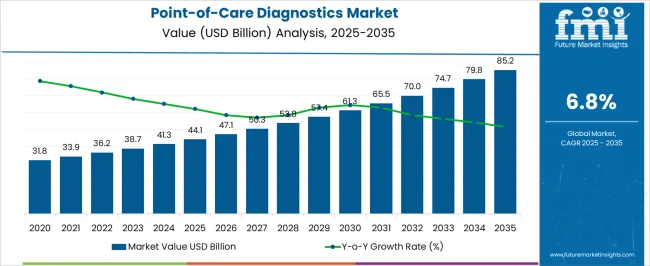

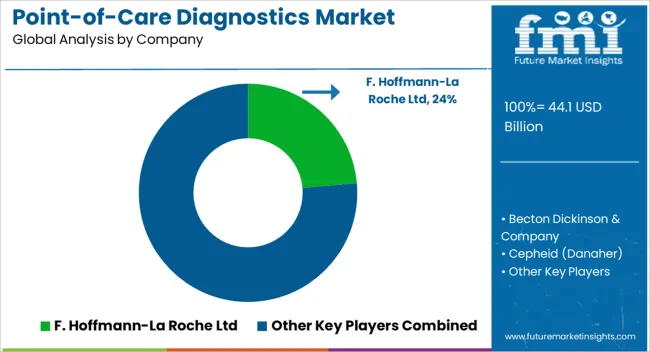

The Point-of-Care Diagnostics Market is estimated to be valued at USD 44.1 billion in 2025 and is projected to reach USD 85.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period.

| Metric | Value |

|---|---|

| Point-of-Care Diagnostics Market Estimated Value in (2025 E) | USD 44.1 billion |

| Point-of-Care Diagnostics Market Forecast Value in (2035 F) | USD 85.2 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

The point of care diagnostics market is experiencing robust growth supported by rising demand for rapid testing solutions, increasing prevalence of infectious and chronic diseases, and a global shift toward decentralized healthcare. The accessibility of these diagnostic tools has improved patient outcomes by enabling quicker decision making and reducing the reliance on centralized laboratories.

Innovations in assay design, microfluidics, and portable analyzers are further expanding the application scope of point of care diagnostics across hospitals, clinics, pharmacies, and even home settings. In addition, public health campaigns and government initiatives are accelerating adoption to strengthen early detection and disease management capabilities.

The market outlook remains favorable with growing emphasis on affordability, accuracy, and integration with digital health systems that enhance real time monitoring and data sharing.

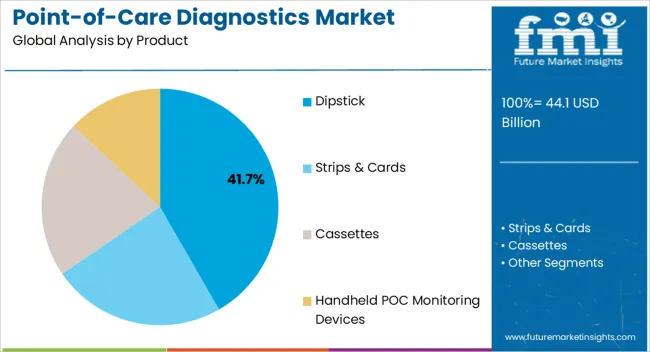

The dipstick segment is projected to represent 41.70% of the total revenue by 2025 within the product category, positioning it as the leading product type. Its dominance is linked to affordability, simplicity, and suitability for rapid screening applications.

Dipsticks offer minimal sample preparation requirements and immediate results, making them widely adopted in both developed and developing healthcare settings.

The format is particularly effective for mass screenings and routine diagnostics, supporting its strong market share within the product category.

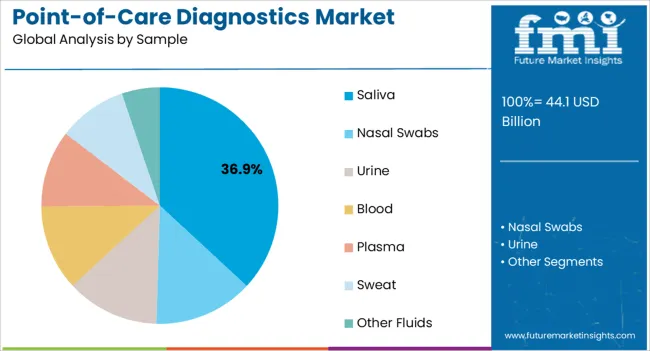

The saliva sample segment is expected to account for 36.90% of the market share by 2025 under the sample category, establishing itself as the leading format. Saliva based testing has gained traction due to its non invasive nature, ease of collection, and suitability for both clinical and at home diagnostics.

