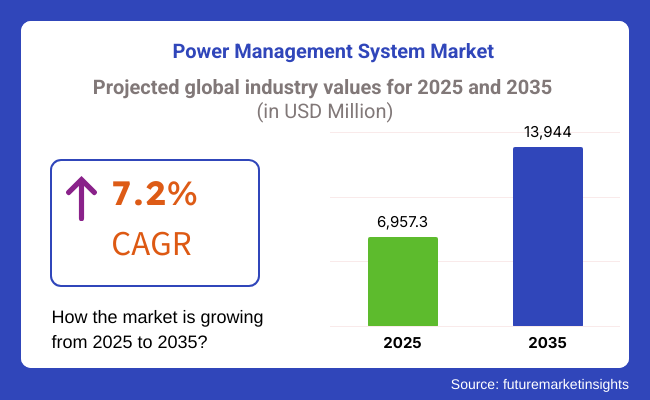

The power management systems market is expected to be valued at about USD 6,957.3 million. Sales are forecast to clock a CAGR of 7.2% through 2035. By 2035, demand is anticipated to grow to USD 13,944 million.

This drives the growth as demand is increasing for products that have sustainable energy solutions, industrial automation, and smart grids. New technologies in IoT, AI-based energy analytics, and cloud-based power management solutions are driving further adoption in the segment.

With energy conservation, cost reduction, and regulatory compliance being key challenges in recent times, several businesses and utilities across the globe are investing in power management systems to ensure maximum utilization of energy while reducing downtime and increasing overall operational efficiency in the rapidly evolving energy landscape.

Factors such as the tightening of energy efficiency regulations, an accelerated shift toward renewable energy, and improved smart grid technologies have placed the industry on a high growth path. Power distribution and optimization solutions: many people agree on what industries demand in this category - utilities, data centers, healthcare, and manufacturing. Businesses are gradually adopting AI energy analytics, IoT-based monitoring, and cloud-based management solutions to optimize operational efficiency and minimize energy losses.

Energy regulators are becoming too harsh on governments, shadowing the focus on implementing systems for commercial and industrial facilities, which are usually described as power management systems. Furthermore, rapid urbanization and demand for efficient 24/7 power supply sources also drive the growth of this market.

The USA and European regions have the lead in technology, whereas Asia Pacific is expected to grow at the fastest rate due to industrial growth rate and smart infrastructure development projects. Nonetheless, given that organizations are looking for energy solutions in an effective yet eco-friendly manner, the PMS industry stands to gain from the steady growth, with continued innovations shaping its prospect.

Explore FMI!

Book a free demo

The industry is seeing robust growth due to the growing demand for energy efficiency, grid resilience, and real-time monitoring. In commercial and industrial applications, companies focus on high reliability, automation, and scalability and embed IoT-based smart power systems for efficient energy consumption.

Residential customers emphasize affordable, easy-to-use solutions, frequently utilizing renewable energy resources such as solar and battery backup. Marine and offshore applications require heavy-duty, fail-safe equipment with rigorous safety and compliance requirements, providing unbroken power to the operations.

Utilities and smart grids are also investing in artificial intelligence-based power management solutions that enhance energy delivery, minimize grid downtime, and facilitate the integration of renewable sources of power. Drivers like cloud-based power management, remote diagnostics, and AI-based predictive maintenance, which promote enhanced efficiency and sustainability in industries' consumption of energy, fuel the trends.

| Company | Contract/Development Details |

|---|---|

| ABB Ltd. | Awarded a contract to implement a comprehensive power management system for a new offshore oil and gas platform, enhancing energy efficiency and operational reliability. |

| Siemens AG | Partnered with a major data center operator to install advanced power management solutions, aiming to reduce energy consumption and ensure uninterrupted operations. |

| Schneider Electric | Secured a deal to upgrade the power management infrastructure of a large manufacturing plant, focusing on automation and real-time monitoring capabilities. |

The industry witnessed robust growth between 2020 and 2024 as a result of growing energy consumption, grid modernization, and the escalation of renewable energy sources. Organizations and industries implemented PMS solutions to maximize power consumption, lower operating expenses, and incorporate sustainability targets. AI and big data enabled real-time monitoring and automated load balancing to maximize energy efficiency and minimize downtime.

Smart grids and IoT-enabled energy management systems gained traction, enabling predictive maintenance and demand-side optimization. High infrastructure investment and cybersecurity threats were the concerns. Between 2025 and 2035, autonomous power management systems powered by AI will enable real-time adaptive load balancing that will improve energy efficiency in manufacturing.

Quantum computing will enhance grid simulation and optimization, reducing power loss and improving power distribution accuracy. Blockchain-based trading platforms for energy will make peer-to-peer energy trading secure, with decentralized networks being encouraged. AI-based fault detection and predictive maintenance will reduce downtime and enhance system resilience.

Carbon-free power management technologies and efficient system architecture will become increasingly popular with rising environmental regulations. Edge AI will enable local power optimization, optimizing transmission loss while making the grid more reliable. Decentralized and AI-based, renewable power management technology will be adopted by the market, shaping the world's energy infrastructure.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Implementation of ISO 50001 standards boosted efficiency improvement. | Dynamic power distribution and predictive analytics using AI-based solutions provide self-optimizing grids. |

| Governments made investments in smart grid technologies for increased resilience. | Blockchain-based decentralized energy trading platforms provide grid independence. |

| Increased use of battery storage options integrated with solar and wind energy. | Hydrogen power storage and AI-driven microgrid networks ensure maximum utilization of renewable energy. |

| Industries concentrated on cost-effective power distribution systems. | AI-integrated, self-healing power management systems demand grows in data centers and smart cities. |

| Increased cyber threats brought about upgraded security measures for power infrastructure. | Quantum encryption-based cybersecurity measures provide for the protection of power infrastructure. |

The industry is experiencing technological evolution, regulatory problems, and cybersecurity threats are at play. Such technologies like the smart grid, AI-based power monitoring, and autonomously generated energy are game changers for the company to invent all the time. The absence of automation and IoT-based solutions can lead to a loss in competitiveness.

Regulatory issues significantly contribute to risk management as the government asserts stringent energy efficiency, carbon emission, and safety measures. Firms across multiple locations need to adjust to different market rules, which increases their costs and complications of compliance. Any breach caused by the company in terms of pollution regulations can harden its reputation and cost it environmental fines.

The establishment of cybersecurity as a threat comes with the increased connections between digital PMS systems. The use of cloud and IoT-integrated PMS gives rise to vulnerability to attacks by hacking, ransomware, and data breaches in power grids, industrial facilities, and smart buildings. Companies are supposed to set aside funds for security plans aimed at warding off the threat of cyberattacks.

| Countries | CAGR (2025 to 2035) |

|---|---|

| The USA | 7.2% |

| The UK | 6.5% |

| France | 6.3% |

| Germany | 6.8% |

| Italy | 5.9% |

| South Korea | 6.7% |

| Japan | 6.4% |

| China | 8.1% |

| Australia | 6.2% |

| New Zealand | 5.8% |

The USA industry is likely to register a CAGR of 7.2% from 2025 to 2035. Increased adoption of renewable energy sources, smart grid technology, and rising demand for energy-efficient technology drive the market growth.

Government policies and energy-saving incentives drive the adoption of advanced power management solutions in industrial, commercial, and residential applications. High market share of large players in the market and continued investment in the development of power infrastructure also fuels market growth.

Digitalization and the introduction of IoT-based systems are efficiency- and cost-gain drivers. Smart meters and real-time monitoring systems are on the rise, allowing companies to optimize energy use. Electric vehicle expansion is causing demand for safe charging infrastructure to rise, spurring demand. With escalating energy security and carbon emissions on the agenda, the USA remains an affluent market for cutting-edge power management technologies.

The UK industry is projected to register a CAGR of 6.5% between 2025 and 2035. The country's intention to become net-zero by reducing emissions and adopting renewable energy resources fuels the growth of the market. Grid infrastructure replacement and rising energy efficiency need to support the need for these systems. High energy regulations and government subsidies drive industries to adopt advanced energy management systems.

Smart energy solutions and automation adoption fuel growth. Commercial and residential participants spend more on demand response programs, smart meters, and energy storage systems to optimize electricity consumption. The proliferation of electric vehicles and the need for highly efficient charging networks also underpin the growth. With technology improvements and government incentives, the UK remains a large market for power management solutions.

The industry is likely to register a CAGR of 6.3% through the forecast period. The nation prefers clean energy and power-efficient consumption, thus fueling market demand. France's monopoly over nuclear power and rising integration of renewable energy requires sophisticated systems to achieve maximum transmission of energy with minimum wastage.

Smart grid implementation and digitalization of energy fuel the growth of the market. Companies and industries make investments in smart power management solutions to boost their efficiency and reduce their operational costs. Electrification of transport and the government's drive to be sustainable create new growth prospects for the market. Increased focus on decarbonization and grid modernization in France boosts its power management system market.

The industry in Germany is likely to expand at a CAGR of 6.8% during 2025 to 2035. The nation's strong emphasis on renewable energy and smart grid growth is driving the market. Germany's Energiewende policy targets energy efficiency and sustainability, thus enhancing the usage of power management solutions in industries.

Industrial digitalization and automation propel the demand for smart systems. Increased penetration of electric vehicles and more reliance on decentralized power generation boost the demand for energy monitoring and control solutions. With a mature regulatory framework and high uptake of technology, Germany is a pioneering industry.

The industry is likely to grow at a CAGR of 5.9% during the forecast period. The government-supported energy transition in the country creates a demand for effective power management systems. Rising investments in smart grids and renewable energy infrastructure facilitate market growth.

Firms seek advanced energy management systems to optimize operations and reduce energy costs. The growth in electric mobility and energy storage technologies offers further growth opportunities. The focus on digitalization and sustainability in Italy fuels the adoption of new power management technologies in industries.

The industry in South Korea is likely to grow at 6.7% CAGR in the period 2025 to 2035. South Korea's industrialization and increasing electricity demand are driving market growth. South Korea's smart city program investments and renewable energy integration investment have led to a high demand for power management systems.

The growing use of power management systems based on AI offers greater efficiency and dependability. Higher technology power monitoring and power control are utilized by companies and households in hopes of reducing expenses and saving consumption. The South Korean industry keeps moving forward through technological innovation and energy security.

The industry in Japan is expected to register a CAGR of 6.4% during the forecast period. Japan's energy-saving regulations and emphasis on reducing carbon emissions are the fuel demand for power management systems. Japan's shift towards the development of smart grids and increased use of renewable energy sources propel market growth.

Firms invest in automated energy management systems for greater sustainability and operational efficiency. Expanded electric mobility and hydrogen energy initiatives further enhance the size of the market. Supported government policies and improved technology, Japan is a competitive industry.

The industry in China is expected to expand at an 8.1% CAGR from 2025 to 2035. Urbanization, industrialization, and clean energy focus are propelling market growth in the country. Government backing for smart grid deployments and energy efficiency programs is fueling market growth.

The advancements in AI and IoT-powered power management solutions enhance grid stability and operating efficiency. Increased investments in electric vehicles and battery storage systems are on the rise, and they offer excellent demand for premium energy management technology. With China dominating renewable energy uptake and smart infrastructure development, the industry increases with zeal.

The industry in Australia is expected to grow at a CAGR of 6.2% from 2025 to 2035. Increased reliance on renewable power sources and distributed generation in Australia drives the market. Smart grid technology and energy storage enhance the efficiency and reliability of the grid.

Firms adopt smart power management solutions to increase efficiency and conserve energy bills. Rising electrification of vehicle mobility and intelligent energy solutions needs to create additional business expansion for the fuels market. The transition towards sustainable energy for Australia in the future ensures the continued growth of power management technologies.

The industry in New Zealand is anticipated to grow at a CAGR of 5.8% during the forecast period. New Zealand's strong renewable energy sector and emphasis on sustainability drive demand. Investment in smart grid and energy efficiency schemes in New Zealand helps market growth.

Firms and residences are increasingly implementing energy management solutions to optimize power consumption. High-tech monitoring and control systems improve grid stability and efficiency. New Zealand, which is concentrating on clean energy and smart infrastructure, remains a good market for power management systems.

| Type | Share (2025) |

|---|---|

| Software | 39.2% |

The PMS-software category is likely to reach 39.2% of the PMS market share in 2025 as the demand for real-time energy monitoring, increased automation, and AI-based analytics achieves continued growth. Intelligent PMS software is used by businesses across industries to keep track of energy usage, manage the distribution of electricity, and reduce operational costs.

The increased adoption of cloud-based PMS solutions in commercial, industrial, and data center facilities is due to the remote monitoring of the grid and the increasing adoption of intelligent grid and predictive maintenance.

The cloud and M2M/cybersecurity technologies, for example, are useful and possibly even necessary for software programs, including EcoStruxure by Schneider Electric, SENTRON by Siemens, ABB Ability, and many others. As a result, energy efficiency will increase by 30%, and, of course, the energy costs will go down. In addition, PMS software fulfills ISO 50001 energy standards and LEED certification requirements, which is further paving the way for market growth.

The hardware segment is likely to account for the larger 60.8% end of the PMS market: Power management systems use controllers, sensors, circuit breakers, and smart meters to monitor and control energy. Advanced distribution management systems (ADMS), energy storage solutions (ESS), and industrial power controllers are accelerating growth in utility, manufacturing & oil gas sectors.

Automation-enabled power management hardware with real-time fault detection, load balancing, and energy optimization is being offered by leading market players, including Eaton, General Electric (GE), and Mitsubishi Electric. The demand for PMS hardware will continue to drive the market, supported by continued investments in projects focused on grid connection with renewable energy integration, microgrids, smart infrastructure expansion, etc.

| End Use | Share (2025) |

|---|---|

| Petroleum Refinery | 17.9% |

The petroleum refinery segment in the power management system market closely holds 17.9% of the revenue share in 2025. Refinery operations are extremely energy intensive, and continuous power supply, real-time monitoring, and fault detection are crucial to improving productivity and preventing costly downtime.

Modern PMS solutions allow the refineries to manage energy consumption, balance power loads, and integrate renewables. Vendors, including Schneider Electric, Siemens, and AB P PMS, can be paired with artificial intelligence to foster greater grid stability, reduce energy losses, and promote greater operational efficiency. Moreover, increasing investments in digitalization, smart grids, and adherence to environmental standards (like carbon emissions reduction measures) are expected to drive refinery PMS adoption.

The marine segment is to dominate the PMS market by 2025 in terms of a market share of 11.3% in 2025. Data for PMS is driven by increasing demand for automated/PM power systems in commercial shipyards, naval ships, and offshore platforms.

Owing to the increase in marine traffic and the absence of environmental regulations, shipping companies are investing in electric and hybrid propellers. As the marine industry moves toward automated and sustainable practices, it is expected that the usage of smart PMS solutions will encourage future growth in the sector.

The PMS market develops dynamically due to the demand for energy efficiency, power grid modernization, and smart automation systems. Such markets involve heavy competition in advanced monitoring, control, and optimization technologies aimed primarily at industrial, commercial, and utility application needs.

Schneider Electric, Siemens AG, General Electric (GE), Eaton Corporation, and ABB Ltd. are some of the global leaders in power automation and energy management solutions. In contrast, midsized companies like Mitsubishi Electric, Rockwell Automation, and Honeywell International focus more on general sector-specific power applications in manufacturing- or process industries- as well as smart buildings.

Others like Emerson Electric and Larsen & Toubro (L&T) are also growing their respective footprints through regional partnerships and infrastructure-based solutions.

Thus far, the market evolution of IoT and AI, as well as cloud-driven PMS as real-time energy and predictive maintenance, further improved competition. Competing factors are sustainable roles and newer technologies like smart grids and decentralized energy systems.

Concerning strategy mergers, acquisitions, and alliances in achieving market consolidation and technological advancement in digital power management, as industries are shifting toward net-zero objectives and intelligent power distribution, companies investing in the so-called edge intelligence, cybersecurity, and highly scalable PMS solutions have a more promising competitive edge.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Schneider Electric | 18-22% |

| Siemens AG | 14-18% |

| General Electric (GE) | 12-16% |

| Eaton Corporation | 10-14% |

| ABB Ltd. | 8-12% |

| Other Players | 25-35% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| Schneider Electric | Leading in integrated PMS software, smart automation, and IoT-based power control for commercial and industrial applications. |

| Siemens AG | Strong portfolio in smart grids, real-time energy management, and AI-powered power distribution systems. |

| General Electric (GE) | Specializes in industrial automation, predictive analytics, and AI-driven PMS for critical infrastructure. |

| Eaton Corporation | Focuses on modular power management, UPS solutions, and sustainable energy optimization. |

| ABB Ltd. | Provides cloud-enabled PMS platforms, digital twin technologies, and industrial power automation. |

Key Company Insights

Schneider Electric (18-22%)

World leader in energy efficiency solutions, combining AI, IoT, and automation for smart PMS.

Siemens AG (14-18%)

Leaders in smart grids and industrial automation, with AI-driven energy forecasting for industries.

General Electric (GE) (12-16%)

The industry leader in industrial power monitoring, with AI-based analytics and predictive maintenance.

Eaton Corporation (10-14%)

Concentrates on UPS and modular power solutions, with dominance in data centers and industries.

ABB Ltd. (8-12%)

Employs cloud-based PMS and industrial automation to maximize energy usage in industries.

Other Key Players (25-35% Combined)

Recent Developments

The global Power Management System industry is projected to witness CAGR of 7.2% between 2025 and 2035.

The global Power Management System industry stood at USD 6957.3 million in 2025.

The global Power Management System industry is anticipated to reach USD 13944.0 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 7.9% in the assessment period.

The key players operating in the global Power Management System industry include Schneider Electric, Siemens AG, General Electric (GE), Eaton Corporation, ABB Ltd. and others.

In terms of Type, the segment is categorized into Software, Hardware, and Services.

In terms of Module, the segment is classified into Power Monitoring and Control, Load Shedding and Management, Power Simulator, Generator Control, Energy Cost Accounting, Switching and Safety Management, and Others.

In terms of End Use, the segment is distributed into Marine, Petroleum Refinery, Data Centers, Chemical Industry, Utilities, Paper and Pulp, and Others.

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & pacific, Middle East and Africa (MEA) have been covered in the report.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.