The polymer-based prefilled syringe market is advancing steadily, driven by the need for safe, precise, and patient-friendly drug delivery systems across healthcare settings. Growing adoption of biologics and biosimilars, which often require high-barrier packaging to maintain stability, has accelerated demand for advanced polymer materials. Industry publications and pharmaceutical manufacturing updates have highlighted the limitations of traditional glass syringes, including breakability, delamination risks, and incompatibility with certain sensitive drugs.

Polymer-based alternatives, particularly cyclic olefin-based materials, are being preferred for their superior chemical resistance, dimensional stability, and transparency. Increasing pharmaceutical outsourcing and the shift toward self-administration therapies have further fueled the transition toward polymer-based syringes.

The rise in demand for injectable treatments in chronic disease management, coupled with stringent regulatory standards on drug-device combination products, has reinforced the market's focus on quality, precision, and safety. Looking ahead, continued investment in polymer engineering, fill-finish technologies, and hospital-based drug delivery innovations is expected to drive sustained growth across material, capacity, and end-use segments.

| Metric | Value |

|---|---|

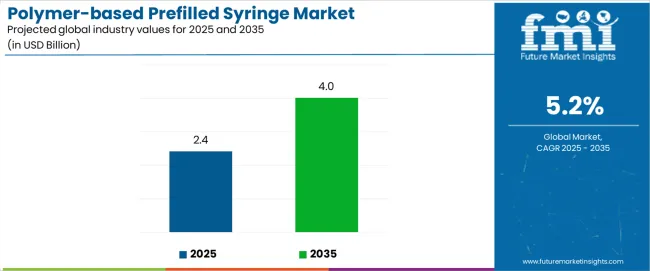

| Polymer-based Prefilled Syringe Market Estimated Value in (2025 E) | USD 2.4 billion |

| Polymer-based Prefilled Syringe Market Forecast Value in (2035 F) | USD 4.0 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

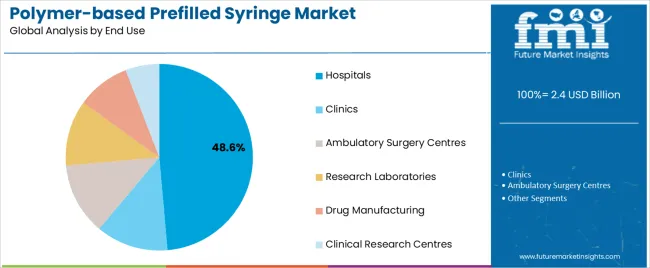

The market is segmented by Material, Capacity, and End Use and region. By Material, the market is divided into Cyclic Olefin Polymer (COP) and Cyclic Olefin Copolymer (COC). In terms of Capacity, the market is classified into Up To 5 Ml, 6 Ml To 20 Ml, 21 Ml To 40 Ml, and Above 40 Ml. Based on End Use, the market is segmented into Hospitals, Clinics, Ambulatory Surgery Centres, Research Laboratories, Drug Manufacturing, and Clinical Research Centres. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

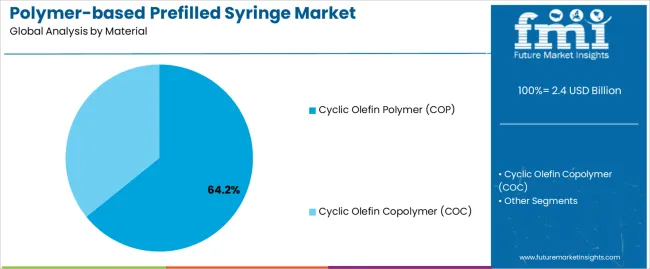

The Cyclic Olefin Polymer (COP) segment is projected to capture 64.2% of the polymer-based prefilled syringe market revenue in 2025, maintaining its dominant share among material types. This growth has been supported by COP’s exceptional moisture barrier properties, dimensional stability, and inertness, which are crucial for the containment of sensitive biologics and high-value injectable drugs.

Manufacturers have preferred COP due to its compatibility with autoclaving and reduced risk of protein aggregation or adsorption. Regulatory filings and pharma industry feedback have highlighted the role of COP in extending shelf-life and ensuring dosage accuracy, especially in ophthalmology, oncology, and biotechnology applications.

Furthermore, its resistance to breakage and shatterproof design offers enhanced safety for healthcare professionals and patients during handling and transportation. As injectable biologics continue to grow in therapeutic importance, the COP segment is expected to retain its leadership due to performance advantages and expanding use in next-generation combination devices.

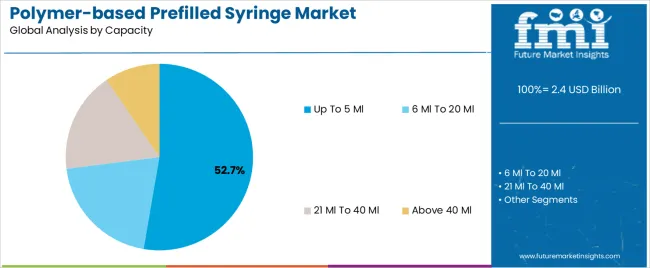

The Up To 5 Ml segment is projected to account for 52.7% of the polymer-based prefilled syringe market revenue in 2025, leading the market in terms of capacity preference. This dominance has been driven by its suitability for single-dose applications across a wide range of therapeutic areas, including vaccines, anticoagulants, and chronic disease injectables.

Healthcare professionals have favored this capacity range due to ease of use, minimal drug wastage, and standardization in clinical and outpatient settings. Pharmaceutical companies have continued to design prefilled systems in this size to ensure compatibility with automated injection systems and to meet regulatory dosing limits.

Additionally, the smaller fill volume supports cold-chain efficiency and reduces material use, aligning with pharmaceutical sustainability goals. With the continued development of low-volume biologics and self-administered therapies, the Up To 5 Ml segment is expected to remain the preferred capacity for both manufacturers and end-users.

The Hospitals segment is expected to hold 48.6% of the polymer-based prefilled syringe market revenue in 2025, maintaining its leading position among end users. This growth has been influenced by the need for rapid, safe, and precise medication delivery in hospital environments, particularly in emergency and critical care settings.

Hospitals have increasingly adopted prefilled syringes to reduce preparation time, eliminate dosing errors, and enhance infection control by minimizing handling. Reports from healthcare systems and procurement bodies have emphasized the cost-effectiveness and operational efficiencies associated with ready-to-use injectable formats.

The rise in biologic drug usage in inpatient care, along with the growing emphasis on standardized protocols for drug administration, has strengthened the role of polymer-based prefilled syringes in hospitals. Furthermore, as injectable therapy volumes increase with expanding healthcare access, hospital systems are expected to sustain high demand for prefilled formats that optimize safety and workflow efficiency.

Advancements in Polymer Technology

Advancements in polymer technology have revolutionized the design and manufacturing of prefilled syringes, leading to the development of high-performance syringe systems that offer numerous advantages in drug delivery and patient safety.

The innovations have significantly improved the compatibility, performance, and reliability of polymer-based prefilled syringes, making them a preferred choice for pharmaceutical manufacturers and healthcare providers.

Drug developers are introducing complex and sensitive biologics, vaccines, and other medications, with the continuous evolution of pharmaceutical formulations. The advanced drug formulations require specialized packaging solutions to maintain their stability and efficacy.

Polymer technology advancements have allowed for the creation of syringes with materials that are highly compatible with a wide range of drugs, including biologics, vaccines, monoclonal antibodies, and high-viscosity formulations. The syringes minimize the risk of drug interactions, degradation, or adsorption, ensuring that the drug remains intact and effective during storage and administration.

Advanced polymer technologies have also enabled the development of syringe materials with reduced levels of extractables and leachables. The advancements ensure that the drug's purity and stability are preserved, reducing the potential for adverse reactions or drug contamination.

Pharmaceutical manufacturers can confidently use polymer-based prefilled syringes, knowing that the syringe material will not compromise the drug's quality or safety.

Expansion of Biopharmaceutical Industry

The expansion of the biopharmaceutical industry is a major driver of the increasing demand for specialized and advanced prefilled syringes. The innovative therapies offer promising solutions for various chronic and life-threatening diseases, such as cancer, autoimmune disorders, and genetic disorders. The need for suitable delivery systems, like prefilled syringes, becomes critical, as more biopharmaceuticals enter clinical development and receive regulatory approval.

Biopharmaceuticals are often complex and sensitive drugs that require specialized handling and delivery systems. They may be susceptible to degradation, denaturation, or instability when exposed to certain conditions, such as light, oxygen, or temperature variations. Prefilled syringes made from advanced polymer materials are designed to provide excellent protection against these environmental factors, ensuring the stability and potency of biopharmaceuticals throughout their shelf life.

Biopharmaceuticals are manufactured using living cells or genetic material, making them more susceptible to contamination from external sources. Prefilled syringes with advanced polymer materials offer excellent barrier properties, minimizing the risk of microbial or particulate contamination during drug administration, which is especially crucial for biopharmaceuticals intended for chronic therapies, as contamination could lead to serious health risks for patients.

High Development and Manufacturing Costs Restricts Market

Polymers such as COP and COC are highly expensive which increases the overall manufacturing cost of prefilled syringes. Manufacturing of polymer-based prefilled syringes requires cutting-edge technology and higher precision which increases the capital expenditure and operational costs.

The production of prefilled syringes involves advanced moulding techniques, stringent quality, and precise control of manufacturing conditions which increase the cost of production. Significant investment is required for specialized investment in equipment and technology for setting up the production facility for polymer-based prefilled syringes.

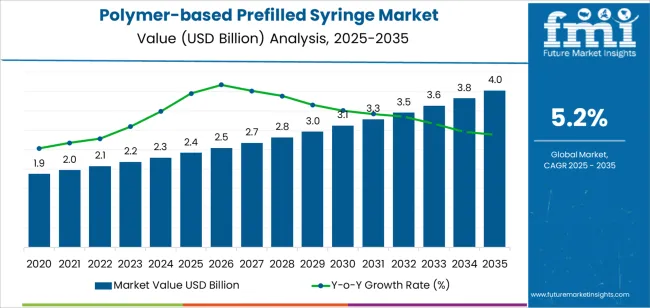

The global polymer-based prefilled syringe industry recorded a CAGR of 5.9% during the historical period between 2020 and 2025. The growth of polymer-based prefilled syringe industry was positive as it reached a value of USD 2.4 billion in 2025 from USD 1.9 billion in 2020.

The growing focus on self-administration of medications is a significant trend in the healthcare industry, driven by several factors, including the rising prevalence of chronic diseases and the increasing aging population. Patients with chronic conditions, such as diabetes, rheumatoid arthritis, multiple sclerosis, and certain autoimmune disorders, often require regular injections of medications to manage their conditions effectively.

In recent years, there has been a shift towards empowering patients to take control of their healthcare by enabling them to administer medications themselves. Self-administration offers numerous benefits to patients, including increased independence, reduced healthcare costs, and improved quality of life. Polymer-based prefilled syringes play a crucial role in facilitating self-injection at home due to their user-friendly design and features:

Polymer-based prefilled syringes are designed with clear and easy-to-read dosing scales, making it simple for patients to measure and administer the correct dosage of the medication. The feature is especially important for patients with visual impairments or limited dexterity, as it ensures accurate dosing and reduces the risk of dosing errors.

Many polymer-based prefilled syringes are engineered with ergonomic features, such as finger grips and smooth plunger movement, to enhance the ease of use. The design elements make the syringes comfortable to handle and enable patients to administer injections with minimal effort and discomfort.

| Particular | Value CAGR |

|---|---|

| H1 | 5.4% (2025-35) |

| H2 | 3.9% (2025-35) |

| H1 | 3.7% (2025-35) |

| H2 | 5.5% (2025-35) |

The above table presents the expected CAGR for the global polymer-based prefilled syringe market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2025 to 2035, the business is predicted to record at a CAGR of 5.4%, followed by a slightly lower growth rate of 3.7% in the second half (H2) of the same decade.

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 3.7% in the first half and remain relatively high at 5.5% in the second half. In the first half (H1) the market witnessed a decrease of 70 BPS while in the second half (H2), the market witnessed an increase of 60 BPS.

Asia is witnessing a rapid increase in its aging population. Elderly individuals often require frequent medication, and prefilled syringes offer a convenient and easy-to-use drug delivery system for healthcare providers and patients. The rising elderly population is expected to drive the demand for polymer-based prefilled syringes in the region.

The prevalence of chronic diseases, such as diabetes, cardiovascular diseases, and rheumatoid arthritis, is on the rise in Asia. Prefilled syringes are commonly used for the administration of chronic disease medications, providing accurate dosing and reducing the risk of errors in self-injection. The rising burden of chronic illnesses is expected to fuel the demand for prefilled syringes in the region.

Asia has witnessed a surge in the adoption of biologic drugs and biosimilar. Prefilled syringes are well-suited for the delivery of biologics, which are often sensitive to environmental factors. The increasing demand for biologic therapies is anticipated to drive the market for polymer-based prefilled syringes in the region.

Several countries in South Asia and Pacific as well as East Asia are implementing healthcare reforms and initiatives to improve access to quality healthcare services. Government support for the adoption of advanced medical technologies and devices, including prefilled syringes, is likely to boost market growth. The region is expected to hold a CAGR of 5.4% over the analysis period.

North America is a hub for the biopharmaceutical industry, with numerous pharmaceutical and biotech companies engaged in the development of biologic drugs and biosimilars. Prefilled syringes are well-suited for the administration of these complex and sensitive medications. The expansion of the biopharmaceutical industry is likely to fuel the adoption of polymer-based prefilled syringes.

Patient safety and convenience are paramount in the healthcare sector. Polymer-based prefilled syringes with safety features, such as needlestick prevention mechanisms and tamper-evident caps, are becoming increasingly popular among healthcare providers and patients alike. The safety features reduce the risk of needlestick injuries and enhance patient compliance with self-administered medications.

There is a growing trend towards home-based healthcare in North America, driven by the aging population and the desire for more convenient healthcare solutions. Prefilled syringes enable patients to self-administer medications at home, reducing the need for frequent hospital visits and improving patient outcomes.

Advancements in polymer-based materials and manufacturing technologies have led to the development of high-quality prefilled syringes with improved barrier properties, reduced leachables, and enhanced drug compatibility. The technological advancements are expected to drive the adoption of polymer-based prefilled syringes in the region. The region is expected to hold a CAGR of 3.5% over the analysis period.

| End Use | Hospitals |

|---|---|

| Value CAGR (2035) | 5.1% |

The hospitals segment holds the largest share of the market. The segment is expected to hold a CAGR of 5.1% during the forecast period. Hospitals are primary healthcare facilities where a significant number of patients are admitted for various medical conditions and treatments.

The growing number of hospitalizations increases the demand for prefilled syringes as they offer a convenient and efficient drug delivery method for healthcare professionals.

Hospitals prioritize the use of ready-to-use medical products to streamline their workflow and save time. Polymer-based prefilled syringes eliminate the need for manual drug preparation, reducing the risk of dosing errors and ensuring accurate and consistent drug administration.

In a hospital setting, quick and accurate drug administration is crucial for patient care. Prefilled syringes provide a reliable and precise method for delivering medications, especially during emergency situations or when rapid interventions are required.

Prefilled syringes are manufactured in a controlled environment, minimizing the risk of contamination and maintaining the sterility of medications. Hospitals prioritize the safety of patients, and prefilled syringes contribute to infection prevention and control.

| Material | COP |

|---|---|

| Value CAGR (2035) | 4.6% |

COP-based prefilled are mostly preferred in the market as they offer high purity and excellent chemical resistance which is essential for drugs to maintain their integrity.

This sensitivity and resistance is essential for biologics and biopharmaceutical industries. COP Syringes provide high mechanical strength and impact resistance which reduce the breakage risk while handling and transportation.

Additionally, they provide excellent barrier properties against moisture and gases which protects the stability and shelf life of the pharmaceutical products. These attributes make COP the material of choice for ensuring the safety, efficacy, and integrity of the pharmaceutical products they contain. COP is anticipated to record a 4.6% CAGR in the upcoming decade.

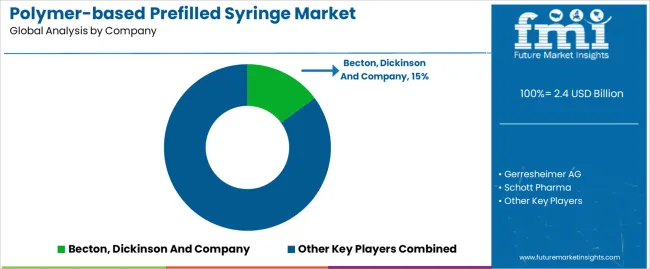

Key players in the polymer-based prefilled syringe market are strongly focusing on profit generation from their existing product portfolios along while exploring potential new applications. The players are emphasizing on increasing their polymer-based prefilled syringe production capacities, to cater to the demand from numerous end use industries. Prominent players are also pushing for geographical expansion to decrease the dependency on imported polymer-based prefilled syringe.

Recent Industry Developments in Polymer-based Prefilled Syringe Market

In terms of material, the industry is divided into Cyclic Olefin Polymer (COP), and Cyclic Olefin Copolymer (COC).

In terms of capacity, the industry is segregated into Up to 5 ml, 6 ml to 20 ml, 21 ml to 40 ml and above 40 ml.

The industry is classified by end use industries as hospitals, clinics, ambulatory surgery centers, research laboratories, drug manufacturing, and clinical research centers.

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia and Pacific, and Middle East and Africa (MEA) have been covered in the report.

The global polymer-based prefilled syringe market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the polymer-based prefilled syringe market is projected to reach USD 4.0 billion by 2035.

The polymer-based prefilled syringe market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in polymer-based prefilled syringe market are cyclic olefin polymer (cop) and cyclic olefin copolymer (coc).

In terms of capacity, up to 5 ml segment to command 52.7% share in the polymer-based prefilled syringe market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Global Prefilled Formalin Vials Market Trends – Size, Share & Growth 2025 to 2035

Prefilled Syringe Drug Molecule Market Analysis - Size, Share, and Forecast 2025 to 2035

Europe Glass Prefilled Syringes and Glass Vials Packaging Equipment Market Analysis – Outlook & Forecast 2025–2035

Syringes and Injectable Drugs Packaging Market Size and Share Forecast Outlook 2025 to 2035

Syringe Scale Magnifiers Market Size and Share Forecast Outlook 2025 to 2035

Syringe Labels Market Size and Share Forecast Outlook 2025 to 2035

Syringes Market Analysis - Growth & Demand 2025 to 2035

Syringeless Injector Market Analysis – Size, Share & Forecast 2025-2035

Syringe Filling Machine Market from 2024 to 2034

Syringe Trays Market

BFS Syringes Market Analysis - Size & Growth Forecast 2025 to 2035

MENA Syringes & Cannula Market Size and Share Forecast Outlook 2025 to 2035

Oral Syringe Market

Safety Syringe Market Size and Share Forecast Outlook 2025 to 2035

Plastic Syringe Market Trends & Healthcare Innovations 2025 to 2035

Slip Tip Syringe Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of Slip Tip Syringe Providers

Luer Lock Syringe Market Size and Share Forecast Outlook 2025 to 2035

Irrigation Syringe Market Size and Share Forecast Outlook 2025 to 2035

Hypodermic Syringes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA