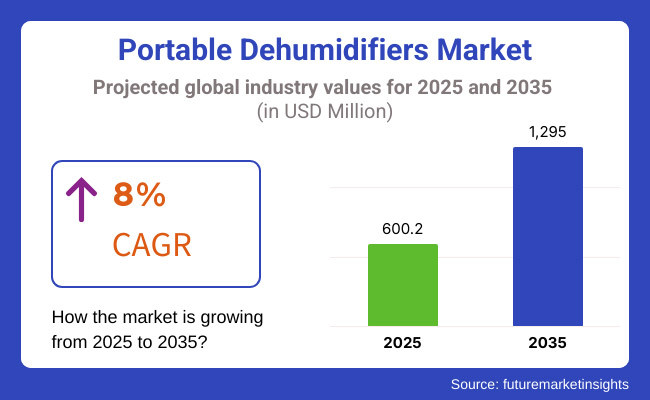

Grass Leaf specialises in string grass to provide an ideal physical and chemical environment for plant growth and turf grass for beautifying the garden area. The market is estimated to reach USD 600.2 million in 2025, accelerating at a CAGR of 8% to reach USD 1,295.0 million by 2035.

The major drivers for growth are innovations in energy-efficient dehumidifier technologies, rising urbanisation, and the disposable income of customers, allowing them to purchase air quality enhancement items.

Rapid developments in industrialisation and urbanisation in the emerging economies, coupled with the increasing number of smart homes and smart office buildings, are playing an instrumental role in making the systems favourable for manufacturing and development for long-term growth soon.

Government standards that aid indoor air quality coupled with the growing demand for smart appliances also drive market growth. Based on the technical innovations and the growing aware and well-informed customer base, the demand for portable or portable dehumidifiers will remain stable for the last decade.

Explore FMI!

Book a free demo

The Portable Dehumidifiers Market report describes an in-depth analysis of the market based on key parameters like market size, share, diversity, and growth for the period 2020 to 2024. The market was valued at approx. 435 million USD in 2020, and the demand is expected to grow to finite factors of urbanisation and climate change.

Due to an emphasis on health, comfort, and liveability during lockdown, consumers had increasingly adopted portable dehumidifiers in residential as well as commercial spaces.

The market managed to touch USD 470.6 million by 2022, which had further been propelled by developments around energy-efficient technologies along with the incorporation of smart features. Manufacturers shifted to creating small, easy-to-use models.

The market keeps growing continuously in 2023, touching USD 513 million, with more effluxes from regions with weather extremities. To 2024, and [the industry continued its growth trajectory, paving the way for a decade of growth ahead as innovations and regulatory policies supercharged demand.

| Key Drivers (2025 to 2035) | Key Restraints (2025 to 2035) |

|---|---|

| More five-hundred-year weather events affecting moisture levels. | The demand for multi-functional HVAC systems over standalone dehumidifiers. |

| Increasing use of dehumidifiers in food storage and pharmaceutical industry. | Limited longevity and high maintenance costs. |

| Increased incidence of Mold-related allergy as well as respiratory illness fuel health-conscious spending. | Adoption of cost-sensitive markets is slow due to affordability issues. |

| The global reach of e-commerce is now enabling you to buy advanced dehumidifiers. | Environmental issues: Disposable filters and non-recyclable elements. |

| Rising smart home adoption is driving demand for Internet of Things-enabled dehumidifiers. | Differences in climate and regional needs lead to variability in product efficiency. |

| Ultra-quiet dehumidifiers developed for bedroom and office spaces. | Not much innovation in battery-operated dehumidifiers for off-grid use. |

| Key Driver | Impact Level |

|---|---|

| More five-hundred-year weather events affecting moisture levels | High |

| Increasing use of dehumidifiers in food storage and pharmaceutical industry | Medium |

| Increased incidence of Mold-related allergies and respiratory illness fuelling health-conscious spending | High |

| The global reach of e-commerce is now enabling you to buy advanced dehumidifiers | Medium |

| Rising smart home adoption is driving demand for Internet of Things-enabled dehumidifiers | High |

| Ultra-quiet dehumidifiers developed for bedroom and office spaces | Medium |

| Key Restraint | Impact Level |

|---|---|

| The demand for multi-functional HVAC systems over standalone dehumidifiers | High |

| Limited longevity and high maintenance costs | Medium |

| Adoption in cost-sensitive markets is slow due to affordability issues | High |

| Environmental issues: Disposable filters and non-recyclable elements | Medium |

| Differences in climate and regional needs lead to variability in product efficiency | Medium |

| Not much innovation in battery-operated dehumidifiers for off-grid use | Low |

The progress of each of those segments. Based on type, refrigerant dehumidifiers will account for the largest share, as these dehumidifiers are most efficient in high-humidity environments, making them a popular choice in residential as well as commercial spaces.

Desiccant dehumidifiers will also be increasingly adopted in colder climates and industrial applications, where low-temperature performance is crucial. As a compact, energy-efficient solution, Peltier dehumidifiers will see more demand in small residential and office spaces.

The power footprint will still prosper across each category. Models of 100 watts or less will suit energy-conscious buyers looking for solutions to fit smaller areas.

The 101 to 300-watt range will reign for a middle-of-the-road solution with up-to-date efficiency and performance for the mid-size applications. Demand for high-powered models rated at over 300 watts may be key for sizeable industrial and commercial applications in need of rapid moisture mitigation.

In terms of capacity, small dehumidifiers are likely to continue in high demand in urban settings, apartment living quarters, and small equipment room setups, where space limitations are an ever-present challenge. Medium-capacity units will meet a wide variety of residential and light commercial needs, offering the optimum size-to-performance ratio.

Large dehumidifiers will witness high demand in warehouses, factories, and commercial buildings where extensive removal of humidity is required.

The application proliferation will occur as residential consumers increasingly invest in dehumidifiers for health and comfort. The commercial sector, like hotels, offices, and retail stores, will start to follow energy-efficient models for better indoor air quality. Demand for high-capacity units to avoid mould in industrial applications, including food processing, pharmaceuticals, and storage facilities, will drive unit growth.

Online platforms will keep booming in the sales channel. E-commerce websites and company-owned websites will serve to provide consumers with a wider range of dehumidifiers at competitive prices and create brand loyalty through direct sales.

Supermarkets and hypermarkets will continue to play an important role in meeting the needs of consumers with more popular models for sale. Speciality stores will serve customers looking for expert recommendations, while the other retail stores will contribute to the local market penetration.

Our exhaustive study of the factors expected to impact the market positively concludes that the USA portable dehumidifiers market will grow robustly from 2025 to 2035, driven by ever-rising humidity levels, climate change, and rising awareness relating to indoor air quality.

Home demand will stay high, especially in hurricane and moisture areas. Subsequently, the commercial applications will grow with offices, hotels, and healthcare outlets spending on the same. The introduction of IoT-based smart dehumidifiers would also create growth opportunities.

E-commerce will shift distribution, enabling advanced models. The innovation will thrive due to regulatory measures encouraging energy efficiency, while growth in competition between the main players will redefine product features and prices.

Extreme weather patterns will increase humidity fluctuations, especially in coastal and northern regions, and Canada's portable dehumidifiers market will follow suit. Demand will be driven by the residential sector, where homeowners will look for ways to stop mould and damp from forming in basements and crawl spaces.

Demand in sectors such as hospitality, real estate, and healthcare will boom. The energy-efficient dehumidifier segment is indeed going to register a high adoption rate across this application industry, backed by government incentives on sustainable appliances.

Market expansion of e-commerce, as online sales will continue growing. “High product costs and seasonal demand fluctuations are likely to restrain rapid growth relative to other North American markets.”

UK market growth is expected to be more or less static with erratic weather and rising concern about household dampness ensuring a vigorous market for the product. However, older residential properties with minimal ventilation will drive dehumidification system adoption, particularly in urban areas.

Commercial buildings, offices, hotels, warehouses, and others will continue to focus on humidity control to ensure comfort and storage hygiene in the workplace. Energy-saving smart dehumidifiers will be the preferred product, supported by strict energy laws.

Consumers will prefer direct buying from brands, as online retail takes the cake. But volatility in the economy, along with shifting consumer spending patterns, could hinder the market’s near-term play in this region.

The German portable dehumidifiers market will flourish due to the emphasis on energy efficiency and indoor air quality in the country. Rising penetration of smart home technology will drive the adoption rate of Internet of Things (IoT)-enabled dehumidifiers, especially in urban households.

This subsequently will create huge demand for industrial dehumidifying solutions, such as automotive and pharmaceutical industries, to improve performance across production and storage facilities. Following EU environmental directives, in commercial spaces, solutions for air quality will be the highest priority.

The fast sales growth of the online segment will occur as consumers switch to digital purchasing channels. But more expensive models provoke big upfront bills that may dampen broad uptake among price-sensitive consumer sectors.

The dehumidifier market in South Korea can be attributed to growing humidity levels and increasing awareness towards health. The compact, low-energy dehumidifier will see increased interest, particularly in high-rise urban apartments. Residential will make the bulk of the demand, with commercial indoor spaces (shopping malls, offices) investing in smart dehumidification.

Features such as AI integration will attract tech-savvy consumers. E-commerce will thrive, with big platforms first. Intense market competition, particularly from multi-functional HVAC products and integrated & combined solutions, is anticipated to dampen the sales for standalone dehumidifiers, which will, in turn, drive the manufacturers to innovate & differentiate the product portfolio through innovation & smarter connectivity.

The Japan portable dehumidifiers market will grow at a moderate rate as consumers prioritize air quality and indoor comfort in humid regions of the country. The need for ultra-quiet, compact models will grow-particularly in cramped city apartments.

Sales will surge seasonally thanks to high humidity levels during the rainy season. Commercial spaces, including hotels and offices, will see the implementation of advanced dehumidifiers with energy-saving technology.

The growth of the elderly population will drive demand for automated, low-maintenance models. Online retail will flourish, and brick-and-mortar stores will appeal to the old-school shoppers. Nevertheless, strong competition from air conditioners that have an inbuilt dehumidification function may restrain standalone unit sales.

The increasing urbanisation and industrialisation in China will also increase the demand for humidity control solutions, which will lead to significant growth of the dehumidifiers market in China. Growing disposable incomes will boost residential sales, with commercial and industrial sectors-such as electronics manufacturing and food processing-needing high-capacity units.

Government policies will orient towards energy efficiency, which is likely to open avenues for innovation of smart and eco-conscious dehumidifiers. Sales are expected to be dominated by the e-commerce sector, where Chinese consumers prefer to buy their appliances online.

As a result, the market will become fragmented, and premium brands will face competition from local low-cost manufacturers; in response, premium brands will need to invest heavily in technology and branding to maintain market share.

Indoor pet safety tips with 7 protectors for pets during winters and residential adoption is on the way up as consumers better recognise the value of moisture control for better air quality indoors.

The types of facilities that benefit from a dehumidifier, such as hospitals, hotels, and retail stores, will need to invest more heavily in these types of units to provide better comfort and mould prevention.

The market accessibility will be initiated by e-commerce providing affordable options. Price sensitivity among Indian consumers and widespread alternative cooling solutions, such as air conditioners, could come in the way of swift adoption, and the manufacturers will need to put more focus on cost-effective, multi-function models.

The Tier 1 organisation's endeavours, such as Honeywell, LG Electronics, Whirlpool, Haier, and Mitsubishi Electric, to usher in technology innovations, sustainability, and market growth are propelling the portable dehumidifiers market and industry chain analysis.

Now these organizations shall invest heavily in intelligent IoT based dehumidifiers which shall comprise of embedded AI and automation to monitor real-time air quality. Energy efficiency will remain a key concern, with manufacturers creating sustainable refrigerants and low power consumption models to cater to strict global regulations.

Reacting to the e-commerce explosion, these behemoths will need to enhance their direct-to-consumer sales platforms - personalized recommendations, subscription maintenance services. They will also enter emerging markets, like India and Southeast Asia, where demand will be fuelled by urbanisation and new disposable income.

New Designs and Tech Innovation Startups will play a market challenge; battery-operated dehumidifiers are shrinking into portable, off-grid formats. Companies that will see success are those requiring multi-purpose, modular devices, as consumers want air and dehumidification in one device.

Green-minded buyers will gravitate toward sustainably made startup powertrains with recyclable parts-companies targeting low-cost markets with a high degree of value will fill price-sensitive spaces.

With their future in the hands of crowdfunding, connections between smart home ecosystems that work together, and intense online marketing focused on attracting customers into this increasingly competitive market, the new entrants will be left fighting for their market share.

The portable dehumidifiers market went through a phase of steady growth between the years 2020 and 2024, which can be attributed to a surge in consumer awareness regarding indoor air quality along with the rise in humidity levels because of climate changes.

The residential segment accounted for the largest revenue share, as more individuals became aware of solutions to mould, allergens, and moisture-related damage. Demand for energy-efficient and smart dehumidifiers began to gain momentum, with manufacturers incorporating the Internet of Things (IoT) and automation.

Meanwhile, the commercial sector, covering hotels, hospitals, data centres, etc., expanded its use of dehumidifiers to preserve air quality and protect equipment. Brands were able to broaden their world through e-commerce that surged in growth, while sales offline continued to play a vital role, particularly in North America and European markets.

Nonetheless, challenges around supply chains arising from the COVID-19 pandemic and the volatility of raw material prices translated into short-term constraints.

Toward 2025 to 2035, the market will move toward technology and sustainability. Smart, IoT-enabled, AI-optimised dehumidifiers will take over the market for major sectors, providing automated climate control and remote access monitoring.

They will also appear battery-powered and solar-powered, designed for off-grid and environmentally conscious customers. The commercial and industrial sectors will be the main drivers of demand, especially in pharmaceuticals, food storage, and data centres.

Urbanisation and growing construction activities in developing economies will spur growth, while Asia-Pacific emerges as a key revenue-generating region. Also, regulatory policies are favouring low-energy and eco-friendly refrigerants, which will drive manufacturers toward greener innovations.

This will increase competition, but companies focused on intelligent technology, ease of being sustainable, and compact and affordable high-performance solutions will drive the next phase in market growth.

Those concerns are driving greater demand across the industry, especially with increased humidity due to climate change and a rise in mould-related allergies and respiratory problems.

IoT and AI enablement will give rise to smart dehumidifiers, which allow users to monitor and control humidity levels remotely, making them highly energy-efficient and easy to use.

Rapid growth is expected in the Asia-Pacific region, led by China and India, owing to urbanisation, increasing disposable incomes, and rising awareness of the need for air quality.

The next generations will emphasise energy efficiency, battery and solar power, sustainable refrigerants, and multi-functionality like air purification.

Diaphragm Coupling Market Growth - Trends & Forecast 2025 to 2035

HID Ballast Market Growth - Trends & Forecast 2025 to 2035

Fluid Conveyance Systems Market Growth - Trends & Forecast 2025 to 2035

GCC Magnetic Separator Market Outlook – Growth, Trends & Forecast 2025-2035

United Kingdom Magnetic Separator Market Analysis – Size, Share & Forecast 2025-2035

Hydrostatic Testing Market - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.