Growing requirements of vehicle automation, increasing adoption of luxury vehicles, as well as inclusion of smart features in vehicles are driving the market growth of the global power liftgate from 2025 to 2035. Power liftgates, which allow a vehicle’s rear door to automatically open or close, have grown popular with consumers looking for a combination of a convenience and safety feature in today’s vehicles. Previously available only on luxury and premium models, power liftgates are now trickling down to mid-range SUVs and crossovers to bring the feature to more people.

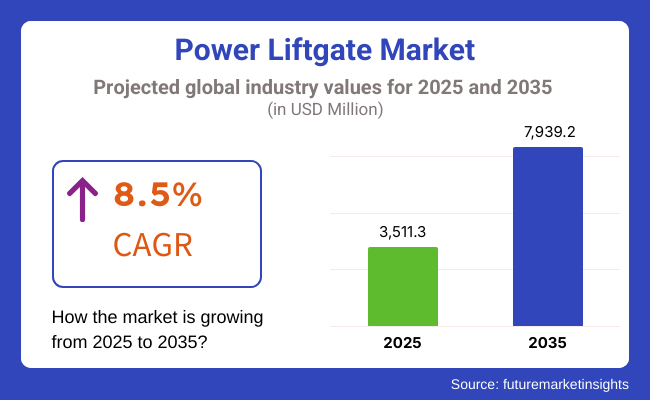

In 2025, the power liftgate market size was USD 3511.3 million and it is expected to reach USD 7939.2 million by the end of 2035, with a CAGR of 8.5% between 2025 and 2035. The 8.5% compound annual growth rate (CAGR) shows the continued maturation of vehicle automation and growing consumer preferences for hands free and remote access to vehicle functions.

As tech has gotten better and people have become more focused on the ability to move vehicles in and out of the garage without physically operating the liftgate, brands are putting in things like gesture control, artificial intelligence, and app-based systems into their vehicles.

Urban motorists want comfort and convenience more than ever before, but ease of loading and unloading cargo is often a make-or-break factor in the vehicle-selection process. Robust growth of the electric vehicle (EV) sector in recent years has driven the market further, as power liftgates are becoming a standard feature in various newly rolled-out EV nameplates. Moreover, the increasing adoption of such connected car technologies had crowned the power liftgates with the smart home systems and voice-activated controls for better user accessibility and operational efficiency.

8.5% CAGR demonstrates the vigorous growth of the power liftgate market in various vehicle class. Increasing sales of SUVs and luxury cars along with rising customer preference for automated and convenient features in vehicles are projected to propel market growth further. Innovation in mobility is driving the evolution of automotive architectures of the future with components such as power liftgates emerging as integral parts.

Explore FMI!

Book a free demo

Substantial demand for SUV and crossovers in North America makes the region as one of the key markets for the power liftgates. The United States and Canada represent a considerable proportion of global vehicle sales and automakers in this region are increasingly implementing automated liftgate solutions across various vehicle segments. The expansion of the market is also fuelled by the presence of the leading luxury and premium vehicle manufacturers, such as Tesla, Ford, General Motors, and Jeep.

There is also increasing demand for power liftgates in the North American aftermarket segment as consumers look for retrofit solutions for their current models. The e-commerce upsurge has translated into greater commercial conglomerate operation of power liftgates that allow for increased rapid loading and unloading in delivery services.

The European market also continues to be the main profit pool for power liftgates, largely due to the region’s emphasis on automotive innovation and its relatively high safety standards. A lot of countries, including Germany, France, and the UK already have a robust automotive sector that is focused on automation of vehicles. Luxury brands like Audi, Mercedes-Benz, and BMW are spearheading many of the new technological advancements to integrate the liftgate, including ones that add hands-free, voice-activated, even AI-enhanced control of the liftgate in new models.

The growth of electric vehicles sales across the European automotive market has also backed power liftgate installations. Growing initiatives towards sustainability as well as government incentives supporting smart mobility solutions are anticipated to drive the market growth in the region.

The Asia-Pacific power liftgate industry is anticipated to grow the fastest due to the growing population along with increasing number of vehicles in the region including China, India, and Japan. Demand for SUVs and Crossovers On account of Urbanization this trend is being aided by the adoption of power liftgates in mid-range and premium cars due to growth in urbanization and infrastructure development.

With disposable incomes on the rise, consumers in Asia-pacific are increasingly favouring technologically advanced vehicles packed with modern convenience features. Furthermore, the escalation of automotive manufacturing across the region has compelled both domestic and international automotive OEMs to launch feature-rich offerings bundled at competitive prices, further intensifying power liftgate adoption.

Challenges

However, the high cost of such systems is a key challenge as they put pressure on the overall vehicle price. Consumers in price-sensitive markets might not be amenable to choosing a vehicle equipped with a power liftgate, especially in the entry-level and mid-range cheery segments. Moreover, consumers who like to watch their budget would have to consider the maintenance and repair costs associated with the electronic liftgate hardware failures in sensors or motorized actuators must be addressed by specialists in some cases.

Opportunities

The aftermarket segment presents significant growth potential, as more consumers look for retrofit solutions to enhance their vehicles. Automation and AI-driven predictive maintenance for power liftgates are expected to drive future demand. Moreover, the manufacturers will gain additional revenues through the introduction of energy-efficient liftgate systems specifically designed for electric vehicles

Between 2020 and 2024, the power liftgate market expanded rapidly due to increasing consumer demand for hands-free, convenient vehicle access solutions. Power liftgates became standard on a wider variety of SUVs and crossovers as well as luxury vehicles, which began adding them for their additional ease of use.

With the increase in demand for smart and automated features in vehicles, power liftgates that were controlled via gesture and foot were created by manufacturers. Such innovations enhanced user experience, minimizing the need for manual effort and enabling access for a broader pool of consumers, including the mobility impaired.

The rise in vehicle power liftgate fitments in premium and mid-range vehicles was fuelled by increased disposable income, urbanization, and heightened vehicle safety awareness. Auto companies partnered with sensor tech manufacturers and automation solution companies to make smart liftgates that could sense proximity, be opened at different angles, and make use of obstacle-detection systems. Newer liftgate models started incorporating features like anti-theft sensors as well as emergency manual overrides for additional security.

The increasing production of electric and hybrid automobiles (EVs & HEVs) also spurred demand, as automakers required lightweight and energy. This shift incorporates soft-close as well as power-assisted liftgates that provided smoother operation coupled with lower noise levels.

Automakers were concentrating on integrating liftgates with in-vehicle infotainment and mobile applications, which allowed users to remotely control various liftgate functions through their smartphones and keyless entry systems. These smart connectivity features enhanced vehicle automation, making power liftgates an essential convenience feature for modern consumers.

Even as the market grew, it encountered obstacles, such as supply chain disruptions, a shortage of semiconductors, and varying raw material prices. High initial costs and maintenance expenses limited power liftgate adoption in entry-level and budget vehicle segments. However, automakers introduced cost-effective liftgate options to expand accessibility across various vehicle classes.

Additionally, advancements in modular liftgate designs allowed manufacturers to develop interchangeable and customizable solutions, reducing production costs while maintaining premium functionality. Cient mechanisms to minimize fuel consumption and maximize power efficiency of liftgates.

Automakers increasingly relied on regional suppliers and digitalized production processes to counteract supply chain constraints and maintain steady production levels. Strategic partnerships between automotive OEMs, smart technology firms, and material science innovators further accelerated the pace of power liftgate advancements, positioning the market for sustained growth in the coming decade.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Safety standards focused on basic obstacle detection. |

| Technological Advancements | Automakers introduced gesture-based and foot-activated liftgates. |

| Industry Applications | Power liftgates gained popularity in SUVs, crossovers, and luxury vehicles. |

| Environmental Sustainability | Some manufacturers experimented with recyclable materials. |

| Market Growth Drivers | Increased demand for convenience, safety, and luxury features. |

| Production & Supply Chain Dynamics | Companies faced supply chain disruptions and semiconductor shortages. |

| End-User Trends | Consumers preferred affordable, reliable power liftgate solutions. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Authorities will mandate AI-driven safety mechanisms and real-time diagnostics. |

| Technological Advancements | Companies will implement AI-enabled, energy-efficient, and ultra-lightweight liftgate systems. |

| Industry Applications | Expansion into EVs, commercial vehicles, and urban mobility solutions will drive market evolution. |

| Environmental Sustainability | The industry will adopt eco-friendly coatings, smart energy consumption, and sustainable production. |

| Market Growth Drivers | Growth in urban mobility, fleet automation, and hands-free access solutions. |

| Production & Supply Chain Dynamics | Businesses will focus on regional manufacturing, AI-driven automation, and blockchain verification. |

| End-User Trends | The market will shift toward premium, customizable, and AI-integrated liftgates. |

Additionally, increasing preference towards SUVs, rising demand for luxury cars and higher penetration rate of smart automotive solutions drive the United States power liftgate market growth. With one of the largest automotive markets in the world, the country has invested significantly in connected vehicle solutions and technologies that offer autonomous driving capabilities.

The rapid expansion of the power liftgate market is primarily driven by the SUV and crossover segment, which represents more than 50% of all vehicle sales in the USA As a result, due to consumer preference for that convenience in product usage, electric, foot-activated, and sensor-based liftgates are on the rise in new vehicle models. Ford, General Motors, Tesla, and Stellantis are among the automakers offering automated rear doors on mid- and upper-range vehicles.

Most notably, power liftgate technology is not limited to passenger and luxury vehicles alone, as it is now being introduced in commercial fleets such as delivery vans and even in various autonomous logistics vehicles, owing to the rapid growth of the e-commerce sector. Additionally, the rise of e-commerce and last-mile delivery services has led to the increased need for automated cargo access solutions, propelling the growth of the market.

In addition, features such as artificial intelligence (AI), superb sensors, remote control systems, and Internet of Things (IoT) connections have been developed to take the reliability and efficiency of the power liftgates to the next level, making it one of the key elements in modern electric and autonomous vehicles. Installed in EVs, the incentives and infrastructure investments from governments in the electric vehicle development integrator section have encouraged automakers to adopt lightweight, energy-efficient power liftgate product systems.

As consumers continue to fixate on convenience, safety, and hands-free automation, the power liftgate market for cars in the USA is sure to grow steadily over the next ten years.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.9% |

The UK colonial Power liftgate market is seeing healthy growth owing to robust demand for luxury and top range Rides, the expansion of the electric the car (EV) segment and the there is, among consumers, preference for smart automotive Technologies. There are a lot of high-end SUVs and crossovers along with executive saloons around these parts, so the UK also is a strong market for power liftgates.

As automakers step up vehicle convenience features and accessibility, so too are gesture-controlled, remote-operated, and foot-sensor-activated power liftgates. The increasing need for hands-free tailgate access is being answered by leading manufacturers, such as Jaguar Land Rover, BMW and Audi, which include automated liftgate solutions in their new vehicle models.

Another factor driving growth in the market is the UK government's strong push for electrification and smart vehicle infrastructure. Due to the rapid adoption of electric vehicles, manufacturers are increasingly integrating light-weight power liftgate systems into electric SUVs and crossovers.

Moreover, demand for automate, app-controlled liftgate solutions is being fostered by emerging technology trends including intelligent a smart key technology, voice recognition systems and IoT connectivity solutions, with sophisticated consumers increasingly looking to integrate these technologies. As a result, the continuing shift towards premium automotive experiences and expanding EV infrastructure will further bolster power liftgate market growth within the UK.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.5% |

Growing sales of luxury vehicles, demand for smart automotive features, and adoption of electric mobility in the region are all driving robust growth of the European power liftgate market. Europe, with a mature premium car market, is embracing advanced vehicle automation solutions (such as AI-enabled, gesture-activated and voice-activated power liftgates) like no other region.

So, Germany, France and Italy lead the market, with the most prominent automakers in the above mentioned countries, including their top high-tech liftgate systems in their SUVs, crossovers and high-performance sedans; BMW, Mercedes-Benz, Volkswagen and Audi.

Europe’s electric vehicle revolution also significantly influences power liftgate adoption, with manufacturers opting for energy-efficient, lighter tailgate mechanisms for battery-powered vehicles. Moreover, the emergence of shared mobility, car subscription services, and smart fleet management has further propelled the adoption of automated liftgates in ride-sharing and commercial vehicles.

EU regulations mandating that vehicles offer higher levels of safety and convenience features is further pressuring automakers into offering more access-friendly features as standard (power liftgates are becoming standard on mid-range and above models). The European market is likely to see sustained growth in the coming years owing to the continued investments in AI-powered automotive applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 8.2% |

The Japanese power liftgate market is growing steadily, bolstered by the country’s technological prowess in automotive innovation, growing sales of SUV and crossovers, and growing consumer inclination towards convenience-oriented features.

Japanese manufacturers such as Toyota, Honda, Nissan, and Mazda have been some of the first in the world to implement these advanced liftgate systems in the vast majority of their new models. Japanese car makers are ramping up innovations in the vehicle access solutions market with the growing demand of smart access, AI-powered automation, and gesture-controlled tailgate systems.

Japan's production of hybrid and electric vehicles has also spurred growth in energy-efficient, lightweight power liftgates. Furthermore, the rising implementation of sensor-based tailgate systems in compact vehicles and passenger cars is increasing market opportunities outside the luxury vehicle segment.

Japan’s rapidly expanding logistics and e-commerce industry has bolstered adoption of power liftgates too, with delivery vehicles and smart logistics fleets adopting automated tailgate systems for effectively handling cargo. Given its reputation as a trailblazer in the AI-infused automotive systems space, Japan's contributions to liftgate automation are likely to spur further innovation and bolster its share of the global marketplace as well.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.8% |

The South Korean power liftgate market is experiencing substantial growth, driven by the country’s strong automotive industry, rapid expansion of the electric vehicle sector, and increasing demand for smart vehicle features.

South Korea is home to leading automakers like Hyundai, Kia, and Genesis, which are actively incorporating automated liftgate solutions into their latest SUV and EV models. With rising consumer expectations for luxury and convenience, manufacturers are equipping mid-range and high-end vehicles with remote-controlled, voice-activated, and foot-sensor-based power liftgates.

Additionally, the South Korean government’s EV incentives have accelerated the integration of lightweight, energy-efficient liftgate technologies in hybrid and electric cars. The increasing adoption of connected car technologies and smartphone-controlled vehicle systems has further expanded demand for AI-powered liftgate solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.2% |

Today's cars continually see more of these advanced convenience features, and the power liftgate is where the market is, with SUVs and luxury vehicles leading the charge. Power liftgates are in higher demand, especially among premium and high-end models, as consumers are placing a greater emphasis on hands-free, automated, and remote-operated trunk access. This generally results in more user-friendly, easily accessible cargo and is protective for families, commuters, and commuters alike.

The power liftgate segment is dominated by SUVs, which are being propelled by growing global demand for larger vehicles with plenty of space and equipment. This makes popularity among consumers since they can be used for the versatility, cargo space and off-road capabilities of SUVs, thus, automated liftgates can be a great help to ease its usability. As more drivers use SUVs for everything from daily commuters to long-distance road trips to trips to the great outdoors, power liftgates offer a hands-free alternative for loading and unloading bulky items with ease.

Automakers like Toyota, Ford, Honda, and Hyundai have made power liftgates a default feature in mid-to-high-end SUV models - which means consumers can be assured of automated rear hatch functionality when they buy these vehicles. Sensor-based, foot-activated power liftgates have also boomed in popularity, making it possible to open and close the trunk simply by waving a foot under the rear bumper. This feature is designed for drivers who commonly load groceries, luggage or sports equipment into the back, eliminating the need for physical interaction with the tailgate.

The rising penetration of enhanced power liftgate features across multiple regions including North America, Europe, and Asia-Pacific is due to the growing sales of SUVs. Such innovations enhance user experience and vehicle safety by preventing power liftgates from inadvertently hitting nearby objects like other parked cars or low-clearance structures.

The power liftgate market also constitutes a significant share from luxury vehicles such as premium SUVs and high-end sedans. Vehicle automation is a priority for luxury carmakers, and power liftgates fit in with their goals of providing comfort, refinement, and high-tech luxury goodness. Intelligent liftgate systems with voice activation, smartphone app integration, and adjustable opening angles are available on brands like Mercedes-Benz, BMW, Audi and Lexus.

Power liftgates have become a standard feature of executive sedans and premium crossovers, as luxury vehicle buyers expect that the automation and smart accessibility features will keep coming. Additionally, the implementation of lightweight components, including aluminium and reinforced polymers in power liftgate construction, have enabled automakers to minimize vehicle weight without compromising durability, thus securing fuel economy and long-lasting serviceability.

While SUVs and luxury vehicles dominate, power liftgates are progressively making their way into mid-sized and compact vehicle categories. With power liftgate becoming increasingly accessible, generally more affordable automotive technology, automakers are rolling out entry-level options so a wider segment of consumers can have access to them. This trend is likely to trigger steady market traction, as an increasing number of mid-range cars are equipped with smart trunk opening systems.

OEMs dominate the power liftgate market due to the craze for factory integrated high-tech trunk automation systems among the automakers in new vehicle models. Consumers opt for OEM Power Liftgates because they are less likely to cause issues down the road as they are integrated into the vehicle compared to aftermarket products that have warranties through the aftermarket, which may not resolve the issues with the aftermarket power liftgates long-term.

No wonder, automakers have noticed the growing appeal of automated liftgates, making them regular or optional equipment on many SUVs, luxury cars, and EVs. Top automotive manufacturers, such as General Motors, Toyota, Volkswagen, and Tesla, have widely utilized OEM power liftgates, contributing to improved styling, advanced functionality, and smart connected vehicle capabilities.

OEM power liftgates are engineered with precision, undergo rigorous quality testing, and are integrated with vehicle safety systems. With OOEM power liftgate systems today, pinch-proof sensors, soft close options and settable-opening angles are available for a safe and convenient trunk operation.

Additionally, automakers work with tier-one suppliers like Magna International, Aisin Seiki, and Brose Fahrzeugteile to create next-generation power liftgate solutions, enhancing vehicle powertrain efficiency and overall user experience. Electrification and lightweight components have resulted in energy-efficient liftgate motors, noise-reduction actuators, and smart tailgate modules - all of which make OEM-installed power liftgates more attractive to consumers.

As EV manufacturers work to create increasingly automated and user-friendly vehicles, the existing OEM power liftgate segment continues to bolster the growth of electric and hybrid vehicles. Picking up where Tesla and rivals Rivian and Lucid Motors have left off, high-tech electric vehicles now have power liftgates as standard-sold features, giving drivers the ultimate in seamless, hands-free cargo accessibility.

The OEMs are dominating the markets; however, the aftermarket segment also holds strong, especially for the car owners looking for the power liftgate feature in already existing car models. People generally want the latest technology to be installed in their vehicles, and since vehicles can remain on the road for a decade or more, the aftermarket exists to meet the retrofitting needs of some consumers that just want the convenience of automation without having to invest in a new vehicle.

As such, aftermarket power liftgate kits have been popular in many verticals thanks to their affordability, availability to be used on many different kinds of vehicles, and simple installation process. Aftermarket specialists sell universal and model-specific kits that add power liftgates to an existing trunk, letting you automate your trunk at a fraction of the price.

The availability and accessibility of aftermarket power liftgates have also been enhanced through online shopping platforms and automotive specialty shops, offering consumers convenient access to solutions with features such as remote control operation, sensor activation, and smartphone connectivity. Known aftermarket brands have developed DIY-friendly kits with plug-and-play wiring systems for easier installation in most vehicles.

That said, the aftermarket industry can be problematic with inconsistent quality, compatibility issues, and warranty restrictions. Since OEM-fitted power liftgates are generally of higher quality and more integrated with the vehicle (which adds to overall safety), consumers typically tend to choose OEM first with aftermarket power liftgates being a secondary choice for users looking for more cost-effective solutions.

However, with increasing preferences for customization of smart vehicles, the aftermarket segment is likely to have a greater scope, complemented by more advanced retrofitting options with advanced automation and safety features. OEMs and the aftermarket, therefore, can expect long-term growth as their businesses gain from the companies that will invest in higher compatibility and enhanced motor efficiency at the same time which will facilitate simple installations as its cornerstone.

The power liftgate market is expected to experience substantial growth in the coming years due to factors such as the growing need for convenience among consumers, technological advancements in the automotive sector, and the increasing adoption of electric and luxury vehicles.

This implementation of technology has resulted in much more than just a simple tailgate in our vehicles today, power liftgates offer hands-free operation, increased vehicle accessibility, and improved safety, all desirable qualities in a device that continues to be a commonplace feature in our vehicles. As all car manufacturers are adopting power liftgates across vehicles from SUVs to sedans, it is expected to drive the growth of the market.

Technological progress such as smart sensors, gesture control, and integration with in-automobile automation systems is playing a major part in shaping the aggressive landscape. Business is specializing in lightweight materials, energy-efficient, and economical derivatives to accommodate a wider population. The growing safety regulations along with increasing consumer demand for a better vehicle comfort are boosting the ongoing innovations in the power liftgate mechanism.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Magna International Inc. | 18-21% |

| Brose Fahrzeugteile SE & Co. KG | 15-19% |

| Aisin Seiki Co., Ltd. | 10-13% |

| Johnson Electric Holdings Limited | 8-11% |

| Stabilus GmbH | 5-10% |

| Other Companies (combined) | 35-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Magna International Inc. | Develops advanced power liftgate systems with integrated sensors, automation, and lightweight materials for enhanced efficiency. |

| Brose Fahrzeugteile SE & Co. KG | Specializes in intelligent power liftgate mechanisms with smart control and safety features for premium and mid-range vehicles. |

| Aisin Seiki Co., Ltd. | Offers high-performance liftgate solutions optimized for durability, energy efficiency, and smooth operation in diverse weather conditions. |

| Johnson Electric Holdings Limited | Provides compact, cost-effective power liftgate motors with improved torque and noise reduction technology. |

| Stabilus GmbH | Focuses on hydraulic and electromechanical liftgate systems with innovative motion control and enhanced security mechanisms. |

Key Company Insights

Magna International Inc.

Magna International Inc. is a leading global automotive supplier, and always at the forefront of technology to address the industry's current and future power liftgate needs. The company’s liftgates leverage lightweight materials, intelligent sensors, and automation features for greater user convenience and improved vehicle efficiency.

With the ongoing innovation of Magna's R&D team, our power liftgates are now designed as part of an ADAS environment, contributing to overall safety and user-friendliness. As a partner to the world's top automakers, the company offers customized solution with compatibility across multiple vehicle types.

Magna is also committed to sustainability with liftgates with energy-efficient features that lower emissions from the rest of the vehicle as it moves toward more sustainable automotive technologies. Magna continues to be a global leader with manufacturing plants in North America, Europe and Asia, and expanding capabilities to support growing market demands.

Brose Fahrzeugteile SE & Co. KG

Brose Fahrzeugteile is a key player in the power liftgate market, known for its expertise in intelligent mechatronics. The company focuses on designing liftgate systems that utilize gesture-based controls, automatic detection of obstacles, and improved safety features for hands-free operation.

Brose’s specialized energy-efficient actuators reduce power consumption, which makes their solutions widely adopted for e- and hybrid vehicles. Alpine also works closely with luxury automotive brands and its solutions integrate at high-performance levels with next-gen automotive architectures.

And Brose is also pouring nice sums of money into AI-powered diagnostics and predictive maintenance tech, which enables users to monitor liftgate performance in real time. Accordingly, this optimism shows the company's commitment and efforts towards its expansion strategy through continuous development and improvements in the manufacturing processes while increasing the footprint into emerging market, to keep up with its heritage of quality and innovation.

Aisin Seiki Co., Ltd.

Aisin Seiki Co., Ltd., the automotive components manufacturer, provides powerful liftgates systems which are known for their robustness and efficiency. The company’s liftgates are designed with smooth operation mechanisms that are very reliable in all sorts of weather, making them suitable for luxury as well as mass-market vehicles.

Aisin's focus here is to reduce weight and power consumption while still fulfilling liftgate strength and function. Its liftgates utilize smart safety features driven by sophisticated sensor technology, like automatic anti-pinch detection and customizable opening angles.

The business is focused on adding integrated connectivity products that will enable drivers to manage liftgates through mobile apps. Aisin continues to strengthen its market position ensures its products remain at the forefront of technological advancements.

Johnson Electric Holdings Limited

Johnson Electric is a leading provider of motion systems, offering compact and cost-effective power liftgate motors designed to deliver high torque and minimal noise. Designed for smooth and reliable operation, the company's motors deliver long-term performance. Johnson Electric delivers scalable solutions to a wide range of automakers that can be flexibly tailored to match a wide variety of vehicle types, from entry-level sedans to full-size SUVs.

Research continues, with an emphasis on brushless motor technology, the aim being to increase efficiency while at the same time decreasing energy consumption. Johnson Electric is also working towards integrating intelligent control modules for real-time monitoring and diagnostics which will increase user comfort. Johnson Electric continues its innovation and market reach globally, with strong partnerships spanning to both OEM and aftermarket segments.

Stabilus GmbH

With innovative motion control solutions for improved access to vehicles, Stabilus GmbH is a market leader in hydraulic and electromechanical liftgate systems. Features on the company’s power liftgate technology include anti-pinch protection as well as remote operation of the liftgate. It focuses on research to develop a new range of products like energy-efficient actuators and sustainable materials that offer ultimate long-lasting performance.

The company works with top vehicle producers to embed functional liftgate solutions into the vehicles, resulting in improved user accessibility and automobile security. Next-gen liftgate systems with adaptive speed control and noise reduction technology are also in the works from Stabilus. But the company also prides itself on innovation, and it plans on adding other liftgate products to its offerings as there are hundreds of automotive segments to serve in which it seeks to satisfy.

The global power liftgate market is projected to reach USD 3,511.3 million by the end of 2025.

The market is anticipated to grow at a CAGR of 8.5% over the forecast period.

By 2035, the power liftgate market is expected to reach USD 7,939.2 million.

The Passenger Vehicle segment is expected to hold a significant share due to increasing demand for comfort and convenience features in modern automobiles.

Key players in the power liftgate market include Stabilus GmbH, Mitsuba Corporation, STRATTEC Security Corporation, HI-LEX Corporation, and Continental AG.

The market is segmented into OEM and Aftermarket.

The industry is categorized into Passenger Vehicles and Commercial Vehicles.

The market is classified into Automatic and Semi-Automatic.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

Sales of Used Bikes through Bike Marketplaces Market- Growth & Demand 2025 to 2035

Engine Tuner Market - Growth & Demand 2025 to 2035

Start Stop System Market Growth – Trends & Forecast 2025 to 2035

Motorcycle Lead Acid Battery Market - Trends & Forecast 2025 to 2035

Automotive Connecting Rod Bearing Market -Trends & Forecast 2025 to 2035

Aircraft Strut Market - Market Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.