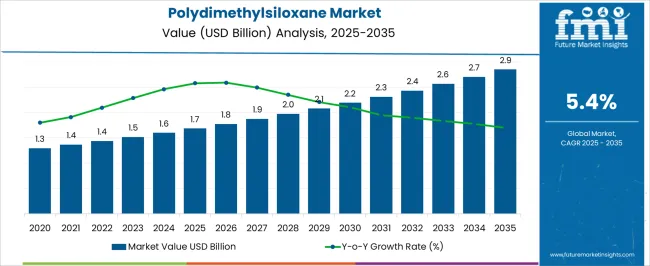

The Polydimethylsiloxane Market is estimated to be valued at USD 1.7 billion in 2025 and is projected to reach USD 2.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

The Polydimethylsiloxane market is witnessing significant growth driven by its versatile applications across multiple industries, including automotive, electronics, personal care, and manufacturing. The future outlook of this market is largely influenced by the increasing demand for high-performance materials with excellent thermal stability, chemical resistance, and lubricating properties. Rising industrialization and growing adoption of advanced manufacturing processes have accelerated the need for silicone-based solutions, particularly in applications requiring durability and efficiency.

Technological advancements in polymer chemistry are enhancing product performance, enabling new formulations that cater to evolving industry requirements. Additionally, the trend toward eco-friendly and sustainable materials is creating opportunities for innovative applications of Polydimethylsiloxane.

The market is also being supported by the rising consumption of personal care and cosmetic products, where the material’s properties improve texture, spreadability, and skin compatibility As industries continue to prioritize performance, safety, and sustainability, Polydimethylsiloxane is expected to maintain steady growth across established and emerging markets.

| Metric | Value |

|---|---|

| Polydimethylsiloxane Market Estimated Value in (2025 E) | USD 1.7 billion |

| Polydimethylsiloxane Market Forecast Value in (2035 F) | USD 2.9 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

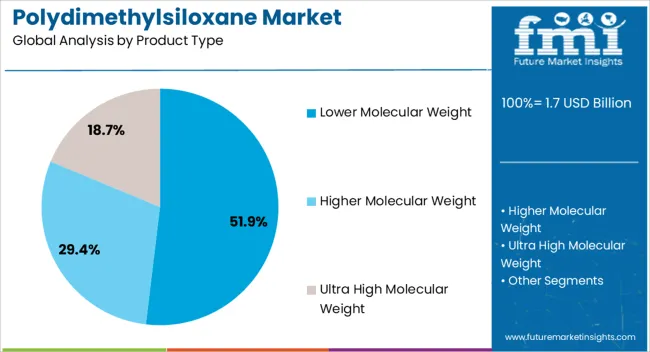

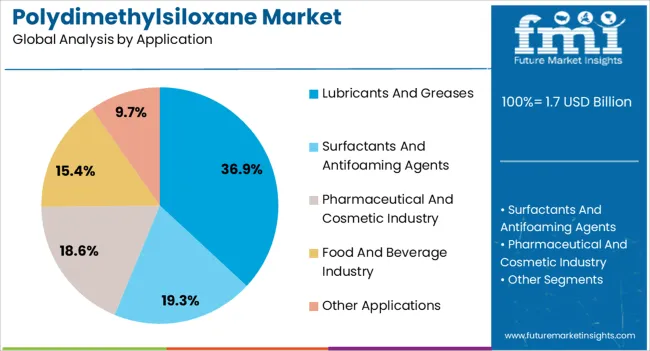

The market is segmented by Product Type and Application and region. By Product Type, the market is divided into Lower Molecular Weight, Higher Molecular Weight, and Ultra High Molecular Weight. In terms of Application, the market is classified into Lubricants And Greases, Surfactants And Antifoaming Agents, Pharmaceutical And Cosmetic Industry, Food And Beverage Industry, and Other Applications. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The lower molecular weight product type segment is projected to hold 51.90% of the Polydimethylsiloxane market revenue share in 2025, establishing it as the leading product type. This dominance is attributed to its superior processability, low viscosity, and compatibility with a wide range of formulations. The segment has benefited from increasing demand in industrial applications where uniform coating, lubrication, and stability are critical.

