Japan’s premade pouch packaging market is highly anticipated to grow in the forthcoming decade as the consumers will be demanding convenient, lighter, and sustainable packaging solution. This packaging format has been widely adopted in areas like Kanto and Chubu, where e-commerce and food delivery services are growing significantly along with retail-related industries.

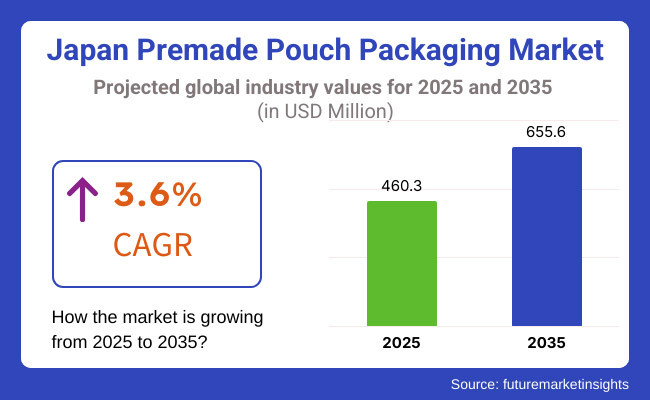

Japan’s premade pouch packaging market is expected to grow by USD 16 million, representing a 3.6% increase from 2024 to 2025. By 2025 the industry is projected to be valued at USD 460.3 million, and the industry is expected to reach the value of USD 655.6 million by 2035, growing at a CAGR of 3.6% during 2025 to 2035. Industry trends will be shaped by the growing online shopping, food and beverage innovations and sustainability.

Japanese firms are expected to make significant investments on sustainable materials like biodegradable films and recyclable pouches amid changing consumer habits and government rules on plastic waste reduction. This is followed by increasing preference of same day fresh vegetables, demand for reusable and high-barrier packaging in pharmaceuticals and personal care products.

With automation and digitalization continuing to shape Japan’s packaging sector, the trend of smart pouches integrated with QR codes and interactive packaging. Technology and sustainability will be the key drivers of innovation, and premade pouch packaging will play a crucial role in the future packaging landscape of the country.

Explore FMI!

Book a free demo

| Past (2020 to 2024) | Future (2025 to 2035) |

|---|---|

| Significant growth driven by fast-paced lifestyles and e-commerce expansion. | Continued transformation with a strong focus on sustainability. |

| Rising demand for on-the-go, lightweight, and easy-to-carry packaging solutions. | Innovation in recyclable materials, bio-based polymers, and eco-friendly manufacturing. |

| Increased need for strong, compact packaging for safe and efficient shipping. | Sustainable packaging solutions to align with global environmental concerns. |

| Digital printing technology improved pouch designs and functionality. | Advanced technologies to enhance quality, utility, and personalization. |

| Consumers sought unique and visually appealing packaging solutions. | Packaging differentiation to help brands stand out in a competitive segment. |

| Growth fueled by convenience-driven consumer behavior. | Emergence of new segments and business opportunities through innovation. |

Closure Types of Pre-made Pouch Packaging Sector are segmented into Tear Notch, Spout, Zipper, Flip Lid, among others. Tear notch pouches are popular because they are easy to use and designed for packaging dry goods and snacks. By 2025, the tear-notch closure type segment will be preferred by end users, constituting 43.4% of the premade pouch packaging industry.

The convenience and improved product visibility offered by spouted pouches are crucial for the food and beverages sector, which is indicated to be driving the pouch sector growth globally. Zipper closures enable reseal ability, an important factor in preserving the freshness of the product as well as increasing shelf life.

Closure types like flip lids provide key features such as child resistance and tamper evidence, which are essential in the pharmaceutical industry. Consumer preferences like convenience and product safety drive demand for various closure types of closures.

However, there is an increasing demand for pre-made pouches with different types of closures, with consumers looking for portable and easy-to-use packaging solutions, which is expected to create a significant opportunity in the pre-made pouches with different types of closures sector over the forecast period of 2025 to 2035. R&D for new closure-based technology designs that are easier to reseal and are spill-proof will further propel sector growth.

Based on material type, the pre-made pouch packaging market is segmented into plastic and paper based. Plastic, such as Polyethylene Terephthalate (PET), Polyethylene (PE), Polypropylene (PP), Polyamide (PA), are commonly used materials for pouches in form of pre-made pouches considering strength and flexibility.

PET is considered the clearest and strongest; PE and PP are regarded as cheaper and more flexible. Polyamide is recognized for its excellent barrier properties and is used to package sensitive products.

Eco-Friendly Alternatives Drive Demand for Paper Pre-Made Pouches in Packaging Market aluminum laminates are included as part of paper pre-made pouches, which are highly attractive for environmentally conscious consumers.

Sustainability is another key trend, as more companies turn towards biodegradable resins and recyclable films, aligning with both consumer and regulatory demands for minimized environmental impact. With increasing environmental consciousness, the need for sustainable materials in pre-made pouch packaging will grow rapidly and will lead to breakthroughs in biodegradable packaging solutions in the next decade.

Pre-formed pouch packaging finds application in a variety of industries such as food, pharmaceuticals, cosmetics, and personal care. Pre-made pouches are widely used in the food package fruits & vegetables, meat, poultry, and seafood, bakery and confectionery, ready-to-eat meals, dairy, and pet food.

Good for the food industries long shelf life, convenience, and less packaging waste can be achieved with these pouches. If you work in pharmaceuticals, you may have noticed that they use pre-made pouches to pack their medicines because pouches are ideal for preserving the integrity and safety of the product.

Pre-made pouches allow cosmetics and personal care products to provide versatility and branding in certain suitable applications, improving product compatibility and user experience. The increase in demand for packaged and ready-to-eat food products alongside the adoption of sustainable packaging solutions influences the application of pre-made pouches in the industries.

As the densest urban and the most extensive retail and e-commerce population in Japan, Kanto has presented as the largest and most potential landscape for premade pouch packaging. As the economic center of Japan, Tokyo and Yokohama at the forefront of innovation, the region of Kanto has a high demand of flexible packaging to produce food, beverage, cosmetics, pharmaceutical among other sectors.

The flexible packaging formats in superlandscapes, convenience stores, and online shopping will drive the market demand as they occupy less space and are lighter in weight.

Consumers in the region also demand sustainable packaging and brands are turning to biodegradable and recyclable pouch solutions. There is also a trend of increasing automation in the act of packaging, which is accelerating landscape penetration.

Being the industrial and manufacturing powerhouse area of Japan, Chubu has an increasing demand for premade pouch packaging, mainly in the automotive, electronics, and food processing sectors. Nagoya a key business center sees rising demand for export-oriented packaging as companies need durable, moisture-resistant pouches for transporting sensitive precision components.

In the food sector, ready-to-eat meals and pre-packaged fresh produces show increasing demand - especially in convenience store networks. Sustainable packaging initiatives have seemed to pop up in this region as key players in this region seek to quell their contribution to plastic waste, driving manufacturers toward paper-based or bioplastic pouch solutions.

Kansai region, which includes Osaka, Kyoto and Kobe, is the cultural and commercial center of Japan and has a stable demand for high quality and visually appealing packaging. Pouch packaging is commonly used in the food landscape, especially for traditional Japanese and confectionery items.

Artisanal brands and green tea exporters in Kyoto use high-quality resealable pouches to maintain freshness. As a consumer goods and retail center, Osaka is helping to drive flexible packaging uptake in the personal care and homecare fields. It has also been innovated with smart packaging technologies including QR codes and interactive labels, which are designed to enhance consumer engagement.

The demand for premade pouch packaging in Kyushu and Okinawa regions is steadily rising due to the booming food and beverage sectors and increasing tourism in the regions. Okinawa, where some varieties of regional food are unique, has put more emphasis on attractive, travel-friendly pouches for packaged food souvenirs.

Flexible Packaging Solutions to Boost Kyushu's Agriculture and Seafood Exports Moreover, as eco-focused tourism continues to catch on, hotels and resorts across the region are steadily moving away from PET plastic containers and their single-use products / for toiletries in favor of biodegradable pouch packaging.

Tohoku has been historically dependent on agriculture and fisheries, but in line with reconstruction efforts modernization is driving uptake of premade pouch packaging. These pouches are vacuum sealed for enhanced preservation and longer shelf life, making them an effective option for local food producers looking to tap into the growing demand for organic and minimally processed foods.

Regional businesses are pouring investment into light, durable pouches the better to sell food and beverage online, as e-commerce expands beyond Japan’s urban centers. Miyagi and Fukushima prefectures are also becoming leading suppliers of sustainable packaging, backed by government-supported initiatives for recyclable and biodegradable materials.

Other areas of Japan are highly field-dependent when it comes to adopting premade pouch packaging. The benefits of flexible packaging need to be carefully considered in rural communities which have artisanal food producers, as well, who are learning how the role of flexible packaging may help with branding and shelf-life extension.

In the meantime, in specialized sectors like pharmaceuticals and cosmetics, smaller prefectures are turning to high-performance laminated pouches in individual locations to comply with strict safety and quality regulations. This demonstrated that the government’s efforts to implement circular economy practices are bringing positive pressure even to faraway areas to switch to eco-friendly alternatives from plastic packaging.

Japan’s premade pouch packaging industr is highly consolidated, with Tier 1 players dominating 90% of the market share. A few large-scale packaging companies control the field, leveraging advanced manufacturing capabilities, established distribution networks, and strong R&D investments.

Their dominance limits opportunities for smaller players, making it challenging for new entrants to gain a foothold. However, niche segments focusing on eco-friendly and customized packaging solutions are emerging, providing space for specialized manufacturers. Consolidation ensures consistent quality, scalability, and innovation, as leading firms set field standards and drive the shift toward sustainable and smart packaging technologies in Japan.

As of 2024, major players in Japan's premade pouch packaging field were working on acquiring businesses and forming partnerships in order to enhance their international reach. However, while this trend has been declining, it is expected to rebound and gain traction in the future as the global flexible packaging field is flourishing due to the increasing demand for value-added convenience products as well as the booming e-commerce segment that has witnessed a significant rise in the last few years.

Existing companies, along with startups, are jumping on the sustainability bandwagon and creating green packaging solutions. They are using recyclable materials and reducing plastic usage as part of initiatives matched to their environmental goals. With a growing demand for flexible packaging, companies are investing heavily in machinery. The rise of Vertical Form Fill Seal (VFFS) Machines is noteworthy, especially given their efficiency in optimizing production for both small and large-scale operations, highlighting Japan's focus on automation and labor efficiency.

The premade pouch packaging industry in Japan offers lucrative opportunities for expansion, especially in the area of sustainable packaging solutions, as environmental considerations and regulatory policies fuel demand for recyclable plastics, bio-based polymers, and compostable materials in Japan. The surging e-commerce and food delivery sectors, especially in Kanto and Chubu, provide strong demand for durable, lightweight, and tamper-proof packaging.

Furthermore, digital printing is a tailor-made solution that enables brands to personalize their products to be more unique with different designs, QR codes, and a superior feel. Smart packaging technologies such as temperature-sensitive inks, freshness indicators, and RFID tracking are bringing new value, especially within the pharmaceutical industry and premium food categories, such as gourmet and organic products.

In addition, the increasing acceptance of premade pouches in non-food segments involving personal care, pet food, and household products can act as new opportunities for the participants to explore.

Hence, to tap these trends, these players must invest in R&D for green materials and smart packaging innovations. E-commerce and food delivery will be key drivers for continued growth as well as digital prints for customization and optimizing supply chains. Businesses should also consider investing in these sectors that represent new horizons; pharmaceuticals, for example, have high demand for resealable and protective packaging solutions.

This allows newcomers to understand consumer preferences, regulatory requirements, and retailers’ openness to collaboration, which can help them supply information to wholesalers. As customers want more and more sustainable and innovative packaging solutions, a case of customer differentiation from established suppliers. Industry expansion will be achieved through local partnerships, collaborations, or joint ventures with other suppliers, manufacturers, and e-commerce platforms.

Direct-to-consumer sales, digital marketing, and e-commerce presence will enhance brand awareness. Investing in technological innovation and premium branding can help to scale up, while the introduction of custom-printed and smart pouches can further solidify sector positioning. As a newcomer, you can get these insights directly from the findings provided in this report, which will help you to better position yourself in photodegradable premade pouch packaging in Japan.

The demand for convenient, lightweight, and sustainable packaging, along with the rise of e-commerce and ready-to-eat food, is fueling the growth.

Companies are shifting to biodegradable films, recyclable materials, and eco-friendly alternatives to align with consumer preferences and government regulations.

The food, pharmaceuticals, and personal care sectors are the largest adopters, leveraging premade pouches for freshness, branding, and convenience.

Technology is leading efficiency and innovation in ready-to-use pouch packaging via AI-based quality control, automation, and digital printing to enable customization. Intelligent packaging functionalities such as RFID tracking and freshness indicators add supply chain visibility and product safety, particularly in food and pharma.

Tighter regulations like the Plastic Resource Circulation Act and the Containers and Packaging Recycling Law are encouraging manufacturers to embrace sustainable materials, better recyclability, and sustainable production processes, impacting packaging innovation and design.

Tear Notch, Spout, Zipper, Flip Lid & Others

Plastic Pre-made Pouch Packaging, Polyethylene Terephthalate (PET), Polyethylene (PE), Polyvinyl Chloride (PVC), Polypropylene (PP), Polyamide (PA), Paper Pre-made Pouch Packaging, Aluminum Laminates, Others

Food, Fruits & Vegetables, Meat Poultry and Seafood, Bakery & Confectionery, Ready-to-eat, Dairy Products, Pet Food, Others, Pharmaceuticals, Cosmetics & Personal Care, Others

Kanto Region, Chubu Region, Kinki (Kansai), Kyushu and Okinawa, Tohoku, Rest of Japan

Sustainable Packaging Market Trends – Innovations & Growth 2025 to 2035

Thermoforming Machines Market Trends - Demand & Forecast 2025 to 2035

Strapping Devices Market Trends - Size, Growth & Forecast 2025 to 2035

Specialty Pulp and Paper Chemicals Market Analysis – Growth & Forecast 2025 to 2035

Silicone Elastomer Market Insights – Growth & Forecast 2025 to 2035

Tapes Market Insights – Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.