The precipitation hardening market valuation is anticipated to grow at a considerable pace, with an estimated 2025 valuation ofUSD 3.17 billion, which is likely to reach around USD 7.04 billion by 2035, growing at a CAGR of about 8.3%. The robust growth of the industry is driven by applications for high-strength, corrosion-resistant alloys in the aerospace, automotive, and industrial manufacturing industries.

One of the key drivers of growth is the aerospace sector, for which precipitation-hardened alloys are utilized for landing gear, engine components, and structural elements. These alloys offer the thermal stability, fatigue life, and strength-to-weight ratio required for aircraft performance, fuel efficiency, and safety standards.

The automotive sector is also adopting precipitation-hardening alloys, especially for electric vehicle (EV) lightweighting initiatives. These alloys are used in powertrain components, transmission systems, and structural parts. With OEMs focusing on emission reduction and improved energy efficiency, high-strength alloys become a competitive edge.

In marine, power generation, and oil & gas, nickel alloys and precipitation-hardened stainless steels guarantee high corrosion and wear resistance. Such functionality is critical for service in hostile environments such as offshore rigs, high-pressure turbines, and chemical process facilities, where part longevity dictates operational reliability.

Technical advances are increasingly enhancing the diversity of precipitation hardening. Advances in powder metallurgy, additive manufacturing, and high-performance heat treatment are enabling tighter control over microstructures, thereby enabling tailor-made mechanical properties optimized based on specific functions and industries.

Although these materials have advantages, they are confronted with higher production and processing costs, unique heat treatment equipment, and expert labor. However, performance improvement in harsh applications usually outweighs initial cost considerations, especially in applications where reliability is not a choice.

Explore FMI!

Book a free demo

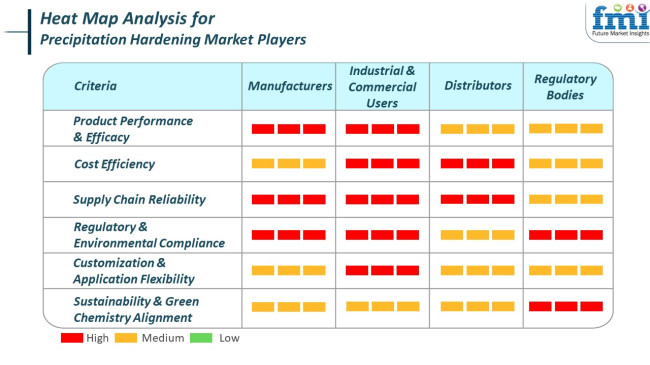

Producers focus on manufacturing high-performance precipitation hardening alloys that meet the demanding requirements of commercial and industrial customers. They ensure using eco-friendly manufacturing processes and aim to deliver a stable supply chain to meet the growing worldwide demand.

Industrial and commercial customers, including aerospace, automotive, construction, and medical devices markets, appreciate low-cost and reliable precipitation hardening solutions that ensure top performance in multi-application applications. They seek products with high performance, conforming to environmental specifications, and adjustable to specific operating conditions.

Distributors emphasize the necessity of maintaining a regular supply chain to supply industrial and commercial customers, emphasizing on-time delivery and competitive pricing. They focus on providing a wide range of products with different applications while maintaining competitive pricing and on-time delivery.

Expropriation authorities enforce the implementation of environmental and safety standards, promoting the adoption of sustainable and environmentally friendly precipitation hardening technologies. The regulatory agencies are also responsible for determining the direction of the industry by enforcing regulations that promote the uptake of clean technology and minimize the footprint of industrial activities on the environment.

Growth in the precipitation hardening industry in the period from 2020 to 2024 was picking up mainly in the aerospace, auto, and manufacturing industries. It increased demand for more durable materials with corrosion-resistant properties, mainly in aircraft body structures, engine turbine components, and high-end parts.

Producers during this period depended heavily on traditional alloys like stainless steel (17-4 PH) and aluminum-based variants. Developments focused on improving machine efficiency and improving fatigue life in extreme conditions dominated. However, limitations in the flexibility of alloys and production costs restricted widespread applications beyond niche industries.

Between 2025 and 2035, the industry is expected to develop more rapidly, with a greater focus on high-performance materials science and energy-saving production techniques. As additive manufacturing continues to grow and greater emphasis is placed on high-performance materials for electric vehicles, renewable energy equipment, and space exploration, precipitation-hardened alloys will become further diversified.

Industry players will invest in nano-precipitation process research and hybrid alloy systems to meet niche needs. Lifecycle analysis models and regulatory demands will spur demand for durable, lightweight materials with higher recyclability and lower carbon footprints.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Parts for aerospace, turbine blades, and precision instruments. | Electric vehicles, green infrastructure, space technology, and advanced robotics. |

| Majorly traditional alloys such as stainless steel (17-4 PH) and aluminum alloys. | Emphasis on nano -structured alloys, hybrid materials, and additive manufacturing-specific alloys. |

| Enhancements in heat treatment and machinability. | Advancements in nano -precipitation hardening, AI-driven alloy design, and environmentally friendly material development. |

| Traditional casting and forging processes prevailed. | Transition towards additive manufacturing, precision laser sintering, and integrated performance modeling. |

| Limited recycling and high energy consumption in production. | Strong emphasis on low-emission processing, recyclability, and lifecycle optimization. |

| Strong presence in North America and Western Europe as a result of defense and aerospace. | Balanced growth in Asia-Pacific and Middle East as industrial modernization and aerospace programs increase. |

The industry finds roles in the production of high-strength alloys used in aerospace, automotive, defense, and precision engineering and is gradually growing, but not without enormous challenges. One of the biggest risks facing the company in 2024 is the cost of alloying elements and complex heat treatment steps involved in achieving optimum material properties.

Aluminum, nickel, and precipitation-hardening stainless steels require closely controlled heat cycling and purpose-prepared hardware, and these are more costly to operate. These considerations tend to discourage usage in cost-conscious applications or low-volume manufacturing situations. On top of these, the industry is extremely competitive, with numerous local and international producers eager to present cost-competitive alternatives.

Environmental standards are another major challenge. The usage of certain chemicals in surface treatment and heat processes has come into question, where companies need to invest in cleaner technologies or replace existing industrial procedures. These overhauls are capital-intensive and may, from time to time, close down business procedures or increase the cost of compliance.In the future, technological disruption poses a threat.

With newer materials like high-end composites and additive manufacturing alloys gaining mainline production status, precipitation-hardened metals will lose their traction in those end-use applications where lighter or flexible substitutes are an option. In addition, global supply chain risk-especially in major raw materials of politically unstable regions-is a long-term risk. Rare earth or special alloying element sourcing slippage freezes production and tests contract terms.

| Countries | Projected CAGR (2025 to 2035) |

|---|---|

| USA | 8.2% |

| UK | 8.0% |

| France | 8.1% |

| Germany | 8.3% |

| Italy | 8.0% |

| South Korea | 8.4% |

| Japan | 8.2% |

| China | 8.6% |

| Australia | 8.1% |

| New Zealand | 8.0% |

The USA is projected to grow at a CAGR of 8.2% from 2025 to 2035. Growth in aerospace, defense, and energy sectors, where corrosion-resistant, high-strength alloys are essential, is driving the rising demand. The usage of precipitation-hardened stainless steels and aluminum alloys in turbine components, airframes, and critical joints is propelling sales growth.

Industry leaders such as Allegheny Technologies Inc. (ATI), Carpenter Technology Corp., and Special Metals Corp. are investing in advanced metallurgical processes and hardening alloys compatible with additive manufacturing. Government spending on aerospace R&D and defense modernization is anticipated to drive adoption further [Source: USA Department of Defense].

The UK is expected to grow at a CAGR of 8.0% during the forecast period. High demand comes from the aerospace and automotive industries due to precision engineering applications. The superior mechanical properties and weldability of precipitation-hardened alloys make them imperative in jet engines, gear sets, and medical implants.

Industry like Rolls-Royce plc and BAE Systems are actually using precipitation-hardened superalloys in propulsion systems and airframe components. National investment in clean aviation technology and defense resilience is poised to underpin further long-term demand [Source: UK Ministry of Defence].

France is also likely to have a CAGR of 8.1%. The country's strong aerospace manufacturing base, particularly in Toulouse, is among the key drivers of growth. Precipitation-hardened materials are extensively used in airplane structures, turbine disks, and engine casings due to their high tensile strength and fatigue resistance.

Large suppliers such as Aubert & Duval and Aperam are focusing on alloy development and thermomechanical processing. Collaboration with Airbus and participation in European defense programs further consolidate France's position in this industry[Source: European Defence Agency].

Germany is poised to expand with a CAGR of 8.3%. Industrial machinery, automobile, and high-speed rail industries are key drivers of demand owing to strong industries. Strong alloys are required in applications relating to durability with respect to extreme loads and cycling temperatures.

Voestalpine High-Performance Metals GmbH and Deutsche Edelstahlwerke are the major contributors, supplying hardening alloys for toolmaking, transportation technology, and energy applications. Germany's focus on engineering quality and sustainability in production is matched by the precision demands of this material industry [Source: German Federal Ministry for Economic Affairs].

Italy is expected to achieve a CAGR of 8.0% from 2025 to 2035. The market benefits from growing demand in defense production, aerospace tooling, and offshore equipment production. Precipitation-hardened materials find extensive applications in valve bodies, fasteners, and structural supports.

Producers such as AcciaierieValbruna and FonderieAriotti are increasing their capacity in corrosion-resistant alloys and advanced heat-treatment methods. Italian industrial policy emphasizing localization and high-performance materials in defense and energy applications provides additional support to the market [Source: European Commission - Industrial Strategy].

South Korea is projected to grow at a CAGR of 8.4% on the basis of aerospace, shipbuilding, and high-tech manufacturing industries. Precipitation hardening is a critical characteristic in turbine blades made from superalloys, naval equipment, and semiconductor manufacturing equipment, requiring dimensional stability and wear resistance.

Companies such as POSCO and Hyundai Steel are investing in alloy portfolios and making alliances with global aerospace suppliers. Investments in national defense autonomy and aerospace innovation are set to fuel market growth throughout the decade [Source: OECD].

Japan will advance at an 8.2% CAGR. The aerospace, robotics, and energy markets are significant consumers of precipitation-hardened alloys. Precipitation-hardened materials are interested in highly demanding load-carrying parts as well as temperature components that need continuous mechanical behavior.

Major producers such as Nippon Steel Corporation and Daido Steel are developing powder metallurgy and microalloying techniques to promote precipitation kinetics as well as resist stress. Government actions in rejuvenating high-value manufacturing and insuring rare alloy resources enhance the long-term perspective [Source: IMF].

China is estimated to lead with a CAGR of 8.6%, the highest among nations surveyed. Strong growth in military, aerospace, and nuclear energy markets is driving heavy investment in precipitation-hardening technologies. Structural reform and technological self-reliance policies are supporting the indigenous development of advanced metallurgical capabilities.

Government-owned enterprises such as Baosteel and AVIC Manufacturing Technology are investing in alloys for high-performance aircraft engines, marine propulsion equipment, and reactor internals. Other strategic national initiatives, such as Made in China 2025, continue to propel domestic R&D and alloy development [Source: UN].

Australia is anticipated to record a CAGR of 8.1%. Sales are driven by usage in mining machinery, offshore engineering, and defense ships. Precipitation-hardened stainless steels and aluminum alloys are heavily used in drill bits, subsea connectors, and structural supports in harsh environments.

Firms like Austal Limited and Bisalloy Steel are forming global partnerships to co-develop solar energy-based equipment for naval vessel construction and energy infrastructure. Government-supported industry transformation plans are enhancing competitiveness in the advanced processing of materials [Source: Australian Industry & Science Department].

New Zealand is also expected to grow at a CAGR of 8.0%. The industry size is smaller in this country. However, demand is emerging from aerospace maintenance, farm machinery, and seaborne transportation industries. Precipitation-hardened grade components offer advantages in terms of wear life and fatigue resistance under harsh conditions of operation.

Engineering firms and materials research institutions are joining forces more and more to promote the use of high-strength alloys. Precision manufacturing and export-oriented growth-promoting policy actions are propelling sales expansion [Source: New Zealand Ministry of Business, Innovation and Employment].

By hardening types, the industry is segmented into coherency strain and chemical hardening, with the former being related to the expected uptake of 42% of the industry share in 2025 and the latter accounting for 30%.

Coherency strain hardening occurs when fine precipitation is generated in the crystal lattice of a material, restricting dislocation movements to enhance material strength thereby. The process is most common in aerospace, automotive, and high-performance engineering materials, including aluminum alloys, titanium alloys, and some steel alloys.

Companies such as Alcoa and ATI Metals are taking advantage of coherency strain to manufacture lightweight strength materials for their aircraft and automotive applications. For example, Alcoa's major commercial application of aluminum alloys is aerospace, where the alloys are perfectly set to employ coherency strain hardening for the attainment of desired strength/weight properties. The key factor for driving the industry is advanced material development for very high-performance applications where strength-to-weight ratios are critical.

Chemical hardening generally involves the addition of alloying elements or chemical treatment for the hardening and strength improvement of material. This hardening is known to be most practiced in the production of steel, stainless steel, and nickel-based alloys in petrochemicals, power generation, and manufacturing industries.

Sandvik and Carpenter Technology are among the significant players in this segment, providing chemical hardening technology for high-performance materials in turbine blades, oil pipelines, and other industrial machinery. For example, Sandvik makes use of its high-performance steel grades, which are chemically hardened, mainly in critical applications, such as gas turbines and downhole oil tools, where high resistance to wear and corrosion is essential.

By material, the industry is segmented into stainless steel and aluminum. Stainless steel is expected to account for 38% of the revenue share, and aluminum will account for 32%.

The apparent strength and corrosion-resistant characteristics of stainless steel have earned it a favorable reputation in industries such as aerospace, automotive, medical, and chemical processing. Partial precipitation-hardening of stainless steel imparts a significant improvement in some physical characteristics, including strength, hardness, and fatigue resistance.

Some major companies that manufacture precipitation-hardened stainless steels for demanding applications include Carpenter Technology and Allegheny Technologies Incorporated (ATI). For instance, ATI's precipitation-hardened alloy 17-4PH stainless steel is used in aerospace applications such as landing gears and jet engine components that are exposed to high-temperature and high-stress environments. As the demand for materials with high strength and corrosion-resistant properties keeps on rising globally, the role of stainless steel in the industry will remain vital.

Aluminum, lightweight with a high strength-to-weight ratio, determines its foremost usage in applications where performance and weight reduction are of utmost importance, i.e., aerospace, automotive, and defense. Precipitation-hardened aluminum alloys offer superior mechanical properties, strength, and hardness and can be used in demanding applications, such as structure components, airplanes and high-performance vehicles.

Precipitation-hardened aluminum products are supplied by major manufacturers like Alcoa and Rio Tinto, focusing primarily on the production of alloys for industries where weight reduction and high strength are essential. For instance, precipitation hardening of Alcoa's 7050 aluminum alloy serves the aerospace industry by allowing load-bearing structures to achieve optimal strength and stress resistance while maintaining low weight, which is critical for aircraft construction.

The industry is dominated by preeminent metallurgical service providers specializing in advanced heat treatment solutions. Further, Bodycote and Paulo are also vying for a cut on the competitive edge by building their facilities and leveraging automation for process optimization.

On that, both Wallwork Heat Treatment Ltd. and Pilkington Metal Finishing are bent upon precision alloy treatments for aerospace, automotive, and industrial applications, strengthening their market tripods. Besides, Bluewater Thermal Solutions recently unveiled AI-driven monitors to gauge precipitation hardening processes continuously.

However, innovations and technological advancements remain marks that set these companies apart. In 2024, Bodycote unveiled North America's advanced vacuum heat treatment and achieved a new stand with in-house capability to produce next-generation aerospace alloys.

Paulo also uses artificial intelligence to control its facilities and technologies, hence streamlining its entire hardening activity in order to spur up hardening efficiency while ensuring material property consistency. Similarly, Wallwork Heat Treatment Ltd. is heavily investing in sought-after automation to minimize cycle times and thus improve competitiveness on highly precise applications.

Innovative product additions have been among the eminent sections in shaping the competition. AI-associated process optimization was recently unveiled by Bluewater Thermal Solutions to improve efficiency in hardening high-performance alloys. Pilkington Metal Finishing has created proprietary rapid-cycle heat treatment development for tooling and abrasive applications. Further, Indo-German Vacu Treat Pvt. Ltd. and Thermex Metal Treating have advanced by honing aging treatments to improve strength-to-ductility ratios in precipitation-hardened materials.

Sustainability and processing efficiency continue to forge competition. In the process, Specialty Steel Treating has adopted low-emission heat treatment techniques to be in line with the stringent environmental standards. These trends point towards an industry shift to make the processes better, more efficient, automated, and environmentally much more sustainable.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Bodycote | 20-24% |

| Paulo | 15-19% |

| Wallwork Heat Treatment Ltd. | 10-14% |

| Pilkington Metal Finishing | 8-12% |

| Bluewater Thermal Solutions | 6-10% |

| Other Players (Combined) | 27-32% |

| Company Name | Offerings & Activities |

|---|---|

| Bodycote | Advanced vacuum heat treatment for aerospace and defense. Expanding North American operations. |

| Paulo | AI-integrated precipitation hardening for automotive and industrial applications. Process optimization focus. |

| Wallwork Heat Treatment Ltd. | High-precision hardening for medical and tooling applications. Investing in automation. |

| Pilkington Metal Finishing | Custom heat treatment solutions with fast cycle times. Growing in industrial tooling segments. |

| Bluewater Thermal Solutions | AI-driven process control for consistent alloy hardening. Enhancing treatment efficiency. |

The industry valuation is estimated to reach USD 3.17 billion by 2025.

The industry is projected to grow to USD 7.04 billion by 2035, driven by increasing demand for high-strength and corrosion-resistant materials in aerospace, automotive, and industrial applications.

China is expected to grow at a rate of 8.6%, supported by rapid industrialization and advancements in manufacturing technologies.

Coherency strain and chemical hardening are leading mechanisms that are preferred for enhancing mechanical properties in stainless steel and superalloys.

Key players in this industry include Bodycote, Paulo, Wallwork Heat Treatment Ltd., Pilkington Metal Finishing, Bluewater Thermal Solutions, MSL Heat Treatment Limited, Indo-German Vacu Treat Pvt. Ltd., Irwin Automation Inc., Pacific Metallurgical, Inc., Thermex Metal Treating, Hauck Heat Treatment Ltd., and Specialty Steel Treating.

The segmentation is into Coherency Strain, Chemical, and Dispersion.

The segmentation is into Stainless Steel, Aluminium, Magnesium, and Others.

The segmentation is into the Automotive Industry, Aerospace Industry, and Others.

The report covers North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

Polyethylene Terephthalate Glycol (PETG) Market Growth - Innovations, Trends & Forecast 2025 to 2035

Sodium Bicarbonate Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Phenylethyl Market Growth - Innovations, Trends & Forecast 2025 to 2035

PP Homopolymer Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Phenoxycycloposphazene Market Growth - Innovations, Trends & Forecast 2025 to 2035

Drag Reducing Agent Market Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.