding. | Intense competition will drive innovation, with companies differentiating through eco-friendly solutions, smart packaging, and high-performance materials. |

| The rise of e-commerce, particularly post-pandemic, boosted demand for durable and lightweight packaging. | E-commerce expansion will continue to fuel demand for robust, tamper-proof, and sustainable packaging, with innovations in delivery-friendly pouch designs. |

| Investment in flexible packaging technology increased, with companies exploring biodegradable and recyclable alternatives. | Greater investments in R&D for sustainable packaging, AI-driven production, and enhanced material efficiency will define the industry’s future. |

| Brands increasingly used digital printing for attractive, customizable pouch designs, supporting product differentiation. | Hyper-personalization through digital printing, smart labels, and AR-enabled packaging will enhance brand engagement and consumer experience. |

As per FMI analysis, Korean consumers are proactively leading the trend toward sustainability in pre-made pouch packaging. They need green solutions, such as recyclable, biodegradable, and compostable packaging materials, and this makes brands move towards more eco-friendly options. As people become more and more environmentally aware, companies will need to cut down on plastic waste and implement circular economy principles to stay competitive.

The convenience and portability trend is only growing stronger as urban life with an active lifestyle fuels the buying behavior. Consumers prefer convenient, resealable, and lightweight sachets of personal care items, beverages, and foodstuffs. Single-serve and portion-sized packaging is on the rise as it becomes convenient to use on the move and reduces wastage of food.

Personalization is becoming a leading driver more and more because customers are seeking customized packaging experiences. Pouches are being empowered by businesses with digital printing, smart labels, and AR features to develop customized and engaging product experiences. QR code and NFC packs provide real-time product information, traceability, and interactive dialogue with consumers.

The online growth is driving the demand for pouches that are shipping-friendly and robust. Individuals are looking for light, flexible, and secure packaging that can endure long-distance shipping and reduce waste material. Direct-to-consumer (DTC) brands and subscription brands are transforming pouch packaging to create improved unboxing experiences.

| Metric | Value |

|---|---|

| Closure Type | Tear Notch |

| Expected Share in 2025 | 43.90% |

Based on closure type, the market is divided into tear notch, spout, zipper, and flip lid & others. It has the highest share of 43.90% in 2025. Tear-notch premade pouch packaging is also common in Korea because it is convenient, functional, and user-friendly.

Easy-to-open packages are favored by Korean consumers, particularly for food, snacks, and personal care products, because it makes the product more usable without the need for extra tools. The tear notch provides instant and controlled opening of the product, which makes it highly suitable for single-use or resealable pouches.

On the basis of material type, the market is segmented as plastic, aluminium laminates, paper, and others. Premade pouch packaging using plastic remains the most widely used method in Western Europe due to its versatility, resistance, and affordability.

Plastic pouches continue to dominate the food, beverage, personal care, and pharmaceutical markets despite increasing regulation and consumer demand for sustainability because they offer improved barrier protection against water, oxygen, and contaminants. Lightweight and resealable packaging solutions offered by flexible plastics such as polyethylene (PE) and polypropylene (PP) make them suitable for extended shelf life and convenience.

| Metric | Value |

|---|---|

| End-Use Industry | Food |

| Expected Share in 2025 | 73.90% |

Based on end-use industry, the market is divided into food, pharmaceuticals, cosmetics & personal care, and others. Premade pouch packaging of food is common in Korea due to its convenience, extended shelf life, and versatility for use in a wide variety of foods.

With their hectic lifestyles, Korean consumers prefer light, portable, and convenient packaging, and premade pouches are therefore ideal for ready-to-eat foods, snacks, frozen food, and drinks. The increasing demand for single-serve and portion-packaging also increases the application of pouches, which is attractive to on-the-go consumers as well as consumers who want less food waste.

Korean food manufacturers rely on advanced barrier protection from pre-filled pouches to preserve freshness, prevent contamination, and extend product shelf life. High-performance packaging materials, such as multi-layer plastics and aluminum laminates, provide excellent resistance to moisture, oxygen, and UV light and are well suited for perishable and processed foods. Pouches also offer flexibility to have a range of innovative features, such as resealable zippers, spouts, and tear notches, that increase user convenience.

The Korean premade pouch packaging market is still fairly concentrated, with major players competing on innovation and sustainability. Market leaders invest in new materials, automation, and intelligent packaging to stand out. Domestic manufacturers challenge international players with affordable, green solutions to accommodate changing consumer and regulatory needs.

Large industry players emphasize sustainable solutions, leading the way toward recyclable and biodegradable materials. Firms work with research centers to create high-barrier, lightweight, and compostable pouches. Government policies also compel manufacturers to innovate, increasing competition among companies to meet the challenge of balancing affordability, functionality, and environmental stewardship in packaging designs.

The growth of online shopping and food delivery business enhances demand for durable and tamper-evident pouches and competition. Firms invest in customization, digital printing, and intelligent packaging to strengthen brand identity and consumer interaction. With the rising trend of sustainability, the firms that embrace circular economy principles and mono-material packaging have an upper hand in the Korean market.

The Korean premade pouch packaging market is highly competitive with domestic and international players competing for market share. Industry leaders emphasize sustainability, innovation, and sophisticated manufacturing methods to set themselves apart. Companies investing in green materials, intelligent packaging solutions, and automation offer a vast lead in the changing scenario.

Sustainability standards compel fierce competition that compels companies to make biodegradable, recyclable, and mono-material pouches. Businesses adopting the circular economy mindset and fulfilling the policies set by the government emerge as examples to follow. Korean companies cooperate with research institutes in developing lightweight, high-barrier, and compostable pouches, competing and solving for the environment as well.

Food delivery services and e-commerce drive demand for tamper-proof, durable pouches, boosting competition among producers. Firms combine resealable features, digital printing, and customization to improve the customer experience. Premium aesthetics, interactive designs, and new packaging technologies are key areas of focus for brands seeking to position themselves advantageously in the competitive Korean packaging market.

Technological changes determine market dynamics with firms investing in automation, AI-based manufacturing, and intelligent packaging. Companies that optimize production processes and enhance efficiency cut down on costs and increase scalability. Digital printing and QR code pouches enable real-time consumer interaction and product tracing, allowing brands to compete in a growing tech-oriented market.

Foreign players are competing with local producers by providing affordable, high-quality packaging solutions. Global brands utilize established knowledge and sophisticated technologies, whereas Korean firms emphasize customization, sustainability, and fast adjustments to changing consumer patterns. The future of the industry will be good for those companies that strike a balance between innovation, environmental sustainability, and consumer convenience in their product profiles.

With respect to closure type, the market is classified into tear notch, spout, zipper, and flip lid & others.

In terms of material type, the market is segmented into plastic, aluminium laminates, paper, and others.

In terms of end-use industry, the market is divided into food, pharmaceuticals, cosmetics & personal care, and others.

In terms of province, the market is segmented into South Gyeongsang, North Jeolla, South Jeolla, Jeju, and Rest of Korea.

The market is anticipated to reach USD 197 million in 2025.

The market is predicted to reach a size of USD 284 million by 2035.

Prominent players include Solpac Packaging Solution, Honorpack, Viking Maseak, Stand Pouch, C-P Flexible Packaging, Accredo Packaging, Leepack / PSG LEE, Mondi Group plc, and Karlville.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Industry Analysis and Outlook Volume (Tonnes) Forecast by Region, 2019 to 2034

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Closure Type, 2019 to 2034

Table 4: Industry Analysis and Outlook Volume (Tonnes) Forecast by Closure Type, 2019 to 2034

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 6: Industry Analysis and Outlook Volume (Tonnes) Forecast by Material Type, 2019 to 2034

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by End-use Industry, 2019 to 2034

Table 8: Industry Analysis and Outlook Volume (Tonnes) Forecast by End-use Industry, 2019 to 2034

Table 9: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Closure Type, 2019 to 2034

Table 10: South Gyeongsang Industry Analysis and Outlook Volume (Tonnes) Forecast by Closure Type, 2019 to 2034

Table 11: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 12: South Gyeongsang Industry Analysis and Outlook Volume (Tonnes) Forecast by Material Type, 2019 to 2034

Table 13: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by End-use Industry, 2019 to 2034

Table 14: South Gyeongsang Industry Analysis and Outlook Volume (Tonnes) Forecast by End-use Industry, 2019 to 2034

Table 15: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Closure Type, 2019 to 2034

Table 16: North Jeolla Industry Analysis and Outlook Volume (Tonnes) Forecast by Closure Type, 2019 to 2034

Table 17: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 18: North Jeolla Industry Analysis and Outlook Volume (Tonnes) Forecast by Material Type, 2019 to 2034

Table 19: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by End-use Industry, 2019 to 2034

Table 20: North Jeolla Industry Analysis and Outlook Volume (Tonnes) Forecast by End-use Industry, 2019 to 2034

Table 21: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Closure Type, 2019 to 2034

Table 22: South Jeolla Industry Analysis and Outlook Volume (Tonnes) Forecast by Closure Type, 2019 to 2034

Table 23: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 24: South Jeolla Industry Analysis and Outlook Volume (Tonnes) Forecast by Material Type, 2019 to 2034

Table 25: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by End-use Industry, 2019 to 2034

Table 26: South Jeolla Industry Analysis and Outlook Volume (Tonnes) Forecast by End-use Industry, 2019 to 2034

Table 27: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Closure Type, 2019 to 2034

Table 28: Jeju Industry Analysis and Outlook Volume (Tonnes) Forecast by Closure Type, 2019 to 2034

Table 29: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 30: Jeju Industry Analysis and Outlook Volume (Tonnes) Forecast by Material Type, 2019 to 2034

Table 31: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by End-use Industry, 2019 to 2034

Table 32: Jeju Industry Analysis and Outlook Volume (Tonnes) Forecast by End-use Industry, 2019 to 2034

Table 33: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Closure Type, 2019 to 2034

Table 34: Rest of Industry Analysis and Outlook Volume (Tonnes) Forecast by Closure Type, 2019 to 2034

Table 35: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 36: Rest of Industry Analysis and Outlook Volume (Tonnes) Forecast by Material Type, 2019 to 2034

Table 37: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by End-use Industry, 2019 to 2034

Table 38: Rest of Industry Analysis and Outlook Volume (Tonnes) Forecast by End-use Industry, 2019 to 2034

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Closure Type, 2024 to 2034

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Material Type, 2024 to 2034

Figure 3: Industry Analysis and Outlook Value (US$ Million) by End-use Industry, 2024 to 2034

Figure 4: Industry Analysis and Outlook Value (US$ Million) by Region, 2024 to 2034

Figure 5: Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Industry Analysis and Outlook Volume (Tonnes) Analysis by Region, 2019 to 2034

Figure 7: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Industry Analysis and Outlook Value (US$ Million) Analysis by Closure Type, 2019 to 2034

Figure 10: Industry Analysis and Outlook Volume (Tonnes) Analysis by Closure Type, 2019 to 2034

Figure 11: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Closure Type, 2024 to 2034

Figure 12: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Closure Type, 2024 to 2034

Figure 13: Industry Analysis and Outlook Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 14: Industry Analysis and Outlook Volume (Tonnes) Analysis by Material Type, 2019 to 2034

Figure 15: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 16: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 17: Industry Analysis and Outlook Value (US$ Million) Analysis by End-use Industry, 2019 to 2034

Figure 18: Industry Analysis and Outlook Volume (Tonnes) Analysis by End-use Industry, 2019 to 2034

Figure 19: Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-use Industry, 2024 to 2034

Figure 20: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-use Industry, 2024 to 2034

Figure 21: Industry Analysis and Outlook Attractiveness by Closure Type, 2024 to 2034

Figure 22: Industry Analysis and Outlook Attractiveness by Material Type, 2024 to 2034

Figure 23: Industry Analysis and Outlook Attractiveness by End-use Industry, 2024 to 2034

Figure 24: Industry Analysis and Outlook Attractiveness by Region, 2024 to 2034

Figure 25: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Closure Type, 2024 to 2034

Figure 26: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Material Type, 2024 to 2034

Figure 27: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by End-use Industry, 2024 to 2034

Figure 28: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Closure Type, 2019 to 2034

Figure 29: South Gyeongsang Industry Analysis and Outlook Volume (Tonnes) Analysis by Closure Type, 2019 to 2034

Figure 30: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Closure Type, 2024 to 2034

Figure 31: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Closure Type, 2024 to 2034

Figure 32: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 33: South Gyeongsang Industry Analysis and Outlook Volume (Tonnes) Analysis by Material Type, 2019 to 2034

Figure 34: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 35: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 36: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by End-use Industry, 2019 to 2034

Figure 37: South Gyeongsang Industry Analysis and Outlook Volume (Tonnes) Analysis by End-use Industry, 2019 to 2034

Figure 38: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-use Industry, 2024 to 2034

Figure 39: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-use Industry, 2024 to 2034

Figure 40: South Gyeongsang Industry Analysis and Outlook Attractiveness by Closure Type, 2024 to 2034

Figure 41: South Gyeongsang Industry Analysis and Outlook Attractiveness by Material Type, 2024 to 2034

Figure 42: South Gyeongsang Industry Analysis and Outlook Attractiveness by End-use Industry, 2024 to 2034

Figure 43: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Closure Type, 2024 to 2034

Figure 44: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Material Type, 2024 to 2034

Figure 45: North Jeolla Industry Analysis and Outlook Value (US$ Million) by End-use Industry, 2024 to 2034

Figure 46: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Closure Type, 2019 to 2034

Figure 47: North Jeolla Industry Analysis and Outlook Volume (Tonnes) Analysis by Closure Type, 2019 to 2034

Figure 48: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Closure Type, 2024 to 2034

Figure 49: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Closure Type, 2024 to 2034

Figure 50: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 51: North Jeolla Industry Analysis and Outlook Volume (Tonnes) Analysis by Material Type, 2019 to 2034

Figure 52: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 53: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 54: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by End-use Industry, 2019 to 2034

Figure 55: North Jeolla Industry Analysis and Outlook Volume (Tonnes) Analysis by End-use Industry, 2019 to 2034

Figure 56: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-use Industry, 2024 to 2034

Figure 57: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-use Industry, 2024 to 2034

Figure 58: North Jeolla Industry Analysis and Outlook Attractiveness by Closure Type, 2024 to 2034

Figure 59: North Jeolla Industry Analysis and Outlook Attractiveness by Material Type, 2024 to 2034

Figure 60: North Jeolla Industry Analysis and Outlook Attractiveness by End-use Industry, 2024 to 2034

Figure 61: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Closure Type, 2024 to 2034

Figure 62: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Material Type, 2024 to 2034

Figure 63: South Jeolla Industry Analysis and Outlook Value (US$ Million) by End-use Industry, 2024 to 2034

Figure 64: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Closure Type, 2019 to 2034

Figure 65: South Jeolla Industry Analysis and Outlook Volume (Tonnes) Analysis by Closure Type, 2019 to 2034

Figure 66: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Closure Type, 2024 to 2034

Figure 67: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Closure Type, 2024 to 2034

Figure 68: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 69: South Jeolla Industry Analysis and Outlook Volume (Tonnes) Analysis by Material Type, 2019 to 2034

Figure 70: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 71: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 72: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by End-use Industry, 2019 to 2034

Figure 73: South Jeolla Industry Analysis and Outlook Volume (Tonnes) Analysis by End-use Industry, 2019 to 2034

Figure 74: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-use Industry, 2024 to 2034

Figure 75: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-use Industry, 2024 to 2034

Figure 76: South Jeolla Industry Analysis and Outlook Attractiveness by Closure Type, 2024 to 2034

Figure 77: South Jeolla Industry Analysis and Outlook Attractiveness by Material Type, 2024 to 2034

Figure 78: South Jeolla Industry Analysis and Outlook Attractiveness by End-use Industry, 2024 to 2034

Figure 79: Jeju Industry Analysis and Outlook Value (US$ Million) by Closure Type, 2024 to 2034

Figure 80: Jeju Industry Analysis and Outlook Value (US$ Million) by Material Type, 2024 to 2034

Figure 81: Jeju Industry Analysis and Outlook Value (US$ Million) by End-use Industry, 2024 to 2034

Figure 82: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Closure Type, 2019 to 2034

Figure 83: Jeju Industry Analysis and Outlook Volume (Tonnes) Analysis by Closure Type, 2019 to 2034

Figure 84: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Closure Type, 2024 to 2034

Figure 85: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Closure Type, 2024 to 2034

Figure 86: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 87: Jeju Industry Analysis and Outlook Volume (Tonnes) Analysis by Material Type, 2019 to 2034

Figure 88: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 89: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 90: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by End-use Industry, 2019 to 2034

Figure 91: Jeju Industry Analysis and Outlook Volume (Tonnes) Analysis by End-use Industry, 2019 to 2034

Figure 92: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-use Industry, 2024 to 2034

Figure 93: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-use Industry, 2024 to 2034

Figure 94: Jeju Industry Analysis and Outlook Attractiveness by Closure Type, 2024 to 2034

Figure 95: Jeju Industry Analysis and Outlook Attractiveness by Material Type, 2024 to 2034

Figure 96: Jeju Industry Analysis and Outlook Attractiveness by End-use Industry, 2024 to 2034

Figure 97: Rest of Industry Analysis and Outlook Value (US$ Million) by Closure Type, 2024 to 2034

Figure 98: Rest of Industry Analysis and Outlook Value (US$ Million) by Material Type, 2024 to 2034

Figure 99: Rest of Industry Analysis and Outlook Value (US$ Million) by End-use Industry, 2024 to 2034

Figure 100: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Closure Type, 2019 to 2034

Figure 101: Rest of Industry Analysis and Outlook Volume (Tonnes) Analysis by Closure Type, 2019 to 2034

Figure 102: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Closure Type, 2024 to 2034

Figure 103: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Closure Type, 2024 to 2034

Figure 104: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 105: Rest of Industry Analysis and Outlook Volume (Tonnes) Analysis by Material Type, 2019 to 2034

Figure 106: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 107: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 108: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by End-use Industry, 2019 to 2034

Figure 109: Rest of Industry Analysis and Outlook Volume (Tonnes) Analysis by End-use Industry, 2019 to 2034

Figure 110: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-use Industry, 2024 to 2034

Figure 111: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-use Industry, 2024 to 2034

Figure 112: Rest of Industry Analysis and Outlook Attractiveness by Closure Type, 2024 to 2034

Figure 113: Rest of Industry Analysis and Outlook Attractiveness by Material Type, 2024 to 2034

Figure 114: Rest of Industry Analysis and Outlook Attractiveness by End-use Industry, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Korea Automotive Performance Tuning and Engine Remapping Service Industry Size and Share Forecast Outlook 2025 to 2035

Korea Smart Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

Korea Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Korea Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Korea Isomalt Industry – Market Trends & Industry Growth 2025 to 2035

Korea Probiotic Supplement Industry – Industry Insights & Demand 2025 to 2035

Korea Calcium Supplement Market is segmented by form,end-use, application and province through 2025 to 2035.

The Korea Non-Dairy Creamer Market in Korea is segmented by form, nature, flavor, type, base, end-use, packaging, distribution channel, and province through 2025 to 2035.

Korea Women’s Intimate Care Market Analysis - Size, Share & Trends 2025 to 2035

Korea Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Korea Visitor Management System Market Growth – Trends & Forecast 2025 to 2035

Korea fiber optic gyroscope market Growth – Trends & Forecast 2025 to 2035

Korea Event Management Software Market Insights – Demand & Growth Forecast 2025 to 2035

Korea Submarine Cable Market Insights – Demand & Forecast 2025 to 2035

Last-mile Delivery Software Market in Korea – Trends & Forecast through 2035

Korea HVDC Transmission System Market Trends & Forecast 2025 to 2035

Korea Base Station Antenna Market Growth – Trends & Forecast 2025 to 2035

Smart Space Market Analysis in Korea-Demand & Growth 2025 to 2035

Korea Banking-as-a-Service (BaaS) Platform Market Growth – Trends & Forecast 2025 to 2035

Korea I2C Bus Market Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA