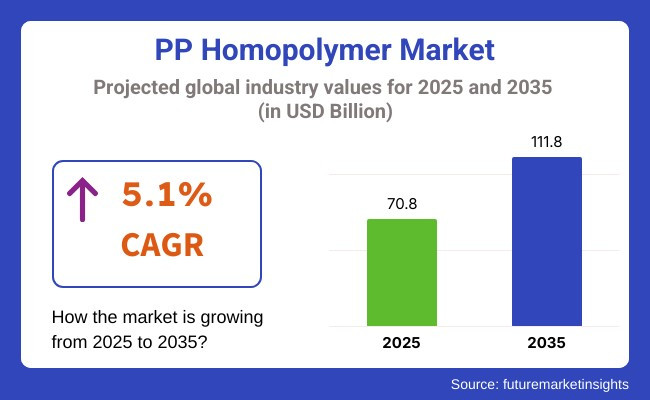

The PP homopolymer market is anticipated to grow at a steady rate, with an industry size of USD 70.8 billion in 2025, expected to reach around USD 111.8 billion by 2035, indicating a CAGR of 5.1%. The growth is fueled by extensive application in packaging, automotive, textile, and consumer goods sectors.

Among the key drivers of industry expansion is the packaging sector, where it is utilized in the production of rigid containers, caps, closures, thin food packaging, and woven sacks. With the growth of e-commerce, logistics, and consumer goods industries across the world, the demand for light and strong packaging materials also grows.

In the textile industry, homopolymer is applied to make non-woven fabrics, fibers, and filaments in the form of products like diapers, sanitary napkins, and medical gowns. Increased health awareness and consumption of hygiene products during the post-COVID era further boosted utilization in the industry.

The chemical resistance and electrical insulation features of the material render it highly applicable in electronic and domestic appliances use. It is also employed in furniture, toys, pipes, and components for industry through its recyclability and versatility that are highly desired in sustainability aims.

Advances in copolymer compounding, filler reinforcement, and additive formulation are expanding the use of homopolymers into high-performance applications. These developments enable greater impact strength, heat stability, and appearance so that it can be applied to more demanding product segments.

However, the industry is confronted by environmental and regulatory challenges. As plastic pollution is a global problem, governments are imposing bans and regulations on single-use plastics. PP can be recycled, but loopholes in infrastructure and consumer awareness still constrain the widespread use of recycling.

Geographically, the Asia-Pacific dominates the industry due to strong manufacturing and consumption in China and India. North America and Europe are trailing closely, with consistent demand from the packaging, automotive, and healthcare industries, along with efforts to improve circular economy practices.

Explore FMI!

Book a free demo

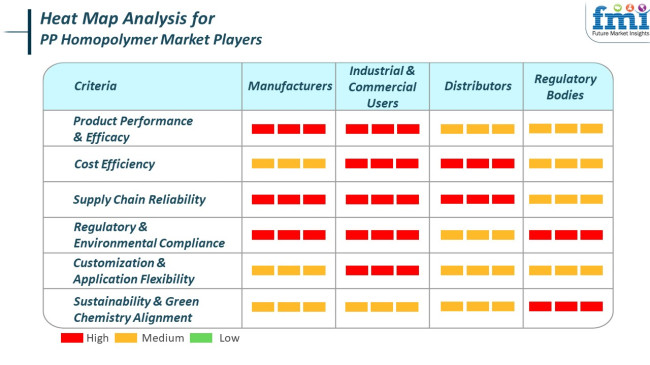

The industry is witnessing high growth as a result of growing demand from different industries including packaging, textiles, automotive, and consumer goods. The reasons for this growth include the need for lightweight and strong materials, strict government policies favoring green packaging solutions, and the growing applications in the emerging industries.

Distribution companies emphasize the necessity of maintaining a stable supply chain so that industrial and commercial customers can have their needs met. They deal with offering an assortment of products to be utilized for different purposes in a timely manner and at competitive prices. Regulatory agencies enforce the compliance with environment and safety norms, promoting the use of green and environmentally benign homopolymer solutions.

They are mandated to influence the industry by bringing in regulations which promote the utilization of green technology and minimize the environmental impact of industrial operations. The industry is dominated by a general trend among stakeholders towards product production and consumption that guarantees performance specifications, environmental friendliness, and responsiveness to changing industry needs.

During 2020 to 2024, the industry witnessed consistent growth, driven by growing applications in packaging, automotive, textiles, and medical applications. The outstanding strength-to-weight ratio and economy of the material rendered it a preferred option, especially in rigid packaging, non-woven materials, and home appliances.

The COVID-19 pandemic spurred the demand for hygiene solutions such as disposable masks and medical equipment, which prominently included homopolymers. But plastic waste and increasingly stringent regulations on single-use plastics started building pressure on manufacturers to explore sustainable solutions and recycling methods.

The industry will shift towards sustainability and performance enhancement ahead to 2025 to 2035. Companies will need to focus on innovation of recyclable and bio-based homopolymers, enabling them to better fit into circular economy systems.

Polymer processing and compounding technologies will increase the level of performance to render the material acceptable in premium applications such as lightweight automotive components and sustainable packaging. Furthermore, growing regulatory mandates across regions will encourage investment in advanced recycling technologies like chemical depolymerization and mechanical reprocessing of PP-based products.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| High demand from packaging, automotive, and healthcare due to cost efficiency and versatility. | Focus on recyclability, sustainability, and lightweight advanced manufacturing solutions. |

| Use of conventional homopolymer grades in rigid applications. | Creation of bio-based and performance-enhanced PP grades and improved recycling compatibility. |

| Early adoption of post-consumer recycling and plastic reduction initiatives. | Strong demand for closed-loop systems, use of renewable feedstocks , and compliance with international environmental laws. |

| Packaging, textile, and hygiene products leadership during and post-pandemic. | Growing applications in green automotive parts, smart packaging, and sustainable consumer products. |

| Heightened emphasis on single-use plastics; emerging plastic bans in some industries. | Increasing globalization of policy measures to mandate recyclable content and limit virgin plastic production. |

| Robust growth in Asia-Pacific, with modest take-up in Europe and North America. | Ongoing growth in all major industries, especially those driving the trend toward green infrastructure and manufacturing. |

The industry, commonly used in packaging, automotive, textiles, and consumer products, is dealing with a tangled web of risks in 2024. One of the major issues is the uncertainty in raw material prices, especially polymer-grade propylene (PGP), which has seen dramatic price swings due to supply chain disruptions and maintenance at major production plants.

This volatility in prices complicates it for companies to offer consistent profit margins and affects pricing policies across the supply chain. The industry is also facing an overcapacity, especially in Asia, where new production capacities have entered the industry, but this has led to an oversupplied industry and put too much pressure on prices.

Environmental laws are also a major threat. Growing worldwide interest in sustainability and reducing plastic waste has led to further regulations on plastic product usage and disposal. Such regulations require investment in recycling technology and the production of bio-based substitutes, which can be costly and might not be profitable in the short term.

Geopolitical uncertainty and trade policy are risks through the ability to interfere with global supply chains, impacting the distribution of raw materials and finished products. As an example, trade tensions can be followed by tariffs or import quotas that will impact industry dynamics and result in regional demand and supply imbalances.

In general, with the industry still on a growth trajectory, it has to deal with subjects of raw material price fluctuations, overcapacity, environmental legislation, competition from the use of different materials, and geopolitical exposures. Active initiatives such as supply sources diversification, investments in renewable technology, and responsiveness to regulations will be most important to actors who seek to preserve resiliency and competitiveness in this subject industry.

Injection molding is expected to hold a 36% industry share in 2025, while film processing is expected to occupy about 20%.

The industry is segmented based on processing technology, with injection molding and film extrusion being the largest. Injection molding remains the most common processing technology because of its efficiency, precision level, and flexibility to accommodate elaborate designs. Homopolymer is suitable for injection molding due to its rigidity, heat resistance, and dimensional stability.

Leading manufacturers such as LyondellBasell and ExxonMobil produce injection molding-grade homopolymers specifically for automotive applications (dashboards and door trims), household products (storage boxes), and medical disposables (syringes and diagnostic trays). Daplen and BorPure grades were supplied earlier by Borealis for consumer goods packaging and appliances.

Reliance Industries supplies optimized injection-grade PP for strength and moldability in the packaging and electronics industry. They cater to the growing demand for lightweight, recyclable, and inexpensive plastic parts in developing regions facing rapid urbanization and fast-paced manufacturing activities.

Homopolymers processed into film are widely used for packaging applications because of their transparency, moisture-barrier properties, and good recyclability. Film-grade homopolymers are preferred for making BOPP (biaxially oriented polypropylene) films used for food packaging, gift wrap, and labeling.

Companies such as SABIC provide film-grade homopolymers utilized in flexible packaging to enhance shelf life while allowing product visibility. Jindal Poly Films and Taghleef Industries are the first two converters downstream, using homopolymers as the main raw material in manufacturing performance-packaging films for snacks, bakery products, and hygiene products. Safety and sustainability define Braskem as it offers specialty high-clarity film solutions for the food and pharmaceutical industries.

The packaging industry is expected to command the highest industry share of 48% in 2025, while the electrical & electronics segment is likely to account for 12%.

The industry is segmented based on end-use, among which packaging and electrical & electronics stand out as the key sectors. Homopolymer is the biggest segment of all the applications in use, and its popular usage is in packaging, which is very versatile, lightweight, and resistant to moisture as well as chemicals.

Applications range from rigid packaging formats such as caps, closures, containers, and trays for food to flexible films such as BOPP, and many others. Some of the major companies involved in this business are LyondellBasell and Braskem, which sell packaging-grade PP homopolymers with properties of clarity, rigidity, and processability. For example, high-purity homopolymer is marketed by SABIC for food-grade containers and applications like medical packaging, where hygiene and safety play a prominent role.

In India, Reliance Industries and Haldia Petrochemicals are manufacturing injection-molded containers and film-extruded homopolymers in response to growing demand from FMCG and e-commerce packaging. The packaging sector is also propelling PP homopolymer demand, mostly due to its past transition to sustainable and recyclable materials, particularly in the single-polymer system designs that facilitate the recycling step.

With regard to the electrical and electronics segment, homopolymer is appreciated for its excellent electrical insulation, low dielectric constant, and thermal and chemical resistance, making it the right choice for use in components such as wire and cable insulation, battery cases and small appliance housings.

Companies like Borealis and Total Energies offer specialty PP grades matching electronics production requirements with stringent safety and performance needs. LG Chem and Formosa Plastics also supply high-performance polypropylene to casings, connectors, and insulating components. This segment is gaining momentum because of some key factors, such as the burgeoning demand for consumer electronic goods and automotive electrification, especially in Asia-Pacific, where the electronics manufacturing hub continues to grow.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 4.5% |

| UK | 4.3% |

| France | 4.4% |

| Germany | 4.6% |

| Italy | 4.3% |

| South Korea | 4.7% |

| Japan | 4.5% |

| China | 4.9% |

| Australia | 4.4% |

| New Zealand | 4.3% |

The USA industry is anticipated to grow at a CAGR of 4.5% throughout 2025 to 2035. Strong demand for automotive parts, packaging, and consumer product segments has influenced the rise. The superior stiffness, satisfactory chemical resistance, and economical nature of the product facilitate extensive applications in injection molding and extrusion processes.

Major companies like ExxonMobil, LyondellBasell, and Braskem America are increasing capacity and optimizing catalysts to produce high-clarity and lightweight homopolymers. Sustainability initiatives like the incorporation of post-consumer recycled material influence procurement and production processes [Source: USA Department of Energy].

The UK industry will grow at a CAGR of 4.3%. The increasing requirement for homopolymers in rigid packaging, consumer electronics, and textile fibers is driving industry performance. Strong regulatory emphasis on recyclability and lightweight is driving the demand for mono-material packaging solutions.

Companies such as INEOS and RPC Group (Berry Global) are investing in next-generation homopolymer grades with improved transparency and barriers. National plastic waste reduction strategies are driving more substitution of multi-layer packaging by recyclable PP-based formats [Source: UK Environment Agency].

France is forecasted to have a CAGR of 4.4% up to 2035 on the back of demand for automotive interiors, food packaging, and medical disposables. homopolymer has good processability and low density, making it a fit for thermoforming and thin-wall injection molding.

Arkema and Total Energies are leading suppliers that focus on high-flow resins and bio-based feedstocks to meet the evolving needs of sustainable mobility and packaging businesses. Government initiatives encouraging the development of recyclable plastics are behind higher industry take-up [Source: European Environment Agency].

The German industry will grow by 4.6% CAGR. Automotive, industrial packing, and building industries are the country's leading downstream industries. Applications requiring precision engineering and recycling suitability have given under-the-hood applications, and lightweight casings of PP homopolymer increased leverage.

BASF SE and Borealis AG are producing resins that are future-proof, highly rigid and have improved thermal resistance to meet EU standards for car emissions as well as environmentally friendly packaging. German innovation clusters focusing on polymer processing efficiency are improving competitive strength [Source: German Federal Ministry for Economic Affairs].

Italy is expected to grow at a CAGR of 4.3%. It expands on the basis of increased consumption of domestic appliances, blow-molded packaging, and protective coverings. A strong presence in small-scale and mid-scale plastic processing businesses in the country has created a stable platform for the consumption.

Producers such as RadiciGroup and Mapei produce flame-retardant and UV-stable grades of PP that are suitable for building and electrical applications. EU Green Deal regulations and national waste management legislative reform are stimulating demand for mono-material, recycled thermoplastics [Source: European Commission].

South Korea is predicted to achieve a CAGR of 4.7% over the period, with internal consumption driving the electronics, consumer durables, and textile industries. Homopolymers find application of preference owing to the high melting point, fatigue resistance, and processability in nonwovens and medical applications.

Industry leaders such as Hanwha Total Energies Petrochemical and LG Chem are expanding capacity and formulating impact-modified grades to serve local and export industries. Government-supported R&D activities and environmental performance requirements are supporting the country's move towards a circular polymer economy [Source: OECD].

Japan is expected to expand at a CAGR of 4.5% between 2025 and 2035. Firm demand from automotive, packaging, and precision molding end-use segments supports industry stability. Dimensional stability and molding material flexibility enable it to fit component miniaturization and green manufacturing.

Manufacturers such as Prime Polymer Co. and Sumitomo Chemical are focusing on enhancing melt flow indices and compounding recycled polymers in high-purity homopolymer streams. Industrial policies promoting energy efficiency and optimal use of resources are enabling broad industry penetration [Source: IMF].

China is expected to lead the growth with a CAGR of 4.9%, fueled by strong consumption in the packaging, household, automotive, and construction sectors. Rising investment in consumer electronics and e-commerce logistics has driven rapid material demand.

Companies like Sinopec, PetroChina, and Yanshan Petrochemical are increasing production and investing in low-emission, high-performance PP technologies. Strategic national goals to stem plastic pollution and encourage regionally sourced thermoplastics are further solidifying industry strength [Source: UN].

Australia is projected to grow at 4.4% CAGR. Rigid packaging, agribulk films, and healthcare consumables drive the demand. Recyclability and mechanical stability are reasons it finds its way into regulation-mandated sectors such as food safety and environmental protection.

Local converters and distributors are increasingly aligned with international suppliers, promoting ISCC-certified and food-grade materials. National initiatives under the Australian Recycling Label program are encouraging increased use of mono-material, high-recyclability polymers [Source: Australian Department of Climate Change, Energy, the Environment and Water].

New Zealand is expected to expand at a CAGR of 4.3% over the forecast period. The industry benefits from frequent applications in dairy packaging, household storage, and agricultural product lines. The low price and versatility of PP homopolymer continue to drive stable demand across rural and urban manufacturing bases.

Local importers and processors are embracing circular economy strategies and greater use of post-industrial recycled content. Government-supported waste minimization initiatives are further enhancing the role of homopolymer PP as a recyclable consumer product and packaging solution [Source: New Zealand Ministry for the Environment].

The industry is largely dominated by major petrochemical companies due to their immense production capacity and conferred technological advantages.

LyondellBasell Industries, Reliance Industries, and Braskem have maintained their leading incumbency in the industry, mainly due to their large-scale production capacities and worldwide supply chain. INEOS Group and ExxonMobil further develop their industry presence through investment in capacity increments. Novel processing techniques are continuously designed to enhance product performance.

Strategic acquisitions and mergers continue to play a major role for industry leaders. ExxonMobil reinforced its PP production footprint by developing strategic partnerships with regional distributors, which improves the penetration of its products in emerging economies.

Similarly, INEOS Group has enlarged its collaboration with polymer recyclers in order to enhance more sustainable PP offerings due to growing industries requiring eco-friendly materials. Braskem, on its part, continues to focus on circular economy initiatives where funds are being pumped into advanced recycling technologies that will enable the production of high-performance recycled options.

Product innovation is a crucial differentiating factor among the large players. Recently, LyondellBasell introduced a high-melt flow variant designed for advanced injection molding applications in response to increasing demand from packaging and automotive manufacturers. Borealis launched an elevated impact-resistant PP grade for the construction and consumer goods sectors, which has enhanced durability and lightweight characteristics.

Sustainability and supply chain resilience have become important factors in their competitive positioning. Total Petrochemicals USA has been concentrating on bio-based developments in polypropylene, while Reliance Industries has integrated advanced catalyst technologies to optimize polymerization efficiency. Sasol Limited and IRPC Public Company Limited are enhancing their logistics and distribution networks to ensure stable supplies across key regional industries.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| LyondellBasell Industries N.V. | 18-22% |

| Reliance Industries Limited | 14-18% |

| Braskem S.A. | 12-16% |

| INEOS Group Ltd. | 10-14% |

| ExxonMobil Corporation | 8-12% |

| Other Players (Combined) | 27-32% |

| Company Name | Offerings & Activities |

|---|---|

| LyondellBasell Industries N.V. | High-performance PP for automotive, packaging, and healthcare. Focused on R&D in lightweight applications. |

| Reliance Industries Limited | Integrated PP production with sustainable catalyst technology. Strengthening supply chain logistics. |

| Braskem S.A. | Developing bio-based and recycled PP. Expanding global reach with advanced polymer solutions. |

| INEOS Group Ltd. | Enhancing PP recyclability. Collaborating with European recyclers for sustainable product innovation. |

| ExxonMobil Corporation | Investing in advanced melt flow PP for molding and extrusion applications. Expanding industry penetration. |

The industry is estimated to reach USD 70.8 billion by 2025.

The industry is projected to grow to USD 111.8 billion by 2035.

China is expected to grow at a rate of 4.9%.

Injection molding is the leading product segment.

Key players in this industry include LyondellBasell Industries N.V., Reliance Industries Limited, Braskem S.A., INEOS Group Ltd., ExxonMobil Corporation, Borealis AG, Total Petrochemicals USA Inc., Sasol Limited, IRPC Public Company Limited, National Petrochemical Industrial Company, Polyolefin Company, and L.C.Y. Chemical Corporation.

By processing technology, the industry is segmented into injection moulding, film, extrusion, fiber, and others (which includes blow moulding and sheet).

By end use, the industry is categorized into packaging (flexible packaging and rigid packaging), electrical & electronics, textile, automotive, building & construction, and others.

By region, the industry is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East and Africa.

LATAM Road Marking Paint & Coating Market Analysis by Material Type, Marking Type, Sales Channel, and Region Forecast Through 2035

Refinery and Petrochemical Filtration Market Analysis by Filter Type, Application, End-User and Region 2025 to 2035

Industrial Oxygen Market Report - Growth, Demand & Forecast 2025 to 2035

Medical Grade Coatings Market Trends – Demand, Innovations & Forecast 2025 to 2035

Fertilizer Additive Market Report – Growth, Demand & Forecast 2025 to 2035

Malonic Acid Market Report – Demand, Growth & Industry Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.