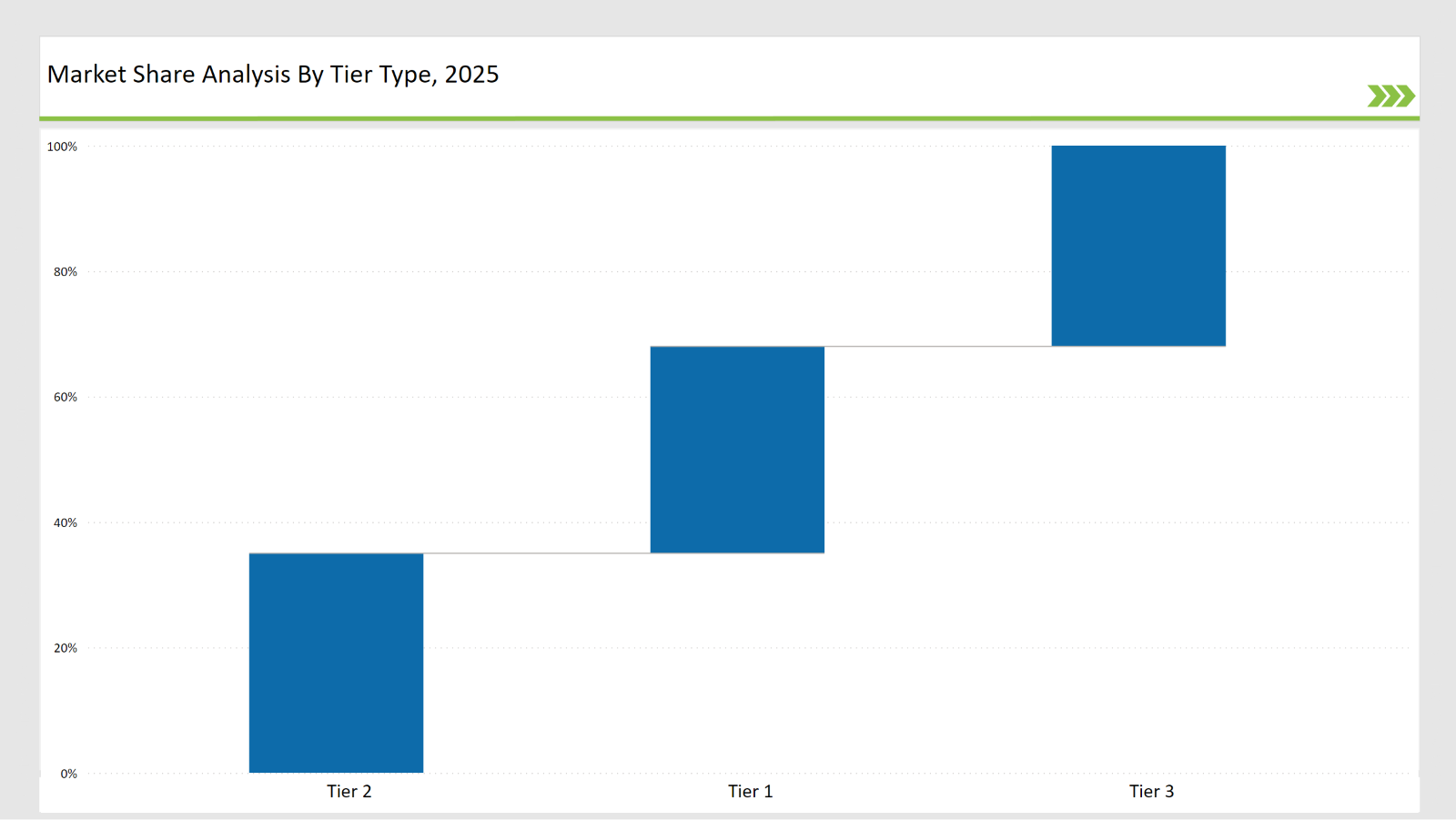

The Polycoated Packaging Market is moderately fragmented and competitive. Tier 1, Tier 2, and Tier 3 players compete in this industry. The leading manufacturers-Amcor Plc, Mondi Group, and WestRock-control approximately 52% of the total market. High-barrier coating technologies, compliance with food safety and pharmaceutical regulations, and extensive global supply chains have led to the same. These are the drivers of market due to increased demand for moisture-resistant, recyclable, and sustainable polycoated packaging solutions.

Tier 2 players include Sealed Air Corporation, UFlex, and Huhtamaki. They occupy about 32% of market share. These players mostly manufacture cost-effective, high-barrier, and customized polycoated packaging that caters to mid-sized food and beverage, personal care, and pharmaceutical packaging firms.

Tier 3 players represent the remaining 16% of the market, consisting of regional manufacturers and niche players. These companies specialize in customized, low-cost polycoated packaging solutions, meeting specific client needs such as biodegradable coatings, lightweight structures, and enhanced grease and moisture resistance.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Amcor Plc, Mondi Group, WestRock) | 15% |

| Rest of Top 5 (Sealed Air Corporation, UFlex) | 8% |

| Next 5 of Top 10 (Huhtamaki, Tetra Pak, Stora Enso, DS Smith, Smurfit Kappa) | 10% |

Type of Player & Industry Share (%), 2025

| Player Tier | Industry Share (%) |

|---|---|

| Top 10 Players | 33% |

| Next 20 Players | 35% |

| Remaining Players | 32% |

Segmented by primary end-use industries, the Polycoated Packaging Market includes:

To meet industry needs, vendors offer various solutions, including:

Sustainability remains a priority, with companies investing in water-based coatings, recyclable laminated packaging, and lightweight material innovations.

Manufacturers are investing in biodegradable barrier coatings, advanced polymer lamination technologies, and AI-driven quality control to continue leading the market. Companies are also making use of automated manufacturing, digital twin models, and sustainable material innovations to make it more durable, recyclable, and compliant. Strategic partnerships with food packaging firms, pharmaceutical brands, and e-commerce retailers are increasing market reach.

Year-on-Year Leaders

Technology suppliers should prioritize

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Amcor Plc, Mondi Group, WestRock |

| Tier 2 | Sealed Air Corporation, UFlex, Huhtamaki |

| Tier 3 | Tetra Pak, Stora Enso, DS Smith, Smurfit Kappa |

| Manufacturer | Latest Developments |

|---|---|

| Amcor Plc | Developed fully recyclable, moisture-resistant polycoated packaging in January 2024. |

| Mondi Group | Introduced AI-driven, high-barrier fiber-based polycoated solutions in March 2024. |

| WestRock | Launched tamper-proof, eco-friendly polycoated cartons in April 2024. |

| Sealed Air Corporation | Expanded bio-based polycoating for perishable food packaging in May 2024. |

| UFlex | Enhanced customization options for laminated flexible packaging in June 2024. |

| Huhtamaki | Invested in antimicrobial coatings for polycoated food packaging in July 2024. |

Leading companies in the Polycoated Packaging Market leverage

The market for Polycoated Packaging is shifting towards biodegradable coatings, smart manufacturing, and AI-driven quality control. Companies are adopting processes of IoT-enabled real-time monitoring and predictive maintenance in enhancing efficiency while removing wastage.

Focus is on environmentally friendly innovation aligned with market leaders' expectations of regulatory and consumer requirements: biodegradable polycoatings, fiber-based light-weight packaging, and water-based barrier coatings. There is increasing demand for high-performance, fully compostable polycoated packaging for food, pharma, and industrial applications.

Leading manufacturers include Amcor Plc, Mondi Group, WestRock, Sealed Air Corporation, and UFlex.

The top 3 players collectively account for 15% of the global market.

The market concentration is medium, with leading players controlling approximately 37% of the industry.

AI-driven automation, smart monitoring, and increasing demand for recyclable polycoated packaging.

Tape Banding Machine Market Overview - Demand & Growth Forecast 2025 to 2035

Takeaway Containers Market Report - Key Trends & Forecast 2025 to 2035

PVC Packing Straps Market Report – Key Trends & Forecast 2025 to 2035

Reusable Packing Market Analysis – Size, Share & Forecast 2025 to 2035

Printed Boxes Market Analysis – Trends, Demand & Forecast 2025 to 2035

Poultry Packaging Market Insights - Trends & Future Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.