Porous ceramics showed steady growth in 2024 as demand increased in the electronics and medical sectors. The use of porous ceramics in fuel cells and biomedicine has experienced significant growth in North America and Europe. Presence of the semiconductor industry: demand increased due to improved chip production and high-efficiency filtration media. The use of ceramic-based implants in medicine increased due to better biocompatibility.

China and India were the main drivers for the industry to grow due to rising investments in infrastructure and environmental applications. Ceramic membranes were also in demand for water treatment projects due to stringent regulatory requirements. Supply chain disruptions, particularly in silicon carbide and alumina, posed challenges for producers.

From 2025 onwards, the industry is expected to benefit from advancements in additive manufacturing, which will enhance efficiency and production customization. The aerospace industry is also set to adopt light, ceramic parts more readily.

Furthermore, sustainability-related challenges will drive the investigation of cost-effective and environmentally friendly ceramic alternatives. The global porous ceramics industry is anticipated to generate USD 4.64 billion by 2025. It will grow at a CAGR of 6.7% over the prediction duration and reach USD 8.88 billion by 2035.

Industry Forecast Table

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 4.64 billion |

| Industry Value (2035F) | USD 8.88 billion |

| CAGR (2025 to 2035) | 6.7% |

Explore FMI!

Book a free demo

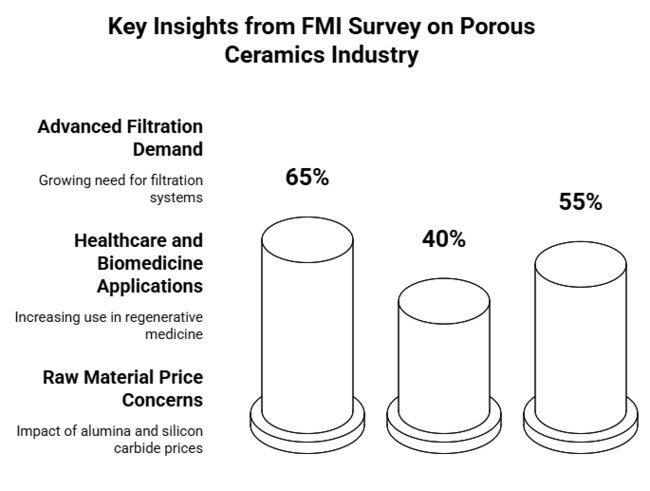

Future Market Insights conducted a survey of the porous ceramics industry and held discussions with various end-users, suppliers, and manufacturers in a bid to understand their perspectives on the industry. More than 65% of the respondents claimed that the growing demand for advanced filtration systems is among the few key factors sustaining the growth of the industry. Industry experts stated that ceramic membranes are gaining preference over polymer-based membranes for water and wastewater treatment.

The growing use of these ceramics in healthcare and biomedicine was another key finding of the survey. Almost 40% of industry professionals reported increasing applications of ceramic-based implants and scaffolds in regenerative medicine. The stakeholder also added that the advances in additive manufacturing are helping in improving customization and reducing production costs, thus making ceramic medical parts more viable.

The survey also identified areas of challenge, with supply chain constraints and raw material prices being the key areas of concern. About 55% of respondents cited changes in alumina and silicon carbide prices as a main driver of profit margins. Environmental controls are likely to impact ceramic production more in the future as companies seek sustainable production methods.

| Countries | Regulations & Certifications Impacting the Industry |

|---|---|

| United States | Used for the treatment of the environment controlled by the EPA (i.e., water filter ceramic membranes). Drugs, medical devices, and other biomedical applications require FDA approval. ASTM & ISO specifications control industrial-grade ceramics. |

| United Kingdom | Under UK REACH legislation following Brexit: implications for material sourcing and chemical makeup BSI standards govern ceramics used in medical and industrial applications. |

| France | EU REACH and CE marking for product safety. French Environmental Code strict emission control on ceramic manufacture. Medical ceramics should comply with ANSM. |

| Germany | DIN and EU REACH govern material composition and safety. Firm focus including sustainable production MBO on BImschG (Bundes-Immissionsschutzgesetz): Germany’s emission control legislation. |

| Italy | NORMATIVE UNI (Ente Nazionale Italiano di Unificazione) and EU REACH regulation. Porous ceramics: CE certification required for construction and medical applications. |

| South Korea | K-REACH regulates the chemical substances used in ceramic preparation. The Ministry of Food and Drug Safety (MFDS) approves them, just as it does with medical-grade ceramics. National technology programs drive strong R&D incentives for advanced ceramics. |

| Japan | JIS (Japanese Industrial Standards)-Regulated to JIS for quality control. PMDA (Pharmaceuticals and Medical Devices Agency) certified biomedical ceramics. Controlled environmental conditions by emissions emitted JIS Z 2801 |

| China | Industrial ceramics must obtain CCC (China Compulsory Certification). The National Medical Protection Agency (NMPA) regulates the use of industrial ceramics for medical purposes. |

| Australia & New Zealand | The product meets the ANZ Standard AS/NZ4020 for ceramic parts used in water refurbishing. For use in biomedical goods, it requires Therapeutic Goods Administration certification. Environmental compliance under the National Greenhouse and Energy Reporting Act |

| India | Governed by the Bureau of Indian Standards (BIS). The CDSCO (Central Drugs Standard Control Organization) must approve medical ceramic devices. The CDSCO (Central Drugs Standard Control Organization) has regulations for sustainability to manage emissions in ceramic production. |

The USA industry is expected to grow at a CAGR of 6.9% from 2025 to 2035, slightly above the global average due to increasing demand in medical, electronics, and defence industries. The nation's strong R&D setup, especially in biomedical applications, has driven the use of ceramic-based implants and scaffolds.

Furthermore, strict EPA guidelines on industrial filtration are boosting the application of ceramic membranes to treat wastewater. These ceramics play a crucial role in high-end chip production for the semiconductor industry. High energy prices and supply chain risks might, however, affect production expenses. Government support of clean technologies like fuel cells and advanced filtering technologies will be another driver that continues to drive the industry higher.

The UK's industry is forecasted to have a CAGR of 6.5% over the period from 2025 to 2035. Demand for biomedical ceramics in dentures and implants is a leading driver of growth. Post-Brexit policies, specifically UK REACH, have added relatively little to the costs of manufacturers but provided scope for domestic suppliers to increase their industry share.

The increasing focus on sustainability in the environment has seen increased uptake of ceramic membranes for industrial emissions control and filtration. In addition, the UK aerospace sector has been incorporating porous ceramics into fuel-efficient, lightweight components. While there is strong industry potential, supply chain issues caused by geopolitical uncertainties could pose a challenge in the future.

France's industry will grow at a CAGR of 6.4% between 2025 and 2035, led by growing adoption in medical devices, environmental use, and defence technology. France's stringent emission control regulations under the French Environmental Code are encouraging industries to move toward ceramic-based filtration systems. France is also a player in the advanced ceramics for aerospace and nuclear applications with continuous investment in heat-resistant material research.

With help from the ANSM (Agence Nationale de Sécurité du Médicament), the health sector is growing, which is speeding up the development of these ceramics for implants and bone implants. Yet high production expenses and reliance on foreign raw materials could affect growth. However, government support for sustainable materials innovation will mitigate these challenges.

Germany's industry is anticipated to expand during 2025 to 2035 at a CAGR of 6.8% due to the presence of a robust manufacturing industry and technological innovations. High-quality standards as per DIN and EU REACH regulations place Germany among the largest exporters of these ceramics, especially for industrial filtration and automotive industries. The nation's drive toward green energy and hydrogen fuel cells has also increased demand for porous ceramics in energy storage and conversion technologies.

Furthermore, the BImSchG environmental law encourages industries to implement cleaner, more efficient filtration systems, thereby supporting the industry. Agreed, economic downturns and high energy prices have impacted industries, but Germany's heavy investment in R&D and automation in the manufacture of ceramics should be enough to keep the industry growing during the forecast period.

Italy is anticipated to see a CAGR of 6.3% in the industry for ceramics between 2025 and 2035, just marginally less than the world average because of economic uncertainty and dependencies on supply chains. The building industry continues to be a dominant driver, with higher applications of these ceramics for insulation and soundproofing purposes. Italy's automotive sector, a strong economic sector, is incorporating advanced ceramics for lightweight parts in electric vehicles.

Additionally, EU sustainability policies are nudging industries toward the use of ceramic filtration systems as a means of controlling emissions. The medical industry is also growing, with CE-marked ceramics utilized in orthopedics and dental implants. However, volatility in raw material pricing and tight environmental regulation can be challenges to manufacturers.

South Korea's industry will grow at a CAGR of 7.1% from 2025 to 2035, surpassing the global average due to its strong electronics and semiconductor sector. The K-REACH regulations of the country have spurred investment in high-tech ceramic materials for industrial use. South Korea's healthcare industry is also quickly adopting these ceramics for orthopedic implants and regenerative medicine.

Furthermore, the South Korean government's hydrogen economy drive has spurred research in ceramic-based fuel cell technologies. Despite its significant reliance on raw material imports, South Korea's investment in ceramic 3D printing and nano-ceramic technologies is poised to establish it as a significant player in the global industry.

Japan's industry is set to grow at a CAGR of 6.7% during 2025 to 2035, following global trends. The nation's JIS standards guarantee high quality and precision, and Japan is a leader in high-performance industrial ceramics. PMDA approvals for medical ceramics have led to the extensive use of porous materials in dental and orthopaedic applications.

Energy-efficient filtration systems are also a focus in Japan, with significant investments in ceramic membrane technologies. The automotive and aerospace sectors are incorporating lightweight for enhanced fuel efficiency and durability. Though domestic demand can be slowed by an aging population and stagnating economy, exports to Southeast Asia and Europe are projected to lead overall growth.

Between 2025 and 2035, projections indicate that China will expand at the highest rate among major industries, with a 7.3% CAGR. The Made in China 2025 program is fueling major investment in advanced materials, such as ceramics for industrial and medical uses. The CCC certification guarantees the quality and safety of the product, while stringent regulations by the NMPA for medical ceramics are prompting companies to enhance product innovation.

The rapid urbanization of China and its water shortage problems have increased the demand for ceramic filtration membranes for wastewater treatment. The country is also a major provider of raw materials for these ceramics, which confers an advantage in cost on Chinese companies against their competitors. Nevertheless, environmental regulations and trade barriers may affect the scalability of production in the future.

The Australia-New Zealand industry is projected to expand at a CAGR of 6.2% between 2025 and 2035, just below the world average owing to a relatively small industrial base. Nevertheless, applications in water filtration are a strong growth driver with support from AS/NZS 4020 standards for drinking water systems.

Strict adherence under Therapeutic Goods Administration (TGA) regulations opens prospects for biomedical ceramics in dental implants and orthopaedic devices. Even with minimum domestic production, greater imports of ceramics from China, Japan, and the United States are proving to support demand. Incentives from the government on clean technologies, such as those involving fuel cells with ceramic materials, are also backing adoption.

Rapid Industrialization and infrastructure growth will drive India's industry to a 7.0% CAGR from 2025 to 2035. The BIS certification upholds quality standards, and the CDSCO approval process is driving demand for medical ceramics. Water filtering and air filtering are key industries growing, led by increasing concerns for pollution leading to adoption.

Furthermore, the automotive sector is using these ceramics as lightweight, heat-resistant materials. The Indian government's "Make in India" program is also drawing in foreign investment in ceramic production. But raw material price volatility and the cost of energy can be an issue in the long term.

Due to their application in catalytic converters, filtration, and heat exchangers, ceramic honeycombs will take the lead in this. Tighter emission regulations in large industries are driving the demand for exhaust cleaning and renewable energy. Although the production levels are still relatively high, the R&D with regard to light alternatives is ensuring strong growth.

The fastest-growing segment is ceramic foam, expected to hold a leading industry share of over 47% in 2025, driven by areas such as molten metal filtration, biomedical scaffolds, and aerospace insulation. As a result, its high porosity increases filtration efficiency and thermal shielding. Advances in materials science and 3D printing are improving performance and cost-effectiveness despite issues like brittleness.

A major driver of the global ceramic membrane industry is its expanding use in water treatment, pharmaceuticals, and food processing, thanks to its excellent chemical resistance. Rising demand for green filtration solutions and strict environmental legislation are driving adoption even in the face of high capital costs.

Porous ceramics, used in catalysis, separation of gases, and refining, make the chemical industry the most dominant with a share of more than 42.3% in 2025. In petrochemicals and polymerization, there is growing demand in Europe and Asia, and new developments are improving efficiency.

The oil & gas industry is growing vigorously, driven by tighter emissions policy. The industry is expanding from filtration and refining to hydrogen processing, utilizing these ceramics to enhance hydrogen fuel and carbon capture.

The environmental segment is experiencing growth in air and water treatment, emission control, and clean energy sectors. Wastewater treatment is the most important application for ceramic membranes, while growth in fuel cells and particulate filters should also support long-term demand.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The pandemic-induced supply chain disruption and raw material shortage hindered the industry's consistent expansion. | Expected to see rapid growth driven by increasing demand in filtration, energy storage, and biomedicine. |

| Stringent environmental regulations in major economies fuelled demand for these ceramics in emission control and water treatment. | Global sustainability compliance regulations will drive ceramic-based filtration and energy applications. |

| Projects focused on enhancing porosity and mechanical strength have significantly improved the efficiency and durability of the ceramics. | Developments in areas like 3D printing, nanoceramics, or composite materials will make outputs more efficient and widen the fields of applications. |

| Ceramic honeycombs used in catalytic converters had a major industry, with the automotive sector being the largest customer. | Electric vehicles and hydrogen fuel cell development will also spur demand for light and heat-resistant ceramics. |

| High production costs and previously limited regional manufacturing have inhibited industry growth, though recent expansion efforts are improving accessibility. | Increased local production capabilities and cost-reduction strategies will improve accessibility and affordability. |

These ceramics play a crucial role in the advanced materials and industrial ceramics industry, serving key applications such as filtration, separation, catalysis, energy storage, biomedical implants, dentistry, and high-temperature insulation. It is fed by macroeconomic developments in the primary sectors of automotive, oil & gas, chemicals, healthcare, and environmental technology.

Alexis Fréchette, a doctoral student at the University of Alberta, explores the macroeconomic impact of various factors, including global industrial production, investment in infrastructure, the regulatory regime, and sustainability policies on a particular sector. The increasing focus on green technology and stricter emissions control legislation is driving demand for ceramic membranes and honeycombs in water treatment and catalytic converters.

The global economic slowdown between 2020 and 2021 temporarily halted growth due to supply chain disruptions and rising raw material prices. However, the recovery from 2022 has been strong, led by Asia-Pacific as the regional powerhouse of production and consumption. Moreover, evolving hydrogen energy, electric vehicles, and biomedical engineering applications will propel future long-term growth.

Despite several barriers, including high production costs and scalability challenges, ongoing state incentives for green industries will ensure these ceramics remain a leading material in the evolving industrial landscape.

Major players in the industry are competing on price, innovation, mergers & acquisitions, and internationalization. Most major players are investing heavily in R&D to develop longer-lasting and cost-effective materials, while others focus on 3D printing and nanotechnology for enhanced performance. Collaborations with the automotive, energy, and water treatment sectors expand market reach and application scope.

Other firms, including Asian-Pacific or North American firms, are employing mergers and acquisitions as a means of building a regional presence as part of their global expansion strategy. Furthermore, the leading players in the industry are optimizing their sustainable manufacturing practices and earning government regulatory licenses to comply with industry regulations, providing them with a competitive advantage in emerging industries such as hydrogen energy and semiconductor production.

Industry Share

CoorsTek, Inc. (Industry Share: ~20-25%)

A global technology leader in advanced ceramics, CoorsTek has been the world's leading manufacturer of these ceramic products through a cycle of ongoing innovation and strategic collaboration. CoorsTek focuses on high-performance materials for catalysis, filtration, and energy applications.

Saint-Gobain S.A. (Industry Share: ~15-20%)

Due to its skills in materials science, Saint-Gobain has continued to be among the key players in the industry for these ceramics. Saint-Gobain has a strong presence in industrial and environmental applications, particularly in filtration systems.

CeramTec GmbH (Industry Share: ~10-15%)

CeramTec is a worldwide industry leader with its technical ceramics. The company offers custom solutions in the fields of medical, automotive, and industrial applications.

Kyocera Corporation (Industry Share: ~10-15%)

Kyocera: A large player with an emphasis on high-tech ceramic materials for electronic, automotive, and environmental applications. To ensure its competitive status, the company spends heavily on R&D.

Morgan Advanced Materials (Industry share: ~5-10%)

Morgan Advanced Materials possesses a strong portfolio in the porous ceramic segment, especially in high-temperature and corrosive environment applications. Some leading companies prioritize sustainability and innovation in their product portfolio.

Vesuvius plc (Industry Share: ~5-10%)

Vesuvius plc specializes in ceramic solutions for the foundry and steel industries and has been expanding its portfolio of porous ceramic products to address emerging applications in renewable energy and environmental sustainability.

IBIDEN Co., Ltd. (Industry Share: ~5-10%)

IBIDEN is one of the leading players in the industry, especially in the Asia-Pacific region. It is a leading manufacturer specializing in automotive and environmental ceramics.

Kyocera Corporation has developed an innovative material for hydrogen fuel cells-porous ceramics. Kyocera is one of the primary providers utilized for the expanding hydrogen fuel/energy business, and the new material is more durable and efficient. The innovation demonstrates Kyocera's commitment to clean energy technology.

Morgan Advanced Materials unveiled a portfolio of porous ceramic parts for sealing in harsh environments for aerospace clients. Morgan Advanced Materials designs components for high-pressure and extreme temperature applications, including jet engine and space exploration systems. The launch is proof of Morgan's commitment to innovative, high-performance materials.

Vesuvius plc, a ceramics industry company, acquired a firm specializing in porous products for renewable energy applications in October 2020. The acquisition, completed in early 2024, will likely add to Vesuvius' current energy sector business. It is part of one of the company's efforts to expand its products and enter new industries.

Porous ceramics have a lot of room to grow in the fields of hydrogen energy and fuel cell technology, especially hydrogen purification membranes and solid oxide fuel cells (SOFCs). As leading economies plow money into the clean energy transition, players will diversify their product portfolios to address applications in energy storage, carbon capture, and substitute fuels.

Moreover, the growing adoption of ceramic membranes in industrial wastewater treatment plants and desalination plants provides lucrative opportunities, especially in water-stressed countries, including the Middle East, India, and the USA Establishing manufacturing bases in local regions and strategic partnerships ensures industry penetration.

Companies should focus on cost reduction and scalability improvements through unique manufacturing techniques such as 3D printing and AI-driven process optimization. Entering the booming industries of Southeast Asia and Latin America through partnerships with local producers is going to give an edge over competitors.

Moreover, stakeholders should focus on obtaining regulatory approvals for environmental and biomedical applications, as FDA (USA), EMA (Europe), and ISO 14001 certification for industrial filtration will instill confidence in the industry and drive further adoption. Therefore, forming partnerships for research and development with the electronics and energy sectors could potentially contribute to the development of next-generation high-performance ceramics.

They find applications in filtration, catalysis, biomedical implants, energy storage, and insulation at high temperatures.

Tougher emission regulation, water treatment, and industrial safety legislation are spurring increased uptake worldwide.

The industries of hydrogen power, electric cars, semiconductor production, and sewage treatment are experiencing rapid growth.

High cost of production, brittleness of materials, and scalability are challenges to broader adoption.

3D printing, AI-optimized material, and nanostructured coatings are increasing efficiency and durability.

The industry is segmented into ceramic honeycombs, ceramic foam, ceramic membranes, and others.

It is segmented into chemical, oil & gas, environmental, and others.

The industry is fragmented among North America, Latin America, Europe, East Asia, South Asia, Oceania, and Middle East & Africa (MEA).

LATAM Road Marking Paint & Coating Market Analysis by Material Type, Marking Type, Sales Channel, and Region Forecast Through 2035

Refinery and Petrochemical Filtration Market Analysis by Filter Type, Application, End-User and Region 2025 to 2035

Plastic Market Growth Analysis by Product, Application, End Use, and Region 2025 to 2035

Medical Grade Coatings Market Trends – Demand, Innovations & Forecast 2025 to 2035

Fertilizer Additive Market Report – Growth, Demand & Forecast 2025 to 2035

Malonic Acid Market Report – Demand, Growth & Industry Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.