During the forecast period between 2025 and 2035, the demand for point-of-care diagnostics, wearable health monitoring devices, and next-generation patient care solutions are likely to boost growth of portable medical devices market. The rising prevalence of chronic diseases, the aging population, and a shift toward home-based healthcare alternatives, is also fuelling the acceptance of portable devices.

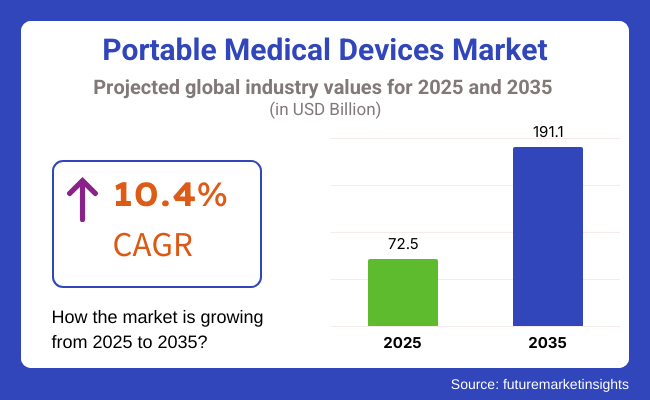

Global portable medical devices market share in 2025 will be USD 72.5 Billion, and is expected to take place USD 191.1 Billion in 2035, at a CAGR of 10.4% between 2025 and 2035.

Key market growth factors include the development of smaller and AI-enabled medical devices, increasing healthcare expenditure, and initiatives taken by the government to promote remote patient monitoring. The surge in telehealth services and digital healthcare platforms is also driving demand for portable medical diagnostic and therapeutic devices in hospitals, clinics, and home-care settings.

Furthermore, integrating of Internet of Things, cloud corporations offered health care system, and artificial intelligence-based predictive analytics is propelling the portable medical inventions industry because of instant patient monitoring and ameliorated health care outcomes.

Explore FMI!

Book a free demo

Nevertheless, North America accounts for a considerable share of portable medical devices market, due to presence of sophisticated healthcare infrastructure, increasing adoption of digital healthcare solutions, as well as a strong presence of medical device manufacturers in the region. The step-up of demand for the ever-increasing chronic disease such as diabetes and cardiovascular or heart diseases coupled with the high-level expenditure on healthcare makes the USA and Canada the top contributors.

Government funding promoted telemedicine and remote patient monitoring programs, and favourable reimbursement policies have helped as well. AI-Driven Health Monitoring System and IoT-Embedded Medical Devices in Hospitals and Home-Care Level Is Shaping the Patients Care Management.

Additionally, the USA FDA approach to accelerate mobile health and wearable medical devices approval is expected to drive ongoing innovation and growth across the region.

The Europe market is expected to hold the largest market share owing to the increasing government initiatives for digital healthcare, increasing geriatric population and expansion of telehealth services. AI-Powered Medical Technologies, Mobile Health Applications, and IoT-Enabled Patient Monitoring Devices Are Predominantly Used by Countries to Make Healthcare Ready.

Europe will continue to be a unique mechanical medical devices market opportunity drivers due to the shift to patient-centric health ecosystems and increased regulation of medical devices, resulting in manufacturers focusing on developing sophisticated and compliance-enabled procedures that are easy to use.

Rising adoption of wearable health monitoring devices such as smartwatches and fitness bands for utilization in fitness tracking, chronic disease management, and post-surgical recovery monitoring has also witnessed an increase in the region. The increase in wireless ECG monitors, portable ultrasound devices, and remote glucose monitoring devices is paving the way for real-time diagnostics and treatment.

The fastest growth in Asia-Pacific is due to the rapidly developing healthcare infrastructure, rising chronic disease burden and adoption of PPG-based wearable and remote healthcare technologies. Demand growth in countries like China, India, Japan, and South Korea (Asia-pacific) is also expected to drive the market.

The increasing disposable income, growing government investment on healthcare digitization, and increasing adoption of digital healthcare are expected to drive the market growth. The demand for inexpensive portable medical devices is rising in countries like China and India, in rural areas and semi-urban sections where there is less access to health care; this will fuel the growth of this market.

Furthermore, at a regional level, diagnostic tools powered by AI and wearable corona health monitoring devices are on the rise in the region. With the development of smart hospitals and AI-based healthcare ecosystems in Japan and South Korea, adoption of instrument able medical technologies is expected to grow 3 times.

Challenges

Opportunities

From 2020 to October 2024, the demand for miniaturised electromechanical solutions has been driven by the increase in need for remote patient monitoring, point-of-care and wearable health systems. It has prompted widespread embrace of wearable electrocardiogram monitors, pulse oximeters, wearable continuous glucose monitors, or CGMs, portable ventilators and handheld ultrasound machines all of which health care workers can use to treat and keep track of patients remotely.

Spending on miniaturized biosensors, artificial intelligence-based diagnostic tools and cloud-connected health-monitoring devices also surged, as telemedicine boomed and health care shifted from hospitals to homes, resulting in earlier disease detection and more proactive health systems.

Patients and physicians were increasingly relying on smart biosensors, Bluetooth-enabled diagnostics and AI-powered health analytics to manage chronic diseases, like diabetes, cardiovascular disorders and respiratory conditions. The market has also witnessed the growth of personalized, non-invasive and continuous health monitoring devices due to the surging geriatric population as well as rising prevalence of lifestyle diseases.

Miniaturized sensors, low-power microelectronics, and advances in wireless communication found their way into medicine in the form of “affordable” and efficient medical devices. This allows seamless communication between the wearing health monitoring devices, AI-enabled analytics and health care providers, making disease management and preventive healthcare better with wide reach in 5G as well as IoT connectivity.

Also, AI-assisted diagnostics enhanced accuracy through the automated detection of irregularities in heart rhythms, blood oxygen levels and metabolic functions. Low-cost power solutions such as energy-efficient, longer duration, re-chargeable and energy harvesting medical devices drastically improved maintenance cost and increased availability and accessibility for health care of a global population. In addition to promising innovations, the market also faced challenges such as data privacy issues, interoperability concerns, and regulatory complexities.

The rapid embrace of related clinical instruments brought along cyber threat risks that required closer alignment with HIPAA (Health Insurance Portability and Accountability Act) and GDPR (General Data Protection Regulation). Moreover, lack of adoption in lower-income areas was due to the high initial costs of large AI-enabled wearables and telehealth devices. This is adversely affecting the growth of the market segment as disrupted supply chain and shortage of components particularly semiconductor chips and sensor technology.

However, as production lines tightened and health monitors affordable to the consumer began to be developed by manufacturers, decreasing the price points of portable medical devices, this opened the door for a wider health uptake access into both developed and emerging healthcare markets.

These next-generation devices will leverage self-learning algorithms, biometric authentication, and cloud-based neural processing to provide personalized, automated in-situation treatment recommendations, tailored on an individual’s unique physiological data. Advises will usher in nano-sensor technology for next-gen meters that are ultra-tiny, skin-integrated, and even implantable, measuring blood-glucose concentration at will, monitoring hydration levels, and gauging metabolic dynamics in real-time, without an invasive procedure.

AI will modify traditional diagnostics through non-invasive techniques, such smart contact lenses, sweat-analysing patches and bioelectronics skin sensor that improve early disease detection and proactive health management. They are intelligent biosensors that also use block chain-based secure health data exchange, which means tamper-proof remote patient monitoring and data security. Whether AI-enabled predictive models revolutionise diagnostics and trigger an age of preventive, personalised medicine.

This combo with quantum computing has the potential to revolutionise real-time analyses of such tests as it can make predictions about diseases and treatment better within days by real-time patient data-taken from the genetic makeup of the individual and processed through tailor-made AI algorithms. Mobile molecular diagnostic devices will enable detection of infectious diseases, genetic disorders and early-stage cancers at the point of care, shifting health care from a reactive treatment paradigm to a preventive focus.

The emergence of 5G and edge computing will make telehealth consultations, remote surgery planning, and AI-augmented mobile imaging more accessible than ever, as distance-based health inequities no longer impede consumers, no matter where they live, from receiving state-of-the-art diagnostics.

Wearable medical devices will go beyond chronic disease management and will be a great service for mental health trackers, cognitive enhancers, stress analytics, etc. Whether through brainwave-tracking headsets, smart neural implants, or AI-advanced mood detection wearables and other tools, technology will increasingly provide real-time support for the mental wellness of individuals, as well as establishing early detection of neurological conditions and personalized recommendations for therapy.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments put approvals on fast track for AI-integrated and wireless portable medical devices to support remote patient monitoring. The security of patient data was bolstered by adherence to HIPAA and GDPR. |

| Technological Advancements | It meant loss of signal in certain countries for portable devices embedded with 5G, AI, IoT (Internet of Things) for tracking diseases and early diagnosis & treatment. With settings to detect heart loss, oxidative capacity, and hyperglycaemia, using AI-powered algorithms can improve these metrics. |

| Industry Applications | Healthcare portable medical device were large in the area of chronic disease management, telehealth, and fitness tracking. The devices drove better patient outcomes, reducing hospital visits and allowing early-stage disease intervention. |

| Adoption of Smart Equipment | The ubiquitous use of wearables like ECGs, smart glucose monitors, and Bluetooth pulse oximeters. Predictive models driven by AI helped with remote monitoring and early detection of symptoms. |

| Sustainability & Energy Efficiency | Portable devices were improved by the battery found in portable devices, which became rechargeable lithium-ion batteries, and then all components were optimized for energy savings. Corporations about the other hand targeted the waste mitigation with disposables sensors and wearables. |

| Data Analytics & Predictive Maintenance | Cloud diagnostics and predictive analytics, based on AI processing, improved patient engagement in remote care systems and early disease diagnosis. Device error detection and sensor calibration were optimized using AI-driven systems. |

| Production & Supply Chain Dynamics | The pandemic fuelled demand for portable ventilators, remote health monitors and diagnostic wearables. Supply chain bottlenecks were impacting availability of key components such as semiconductor chips and biosensors,. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Novel nano-biosensors linked to quantum-assisted diagnostic systems and non-invasive AI-driven health monitoring systems will revolutionize personalized medicine. Neuroethology powered by AI will improve mental health monitoring, cognitive testing, and brainwave assessment. |

| Technological Advancements | Through mental health analysis, cognitive boost, personal wellness optimization, and genetic risk assessment, healthcare will revolutionize. Portable diagnostics will enable early cancer detection, real-time gene editing, and AI-aided fertility tracking. |

| Industry Applications | Artificial intelligence (AI) will empower neural-wearables, hydration sensors and bioelectronics skin-patches that will allow hands-free, real-time, automated health monitoring. The use of AI to monitor sleep quality, track metabolism, and real-time drug interaction. |

| Adoption of Smart Equipment | Such energy-harvesting technologies for self-powered, biodegradable medical devices will enable sustainable healthcare solutions. The high-frequency wearable products will consume less and less power through AI-driven power optimization. |

| Sustainability & Energy Efficiency | Personalized Healthcare: Quantum-enhanced AI algorithms, edge computing-based health tracking, and AI-assisted disease forecasting. Real-time validation of AI diagnostics will ensure trustworthy autonomous health monitoring. |

| Data Analytics & Predictive Maintenance | AI-enabled supply chains, decentralised health manufacturing, and personal bio-device production will drive accessibility and affordability. Ever cheaper mass global production of specialized health devices will be catapulted by manufacturing efficiency based on AI. |

| Production & Supply Chain Dynamics | AI-optimized supply chains, decentralized health manufacturing, and personalized bio-device production will enhance accessibility and affordability. AI-driven manufacturing efficiency will accelerate affordable mass production of customized health devices. |

United States Portable Medical Devices Market is one of the emerging portable medical device market due to high demand for remote patient monitoring, increasing prevalence of chronic diseases and advancements in wearable healthcare technologies. Increasing the adoption of digital health solutions, high prevalence of healthcare infrastructure, and a growing geriatric population in the country are some of the major factors driving the growth of this market.

One of the key factors fuelling the growth is the rising prevalence of chronic diseases like diabetes, cardiovascular diseases, and respiratory issues requiring a constant check on the portable medical devices. There are more than 37 million diabetic people in the USA, which creates a demand for portable glucose monitors and insulin pumps.

Telemedicine and home-based services are also experiencing rapid adoption as healthcare providers include portable ECG monitors, pulse oximeters, and blood pressure monitors into remote patient programs. The USA Centres for Medicare & Medicaid Services (CMS) extended reimbursement policies for remote health monitoring, driving further adoption.

There is a boom in the wearable medical devices as well, brands including Apple, Fitbit, and Medtronic launched their AI-powered wearables that help to real-time tracks the health. 5G, IoT, and AI are leveraging more accurate and real-time remote diagnostics.

Portable ventilators, ultrasound devices, and defibrillators are also in demand for military and emergency medical applications, whereby it improves critical care in ambulances, field hospitals, and rural healthcare, thus driving volume growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 10.7% |

UK Home healthcare devices market Government initiative Initiatives to Maintain Homecare addressing Growth of market Benefits to Portable Medical Devices Market in UK Government initiative Government Novelties Initiatives by the UK Government Initiatives to Make Healthcare Accessible and Affordable Units aim to achieve affordability, continuity and accessibility of healthcare.

We can make use of Portable medical devices and keep a track of our health. This will increase remote monitoring, reducing hospital visits In Short NHS (National Health Service) in on the way to adopt Portable medical devices.

This is mainly due to the increasing incidence of chronic diseases such as cardiovascular diseases, hypertension, and diabetes. There are more than 4.3 million diabetic patients in the UK alone, fuelling demand for glucose monitors, insulin pumps and smart inhalers.

The expansion of telehealth services is one element driving that. The UK’s digital health strategy that includes AI-based diagnostics and wearable health surveillance is encouraging the adoption of portable electrocardiogram (ECG) devices, blood pressure monitors, and oxygen saturation monitors.

In the UK, we have seen an increase innovation in the Digital Therapeutics and Connect Devices space with match and start-ups building AI-driven smart health wearables that provide personalized health tracking.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 10.3% |

The Portable Medical Devices Market in the European Union is driven by various factors such as increasing investments in digital health, an increasing burden of chronic diseases, and quick acceptance of wearable healthcare technologies. Remote Monitoring and AI based Health Management Solutions Adoption is driven by the EU’s eHealth Action Plan and Digital Health strategy.

Europe dominates the market, with a few of the largest players being Germany, France, and Italy, where the governments have planned on investing in portable diagnostic devices, point of care diagnostic, and wearable medical sensors, which will aid in the early detection and preventive healthcare diagnosis.

And another significant factor is Europe's aging population. According to the EU, the population of people aged 65 and over is expected to grow to 150 million by 2035, resulting in further demand for home healthcare solutions, portable ECG monitors and wearable health equipment.

This has led to development of more sophisticated and user-friendly portable medical devices with higher connectivity, accuracy and safety while the new EU Medical Device Regulation (MDR) has introduced higher quality standards.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 10.4% |

Technological advancement in the healthcare industry, growing telemedicine adoption, and government-supported elderly healthcare initiatives are driving the growth of portable medical devices in Japan. More than 28% of citizens in Japan are over 65 years old, making Japan one of the most aging population of the world, this situation drives demand for portable health monitoring devices.

Japan's government has poured money into digital healthcare, encouraging the adoption of wearable ECG monitors, smart glucose monitors, and AI-powered health wearables for remote patient management.

The surge in robotics and AI contributions in healthcare is another driver that cannot be ignored, and international players such as Omron and Sony already offer smart medical wearables and home-use diagnostic devices.

The growth of Japan’s smart city projects is pushing the uptake of 5G-enabled telehealth platforms and enabling them to deliver seamless remote diagnostics and trace health statuses in real time.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 10.6% |

The key growth drivers for the Portable Medical Devices Industry in South Korea are the rising penetration of smartphone and support from the government for digital medicine and the advancements in smart healthcare. Korea is also at the forefront of medical technology innovation, with names such as LG, Samsung and Medtronic’s Korea spearheading production of AI-enabled health monitoring devices.

South Korea: The South Korean Ministry of Health and Welfare has earmarked 2.5 trillion (around 2 billion) to finance the expansion of digital healthcare programs, mainly targeting portable medical devices, wearables diagnostics, and smart hospitals systems.

Adoption of AI powered health tracking technology is driving the demand for smart ECG monitors, connected blood pressure monitors, digital stethoscopes, etc. Meanwhile, South Korea’s superfast 5G network is enabling even better real-time transmission of health data, including remote patient monitoring and emergency medical response.

Moreover, the growing geriatric population and the increasing prevalence of chronic diseases, such as hypertension and diabetes, are also driving the demand for portable monitoring solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 10.7% |

Portable medical devices have high share in the portable medical devices market owing to increasing demand for efficient, and reliable medical technologies among healthcare providers, emergency medical responder, and home care patients. These devices are at the heart of point-of-care diagnostics, home-based therapy, emergency care, and rural healthcare access, offering early disease diagnosis, better patient monitoring, and easier access to treatments.

Innovative portable ultrasound devices have emerged as a necessary tool for contemporary medicine access in hospitals, clinics, ambulatory care, and emergency medical services, which can provide non-invasive, real-time imaging. Portable ultrasound systems are lightweight, and can be operated in a wireless way and using a mobile- device, while, conventional ultrasound systems are standalone devices that facilitate physicians for immediate diagnosis at the bed for critical care, sports medicine as well as rural healthcare

Chronic diseases such as cardiovascular disorders, musculoskeletal injuries and abdominal conditions persists to drive innovation in portable ultrasound solutions. These devices enabling early detection of abnormalities, thus resulting in better patient outcomes and reduced overall healthcare costs by preventing costly, unnecessary admissions to the hospital.

Portable ultrasound imaging is also extensively used in the obstetrics and gynaecology market, wherein doctors employ small form-factor, high definition imaging ultrasound probes to monitor fatal growth, detect pregnancy-associated lesions, and assess maternal health. Some of this demand was also driven for midwifery, prenatal and neonatal intensive care unit (NICU) settings, handheld ultrasound devices can deliver imaging seconds after turning the machine on.

Portable ultrasound has quickly worked its way into the trauma assessment, cardiac monitoring, and rapid diagnostics arsenal of emergency medicine and critical care both in prehospital and unit-intentional (ICU) care settings. Emergency responders and paramedics can use wireless, AI-powered ultrasound probes in the field to measure internal bleeding, cardiac function, and pulmonary status, leading to faster clinical decision-making.

Musculoskeletal Ultrasound in sports medicine and orthopaedics also has been supported by the establishment of portable ultrasound solutions, which are developed to complement the diagnosis of soft injuries, joint diseases, and musculoskeletal disorders. Doctors and physiotherapists use live imaging to direct injections, track rehabilitation progress and evaluate the health of ligaments and tendons, enabling accelerated recovery for athletes and other active patients.

Portable ultrasound systems can penetrate these limitations by being portable and imaging in real-time, but the current commercial solutions available have limitations such as an imaging depth of penetration, user dependence, and cost of hardware during implementation in third-world regions. As of now, increasing accuracy & cost-efficiency of devices attributed to development of image miners employing AI, data-sharing capability being enabled by cloud computing & development of miniaturized transducer technologies is likely to ascertain a market extend.

Oxygen concentrators have established wide market penetration, especially in respiratory care, home-based therapy, and are being extensively used in emergency medical applications for patients suffering from chronic respiratory disorders owing to the continuous supply of oxygen it provides. Portable oxygen concentrators (POCs) don’t work like regular oxygen tanks, in that they draw in and concentrate oxygen from the air around you, and they don’t need to be refilled like traditional tanks with oxygen.

Growing incidence of respiratory diseases including chronic obstructive pulmonary disease (COPD), asthma, and interstitial lung diseases are some key factors behind the growing demand of oxygen concentrators in home care and ambulatory settings. And for patients that need to be on oxygen for the rest of their lives, portable light-weight battery-operated concentrators allow them freedom of decoration that allows them to carry on with their daily activities and not be tethered to stationary oxygen supply systems.

Home oxygen concentrators by end user segment are expected to adopt on a significantly higher growth trajectory owing to the increasing geriatric population and rising incidences of pulmonary disorders. And the global population is aging, increasing the number of patients requiring for chronic respiratory insufficiency treatment or age-related lung disease.

Bluetooth monitoring, remote adjustment of oxygen levels, AI-driven oxygen flow optimization ensuring patient safety, compliance, and convenience are some of the Smart oxygen concentrators that have emerged that greatly enhance the examination of these patients. These advances allow health care providers to rapidly and easily monitor patients’ oxygen saturation levels from the comfort of their homes, without needing to go to a hospital, and better manage the patient experience to ensure they remain safe as they recover at home.

For all of their growing use, oxygen concentrators have challenges battery life, noise, cost for impoverished regions that restrict their use. However, product enhancements such as ultra-silent compressor technology and rechargeable power systems, and mobile application linked systems offer improved usability, efficiency, and affordability of devices, and keep the tree of portable oxygen concentrator market growing.

Cardiology and respiratory applications are the largest segments in the portable medical devices market as healthcare systems lean towards early detection, remote patient monitoring, and even mobile healthcare solutions which lead to better management of chronic disease.

Portable medical devices are primarily being applied to the field of cardiology, where cardiovascular diseases (CVDs) are the foremost cause of death worldwide. Summary: The most published non-invasive remote monitoring techniques include portable electrocardiography (ECG) devices, Holter and event monitoring systems for remote cardiac monitoring, identification of arrhythmias at initial presentation, and the determination of left ventricular ejection fraction after major heart procedures.

Wearable ECG monitors, such as smartwatches with the ability to perform electrocardiography, have transformed the way in which patients can monitor their own heart health, as these devices allow the patient to detect early signs of abnormal heart rhythms (arrhythmia), track fluctuations in heart rate variability, and send and receive real time single-lead ECG information to their physician. These devices assist the knitting of: Prevent strokes, Detect atrial fibrillation (AFib) and Enhance heart failure management

Therefore, the amalgamation of AI with wearable ECG systems leads to enhanced early diagnosis accuracy, along with automatic rhythm classification and predictive analytics for heart/ arrhythmic risk profiling. AI-based ECG readers could help remote continuous and real-time heart rate monitoring in minimizing heart attack hospitalizations while reaping the benefits of long-term monitoring in CVD management.

At ambulatory blood pressure monitors and wireless Holter monitors are being more used in monitoring of hypertension, cardiac surgery patients and cardiac arrhythmias detection, becoming possible to monitor the heart 24 hours a day without an important discomfort for the patient. These affordable, small, easy-to-use products can help to screen for silent heart diseases and optimize treatment regimens in at-risk patients.

However, portable ECG devices and heart monitors also present challenges in that they are crucial to cardiac care, but they face issues with data privacy concerns, difficulty with regulatory approval processes, and variability in device accuracy among various patient populations. However, new technology cloud-based cardiac data storage, real-time physician alerts and AI-driven diagnostics can enhance engagement with patients, prediction of disease, and accessibility to portable cardiac care

The respiratory care segment is forecasted to witness strong growth, due to the rising global prevalence of respiratory diseases, including COPD, asthma, and pulmonary fibrosis. Portable devices for monitoring respiration, like spirometers, peak flow meters, and capnographs, have expedited early diagnosis of respiratory limitations, aided in self-management of patients, and enhanced emergency responses to respiratory compromise events.

For example, portable spirometers allow asthma and COPD patients to monitor lung function, adjust medication use, transmit up-to-date respiratory data to healthcare providers, and in turn optimise disease control and receive early intervention if symptoms worsen.

Undetected EtCO2 levels for early detection was also an additional factor to enhance better monitoring of patients both in the pre-hospital emergency scenario and post-operative hypoxic patients. Basic pulmonary physiology and training on capnographs and peak flow meters laid the groundwork for improved patient survival during and after emergencies. According to which all must be used manually and be non-invasive devices capable of identifying hypoxia and optimizing ventilator settings and of eliminating rhino logic failure-related complications.

Portable devices for respiratory monitoring are crucial tools to help tackle these limitations, albeit compromised by limitations in calibration accuracy, patient adherence and as well as costs of roll-out in developing areas. However, emerging technologies in the areas of on-spot breath analysis, artificial intelligence-based identification of respiratory diseases, and home-monitoring solutions aid in predicting diseases, personalizing treatment, and improving the efficiency of home care which augurs well for the growth of the market.

Portable medical devices market is majorly supported by increasing demand for in-home healthcare services, remote patient monitoring, and wearable diagnostics. Because there are companies in the United States and Europe by this time that are developing things like remote connectivity, AI-driven analytics and miniaturised match that can increase patient comfort and help track chronic health conditions in real time in order to catch disease early. Troops at the frontline supported by global leaders and specialized manufacturers are innovating ideas in telemedicine, smart biosensors, and cutting-edge technology, energy-efficient medical wearables.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Medtronic plc | 12-17% |

| GE Healthcare | 10-14% |

| Koninklijke Philips N.V. | 9-13% |

| Omron Healthcare, Inc. | 7-11% |

| Abbott Laboratories | 5-9% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Medtronic plc | Develops portable cardiac monitors, insulin pumps, and neurostimulation devices, integrating AI-based predictive analytics. |

| GE Healthcare | Specializes in portable ultrasound machines, wearable ECG monitors, and telemedicine solutions, optimizing remote patient diagnostics. |

| Koninklijke Philips N.V. | Manufactures wearable sleep apnea monitors, portable vital sign monitors, and smart biosensors, enhancing continuous health tracking. |

| Omron Healthcare, Inc. | Produces digital blood pressure monitors, wearable ECG devices, and home respiratory monitoring solutions. Focuses on AI-powered hypertension management. |

| Abbott Laboratories | Offers continuous glucose monitoring (CGM) devices and implantable biosensors, ensuring real-time diabetes management and cardiovascular monitoring. |

Key Company Insights

Medtronic plc (12-17%)

Medtronic acquiring real-time telemetry is a natural entry point due to its leadership position in portable medical devices making it an ideal smart implantable wearables provider. The firms use AI to create predictive analytics solutions for chronic disease management solutions like continuous glucose monitoring and cardiac health monitoring solutions.

GE Healthcare (10-14%)

GE Healthcare focuses on portable imaging and diagnostic devices such as handheld ultrasound and wireless ECG monitors. The firm focuses on telehealth and remote patient care, enabling faster diagnoses and in-home treatment.

Koninklijke Philips N.V. (9-13%)

Philips also makes wearables that include medical sensors to track everything, in real time, from sleep apnea to smart biosensors to remote vital signs. The company specializes in patient data management through cloud computing technology and artificial intelligence for diagnostic purposes.

Signify Health, Inc. (7-11%) Omron Healthcare, Inc. (7-11%)

Omron - A Leading Provider of Smart Health Care Solutions Omron has long been a pioneer in home-based health monitoring, offering digital blood pressure monitors, portable ECG, respiratory and a range of other health monitoring solutions. A company that specializes in hypertension and cardiovascular disease management with AI-driven health insights.

Abbott Laboratories (5-9%)

Abbott is a trailblazer in continuous glucose monitoring (CGM) and implantable biosensors that allow for real-time monitoring of diabetes and cardiovascular health. The upcoming has a consistent feature of wireless health monitoring integrating all the pieces of the digital healthcare puzzle.

Other Major Players (Total 45-55%)

Various manufacturers offer: sophisticated devices for wearable diagnostics, home healthcare technologies, and AI-driven medical and health analytics. These include:

The size of Portable Medical Devices Market was USD 72.5 Billion in 2025.

Portable Medical Devices Market to Amounts USD 191.1 Billion Toward 2035.

Increasing demand for portable medical devices due to the high prevalence of chronic diseases, growing preference for home healthcare, technological advancements related to wearables and the rising need for home-based patient monitoring solutions to enhance accessibility and efficiency in healthcare are expected to boost demand for the market.

Portable Medical Devices Market Top 5 Countries the Netherlands, Canada, India, Japan and USA.

Ultrasound & Oxygen Concentrators to Hold Major Shares & Are Driving Growth through the Assessment Period.

The Prurigo Nodularis (PN) Treatment Market is segmented by product, and end user from 2025 to 2035

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Atrophic Vaginitis Treatment Market Analysis And Forecast by Diagnosis, Treatment, Therapy Type, Distribution Channel, and Region through 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.