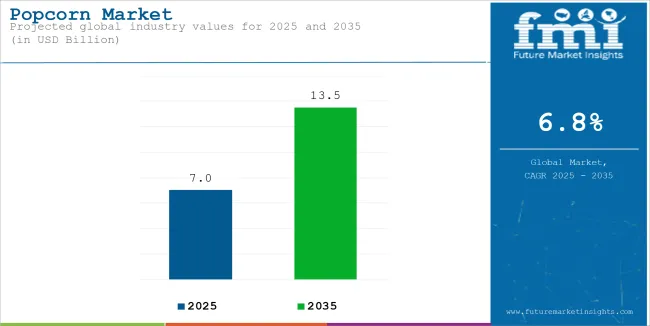

The global popcorn market is estimated to account for USD 7.01 billion in 2025. It is anticipated to grow at a CAGR of 6.8% during the forecast period and reach a value of USD 13.5 billion by 2035.

| Attributes | Description |

|---|---|

| Estimated Global Popcorn Market Size (2025E) | USD 7.01 billion |

| Projected Global Popcorn Market Value (2035F) | USD 13.5 billion |

| Value-based CAGR (2025 to 2035) | 6.8% |

The popcorn market has experienced considerable expansion mainly due to the ever-growing consumer requirement for healthy and quick-to-eat choices. Consumers are now more inclined towards popcorn, which is a good option as a low-calorie, gluten-free, and high-fibre healthy snack, particularly for fitness enthusiasts.

Simultaneously, the industry is further supported by the perpetual development of products like glowy, organic, and gourmet popcorn that meet customers' specific interests and dietary constraints.

The trend of watching movies with snacks and the popularity of ready-to-eat popcorn in practical packaging make a difference. The growing trend of using natural ingredients and clean labels is also changing the market since more consumers are asking for healthier and more natural popcorn alternatives.

Rising Demand for Convenient Snacks

Growing Popularity of Popcorn in Entertainment

Supply Chain and Raw Material Issues

Health-Consciousness and Nutritional Awareness

Flavor Preferences and Product Innovation

Sustainability Concerns

The pricing dynamics of the popcorn market are influenced by various factors, including raw material costs, packaging, distribution channels, and product segmentation. With a wide range of offerings from budget-friendly to premium, pricing plays a critical role in determining consumer choice and market competitiveness.

From 2020 to 2024, the rising prices of corn significantly affected popcorn prices. In 2020, corn was priced at USD 3.60 per bushel. By 2023, it peaked at USD 6.75 before settling at USD 6.10 in 2024. This increase in corn prices led to higher popcorn prices, which rose from USD 2.50 per unit in 2020 to USD 3.50 in 2023, reflecting a 25% increase due to the cost of raw materials.

Although corn prices dropped slightly in 2024, popcorn prices remained high at USD 3.30 per unit, showing that fluctuations in input costs have a lasting impact on consumer prices.

Understanding these pricing dynamics is essential for businesses to optimize their market positioning and identify potential growth opportunities across diverse markets.

| Attributes | Details |

|---|---|

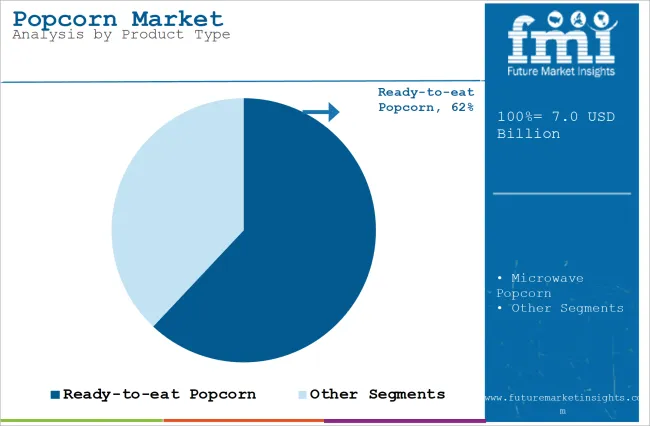

| By Product Type | Ready-to-eat Popcorn |

| Market Share in 2025 | 62% |

By product type, the popcorn market is segmented into ready-to-eat popcorn, and microwave popcorn. Ready-to-eat popcorn segment is expected to attain a market share of 62% in 2025. Ready-to-eat popcorn offers significant convenience as it requires no preparation, unlike microwaveable or stovetop popcorn.

The snack is lightweight and easy to carry, making it a popular choice for people who need a quick, portable snack during travel, at work, or while engaging in recreational activities. Ready-to-eat popcorn leads the market due to its unmatched convenience, health benefits, product variety, and alignment with modern snacking trends.

As consumers continue to seek healthier, portable, and easy-to-consume snacks, ready-to-eat popcorn remains the dominant segment in the forecast period.

| Attributes | Details |

|---|---|

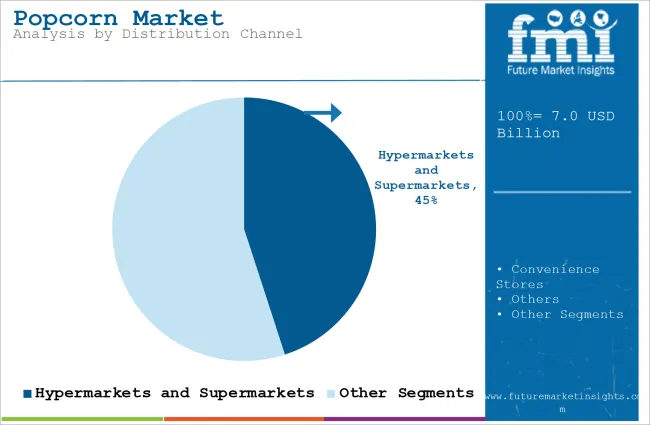

| By Distribution Channel | Hypermarkets and Supermarkets |

| Market Share in 2025 | 45% |

By distribution channel, the popcorn market is segmented into hypermarkets/ supermarkets, convenience stores, and others.

Hypermarkets and supermarkets are expected to account for 45% market share in 2025. offer a wide range of popcorn products, including various flavors, brands, and sizes, which attracts many customers. Consumers prefer hypermarkets and supermarkets because they can purchase a wide variety of products, including popcorn, in one convenient location. This drives impulse buying, particularly for snacks like popcorn.

The combination of high foot traffic, convenient shopping experiences, and regular promotions positions these retail channels as the dominant sales venues for popcorn, meets the growing demand for both traditional and innovative snack options.

In North America, the USA leads in popcorn production, and is estimated to grow with a CAGR of 6.8% during the forecast period. With increasing health consciousness, popcorn is being viewed as a healthier snack due to its low-calorie, high-fiber, and gluten-free properties. The demand for air-popped, organic, and non-GMO popcorn is rising as consumers opt for snacks with cleaner ingredients and lower fat content.

Snacking has become a common habit in North America, with consumers looking for quick, easy, and nutritious options. Popcorn, being portable and versatile, fits well into the growing trend of on-the-go snacking, contributing to its widespread consumption. The market is also likely to witness a continued demand for on-the-go, ready-to-eat, and microwaveable popcorn products, supported by the rise of e-commerce and changing consumer lifestyles.

In Europe, Spain will lead the popcorn production during the forecast period with an anticipated CAGR of 6.4% during the forecast period. The popcorn industry is likely to grow due to changing consumer habits. As Spanish consumers become more health-conscious, demand for popcorn as a low-calorie, gluten-free, and high-fiber snack is rising. This is particularly true for air-popped and organic popcorn varieties.

Popcorn is increasingly replacing traditional snack foods due to its perceived health benefits and convenience. Manufacturers are focusing on innovation with new flavors, healthier ingredients (like reduced salt and sugar), and specialized varieties such as vegan, organic, and non-GMO popcorn. Gourmet and premium popcorn varieties are also gaining traction in Spain.

China is a leading country with an anticipated CAGR of 7.8% by 2035. Snack culture is growing in China, and this is making popcorn a popular choice among consumers who enjoy convenient and tasty snacks.

Increased availability of popcorn through modern retail channels, including supermarkets, convenience stores, and e-commerce platforms, is making the snack more accessible to a larger consumer base.

The busy lifestyles of urban consumers are driving demand for ready-to-eat and microwaveable popcorn. Popcorn fits well into the growing trend of on-the-go snacking, especially in densely populated markets in China.

The popcorn market is dominated by established brands like Orville Redenbacher’s, Pop Secret, and BoomChickaPop, which have a strong global presence. Local brands also play a role, catering to specific tastes in different regions.

For example, in India, masala-flavored popcorn is trending, while major German consumer prefer sweeter varieties. The market is divided into segments like microwave popcorn, ready-to-eat (RTE), and gourmet options, each targeting different groups of consumers.

Established players focus on product innovation, introducing new flavors and healthier options to attract more customers.

Large brands benefit from strong distribution networks, making their products widely available in stores and online platforms. However, new entrants struggle to gain market share due to strong brand loyalty and the entry costs involved. This makes it challenging for newcomers to compete effectively.

| Company | Area of Focus |

|---|---|

| Campbell Soup Company | Campbell Soup Company owns several popular snack brands, including those that produce popcorn, allowing them to reach a wide audience. They focus on innovation, often introducing new flavors and healthier options to meet changing consumer preferences. |

| PepsiCo Inc. | PepsiCo is known for its strong marketing strategies, promoting its popcorn products alongside its other snack foods and beverages. The company invests in sustainability, aiming to use environmentally friendly practices in its popcorn production and packaging. |

| Conagra Brands, Inc | Conagra offers a variety of popcorn products, including microwave and ready-to-eat options, catering to different consumer needs. They focus on quality ingredients and often highlight their commitment to health by providing lower-calorie and whole-grain popcorn choices. |

| Weaver Popcorn, Inc. | Weaver Popcorn is one of the largest popcorn manufacturers in the world, known for its expertise in growing and processing high-quality popcorn. The company produces a wide range of popcorn products, including private label options for retailers, allowing them to serve various market segments. |

| Quinn Foods LLC | Quinn Foods specializes in making popcorn with clean ingredients, emphasizing organic and non-GMO options to attract health-conscious consumers. They focus on unique flavors and innovative packaging, often using compostable materials to appeal to environmentally aware shoppers. |

Startups in the snack industry often focus on making health-conscious products, such as organic and non-GMO snacks, or unique gourmet flavors. Companies such as Pipsnacks and LesserEvil creates premium and sustainable snacks.

They stand out by using eco-friendly packaging, innovative flavors, and sourcing ingredients locally. To attract young consumers, these startups connect with them through such social media campaigns and influencer partnerships. Some of the notable startups in the popcorn industry analysis include;

By product type, the popcorn market is segmented into ready-to-eat popcorn, and microwave popcorn.

By distribution channel, the popcorn market is segmented into hypermarkets/ supermarkets, convenience stores, and others.

By Region, the market is segmented as North America, Europe, Middle-East, and Asia-Pacific

The popcorn market is projected to value at USD 7.01 billion in 2025.

The popcorn industry is predicted to reach a size of USD 13.5 billion by 2035.

The projected growth rate for popcorn market is 6.8% for the forecast period.

Some of the key companies manufacturing popcorn include Campbell Soup Company, PepsiCo Inc., Conagra Brands, Inc., Weaver Popcorn, Inc., and Others.

Hypermarkets and supermarkets are the leading segment for distribution channel for popcorn market.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Popcorn Making Cart Market Growth - Demand & Forecast 2025 to 2035

Popcorn Makers Market

Popcorn Containers Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA