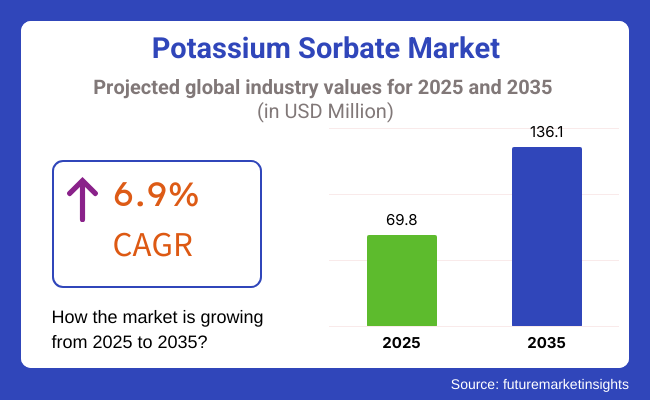

Demand for potassium sorbate is on track to experience a steady rise, with its industry value estimated to reach USD 69.8 million by 2025. The total industry size is anticipated to grow at a CAGR of 6.9% from 2025 to 2035. The net worth of the industry is predicted to increase to USD 136.1 million by 2035.

Given the rising trends in packaged and processed foods the need for sure and safe preservatives are more than ever before. Besides, the ingredient is used in a variety of other sectors as well, e.g., personal care, cosmetics, and pharmaceuticals which opens even more industry opportunities.

The main driving force for the industry has been the increasing consumption of ready to eat and drink products. People are examining grocery products that can last longer without compromising food safety and quality, hence the gaining popularity of it in the food industry. On the other hand, the surging need for preservatives in the dairy sector, baking goods, and beverages is adding to the gradual growth of the industry.

Along with that, regulatory approvals and guidelines supporting the right use of it in food preparation are also contributing to the rise in the industry setting. Food safety authorities in most parts of the world including the FDA and EFSA have authorized its use at permissible levels, this in turn has encouraged the manufacturers to use it in their formulations. What's more, there is a growing preference for using it in organic and natural food products as a fairly harmless preservative which is effectively pacing up its industry reach.

In the middle of its benefits, the industry is also pursuing drawbacks like regulatory limitations in some areas and consumer-oriented growth for free from preservatives and clean-label food products. The introduction of natural alternatives such as rosemary extract and vitamin C-based preservatives may be also seen as a threat to the industry.

The industry growth possibilities are extensive. The increasing focus on low-cost, efficient preservatives in the food and beverage sectors, alongside the cosmetic industries, is what companies are banking on to achieve a sustainable growth rate.

Explore FMI!

Book a free demo

The industry is growing as demand is rising from its use as a preservative extensively in food, drinks, drugs, and cosmetics. It inhibits the growth of mold, yeast, and bacteria, which increases the shelf life of products.

In the food & beverage industry, it is a favored preservative in dairy, bakery, and beverages, thanks to its GRAS (Generally Recognized as Safe) approval by regulatory agencies such as the FDA and EFSA. The pharma sector applies it in ophthalmic solutions and oral suspensions to offer product stability.

It is applied by personal care products in creams, shampoos, and lotions for the sake of formulation stability. However, consumer demand for natural and clean-label preservatives is influencing demand. Retail & e-commerce platforms are observing increased bulk purchasing by small industries and home-based manufacturers. Although the industry is cost-sensitive, innovation in terms of natural preservative blends and compliance with laws will be key to future directions.

Between 2020 and 2024, the industry experienced steady growth, driven by its widespread application as a preservative in the food and beverage industry. Manufacturers utilized it to inhibit mold and yeast growth, thereby extending product shelf life.

The pharmaceutical and personal care industry also drove the growth of markets by using it as an additive in products to preserve quality and purity. Despite industry growth being influenced by restraints such as instability in raw material prices and growing competition from natural preservative agents, challenges nonetheless remained in abeyance until this period was over.

To the years from 2025 to 2035, there is a potential for accelerated industry growth. This forecast growth can be credited to rising demand for convenience foods and drinks, and enhanced consumer sensitivities towards food preservation and food safety. Innovation in manufacturing technology will help maximize the efficiency of manufacturing it, lowering the costs involved and improving quality.

The pharmaceuticals and personal care sectors also promise to uphold the usage of potassium sorbate as a preservative, complementing further growth of the industry. Nevertheless, the industry may face challenges from the growing consumer preference for natural preservatives, prompting manufacturers to innovate and adapt to evolving consumer trends.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Steady growth driven by applications in food, beverage, personal care, and pharmaceutical sectors. | Steady growth driven by greater demand for convenience food and heightened food safety concern. |

| Low innovation tied to utilization of traditional preservative technologies. | Development of new manufacturing technologies and production of value-for-money high-quality products. |

| Growing consumer demand for natural and clean-label products, which threatens synthetic preservatives. | Persistent demand for natural preservatives, leading manufacturers to innovate in this direction. |

| Compliance with prevailing food safety and preservative rules. | Potential for more stringent legislation in favor of natural preservatives and cleaner labeling. |

| Incumbent players preserved industry shares with conventional product offerings. | Growing competition with new entrants targeting natural and innovative preservative solutions. |

The industry is expanding owing to its robust application in food preservation but the food profiling laws regarding food additives act as a counter-compliance issue. To facilitate continued industry acceptance and regulatory approval, companies have to navigate changing global safety standards, labeling requirements, and possible restrictions on synthetic preservatives.

Supply chain disruptions such as the raw material availability fluctuations and the production constraints are factors influencing the pricing and the industry stability. The chemical synthesis dependence puts the industry at risk from supplier shortages and the production cost increase. To lessen those threats, businesses could consider alternative sourcing and green manufacturing options.

The increase in the consumer's desire for preservatives produced from natural sources and the clean label products is directing demand towards the non-synthetic additives. This change might lead to a drop in its sales, and it will be necessary for companies to focus on campaigns promoting its safety, efficacy, and regulatory approvals to hold the consumer trust and industry share.

A growing threat comes from the competition with preservatives that are alternatives such as sorbic acid, natamycin, and plant-based antimicrobials. Companies need to emphasize their innovations and newly developed products, as well as to find cooperation with others in this regard, keeping in mind that they should produce proficiently and at low costs in order to stay competitive in the morphed industry setup.

By form, powdered is expected to be the leading segment, with an industry share of 62.3% by 2025. Being highly soluble, well mixable, and quickly dissolvable at low temperatures, it is the most commonly used one in food and beverage formulations. Powdered potassium sorbate is widely used in the dairy, bakery, and beverage industries to control mold and yeast growth, resulting in improved product shelf stability while ensuring that there is no flavor transfer.

Several leading producers, such as Lanxess, Celanese Corporation, and Sorbic International, are moving towards increased production to cater to the growing global demand for these materials, especially in clean-label and organic food. Moreover, the demand for it in powder form is surging in ready-to-eat and convenience foods, which require extended shelf stability.

With the growing shelf life and controlled-release features, granular form is estimated to account for 37.7% of the industry share in 2025. It finds application in cosmetics, pharmaceuticals, and pet food, where accurate dosing and long-lasting preservation are of great importance. Microbial contamination of cosmetics and personal care formulations is a challenge for brands like L’Oréal and Unilever, which use granular form in their formulations.

In the pet food industry, it’s used in moist and semi-moist goods produced by brands like Mars Petcare and Nestlé Purina. Large suppliers like FBC Industries Nantong Acetic Acid Chemical Co. and Lubon Industry Co. are extending their granular form lines as a response to natural preservative trends.

The powdered form will account for the largest share, driven primarily by an increasing need for food safety and extended shelf life of products. However, granular potassium sorbate will gain increased prominence in some smaller applications.

Food and beverage segment will continue in dominating the industry with7 2.4% industry share in 2025. Increasing consumer demand for natural, clean-label preservatives is boosting the demand, especially in dairy, bakery, and beverage products. It works to protect the antifungal and anti-bacterial properties of cheese, yogurt, wine, fruit juices, and carbonated drinks without altering taste, texture, and color while helping to preserve the food for a longer period.

Global food safety regulatory bodies like those under FDA, EFSA, and Codex Alimentarius are met with it, thereby being used by key manufacturers like Nestlé, Danone, and Pepsico. Moreover, the rising trend around organic and plant foods has offered all the better applications in preservative-free and low-additive formulations. Due to the increased focus on livestock health and feed preservation, the animal feed segment is projected to account for 27.6% of the industry share in 2025.

Used in poultry, cattle, and pet feed to prevent the growth of mold, bacteria, and spoilage to promote nutrient retention and shelf lifeCargill, ADM, and BASF, for example, are working on a proprietary range of products for livestock, aquaculture, and companion animals, according to them, to help meet feed safety expectations outlined by the USDA and the European Food Safety Authority (EFSA).

Given the increase in demand for longer shelf life and fewer synthetic additives in food products, It remains an imperative preservative in consumption sectors such as both food & beverage and animal feed, with applications in food outpacing its usage in animal feed owing to wider consumer adoption.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 4.5% |

| UK | 4.2% |

| France | 3.8% |

| Germany | 4% |

| Italy | 3.9% |

| South Korea | 4.3% |

| Japan | 3.7% |

| China | 5.1% |

| Australia | 4.1% |

| New Zealand | 3.6% |

The USA industry is predicted to grow at a CAGR of 4.5% during the period from 2025 to 2035. Increased demand for preservatives in food and beverages, particularly in bakery and dairy applications, is driving this industry. The USA possesses huge food processing companies such as Kraft Heinz, PepsiCo, and General Mills, which widely utilize it to prolong shelf life and ensure product safety. The stringent food safety regulations under FDA legislation also help in the use of high-quality preservatives such as potassium sorbate.

Besides food, it is widely used in the pharmaceutical and cosmetic industries. Skincare and haircare products of companies like Procter & Gamble and Estée Lauder include this preservative. Growing demand for clean labels is forcing manufacturers to employ it as an alternative to parabens, which are safer. The rising consumption of packaged food and ready-to-eat foods is also propelling the industry growth.

The UK industry is expected to register a CAGR of 4.2% during the forecast period of 2025 to 2035. The strong food processing industry of the UK, led by industry majors such as Unilever and Premier Foods, is a key growth driver. It finds extensive applications in bakery, confectionery, and dairy food as an inhibitor of mold and yeast. Increased demand for natural and organic food products is driving the demand for preservatives with clean-label compliance.

Tight UK regulations placed by the Food Standards Agency (FSA) guarantee that authorized preservatives are utilized in the case of food and cosmetic products. It is increasingly used by the pharmaceutical industry as well, where it applies to oral and dermal medication. Increased consumer demand from companies like Lush and The Body Shop, which place prominence on gentle and safe preservatives, is driving the gradual development of the industry.

The French industry is projected to develop at a CAGR of 3.8% during the period from 2025 to 2035. The country's fierce bakery and dairy industries, dominated by the likes of Danone and Lactalis, are the prime movers of the industry. It is widely employed to inhibit spoilage and guarantee freshness in cheese, yogurt, and baked products. The growing demand for preservative-free and organic foods is propelling the producers towards the use of safer preservatives such as potassium sorbate.

Apart from use in foodstuffs, the robust cosmetics industry of France, with global industry leaders L'Oréal and Clarins, also supports demand. It has extensive use in skincare and hair care products due to its antifungal properties. The emphasis in the country towards green and green cosmetics is nudging manufacturers towards using mild preservatives in association with the shift towards natural cosmetics.

The German industry is forecast to have a CAGR of 4% during the period from 2025 to 2035. Germany's technologically advanced food processing sector, featuring companies such as Dr. Oetker and Nestlé Germany, contributes significantly to food preservative demand. The growing trend for packaged food and ready-to-eat food also fuels the industry.

Germany also boasts a contemporary pharma sector where Merck and Bayer employ it in medicinal syrups and topical creams. The cosmetics sector, with Weleda and Nivea, also operates the preservative to impart stability to skincare and haircare formulation. Growing customer awareness on product quality and safety will further boost applications.

The Italian industry is anticipated to expand at a CAGR of 3.9% from 2025 to 2035. Italy's robust dairy and bakery industries, dominated by players like Parmalat and Barilla, are highly dependent on potassium sorbate to maintain the freshness of their products. Increasing demand for organic and gluten-free food is prompting food manufacturers to adopt safer preservatives.

Pharmaceutical and cosmetic firms in Italy are also growing, with the addition of it by Kiko Milano and Bionike. The nation's historic use of herbal remedies and natural skin care is generating demand for gentle yet effective preservatives and spurring industry growth.

The industry in South Korea is expected to grow at a CAGR of 4.3% between 2025 and 2035. Food is one of the biggest drivers in the country, thanks to the presence of groups such as CJ CheilJedang and Lotte Confectionery. Growing demand for convenience foods and dairy products is driving the consumption of it.

K-beauty companies, such as Laneige and Innisfree, also drive industry growth by employing it in their beauty products. Global demand for South Korean cosmetics continues to increase, and strict security measures guarantee regular demand for good-quality preservatives.

The Japanese industry is expected to increase at 3.7% CAGR from 2025 to 2035. The use of the product in food preservation is facilitated by the country's focus on the safety and hygiene of food, combined with industry leaders such as Ajinomoto and Meiji. In the cosmetic business, Japanese firms like Shiseido and SK-II utilize it in order to offer stability in skincare. The demand for quality and durable beauty products is propelling further uptake.

The Chinese industry will register the highest CAGR of 5.1% during the forecast period 2025 to 2035. The nation's large food processing industry, dominated by giants such as Yili and Mengniu, is one of the catalysts for the growth. Rising urbanization and rising disposable incomes are driving demand for packaged foods and beverages.

China also leads the production of it, catering to most of the demand in the world. Additionally, enhanced growth in the pharmaceutical and cosmetics industry, with Pechoin and Chandos being the leading brands, is powering industry expansion.

The industry in Australia is expected to register a CAGR of 4.1% from 2025 to 2035. Goodman Fielder and Bega Cheese, leading Australia's food sector, use it in bakery and dairy products. Rising demand for organic cosmetics like Sukin and Jurlique is creating industry demand within the cosmetics industry. The focus on natural and green products is promoting the use of gentle preservatives such as potassium sorbate.

The demand in New Zealand is predicted to increase at a CAGR of 3.6% during the period 2025 to 2035. The demand is mainly sourced from the country's dairy sector, which Fonterra dominates. The trend of organic and preservative-free food is driving the use of it as a safer additive. In the cosmetics industry, companies like Antipodes and Trilogy use it in their products. Industry development is driven by escalating demand for natural beauty products.

The industry continues to grow steadily, with food preservation, personal care, and pharmaceutical applications driving demand. It is one of the most widely used preservatives in food and beverage products; hence, its role becomes vital in prolonging shelf life and checking microbial growth.

Key players in the industry include Celanese Corporation, FBC Industries, Sorbic International, Lubon Industry, and Wanglong Tech. Startups and niche suppliers are emerging, which provide specialty-grade and organic-compliant potassium sorbate solutions. The industry is buoyed by heavy usage in bakeries, dairy, beverages, and packaged foods to stabilize the finished product. The cosmetics and pharmaceutical industries also employ it for preservation purposes, for lotions, creams, and ophthalmic solutions.

Recent industry trends are impacted by innovations in clean-label preservation, various alternative antimicrobial solutions, and stringent food safety regulations. Since then, companies have been increasingly investing money into multiple processes, such as cost-effective production methods, environmentally friendly sourcing methods, and compliance with food safety standards recognized throughout the globe.

Industry participants are investigating natural alternatives and newly reformulated blends as these kinds of products are beginning to draw closer scrutiny, considering regulatory issues concerning synthetic preservatives. Nevertheless, it will always find its way into the industry for all possible reasons due to its safety, cost-effectiveness, and truly broad-spectrum antimicrobial ability.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Celanese Corporation | 18-22% |

| FBC Industries | 14-18% |

| Sorbic International Plc | 10-14% |

| Lubon Industry Co., Ltd. | 8-12% |

| Wanglong Tech Co., Ltd. | 6-10% |

| Other Players (Combined) | 25-35% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| Celanese Corporation | Leading producer of high-purity potassium sorbate, serving food, beverage, and pharmaceutical industries with a focus on regulatory compliance. |

| FBC Industries | Specializes in food-grade potassium sorbate solutions, catering to processed foods and dairy applications with a focus on cost efficiency. |

| Sorbic International Plc | Major supplier of sorbic acid derivatives, focusing on clean-label and organic-compatible preservatives. |

| Lubon Industry Co., Ltd. | Provides industrial-grade potassium sorbate for food and non-food applications, with an emphasis on bulk supply and global distribution. |

| Wanglong Tech Co., Ltd. | A key Chinese manufacturer, offering high-volume potassium sorbate production to meet the needs of large-scale food and beverage manufacturers. |

Key Company Insights

Celanese Corporation (18-22%)

As a global leader in food preservation solutions, it is actively using its capabilities in R&D for advanced potassium sorbate solutions that are compliant with regulatory norms.

FBC Industries (14-18%)

Focused on cost-effective and high-quality preservatives, the company supplies it to leading food and beverage brands.

Sorbic International Plc (10-14%)

People enjoying clean-label, natural preservative alternatives in the organic and health-conscious food segment will be targeted consumers for the products.

Lubon Industry Co., Ltd. (8-12%)

This is one of the key players in bulk industrial-grade preservatives, offering cost-effective solutions for worldwide distribution.

Wanglong Tech Co., Ltd. (6-10%)

The biggest producer in China, supporting industrial and food applications at a grand scale.

Other Key Players

The industry is expected to generate USD 69.8 million in revenue by 2025.

The industry is projected to reach USD 136.1 million by 2035, growing at a CAGR of 6.9%.

Key players include Celanese Corporation, FBC Industries, Sorbic International Plc, Lubon Industry Co., Ltd., Wanglong Tech Co., Ltd., Nantong Acetic Acid Chemical Co., Ltd., Tengzhou Aolong Fine Chemical Co., Ltd., Daicel Corporation, Henan Honghui Biotechnology Co., Ltd., and Seidler Chemical Co.

North America and Asia-Pacific, driven by rising demand in food preservation, pharmaceuticals, and cosmetics industries.

Food-grade potassium sorbate dominates due to its extensive use as a preservative in baked goods, dairy products, beverages, and processed foods.

By product type, the industry is classified as powder, granular, and liquid.

By application, the industry is classified as food and beverages, animal feed, pharmaceuticals, and personal care.

By region, the industry divided as North America, Latin America, Europe, East Asia, South Asia, Oceania, and The Middle East & Africa.

Cheese Analogue Market Insights - Growth & Demand Analysis 2025 to 2035

Sports Nutrition Market Brief Outlook of Growth Drivers Impacting Consumption

Brined Vegetable Market Analysis by Nature, Type, End-use, Distribution Channel and Region through 2035

Natural Dog Treat Market Product Type, Age, Distribution Channel, Application and Protein Type Through 2035

Buttermilk Powder Market Analysis by Product Type, Sale Channel, and Region Through 2035

Oat-based Beverage Market Analysis by Source, Product Type, Speciality and Distribution channel Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.