The boosting requirement for precise and effective pumping solutions in the range of applications across a variety of end-use factories, including, but not limited to, oil & gas, chemical processing industry, water treatment, food & beverage, pharmaceuticals, and mining are measured to be access the demand for mining pumps in the market.

Positive displacement pumps can maintain a constant flow rate regardless of the pressure, making them ideal for pumping viscous liquids, slurries and delicate materials. These are why these pumps are a preferred choice for industrial processing plants, municipal water systems and agricultural irrigation systems.

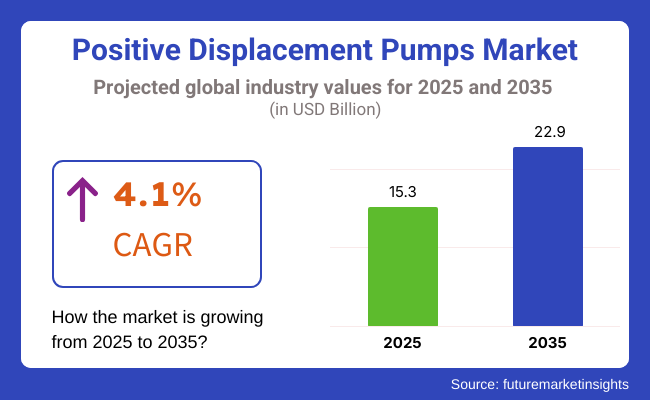

Based on revenue, the market is estimated at approximately USD 15.3 Billion in 2025 and is projected to record an income of almost USD 22.9 Billion by 2035. This suggests a CAGR of 4.1% growth due to increasing industrialization, infrastructure development, and growing demand for reducing the wastage and managing the water across urban and rural areas.

Advances in pump technology itself, including high-tech digital-monitored pumps, eco-friendly motors and smart-monitoring solutions, are also helping drive adoption of positive displacement pumps across industries. The pump manufacturing manufacturers are also targeting recyclable usage along with sustainable practices. Government initiatives for upgrading the water infrastructure and across the industry for energy consumption reduction benefits the market

Explore FMI!

Book a free demo

Positive displacement pumps in North America held a large market share owing to well-developed industrial sector and oil & gas infrastructure as well as water treatment plants in North America. The progressive cavity pumps market in North America is segmented into the United States and Canada, where the United States and Canada are the top consumers of peristaltic pumps and rotary lobe pumps for chemical processing plants, refineries, and food production plants.

The growing concerns over the emission control and safety of fluid handling across the industry along with stringent government regulations have encouraged the industries to adopt high-performance positive displacement pumps as per the latest standards. Moreover, the increasing investment in municipal water infrastructure, underpinned by federal funding programs, is fueling the demand for dependable and low-maintenance pumping solutions.

The aforementioned factors are favoring North America for the development of smart pumps integrated with IoT based monitoring systems as North America focuses greatly on technological innovation. These systems enable operators to monitor flow rates, pressure levels, and pump conditions in real time. As a result, downtime is minimized and overall operational costs are lowered. Consequently, the region is projected to continue holding its prominence as significant revenue contributor to the global positive displacement pumps market.

Europe is also a key market for positive displacement pumps, underpinned by a strong industrial base and strict environmental regulations. Regions of France, Germany and Italy are responsible for key manufacturers of progressive cavity pumps, diaphragm pumps and gear pumps that service pharmaceuticals, food & beverage and chemicals industry.

Accelerating the Adoption of Energy-efficient and Eco-Friendly Pumps: The European Union has increased its focus on sustainable industrial practices, which has consequently accelerated the adoption of energy-efficient and eco-friendly pumps. EU directives on wastewater treatment, industrial emissions and energy efficiency have been a major exhortation for companies to upgrade their fluid handling systems. This has led to rising need for positive displacement pumps that are known for their accuracy, low energy consumption and long operational life.

Moreover, Europe’s leading role in the automotive and aerospace industries necessitates specialized pump solutions capable of managing complex fluids while ensuring stable performance under differing pressure conditions. This has opened up an ever-increasing market for bespoke positive displacement pumps, particularly ones fabricated from extreme materials that will tolerate harsh environments.

Among regions, the market in Asia-Pacific is expected to be the fastest growing in terms of demand for positive displacement pumps in the next few years. The demand for advanced fluid handling solutions is driven by rapid urbanization, industrialization, and infrastructure development in countries such as China, India, Japan, and South Korea.

Being one of the world’s largest manufacturing markets, positive displacement rotary and reciprocating pumps serve critical functions in chemical processing, food production, water treatment and more in China. The adoption of these pumps is also being driven by the Chinese government’s emphasis on upgrading industrial facilities and improving water resource management.

Growth of the pharmaceutical and food processing seamless industries in India are propelling robust demand for hygienic and reliable positive displacement pumps. Market growth is also being spurred by the Indian government’s clean drinking water promotion and wastewater treatment capacity expansion initiatives.

Challenge

Operational Efficiency in Rising Energy Costs

Some of the challenges faced by Positive Displacement Pumps Market are to achieve operational efficiency together with increasing energy costs. Traditional pump designs often stand as energy inefficient and what follows are increased operational expenses.

Also, heightened regulatory pressures around energy consumption and emissions require more efficient pump technologies. Manufacturers, to stay abreast in the competition, need to design energy-efficient pump systems that meet international efficiency standards, while delivering steady performance under the stress of industrial applications. Trendy implementations of smart monitoring and predictive maintenance will also help reduce energy consumption and downtime, giving businesses the ability to save money while extending the life of their equipment.

Opportunity

Increasing Smart Pumping Solutions and Industrial Automation Demand

The growing penetration of intelligent pumping solutions and automation opens a massive opportunity for the Positive Displacement Pumps Market. Such sectors are now leveraging smart pump technology involving IoT-enabled sensors, real-time monitoring strategies or AI-DP predictive maintenance to provide greater efficiency and reliability. Industry or digital transformation in manufacturing has created a need for intelligent pumps that enhances fluid handling and reduces maintenance.

Moreover, hougting water treatment industry and the demand for accurate fluid control in pharmaceuticals and food processing is also driving the market. The ability of companies to leverage automation, digital connectivity and remote monitoring capabilities will be a competitive differentiator as the pump market continues to advance technologically.

Between 2020 and 2024, the Positive Displacement Pumps Market will grow significantly, mainly driven by the growth of industrial sectors and a rising need for energy-efficient pumping solutions. Sectors dedicated to fluid dynamics optimization, along with minimizing mechanical failures, embraced novel pump designs coupled with these superior materials and sealing technologies.

However, production costs and delivery timelines were affected by supply chain disruptions and raw material price fluctuations. In response, firms began diversifying their supply chains, improving production efficiency, and using automation to manage the operational difficulties of sectors.

In upcoming years 2025 to 2035, market for pump combining innovations in pump design, digital integration, and sustainability that will reduce costs, offer lighter, smaller systems, and increase competitiveness in compliance. Predictive analytics driven by machine learning if integrated into the factory processes will facilitate real-time performance monitoring and error prevention in order to minimize unplanned downtime or sustainment costs.

Also, shift to sustainable pump designs with recycled and energy from-efficient materials would meet the global sustainability goals. Oil & gas, pharmaceuticals and food processing to remain key underpinning industries for high-pressure positive displacement pump market growth. As the next-generation energy-efficient pump solutions will have a significant impact, companies integrating automation and sustainability will shape the evolution of the pump market in the next 10 years.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Tightening regulations on energy efficiency of industrial pumps |

| Technological Advancements | Advancements in material resilience and pump productivity |

| Industry Adoption | Oil & Gas, Water Treatment, and Chemical Expansion |

| Supply Chain and Sourcing | Challenges in raw material availability and cost fluctuations |

| Market Competition | Established players investing in R&D for performance improvement |

| Market Growth Drivers | Increasing demand for effective fluid control in industrial applications |

| Sustainability and Circular Economy | Initial implementation of high-efficiency pumps |

| Integration of AI and IoT | Limited adoption of digital monitoring in pump systems |

| Advancements in Pump Materials | Standard metal and polymer components in pump construction |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Additional stringent environmental policies and requirements for sustainable pump production |

| Technological Advancements | These include AI powered predictive maintenance, smart sensors, IoT enabled pump systems. |

| Industry Adoption | Fortifying into precise applications across biotech, pharma, and food processing. |

| Supply Chain and Sourcing | Localization of supply chains and increased investment in sustainable materials. |

| Market Competition | Emergence of technology-driven start-ups offering smart pumping solutions and energy-efficient models. |

| Market Growth Drivers | More adoption of pumps based on automation, digitalization, and sustainability. |

| Sustainability and Circular Economy | Switching to carbon-neutral production, recyclable pump materials and closed-loop systems. |

| Integration of AI and IoT | Widespread use of AI-powered performance tracking, automation, and smart pump diagnostics. |

| Advancements in Pump Materials | Development of high-performance alloys, bio-based materials, and self-healing coatings to enhance pump longevity. |

The United States positive displacement pumps market has been steadily rising with increasing needs in oil and gas, water treatment, and food processing industries. The oil and gas sector in Texas and along the Gulf Coast heavily relies on positive displacement pumps to maneuver crude oil, inject chemicals, and carry out hydraulic fracturing.

Water and wastewater treatment plants across the country have also augmented demand, with EPA regulations necessitating efficient fluid handling in municipal and industrial wastewater facilities. In addition, food and drink companies have been adopting hygienic positive displacement pumps for shifting dairy, beverages, and processed eats.

Advancements in networked pump surveillance and a growing requirement for highly-productive pumps suggest the United States positive displacement pumps market shall continue expanding steadily going forward. Pump engineers develop increasingly smart pumps with integrated sensors and web-connectivity to remotely track functionality and foresee maintenance needs.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.4% |

The United Kingdom's positive displacement pumps industry has greatly expanded due to surging needs in water therapy, pharmaceuticals, and sustainable energy sectors. The UK's strict environmental policies on wastewater administration are driving financial investment in state-of-the-art positive displacement pumps for sludge handling and chemical dosing.

The drug industry, a major sector in Britain, is progressively utilizing positive displacement pumps for sterile liquid transfer and precise medication formulation processes. Furthermore, the nation's developing emphasis on hydrogen and biofuel creation is generating fresh chances for positive displacement pumps in energy applications. The stringent requirements for error-free operations have made positive displacement pumps very popular.

With ongoing industrial automation and increasing demand for precision pumping solutions that can handle corrosive or abrasive fluids at variable speeds, the UK positive displacement pump market is poised for moderate growth and potential expansion into international markets. The market is driven by the need for environment-friendly and energy-efficient pumping technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.9% |

The European Union's growing dependence on positive displacement pumps began decades ago as its chemical processing, pharmaceutical and wastewater treatment sectors expanded greatly. Chief among the consumers were Germany, France and Italy, where industries relied extensively on positive displacement pumps for fluid transport needs. Strict EU directives on wastewater, like the urban waste water treatment directive, compelled facilities to modernize pumping systems with advanced models that could precisely dose chemicals and dewater sludge.

Separately, the thriving pharmaceutical and food industries continually demanded sanitary and accurate positive displacement pumps. Experts anticipate the long-term escalation of the EU positive displacement pump market as intelligent manufacturing and energy-efficient pumps are progressively adopted, allowing facilities to satisfy regulations and production demands through technology in a sustainable manner.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.2% |

The Japanese positive displacement pumps market has flourished significantly due to immense demand from precision manufacturing industries and burgeoning investments in wastewater treatment plants coupled with expansion of the chemical and pharmaceutical sectors. Japan’s technologically superior industrial framework, with enterprises uniquely focused on automated and high-precision fluid management approaches, has considerably contributed to market growth.

The country’s concentrated efforts to ensure sustainable water administration has augmented the implementation of positive displacement pumps in desalination facilities and wastewater handling centres. In addition, Japan’s prospering chemical and semiconductor ventures have increasingly opted for positive displacement pumps for exact chemical dispensing and transferring of ultra-pure liquids.

With proliferating use of intelligent pumps and amplified requirements for energy-efficient choices, the Japanese positive displacement pumps industry is slated to witness moderate but steady development in the coming years.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.0% |

The South Korean positive displacement pumps industry has flourished significantly owing to the escalating industrialization levels, proliferating water treatment ventures, and amplified investments in semiconductor and electronics manufacturing industries. South Korea’s robust involvement in cutting-edge sectors, distinctly microchip fabrication and pharmaceutical sectors, has stimulated the requirement for high-precision positive displacement pumps.

Moreover, the administration's push for greener energy and more sustainable industrialization is likewise energizing expenditures in positive displacement pumps for biofuel synthesis, hydrogen handling, and wastewater remediation ventures. In addition, the nation's speedy urbanization and developing infrastructure undertakings are amplifying demand for positive displacement pumps in construction and water provision projects.

Given the carrying on investments in leading-edge pumping technologies, the South Korean positive displacement pumps trade is anticipated to develop in a stable manner going forward.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.1% |

The positive displacement pumps market type consists of reciprocating pump and rotary pump, and the reciprocating pump segment is anticipated to hold a significant share of the market as more industries are relying on efficient and accurate pumping solutions for improved fluid movement and enhanced operational efficiency along with high viscosity material handling.

Specialty pump types are key solutions to keeping flow rates consistent while allowing for better handling of pressure, consequently minimizing energy consumption, and become essential in oil & gas, chemicals, water treatment, and power generation related industries.

Reciprocating pumps are generally considered as one of the most used positive displacement pump, also provide some advantages including high-pressure capability, high accuracy, and volume accuracy. Centrifugal pumps may struggle with maintaining pressure over time or under varying fluid viscosity conditions, while reciprocating pumps provide steady, controlled delivery for constant output across fluid types.

Increasing adoption of reciprocating pump systems in high-pressure applications is a key trend driving adoption, with many industries relying on them to achieve precision dosing, hydraulic power transmission, and fluid metering capabilities, all of which necessitate the use of advanced reciprocating pump solutions that can meet the reliability and efficiency challenges posed by complex fluid handling applications.

According to Research the reciprocating pumps allow for better process control, prevention of fluid loss and waste, thus further contributing to effective cost management and improvement in operation efficiency.

In addition, the growing deployment of reciprocating pumps in the oil & gas applications with high-pressure injection pumps for well stimulation, crude oil transfer, and chemical dosing has bolstered industry growth, promoting higher utilization in upstream & midstream oil extraction.

The use of reciprocating pumps in chemical processing with accurate metering solutions for transferring hazardous fluids, polymer injection, pH control, and others has also propelled adoption, assuring better safety compliance with the trends for these processes.

New, next-gen reciprocating pumps leveraging advanced seal designs, corrosion-resistant materials, and AI and analytics-driven predictive maintenance have streamlined the market making them ubiquitous across water treatment, pharmaceuticals, and food processing industries.

The increasing usage of reciprocating pumps in high-pressure steam and power operations, including feedwater injection, boiler feed control, and steam generating systems, has further contributed towards market growth, resulting in enhanced energy efficiency and less downtime.

Reciprocating pumps have advantages include precision, high-pressure capability, and versatility however they are faced with pulsation effects, higher maintenance costs, and wear-related degradation of components. However, challenges that will affect market growth include the use of adverse environmental conditions in the design process, short life span, and growing number of regional participants· Nonetheless, advancements in techniques such as AI-enabled pump diagnostics, real-time operational efficiency metrics, and intelligent valve remote control systems are taking operational efficiency to another level, lowering maintenance downtime, and boosting long-term reliability, all of which will maintain the industry-wide growth of reciprocating pumps.

Rotary pumps have seen substantial market penetration, especially in chemical processing, food & beverage, and pharmaceutical applications, as industries increasingly leverage rotary pump solutions for handling high-viscosity fluids, delicate emulsions, and shear-sensitive materials. Reciprocating pumps work on a cyclical process, where they have to start from the beginning every time, while rotary pumps work with continuous flow, allowing them to transfer the fluid with a lower pulsation for a more consistent process.

Rotary pumps offer high efficiency to transfer viscous materials including crude oil, adhesives, and resins, making rotary displacement pumps a popular choice in bulk fluid transfer applications as industries are leaning towards low energy consumption and smooth fluid flow. According to studies, rotary pumps consume up to 25% less energy than their reciprocating counter parts, thus providing improved cost and environmental performance.

For instance, the introduction of sanitary grade rotary pumps for the dairy, sauces, and liquid to semi-solid chocolate applications has fuelled market demand, ensuring that the market will continue to offer various options capable of addressing hygiene-sensitive production environment end users.

The implementation of rotary pumps in pharmaceuticals and biotechnology for the gentle handling of biologics, vaccines, and gel-based compounds has also fuelled their adoption as it results in improved product integrity and sterility compliance.

The development of magnetically-driven rotary pumps, featuring seal less designs that minimize leakage risks and contamination, has optimized market growth, ensuring greater adoption in hazardous chemical processing and high-purity applications.

The coupled rotary pumps in wastewater treatment (self-priming, sludge-handling solutions, with improved solids tolerance) have further supported the market landscape by delivering better water reclamation and environmental protection initiatives.

Rotary pumps have a smooth fluid transfer, and are more energy-efficient, and run with low pulsation, but they have challenges similar to wear-related efficiency loss, complex sealing requirements, and the fact that they are not compatible with any abrasive fluids or gas-laden fluids. But new developments on the horizon, including AI-assisted flow optimization, advances in composite rotor materials and automated self-cleaning pump technology, are leading to longer performance lifetimes, reduced maintenance predictability and better adaptability between industries, driving forward an ever-increasing market for rotary positive displacement pumps.

The oil & gas and chemicals segments act as two significant drivers of market; as industries progressively utilize positive displacement pumps to generate efficiency in fluid transport, improve safety compliance, and optimize stream stability.

One of the largest markets for positive displacement pumps, has been oil & gas applications where energy producers, pipe-line operators, and refinery facilities are all incorporating high-performance pumping systems to transfer crude oils, gas condensates, and chemical additives. Positive displacement pumps do not suffer from the limitations that typical pumping technologies possess, these advantages include metering precision, effective suction, and the ability to pump high viscosity hydrocarbons, making them ideal even in challenging environments.

Growing demand for positive displacement pumps in EOR processes, with high-pressure injection systems for steam, polymer and chemical flooding, has driven adoption of high-performance reciprocating pumps as oil producers increasingly look to maximise reservoir output and prolong well productivity.

The growing use of rotary pumps in offshore drilling platforms, equipped with low-pulsation crude transfer and subsea fluid injection, are expected to bolster market growth, leading to increased uptake in deep water exploration and production.

Due to their benefits like optimal handling in high-pressure applications, accurate injection of chemicals, and multi-phase fluid compatibility, positive displacement pumps are widely used in the oil & gas industry, yet the oil & gas sector also faces problems like wear-related efficiency loss, exposure to rough environmental conditions, and also high maintenance costs. Still, novel technologies including AI-based predictive maintenance, automated remote monitoring, and corrosion-resistant pump materials are showing promise for improved reliability, lower operational costs, and long system life. Thus, market growth should sustain in oil & gas applications.

The chemicals industry has a well-developed data model and is thus one of the most widely adopted industry verticals for positive displacement pumps, employed primarily in fine chemical synthesis, polymer processing, and the transfer of bulk chemicals, as manufacturers are increasingly using positive displacement pumps to ensure accurate dosing, safe hazardous material handling, and production efficiency. Positive displacement technology offered precise flow meter control, unlike conventional pumps, that ensures consistent chemical formulation, which results in reduced process variability.

In the chemical segment, the adoption of special-purpose reciprocating and rotary pumps for handling aggressive acids, solvents, and alkalis has been galvanized by the demand for high-precision chemical dosing & corrosion-resistant pumps, as chemical manufacturers focus on production safety and process dependability.

Recent years have witnessed the intensifying dispense of positive displacement pumps in polymer processing specifically pertaining to high-viscosity material handling and precision metering of monomers, which have aided in the robust growth of this market.

Despite its benefits such as precision, chemical compatibility, and process safety, positive displacement pumps in the chemicals sector face challenges such as complexities owing to regulatory compliances, compatibility inadequacies with abrasive materials and volatility in raw materials costs. Nevertheless, new technologies in AI-driven automation of chemical processes, new generation polymer coatings for pump internals and hybrid pump technologies are enhancing safety, performance and market acceptance and promising further growth for positive displacement pumps in chemical applications.

The positive displacement (PD) pumps market is on its way toward growth, especially considering the high-efficiency and low-maintenance nature of these pumps making them a desirable choice for fluid handling in various industries like oil & gas, water treatment, pharmaceuticals, food & beverages, and chemicals. Companies are emphasizing on smart pump technologies, AI-based predictive maintenance, and energy-efficient pump designs to improve operational reliability, accurate flow control, and sustainable operation.

The competitive landscape covers both global pump producers and niche industrial pump suppliers, which are all adapting to the trends in rotary, reciprocating, and peristaltic PD pump technology.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Grundfos Holding A/S | 12-17% |

| Xylem Inc. | 10-14% |

| Flowserve Corporation | 9-13% |

| SPX Flow, Inc. | 7-11% |

| IDEX Corporation | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Grundfos Holding A/S | Develops smart displacement pumps with AI-based predictive maintenance and energy-efficient flow control solutions. |

| Xylem Inc. | Specializes in industrial-grade PD pumps for wastewater treatment, chemical processing, and fluid metering applications. |

| Flowserve Corporation | Manufactures rotary and reciprocating PD pumps for high-pressure oil & gas, power generation, and water management sectors. |

| SPX Flow, Inc. | Provides positive displacement pumps for food & beverage processing, hygienic fluid handling, and pharmaceutical applications. |

| IDEX Corporation | Offers precision gear pumps, metering pumps, and chemical dosing solutions with real-time monitoring. |

Key Company Insights

Grundfos Holding A/S (12-17%)

The PD pumps market through its leading intelligent pumping systems, AI-based performance monitoring, and high-performance rotary displacement pumps.

Xylem Inc. (10-14%)

Xylem is a global manufacturer of water and wastewater management PD pumps that combine sustainable, energy-efficient fluid handling technologies.

Flowserve Corporation (9-13%)

Flowserve is another industrial-grade PD pump offering; their PD pumps are used in critical applications like oil refining and chemical processing.

SPX Flow, Inc. (7-11%)

PD pump is highly focused on hygienic needs, with designs meant for food, beverage, and pharmaceutical markets that require precise flow rates and contamination-free processes.

IDEX Corporation (5-9%)

Specialty gear and metering pump manufacturer, IDEX, integrates smart sensors for real-time diagnostics and maintenance optimization.

Other Key Players (40-50% Combined)

Several industrial equipment and fluid handling companies contribute to next-generation PD pump innovations, AI-driven efficiency optimizations, and sustainable fluid control technologies. These include:

The overall market size for Positive Displacement Pumps Market was USD 15.3 Billion in 2025.

The Positive Displacement Pumps Market expected to reach USD 22.9 Billion in 2035.

The demand for the Positive Displacement Pumps Market will be driven by the growing need for efficient fluid handling in industries such as oil and gas, water treatment, chemicals, and food & beverage. Increasing industrial automation and the demand for precise flow control will further boost market growth.

The top 5 countries which drives the development of Positive Displacement Pumps Market are USA, UK, Europe Union, Japan and South Korea.

Reciprocating and Rotary Pumps Drive Market Growth to command significant share over the assessment period.

Fluid Conveyance Systems Market Growth - Trends & Forecast 2025 to 2035

GCC Magnetic Separator Market Outlook – Growth, Trends & Forecast 2025-2035

United Kingdom Magnetic Separator Market Analysis – Size, Share & Forecast 2025-2035

Glass Door Merchandisers Market Growth - Trends & Forecast 2025 to 2035

Hydrostatic Testing Market - Trends & Forecast 2025 to 2035

Retail Printers Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.