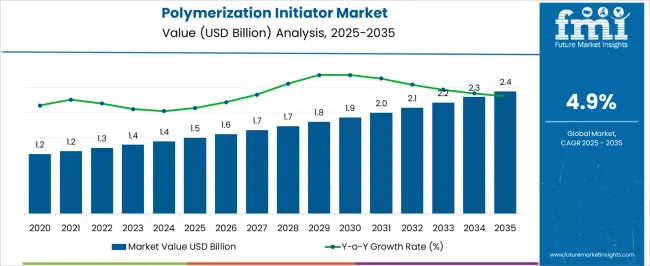

The Polymerization Initiator Market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 2.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

| Metric | Value |

|---|---|

| Polymerization Initiator Market Estimated Value in (2025 E) | USD 1.5 billion |

| Polymerization Initiator Market Forecast Value in (2035 F) | USD 2.4 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The polymerization initiator market is recording stable growth, supported by rising demand for polymers in packaging, automotive, construction, and electronics industries. The ability of initiators to control polymerization reactions efficiently has reinforced their critical role in enhancing polymer quality and performance.

Market expansion is being driven by increasing consumption of plastics in lightweight components and packaging formats that align with sustainability and cost-efficiency trends. Manufacturers are focusing on producing initiators with improved thermal stability, controlled decomposition rates, and reduced environmental impact to meet evolving regulatory standards.

The current market benefits from technological advancements in radical polymerization and the growing need for high-performance specialty polymers. Looking forward, expansion in emerging economies, coupled with strong investments in polymer manufacturing infrastructure, is expected to support long-term growth.

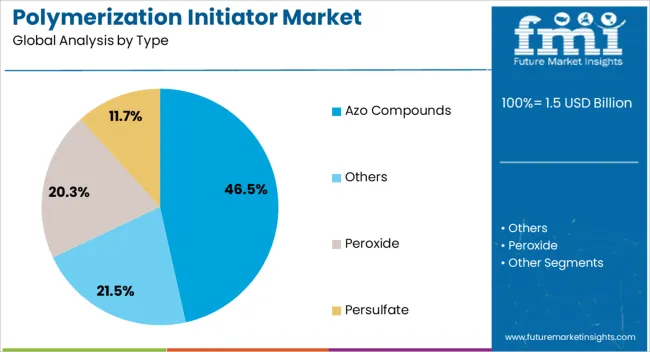

The azo compounds segment dominates the type category with approximately 46.5% share, owing to its broad application in controlled radical polymerization processes. The stability of azo initiators under storage and their ability to generate free radicals at predictable decomposition rates have reinforced their widespread use.

The segment has benefited from strong adoption in vinyl and styrene-based polymers, where uniformity and process control are critical. Azo compounds are also favored for their relatively clean decomposition by-products, aligning with environmental and safety considerations.

Continuous improvements in manufacturing efficiency and cost reduction have strengthened their competitiveness against alternative initiators. With demand for advanced polymers increasing across multiple end-use sectors, the azo compounds segment is expected to retain its leading position in the forecast horizon.

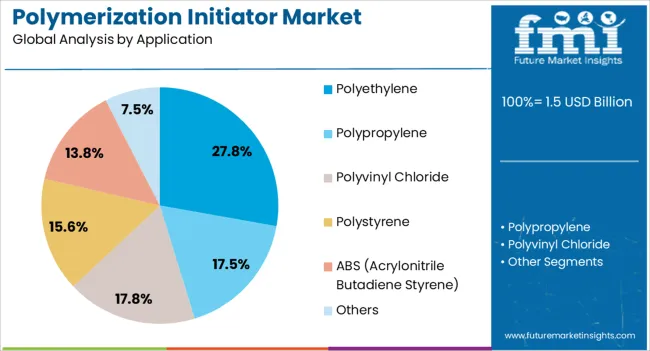

The polyethylene segment leads the application category, representing approximately 27.8% share of the polymerization initiator market. This dominance is linked to the large-scale production of polyethylene as one of the most widely used plastics globally.

Initiators play a critical role in ensuring process efficiency, molecular weight control, and performance consistency in polyethylene production. The segment benefits from polyethylene’s extensive application in films, packaging, containers, and construction materials, all of which exhibit strong global demand.

Expansion in emerging economies, coupled with investments in high-capacity polymer plants, has further reinforced initiator consumption in this application. With continued growth in packaging and construction sectors, the polyethylene segment is projected to maintain steady demand for initiators.

Versatile Solutions for Diverse Applications Across Industries

The demand for thermal initiators in industries, which initiate the polymerization through heat input, is rising. These initiators provide high precision in controlling kinetics, guarantee efficient processing at elevated temperatures, and afford high productivity and product quality in manufacturing operations.

Many dual-cure initiators are versatile in nature, and they initiate the process of polymerization using energy from both light and heat. This is where such dual-cure systems have the potential for a range of applications in electronics, automotive, and medical devices, where very exacting conditions are necessary for curing.

Nano-initiators Open the Gate! Advances in Nanotechnology for Enhanced Polymerization

Nanoscale initiators are driving a revolution in polymerization by opening the way for a new era of materials with properties for high performance and open creativity in most industrial fields. Advanced nano-initiators with significantly improved control over the kinetics of polymerization furnish opportunities for the preparation of high-performance materials with tailor-made properties.

Smart Technologies Drive Integration for Improved Polymerization Efficiency

A new generation of smart initiator-integrated technology enables one to realize the monitoring and control of polymerization reactions in real time. Smart initiators are integrated with sensors and feedback that either optimize the conditions of the reaction or induce conditions to maximize efficiency, minimize waste, and maintain product consistency.

The polymerization initiator industry exhibited a historical CAGR of 2% between 2020 and 2025, suggesting a moderate trend of growth. During this period, the sectors that use polymerization initiators as primary components, such as automotive or construction, might not have grown at such a rapid pace. Such a scenario could have caused the lowering of the total demand for initiators.

International trade disputes, political instability, or recession might have had a negative impact on the market and investments in businesses producing polymerization initiators. The primary goal for the industrialists of the period was possibly to cut production costs. It could have resulted in the users liking and using the cheaper initiators, which in turn could have an impact on the growth of higher-end products.

The future projection is markedly more positive. The considerable rise points to a possibly growing industry, which is affected by several current trends. It is evident that eco-friendly measures are spreading into mainstream business. This will result in a rise in the market for biodegradable polymerization initiators that do not produce any negative environmental effects.

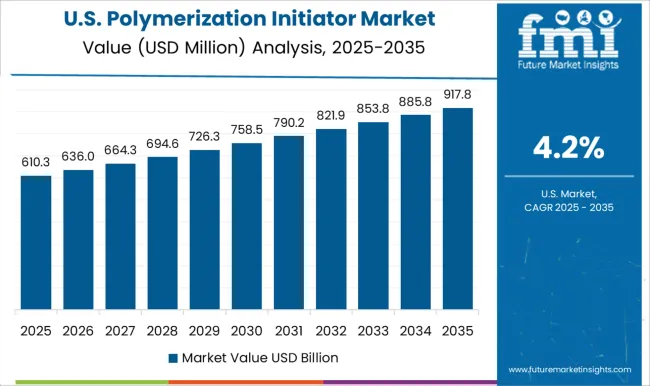

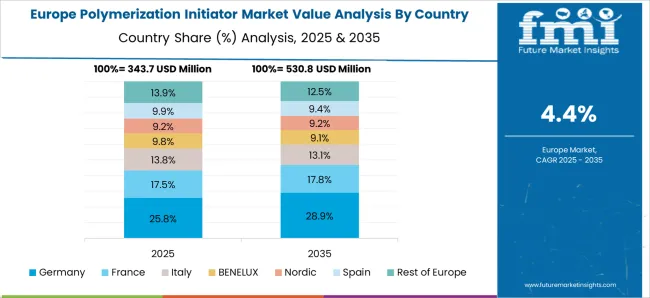

Emerging countries like India and China have untapped potential and a lot more room for polymerization initiator businesses. Meanwhile, the United States, United Kingdom, and Germany hint toward market maturation. However, this does not indicate the end, instead, the CAGR of these countries shows moderate yet steady expansion through 2035.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 2.7% |

| United Kingdom | 1.9% |

| Germany | 2.3% |

| India | 7.2% |

| China | 5.4% |

The United States remains a stronghold in the polymerization initiator market, rising at a CAGR of 2.7% from 2025 to 2035. The growth is not forecast to be dynamic, as in the Asia Pacific region. However, it means a strategic focus on optimization and innovation.

Keying these drivers, as the industry matures, manufacturers are likely to turn to significant process optimization to drive gains in efficiency and exploration in new areas in specialty initiators developed for specific applications that overlay with a sustainable trend and performance improvement.

The polymerization initiator industry in the United Kingdom is expected to hold moderate growth with a CAGR of 1.9% during the forecast period. This growth is expected to be moderated by growing attention toward environmental sustainability.

Stringent regulations on the environment are likely to trigger the uptake of environmentally friendly alternatives, and the sustainable practices required to be adopted by manufacturers in order to achieve minimal environmental impact go on to reflect a balance between growth objectives and environmental concerns.

Driven by the pursuit of technological advancement, Germany is likely to maintain growth at 2.3% CAGR in the polymerization initiator industry between 2025 and 2035. Meanwhile, the German manufacturing industry is very well poised to continue taking the lead in the implementation and development of advanced polymerization techniques, driven further by an increasingly high demand for high-performance materials that mandate innovative initiator solutions and re-establish Germany as a technological powerhouse.

In China, with its booming manufacturing industries, the polymerization initiator industry is expected to surge by a CAGR of 5.4% from 2025 to 2035. This is because the country is witnessing tremendous growth in the manufacturing domain across industry verticals, with state-backed policies focusing on strengthening in-country manufacturing capabilities. As China marches toward the center of the global industry, its high-octane manufacturing landscape remains one of the prominent sources of growth opportunities for polymerization initiator manufacturers.

The demand for polymerization initiators in India is projected to expand at a significant rate of 7.2% from 2025 to 2035. This growth is being driven by a number of really exciting factors. In fact, as in many fields like automotive, construction, and packaging, India is following the footprints of China in rapid industrialization; hence, demand for polymers and polymerization initiators is on the rise.

The second driving factor behind consumer spending on polymer-based products is the rising middle class in India with higher disposable incomes, stimulating the demand for a host of goods and further boosting demand for raw materials, including polymerization initiators. In other words last but not least, proactive initiatives of the Indian government, like "Make in India," which is expected to boost domestic manufacturing, could be directly favorable for creating a conducive polymerization initiator industry.

| Segment | Azo Compounds (Product Type) |

|---|---|

| Value Share (2025) | 46.5% |

Azo compounds lead when it comes to the industry segmentation, with a 46.5% share in 2025. It is their many strengths that have contributed to their widespread usage. Initially, azo compounds have been provided with extensive adaptability.

They come in a variety of formulations with different decomposition temperatures and decomposition times, thereby making them applicable to many polymerization mechanisms.

Moreover, they are frequently in the low-cost category compared to other starter types, which are of relevance to manufacturers who are not willing to spend extra. Also, azo compounds have a wide variety of applications in the industry with a long history of successful use that has created strong trust and confidence among producers.

| Segment | Polyethylene (Application) |

|---|---|

| Value Share (2025) | 27.8% |

The polyethylene segment dominates the application category occupying about 27.8% share in 2025. This domination is based on two factors, the first being its growing demand from across numerous sectors where it serves as an all-purpose plastic used widely for packaging materials, automotive parts, construction supplies, etc., thus necessitating more initiators during production because of such high consumption rates Secondly, there are different types/forms through which polyethylenes exist, and each one requires specific polymerization technologies.

This broad-based application area in the polyethylene segment, therefore, increases the potential of using different types of initiators efficiently.

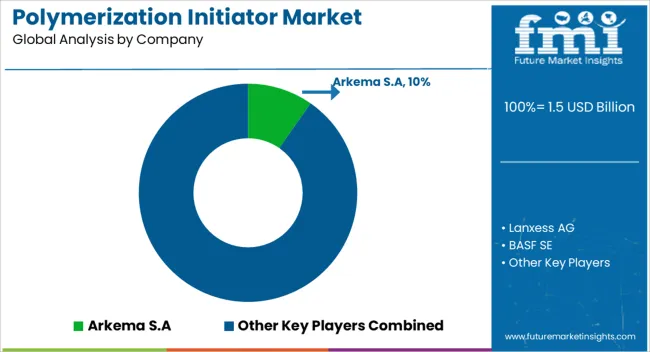

The polymerization initiator market is relatively fragmented, with both global and regional players constituting a mix of established leaders and emerging participants. The first to stand out are the firms of Arkema, Lanxess, BASF, ADEKA, and Fujifilm which acquire 60% of the industry. They succeed in this with their product portfolios that are as diverse as they are, their global presence, and their continued investment in research and development, which is what keeps them a step ahead of every innovation.

Interestingly, the broad group of these regional and niche players is just a small percentage of the remaining 40%. These companies tend to develop niche applications and compete on cost-efficiency, and being nimble allows them to quickly respond to changing market conditions. The survival of the competitive arena depends on a harmonious existence of efficiency and profit.

Established companies remain the prominent players in the industry. They can command premium prices, but smaller players focus on competitive pricing to have their share of the industry. With the aid of technological improvements in initiator manufacturing and a growing emphasis on sustainable technologies, this industry will be the key driver of progress in the future. The success will be mainly dependent on the ability of continuous innovation, strategic partnerships, and the capitalization of the trend of both polymers and high-performance polymers.

Industry Updates

The sub-segments of the product type category are peroxide, persulfate, azo compounds, and others.

The application category is divided into polyethylene, polypropylene, PVC, polystyrene, ABS, and others.

The regions included in the report are North America, Latin America, Europe, East Asia, South Asia and Pacific, and Middle East & Africa.

The global polymerization initiator market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the polymerization initiator market is projected to reach USD 2.4 billion by 2035.

The polymerization initiator market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in polymerization initiator market are azo compounds, others, peroxide and persulfate.

In terms of application, polyethylene segment to command 27.8% share in the polymerization initiator market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dental Polymerization Lamps Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA