The global potato flakes market is mildly concentrated, highly dominated by big multinational companies operating in the international supply chain: they hold a combined 55%. These players draw benefits from global supply chains, advanced processing technologies, strong B2B linkages with the food manufacturers as well as with QSR operators.

Companies McCain Foods, Lamb Weston, as well as Simplot are significant players in the international market with solid distribution networks, and innovative portfolio of products in the market. Aviko and Mydibel have regional leadership status with 25%, offering differentiated products that would respond to regional consumers' demands and preferences.

Then, the startup and niche players, those offering organic or specialty products, hold 12%. Finally, there are private labels holding 8%, driven mainly by low-cost, store-brand type products from major retailers such as Walmart and Tesco.

The top 5 multinational companies in total command an impressive 45% of the overall market; the level is moderately high while leaving enough headroom for the regional and emergency players to thrive and innovate.

Explore FMI!

Book a free demo

| Global Market Share 2025 | Industry Share (%) |

|---|---|

| Top Multinationals (McCain Foods, Lamb Weston, Simplot, Aviko, Mydibel) | 50% |

| Regional Leaders (Clarebout Potatoes, Rösti Stübli, Emsland Group) | 30% |

| Startups & Niche Brands (Bob’s Red Mill, Balaji Wafers, Pacific Valley Foods) | 12% |

| Private Labels (Walmart (Great Value), Tesco (Finest), Carrefour (Bio)) | 8% |

The market is moderately concentrated, with industrial supply dominated by multinationals, and there is a thriving opportunity for regional leaders and niche brands in specific applications and markets.

Standard potato flakes account for the highest market share at 45%. This is mainly because they are widely used in ready meals, soups, and sauces. The leaders of this category are McCain Foods and Simplot, who supply bulk flakes to food manufacturers and QSRs.

These flakes are versatile regarding texture and flavor. Mashed potato pellets make up 28% of the market share, supported by the popularity in frozen meal kits and food service applications. Lamb Weston leads this category with its ability to use relationships with international fast-food chains for custom formulations.

Specialty flakes that include organic, gluten-free, and nutrient-enriched items are growing popularity in North America and Europe and represent 15% of the market. Powder or granule formats, at 12%, include bakery mixes and soups, used by specialty providers such as Bob's Red Mill

The largest end use application is snacking at 32%. Chip and extruded products are mass consumed around the world from makers such as Lay's and Pringles.

This snacking segment aligns with an increasing Asian and Latin American prepared-to-eat snack consumption growth. Ready meals account for 25% of the share, which is mainly due to the convenience factor and increasing urbanization.

Simplot and Aviko deliver premium flake products for frozen meals and meal kits, particularly in North America and Europe. Bakery applications, soups, and sauces accounted for another 30%. The specialty bakery business, including gluten-free bread and snacks, is very important. The food service application is also rising, as flakes are used to ensure consistent, scalable recipes for QSRs.

The year 2024 really marked a moment for growth and innovations in the global potato flakes market, which was primarily fueled by changes relating to sustainability and diversification of the product portfolio and strategic partnerships.

The leading market participants were focused on geographic expansion, increasing production capacities, and meeting different tastes. McCain Foods and Lamb Weston engaged in initiatives concerning sustainable production and innovative formulations, whereas region-specific leaders took up products customized to the local taste preferences.

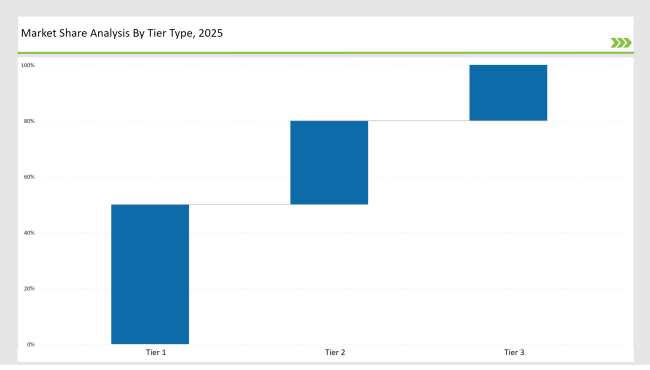

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 50% |

| Example of Key Players | McCain Foods, Lamb Weston, Simplot |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 30% |

| Example of Key Players | Aviko, Mydibel, Clarebout Potatoes |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 20% |

| Example of Key Players | Regional players, startups, private labels |

| Brand | Key Focus |

|---|---|

| Simplot’s Expansion | Invested in advanced manufacturing facilities for Asian markets. |

| McCain’s Innovation Hub | Focused on R&D for premium and functional potato flakes. |

| Lamb Weston’s Digital Push | Implemented AI-driven coordination for efficient global distribution. |

| Aviko’s Vegan Portfolio | Added plant-based product lines in response to growing demand. |

| Tesco’s Sustainability Goal | Committed to 100% biodegradable packaging by 2025. |

| Bob’s Red Mill’s Education Campaign | Promoted consumer awareness on the benefits of organic flakes. |

| Mydibel’s Partnership Model | Collaborated with specialty food stores in Europe for exclusive offerings. |

| Rösti Stübli’s Craft Strategy | Focused on artisan-level product differentiation. |

| Balaji Wafers’ Infrastructure Upgrade | Established automated facilities to scale production. |

| Clarebout’s Supply Chain Digitization | Improved transparency with blockchain for ingredient sourcing. |

Organic and gluten-free potato flakes are rapidly gaining popularity in North America and Europe. Health-conscious consumers are seeking clean-label, free-from products. Manufacturers can leverage such trends with expanding product portfolios of organic and gluten-free potato flakes marketed at a premium price level for willing-to-pay target audiences interested in premium-quality, sustainable, and healthy offers.

The development of new recipes and menu items featuring potato flakes is possible when potato flake manufacturers collaborate with QSRs, cafes, and restaurants. This increases the adoption and visibility of potato flakes in the foodservice industry, which leads to market penetration. Manufacturers can also work closely with chefs and culinary teams to showcase the versatility and functionality of their potato flake products, leading to increased usage in various food service applications.

Innovations in processing and packaging technologies are likely to increase the quality and shelf life of potato flakes, which would make it more attractive for industrial buyers as well as the end consumer.

Processing techniques can help in improving the texture, flavor, and nutritional quality of potato flakes, while better packaging can prolong the shelf life of the product and keep the products fresh for a longer period. These technological improvements can help the manufacturers differentiate their offerings and meet the evolving demands of the market.

McCain Foods, Lamb Weston, Simplot, Aviko, and Mydibel collectively hold 45% of the market, driven by their strong B2B presence.

Organic potato flake account for 18% of the market, with high growth rates in North America and Europe.

B2B/Industrial channels dominate with 58%, as potato flakes are a key ingredient in snacks, ready meals, and soups.

Online retail holds 10% of the market and is expected to grow significantly, driven by demand for specialty and organic products.

The snack food segment, contributing 32%, is driven by increasing demand for convenience and ready-to-eat products in emerging markets.

Liqueurs Market Analysis by Type, Packaging, Distribution Channel, and Region - Growth, Trends, and Forecast from 2025 to 2035

Japan Dietary Supplements Market, By Ingredients, Form, Application, and Region through 2035

Dehydrated Pet Food Market Insights – Premium Nutrition & Market Trends 2025 to 2035

Cat Food Market Insights – Trends & Growth Opportunities 2025 to 2035

Food Grade Lubricant Market Analysis by Base Oil Type, Product Type and Application Through 2035

Yeast Extract Market Analysis by Type, Grade, Form, and End Use

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.