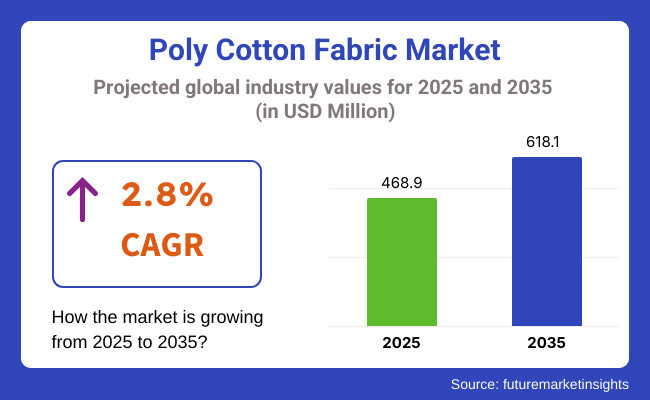

The growth of poly cotton fabric market across the world is anticipated to be steady between 2025 and 2035 owing to its storm resistant and wrinkle resistant textile and increasing demand for the same. In 2025, the market USD 468.9 million expects to be valued at USD 618.1 million by 2035, with a CAGR of 2.8% on the forecast period.

Poly cotton is a blend of polyester and cotton, giving it greater strength, wrinkle resistance, and moisture-wicking properties; it is often used for work wear, bedding, and sportswear. The increasing shift towards sustainable textiles, innovations in fabric finishing technology, and growing need for lightweight but long-lasting clothing are also steering market growth. Nevertheless, competition with synthetic fibre alternatives and 100% organic cotton pose a challenge for the polyester market growth due to environmental issues related to polyester production.

Other factors such as green dyeing methods, outfitting biodegradable polyester and natural fibres into hybrid materials, as well as the conduction of sustainable recycling processes for plant origin fibres can assist the disposability of your poly cotton textiles.

Poly-cotton fabric maintains a significant market share in North America due to the rising demand for blended textiles in the apparel, hospitality, and healthcare sectors. The increasing demand for lightweight, wrinkle-resistant clothing in the United States and Canada drives demand for flame-retardant fabrics in workwear and industrial safety gear. Because of the rise of eco-conscious fashion trends and sustainable fabric production, some manufacturers are investing in blends of recycled polyester and organic cotton.

The poly cotton fabric market in Europe is growing steadily, supported by quickly growing textile manufacturing industries in Germany, Italy, France and the UK. Innovations are driven by the demand for high-performance work wear, moisture-resistant home textiles, and premium-quality blended fabrics. The focus on sustainable textiles in the EU is driving the development of low-impact polyester-cotton blends with a reduced carbon footprint, spurred by circular economy initiatives and EU policy.

The Asia-Pacific region is expected to be the fastest-growing region, driven by high textile production capacity, rising disposable income, and increasing demand for low-cost, durable clothing from countries such as China, India, Japan, and Bangladesh. As the leading producer of poly cotton textiles, China is at the forefront of innovation in fabric manufacturing, digital textile printing, and automation in textile mills.

Apparel brands and home furnishing manufacturers are in strong demand for blended fabrics, and India is a key exporter of it. Japan and South Korea are also investing in high-tech textile finishing to enhance the performance and longevity of poly-cotton blends.

Challenges

Competition from Organic and Synthetic Fabrics

While poly cotton is a very versatile fabric, 100% cotton fabrics are also in stiff competition with it due to issues of sustainability and the pure polyester alternatives, which offer cost-effectiveness and moisture resistance. Moreover, political regulations and consumer perception challenges arise regarding the production of polyester and its environmental impact due to its recyclability issues.

Opportunities

Sustainable and Smart Poly Cotton Textiles

New opportunities for next-generation poly cotton fabrics are emerging to cater to trends ranging from sustainable fashion and eco-friendly textiles to smart fabric innovations. To achieve durable, sustainable, and functional poly-cotton textiles, manufacturers are exploring bio-based polyester, waterless dyeing technologies, and performance coatings. Moreover, innovations in Nano-coatings, UV-resistant blends, and antimicrobial treatments are enabling healthcare, sportswear, and protective clothing to explore applications as well.

The poly cotton fabric industry has experienced consistent growth between 2020 and 2024, fuelled by increasing demand for low-maintenance, cost-effective, and long-lasting clothing in the fashion, home furnishing, and industrial segments.

The demand trend for blended fabrics, combining cotton's breathability with polyester's strength and wrinkle resistance, was fueled, especially in segments such as workwear, uniforms, and upholstery. Advanced moisture-wicking poly-cotton fabrics, anti-microbial treatments, and new, sustainable dyeing methods heightened product appeal and performance. They did face hurdles to widespread adoption, however, such as increasing raw material costs, environmental concerns over synthetic fibres, and competition from fully organic textiles.

Between 2025 and 2035, the market is expected to undergo transformative changes, featuring AI-driven fabric optimization, biodegradable polyester alternatives, and innovative self-cleaning textiles. AI-assisted fabric blending to supply better-performance customization, nanotechnology embedded into poly-cottons, allowing for anti-odour properties, and blockchain-enabled sustainable textile tracking will be normal protocols to increase efficiency in the process.

This will also be accompanied by new materials, such as smart textiles that react to temperature, predictive analysis of worn fabrics, and bio-based polyester components that can transform the industry as a whole.

Furthermore, the advent of zero-waste poly-cotton production, AI-enabled customization in fashion manufacturing, and sustainable recycling techniques for blended fabrics will reshape industry standards, driven by enhanced longevity, sustainability and performativity.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with OEKO-TEX, GOTS, and REACH textile safety and sustainability standards. |

| Material Innovation | Use of traditional polyester-cotton blends with standard moisture-wicking and wrinkle resistance. |

| Industry Adoption | Growth in fashion, work wear, home textiles, and industrial fabric applications. |

| Smart & AI-Enabled Solutions | Early adoption of moisture-wicking technology, anti-microbial coatings, and energy-efficient dyeing. |

| Market Competition | Dominated by traditional textile manufacturers, fashion brands, and industrial uniform suppliers. |

| Market Growth Drivers | Demand is fuelled by the rising need for durable, wrinkle-free, and easy-care textiles in everyday wear and work wear. |

| Sustainability and Environmental Impact | Early adoption of recycled polyester blends, reduced water usage in textile production, and eco-friendly dyeing processes. |

| Integration of AI & Digitalization | Limited AI use in basic textile manufacturing and quality control. |

| Advancements in Manufacturing | Use of traditional textile weaving, synthetic dyeing, and mechanical blending of fibres. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter AI-driven compliance tracking, blockchain-backed textile sourcing verification, and carbon-neutral poly-cotton mandates. |

| Material Innovation | Adoption of biodegradable polyester fibres, nanotech-infused odour-resistant textiles, and bio-engineered cotton-polyester blends. |

| Industry Adoption | Expansion into AI-optimized custom fabric blends, smart textile wearables, and eco-friendly poly-cotton manufacturing. |

| Smart & AI-Enabled Solutions | Large-scale deployment of self-cleaning fabrics, AI-driven predictive fabric wear analytics, and smart textiles with temperature adaptability. |

| Market Competition | Increased competition from AI-integrated textile firms, bio-sustainable fabric innovators, and smart textile technology developers. |

| Market Growth Drivers | Growth driven by AI-powered personalized textile production, climate-adaptive fabric innovations, and fully sustainable textile recycling systems. |

| Sustainability and Environmental Impact | Large-scale transition to zero-waste poly-cotton recycling, AI-assisted resource optimization, and fully biodegradable textile materials. |

| Integration of AI & Digitalization | AI-powered real-time fabric durability tracking, blockchain-backed sustainable material sourcing, and AI-driven textile customization for individual consumers. |

| Advancements in Manufacturing | Evolution of 3D-printed textile composites, AI-enhanced fibre blending, and self-repairing poly-cotton fabric materials. |

The USA is a significant market for poly cotton fabric, driven by increasing demand for poly cotton fabric in apparel, home textiles, and industrial applications. Durable, breathable, and economical, the blend is a favourite for work wear, uniforms, and casual clothing. The increasing demand for wrinkle-free and easy-care material is also driving the market growth.

Sustainably produced textiles, such as those made from recycled polyester blends, organic cotton-polyester mixes, and more sophisticated technical fabrics, are trending in the industry. Moreover,the rise of e-commerce and customization in the fashion industry is also supporting demand for poly cotton fabrics in the USA market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.0% |

Consumer preference towards blended textile continues to fuel demand for different kinds of fabric, which is utilized in the UK Poly Cotton fabric market. Demand for poly-cotton fabrics is being fueled by the expansion of the hospitality and healthcare sectors in bedding, uniforms, and institutional textiles. Increasing awareness of eco-friendly and sustainable fabric production is influencing market trends.

The further demand for smart textiles and moisture-wicking poly-cotton blends in active wear is expected to contribute significantly to growth. The expansion of digital textile printing, along with the rise of personalized fashion, is another factor propelling market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 2.6% |

Among other regions, Germany, France, and Italy hold a dominant market position within the poly cotton fabric market in the Eastern Europe region, attributed to their robust textile manufacturing capabilities along with an increasing need for sustainable fabric solutions, which is spurring the adoption of blended textiles in fashion and home furnishing.

The EU initiative to significantly reduce the environmental impact of textile production is driving the transition toward recycled and organic poly-cotton blends. Further driving the industry growth are the growth of technical textiles, such as flame-retardant and antimicrobial poly cotton fabric. The popularity of fast fashion and athleisure trends are also influencing market demand, they said.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 2.7% |

The growing demand for high-quality blended textile products, the presence of technologically advanced fabric manufacturers, and the increasing use of poly cotton in workwear and industrial applications are some factors expected to drive growth in Japan's poly cotton fabric market. At the same time, the country’s dominance in textile innovation is paving the way for breathable, lightweight, and moisture-resistant fabric blends.

The growing influence of nanotechnology in textile production, enhancing durability and stain resistance, is also driving product development. Moreover, the advent of smart fabrics and sustainable dyeing processes is also driving market trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 2.5% |

South Korea is also emerging as a significant market for poly cotton fabric, driven by growing investments in textile technologies, high demand for functional and performance fabrics, and increasing exports of blended textiles. A focus on sustainable fabric production and ithe adoption of nnovative dyeing techniques drives the overall growth of the market in the country.

Product trends are also being positively influenced by the development of synthetic fibre technology and the use of eco-friendly polyester in poly-cotton blends. The increasing demand for antibacterial and UV-resistant poly cotton fabrics from the outdoor and sportswear industries is acting as a significant tailwind for the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 2.9% |

10-20 Inch and More than 30 Inch Drive Market Demand

High market growth is a result of their versatile use in the textile industry, and the segments of 10-20 Inch and More than 30 Inch poly cotton fabric have also received high market attention. These sizes are suitable for home furnishing, clothing, and terry towel fabric, providing exceptional flexibility, wear resistance, and mechanical property processing.

10-20 Inch Poly Cotton Fabric Gains Popularity in High-Precision Textile Applications

The 10-20 Inch segment has been gaining popularity, as this size category is suitable for applications requiring precision in textiles, such as upholstery, bedding accessories, and tailored garments. This segment provides an ideal endpoint between smaller fabric sizes, making it highly manufacturable while ensuring minimal waste and costs, allowing the fabric to be used as much as possible.

Market adoption has also been bolstered by a rising demand for poly cotton mixes in mid-segment textile products such as cushion covers, uniforms and fashion garments. The growing availability of customizable fabric patterns, pre-cut textile rolls, compatible digital printing, and eco-friendly dyeing options has further fostered market demand, ensuring better design flexibility and sustainability.

Further adoption has been driven by the inclusion of mixed poly-cotton materials with high thread count weaves, antimicrobial finishes, and improved moisture-wicking properties, which ensure that such materials are both comfortable and durable enough for everyday use.

The presence of basic conductive fibres, UV-resistant coatings, and thermoregulation patterns in smart textiles in the 10-20 inch range has allowed for optimization of market growth through its utility enhancing performance across fashion and functional apparel.

Although it excels in versatility, cost efficiency, and broad acceptance, the 10-20 inch poly cotton fabric portion encounters limitations, including limited adaptability for large-scale applications, its higher sewing complexity due to detailed outlines, and moderate tear resistance.

