From 2025 to 2035, global demand for biodegradable polymers for packaging, agriculture, textiles, consumer goods and others are increasing the growth of poly butylene succinate (PBS) market. PBS, as a sustainable substitute to fossil-fuel-based plastics, is in line with rising shift in consumer demand toward sustainable products and stringent laws to control plastic littering.

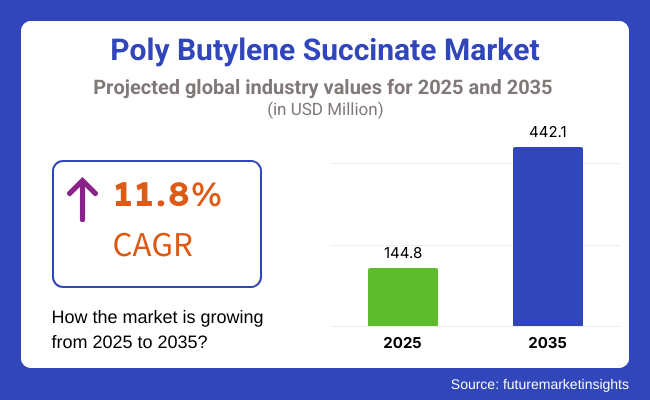

The market for poly butylene succinate is expected to reach approximately USD 144.8 Million by 2025 and for USD 442.1 Million by 2035 reflecting a compounded annual growth rate (CAGR) of 11.8%.

The upsurge of biodegradable and compostable materials fuelled by governmental policies and corporate commitments to going green is driving the acceptance of PBS. Furthermore, advances in high-performance PBS composites and new processing technology are offering manufacturers new opportunities to meet diverse industrial demand.

Explore FMI!

Book a free demo

High demand to reduce plastic waste levels and increased usage of bioplastics including PBS in various packaging and agricultural applications, making North American region a high growth area for North America Poly butylene succinate market. As an illustration, government support for R&D in biodegradable polymers in the United States and Canada is leading to novel PBS grades with superior mechanical properties and enhanced processing performance.

Government entities like the USA Department of Agriculture (USDA) are promoting the adoption of bio based products, while corporate sustainability programs are fuelling the incorporation of PBS in sustainable packaging solutions for food, beverages, and personal care items. The North America PBS market share would continue to be a key contributor to the global PBS market and this shall be confirmed due to the increased number of specialty polymer manufacturers and advancements in production technologies in the region.

Europe leads the way in sustainable materials, backed by ambitious legislation, including the European Union’s Single-Use Plastics Directive and the EU Green Deal. These policies are a driving force behind the shift from traditional plastics to biodegradables such as Poly butylene succinate. Germany, France and Italy are among the countries taking the lead, fuelled by strong investments into bioplastics R&D and a nationwide commercial composting infrastructure.

PBS in mulch films and biodegradable plant pots is also being adopted in the agricultural sector of the region, with this polymer also making its way into compostable bags, wraps, and containers in the packaging industry. European chemical producers are collaborating with universities and research institutions to create new catalysts and synthesis techniques that boost market opportunities for PBS.

The Asia-Pacific region is expected to be the fastest-growing market for Poly butylene succinate, with China, Japan, South Korea, and India contributing most of the demand. The production and utilization of PBS has increased substantially regarding the rapid industrialization of the region and growing knowledge among consumers regarding sustainable packaging solutions. In fact, it has emerged as a global bioplastics hub, building numerous PBS manufacturing plants and also promoting domestic R&D.

Japan and South Korea, which have sophisticated chemical sectors, are concentrating on high-performance PBS grades for niche end uses, including electronics, auto parts and medical devices. At the same time, India’s growing agricultural and packaging industries are using PBS to achieve national sustainability targets. In addition, the commitment of the Asia-Pacific region to green initiatives and the availability of low-cost manufacturing resources act as major-driving factors to boosting the growth of PBS market globally.

Challenge

Expenditure on production and market recognition

The Poly butylene Succinate (PBS) Industry is also scrutinized for its high manufacturing cost, low awareness and regulatory barriers. PBS is synthesized using advanced polymerization techniques and sustainable feedstock’s, resulting in much higher processing cost in compared with conventional plastics. Furthermore, although PBS is a biodegradable and environmentally friendly material, it is still not widely used in many fields due to a lack of knowledge of the material among producers and final users.

Harsh environmental laws add to the difficulty of expanding into the market, necessitating compliance with emerging sustainability requirements. In order to meet these challenges, companies need to invest in cost-effective production methods, broaden market education efforts, and partner with regulatory authorities to streamline compliance and stimulate widespread uptake of PBS.

Opportunity

The booming need for biodegradable polymers and eco-friendly packaging

Sustainability and waste reduction are gaining global participant interest in growing the PBS Market. With various governments and corporations establishing tighter restraints against single-use plastics, biodegradable substitutes such as PBS are being adopted. Bio-based solutions are being actively sought by many industries such as food packaging, agriculture, and consumer goods to decrease their carbon footprint.

Also, recent advances in PBS formulations are increasing its mechanical strength and making it a more competitive alternative to conventional polymers. As demand for these products grows, companies that can provide cost-efficient, top-performing PBS materials and forge partnerships with key packaging and consumer brands will we well positioned to excel in the rapidly evolving bioplastics space.

Due to increasing environmental concerns, governmental bans on non-biodegradable plastics, and escalating investments in biopolymer research, the PBS Market is likely to expand substantially from 2020 to 2024. Governments across the globe implemented incentives and subsidies to promote biodegradable plastics with the aim of encouraging manufacturers to ramp up production. However, the prohibitive cost of raw materials and production processes inhibited widespread deployment. Its manufacturers will work on improving production yield and introduce renewable feedstocks like bio-based succinic acid to foray sustainable as well as cost effective products.

The significant period (2025 to 2035) is expected to witness wide commercialization and technology evolution in the market. As noted in the study, artificial intelligence, or AI, will help to accelerate polymer research and development around next-generation PBS materials that not only perform better but are also more process able, leading to improved durability. Advances in bio-refining and microbial fermentation will improve and decrease the costs of production, making PBS an alternative to common plastics. Applications of PBS in automotive, textiles, and medical applications will increase the market scope for PBS beyond the classical packaging solutions. The next phase of PBS market growth will be possum- and driven by companies who align their strategies with principles of a circular economy, recyclability and capital commitment to scalable production technologies.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Policies promoting biodegradable plastics in select regions |

| Technological Advancements | Improvements in PBS production efficiency and bio-based feedstock’s |

| Industry Adoption | Increased use in packaging and disposable products |

| Supply Chain and Sourcing | High dependence on specific bio-based feedstock’s |

| Market Competition | Presence of biopolymer start-ups and specialty chemical firms |

| Market Growth Drivers | Rising bans on single-use plastics and demand for sustainable materials |

| Sustainability and Circular Economy | Initial efforts to improve PBS recyclability and lifecycle analysis |

| AI and Automation in Polymer Manufacturing | Early-stage AI adoption in biopolymer processing |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Global mandates for replacing single-use plastics with biodegradable alternatives. |

| Technological Advancements | AI-driven polymer research, enhanced formulation techniques, and advanced bio-refining. |

| Industry Adoption | Expansion into automotive, textiles, agriculture, and medical applications. |

| Supply Chain and Sourcing | Diversification of raw material sources and regionalized supply chains. |

| Market Competition | Entry of large petrochemical companies investing in biodegradable plastics. |

| Market Growth Drivers | Full integration of PBS in circular economy models and low-carbon industrial solutions. |

| Sustainability and Circular Economy | Development of closed-loop recycling systems and bio-based PBS with enhanced degradability. |

| AI and Automation in Polymer Manufacturing | Fully automated production with AI-optimized polymer formulations and process control. |

The USA polly butylene succinate market is growing at a very fast rate in the context of increasing demand for green packaging, supporting government regulation of biodegradable packaging, and enhanced investment in bio-refinery processes. The United States Environmental Protection Agency (EPA) and the Department of Energy (DOE) are propelling bio-based plastics and compostable plastics in order to contain plastic pollution.

Packaging of food and beverages is a prime driving factor, with businesses using biodegradable food packaging films, trays, and coatings. Agro business also uses poly butylene succinate-based mulching films and pots for plants in lieu of plastics.

As consumer awareness regarding plastic waste increases and R&D spending on bio-based polymer manufacturing increases, the USA polly butylene succinate market will expand strongly.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 12.3% |

UK polly butylene succinate market is increasing due to rigorous environmental regulations, increased use of compostable packs, and a push by governments to eliminate the use of single-use plastics. The UK's Plastic Packaging Tax is forcing makers to move from traditional materials towards bio-based substitutes like polly butylene succinate.

Food retail chains are among the major customers, including polly butylene succinate-based films, cutlery, and trays, to fulfil the sustainability goals. Circular economy within the UK is also offering encouragement for investment in recycling plants and production of biodegradable polymers.

With growing governmental support and company efforts towards environmental-friendly packaging, the UK polly butylene succinate market is slated for long-term growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 11.4% |

The European Union poly butylene succinate market is growing at a very fast rate, fueled by efforts to restrain plastic waste through tighter regulation, growing application in compostable packages, and healthy investment in R&D of bio-based polymers. The EU Single-Use Plastics Directive (SUPD) and Green Deal initiatives are propelling the market towards biodegradable and eco-friendly material.

Germany, France, and Italy are at the forefront of embracing polly butylene succinate-based packaging material for food, agricultural usage, and pharmaceutical uses. EU bioplastics market, through its robust growth spurred by firms investing in the manufacture of polly butylene succinate from bio-based succinic acid, is driving market growth.

Since the EU is focusing its efforts on plastic reduction and a higher proportion of biologically based products, the need for polly butylene succinate will raise significantly.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 11.9% |

The Japanese polly butylene succinate market is expanding very powerfully due to government backing for biodegradable plastics, rising investment in sustainable materials, and changing agricultural and packaging demand. Japan has been a leader in the drive towards biopolymer technology, and the likes of industry heavyweights Mitsubishi Chemical and PTT MCC Biochem are manufacturing bio-based poly butylene succinate from renewable feedstocks.

The effort by the Japanese government to eliminate plastic waste is inspiring industries to use poly butylene succinate as a material for food packaging, disposable cutlery, and agricultural films. The field of medicine is also adopting poly butylene succinate-based material for medical sutures and drug delivery systems as they are biocompatible and biodegradable.

With constant advancements in bio-based polymer technology and policies to encourage green products, the Japanese market for poly butylene succinate will witness a gradual growth trend.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 11.6% |

Demand for South Korean poly butylene succinate is growing gradually with the government push towards biodegradable plastic, rising application in food packaging, and rising demand from the agriculture sector. Initiatives of the Korean Ministry of Environment to reduce plastic waste are forcing manufacturers to switch over to bio-based and compostable polymers.

Food packaging and drink packaging are significant consumers, using poly butylene succinate-based biodegradable film and containers to meet the demand for sustainability. Mulch films made from poly butylene succinate are being used more in agriculture as an alternative to the traditional polyethylene-based plastic.

Increasing R&D expenditures in bioplastics and incentives from the government towards green packaging materials are propelling the South Korean market for poly butylene succinate towards consistent growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 11.7% |

The PBS market has gained a significant share in the bio-based and petro-based segments, driven by the increasing adoption of biodegradable and high-performance polymers by industries to reduce environmental impact, improve sustainability, and enhance material functionality. PBS product types are key components of the PBS chemical technology. These product types are the main advantage/place in which PBS gives high mechanical strength, high thermal stability, and excellent processability, making them present in packaging, agriculture, automotive, and consumer goods.

Bio-based PBS has become one of the most common green polymers with great biodegradability, good mechanical properties, and less fossil fuel consumption. In contrast to traditional petro-based plastics, bio-based PBS is derived from renewable resources like bio-succinic acid and bio-1,4-butanediol, offering reduced carbon footprints and improved sustainability compatibility.

The increasing adoption of bio-based PBS, mainly used for sustainable packaging, owing to the emerging need for compostable, recyclable and biocompatible alternatives to conventional plastics has been driving the adoption of biodegradable PBS-based films and containers, as brands look to improve their sustainability credentials and comply with the plastic bans of the future. Research results show that bio-based PBS packaging increases product shelf life and reduces waste, especially in the food and beverage industry.

Bioplastics have emerged as a key component in the development of PBS applications, which continue to grow in sectors such as agriculture with biodegradable mulch films, compostable pots, and controlled-release fertilizers, driving demand and encouraging market growth to meet sustainable and organic farming standards.

The properties of bio-based PBS in biomedical application with bio-suture, drug delivery system, and bioresorbable implants have further increased adoption as it plays an important role in ensuring better performance in the application for medical treatments and tissue engineering.

The introduction of high strength bio-based PBS composites with enhanced formulations with natural fibers and biopolymers have further optimized market growth ensuring acceptance in automotive, electronics and durable consumer products.

Adoption of bio-based PBS in textile applications with biodegradable fibers for sustainable fashion, sportswear and eco-friendly nonwovens have further driven the market growth and enhanced compliance with circular economy requirements.

Although bio-based PBS offers significant advantages over petrochemical-derived PBS in terms of biodegradability, renewable sourcing, and processability, it still encounters a host of challenges, including high production costs, limited scalability, and reliance on bio-feedstock availability. But recent breakthroughs in AI enabled fermentation technologies, enzymatic bio-catalysis, and next generation bio-refinery integration are improving cost-efficiency, production scalability, and bio-feedstock optimization spurring continuous market growth of bio-based PBS.

Petro-based PBS also has seen significant market penetration in industrial packaging, automotive components, and durable goods, as manufacturers increasingly use petro-based PBS to improve polymer flexibility, mechanical durability, and thermal resistance. On the other hand, petro-based PBS guarantees steady performance and cost-effectiveness compared to bio-based alternatives, widening the commercial scope and making industrial scale adoption possible.

In addition, adoption of cost effective PBS polymers has witnessed a steady rise, primarily in response to demand for petro-based PBS in high-heat applications that include thermally stable, high-strength formulations for automotive parts and electronic casings, as such industries seek performance-based alternatives to traditional engineering plastics. Petro-based PBS materials are also reported to offer excellent processability, higher impact resistance, and increased durability for enhanced product reliability.

The ongoing proliferation of petro-based PBS in industrial applications, films, and coatings, with moisture resistance and mechanical strength as the key high-barrier properties, has bolstered the market demand, resulting in a substantial adoption rate in food packaging, industrial laminates, and protective films.

The incorporation of petrochemical based PBS in construction materials, such as heat resistant and lightweight composites used in insulation panels, roofing sheets, and flooring for sustainability, has accelerated adoption further, promising better durability and lower environmental footprints.

Hybrid PBS polymer blends, optimized formulations and significantly increased content of polyethylene, polypropylene and polylactic acid (PLA) for enhanced performance, have further optimized market growth and ensured greater penetration in applications such as technical textiles, nonwoven fabrics and specialty coatings.

The utilization of petroleum-based PBS in 3D printing materials with high-resolution, durable and economical filament formulations has bolstered the growth of the overall market, providing improved adaptability in rapid prototyping and additive manufacturing applications.

On the other hand, while petro-based PBS is more cost-effective, highly durable and industrially scalable. Emerging innovations-such as AI-driven polymer formulation, next-gen hybrid PBS resins, and carbon-neutral production processes-are enabling sustainability, recyclability and market competitiveness to ensure the market expansion of petro-based PBS continues.

The injection molding and extrusion segments are two of the largest market drivers as manufacturing facilities adopt PBS-based processing technologies for increased product customization, improved production efficiencies, and enhanced material performance in various applications.

Among all the processing methods, injection molding has become one of the most popular methods for PBS polymers, because it is high precision, small material waste, and good scalability. Injection molding is dissimilar to traditional processing methods and allows complex product designs to guarantee better dimensional precision and cost-effectiveness in mass production.

Due to it desirable attributes such as sustainability, light-weight, and impact-resistant polymer structures, the growing demand for injection-molded PBS parts in automotive applications have been driving the adoption of PBS-based injection -molding as the automakers strive for a sustainable and high-performance substitute for interior and under-the-hood parts of vehicles.

The growing penetration of injection-molded PBS in consumer electronics such as heat-resistant casings, flexible circuit boards, and durable electronic enclosures has bolstered the market growth, which will further ensure increased penetration in green electronics manufacturing.

Furthermore, infusion of injection-molded PBS in the surgical instruments and medical devices & pharmaceuticals packaging along with single-use medical disposables will drive adoption and compliance with the increasing sustainability across health care systems.

While offering benefits like precision, efficiency, and streamlined production, PBS injection molding also brings challenges in terms of processing temperature control, limited mechanical performance in certain scenarios, and higher production costs vs. traditional plastics. However, these challenges would mitigate with evolving innovations in AI-based mold design, novel bio-composite reinforcements, and automated injection molding processes are enhancing manufacturing efficiency, product durability, and cost-effectiveness that would support to sustained growth in the injection-molded PBS products market.

The extrusion allows for a more uniform composition throughout the polymer matrix, manufacturers are paying more attention to different extrusion techniques for PBS films, sheets, and fibers, resulting in strong market adoption of this production process. Extrusion, on the other hand, offers continuous production capabilities, making it highly efficient for high-volume productions while minimizing material wastage, which is not feasible with conventional polymer processing.

PBS-based extrusion techniques have been adopted by packaging companies that are transitioning toward more sustainable materials, due to increasing demand for extruded PBS films in biodegradable food packaging that can be composted and offer moisture-resistant and high-barrier properties.

However, due to the expanding scope of extruded PBS fibers in nonwoven textiles, where soft, breathable, and biodegradable fibers are gaining popularity in hygiene products and technical textiles, market demand has been braced, leading to greater consumption in disposable medical wear, filtration systems, and sustainable fashion.

PBS extrusion, however, has limited heat resistance for high temperature applications and pose challenges in processing stability, equipment modification and cost-effectiveness in application versatility. Nonetheless, advancements in AI-optimized extrusion parameters, advanced PBS copolymer blends, and automated quality assurance systems are enhancing efficiency, sustainability, and product performance that would allow for sustained growth of the extruded PBS market.

Rising demand for biodegradable plastics, sustainable packaging solutions, and eco-friendly polymer alternatives are driving growth in the Poly butylene Succinate (PBS) market. Companies aim to improve sustainability, cost efficiency, and performance with bio-based PBS production, AI-assisted polymer polymerization, and biodegradable plastic applications in packaging, agriculture, and consumer products. A diverse range of players such as global chemical manufacturers and specialized biopolymer producers are creating a dynamic ecosystem with advancements in compostable plastics, PBS copolymers, and green polymer processing.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Mitsubishi Chemical Corporation | 15-20% |

| Anhui Sealong Biotechnology Co., Ltd. | 12-16% |

| Showa Denko K.K. | 10-14% |

| BASF SE | 8-12% |

| NaturePlast | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Mitsubishi Chemical Corporation | Develops bio-based and petroleum-based PBS resins for biodegradable packaging, compostable plastics, and agriculture films. |

| Anhui Sealong Biotechnology Co., Ltd. | Specializes in bio-PBS production from renewable sources, focusing on sustainable food packaging applications. |

| Showa Denko K.K. | Manufactures PBS-based bioplastics for agricultural mulching films, consumer packaging, and industrial applications. |

| BASF SE | Provides PBS copolymers and biodegradable polymer solutions, integrating AI-powered formulation for enhanced performance. |

| NaturePlast | Offers PBS blends and biodegradable polymer solutions for eco-friendly consumer goods and flexible packaging. |

Key Company Insights

Mitsubishi Chemical Corporation (15-20%)

PBS market is led by Mitsubishi who provides high-performance, biodegradable PBS resins, AI-driven polymer synthesis and bio-based raw material sourcing.

Anhui Sealong Biotechnology Co., Ltd. (12-16%)

Straps and sterility made from renewable-source PBS plastics are targeted at food packaging, agricultural mulch films and compostable materials.

Showa Denko K.K. (10-14%)

Persistence and strength of PBS polymer make it ideal for producing high properties bio-degradables through showa denko PBS.

BASF SE (8-12%)

BASF specializes in the development of biodegradable polymers and PBS copolymers for numerous uses, including packaging, industrial coatings, and bio-based replacements.

NaturePlast (5-9%)

NaturePlast develops and produces PBS and PBS-based composites, with an emphasis on compostable consumer products, flexible packaging, and environmentally friendly solutions for products.

Other Key Players (40-50% Combined)

Multiple biopolymer and specialty chemicals manufacturing members are involved in the production of next-generation bio-degradable PBS, the AI-powered polymer performance optimization, and sustainable bioplastic applications. These include:

The overall market size for Poly butylene Succinate Market was USD 144.8 Million in 2025.

The Poly butylene Succinate Market expected to reach USD 442.1 Million in 2035.

The demand for the Poly butylene Succinate Market will be driven by the increasing adoption of biodegradable plastics, growing environmental awareness, and the shift towards sustainable packaging solutions. Rising demand in industries such as automotive, agriculture, and consumer goods will also contribute to market growth.

The top 5 countries which drives the development of Poly butylene Succinate Market are USA, UK, Europe Union, Japan and South Korea.

Bio-Based and Petro-Based PBS Drive Market to command significant share over the assessment period.

Agricultural Fabrics Market Growth - Trends & Forecast 2025 to 2035

Asia Pacific Industrial Solvents Market Growth - Trends & Forecast 2025 to 2035

Asia Pacific Waterproofing Chemicals Market Growth - Trends & Forecast 2025 to 2035

Diamond Wire Market Size & Outlook 2025 to 2035

Thioesters Market Growth & Trends 2025 to 2035

The Self-Healing Materials Market is segmented by product, technology, and application from 2025 to 2035.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.