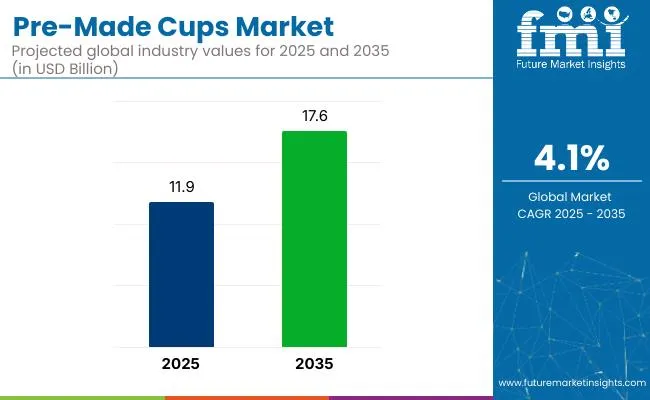

The global pre-made cups market is projected to grow from USD 11.9 billion in 2025 to USD 17.6 billion by 2035, registering a CAGR of 4.1% during the forecast period. Sales in 2024 were recorded at USD 12.94 billion.

This growth is primarily attributed to the increasing demand for convenient, disposable packaging solutions, the expansion of the foodservice and beverage industries, and the rising popularity of on-the-go consumption. Pre-made cups, known for their consistent quality and compatibility with high-speed filling machines, have become a preferred choice for manufacturers and consumers alike.

In April 2024, Starbucks announced the introduction of new disposable cold beverage cups containing up to 20% less plastic, aiming to reduce plastic waste and environmental impact. The redesigned cups are part of Starbucks' broader sustainability efforts to make all packaging reusable, recyclable, compostable.

Recent innovations in the pre-made cups market have significantly transformed the landscape of single-use packaging, with a clear shift toward sustainability, performance enhancement, and consumer engagement. Manufacturers are actively investing in the development of biodegradable and compostable materials, including polylactic acid (PLA), polyhydroxyalkanoates (PHA), bagasse, and molded fiber, to align with regulatory mandates and meet evolving consumer preferences.

These materials are not only plant-based but also industrially compostable, offering a promising alternative to traditional petroleum-based plastic cups.

Advances in coating technologies are enabling enhanced moisture and heat resistance without compromising recyclability. Brands are increasingly integrating aqueous and bio-resin coatings to eliminate polyethylene linings, thereby improving end-of-life processing for paper-based cups. Digital integration is another key trend shaping the innovation curve. Coupled with cloud-based data systems, these innovations facilitate smart tracking, reducing wastage and improving stock efficiency.

The global pre-made cups market is poised for dynamic expansion in the coming decade, particularly across emerging economies, driven by macroeconomic growth, rapid urbanization, and a growing culture of convenience-based consumption. Asia-Pacific is expected to dominate demand, with China, India, Indonesia, and Vietnam witnessing exponential increases in the use of pre-made disposable cups for hot and cold beverages, instant food servings, and desserts.

This uptick is directly tied to the expansion of quick-service restaurants (QSRs), coffee shop chains, and street food vendors, which increasingly rely on lightweight and cost-effective packaging formats to serve high volumes efficiently.

In parallel, rising disposable incomes, youth-driven foodservice consumption, and the adoption of Western dining formats are contributing to the market’s evolution in developing regions. Government regulations aimed at banning single-use plastics are further accelerating the transition toward paper-based and bio-resin cups, creating fertile ground for local and multinational manufacturers to expand capacity and innovate in material sourcing.

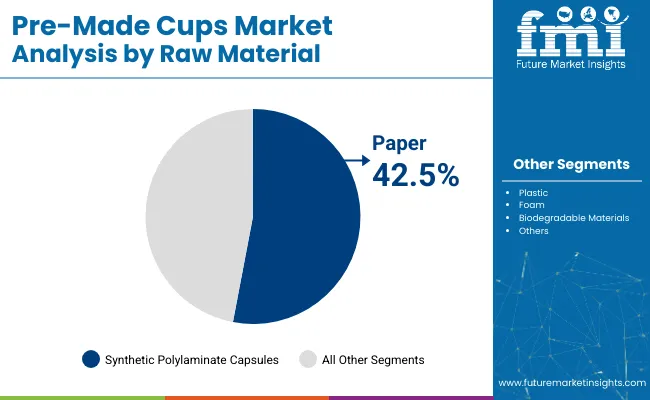

The market has been segmented based on raw material, capacity, usage outlook, design, application, and region. By raw material, paper, plastic, foam, and biodegradable materials are used to meet varying requirements of durability, insulation, and environmental compliance. Capacity segments include small (less than 8oz), medium (8oz - 16oz), and large (16oz or more), supporting portion-controlled packaging across multiple beverage categories.

Usage outlook includes hot beverages, cold beverages, and specialty drinks, reflecting diversification in café and QSR service models. Design segmentation covers plain, printed, textured, and insulated cups, enabling product differentiation, brand visibility, and performance in high-temperature or chilled environments.

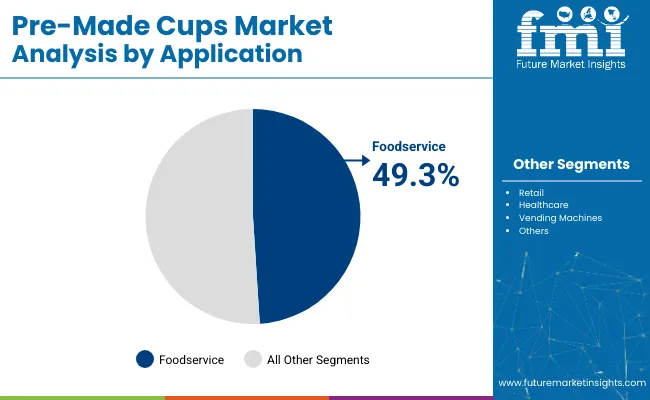

Applications include foodservice, retail, healthcare, and vending machines, addressing institutional, commercial, and automated dispensing needs. Regional segmentation spans North America, Europe, South America, Asia Pacific, and the Middle East and Africa to capture local manufacturing capabilities, sustainability mandates, and beverage consumption trends.

The paper segment is projected to command the highest share of 42.5% in the pre-made cups market by 2025, driven by escalating global demand for sustainable, compostable, and recyclable alternatives to plastic-based food packaging. With increasing bans and levies on single-use plastics across regions such as the EU, North America, and parts of Asia Pacific, paper has emerged as the most viable substrate for hot and cold beverage cups, particularly in the QSR and café segments.

Paper cups are typically lined with a thin layer of bioplastic (PLA) or water-based barrier coatings, which make them liquid-resistant while maintaining their composability under industrial conditions. Their lightweight, stackable design and superior printability allow brands to enhance both functionality and aesthetic appeal. Additionally, the use of FSC-certified paperboard and carbon-neutral production techniques has made paper cups a centerpiece in corporate ESG strategies.

Major beverage chains and foodservice companies are transitioning to paper-based formats not just for regulatory compliance but also to align with consumer preferences for visibly sustainable packaging. With ongoing innovations in double-walled insulation, spill-proof lids, and biodegradable linings, the paper segment is expected to remain the backbone of the pre-made cups market for the foreseeable future.

The foodservice segment is expected to account for the largest share of 49.3% in the pre-made cups market by 2025, fueled by the exponential growth of cafés, quick-service restaurants (QSRs), and takeaway beverage formats across both developed and emerging markets. This includes usage across coffee chains, fast-food outlets, bakeries, smoothie bars, and tea kiosks that require scalable, hygienic, and brand able cup formats for high-volume daily operations.

Foodservice operators rely on pre-made cups for their ready-to-use convenience, consistent quality, and compatibility with high-speed filling lines. With increasing consumer preference for takeaway and delivery services, particularly post-COVID-19, the demand for leak-proof, temperature-retaining cup designs has grown substantially.

Ecofriendly packaging has become a key brand differentiator in the foodservice sector. Operators are increasingly sourcing paper-based, PLA-lined, or compostable pre-made cups that satisfy both environmental regulations and consumer expectations. Customization through digital and flexographic printing technologies allows for seasonal branding, QR code integration, and promotional messaging, adding value to every cup.

Supply Chain Disruptions, Environmental Concerns, and Rising Raw Material Costs

Due to the availability of raw material, increase cost of transportation, and disturbances in global manufacturing, the pre-made cups market experiences some challenges. Moreover, regulatory pressure on disposable premade cup manufacturers is further ramping up on the back of environmental concerns such as plastic waste, ban on single use packaging and carbon emissions.

A second issue is the increasing cost of raw materials such as paperboard, bioplastics, and aluminum coatings which presents challenges to manufacturers in maintaining profit margins while also meeting sustainability standards.

Growth in Sustainable Packaging, AI-Optimized Manufacturing, and Customization Trends

However, the pre-made cups market still holds immense growth opportunities due to the introduction of sustainable packaging innovations, AI-based manufacturing efficiency, and growing need for personalized packaging solutions. This movement focuses on eco-friendlier materials like biodegradable plastics, recyclable paper cups and a plant-based coating and is starting to gain ground with green shoppers and foodservice brands.

AI is also revolutionizing the supply chain used in cup manufacturing through better supply chain optimization and waste reduction. Market growth is also being driven by increased demand for customized branding and specialty cup designs, including heat-sensitive graphics, QR code-enabled cups and interactive packaging.

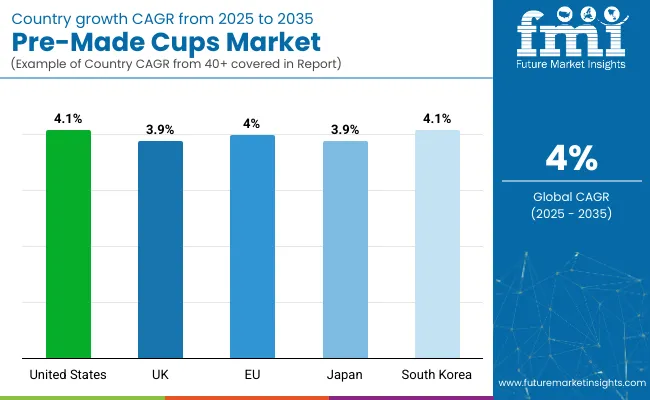

The USA pre-made cups market is characterized by growing demand and is expected to continue to exhibit a high growth rate over the forecast period. Booming demand for QSRs, coffee chains, and RTD beverages are boosting demand in the market. Moreover, the continuous development of recyclable and compostable cup materials is expected to aid the industry growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.1% |

The pre-made cups market in the United Kingdom is driven by increasing awareness and availability of sustainable packaging, and growing restrictions and bans on single-use plastics, as well as growing demand for paper-based and biodegradable cups. Market demand is being driven by the growth of the takeaway culture and innovations in insulated and reusable cup designs.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.9% |

The pre-made cups market in the European Union is on the rise, underpinned by tough sustainability policies, a growing uptake of compostable cups in food and beverage outlets, and greater investments in circular economy packaging solutions. EU directives regulating plastic trash and promoting fiber products as alternatives these days are also expanding the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.0% |

Japan Pre-made cups market has moderate growth owing to growing demand for quality takeaway beverage packing, increased utilization of technical advance cups integrated with heat retention property, and strengthening effort to minimization of plastic. Market trends are being influenced by a shift toward recyclable and reusable packaging materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.9% |

Demand for aesthetic and customized beverage packaging, improvement of coffee shop culture, and growing regulation on plastic waste are supporting the growth of the Pre-made cups market in South Korea. Market growth is fueled by high demand for products such as cold brew coffee, bubble tea, and specialty drinks. Also, the growing demand for biodegradable and good technology packaging is driving this industry demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.1% |

The pre-made cups market is driven by the rising demand for ready-to-use, environmentally safe, and customizable packaging solutions across industries including food & beverage, dairy, personal care and pharmaceuticals.

Growth powered by sustainable material innovations, AI-driven Manufacturing Automation and growing consumer preference for single use convenience packaging. To improve sustainability Without compromising cost efficiency and appealing to branding, businesses are concentrating on biodegradable cup manufacturing, AI-enhanced quality control, and lightweight, durable cup designs.

The overall market size for the pre-made cups market was USD 11.9 billion in 2025.

The pre-made cups market is expected to reach USD 17.6 billion in 2035.

Growth is driven by the rising demand for convenient and sustainable packaging solutions, increasing consumption of ready-to-eat and on-the-go beverages, advancements in biodegradable and recyclable cup materials, and expanding applications in foodservice and retail sectors.

The top 5 countries driving the development of the pre-made cups market are the USA, China, Germany, India, and Japan.

Plastic-Based Cups and the Food Industry are expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Foam Cups Market Size and Share Forecast Outlook 2025 to 2035

Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Leading Providers & Market Share in Paper Cups Industry

Sippy Cups Market Analysis – Size, Growth & Trends to 2033

Edible Cups Market Size and Share Forecast Outlook 2025 to 2035

Dosage Cups Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Cups Market Analysis and Insights for 2025 to 2035

Vending Cups Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cups Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Beverage Cups Companies

Menstrual Cups Market Growth - Trends & Forecast 2025 to 2035

Disposable Cups Market Size and Share Forecast Outlook 2025 to 2035

Competitive Breakdown of Disposable Cups Providers

Industry Share Analysis for Recyclable Cups Companies

Recyclable Cups Market by PE & PP Materials Through 2034

Automotive Cups and Glass Holder Market

Thermoform Cups Market

Ready-to-eat Cups Market Analysis by Product Type, Nature, Packaging, Distribution Channel, and Region - Growth, Trends, and Forecast through 2035

Cold Beverage Cups Market

Paper Pleated Cups Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA