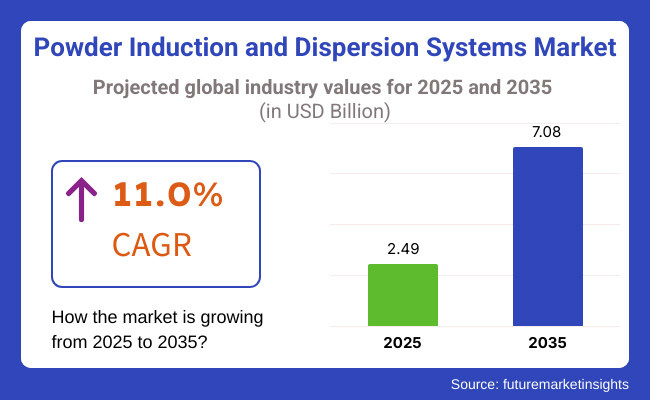

The demand for global Powder Induction and Dispersion Systems market is expected to be valued at USD 2.49 Billion in 2025, forecasted at a CAGR of 11.0% to have an estimated value of USD 7.08 Billion from 2025 to 2035. From 2020 to 2025 a CAGR of 10.5% was registered for the market.

In the food and beverage industry powder induction and dispersion systems (PIDS) are widely adopted and efficiently utilized for processing all ingredients. Therefore, growth in the food industry is probably going to drive sales.

The ability of powder induction and dispersion systems to lessen and eliminate dust formation is a factor in their popularity. They thus considerably improve food safety. In addition, these systems reduce batch times considerably improve operator safety and use less energy.

Two major growth factors impacting the global market for powder induction and dispersion systems are the implementation of strict safety regulations and the growing demand for high-quality products. Dispersion technology advancements are also anticipated to help the sector. End users are also attracted to PIDSs due to their enhanced distribution capabilities and large production capacity.

In addition to saving energy these systems are seen as a shining example of green technology which increases their appeal to environmentally conscious consumers. By lowering power outages these systems help to create a safe working environment.

Key players are investing in product enhancement in order to decrease downtime boost yields and achieve a lower cost of ownership. It is anticipated that in the future end users will spend money on powder induction and dispersion systems in order to take advantage of their efficiency and consistency.

Explore FMI!

Book a free demo

Demand for Sustainability is Driving the Market Growth

Through the reduction of material waste these systems also support environmental sustainability as well as functioning in closed-loop settings that minimize dust production. As an example, a chemical manufacturing company reported that material waste had decreased by roughly 1096 putting a powder induction system into operation.

The exact dispersion of powder guarantees that the cleaner production process supports and that very little material is wasted a manufacturing strategy that is more sustainable this decrease in environmental impact and waste impact is in line with the growing industry and regulatory calls for more sustainable practices behaviors.

Product Quality Improvement Drives the Market growth

Systems for powder induction and dispersion are essential for improving product quality. providing better control over the mixing process resulting in consistency. For example, in the. These systems can assist the pharmaceutical industry in achieving a consistent dispersion of active ingredients. The presence of pharmaceutical ingredients (APIs) in a liquid medium is essential for the effectiveness of drugs.

These systems ensure precise dispersion of powders in liquids leading to more uniform and premium goods. In industries like these this degree of control is particularly important preserving high standards of food and drink chemicals and pharmaceuticals. Product quality is crucial for both customer satisfaction and safety.

During the period 2020 to 2024, the sales grew at a CAGR of 10.5%, and it is predicted to continue to grow at a CAGR of 11.0% during the forecast period of 2025-35.

The food and beverage pharmaceutical and chemical industries are using powder induction and dispersion systems more and more. They are employed in the food and beverage industry to transform powders into liquids. As they provide a lump-and agglomerate-free starter instantly PIDSs are appropriate for making cheese starter solutions. Every ingredient is quickly hydrated and distributed regardless of the product being introduced such as stabilizers starches gums or protein powders.

These considerations have led to significant investments in powder induction and dispersion systems by the food and beverage industry. Paints and water-based systems are among the chemical applications where powder induction and dispersion systems are increasingly being integrated into continuous processing lines.

The demand for these systems is therefore expected to be driven by growth in the chemical and construction industries. Globally governments and other regulatory agencies are enforcing stringent laws pertaining to the quality and safety of products.

During the assessment period this is anticipated to increase demand for PIDSs even more. Accurately combining active pharmaceutical ingredients (APIs) with other solvents or ingredients is frequently necessary in the pharmaceutical industry. Systems for powder induction and dispersion are used for this.

Tier 1 companies comprises industry leaders acquiring a 70% share in the global business market. These leaders are distinguished by their extensive product portfolio and high production capacity. These industry leaders stand out due to their broad geographic reach, in-depth knowledge of manufacturing and reconditioning across various formats and strong customer base. They offer a variety of services and manufacturing with the newest technology while adhering to legal requirements for the best quality.

Tier 2 companies comprises of mid-size players having a presence in some regions and highly influencing the local commerce and has a market share of 25%. These are distinguished by their robust global presence and solid business acumen. These industry participants may not have cutting-edge technology or a broad global reach but they do have good technology and guarantee regulatory compliance.

Tier 3 companies comprises mostly of small-scale businesses serving niche economies and serving at the local presence having a market share of 5%. Due to their notable focus on meeting local needs these businesses are categorized as belonging to the tier 3 share segment, they are minor players with a constrained geographic scope. As an unorganized ecosystem Tier 3 in this context refers to a sector that in contrast to its organized competitors, lacks extensive structure and formalization.

The following table shows the forecasted growth rates of the significant three geographies revenues. USA, Germany and India come under the exhibit of high consumption, recording CAGRs of 9.0%, 7.3% and 14.1%, respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 9.0% |

| Germany | 7.3% |

| India | 14.1% |

Through 2035 the powder induction and dispersion systems market in the USA is expected to grow at a compound annual growth rate (CAGR) of 9.0%. By 2025 it is anticipated that the market will hold a % share. The use of these systems in the food and pharmaceutical industries is being driven by the growing need for production process efficiency.

To improve their dispersion technology and equipment players across the country are constantly investing money. According to projections steady technological advancement will propel steady industrial growth in the US.

India’s industry is expected to grow at a compound annual growth rate (CAGR) of 14.1% through 2035. Pharmaceuticals are a major expense for India. Demand for healthcare services and medication purchases is rising as a result of this sectors subsequent growth as well as the growing number of elderly and ill people.

The environment for powder induction and dispersion systems is expected to be favorable due to these dynamics. Industry growth will be fueled by manufacturers increased emphasis on increasing production capacity. Additionally, the food and beverage industrys growing competitiveness which is supported by advantageous trade policies is anticipated to broaden the Indian market.

The target industry in Germany is anticipated to grow at a compound annual growth rate (CAGR) of 7.3% over the estimated period. Food and beverage chemicals pharmaceuticals cosmetics and personal care products are among the end-use industries that are growing and driving Germanys equipment demand.

Similarly, the industry is expected to grow as automatic PIDSs gain popularity. Leading manufacturers in the nation keep expanding their product lines with automated powder induction and dispersion systems. Complete automation controls and touchscreen operation are added to new additions to further increase efficiency and productivity.

| Segment | Value Share (2025) |

|---|---|

| Food and Beverages (Application) | 70% |

One of the biggest users of powder induction and dispersion systems is the food and beverage industry. Players utilize these systems to efficiently and reliably blend powders into liquids improving the overall quality flavor and texture of the final product. The creation of goods like soups instant beverages yogurts and sauces depends heavily on this function.

Additionally, PIDSs are employed to reduce the amount of dust produced during the mixing process. This improves operator safety and reduces the chance of contamination. Additionally, when PIDSs are used instead of traditional methods the mixing times are significantly shortened.

Companies in the food and beverage industry can increase their production output by using PIDSs. Additionally, it is anticipated that the need for convenient and functional food will fuel the need for effective mixing technologies favoring the use of powder induction systems.

| Segment | Value Share (2025) |

|---|---|

| In-Tank Mixing (Type of Mixing) | 49% |

It is anticipated that the market for powder induction and dispersion systems will see the in-tank mixing segment gain a 49% share. As it enables quick and even wetting of powder particles the creation of a smooth and uniform mixture and the avoidance of clumping in-tank mixing is recommended. These systems can also be modified to operate with different tank sizes and configurations giving current production lines more flexibility.

Leading companies in the market for powder induction and dispersion systems are concentrating on product development and mergers and acquisitions. Companies can reach new markets and increase the range of products they offer by making strategic acquisitions. In order to encourage cooperation and create more complete solutions for client’s players are further collaborating with one another.

Aftermarket solutions are also being considered by the participants. In order to guarantee client satisfaction and encourage repeat business players are making sure that maintenance services and spare parts are readily available. Additionally, players are providing customization choices and retrofit solutions for the available tanks enabling end users to incorporate these systems into pre-existing infrastructure.

The market is expected to grow at a CAGR of 11.0% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 7.08 Billion.

Demand for sustainability is increasing demand for Powder Induction and Dispersion Systems.

North America is expected to dominate the global consumption.

Some of the key players in manufacturing include Silverson Machines, Inc., Noritake Co., Limited, SPX FLOW and more.

Methods industry has been categorized into Food & beverages, Pharmaceuticals, Cosmetic and personal care products and Chemicals

Industry has been categorized into In-tank mixing, Inline mixing

Industry analysis has been carried out in key countries of North America; Europe, Middle East, Africa, ASEAN, South Asia, Asia, New Zealand and Australia

Cheese Analogue Market Insights - Growth & Demand Analysis 2025 to 2035

Sports Nutrition Market Brief Outlook of Growth Drivers Impacting Consumption

Comprehensive Probiotic Strains market analysis and forecast by strain type, application and region.

Comprehensive Probiotic Ingredients market analysis and forecast by from, ingredient type, animal type and region

Brined Vegetable Market Analysis by Nature, Type, End-use, Distribution Channel and Region through 2035

Natural Dog Treat Market Product Type, Age, Distribution Channel, Application and Protein Type Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.