Reduced risk of infection transmission during sample collection and higher patient compliance have supported widespread acceptance.

Its application in infectious disease screening and chronic condition monitoring has driven adoption, positioning saliva as a critical sample type in the market.

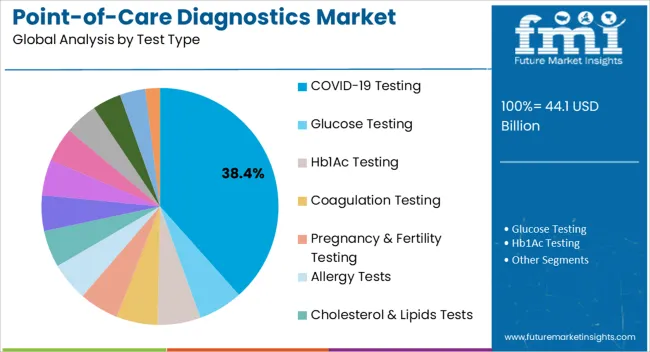

The COVID 19 testing segment is anticipated to hold 38.40% of the market share by 2025 within the test type category, making it the dominant testing area. The unprecedented global demand for rapid and accurate testing during the pandemic accelerated innovation and deployment of point of care diagnostic kits.

Continuous investment in scalable production and streamlined regulatory approvals has reinforced this dominance.

The sustained need for surveillance, variant monitoring, and preventive healthcare measures ensures the continued relevance of COVID 19 testing, supporting its leadership in the test type segment.

Sales of the global point-of-care diagnostics market grew at a CAGR of 6.2% between 2012 to 2025. Global point-of-care diagnostics market contributes 40.0% revenue share to the global in-vitro diagnostics market valued at USD 44.1 Billion in 2025.

The increasing prevalence of Infectious diseases has resulted in higher uptake of POC diagnostic options such as Glucose and Hb1Ac testing. Because of their easy availability and rapid diagnosis, point-of-care diagnostics are typically the first form of testing recommended worldwide.

A significant advance has been made in the effort to identify SARS-CoV-2 coronavirus patients with the addition of saliva samples for the purpose of coronavirus identification. Governments concentrated on raising knowledge about COVID-19 testing during the COVID-19 epidemic to ensure an early identification of the illness. As a result of such initiatives, people become more knowledgeable of Point-of-Care testing for the diagnosis of coronavirus.

Creating awareness about diseases is an essential aspect of early detection and screening. If the public has a general understanding of diseases and symptoms, action plans can be better implemented. On the other hand, if there is a lack of awareness, it stops people from taking preventive measures or availing treatments.

Considering this, FMI expects the global market to grow at a CAGR of 6.8% through the forecasted years.

There is a lack of expansion of biotechnology & pharmaceutical Industries regarding point-of-care diagnostics. Biopharmaceuticals are one of modern science's most technically advanced and exquisite achievements.

Pharmaceutical companies are putting in a lot of effort to produce medications and lifesaving vaccines and biologicals for the entire world. When the pharmaceutical sector employs biotechnological advancements and advanced processes, the result is better and faster drug delivery. Biotechnology has aided the pharmaceutical sector in the correct manufacturing of vaccines and medications.

The pharmaceutical sector intends to establish products that support the treatment of various diseases. This may result in pharma companies manufacturing point-of-Care (POC) devices.

While greater investment for innovative products is required for the growth of the market, the healthcare infrastructure can have a substantial impact on market expansion. Most healthcare authorities have recently committed increased financing for the development and enhancement of their healthcare infrastructure as a result of the COVID-19 pandemic. The development of Point-of-Care diagnostics kits and their production need more investment.

Overall, healthcare infrastructure for POCT is complex and evolving, and it is important that companies stay abreast of regulatory changes and work closely with regulators to ensure compliance. However, regulatory initiatives that promote safe and effective pain management can create growth opportunities for the POCT market, especially for companies that offer innovative solutions.

Increased testing of point-of-care diagnosis in patients will pave the way for new technology and treatment options, ultimately leading more improvement in healthcare infrastructure and growth in number of manufacturing facilities.

Point-of-Care tests in some therapy areas have become more accurate (e.g., glucose testing). Overall, POC tests and rapid tests tend to remain less accurate compared to tests run in a laboratory. Accuracy is essential in medical testing, because an incorrect diagnosis can lead to inappropriate treatment, which can have serious consequences for patients. Inaccurate POC results can lead to false positives or false negatives, which can result in unnecessary treatment or missed diagnosis, respectively.

Inaccurate POCT results can also lead to mistrust in the technology, which can impact the adoption and utilization of POCT products. Healthcare providers may be hesitant to rely on POCT if they have concerns about its accuracy and reliability.

The cost of tests and a lack of trust in POC/ rapid testing are major concerns around the globe. The cost of point-of-care kits or devices is very high as compared to laboratory tests, which is compounded by the lower level of accuracy offered by the former.

Due to financial constraints, academic research laboratories are often unable to purchase expensive equipment. The overall cost of these instruments increases as a result of maintenance costs and other indirect expenses. Thus, the higher cost associated with the equipment and other factors causing unaffordability for the laboratories might hamper the market growth.

These factors are expected to hamper revenue growth of the global market over the forecast period.

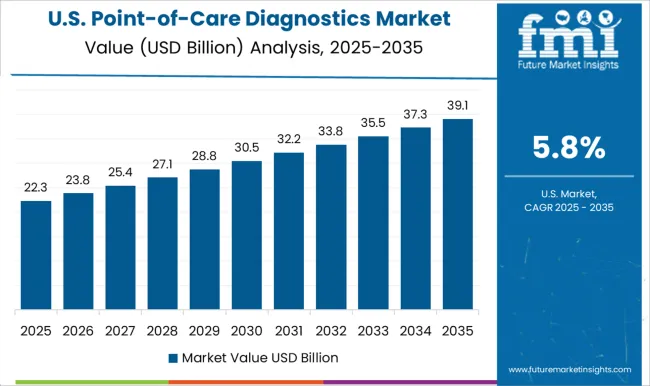

USA dominated the global market in 2025 and is further expected to register growth rate at CAGR of 6.8%.

Diagnostic techniques, such as rapid testing or POCT like COVID-19 testing, glucose testing, and allergy tests, etc., has seen a high rate of patient acceptance as a result of the high prevalence. Awareness campaigns and strategic conferences with focus on point-of-care technologies for healthcare sector, has been undertaken by various associations in USA

In May 2025, American Association for Clinical Chemistry, organized a Point-of-Care testing boot camp for POCT professionals and experts in the lab medicine community.

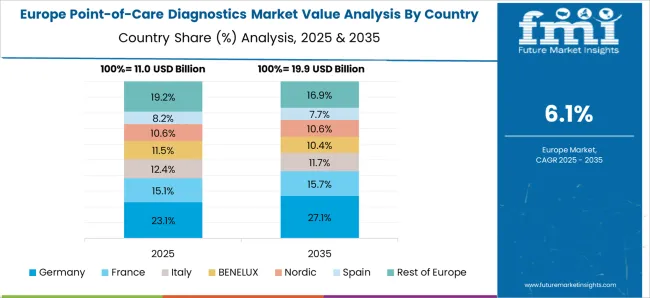

Why is Germany considered to be a Lucrative Market for Point-of-Care Diagnostics?

The general physicians in primary care settings in Germany highly prefer POCTs as a useful diagnostic tool. There are numerous POCTs available in the German market. In the past few years, due to COVID-19 point-of-care diagnostics has been of tremendous importance as first line of defense for testing purpose.

The safe and successful use of point-of-care diagnostics in Germany is likely to influence other European countries to also opt for this method, ultimately resulting in market expansion.

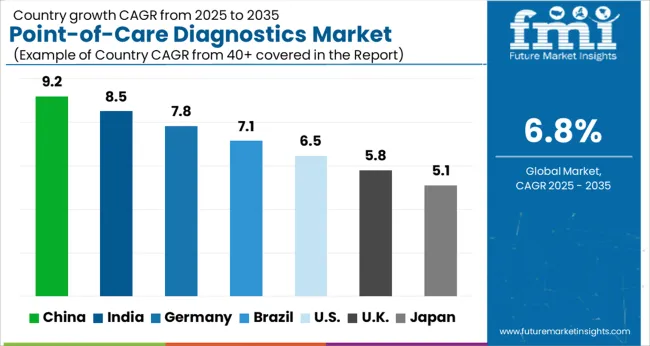

China is projected to be the most attractive market in the east Asia point-of-care diagnostics and is expected to grow over a significant CAGR of 9.0% over the forecast period.

Point-of-care diagnostics market in China is expected to grow significantly in the coming years due to several factors.

One of the main factors driving the growth of the point-of-care diagnostics market in China is the increasing awareness of the condition among the general public and healthcare professionals. As more people become aware of the POC testing, they are more likely to adapt to the testing method, which is leading to increased demand for testing for Point-of-care diagnostics.

Another factor contributing to the growth of the Chinese market is the increasing availability of advanced medical technologies. China has made significant investments in its healthcare infrastructure, and many new hospitals and clinics have been built in recent years.

The COVID-19 testing diagnostic segment held the major chunk of about 15.1% in global market by the end of 2025. However, food sensitivity testing is the most lucrative segment over the forecast period due to increase in food allergic cases. Many of allergic reactions require rapid diagnosis that’s where point-of-care diagnostics plays a significant role.

Nasal swabs segment accounted for revenue share of 28.4% in the global market at the end of 2025.

A nasopharyngeal swab, one type of nasal swab, is a test used to look for bacteria or viruses that cause respiratory infections. Your healthcare provider uses a swab to take a small sample of cells from your nasopharynx, the top part of your nose and throat.

Overall, nasal swabs offers a convenient sample type for point-of-care diagnostics for sample withdrawal, making it the largest sample type for this segment.

Handheld POC Monitoring Devices segment accounted for revenue share of 41.3% in the global market at the end of 2025.

Handheld POC monitoring devices can be used to monitor a wide range of medical conditions, such as diabetes, cardiovascular disease, and infectious diseases. For example, a handheld blood glucose meter can be used by patients with diabetes to monitor their blood sugar levels, while a handheld device that measures blood pressure can be used to monitor patients with hypertension.

Overall, Handheld POC Monitoring Devices offers a convenient Product type for Global Point-of-Care diagnostics treating products, making it the largest Product for this segment.

Hospitals held the major chunk of about 27.7% in global market by the end of 2025.

Hospitals offers a convenient end user for POCT market conducting POC tests, making it the dominant end user for this segment. Hospitals segment is set to be highly lucrative in the upcoming years due to ease and access of POCT.

Collaboration are the top strategy being adopted by leading players to expand their product portfolio, their customer base as well as maintain their foothold in the market.

For instance:

Similarly, recent developments have been tracked by the team at Future Market Insights related to companies in the Point-of-care Diagnostics Market space, which are available in the full report

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2012 to 2025 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; Middle East and Africa (MEA) |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Argentina, Germany, UK, France, Italy, Spain, Russia, BENELUX, China, Japan, South Korea, India, Thailand, Indonesia, Malaysia, Australia, New Zealand, Türkiye, South Africa, and GCC Countries |

| Key Segments Covered | Test Type, Sample, Product, End User, Region |

| Key Companies Profiled | F. Hoffmann-La Roche Ltd; Becton Dickinson & Company; Cepheid (Danaher); Siemens Healthineers; Abbott; Diasorin S.p.a.; Thermo Fisher Scientific Inc.; Qiagen; BIOMÉRIEUX; Hologic Inc.; Bio Rad Laboratories; Quidel Corporation; EKF Diagnostics; SEKISUI Diagnostics; DiaSys-Diagnostic Systems GmbH; InBios International, Inc.; Jiangsu Mole Bioscience Co., Ltd.; ACON Laboratories, Inc.; Visby Medical, Inc.; UNIMA, INC. |

| Report Coverage | Market Forecast, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global point-of-care diagnostics market is estimated to be valued at USD 44.1 billion in 2025.

The market size for the point-of-care diagnostics market is projected to reach USD 85.2 billion by 2035.

The point-of-care diagnostics market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in point-of-care diagnostics market are dipstick, strips & cards, cassettes and handheld poc monitoring devices.

In terms of sample, saliva segment to command 36.9% share in the point-of-care diagnostics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Point-of-care Molecular Diagnostics Market Insights – Trends & Growth 2025 to 2035

DNA Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

HIV Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Food Diagnostics Services Market Size, Growth, and Forecast for 2025–2035

Rabies Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Cancer Diagnostics Market Analysis - Size, Share and Forecast 2025 to 2035

Tissue Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Sepsis Diagnostics Market Growth - Trends & Forecast 2025 to 2035

Poultry Diagnostics Market - Demand, Growth & Forecast 2025 to 2035

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

In-vitro Diagnostics Kit Market Size and Share Forecast Outlook 2025 to 2035

In Vitro Diagnostics Market Insights - Trends & Forecast 2025 to 2035

Clinical Diagnostics Market Insights – Size, Share & Forecast 2025 to 2035

Covid-19 Diagnostics Market – Demand, Growth & Forecast 2022-2032

In-Vitro Diagnostics Packaging Market

Connected Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Molecular Diagnostics In Pharmacogenomics Market Size and Share Forecast Outlook 2025 to 2035

Psychosis Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Pneumonia Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

The Companion Diagnostics Market is segmented by product, technology, application and end user from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA