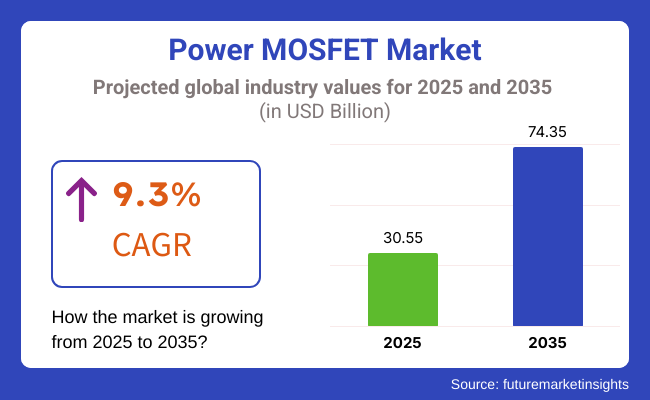

The Power MOSFET market would become hugely successful and is predicted to reach a market value of USD 30.55 billion by 2025, before hitting USD 74.35 billion by 2035, at a compound annual growth rate (CAGR) of 9.3% during the predicted period. This overabundance is the result of the increasing demand from important sectors like automotive, consumer electronics, and energy.

The movement to electric cars (EVs) and renewable power sources is the cause of the need being more than ever for efficient power management solutions, where MOSFETs are crucial, as they are the ones who deliver system performance and reliability.

In addition, the innovation in the semiconductor technologies specifically in silicon carbide (SiC) and gallium nitride (GaN) is the factor that is transforming the market with the benefits of better efficiency, less power loss, and the possibility of high-speed switching operations. The diversification is, therefore, the reason for their increased flexibility in high-performance applications in many sectors.

In terms of regions, North America, East Asia, and Europe are anticipated to be the largest regions in the Power MOSFET market with China, the USA and Germany, being the top players. These regions are posting remarkable progress in the infrastructure of electric vehicles and industrial automation which are additional reasons for the increased demand for high-power and energy-efficient MOSFETs.

South Asian and Latin American markets, respectively, also show improvement because of their new industrial plants, the government directives that support energy-saving and capital injection in power electronics. The settlement of companies with energy-efficient measures will also, hence, bring about a surge in the use of MOSFETs in smart grids and decentralized power systems.

A transistor that is power-efficient would be necessary for communication devices that have an increased preference for electricity-saving cars and equipped with a car charger that permits fast charging, consequently extending the battery life and improving the power conversion rate.

The introduction of electric vehicles (EVs) and hybrid vehicles has led to the improvements that SiC and GaN have achieved, thus, these materials are now providing the best power efficiency, which is beneficial for manufacturers of electric drivetrains.

Furthermore, on the heels of household and work IoT devices that are the latest cutting-edge digital tools, the surge in potent power management mechanisms occurs. AI and IoT gadgets begin to proliferate in households with smart appliances, and smart energy systems, which rely on MOSFETs for energy distribution and connectivity improvements.

Also, the growth of 5G technology and high-performance computing is fueling the demand for even smaller, high-power transistors capable of handling heavy power loads. As the data centers and cloud computing networks worldwide amp up, the use of MOSFETs will be able to maintain energy efficiency while simultaneously supporting the higher processing speeds and stable connectivity.

Explore FMI!

Book a free demo

Between 2020 and 2024, the power MOSFET market experienced strong growth, driven by the rising demand for energy-efficient electronics, electric vehicles (EVs), and renewable energy systems. The shift toward high-power applications in industrial automation, consumer electronics, and telecommunications fueled advancements in MOSFET technology, including lower on-resistance and improved thermal performance.

Wide bandgap semiconductors such as silicon carbide (SiC) and gallium nitride (GaN) started being used. Due to this, efficiency increased, and higher speeds were attained. Increasing adoption of 5G networks and data centers also grew the demand for power MOSFETs to support high-frequency operations with minimal energy loss.

From 2025 to 2035, power devices will be available, which are very efficient, and possess AI-driven energy management. SiC and GaN MOSFETs with enhanced features will lead EV fast charging, smart grids, and industrial robotics applications, offering improved efficiency and reliability. The push for carbon neutrality will drive low-power semiconductor design innovations, and quantum computing and next-generation IoT devices will demand even more rapid and reliable MOSFET solutions.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Moderate growth at 3.45% | Rapid expansion with an estimated 9.3% CAGR |

| Increased from USD 20.43 billion (2018) to USD 23.40 billion (2022) | Projected to reach USD 74.35 billion by 2035, tripling in size |

| Early-stage use of SiC (Silicon Carbide) & GaN (Gallium Nitride) Transistor, primarily in high-end applications | SiC & GaN Transistors become mainstream, replacing traditional silicon Transistor for better efficiency |

| Growth in consumer electronics, industrial automation, and power management | Strong demand from EVs, renewable energy, AI-driven power systems, and 5G infrastructure |

| MOSFET demand rising with early EV adoption, but market share still dominated by traditional vehicles | Mass adoption of EVs drives high demand for energy-efficient MOSFETs in batteries and charging infrastructure |

| Growing interest in solar and wind energy, but limited integration | Widespread deployment in solar inverters, wind power systems, and smart grids |

| Increasing use in robotics, automation, and motor control | Advanced industrial automation, IoT-enabled factories, and AI-powered energy solutions expand MOSFET use |

| MOSFETs used in power supplies, chargers, and portable devices | Demand shifts to ultra-efficient, compact MOSFETs for high-speed and AI-powered devices |

| Dominated by North America & Europe, with early adoption of high-power Transistor. | Asia-Pacific, Latin America, and the Middle East emerge as high-growth regions due to industrialization and EV expansion |

| Supply chain disruptions, semiconductor shortages, and fluctuating raw material costs | Power efficiency demands, sustainability concerns, and production scalability challenges |

| Gradual transition toward high-efficiency Transistors. | Full-scale adoption of next-gen MOSFETs with AI-driven energy optimization |

New generations of MOSFETs are faster, able to manage power and heat better, and produce less strain, and with new material substrates like silicon carbide (SiC) and gallium nitride (GaN), are becoming ubiquitous. These materials have a much higher power density and much better heat dissipation than silicon, making them perfect for applications like electric vehicle traction inverters and fast chargers.

As electric vehicles, industrial automation, consumer electronics and 5G infrastructure become more ubiquitous, the demand for MOSFETs is increasing dramatically. Availability is still being affected, however, by global supply chain problems, chip shortages and geopolitical trade policies.

Suppliers will need to implement agile strategies, diversify sourcing and anticipate future regulatory changes, as they face an increasingly competitive environment to keep production, and market growth, steady. It means suppliers are required to adjust product development to support these trends in order to meet ever increasing performance requirements.

Energy-efficient MOSFETs are essential components to be included in renewable energy systems and electric vehicles. Together, these parts help to make solar and wind energy more efficient as well as make battery in electric vehicles more sustainable.

Moreover, AI and automation are revolutionizing power management. Ginsberg was a pioneer in the development of predictive analytics, which is paving the way for real-time equipment monitoring and failure and preventive maintenance prediction, minimizing downtime and prolonging device life regarding MOSFETs.

| Region/Market | Investment Level |

|---|---|

| European Union (EU) | High |

| Germany (Automotive and Industrial Electrification) | High |

| China (EV and Semiconductor Manufacturing Expansion) | High |

| United States (EV and Renewable Energy Sector) | Medium |

| Japan (Advanced Semiconductor R&D) | Medium |

| India (Growing Demand in Consumer Electronics) | Low |

The general concept for Enhancement Mode MOSFETs bringing in more than 85% of the Power MOSFET market share well more applicable and extensively used in high rate industries like EVs, home machines and industrial automation due to high efficiency and low power loss.

They are of ultra-low energy consumption, off at zero gate voltage and can hence also be used in high performance systems needing reliability and minimal energy consumption. It is capable of encoded power management and high-speed switching and therefore, has become the most preferred choice by industries looking for optimized power management.

Disposable Mode MOSFETs, on the other hand, account for a small size of approximately 15% of the market which serves only a handful of applications including voltage regulation circuits and RF amplifiers. Although they are outperforming in a few specific areas of applications, their narrow effectiveness and functionality are restricting them to be adopted on a broader scale when contrasted against the Enhancement Mode MOSFETs.

The enhancing Mode MOSFET market is also being stimulated by high penetration of silicon carbide (SiC) and gallium nitride (GaN) technologies, which are further enhancing the characteristics of Enhancement Mode MOSFETs in high voltages and high frequency applications. It is pushing power conversion, thermal efficiency and system-level performance forwards.

The increasing demand for energy efficiency solutions will be a prominent factor contributing to the growth of its application in electric vehicles (EVs) and renewable energy solutions which will support the growth of future power management technologies and result in the superior growth of Enhancement Mode MOSFETs segment.

Electricity Local splits the Power MOSFET Market by Application- Energy and Power, Transportation, Automobiles, Telecommunication, and Consumer Electronics Power Disc for Energy and Power local MOSFET leading the pack with a 25% contribution towards the Energy And Power sector in the EC Pretory Global are of the fast progressing segments of the universal power mosfet showcase is the Energy And Power local MOSFET usage and the ascendancy of consumption by green energy sources in international market.

Micheal Field here to talk about one of the applications of MOSFET, the switching systems in solar and wind power plants. Similarly, smart grids also demand accurate power management for seamless integration of renewable energy with conventional power systems.

In addition, battery energy storage systems (BESS) are scaling up and leading to more demand for Power MOSFETs to optimize charge and discharge cycles. With the global commitment to carbon neutrality and clean energy adoption, Power MOSFETs will remain a required means for digging energy-saving and grid balance, which needs long-term vitality in ammunition industry.

20% of market, driven by increased usage of AI-enabled devices, IoT applications, portable electronics. Smart phones, laptops, wearables and smart home devices that require precise power management for optimal performance and power efficiency are the backbone of these applications - at the heart of those, the power MOSFETs.

The growing number (in fact, up to trillion numbers) of Internet of Things (IoT) devices, which require reliable power supply during operation, as well as very low power consumption during standby continue to drive the demand for MOSFETs.

This segment continues to be a stronghold of the Power MOSFET market, and with ongoing advancements in battery technology and mobile devices necessitating more compact power solutions, it is anticipated to witness rapid growth with further technology development.

| Countries | Market Share |

|---|---|

| China | 35% |

| USA | 20% |

| Japan | 10% |

| Germany | 8% |

| India | 7% |

| South Korea | 5% |

| UK | 3% |

China dominates in frontier semiconductor manufacturing, electric vehicle production, and industrial automatization. Government-supported initiatives in 5G as well as AI-based power solutions, and green energy push the growth exponential. Its excellent supply chain makes it the world's powerhouse electronics manufacturing center.

Growth Factors in China

| Growth Factors | Details |

|---|---|

| Industrial Automation Expansion | Rapid adoption of automation technologies in manufacturing sectors increases demand for efficient power components. |

| Electric Vehicle (EV) Adoption | Government incentives and consumer interest drive the EV market. |

| Consumer Electronics Production | As a leading producer of electronics, there's a continuous need for power-efficient components. |

The USA leads R&D, AI-enabled power systems, and supercomputing. Rise in EV demand, space exploration, and future telecom (5G, data centers) is driving growth in the market. Heavy investment in semiconductor autonomy is also further augmenting its share.