Additionally, its adaptability to chemical modifications allows it to meet specific performance requirements across diverse sectors. The widespread use of lower molecular weight Polydimethylsiloxane in applications requiring precise viscosity control, high thermal stability, and effective surface protection has reinforced its position in the market.

Growing investments in research and development to optimize polymer characteristics further support the adoption of this product type Its combination of performance, versatility, and cost-effectiveness continues to drive its leading share in the market.

The lubricants and greases application segment is expected to account for 36.90% of the Polydimethylsiloxane market revenue share in 2025, positioning it as the leading application. This growth is driven by the increasing demand for high-performance lubricants that provide superior thermal stability, oxidation resistance, and long-lasting lubrication under extreme conditions.

Polydimethylsiloxane is preferred in this segment due to its ability to reduce friction, prevent wear, and maintain performance over a wide temperature range. The adoption of advanced manufacturing equipment and automotive machinery has further accelerated the use of silicone-based lubricants.

Additionally, the segment benefits from regulatory requirements that encourage the use of environmentally friendly and non-toxic lubricants The combination of enhanced operational efficiency, reliability, and safety has made Polydimethylsiloxane-based lubricants and greases a preferred choice across industries, sustaining the segment’s leading revenue share in the market.

Pioneering Progress, Expanding Horizons with Advancements in Silicone Technology

The world of silicone technology is experiencing a transformative evolution, with ongoing advancements pushing the boundaries of innovation and application versatility. The development of high performance and specialty silicones, in particular, has opened new avenues for polydimethylsiloxane, propelling the market growth.

The advent of high performance PDMS variants allows for the formulation of products with superior durability, temperature resistance, and chemical stability, expanding the scope of applications across industries.

For instance, the high performance PDMS sealants, in the automotive sector, offer enhanced weatherproofing and sealing capabilities, ensuring long term performance in harsh environments.

Role of Polydimethylsiloxane in the Surge of Personal Care Products

Polydimethylsiloxane stands at the forefront of the personal care revolution, offering a versatile solution for formulators seeking to create high performance skincare, haircare, and hygiene products.

The emollient and conditioning properties make PDMS, a prized ingredient in skin creams, shampoos, and antiperspirants, providing a silky smooth texture and enhancing product efficacy.

The allure of PDMS lies in its ability to impart a luxurious feel and improve product performance across various personal care applications.

PDMS creates a soft and velvety texture in skin creams, while helping to lock in moisture and smooth out imperfections. In shampoos, the PDMS provides a silky lather and helps detangle hair, leaving the material feeling soft and manageable.

Building the Future, Polydimethylsiloxane to Pave the Way in the Construction Industry

Polydimethylsiloxane plays a pivotal role in the construction industry, offering a range of applications such as sealants, adhesives, and coatings renowned for the exceptional weather resistance and durability.

The demand for silicone based construction materials, including PDMS, is poised to witness significant growth, as urbanization accelerates and infrastructure development projects surge globally.

The PDMS adhesives play a crucial role in bonding diverse substrates in construction applications, offering superior adhesion strength and durability. PDMS adhesives, whether used for bonding glass panels, metal structures, or composite materials, provide reliable and lasting bonds that withstand the rigors of environmental exposure and structural stresses.

The scope for polydimethylsiloxane rose at a 3.8% CAGR between 2020 and 2025. The global market is achieving heights to grow at a significant CAGR of 5.4% over the forecast period 2025 to 2035.

The market experienced a steady demand from established industries such as cosmetics, healthcare, electronics, and construction during the historical period. The demand was driven by the unique properties of polydimethylsiloxane such as flexibility, thermal stability, and water repellency, which are valued in various applications across the sectors.

There was an emergence of new applications for polydimethylsiloxane, particularly in industries including 3D printing, energy storage, and water treatment. Innovations in polydimethylsiloxane technology and growing awareness of its benefits led to the exploration of new applications, driving market growth and diversification.

Innovations in silicone technology, including the development of high performance and specialty silicones, contributed to the market growth. The advancements enabled the formulation of innovative products with enhanced properties, expanding the application scope of polydimethylsiloxane across various industries.

The market forecast projects continued growth in end use industries such as personal care, automotive, electronics, and construction. Increasing consumer demand for silicone based products and ongoing technological advancements will drive sustained growth in the sectors, boosting the demand for polydimethylsiloxane.

Polydimethylsiloxane will play a significant role in emerging technologies such as electric vehicles, 5G telecommunications, and advanced composite materials. The market forecast projects increased integration of polydimethylsiloxane in the technologies, driven by its unique properties and performance advantages, contributing to market growth in the sectors.

The following table shows the estimated growth rates of the top three markets. India and China are set to exhibit high demand in polydimethylsiloxane, recording CAGRs of 8% and 6%, respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| The United States | 1% |

| The United Kingdom | 2.1% |

| Japan | 2.3% |

| China | 6% |

| India | 8% |

The polydimethylsiloxane market in the United States will expand at a CAGR of 1% through 2035.

The country is home to diverse industries such as cosmetics, healthcare, electronics, automotive, construction, and textiles, all of which are major consumers of PDMS. The growing demand for silicone based products in the industries, driven by factors such as technological advancements, innovation, and consumer preferences, will fuel the market growth.

The United States is a hub for innovation and technological advancements in materials science, polymer chemistry, and engineering. Ongoing research and development efforts in PDMS technology are leading to the development of new formulations, applications, and manufacturing processes, driving market growth and competitiveness.

Infrastructure development projects, including transportation, utilities, and urban development, drive demand for construction materials such as sealants, adhesives, and coatings, where PDMS finds extensive applications.

There is a growing demand for PDMS based products, with increasing investments in infrastructure and construction projects in the United States, boosting the market growth.

The polydimethylsiloxane market in the United Kingdom to expand at a CAGR of 2.1% through 2035.

The country is committed to transitioning to renewable energy sources to meet climate targets and reduce dependence on fossil fuels. PDMS is a key material used in the production of solar panels, and the expansion of solar PV installations in the country is driving demand for PDMS as a raw material.

The country has a strong research and development ecosystem, with academic institutions, research organizations, and industry players collaborating on PDMS technology and applications.

Ongoing innovation and research efforts drive the development of new formulations, applications, and manufacturing processes, driving market growth and competitiveness.

Infrastructure development projects, including transportation, utilities, and urban development, drive demand for construction materials such as sealants, adhesives, and coatings, where PDMS finds extensive applications. There is a growing demand for PDMS based products, boosting the market growth, with increasing investments in infrastructure and construction projects in the country.

Polydimethylsiloxane trends in India are taking a turn for the better. An 8% CAGR is forecast for the country from 2025 to 2035.

PDMS is used in the food and beverage industry for applications such as antifoaming agents, release agents, and food grade lubricants. There is a rising demand for PDMS based materials and additives, with the growing food processing industry and increasing demand for packaged food and beverages in India.

The aerospace and defense sector in India is experiencing significant growth, driven by government initiatives such as Make in India for Defense and increased defense spending. PDMS is used in aerospace applications such as sealants, adhesives, and coatings for aircraft manufacturing and maintenance, contributing to market growth in the sector.

PDMS is used in the textile and apparel industry for applications such as fabric softeners, water repellents, and anti static agents. There is a growing demand for PDMS based additives and finishes to enhance textile properties and performance, with India being a major textile producer and exporter.

| Segment | Lower Molecular Weight (Product Type) |

|---|---|

| Value Share (2025) | 51.9% |

In terms of product type, the lower molecular weight segment will dominate the market, and will account for a share of 51.9% in 2025.

Lower molecular weight typically exhibits better flow properties and improved processability compared to higher molecular weight counterparts. The characteristic makes easier for material to handle and formulate into various products, leading to increased demand across multiple industries.

Polydimethylsiloxane variants are often more cost effective to produce compared to higher molecular weight grades. The affordability makes them attractive for manufacturers looking to optimize production costs while maintaining product quality, thus driving market growth.

Lower molecular weight polydimethylsiloxane finds diverse applications across industries such as cosmetics, personal care products, lubricants, and coatings. Its versatility allows for use in a wide range of formulations and end products, contributing to its market growth.

The lower molecular weight polydimethylsiloxane tends to have better spreadability and coverage, making the material ideal for applications where uniform coverage and smooth texture are desired, such as in skincare and cosmetic products. The property drives demand from the personal care industry, boosting the segmental growth.

| Segment | Lubricants and Greases (Type) |

|---|---|

| Value Share (2025) | 36.9% |

In terms of application, the lubricants and greases segment will dominate the polydimethylsiloxane market, and will account for a share of 36.9% in 2025.

Polydimethylsiloxane exhibits excellent lubrication properties, such as low surface tension, high viscosity index, and thermal stability over a wide temperature range. The properties make polydimethylsiloxane an ideal lubricant additive for enhancing the lubricity and performance of oils and greases in various industrial applications.

Polydimethylsiloxane based lubricants and greases reduce friction and wear between moving mechanical components, prolonging equipment lifespan and reducing maintenance costs.

The ability of polydimethylsiloxane to form durable and protective lubricating films helps prevent metal to metal contact and minimize surface damage, driving demand for PDMS in lubricant formulations.

PDMS based lubricants and greases offer excellent thermal stability and resistance to high temperatures, making them suitable for use in extreme operating conditions. PDMS lubricants, whether in high temperature industrial processes or low temperature environments, maintain the lubricating properties, providing reliable performance across a wide temperature range.

PDMS based lubricants and greases are compatible with a wide range of materials commonly found in machinery and equipment, including metals, plastics, elastomers, and composites. The compatibility ensures that PDMS lubricants do not cause damage or degradation to equipment components, enhancing the suitability for diverse applications.

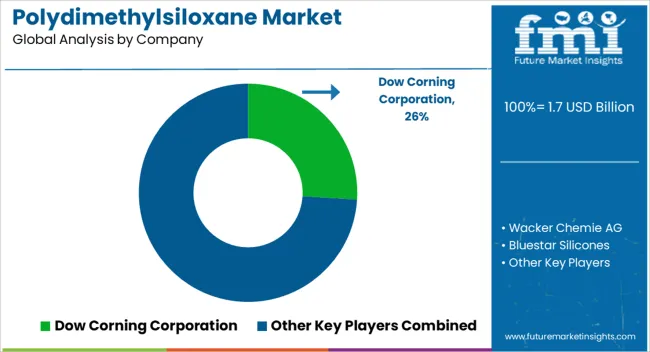

The Polydimethylsiloxane market is characterized by the presence of several key players competing based on factors including product innovation, technological advancements, geographical presence, distribution network, and pricing strategies.

Companies often pursue expansion strategies such as mergers, acquisitions, and partnerships to strengthen the market position, expand the geographical presence, and enhance the product portfolios. Strategic acquisitions allow companies to gain access to new technologies, capabilities, and customer bases.

Companies aim to expand the geographical presence in emerging markets with high growth potential, such as Asia Pacific and Latin America, which includes establishing manufacturing facilities, distribution networks, and sales offices to better serve local customers and capture market opportunities.

A leader in silicone technology, Dow Corning offers a diverse range of polydimethylsiloxane products tailored for various applications, including industrial lubricants, mold making materials, sealants, and personal care formulations.

Wacker Chemie AG, known for its silicone solutions provides polydimethylsiloxane for applications such as coatings, construction materials, electronics encapsulation, and release agents due to its expertise in silicone chemistry.

The report consists of key product types of polydimethylsiloxane including lower molecular weight, higher molecular weight, and ultra high molecular weight.

The market is classified into lubricants and greases, surfactants and antifoaming agents, pharmaceutical and cosmetic industry, food and beverage industry, and other applications.

The analysis of the polydimethylsiloxane market has been carried out in key countries North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, The Middle East and Africa

The global polydimethylsiloxane market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the polydimethylsiloxane market is projected to reach USD 2.9 billion by 2035.

The polydimethylsiloxane market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in polydimethylsiloxane market are lower molecular weight, higher molecular weight and ultra high molecular weight.

In terms of application, lubricants and greases segment to command 36.9% share in the polydimethylsiloxane market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA