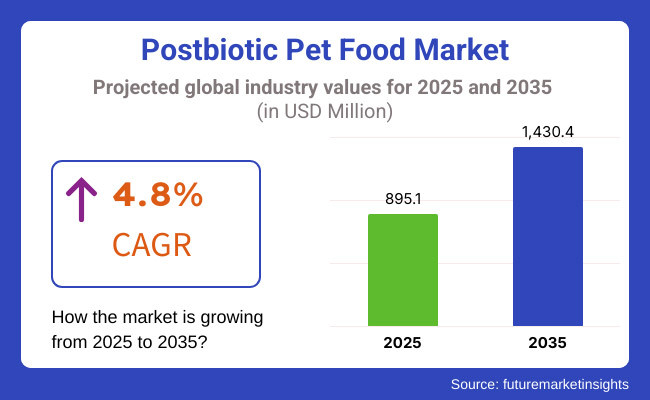

The worldwide postbiotic pet food market is anticipated to increase from USD 895.1 million in 2025 to USD 1,430.4 million by 2035, thus demonstrating a compound annual growth rate (CAGR) of 4.8% through the period. The drivers of this growth are the growing awareness of pet gut health, the increase in pet as a human being, and the introduction of more functional pet nutrition options.

Postbiotic-infused pet foods have become more and more popular since the love of pets for their owners scientifically proposed no other solutions for gut, immune, and metabolic issues than postbiotics. Postbiotics are probiotic-free and give full guarantees because they do not alter the metabolic processes of the bacteria involved in energy utilization and also they can easily be added to heat-killed formulations, thus achieving stomach acid protection and superior bioavailability.

Continuous R&D by industry leaders including Cargill, ADM, and DSM-Firmenich in carrying out clinical trials, coming up with heat-resistant formulations, and synergizing with functional ingredients are their strategies to win the race.

Innovations in product safety regulations are also reshaping the market. While North America is still the biggest consumer, Europe is developing as the main regulatory-driven premiumization hub, with Germany, the UK, and France embracing functional pets more and more. The Asia-Pacific region on its part is punctuated with rapid growth, as urban pet adoption and rising disposable incomes in China, Japan, and South Korea spur its trajectory.

Innovative activities in the industry can be seen as a surge of product launches such as the postbiotic-infused dry kibble, breed-specific, and microbiome-focused treats. Metabolism-reducing ADM's BPL1™ and immunity-bolstering Cargill's truMune® are the superior examples of formulations reversely directed microbionics.

Besides focusing on direct-to-consumer sales, the companies are setting up a framework with veterinary partnerships and are achieving the substitutes for old pets by creating special formulations in order to keep up with the long-range demand.

The soaring growth notwithstanding, there are challenges like a lack of awareness among consumers in emerging regions and opposition from price in mass-market segments which could be confronting. However, continuous progress in ingredients stability, personalized pet nutrition trends, and the growth of e-commerce are the factors that are likely to push the market forward for the next decade.

Explore FMI!

Book a free demo

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global industry. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 4.5% (2024 to 2034) |

| H2 2024 | 5% (2024 to 2034) |

| H1 2025 | 4.7% (2025 to 2035) |

| H2 2025 | 5.1% (2025 to 2035) |

The global industry's predicted compound annual growth rate (CAGR) over a semi-annual period from 2025 to 2035 is shown in the above table. The business is anticipated to grow at a CAGR of 4.5% in the first half (H1) of 2024 and then slightly faster at 5% in the second half (H2) of the same year.

The CAGR is anticipated to decrease somewhat to 4.7% in the first half of 2025 and continues to grow at 5.1% in the second half. The industry saw a decline of 28 basis points in the first half (H1 2025) and an increase of 40 basis points in the second half (H2 2025).

Microbiome-Specific Pet Nutrition

The growing preference of pet owners for the gut health solutions that are specific to each pet's microbiome composition is leading to a rapid increase in the demand for targeted postbiotic formulations. The availability of breed-specific, size-specific, and age-specific postbiotic products that address the distinct digestive needs of dogs and cats has been allowed by the microbial testing kits.

More and more brands offer such testing accessories that allow pet owners to have the possibility of breed/size/age-specific postbiotics that are addressing specific digestive issues. The recalibration of the baseline is the driving force behind the establishment of general research into the strain of the effect, with most of the producers concentrating on postbiotics that facilitate the uptake of nutrients, the reaction of the immune system, and the quality of the stool.

Some companies are investigating the possibility of using species-specific postbiotic blends to make sure that the formulation is in accordance with the digestive profiles of dogs, cats, and other exotic pets. The trend is on the rise, where postbiotics are being vacated from the functional forms of treats, powders, and kibble-added with gut flora imbalance and digestive resilience, which are becoming primary drivers of decisions on premium pet food.

Regulatory Differentiation & Emerging Standards

With postbiotics increasingly becoming popular, regulatory bodies across the globe are working to establish common standards for efficacy claims and labeling transparency. Whereas the USA and Latin America have a relatively relaxed stance on postbiotic regulations, the EU and Japan are increasingly demanding stricter labeling rules including scientific proof of health benefits.

Manufacturers are responding to postbiotic affirmations by conducting clinical trials and also establishing partnerships with veterinary institutions that will bolster their claims on the functional aspects. The industry has already changed track as the emphasis has swung to the demonstration backed by evidence of the product, which has the brands investing in third-party certification plus quality assurance so as to fulfill their part.

The companies concern at least partly the development of postbiotic components that are not alive and which fit into the category of ambient-stable materials. This regulatory requirement is reshaping product innovation as companies emphasize openness, scientific integrity, and committed postbiotic pet food offerings that are compliant and thus facilitate entry into the international market.

Humanization of Pet Diets Driving Functional Additives

The humanization of pet foods that align pet owners' diets with their own has been the most significant driver for the functional postbiotic pet foods that imitate human-grade nutrition trends. Targets: Consumers, RAW (real, whole) food and postbiotics, as with immune-boosting, anti-inflammatory, and digestive-enhancing solutions that directly tackle gut integrity and support systemic health.

Fermentation, polyphenols, and immune-modulating postbiotic compounds are examples of the ingredients used by manufacturers to follow this trend in the development of pet food formulations. Holism is the main focal point that these companies are emphasizing, including the argument that postbiotics are among those elements that ensure more beautiful skin, a longer life, and better metabolism in pets.

The shift in commercial strategies is towards the use of clean-label, science-backed products, and consumers will see more postbiotic pet food brands being grain-free, allergen-free, and organic. This shift is very evident in the case of premium and veterinary-grade formulas, where functional health claims are the most important factor in deciding what to buy.

Bioactive Compound Optimization for Better Absorption

More and more pet food manufacturers realize how crucial bioavailability is, and that makes the realignment from simple postbiotic addition to more complicated bioactive compound optimization the main focus. The advancement is in the direction of targeted-release types of postbiotic formulas, the goal of which is to ensure that the desirable metabolites like short-chain fatty acids (SCFAs), postbiotic peptides, and immunomodulatory compounds hit the gut directly.

Investment routes are also flowing into the technology of microencapsulation and the development of nano-deliverers that target absorption and stability in pet digestive systems. The cooperation also covers joint ventures of postbiotics with prebiotics and probiotics which leads to the creation of next-generation pet food formulations that are symbiotics and thus are able to amplify gut health.

The initiative that the brands are taking on the personalization of nutrition is fostering the R&D activities; the focus is on the strains of postbiotic that are scientifically validated, which in turn leads to enhanced digestibility, metabolic efficiency, and improved immune modulation in pets.

Heat-Stable & Shelf-Stable Postbiotic Integration in Dry Pet Food

Unlike probiotics that are temperature-sensitive, postbiotics are more stable and resilient so they can be widely applied to consumer-marketed pet foods. The trend is mainly in the use of dried pet foods like kibbles, freeze-dried foods, and pet treats with the mass scale production of postbiotics that brands can use without impracticable efficacy.

The manufacturers are in the process of developing heat-stable probiotic strains that endure high-temperature extrusion and baking processes while assuring consistent digestive and immune support in commercial pet foods. Also, there is a notable shift towards the introduction of ambient-stable postbiotic powders and supplements that allow for longer shelf life and easier storage.

The functional feature of the product is coupled with the convenience and effectiveness which is what the pet owners are mostly looking for, and the brands are laying the foundation on cost-effective but powerful postbiotic integration strategies.

Gut-Brain Axis & Stress-Reduction Claims Gaining Traction

With the increasing concern about the pets' gut-brain connection, postbiotics provide the value as major ingredients in food formulations that aid in the prevention of stress and anxiety- with special focus on cognitive enhancement. Science has shown that pets` neurotransmitter levels are influenced by the health of their gut which for example affects their moods and how they deal with stresses.

This point is the basis for the manufacturers who are using postbiotics that induce serotonin and GABA production to create relaxed pet treats, anxiety reducing kibbles, and stress-relief supplements. The focus is on the formulation of postbiotics that will lower the stress reactions connected with inflammation, and thus improve the pets' mood and adaptability to environmental stressors.

Companies are looking to differentiation via postbiotic fortified products as natural alternatives to travel, general separations, and behavioral illnesses, especially in urban markets where pets tend to have a very high-stress environment. This trend has moved from functional foods to pet therapeutic nutrition, which is going to make an impact on future product innovation.

The postbiotic pet food market had a clear trajectory with a continuous rise from 2020 to 2024 which was due to the factors like the expanding animal gut health awareness among pet owners, the increased prevalence of the pet humanization trend, and the progress achieved in the field of functional pet nutrition science. The pandemic, in a way, was a blessing for online pet food sales as they saw a considerable rise, thus benefiting D2C (direct-to-consumer) brands and specialty functional diets.

Prominent manufacturers were involved in the innovation of R&D which included expansion, launching new heat-stable postbiotic formulations, and the fortification of partnerships with veterinarians aimed at increasing market credibility. When we look at 2025 to 2035, we see that demand is predicted to increase, and the market will be driven by the standardization of regulations, the rise of premium pet nutrition, and the expansion of the market in the newly opened areas.

The manufacturers are likely to introduce formulations specific to breeds and life stages as well as the postbiotic delivery device of snacks, and the effects of the microbiome on pet diets. The innovation of ingredient stability and absorption will be the drivers of market proliferation, and the Asia-Pacific and Latin America are reputed to be the regions with the highest innovation growth for postbiotic pet food.

The Tier 1 companies are represented by such organizations as Cargill, ADM (Archer Daniels Midland), and Diamond V, DSM-Firmenich, and Bosch Tiernahrung - the fortresses with their great research and development potential, postbiotic strains that belong to them exclusively, and the global distribution network that they keep.

Their efforts are chiefly concerned with clinical validation, heat-stable postbiotic formulas, and diets that are premium and endorsed by veterinarians which allow them to drive science and reasoning for regulation. Furthermore, they also promote their businesses through strategic acquisitions, alliances with universities, and berkscale monetization in regions like North America, Europe, and the Asia-Pacific area.

The Tier 2 players are the companies that are identified with this tag such as TropiDog, Bewital Petfood, Vet Expert, and Animonda, of course, that have a regional market focus. They are mainly oriented on the European, Latin American, and Asian pet food sectors.

These are the manufacturers that push for low prices, develop local recipes, and practice tailored distribution channels while focusing on solutions like grain-free, hypoallergenic, and high-protein postbiotic pet foods. They mostly team up with local veterinarians and pet specialty retailers to reach more customers.

Tier 3 Players-Such as Fera Pet Organics, Pet Releaf, and Feelwells- are those that promote sales through their website (D2C), functional pet treats, and their brands carried off by organic postbiotic formulations. These companies, along with their web platforms, are a limiting factor for some ingredient-based formulations, and even offer subscription models of pet nutrition that are user-based. Their quick adaptation to changing customer needs is what has driven them to specialty and premium pet food business areas.

The following table shows the estimated growth rates of the top three countries. USA, Poland, and Germany are set to exhibit high consumption, with CAGRs of 3.8%, 5.1%, and 2.7% respectively, through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| United States | 3.8% |

| Poland | 5.1% |

| Germany | 2.7% |

A post biotic USA pet food market is gaining a bigger share of veterinary-endorsed and prescription-based formulations. The growth of this trend is led by the manufacturers Cargill, ADM, and Diamond V, among others. Pet owners are acquiring health concepts related to intestinal and immune health, so brands are increasingly establishing partnerships with veterinary clinics and pet hospitals for the development of clinical-grade post biotic pet foods.

Prescription pet diets with added postbiotics are seen as alternatives to the use of antibiotics and probiotics in the case of gastrointestinal disorders, immune modulation, and chronic inflammation. The companies are investing in the development of formulations based on the scientific research, which promote gut health of some breeds and age groups.

Moreover, by promoting D2C veterinary sales channels and pet insurance partnerships, post biotic pet foods containing functional ingredients are being made accessible to a larger audience, leading to sustained the long-term demand predominantly among premium pet owners.

The postbiotic pet food sector in Poland is being driven by the increasing popularity of breed-specific and life-stage formulations, as companies like TropiDog, Dolina Noteci, and Vet Expert are the ones to implement tailored gut health solutions. Broader digestive and metabolic needs that come with different breeds and their owners' awareness about them have encouraged the manufacturers to prepare tailored postbiotic compositions for large, medium, and small breed dogs and cats.

The absence of puppy- and senior-specific postbiotic pet foods is not a question anymore, as the market for such products has been heavily influenced by the current tendency among pet owners to be more preventive. Polish products have also been working on adding functional postbiotics into grain-free and high-protein pet diets, in order to meet breed-related sensitivities and age-related nutritional needs. This emphasis on breed and life-stage specific formulations is likely to make Poland the country's key innovator in the European postbiotic pet food sector.

There is a noticeable rise in the sales of functional postbiotic treats and supplements in Germany's pet food sector, as manufacturers including Bosch Tiernahrung, Bewital Petfood, and Animonda are putting their emphasis on snackable gut health solutions.

With Germans having a preference for the preventive approach to pet healthcare, they are shifting emphatically towards postbiotic-infused soft chews, dental treats, and powdered supplements that enhance digestive function and the immune response. The leading manufacturers are adding postbiotics to freeze-dried and air-dried snack formulations, ensuring high bioavailability and gut health support.

Also, single-ingredient and limited-ingredient postbiotic treats are becoming popular as they help pets with allergies and sensitivities. The convenience factor in the presentation of functional postbiotics in products for pets is expected to be the driver for the further growth of the premium pet food segment in Germany, and thus, the country will keep its position as a trendy European market in the context of innovative pet nutrition.

| Segment | Value Share (2025) |

|---|---|

| Dog (Pet Type) | 45% |

The postbiotic pet food market is mainly occupied by dogs. This is due to the fact that dogs are more likely to suffer from digestive sensitivities, gut health disorders, and immune-related issues compared to other pets. The trend of using functional foods that effectively prevent bloating, diarrhea, and food sensitivities is also rising among dog owners.

Based on these two facts, it is not surprising that other dog foods infused with postbiotics are the most sought after. Manufacturers including Cargill, ADM, and Diamond V now offer this category of dog food by creating specific postbiotics for different breeds, life stages, and health conditions.

On the other hand, dry kibble and prescription-based veterinary diets with postbiotics are particularly favored by pet parents who are looking for solutions to intestinal health issues. Moreover, the proactive pet owner trend and the boom in humanized pet nutrition are other factors which have also accelerated the segment's growth. The United States and European countries are the most prominent markets, observing a sudden surge in the sale of premium and therapeutic forms of postbiotic dog food.

| Segment | Value Share (2025) |

|---|---|

| Dry Food (Form) | 55% |

Dry pet food remains the first choice for distributing postbiotics since it meets the demands of shelf stability and functional integrity while being cost-effective. Unlike probiotics, postbiotics do not necessitate refrigeration which makes them perfect for dry extruded kibble, freeze-dried meals, and dehydrated formulas.

Prestigious brands such as Bosch Tiernahrung, TropiDog, and Vet Expert are introducing the conception of high-protein, grain-free, and specialized dry food formulas made of postbiotics as a way to improving gut health, immune function, and nutrient absorption.

The easy feeding process, storage convenience, and affordability are the key factors for pet owners to opt for dry food, thus, this style represents the most frequently chosen one in both premium pimento and entire mass market pet nutrition. Due to the interest in functional and therapeutic diets, postbiotics-enriched crunchy food continues to experience steady growth and diversification in products.

Intense competition and the right manufacturers' tools lead to the boom of the key postbiotic pet food market. The development has been heavily influenced by scientific research, premium formulations, and targeted marketing strategies to expand the markets reach. The major players in the market include Cargill, ADM, Diamond V, DSM-Firmenich, and Bosch Tiernahrung, who are all using clinical studies, regulatory approvals, and functional ingredient partnerships to gain market credibility.

To counter the changes in the consumer reference, brands are going for the specialized breeds, lifestyle, and specific targeted disease postbiotic diets. Currently, dry food is the most sought-after category, and as a result, brands are forthcoming with the more stable postbiotic formulations. ADM was the first not not-on no one else to product innovation, by introducing BPL1™ - a postbiotic strain primarily directed at metabolic health -and Cargill TruMune®, which is primarily targeted at immune support.

In addition, they are also focusing on D2C (Direct-to-Consumer) sales expansion, co-operating with veterinarians, and launching premium functional treats which will make sure that they create wider distribution channels and keep the consumer interest sustained.

Leading players include Cargill, ADM, Diamond V, DSM-Firmenich, and Bosch Tiernahrung, known for their scientific research, premium formulations, and extensive distribution networks.

The market is expected to grow from USD 895.1 million in 2025 to USD 1,430.4 million by 2035, reflecting a CAGR of 4.8% over the forecast period.

North America leads in market share, while Asia-Pacific and Europe are expected to witness higher growth rates, driven by rising pet adoption, increased spending on premium pet nutrition, and regulatory developments supporting functional pet foods.

Dogs, Cats, Other Pets

Dry Food, Wet Food, Treats & Supplements

Pet Specialty Stores, Online Retail, Veterinary Clinics, Supermarkets/Hypermarkets

Industry analysis has been carried out in key countries of North America, Latin America, Europe, Middle East and Africa, East Asia, South Asia, and Oceania

Liqueurs Market Analysis by Type, Packaging, Distribution Channel, and Region - Growth, Trends, and Forecast from 2025 to 2035

Yeastless Dough Market Growth - Innovations & Consumer Preferences 2025 to 2035

Japan Dietary Supplements Market, By Ingredients, Form, Application, and Region through 2035

Date Syrup Market Growth – Natural Sweetener Trends & Industry Demand 2025 to 2035

Food Grade Lubricant Market Analysis by Base Oil Type, Product Type and Application Through 2035

Yeast Extract Market Analysis by Type, Grade, Form, and End Use

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.