Growth Factors in The USA

| Growth Factors | Details |

|---|---|

| Technological Innovations | Advancements in semiconductor technologies enhance performance, catering to diverse applications. |

| Automotive Industry Growth | Increased production of electric and hybrid vehicles boosts demand. |

| Renewable Energy Projects | Expansion of solar and wind energy installations requires efficient power management solutions. |

World-leading motor technology, robots, and power-saving technology, Japan is a leader in power-efficient, miniaturized power components. Leadership in EVs, home automation, and consumer electronics drives the demand stream.

Growth Factors in Japan

| Growth Factors | Details |

|---|---|

| Consumer Electronics Innovation | High demand for compact and energy-efficient devices drive usage. |

| Automotive Electrification | Leading automotive manufacturers focus on electric vehicle development. |

| Robotics Industry Expansion | Growth in robotics for industrial and service applications necessitates advanced power components. |

Strong automobile industry and clean energy propel Germany's economy. EV charging infrastructure, smart grid, and industrial automation fund it as a power-efficient innovation hub.

Growth Factors in Germany

| Growth Factors | Details |

|---|---|

| Automotive Industry Leadership | firm grip on making electric vehicles propels demand |

| Industrial Automation | Emphasis on Industry 4.0 and smart manufacturing boosts the need for efficient power devices. |

| Renewable Energy Integration | commitment towards renewable energy requires advanced power management solutions. |

India's expanding its electric vehicle business, telecoms growth, and "Make in India" production drive high expansion. Heavy expenditure on chip production and renewable energy makes it a leading up-and-coming leader globally.

Growth Factors in India

| Growth Factors | Details |

|---|---|

| Electronics Manufacturing Growth | Government initiatives promote local electronics production |

| Infrastructure Development | Expansion of power infrastructure and smart grids necessitates efficient power components. |

| Automotive Sector Expansion | Rising interest in electric vehicles contributes to the demand fo |

The technology powerhouse and market leader of South Korea is already way ahead of the game when it comes to its high-power management technology, artificial intelligence processing, and 5G infrastructure. The emerging EV and battery industries of its demand for next-generation power devices.

Growth Factors in South Korea

| Growth Factors | Details |

|---|---|

| Semiconductor Industry Strength | Leading position in semiconductor manufacturing drives innovation. |

| Display Technology Advancements | Demand for high-quality displays in devices requires efficient components. |

| 5G Network Expansion | Deployment of 5G infrastructure increases the need for advanced power management solutions. |

Clean power, smart grids, and electric vehicle charging stations are the areas of greatest concern to the UK. Governmental funding to semiconductor technology and low-carbon power technology is continually displaying steady growth in the market.

Growth Factors in The UK

| Growth Factors | Details |

|---|---|

| Renewable Energy Initiatives | Strong focus on wind and solar energy projects boosts demand. |

| Automotive Industry Transition | Shift towards electric vehicles increases the need for efficient power components. |

| Industrial Automation Adoption | Growing implementation of automation technologies in various sectors |

The power MOSFET industry has several market participants in cutthroat competition among them-strengthening their market by icon strategies for growth. Chang'An by Infineon Technologies AG is an example of innovation that develops great silicon carbide (SiC) MOSFETs with higher efficiency and reduced thermal loss to suit high-power applications like electric vehicle powertrains and industrial power supplies.

This is similar to Toshiba Corporation, which has extended its product line to offer customers high-performance power MOSFETs in automotive and industrial applications. As for STMicroelectronics N.V., it has also fortified itself with market presence by associating with companies like Bosch to develop and produce advanced power electronics for electric vehicles-an example of a strategy based on collaboration and technological advancement.

Nexperia has expanded its product line by supplying energy-efficient MOSFETs suitable for smartphones and wearables and has also entered strategic alliances for the development of silicon carbide power semiconductors.

Growth through acquisitions has also characterized Diodes Incorporated, having acquired Lite-On Semiconductor in extending its product offerings and market coverage. These strategies are evidence of the trend in the industry at large where innovation, strategic partnership building, and acquisitions work to uplift companies' positions in the transforming power MOSFET market.

Major Market Players and Market Share

| Company | Market Insights & Unique Strengths |

|---|---|

| Infineon Technologies (18%) | GaN & SiC power solution leader with technology focus on EV power systems, industrial automation, and high-efficient semiconductors. |

| STMicroelectronics (15%) | Ergonomics for consumer electronics, IoT products, and automotive power control with focus on automotive chips & smart energy solutions. |

| ON Semiconductor (12%) | AI computing expert, renewable energy, and 5G power management with high-efficiency chips for AI & cloud computing. |

| Toshiba Corp. (10%) | Dedicated to automotive electrification, power conversion, and industrial machinery with a mission to power-efficient silicon devices. |

| Texas Instruments (9%) | Low-power analog semiconductors, analog & embedded power system leadership. |

| Mitsubishi Electric (8%) | Industrial high-power application, renewable energy, and power technology leadership in transmission. |

| NXP Semiconductors (7%) | Leadership in IoT & automotive market presence, ADAS, industrial automation competitiveness, and safe connectivity. |

| Renesas Electronics (6%) | High battery driving efficiency & EV battery power management competency, automotive powertrain solutions competency. |

| Vishay Siliconix (5%) | Low power & compact semiconductor design core competency, discrete power solution core competency, telecommunication power control core competency. |

| Startup | Focus Area & Innovations |

|---|---|

| Navitas Semiconductor | GaN power chips for quick charging, EVs, and data center solutions, providing ultra-high efficiency. |

| GeneSiC Semiconductor | SiC power device specialties in high-voltage industrial and automotive applications. |

| Cambridge GaN Devices | Develops GaN transistors for consumer appliances, telecom, and energy-saving power conversion solutions. |

| Transphorm | Develops GaN power semiconductors in aerospace, automotive, and AI-powered power systems. |

| Odyssey Semiconductor | Develops GaN-on-SiC technology that provides ultra-efficient power solutions for industry and EV application. |

| VisIC Technologies | Develops GaN power electronics for electrification of vehicles, boosting EV drivetrain efficiency. |

| ROHM Semiconductor Startups | Maturity of SiC technology for high power use in solar power, rail transport, and industrial automation. |

| EPC (Efficient Power Conversion) | Leadership in GaN-based power solutions for wireless power, lidar, and medical devices. |

| Helix Semiconductors | Leadership in high voltage power conversion for smart grids, IoT, and next-gen computing. |

Top Market Trends Driving Competition

The global power MOSFET industry is experiencing fierce competition fueled by SiC & GaN wide-bandgap material development, EV electrification, smart energy solutions, AI, and 5G penetration. Infineon, ON Semiconductor, and STMicroelectronics are setting the trend for SiC & GaN devices that are expressed in enhanced efficiency and minimal heat loss in EVs, renewable energy, and industrial automation.

The EV bubble is attracting Renesas, Toshiba, and NXP Semiconductors to battery management, fast charging, and ADAS technology design. Mitsubishi Electric and Texas Instruments are developing smart grids and renewable energy storage to address increasing energy demand. AI, IoT, and 5G surprise adoption are also spurring low-power, high-performance semiconductor design innovation, spearheaded by ON Semiconductor, Vishay, and STMicroelectronics.

The increasing demand for electric vehicles (EVs), renewable energy systems, and industrial automation is fueling the market growth.

Asia-Pacific, and specifically China, will dominate the market with a 45% market share in 2025.

The market will be USD 74.35 billion in 2035 with a 9.3% CAGR from USD 30.55 billion in 2025.

The automobile segment is leading the space with a 40% market share in 2025 with growing EV demand, fast charging technology, and advanced driver-assistance systems (ADAS).

The power MOSFET market is segmented by type into depletion mode and enhancement mode.

Based on power rate, it is classified into high power, medium power, and low power.

The market includes energy and power, automotive, consumer electronics, power electronics, and others.

Geographically, it is divided into North America, Latin America, Western Europe, Eastern Europe, Asia Pacific excluding Japan, Japan, and the Middle East and Africa.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.