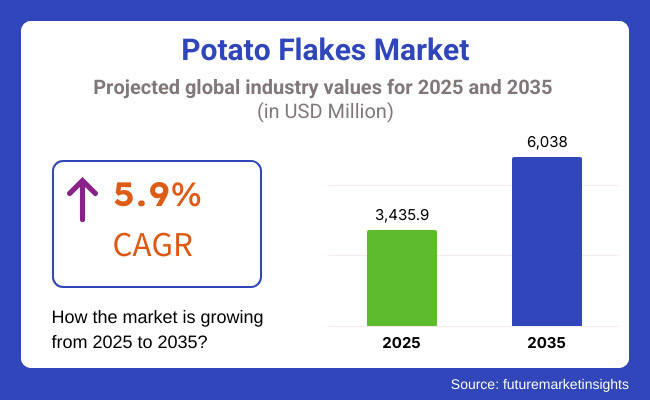

The global potato flakes market is poised for substantial growth between 2025 and 2035, with the market size expected to expand from USD 3,435.9 million in 2025 to USD 6,038.0 million by 2035, reflecting a robust CAGR of 5.9%.

This development is mainly due to the growing preference for convenient foods and the broad application of potato flakes across different industries. Potato flakes are commonly used for their functional benefits such as texture enhancement, better taste, and prolonging the shelf life of food products, thus becoming critical in many areas of application.

The urban population growth and the shifts in consumer lifestyles are accelerating the turn to instant and processed foods while potato flakes are a major component. The foodservice industry often utilizes potato flakes as thickeners in soups and sauces, in mashed potato mixtures, and as coating for snacks.

The addition of potato flakes is a common practice to the bakery segment for the enhancement of dough consistency and superior product quality. Potato nuggets, which are made with potato flakes, have begun to be included in the ready meal category, meeting the demands of customers who are busy with work yet still desire a nutritious meal.

The organic and specialty potato flakes unit is experiencing a significant rise in production as consumers choose healthier and more sustainable products. Organic potato flakes produced without any artificial ingredients are especially attractive for consumers who seek eco-friendly and clean-label items.

Moreover, the development of potato processing technologies like drum drying and vacuum packaging has made the product better in quality and shelf life, thus contributing to the global demand. The Asia-Pacific area has become a rapidly growing market due to the increase in disposable incomes, urban expansion, and changing eating habits.

Parallelly, the older markets in North America and Europe are the ones behind the innovations in the specialty and premium potato flake sectors of the market. The potato flakes market with applications including snacks, bakery, soups, sauces, and many others will stand as the top choice for stakeholders on the entire potato value chain.

Explore FMI!

Book a free demo

The table below showcases the semi-annual growth rate trends for the potato flakes market in the base year (2024) and the current year (2025). H1 represents January to June, while H2 spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 5.7% |

| H2 (2024 to 2034) | 5.9% |

| H1 (2025 to 2035) | 5.9% |

| H2 (2025 to 2035) | 6.1% |

During the decade from 2025 to 2035, the potato flakes market is projected to experience consistent growth. In H1 2025 to 2035, a steady CAGR of 5.9% is driven by rising demand from the foodservice and snack industries.

The second half (H2) is expected to show a slightly higher CAGR of 6.1%, attributed to seasonal trends and an increasing focus on specialty and organic products. A similar trend is observed in the previous decade, highlighting the market’s resilience and steady expansion.

Rising Demand for Convenience Foods Globally.

The global transition to convenience foods has profoundly raised the consumption of potato flakes, which are highly regarded for their adaptability and simple preparation. These products can be quickly prepared and be used in various areas such as, but not limited to, ready-to-eat meals, soups, sauces, and snacks which are the perfect match with a modern lifestyle.

Because of the fact that people are a lot more into ready-to-eat products, most of the families and restaurants use potato flakes as an essential component. Furthermore, the market has been disrupted by the introduction of products that are beneficial to health, for example, low sodium and fortified kinds that appeal to health-oriented shoppers.

Moreover, the demand for potato flakes is also buoyed by the growing trend of premium processed foods, especially in urban areas. Transparency in product labeling through natural ingredients without artificial additives is the basis for companies that seek to be considered by health-conscious customers.

The adaptability of potato flakes gives the possibility to be included in different recipes that fulfill different dietary options such as vegan and vegetarian diets. As the standard of living moves toward convenience and health choices, the potato flakes market is set for further upscale turning into a positive trend.

Expansion of the Organic and Specialty Segment

The organic and specialty sector of the potato flakes market has been in a state of rapid expansion, which brings us to the discussions around the customer- and environment-oriented epistemology, that is quite prevalent now.

This product is made without the use of any additives and is thus popular with clean-label and eco-conscious consumers who are in favor of natural ingredients. When more and more individuals choose to eat more healthily, the organic potato flakes grow in popularity proving the trend towards organic foods.

Specialty potato flakes, like the ones used for mashed potato pellets and granules, are gaining ground in the luxury and upscale food segments. Manufacturers are working on getting the necessary certifications and starting sustainable farming practices in response to these changing consumer preferences.

The commitment to quality and sustainability boosts brand equity and builds customers' trust. Meanwhile, as the segment of organic and specialty significantly expands, it is good to know that potato flakes can be a versatile ingredient in this context being the choice of people who are health-conscious and also fitting with modern diets.

Technological Advancements in Processing and Packaging

Renewable types of potato processing and packaging are the main factors in potato flakes' success. Newer and better approaches to drying, such as drum drying and vacuum drying, which are more effective at ensuring flavor retention, quality, and shelf life for consumers' superior products potato flakes. These methods enable moisture to be extracted efficiently without the loss of the potatoes' natural flavor and nutritional value.

Alongside the aforementioned drying solutions, packaging innovations like resalable and biodegradable options are in keeping with the environmental sustainability campaign, thus winning the favor of eco-friendly conscious buyers.

These advancements guarantee not just the integrity of the product but also satisfy the increased demand for eco-friendly packaging. As manufacturers focus on improving processing sustainability through investments in new technologies, the potato flakes market is in the right place to accommodate revolutionary consumer trends and improve the global demand for healthy, easy-to-cook foods of good quality.

The potato flakes market is segmented into three tiers based on market presence and revenue

The potato flakes market can be divided into three tiers, each one based on the revenue and market presence of companies. The top-tier companies are the ones that hold the highest market share which includes; Nestlé S.A., McCain Foods Limited, and Idahoan Foods LLC, which are the main players on the market as they have a wide global reach and an excellent production process. These firms typically invest a lot in research and development to create new potato products, for example, specialty flakes of potato and fortified options.

Distribution across different channels and a focus on sustainability help them to serve diverse segments including retail, foodservice, and industrial applications.Besides that Tier 1 companies are also engaged in the pursuit of strategic partnerships and acquisitions to strengthen their global presence and product lines.

Bob's Red Mill Natural Foods Inc., Agrarfrost GmbH & Co. KG, and Lamb Weston Holdings Inc. are thermal companies that are in the mid-range section. They concentrate on narrow markets and personalized solutions like organic or gluten-free potato flakes.

By emphasizing their orientation on local markets and customer requirements, Tier 2 companies have gained a success rate of the development of process technologies which enhance the quality of their products. Their flexibility makes them quick to adopt changes which create new consumer needs, thus they get an advantage.

Tier 3 companies such as Rixona B.V., Patwary Potato Flakes Ltd., and Clarebout Potatoes NV are the local players focused on the market with inadequate distribution channels. These companies operate on the basis of local customer preferences with budget-friendly solutions that are very much distinct from original recipes.

Their operation at a lower scale allows them to act quickly to the market conditions getting back to the community by providing potatoes that really want. Even though the Tier 3 companies might not be as vast as their competitors, their innovativity and focus on budget based solutions meaningfully impact the industry's growth and competitiveness.

The following table highlights the projected growth rates of the top five markets for potato flakes. The United States and China lead the market due to their high consumption and versatile applications.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| United States | 6.2% |

| China | 6.8% |

| India | 6.5% |

| Germany | 5.7% |

| Brazil | 5.9% |

The United States was a prominent market for potato flakes, mainly due to the major share of processed and convenience foods in consumption. Potato flakes are the most used food ingredients in ready-to-eat meals, snack coatings, and bakery products, and food manufacturers resort to the ingredient due to its easy-to-use feature and flexibility.

Moreover, the fast-growing interest of customers in clean-label and organic options stands the market growth; this, in turn, is due to the health believers, who look for the products containing only natural elements. Innovations in food processing technologies are an additional driving force that helps to further strengthen USA market position, as they enable manufacturers to enhance the quality and durability of potato flakes.

The presence of formidable companies like Nestlé S.A. and Idahoan Foods LLC operates as a catalyst for competition, innovation, and expansion of the products. The potato wafers market in the USA will have a positive perspective because the customers' interests are inclined towards convenient and health products both in the near and distant future.

China is witnessing a transformative phase in the potato flake market, mainly resulting from the rapid growth in urbanization and the consequent nutrition changes. The soaring middle-class population has emerged as a game-changer in the market by pushing instant foods and snacks where potato flakes occupy the major share. As the fast-paced lifestyles are turned to mainly solution preparation with time, people are more inclined towards potato flake products that require less engagement.

This has also been facilitated by the development of e-commerce where different brands are offering the convenience of the direct delivery of the products to consumers. The market is expected to grow at the CAGR rate of 2.4 throughout the forecast period, showing the increasing popularity of potato flakes in additional cooking, soups, and sauces.

Potato flakes market in India is growing significantly due to the establishment and expansion of foodservice and bakery sectors. The penetration of Western cuisine and convenience foods is one major driver for potato flakes which features them in assorted applications, from instant snacks to bakery products.

Furthermore, the advantages of adopting potato flakes in preparing traditional Indian snack items are supported by the growing trend in snacking culture, which is the key factor for the broadening of the market scope. Another major aspect that vegetarian and organic labels can help with is by creating new markets. The changes in public perception are now causing people to look for the best nutrients they can find in food by the choice of the right products.

The advantage of online shopping that includes the increase in the number of available outlets is another factor working in favor of consumers who will have better access to potato flakes. Therefore, India is ready for the impressive growth in the potato flakes sector, since it is reflecting the general trend of the convenience food market and the health direction in consumption.

The potato flakes market in Germany is mainly characterized by the strong organic and sustainable focus, representing the country's commitment to health and environmental concerns. Potato flakes are also the main ingredients for the health-conscious consumers who pay more attention to the natural sources in the premium product categories for snack and bakery items.

The rigorous quality standards and compliance regulations in Germany demand that the consumer demonstrates a continuous commitment to produce high-quality, sustainably-sourced potato flakes. Thus, consumers can build strong trust in these goods. Plus, the solid food processing sector in Germany is also behind the market growth, which is tied to the manufacturers' growing investments in R&D for hiking their productivity.

With the ever-increasing pervasiveness of consumers interested in organic potato flakes, the expansion of this category will likely follow as well. The European potato flakes industry stands to really benefit from these developments, as it is frontlining the drive toward sustainability and conscious food consumption.

In Brazil, the potato flakes market is also very fast raking in demand, becoming a possible probiotic ingredient in ready-to-eat meals. The market will be fueled by the increasing acceptance of naked potato snacks as it contains no meat, gluten, lactose, or any allergens. Urban people, who are heavily into ready-to-eat snacks, are now feeding the potato flakes market quite well, given that these snacks have potato flakes as one of the common ingredients.

Therefore, apart from attending the brunch, having lunch, and snacking, people are benefiting from the time saved cooking. As their day becomes busier with other activities, they are now seeking out convenient meals that require less preparation time.

Thus, the consumption of potato-based flake products in instant-mixing and baking snacks is increasing at a fast pace. This improvement in consumption of corn and forage maize also coincides with the application of potato flakes by the livestock feed sector. Besides, the potato flakes' commonality in the food sector has gained significance by the fact that they are also used as livestock nutrition feed.

Potato flakes, additionally, are commonly used in snacks while Brazil's expanding middle class also contributes to market growth by providing healthier and more convenient food options. Therefore, the potato flake market in Brazil is well on its way to being a top player in the global market in the following years.

| Segment | Value Share (2025) |

|---|---|

| Snack Foods (By End-Use Application) | 32% |

The potato flakes market is greatly influenced by the snack foods segment which is a significant contributor to its improvement. Potato flakes are signature items for snack coatings and fillings because of their multipurpose benevolence and taste-enhancing properties.

The application of potato flakes in different snack formulations has witnessed a burst in the backdrop of urban consumers looking for ready-to-eat items that are convenient. Disruptions in the market, for example, low-sodium and gluten-free options are introduced exclusively to health-conscious consumers desiring nutritious alternatives that do not come with the curse of bad taste.

Besides, the upsurge of snacking during the day, not regular meals, is another factor that gossip the excess of potato flakes in snack applications. As producers do the necessary innovative work and also adapt to changes in consumer trends, the snack foods section will continue to be a major contributor to the overall success of the potato flakes market.

| Segment | Value Share (2025) |

|---|---|

| Organic (By Nature) | 18% |

The organic part of the potato flakes market is at a moment of a rapid upward swing, pulled by the rising consumer awareness of health and sustainability. Organic potato flakes are made without any synthetic additives and are the clean-label and eco-right choice for the consumers who are concerned about their natural intake.

It is true that there was an increase in the demand of this kind due to the demand for certification and labeling, which is clear and full of trust in organic products.

With people changing their diets to be more healthy and the like, the curiosity of consuming organic potato flakes will proliferate. The producers are answering this question by advocating the use of environmentally friendly agricultural practices in conjunction with advanced methods for processing that will preserve the original characteristics of the final product.

The increased intake of organic foods is a parallel trend in the movement towards the consumption of health-promoting products, thus the organic potato flakes are central in achieving the task. And as this part advances, it also creates many opportunities for the potato flakes market both in expansion and innovation.

| Segment | Value Share (2025) |

|---|---|

| Foodservice (By Distribution Channel) | 58% |

A dominating distribution channel for potato flakes is the foodservice sector, which significantly drives the demand in the market. Potato flakes are a common ingredient for this section as they are easy to prepare and can be used for flavoring and texturing various foods among restaurant, fast food chains, and catering services.

Acknowledging their flexibility, the foodservice operators can use them in soups, sauces, and snack coatings among others to give the dish an interesting appeal with little effort. Besides, the declaration of urbanization and the increasing preference for dining outside are the reasons why this sector is amplifying.

This consumer's drive for convenience also leads to quick restaurants and, consequently, the need for advanced time-saving all-in-one ingredients used for the same quality and taste. The foodservice industry will flourish, thus the demand for potato flakes will follow and they will be a premier resource to meet the needs for convenience and taste of consumers in their meal experiences.

The market for potato flakes is fiercely contested, with manufacturers prioritizing their involvement in the areas of innovation, sustainability, and collaboration to attract the market. Some of the top enterprises participating in the competition like Nestlé S.A, Idahoan Foods LLC, and McCain Foods Limited are allocating their resources to modern processing apparatus in order to provide product improvement coupled with the changing consumer preferences.

Expansion of product lines with the addition of the organic and gluten-free options is the strategy that these companies implement which in turn will help them overcome the challenge of proliferating clean-label products.

Recent Developments

The global industry is estimated at a value of USD 3,435.9 million in 2025.

Sales increased at 5.2% CAGR between 2020 and 2024.

Some of the leaders in this industry include Nestlé S.A., Bob's Red Mill Natural Foods Inc., Idahoan Foods LLC, McCain Foods Limited, Rixona B.V., Basic American Foods, Inc., Agrarfrost GmbH & Co. KG, Patwary Potato Flakes Ltd., and Others.

The Europe and East Asian territory is projected to hold a revenue share of 44.5% over the forecast period.

The industry is projected to grow at a forecast CAGR of 5.9% from 2025 to 2035.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.