However, new technologies, such as Nano-coating treatments, AI-driven fabric cutting automation, and biodegradable poly-cotton blends, are enhancing fabric strength, longevity, and sustainability, creating an ongoing demand for 10-20 inch poly-cotton textiles worldwide.

More than 30-inch Poly Cotton Fabric Expands as Bulk Textile Manufacturing Grows

The key trend influencing the 30 Inch Poly Cotton Fabric Market segment:- High Demand for More than 30 Inch poly cotton fabric. These fabrics have the advantage of a large coverage area, high manufacturing efficiency, and can avoid complex seams compared to small materials.

The rising demand for large-size poly cotton fabric in home textiles, bed linens, and drapery has been a key factor driving its use. The growing demand for bulk textile processing solutions, particularly for fabric, combined with a focus on automation for weaving technology, high-speed printing technology, and process finishing equipment, has contributed to the market's growth. This improvement in efficiency levels and reduction in costs have driven the market forward.

Moreover, the introduction of high-performance coatings on large poly cotton sheets, which require a water-resistant finish, flame-retardant treatment, and retention of enhanced colour, has boosted adoption, providing high-cost usability for a longer period in commercial and residential applications.

While offering benefits in terms of bulk manufacturing, increased textile tensile strength, and improved efficiency, these segments face challenges in material handling complexity, storage, and a limited range in precision garments.

Nevertheless, advancements in smart textile manufacturing, AI quality assurance, and green processing of materials are increasing material efficiency, sustainability, and mass production capabilities, paving the way for large-width poly cotton fabrics to flourish in the global market.

The Clothing, Apparel, Curtains, and Drapes segments hold a significant share in the Poly Cotton Fabric Market, as manufacturers and designers seek lightweight, breathable, and durable textile solutions.

The Clothing and Apparel segment has become one of the most widely adopted applications for poly cotton fabric, offering a balance between breathability, wrinkle resistance, and durability.

The increasing use of poly cotton textiles in daily wear, workwear, and fashion apparel is driving demand for ceramic inks in the market. The growing availability of performance-oriented apparel solutions, featuring moisture-wicking properties, antimicrobial capabilities, and UV protection, has bolstered market demand, delivering enhanced comfort and functionality.

The integration of sustainable poly cotton blends (organic cotton fusion, biodegradable synthetic fibres, and low water-intensive processing) has also contributed to the rising adoption of the market, ensuring the availability of sustainable clothing solutions.

Market growth has been optimized with the development of multi-seasonal poly cotton apparel with temperature-regulating weaves, lightweight thermal layers, and high-resilience yarn blends, further ensuring improvement in adaptability for varying climates.

While the use of clothing and apparel offers advantages such as increased comfort, cost efficiency, and widespread availability, drawbacks include the risk of fabric pilling over time, limited elasticity compared to pure cotton, and moderate susceptibility to shrinkage.

Nevertheless, recent advancements in nanotechnology for textiles, artificial intelligence in optimizing fabric durability tests, and eco-friendly dyeing methods are enhancing the longevity of materials, improving the performance of fabrics, and providing better options for environmentally conscious production, all of which are ensuring that poly cotton clothing continues to grow worldwide.

The Curtains and Drapes segment continues to experience strong market growth, particularly as home furnishings and interior design trends emphasize functional yet aesthetically pleasing textile solutions. The increasing adoption of poly cotton curtains in residential and commercial spaces has also driven market expansion.

The demand in the market is further enhanced by the subsequent development of high-performance curtain fabrics, which also incorporate light-blocking features, thermal insulation, and dust-resistant finishing, providing higher functionality in modern houses and offices.

The introduction of customized curtain designs made from digitally printed poly-cotton fabrics, textured jacquard weaves, and dye-fast color brightness within the fabric has been a contributing factor to market growth, as this ensures greater consumer satisfaction.

Although its home decor benefits, functional versatility, and affordability position the segment favourably, curtains and drapes are susceptible to fading over time, moderate dust accumulation, and have limited flame resistance.

Nonetheless, the growth of poly cotton curtains and drapes is likely to persist worldwide as property owners adopt new technologies, such as self-cleaning textiles —a coating on fabrics that makes them resistant to fire —and AI capabilities for home textile customization, which offer greater durability, safety, and design flexibility.

The major factors driving the growth of the poly cotton fabric market are increasing demand for durable and cost-effective textiles, advancements in fabric blending technology and rising applications in apparel, home textiles and many industrial sectors.

The market is growing steadily, with an increasing use in casual wear, work wear, and upholstery. Sustainable rugs, wrinkle-resistant finishes, and eco-friendly dyeing processes are just some of the trends shaping this industry.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Milliken & Company | 12-16% |

| Parkdale Mills, Inc. | 10-14% |

| Klopman International | 8-12% |

| Teijin Limited | 6-10% |

| Reliance Industries Limited | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Milliken & Company | Develops high-performance poly-cotton blends with stain resistance and enhanced durability. |

| Parkdale Mills, Inc. | Specializes in sustainable poly-cotton fabrics with moisture-wicking properties. |

| Klopman International | Offers industrial-grade poly-cotton fabrics for work wear and protective clothing. |

| Teijin Limited | Focuses on eco-friendly poly-cotton textiles with advanced wrinkle-free finishes. |

| Reliance Industries Limited | Provides polyester-rich poly-cotton blends for high-strength and cost-effective applications. |

Key Company Insights

Milliken & Company (12-16%)

Milliken leads in performance-driven poly-cotton textiles, integrating stain-resistant and durable fabric technologies.

Parkdale Mills, Inc. (10-14%)

Parkdale Mills specializes in moisture-wicking and breathable poly-cotton fabrics for comfort-focused applications.

Klopman International (8-12%)

Klopman focuses on industrial-grade poly-cotton blends, which are widely used in workwear and protective apparel.

Teijin Limited (6-10%)

Teijin pioneers eco-friendly poly-cotton fabric solutions, enhancing wrinkle resistance and sustainability.

Reliance Industries Limited (4-8%)

Reliance Industries provides high-strength, polyester-rich poly-cotton fabrics designed for affordability and durability.

Other Key Players (45-55% Combined)

Several textile manufacturers contribute to the expanding Poly Cotton Fabric Market. These include:

The overall market size for the poly cotton fabric market was USD 468.9 million in 2025.

The poly cotton fabric market is expected to reach USD 618.1 million in 2035.

The demand for poly cotton fabric will be driven by increasing use in apparel and home textiles, rising preference for durable and wrinkle-resistant fabrics, growing demand from the hospitality and healthcare sectors, and advancements in eco-friendly and blended textile manufacturing.

The top 5 countries driving the development of the poly cotton fabric market are the USA, China, India, Germany, and Bangladesh.

The clothing and apparels segment is expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polypropylene Yarn Market Size and Share Forecast Outlook 2025 to 2035

Polysaccharide Films Market Size and Share Forecast Outlook 2025 to 2035

Polysilicon Market Size and Share Forecast Outlook 2025 to 2035

Polytetrahydrofuran (Poly THF) Market Size and Share Forecast Outlook 2025 to 2035

Polysulfide Market Size and Share Forecast Outlook 2025 to 2035

Polyolefin Pipe Market Size and Share Forecast Outlook 2025 to 2035

Polymer Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Adsorbents Market Size and Share Forecast Outlook 2025 to 2035

Polyhydroxybutyrate Market Size and Share Forecast Outlook 2025 to 2035

Polyethersulfone (PES) Market Size and Share Forecast Outlook 2025 to 2035

Polyisocyanurate Insulation Market Size and Share Forecast Outlook 2025 to 2035

Polypropylene Market Size and Share Forecast Outlook 2025 to 2035

Polymerization Initiator Market Size and Share Forecast Outlook 2025 to 2035

Polybenzoxazine Resins Market Size and Share Forecast Outlook 2025 to 2035

Polymer Processing Aid (PPA) Market Size and Share Forecast Outlook 2025 to 2035

Polygon Mirror Scanner Motor Market Size and Share Forecast Outlook 2025 to 2035

Polyguanidine Polymers Market Size and Share Forecast Outlook 2025 to 2035

Polyurethane (PU) Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Polyurethane Precursor Market Size and Share Forecast Outlook 2025 to 2035

Polymer Feed System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA